Professional Documents

Culture Documents

Acctba Q2 Reviewer

Uploaded by

Mia SantosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acctba Q2 Reviewer

Uploaded by

Mia SantosCopyright:

Available Formats

ACCTBA Q2 REVIEWER I.

THE RECORDING PROCESS The Account An account is an individual accounting record of increases and decreases in a specific asset, liability, or owners equity item There are separate accounts for the items we used in transactions such as cash, salaries expense and accounts payable T-account TITLE OF ACCOUNT Debit Credit Normal Balances: Normal Balances: Assets Expenses Drawings Increase in assets Increase in expenses Increase in drawings Decrease in liabilities Decrease in equity Decrease in income o Liabilities Equity Decrease in assets Decrease in expenses Decrease in drawings Increase in liabilities Increase in equity Increase in income Date 2010 Jul 1 GENERAL JOURNAL Account Titles and Ref Explanations Delivery Equipment Cash Accounts Payable Purchased truck for cash with balance on account J1 Debit 14 000 8 000 6 000 Credit

Debit balance Credit balance If the total of debit amounts is bigger than credits, the account has a debit (Dr) balance o If the total of credit amounts is bigger than debits, the account has a credit (Cr) balance Steps in the recording process o Identify the transaction from source documents o Analyse each transaction for its effect on the accounts o Enter the transaction information in a journal o Transfer the journal information to the appropriate account in the ledger

The Ledger Entire group of accounts maintained by a business A general ledger contains all the assets, liabilities and owners equity accounts Standard form of account o A simple T-account for is often useful for illustration purposes and to understand transactions quickly o In practice, account forms in ledgers are more structured Posting o Procedure of transferring journal entries to the ledger accounts o Steps Post to DR account date, journal page, amount Enter DR account number in reference column Post to CR account date, journal page, amount Enter CR account number in reference column The Trial Balance A list of accounts and their balances at a given time The primary purpose of a trial balance is to prove debits = credits after posting If debits and credits do not agree, the trial balance can be used to uncover errors in journalising and posting Steps o List the account titles and their balances o Total the debit and credit columns o Prove the equality of the two columns Limitations o A trial balance does not prove all transactions have been recorded or the ledger is correct o Errors may arise even when DR = CR A transaction is completely omitted A correct journal entry is not posted A journal entry is posted twice Incorrect accounts are used in journalising or posting Offsetting errors are made in recording

The Journal Transactions are initially recorded in chronological order before they are transferred to the ledger accounts Every business has a general journal (but may also have other types of journals) The journal contributes to the recording process by: o Disclosing all effects of transaction in one place o Providing a chronological record of transactions with cross-references o Helping to prevent or locate errors by providing ready comparison of debits and credits Journalising o Process of entering transaction data into the journal o Simple journal entry Involves only two accounts o Compound journal entry Involves three or more accounts

Example (adapted from Ms. Fatima Guerreros Handouts DLSZ) GENERAL JOURNAL Date 2010 May 1 GENERAL JOURNAL Account Titles and Ref Explanations Cash Delivery Equipment Accounts Payable Daf O. Dil, Capital Initial investment 12 Accounts Payable Cash Paid half of the account due for the delivery equipment Cash Loans Payable Bank loan Accounts Receivable Service Income Billed a customer for work done Rent Expense Cash Paid rent 4 1 P 50 000 P 50 000 1 2 4 6 J1 Debit P 176 000 P 90 000 P 20 000 P 246 000 Credit

T-ACCOUNTS CASH Debit P 176 000 P 80 000 DELIVERY EQUIPMENT Debit P 90 000 ACCOUNTS RECEIVABLE Debit P 18 000 ACCOUNTS PAYABLE Debit P 50 000 LOANS PAYABLE Debit P 80 000 DAF O. DIL, CAPITAL P 18 000 P 18 000 SERVICE INCOME Debit Debit Credit P 20 000 Credit P 80 000 Credit Credit Credit P 50 000 P 25 000

13

1 5 3 7

P 80 000

15

Credit P 246 000 Credit P 18 000 RENT EXPENSE Credit

20

8 1

P 25 000 P 25 000 Debit P 25 000

POSTING Date 2010 May 1 13 Particulars Initial investment Bank loan F J1 J1 CASH Debit P 176 000 P 80 000 15 Date 2010 May 1 DELIVERY EQUIPMENT Particulars F Debit Initial investment J1 P 90 000 Date Date 2010 May 12 Particulars Paid half of the account due Paid rent Particulars F Accnt No. 1 Credit P 50 000 2010 May RENT EXPENSE F Debit J1 P 25 000 Accnt No. 8 Credit

Date 15

Particulars Paid rent

Date

Particulars

J1

J1 F

P 25 000

Accnt No. 2 Credit

TRIAL BALANCE

Date Particulars F Accnt No. 3 Credit Daf. O Dil May, 2010 Trial Balance of Totals Accounts Accounts Receivable Cash Delivery Equipment Accounts Payable Loans Payable Daf O. Dil, Capital Service Income Rent Expense Debit P18,000 256,000 90,000 50,000 Credit P75,000 20,000 80,000 246,000 18,000 P439,000 Trial Balance of Balances Debit P18,000 181,000 90,000 30,000 Credit

Date 2010 May 15

ACCOUNTS RECEIVABLE Particulars F Debit Billed a customer for work done J1 P 18 000

Date 2010 May 15

Particulars Paid half of account due

ACCOUNTS PAYABLE F Debit J1 P 18 000

Date 2010 May 1

Particulars Initial investment

Accnt No. 4 Credit P 20 000

J1

80,000 246,000 18,000 25,000 P344,000 P344,000

Date

Particulars

LOANS PAYABLE F Debit

Date 2010 May 13

Particulars Bank loan

Accnt No. 5 Credit P 80 000

25,000 P439,000

J1

Date

DAF O. DIL, CAPITAL Particulars F Debit

Date 2010 May 1

Particulars Initial investment

Accnt No. 6 F Credit J1 P 246 000

** NOTE: CHANGE THE HEADERS! Im not exactly sure on how to do them :P Sorry. Im not sure of what we should use in the event we need to create a trial balance.

Date

Particulars

SERVICE INCOME F Debit

Date 2010 May 15

Particulars Billed a customer for work done

Accnt No. 7 Credit P 18 000

J1

II. REVIEW OF CURRENT AND NON-CURRENT ACCOUNTS Current Assets Cash/cash equivalents o Cash on hand o Cash in bank o Cash equivalents Financial assets at fair value through profit or loss (investment in trading securities) o Stocks and bonds that are held for a short term duration Trade and other receivables o Trade receivables (notes, accounts) o Other receivables (interest, rent) o Allowance for doubtful accounts Inventories o Represents the stock of goods available for sale Prepaid expenses Allowance for bad debts (contra account) Non-current Assets Property, plant and equipment o Used for production of supply of goods and services, for rental to others, or for administrative purposes o Expected to be used during more than one period Long-term investments Intangible assets Accumulated depreciation for non-current assets Other non-current assets Current Liabilities Trade and other payables o Accounts payable, notes payable, interest payable, salaries payable Current portion of long term debt o Partial portion of a long-term debt which is due within twelve months after the reporting period Accrued expenses Unearned revenue to be paid within the year Non-current liabilities Notes payable (long term) Mortgage payable Bonds payable o Usually from five to ten years supported by a formal contract

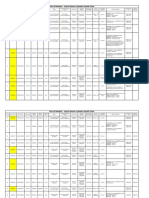

EXERCISE 4-3 Computations of Financial Statements Component Particulars Accounts Payable Accounts Receivable Accrued Expenses Accrued Income Accumulated Depreciation Equipment Accumulated Depreciation Furniture Accumulated Depreciation Office Building Allowance for Bad Debts Bonds Payable Cash in Bank Cash on Hand Equipment Furniture Interest Payable Interest Receivable Land Mortgage Payable Notes Payable (due after 15 months) Notes Payable (due after 6 months) Notes Receivable Office Building Prepaid Insurance Prepaid Rent Prepaid Supplies Unearned Income TOTAL CA TOTAL NCA TOTAL ASSETS TOTAL CL TOTAL NCL TOTAL LIABILITIES OWNERS EQUITY (A L) Classification CL CA CL CA NCA (-) NCA (-) NCA (-) CA (-) NCL CA CA NCA NCA CL CA NCA NCL NCL CL CA NCA CA CA CA CL Amount P 63 200 74 100 20 300 5 000 20 000 10 000 60 000 42 000 1 500 000 280 000 35 000 175 000 96 000 8 400 17 000 1 500 000 600 000 45 000 90 000 75 000 1 820 000 15 000 56 000 7 000 36 000 P 522 100 3 501 000 P 4 023 100 P 217 900 2 145 000 P 2 362 900 P 1 660 200

REMINDERS: Do not forget to bring the ff: o CALCULATOR o 2-column and 10-column worksheets In presenting your computations, make sure you solve it VERTICALLY. Please dont rely on this reviewer alone! This is just a summarized version of the PowerPoint with added examples and such Good luck!

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Conslaw ReviewerDocument44 pagesConslaw ReviewerMia Santos100% (2)

- DLP in Health 4Document15 pagesDLP in Health 4Nina Claire Bustamante100% (1)

- Philippine Coastal Management Guidebook Series No. 8Document182 pagesPhilippine Coastal Management Guidebook Series No. 8Carl100% (1)

- LBYMATB Q1 ReviewerDocument2 pagesLBYMATB Q1 ReviewerMia SantosNo ratings yet

- Tredone Finals ReviewerDocument3 pagesTredone Finals ReviewerMia SantosNo ratings yet

- Scimatb Q1 ReviewerDocument2 pagesScimatb Q1 ReviewerMia SantosNo ratings yet

- Econone Long Exam 1 ReviewerDocument2 pagesEconone Long Exam 1 ReviewerMia SantosNo ratings yet

- Scimatb Block1 ReviewerDocument5 pagesScimatb Block1 ReviewerMia Santos100% (1)

- Scimatb Q1 ReviewerDocument2 pagesScimatb Q1 ReviewerMia SantosNo ratings yet

- Acctba2 Notes 15 January 2013Document1 pageAcctba2 Notes 15 January 2013Mia SantosNo ratings yet

- Acctba q1 ReviewerDocument4 pagesAcctba q1 ReviewerMia SantosNo ratings yet

- Brochure 6Document2 pagesBrochure 6Mia SantosNo ratings yet

- Service and Maintenance Manual: Models 600A 600AJDocument342 pagesService and Maintenance Manual: Models 600A 600AJHari Hara SuthanNo ratings yet

- 5054 w11 QP 11Document20 pages5054 w11 QP 11mstudy123456No ratings yet

- MID TERM Question Paper SETTLEMENT PLANNING - SEC CDocument1 pageMID TERM Question Paper SETTLEMENT PLANNING - SEC CSHASHWAT GUPTANo ratings yet

- NAT Order of Operations 82Document39 pagesNAT Order of Operations 82Kike PadillaNo ratings yet

- Web Api PDFDocument164 pagesWeb Api PDFnazishNo ratings yet

- MBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorDocument20 pagesMBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorPooja GodiyalNo ratings yet

- Olympics Notes by Yousuf Jalal - PDF Version 1Document13 pagesOlympics Notes by Yousuf Jalal - PDF Version 1saad jahangirNo ratings yet

- Chennai Metro Rail BoQ for Tunnel WorksDocument6 pagesChennai Metro Rail BoQ for Tunnel WorksDEBASIS BARMANNo ratings yet

- Logic and Set Theory PropositionDocument3 pagesLogic and Set Theory PropositionVince OjedaNo ratings yet

- Table of Specification for Pig Farming SkillsDocument7 pagesTable of Specification for Pig Farming SkillsYeng YengNo ratings yet

- Fernandez ArmestoDocument10 pagesFernandez Armestosrodriguezlorenzo3288No ratings yet

- Audit Acq Pay Cycle & InventoryDocument39 pagesAudit Acq Pay Cycle & InventoryVianney Claire RabeNo ratings yet

- Exercises2 SolutionsDocument7 pagesExercises2 Solutionspedroagv08No ratings yet

- Exercises 6 Workshops 9001 - WBP1Document1 pageExercises 6 Workshops 9001 - WBP1rameshqcNo ratings yet

- Unit 1 TQM NotesDocument26 pagesUnit 1 TQM NotesHarishNo ratings yet

- Cushman Wakefield - PDS India Capability Profile.Document37 pagesCushman Wakefield - PDS India Capability Profile.nafis haiderNo ratings yet

- KPMG Inpection ReportDocument11 pagesKPMG Inpection ReportMacharia NgunjiriNo ratings yet

- Bluetooth TutorialDocument349 pagesBluetooth Tutorialjohn bougsNo ratings yet

- Maj. Terry McBurney IndictedDocument8 pagesMaj. Terry McBurney IndictedUSA TODAY NetworkNo ratings yet

- ServiceDocument47 pagesServiceMarko KoširNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- 8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemDocument13 pages8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemSatish JadhaoNo ratings yet

- Agricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsDocument84 pagesAgricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsRachel vNo ratings yet

- Data Sheet: Experiment 5: Factors Affecting Reaction RateDocument4 pagesData Sheet: Experiment 5: Factors Affecting Reaction Ratesmuyet lêNo ratings yet

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDocument22 pagesStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasNo ratings yet

- C6030 BrochureDocument2 pagesC6030 Brochureibraheem aboyadakNo ratings yet

- Bharhut Stupa Toraa Architectural SplenDocument65 pagesBharhut Stupa Toraa Architectural Splenအသွ်င္ ေကသရNo ratings yet

- Assignment 2 - Weather DerivativeDocument8 pagesAssignment 2 - Weather DerivativeBrow SimonNo ratings yet