Professional Documents

Culture Documents

Projects & Technology: Intangible Assets 4,521 5,039 5,356 5,021 5,366

Uploaded by

Hafiz Zeeshan ZeeshanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Projects & Technology: Intangible Assets 4,521 5,039 5,356 5,021 5,366

Uploaded by

Hafiz Zeeshan ZeeshanCopyright:

Available Formats

Projects & Technology

1 of 6

The delivery of Shells strategic objectives depends on its capability to build large and complex

projects reliably and safely, on time and on budget. The Projects & Technology (P&T) organisation

has that capability. It executes projects and provides a range of technical services in both Upstream

and Downstream. It also drives the research and innovation to create the technology that will be

needed in the future. Furthermore, it provides functional leadership in contracting and procurement

as well as in safety. In total, more than 8,000 people work in P&T, of whom roughly 600 have PhDs.

Consolidated Balance Sheet

Download XLS

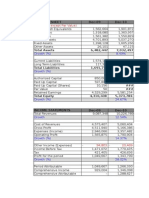

CONSOLIDATED BALANCE SHEET (AT DECEMBER 31)

2011

2010

2009

2008

$ MILLION

2007

[A] In March 2007, Shell acquired the non-controlling interests in Shell Canada for a cash consideration of $7.1 billion.

This was reflected as a decrease in non-controlling interest and in retained earnings of $1,639 million and

$5,445 million respectively. In April 2007, Shell sold half of its interest in Sakhalin 2 for $4.1 billion reducing its

interest from 55% to 27.5%. As a result of this transaction, Sakhalin 2 has been accounted for as an associated

company rather than as a subsidiary with effect from April 2007. The main impact on the Consolidated Balance Sheet

was a decrease of $15.7 billion in property, plant and equipment and $6.7 billion in non-controlling interest, and an

increase in equity-accounted investments of $3.7 billion.

Assets

Non-current assets

Intangible assets

Property, plant and equipment

Upstream

Downstream

Corporate

Equity-accounted investments

Investments in securities

Deferred tax

Pre-paid pension costs

Trade and other receivables

Current assets

Inventories

Accounts receivable

Cash and cash equivalents

Total assets

Liabilities

Non-current liabilities

Debt

Trade and other payables

Deferred tax

Retirement benefit obligations

Decommissioning and other

provisions

4,521

152,081

119,789

31,467

825

37,990

5,492

4,732

11,408

9,256

225,480

5,039

142,705

109,677

32,205

823

33,414

3,809

5,361

10,368

8,970

209,666

5,356

131,619

97,208

33,513

898

31,175

3,874

4,533

10,009

9,158

195,724

5,021

112,038

80,302

30,876

860

28,327

4,065

3,418

6,198

6,764

165,831

5,366

101,521[A]

68,493

31,945

1,083

29,153[A]

3,461

3,253

5,559

5,760

154,073

28,976

79,509

11,292

119,777

345,257

29,348

70,102

13,444

112,894

322,560

27,410

59,328

9,719

96,457

292,181

19,342

82,040

15,188

116,570

282,401

31,503

74,238

9,656

115,397

269,470

30,463

4,921

14,649

5,931

34,381

4,250

13,388

5,924

30,862

4,586

13,838

5,923

13,772

3,677

12,518

5,469

12,363

3,893

13,039

6,165

15,631

14,285

14,048

12,570

13,658

CONSOLIDATED BALANCE SHEET (AT DECEMBER 31)

Current liabilities

Debt

Trade and other payables

Taxes payable

Retirement benefit obligations

Decommissioning and other

provisions

Total liabilities

Equity

Share capital

Shares held in trust

Other reserves

Retained earnings

Equity attributable to

Royal Dutch Shell plc

shareholders

Non-controlling interest

Total equity

Total liabilities and equity

2011

2010

2009

2008

$ MILLION

2007

71,595

72,228

69,257

48,006

49,118

6,712

81,846

10,606

387

9,951

76,550

10,306

377

4,171

67,161

9,189

461

9,497

85,091

8,107

383

5,736

75,697

9,733

426

3,108

102,659

174,254

3,368

100,552

172,780

3,807

84,789

154,046

2,451

105,529

153,535

2,792

94,384

143,502

536

(2,990)

8,984

162,987

529

(2,789)

10,094

140,179

527

(1,711)

9,982

127,633

527

(1,867)

3,178

125,447

536

(2,392)

14,148

111,668[A]

169,517

1,486

171,003

345,257

148,013

1,767

149,780

322,560

136,431

1,704

138,135

292,181

127,285

1,581

128,866

282,401

123,960

2,008[A]

125,968

269,470

Financial ratios

Download XLS

FINANCIAL RATIOS

2011 2010 2009 2008 2007

Return on average capital employed

Income for the period adjusted for interest expense,

less tax for the period, as % of the average

capital employed

Return on sales

Income attributable to Royal Dutch Shell plc

shareholders plus non-controlling interest as %

of sales proceeds (including sales taxes, etc.)

Return on equity

Income attributable to Royal Dutch Shell plc

shareholders as % of average net assets (i.e. equity

attributable to Royal Dutch Shell plc shareholders and non-controlling

interest)

Current ratio

Current assets : current liabilities

Long-term debt ratio

Non-current debt as % of capital employed

less current debt

Total debt ratio

Non-current debt plus current debt

as % of capital employed

Gearing ratio at December 31

Net debt as % of total capital

15.9 11.5

5.6

4.6

19.3 14.0

1.2

1.1

8.0 18.3 23.7

3.5

4.8

7.3

9.4 20.6 26.0

1.1

1.1

1.2

15.1 18.7 18.3

9.7

8.9

17.9 22.8 20.2 15.3 12.6

13.1 17.1 15.5

5.9

6.3

Earnings per share

Download XLS

EARNINGS PER SHARE

Basic earnings per share

Diluted earnings per share

$

2007

2011

2010

2009

2008

4.98

4.97

3.28

3.28

2.04

2.04

4.27 5.00

4.26 4.99

EARNINGS PER SHARE

2011

2010

2009

2008

$

2007

Download XLS

SHARES

Basic weighted average number

of Class A and B shares

Diluted weighted average number

of Class A and B shares

Shares outstanding at the end

of the period

2011

2010

2009

2008

MILLION

2007

6,212.5

6,132.6

6,124.9

6,159.1

6,263.8

6,221.7

6,139.3

6,128.9

6,171.5

6,283.8

6,220.1

6,154.2

6,122.3

6,121.7

6,210.4

You might also like

- Fame Export 1Document42 pagesFame Export 1sharedcaveNo ratings yet

- B. LiabilitiesDocument1 pageB. LiabilitiesSamuel OnyumaNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- FY2011 ResultsDocument1 pageFY2011 ResultsSantosh VaishyaNo ratings yet

- BALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityDocument20 pagesBALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityAitzaz AliNo ratings yet

- Mughal SteelDocument81 pagesMughal SteelFahad MughalNo ratings yet

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- ICI Pakistan Limited: Balance SheetDocument28 pagesICI Pakistan Limited: Balance SheetArsalan KhanNo ratings yet

- Neutral Patel Engineering: Performance HighlightsDocument10 pagesNeutral Patel Engineering: Performance HighlightsAngel BrokingNo ratings yet

- Airthread Connections NidaDocument15 pagesAirthread Connections NidaNidaParveen100% (1)

- Reports 6Document18 pagesReports 6Asad ZamanNo ratings yet

- Tat Hong Research 26 AprDocument4 pagesTat Hong Research 26 AprmervynteoNo ratings yet

- Financial Highlights 2011-2012Document1 pageFinancial Highlights 2011-2012cdcrotaerNo ratings yet

- Infosys Consolidated Financial Statements ReviewDocument13 pagesInfosys Consolidated Financial Statements ReviewLalith RajuNo ratings yet

- New Look Retail Group Limited profile with financialsDocument16 pagesNew Look Retail Group Limited profile with financialsSeine LaNo ratings yet

- Analyze Dell's FinancialsDocument18 pagesAnalyze Dell's FinancialsSaema JessyNo ratings yet

- Desco Final Account AnalysisDocument26 pagesDesco Final Account AnalysiskmsakibNo ratings yet

- Keppel Corp upgraded to Buy on increased confidence in executionDocument5 pagesKeppel Corp upgraded to Buy on increased confidence in executiontansillyNo ratings yet

- Case Solution - A New Financial Policy at Swedish Match - ANIDocument20 pagesCase Solution - A New Financial Policy at Swedish Match - ANIAnisha Goyal33% (3)

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohNo ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- Ceres Gardening CalculationsDocument11 pagesCeres Gardening CalculationsOwaisKhan75% (4)

- Fauji Fertilizer Limited Financial Performance Analysis 2013-2011Document92 pagesFauji Fertilizer Limited Financial Performance Analysis 2013-2011JunaidNo ratings yet

- IRRI AR 2013 Audited Financial StatementsDocument62 pagesIRRI AR 2013 Audited Financial StatementsIRRI_resourcesNo ratings yet

- (Million RP Except Par Value) : Balance Sheet Dec-09 Dec-10Document4 pages(Million RP Except Par Value) : Balance Sheet Dec-09 Dec-10Yulia SasmitaNo ratings yet

- ITC Affect On CompanyDocument10 pagesITC Affect On CompanynavpreetsinghkNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- Ittehad ChemicalsDocument50 pagesIttehad ChemicalsAlizey AhmadNo ratings yet

- MME 3113 Assignment #2 Financial Ratios & Cash FlowDocument8 pagesMME 3113 Assignment #2 Financial Ratios & Cash FlowAnisha ShafikhaNo ratings yet

- Financial Statement Analysis and Strategic Analysis of Dell 121223094730 Phpapp02Document21 pagesFinancial Statement Analysis and Strategic Analysis of Dell 121223094730 Phpapp02Ahmed ZidanNo ratings yet

- Din Textile Limited ProjDocument34 pagesDin Textile Limited ProjTaiba Akhlaq0% (1)

- Balance sheet and cash flow analysisDocument1,832 pagesBalance sheet and cash flow analysisjadhavshankar100% (1)

- KEC International: Key Management TakeawaysDocument8 pagesKEC International: Key Management TakeawaysAngel BrokingNo ratings yet

- Starhill Global REIT Ending 1Q14 On High NoteDocument6 pagesStarhill Global REIT Ending 1Q14 On High NoteventriaNo ratings yet

- Netsole Technologies Investment ReportDocument19 pagesNetsole Technologies Investment ReportAli GulzarNo ratings yet

- Financial Position of The Engro FoodsDocument2 pagesFinancial Position of The Engro FoodsJaveriarehanNo ratings yet

- 3Q14 CIMB Group Financial Statements PDFDocument50 pages3Q14 CIMB Group Financial Statements PDFleong2007No ratings yet

- Income StatementDocument2 pagesIncome StatementharisbukhariNo ratings yet

- Vertical and Horizontal Analysis of PidiliteDocument12 pagesVertical and Horizontal Analysis of PidiliteAnuj AgarwalNo ratings yet

- SIEMENS Analysis of Financial StatementDocument16 pagesSIEMENS Analysis of Financial StatementNeelofar Saeed100% (1)

- Airthread WorksheetDocument21 pagesAirthread Worksheetabhikothari3085% (13)

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodNo ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- InfraDocument11 pagesInfrakdoshi23No ratings yet

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Document11 pagesProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniNo ratings yet

- MCB Bank Limited Consolidated Financial Statements SummaryDocument93 pagesMCB Bank Limited Consolidated Financial Statements SummaryUmair NasirNo ratings yet

- Cisco - Balance Sheeet Vertical AnalysisDocument8 pagesCisco - Balance Sheeet Vertical AnalysisSameh Ahmed Hassan0% (1)

- DFS December 2009 AnswersDocument12 pagesDFS December 2009 AnswersPhilemon N.MalingaNo ratings yet

- Projection of BalboaDocument7 pagesProjection of Balboapradip_kumarNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Beneish M ScoreDocument1 pageBeneish M Scoremidnightsnack09No ratings yet

- Financial Report of Construction CompanyDocument5 pagesFinancial Report of Construction Companypawan_aggarwal_22No ratings yet

- Rashtriya Ispat Nigam Ltd. Balance Sheet and Profit & Loss DetailsDocument2 pagesRashtriya Ispat Nigam Ltd. Balance Sheet and Profit & Loss DetailsRavi ChandNo ratings yet

- Ratio Analysis Tata MotorsDocument8 pagesRatio Analysis Tata Motorssadafkhan21No ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- IT-Driven Business Models: Global Case Studies in TransformationFrom EverandIT-Driven Business Models: Global Case Studies in TransformationNo ratings yet

- Goals-Based Wealth Management: An Integrated and Practical Approach to Changing the Structure of Wealth Advisory PracticesFrom EverandGoals-Based Wealth Management: An Integrated and Practical Approach to Changing the Structure of Wealth Advisory PracticesNo ratings yet

- Projects & Technology: Intangible Assets 4,521 5,039 5,356 5,021 5,366Document3 pagesProjects & Technology: Intangible Assets 4,521 5,039 5,356 5,021 5,366Hafiz Zeeshan ZeeshanNo ratings yet

- ValuationDocument9 pagesValuationHafiz Zeeshan ZeeshanNo ratings yet

- Projects & Technology: Intangible Assets 4,521 5,039 5,356 5,021 5,366Document3 pagesProjects & Technology: Intangible Assets 4,521 5,039 5,356 5,021 5,366Hafiz Zeeshan ZeeshanNo ratings yet

- Stampa Stampa: Italian (Printing Press)Document29 pagesStampa Stampa: Italian (Printing Press)Hafiz Zeeshan ZeeshanNo ratings yet

- AIS Prelim ExamDocument4 pagesAIS Prelim Examsharielles /No ratings yet

- IAS 33 Earnings Per Share: ImportanceDocument8 pagesIAS 33 Earnings Per Share: Importancemusic niNo ratings yet

- Short Iron Condor Spread - FidelityDocument8 pagesShort Iron Condor Spread - FidelityanalystbankNo ratings yet

- KijamiiDocument16 pagesKijamiiRawan AshrafNo ratings yet

- 2016 QP Paper 1 PDFDocument16 pages2016 QP Paper 1 PDFAfra SadafNo ratings yet

- Volkswagen AG PresentationDocument29 pagesVolkswagen AG PresentationBilly DuckNo ratings yet

- Traffic Growth Rate EstimationDocument6 pagesTraffic Growth Rate Estimationmanu1357No ratings yet

- Ass6 10Document1 pageAss6 10Kath LeynesNo ratings yet

- (Marketing Management ENEMBA-KESDM) Finaltest - MUHAMAD FUDOLAHDocument6 pages(Marketing Management ENEMBA-KESDM) Finaltest - MUHAMAD FUDOLAHMuhamad FudolahNo ratings yet

- BUS 1103 Learning Journal Unit 1Document2 pagesBUS 1103 Learning Journal Unit 1talk2tomaNo ratings yet

- Cephas Thesis FinalDocument53 pagesCephas Thesis FinalEze Ukaegbu100% (1)

- MaheshkhaliDocument4 pagesMaheshkhalimail2ferdoushaqNo ratings yet

- Murimi Betty M - Factors Affecting The Success of Start Up of Youth Enterprises in Nairobi County, KenyaDocument82 pagesMurimi Betty M - Factors Affecting The Success of Start Up of Youth Enterprises in Nairobi County, KenyaSteven OchiengNo ratings yet

- Factors Affecting Adoption of Electronic Banking System in Ethiopian Banking IndustryDocument17 pagesFactors Affecting Adoption of Electronic Banking System in Ethiopian Banking IndustryaleneNo ratings yet

- LCG LCPharma EN 160421Document11 pagesLCG LCPharma EN 160421Patrick MontegrandiNo ratings yet

- Job Desc - Packaging Dev. SpecialistDocument2 pagesJob Desc - Packaging Dev. SpecialistAmirCysers100% (1)

- Jun 2004 - Qns Mod BDocument13 pagesJun 2004 - Qns Mod BHubbak Khan100% (1)

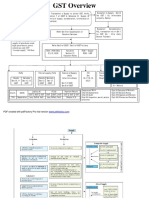

- GST OverviewDocument17 pagesGST Overviewprince2venkatNo ratings yet

- Chapter 9 Saving, Investment and The Financial SystemDocument24 pagesChapter 9 Saving, Investment and The Financial SystemPhan Minh Hiền NguyễnNo ratings yet

- Retail MCQ ModuleDocument19 pagesRetail MCQ ModuleBattina AbhisekNo ratings yet

- Global Business PlanDocument47 pagesGlobal Business PlanMay Hnin WaiNo ratings yet

- Eighth Plan EngDocument419 pagesEighth Plan EngMurahari ParajuliNo ratings yet

- Far-1 Revaluation JE 2Document2 pagesFar-1 Revaluation JE 2Janie HookeNo ratings yet

- General Information SheetDocument6 pagesGeneral Information SheetInnoKal100% (2)

- Calculate Car Interest RatesDocument1 pageCalculate Car Interest RatesKevinNo ratings yet

- Finlatics Investment Banking Experience Program Project 2Document6 pagesFinlatics Investment Banking Experience Program Project 2Aaisha ShahNo ratings yet

- India's Power Sector: Ambitious Goals and Massive Investment NeedsDocument20 pagesIndia's Power Sector: Ambitious Goals and Massive Investment Needsyadavmihir63No ratings yet

- Executive Order No. 398: DteiacDocument2 pagesExecutive Order No. 398: DteiacDanNo ratings yet

- Gold Sporting Equipment Gse Is in The Process of PreparingDocument2 pagesGold Sporting Equipment Gse Is in The Process of PreparingAmit PandeyNo ratings yet