Professional Documents

Culture Documents

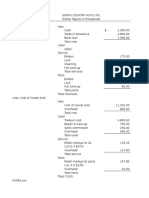

Income Statement 1

Uploaded by

Mhaye AguinaldoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Statement 1

Uploaded by

Mhaye AguinaldoCopyright:

Available Formats

2nd Flr, GF Partners Bldg, 139 H.V. dela Costa, Salcedo Village, Makati City 3 Flr.

Equitable PCI Building, 2070 Claro M. Recto ,Manila Tel.7348895/7349198

rd

Practical Accounting 1

Income Statement Part I 1.

Prof. Rommel M. Valdez

The following items were among those that were reported on Cyprus Co.s income statement for the year ended December 31, 2004: Legal and audit fees P170,000 Rent for office space 240,000 Interest on acceptances payable 210,000 Loss on abandoned data processing equipment used in operations 35,000 The office space is used equally by Cyprus sales and accounting departments. What amount of the above items should be classified as general and administrative expenses in Cyprus income statement? a. P500,000 c. P410,000 b. P290,000 d. P325,000

2.

Information concerning the first month of operations of Avon is presented below. (The periodic inventory system is used.) Transportation-in P 760 Total purchases on account 22,200 Purchase returns on account 700 Transportation-out 810 Total recorded as cash purchases 9,140 Purchase allowances on account 1,350 Inventory at the end of the month 4,800 Sales discounts 750 Refunds for defective items purchased for cash 400 Error made by bookkeeper debiting supplies expense for cash purchase of merchandise 790 The correct cost of goods sold is a. P16,110 b. P24,890 c. P25,640 d. P26,450 The Do It Corporation presented the following income statement and statement of retained earnings for the year ended December 31, 2004 as developed by its bookkeeper who has completed 12 units of accounting. Do It Corporation Revenue Statement December 31, 2004 Net sales P 390,000 Less: Dividends declared (P3.50 per common shares) 15,000 Revenues P 375,000 Less: Selling expenses 41,600 Gross profit P333,400 Less: Operating expenses Interest expense 8,200 Cost of goods sold 227,400 Provision for income taxes 23,920 Net operating income P 83,880 Add: Dividend revenue 3,600 General and administrative expenses 48,600

3.

P1 Net income

Income Statement Part 1

Page 2 P 28,880

Retained Earnings Statement December 31, 2004 Beginning retained earnings Add: Net income Adjusted retained earnings Less: Loss on sale of land Ending retained earnings The corrected net income after taxes is a. P44,000 b. P39,000 4.

P116,000 28,880 P144,880 8,000 P136,880 c. P34,000 d. P35,880

Augusta Co.s trial balance of income statement accounts for the year ended December 31, 2004 showed the following: Debit Credit Sales P1,150,000 Cost of sales P480,000 Administrative expenses 140,000 Loss on sale of equipment 20,000 Sales commissions 100,000 Interest income 50,000 Freight out 30,000 Loss on early retirement of long-term debt 40,000 Uncollectible accounts expense 30,000 _____________ _____________ P840,000 P1,200,000 Other information Finished goods inventory: January 1, 2004 800,000 December 31, 2004 720,000 Augustas income tax rate is 35%. In Augustas 2004 income statement, what amount should Augusta report as the cost of goods manufactured? a. P560,000 b. P430,000 c. P590,000 d. P400,000

5.

You are given the data as follows for CHIN UP CORP.: Net assets at the beginning of the year Net assets at the end of the year Dividends declared Capital stock issued The net income (loss) is a. P45,000 b. P36,000 c. P44,000

P130,000 175,000 8,000 7,000 d. P46,000

6.

Brandon Co.s accounting records for the year ended December 31, 2003 included the following information: Work in process inventory increase P0 Finished goods inventory increase 70,000 Raw materials purchases 860,000 Raw materials inventory decrease 30,000 Freight-out 90,000 Direct labor 400,000 Manufacturing overhead 600,000

P1

Income Statement Part 1 Cost of goods sold of Brandon for 2003 is: a. P1,910,000 b. P1,900,000 c. P1,820,000

Page 3 d. P1,790,000

7. The following information is given for Mint Company: Freight-in P2,000; Purchase returns P3,000; Selling expenses P150,000; Ending inventory P80,000. The cost of goods sold is equal to 800% of selling expenses. What is the cost of goods available for sale? a. P1,200,000 b. P1,205,000 8. c. P1,275,000 d. P1,280,000

The following information for the Lilac Company for the year 2003: Gross profit on sales Cost of goods manufactured Goods in process inventory, beginning Goods in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending P 76,800 272,000 22,400 30,400 36,000 41,600 d. P348,800

How much was the sales of Lilac Company for the year 2003? a. P335,200 b. P343,200 c. P347,200

9. After the initial year of operations, the Beige Company had the following data in its operating results: Net income is P750,000. Selling expenses are 12.5% of sales and also equal to 25% of cost of goods sold. Administrative expenses and other expenses are 17.5% and 5% of sales, respectively. What is Beiges gross profit for the year? a. P5,000,000 b. P2,500,000 c. P1,750,000 d. P750,000

10. The net sales of Ping Mfg. Company in 2003 is P5,800,000. The cost of goods manufactured is P4,800,000. The beginning inventories of Goods in Process and Finished Goods are P820,000 and P650,000, respectively. The ending inventories are: Goods in Process P750,000; Finished Goods P550,000. The selling expenses and general and administrative expenses are 5% and 2.5% of cost of sales, respectively. What is Pinks net income for the year 2003? a. P900,000 b. P457,250 c. P532,500 d. P830,000

11. Net income of Silver Company for the year ended December 31, 2003 was P480,000. Percentage distribution of some of the items in the income statement was as follows: Selling expenses 10% of sales; Administrative Expenses, excluding bad debts 15% of sales (also equal to 25% of cost of sales); Bad debts Expenses 3% of sales. What was the amount of Silver Companys sales during 2003? a. P1,920,000 b. P3,200,000 c. P4,000,000 12. d. P4,800,000

The factory accounts of Silang Corp. for the year ended December 31, 2003 were gathered: Manufacturing cost totaled P900,000; cost of goods manufactured was P800,000, of which factory overhead was 75% of direct labor. Overhead was 25% of total manufacturing cost. Beginning work-in-process inventory January 1, 2003 was 60% of ending work-inprocess inventory, December 31, 2003. Manufacturing costs for the year ended December 31, 2003 submitted to you by the factory accountant was as follows: Raw material used P375,000

P1 Direct labor Factory overhead Total

Income Statement Part 1 300,000 225,000 P900,000

Page 4

Assuming cost percentage relationships as stated are correct. . Work-in-process at December 31, 2003 was: a. P200,000 c. P250,000 b. P225,000 d. P275,000

For questions 13 15: The 2003 operations of Ecru Company resulted in the following: Cost of goods sold amounted to P3,500,000. The beginning inventory is P500,000 greater than the ending inventory, the latter being equivalent to 20% of purchases during the period. Gross profit of the company is 30% of net sales. Total operating expense amounted to 60% of the gross profit while sales returns and allowances amounted to 2% of net sales. The company is subject to income tax rate of 35%. 13. 14. 15. What was the companys net sales for the period? a. P3,500,000 b. P4,100,000 c. P5,000,000 What was the amount of net income after income tax? a. P210,000 b. P390,000 c. P600,000 What was the total purchases for the period? a. P600,000 b. P1,100,000 c. P3,000,000 d. P5,100,000 d. P900,000 d. P4,100,000

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Correction of ErrorsDocument6 pagesCorrection of ErrorsJanjielyn MoralesNo ratings yet

- 37 - Income StatementDocument2 pages37 - Income StatementROMAR A. PIGANo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- Problem Set Ch09 and Solutions'Document5 pagesProblem Set Ch09 and Solutions'ChelseyNo ratings yet

- Solman PortoDocument26 pagesSolman PortoYusuf Raharja0% (1)

- Bonds Payable by J. GonzalesDocument7 pagesBonds Payable by J. GonzalesGonzales JhayVeeNo ratings yet

- At.2507 Understanding The Entity and Its EnvironmentDocument26 pagesAt.2507 Understanding The Entity and Its Environmentawesome bloggersNo ratings yet

- Cash and Accrual Discussion301302Document2 pagesCash and Accrual Discussion301302Gloria BeltranNo ratings yet

- 08 Audit of InvestmentsDocument10 pages08 Audit of InvestmentsAryando Mocali TampubolonNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionDocument5 pagesComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionSyed Tirmizi0% (1)

- Beams10e Ch07 Intercompany Profit Transactions BondsDocument25 pagesBeams10e Ch07 Intercompany Profit Transactions BondsLeini TanNo ratings yet

- MQ1Document8 pagesMQ1alellieNo ratings yet

- Accounting For LaborDocument43 pagesAccounting For LaborAmy Spencer100% (1)

- Adv 1 - Dept 2010Document16 pagesAdv 1 - Dept 2010Aldrin100% (1)

- ACCT 201 Exam 1Document16 pagesACCT 201 Exam 1Steve ZaluchaNo ratings yet

- Cash and Accrual BasisDocument2 pagesCash and Accrual Basisviji9999No ratings yet

- University of Perpetual Help System DaltaDocument9 pagesUniversity of Perpetual Help System DaltaJeanette LampitocNo ratings yet

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- Administrative Office ManagementDocument44 pagesAdministrative Office ManagementLea VenturozoNo ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1Jan ryanNo ratings yet

- ACCTG 33 - Understanding Audit Clients & Their EnvironmentsDocument3 pagesACCTG 33 - Understanding Audit Clients & Their EnvironmentsAlain CopperNo ratings yet

- JV ProbDocument3 pagesJV ProbShara ValleserNo ratings yet

- Audit Sampling For Substantive TestsDocument2 pagesAudit Sampling For Substantive TestsAlaine Doble CPANo ratings yet

- Partnership Formation and Capital Adjustment CasesDocument3 pagesPartnership Formation and Capital Adjustment CasesAlfred DalaganNo ratings yet

- Quiz BeeDocument15 pagesQuiz Beejoshua100% (1)

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanNo ratings yet

- AnswerDocument21 pagesAnswerStephanie EspalabraNo ratings yet

- Acct11 2hwDocument4 pagesAcct11 2hwRonald James Siruno MonisNo ratings yet

- Walker Books Bab 4Document7 pagesWalker Books Bab 4Nuraeni Alti RunaNo ratings yet

- Conceptual Framework and Accounting StandardsDocument3 pagesConceptual Framework and Accounting StandardsGenena QuitasolNo ratings yet

- Fundamentals of Accounting Practice QuestionsDocument17 pagesFundamentals of Accounting Practice QuestionsKimberly MilanteNo ratings yet

- Estate Tax Guide for PhilippinesDocument50 pagesEstate Tax Guide for PhilippinesLea JoaquinNo ratings yet

- #5 Forex Transactions PDFDocument9 pages#5 Forex Transactions PDFJohn Mahatma AgripaNo ratings yet

- AFAR Problem MCQDocument45 pagesAFAR Problem MCQGJames ApostolNo ratings yet

- Periodic inventory system purchase and sale of merchandiseDocument4 pagesPeriodic inventory system purchase and sale of merchandiseDerick FloresNo ratings yet

- PAS 11: Long-term construction contractsDocument5 pagesPAS 11: Long-term construction contractsLester John Mendi0% (1)

- Fair ValueDocument8 pagesFair Valueiceman2167No ratings yet

- Final Preboard May 08Document21 pagesFinal Preboard May 08Ray Allen PabiteroNo ratings yet

- Which Is The Reason Why Entities Are Permitted To Change Accounting PolicyDocument1 pageWhich Is The Reason Why Entities Are Permitted To Change Accounting PolicyCharrey Leigh FormaranNo ratings yet

- Solution To Chapter 21Document25 pagesSolution To Chapter 21Sy Him100% (5)

- CPA Review School Pre-Board ExamsDocument20 pagesCPA Review School Pre-Board ExamsCiatto SpotifyNo ratings yet

- Certified Accounting Technician Examination Advanced LevelDocument2 pagesCertified Accounting Technician Examination Advanced Levelasad27192No ratings yet

- Accounts PayableDocument5 pagesAccounts Payablesamsam9095No ratings yet

- REVENUE VS GAINS TITLE FOR PAS 18 DOCUMENTDocument40 pagesREVENUE VS GAINS TITLE FOR PAS 18 DOCUMENTjose amoresNo ratings yet

- Acc7 Perf MeasuresDocument7 pagesAcc7 Perf MeasuresZerjo CantalejoNo ratings yet

- Weston Corporation Has An Internal Audit Department Operating OuDocument2 pagesWeston Corporation Has An Internal Audit Department Operating OuAmit PandeyNo ratings yet

- BUSCOMDocument5 pagesBUSCOMGeoreyGNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingHalina ValdezNo ratings yet

- Cash and Accrual BasisDocument3 pagesCash and Accrual Basisattiva jade100% (1)

- A2 Recognition, Measurement, Valuation, and Disclosure PDFDocument7 pagesA2 Recognition, Measurement, Valuation, and Disclosure PDFbernard cruzNo ratings yet

- Taxes 4 19 PDFDocument2 pagesTaxes 4 19 PDFlana del reyNo ratings yet

- On The Dot Trading Statement of Financial Position As of December 31 2017 2016 Increase (Decrease) AmountDocument3 pagesOn The Dot Trading Statement of Financial Position As of December 31 2017 2016 Increase (Decrease) AmountRuthNo ratings yet

- Financial Accounting by ValixDocument5 pagesFinancial Accounting by Valixblahblahblue0% (1)

- CORRECTING FINANCIAL STATEMENT ERRORSDocument56 pagesCORRECTING FINANCIAL STATEMENT ERRORSKimberly Pilapil MaragañasNo ratings yet

- Ampongan Chap 1Document2 pagesAmpongan Chap 1iamjan_101No ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Seatwork Income MaDocument3 pagesSeatwork Income MaJoyce Ann Agdippa Barcelona0% (1)

- Negotiable InstrumentDocument19 pagesNegotiable InstrumentPaul Angelo 黃種 武No ratings yet

- Chapter2 Business PloicyDocument7 pagesChapter2 Business PloicyMhaye AguinaldoNo ratings yet

- Negotiable InstrumentDocument19 pagesNegotiable InstrumentPaul Angelo 黃種 武No ratings yet

- Narrative DescriptionDocument3 pagesNarrative DescriptionMhaye AguinaldoNo ratings yet

- ChecklistDocument2 pagesChecklistMhaye AguinaldoNo ratings yet

- Business PolicyDocument8 pagesBusiness PolicyMhaye AguinaldoNo ratings yet

- ChecklistDocument2 pagesChecklistMhaye AguinaldoNo ratings yet

- ch06, Accounting PrinciplesDocument66 pagesch06, Accounting PrinciplesH.R. RobinNo ratings yet

- Variable and absorption costing problemsDocument4 pagesVariable and absorption costing problemsRendyel PagariganNo ratings yet

- Corporate Reporting: Statement of Cash FlowsDocument19 pagesCorporate Reporting: Statement of Cash FlowsageoshyNo ratings yet

- A Collection of Case Studies On Financial Accounting Concepts-YJKDocument65 pagesA Collection of Case Studies On Financial Accounting Concepts-YJKJkNo ratings yet

- W7-Module Concept of Income-Part 2Document21 pagesW7-Module Concept of Income-Part 2Danica VetuzNo ratings yet

- M As99 3 02 PDFDocument52 pagesM As99 3 02 PDFPrima FadilahNo ratings yet

- Chapter 4 SolutionsDocument85 pagesChapter 4 SolutionssevtenNo ratings yet

- Question 4 Presented Below Is Information Related ...Document3 pagesQuestion 4 Presented Below Is Information Related ...gera sistaNo ratings yet

- Chapter 4 - Gross IncomeDocument9 pagesChapter 4 - Gross Incomechesca marie penarandaNo ratings yet

- BSB110 Solutions To RevisionDocument20 pagesBSB110 Solutions To RevisionSiyuan JiNo ratings yet

- Q1 Infor On NA CountyDocument2 pagesQ1 Infor On NA Countysheiji_roNo ratings yet

- This Study Resource Was: Chapter 04 TestbankDocument4 pagesThis Study Resource Was: Chapter 04 TestbankHuu LuatNo ratings yet

- Potato Chips CompanyDocument48 pagesPotato Chips Companyshani2783% (6)

- Inventory Trading SampleDocument28 pagesInventory Trading SampleRonald Victor Galarza Hermitaño0% (1)

- Hilton MA 12e Chap002Document53 pagesHilton MA 12e Chap002Vân HảiNo ratings yet

- PERMALINO - Learning Activity 12 - Short Term BudgetingDocument2 pagesPERMALINO - Learning Activity 12 - Short Term BudgetingAra Joyce PermalinoNo ratings yet

- Assignment 1Document8 pagesAssignment 1JOBNo ratings yet

- Ranjana Project Report On Inventory ManagementDocument93 pagesRanjana Project Report On Inventory Managementranjanachoubey90% (10)

- Audit of InvDocument19 pagesAudit of InvMae-shane SagayoNo ratings yet

- Test1 ReviewDocument8 pagesTest1 Reviewghsoub777No ratings yet

- Consolidated Intercompany InventoryDocument6 pagesConsolidated Intercompany InventoryYasha AthalladhiraNo ratings yet

- Berkshire Toy Case - Calculation Groupe 4 18 FevDocument9 pagesBerkshire Toy Case - Calculation Groupe 4 18 FevchandrakumaranNo ratings yet

- How to prepare a cost sheet to analyze production costsDocument23 pagesHow to prepare a cost sheet to analyze production costsShubham Saurav SSNo ratings yet

- HWChap 006Document67 pagesHWChap 006hellooceanNo ratings yet

- 9.hilton 9E Global Edition Solutions Manual Chapter08 (Exercise+problem)Document22 pages9.hilton 9E Global Edition Solutions Manual Chapter08 (Exercise+problem)Anisa VrenoziNo ratings yet

- BUS 6140 Final ProjectDocument17 pagesBUS 6140 Final ProjectBryan Moore100% (1)

- Intermediate Accounting Chapters 4,5Document24 pagesIntermediate Accounting Chapters 4,5Jonathan NavalloNo ratings yet

- FAR Practical Exercises InventoriesDocument5 pagesFAR Practical Exercises InventoriesAB Cloyd0% (1)

- Group 1 Soli Deo Gloria Business PlanDocument144 pagesGroup 1 Soli Deo Gloria Business PlanDashiel ken SantosNo ratings yet

- Cost & Management Accounting - Paper 7Document7 pagesCost & Management Accounting - Paper 7Turyamureeba JuliusNo ratings yet