Professional Documents

Culture Documents

PBOC

Uploaded by

FiDi007Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PBOC

Uploaded by

FiDi007Copyright:

Available Formats

PBOC to Control Risks, Seek Appropriate Financing Growth - Bloomberg

http://www.bloomberg.com/news/print/2012-12-29/pboc-to-control-risks...

PBOC to Control Risks, Seek Appropriate Financing Growth

By Bloomberg News - Dec 29, 2012

Chinas central bank said it will focus on controlling risks in the financial system and will seek stable and appropriate growth in aggregate financing, a measure of funding that includes loans, stock and bond sales. The Peoples Bank of China also said it will stick to a prudent monetary policy next year and try to stabilize growth, rebalance the economy and contain inflation. The four-paragraph statement released late Dec. 28 after a quarterly meeting of the monetary policy committee, mostly reiterated the stance set out at a government work conference earlier this month. The PBOCs addition of controlling risks as a policy objective may signal growing concern that a surge in non-bank lending over the past two years will lead to defaults that could trigger social unrest. Citic Trust Co., a unit of Chinas biggest state-owned investment company, said on Dec. 21 that it missed a bi-annual payment to investors in one of its wealth management products after a steel company didnt make interest payments on the underlying loan. Regulators may tighten control on the quality and quantity of credit supply, particularly through non-bank channels such as trust loans in the first half of 2013, Zhang Zhiwei, chief China economist at Nomura Holdings Inc. in Hong Kong, said in a note after the central bank report. A slowdown in credit growth would feed through to a moderation in economic expansion, he said. The central bank last year introduced aggregate financing as an indicator designed to capture broader funding sources in the economy, such money raised through trust investment products and bond and stock sales.

Reasonable Scale

The wording of stable and appropriate growth of aggregate financing in the PBOC statement differed from previous statements that referred to a reasonable scale of financing. Loans made outside the formal banking system, including funds raised through wealth management vehicles that offer higher interest rates than bank deposits, expanded at a faster pace than bank credit this year.

1 of 2

12/29/12 14:33

PBOC to Control Risks, Seek Appropriate Financing Growth - Bloomberg

http://www.bloomberg.com/news/print/2012-12-29/pboc-to-control-risks...

Local currency bank loans accounted for 45.8 percent of aggregate financing in November, down from 58.8 percent in the same month last year, according to data compiled by Bloomberg. At the same time, the share of trust loans rose to 17.5 percent from 7.5 percent. Chinas central bank is in a very delicate situation, said Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong. It wants more bank loans and greater financial support for economic growth next year, but it also has to keep a close eye on risks in the shadow banking system.

Wealth Management

Shadow banking in China refers to lending that isnt subject to the same regulation as bank loans and includes banks off-balance-sheet vehicles, such as commercial bills and entrusted loans, and wealth management products as well as underground lending by individuals. In its Dec. 28 statement, the central bank said it will use various tools to ensure steady and appropriate growth in credit and money supply and reiterated that it will push ahead with overhauling interest rates and the yuans exchange-rate system while keeping the currency basically stable. It omitted comments made in previous statements that it would increase the currencys two-way movement. Whether the PBOC explicitly said it or not, the trend toward a freer yuan exchange rate wont change, said Shen, who previously worked for the International Monetary Fund. The central bank said Chinas economy is stable and prices are basically stable, while the global economy remains relatively weak with lingering uncertainties. The statement is a summary of a meeting of the central banks monetary policy committee, an advisory body that includes academics and officials from ministries and government agencies. --Zhou Xin. With assistance from Zheng Lifei in Beijing and Helen Yuan in Shanghai. Editors: Nerys Avery, Paul Panckhurst To contact the reporter on this story: Xin Zhou in Beijing at xzhou68@bloomberg.net To contact the editor responsible for this story: Paul Panckhurst at ppanckhurst@bloomberg.net

2012 BLOOMBERG L.P. ALL RIGHTS RESERVED.

2 of 2

12/29/12 14:33

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Private EquityDocument104 pagesPrivate EquityFiDi007100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Web Bearing and Buck1ling To BS en 1993Document3 pagesWeb Bearing and Buck1ling To BS en 1993antoninoNo ratings yet

- imageRUNNER+ADVANCE+C5051-5045-5035-5030 Parts CatalogDocument268 pagesimageRUNNER+ADVANCE+C5051-5045-5035-5030 Parts CatalogDragos Burlacu100% (1)

- System Description For Use With DESIGO XWORKS 17285 HQ enDocument48 pagesSystem Description For Use With DESIGO XWORKS 17285 HQ enAnonymous US9AFTR02100% (1)

- Probabilistic Programming in Quantitative Finance Probabilistic Programming in Quantitative FinanceDocument86 pagesProbabilistic Programming in Quantitative Finance Probabilistic Programming in Quantitative FinanceFiDi007No ratings yet

- FTSE 100 Index FactsheetDocument2 pagesFTSE 100 Index FactsheetFiDi007No ratings yet

- User Guide TowerDocument90 pagesUser Guide TowerFiDi007No ratings yet

- Algorithm ReportDocument35 pagesAlgorithm ReportFiDi007No ratings yet

- GET IELTS BAND 9 SpeakingDocument54 pagesGET IELTS BAND 9 Speakingm.alizadehsaraNo ratings yet

- 02 Adaptive Tracking Control of A Nonholonomic Mobile RobotDocument7 pages02 Adaptive Tracking Control of A Nonholonomic Mobile Robotchoc_ngoayNo ratings yet

- CV HariDocument4 pagesCV HariselvaaaNo ratings yet

- WFP Situation Report On Fire in The Rohingya Refugee Camp (23.03.2021)Document2 pagesWFP Situation Report On Fire in The Rohingya Refugee Camp (23.03.2021)Wahyu RamdhanNo ratings yet

- Program 7Document6 pagesProgram 7Khushi GuptaNo ratings yet

- How To Start A Fish Ball Vending Business - Pinoy Bisnes IdeasDocument10 pagesHow To Start A Fish Ball Vending Business - Pinoy Bisnes IdeasNowellyn IncisoNo ratings yet

- PIL HANDOUT in TextDocument173 pagesPIL HANDOUT in Textbhargavi mishraNo ratings yet

- Serra Do Mel 3 A 6 - Project - VC1-ReportDocument13 pagesSerra Do Mel 3 A 6 - Project - VC1-Reportjosimar gomes da silva filhoNo ratings yet

- 001-026 Labor RevDocument64 pages001-026 Labor RevDexter GasconNo ratings yet

- DM2 0n-1abDocument6 pagesDM2 0n-1abyus11No ratings yet

- Virtual Vacancy Round 2 Mbbs - Bds Ug Counselling 20Document90 pagesVirtual Vacancy Round 2 Mbbs - Bds Ug Counselling 20Jaydev DegloorkarNo ratings yet

- Businesses ProposalDocument2 pagesBusinesses ProposalSophia Marielle MacarineNo ratings yet

- BIR Form 2307Document20 pagesBIR Form 2307Lean Isidro0% (1)

- Muji Into Denmark MarketDocument13 pagesMuji Into Denmark MarketTròn QuayyNo ratings yet

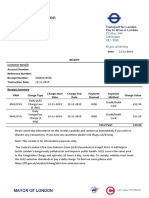

- Transport For London Pay To Drive in London: PO Box 344 Darlington Dl1 9qe TFL - Gov.uk/drivingDocument1 pageTransport For London Pay To Drive in London: PO Box 344 Darlington Dl1 9qe TFL - Gov.uk/drivingDanyy MaciucNo ratings yet

- Area & Perimeter - CRACK SSC PDFDocument10 pagesArea & Perimeter - CRACK SSC PDFSai Swaroop AttadaNo ratings yet

- Important Dates (PG Students View) Semester 1, 2022-2023 - All Campus (As of 2 October 2022)Document4 pagesImportant Dates (PG Students View) Semester 1, 2022-2023 - All Campus (As of 2 October 2022)AFHAM JAUHARI BIN ALDI (MITI)No ratings yet

- HCMA ZW370 6 Brochure - 02 - 22Document24 pagesHCMA ZW370 6 Brochure - 02 - 22Carlos Arturo AcevedoNo ratings yet

- Victory Magazine 2012 PDFDocument19 pagesVictory Magazine 2012 PDFijojlNo ratings yet

- Surname 1: Why Attend To WMO? Who Would Not Trust The Brand That Their Friends Strongly Recommend? It IsDocument4 pagesSurname 1: Why Attend To WMO? Who Would Not Trust The Brand That Their Friends Strongly Recommend? It IsNikka GadazaNo ratings yet

- Megohmmeter: User ManualDocument60 pagesMegohmmeter: User ManualFlavia LimaNo ratings yet

- Paper 1 - 2017 EETDocument10 pagesPaper 1 - 2017 EETRayNo ratings yet

- Challenges Students Face in Conducting A Literature ReviewDocument6 pagesChallenges Students Face in Conducting A Literature ReviewafdtunqhoNo ratings yet

- Steps To Control Water Depletion Jun2019Document2 pagesSteps To Control Water Depletion Jun2019chamanNo ratings yet

- Chapin Dance Syllabus 23-24Document3 pagesChapin Dance Syllabus 23-24api-231581209No ratings yet

- Digest of Agrarian From DAR WebsiteDocument261 pagesDigest of Agrarian From DAR WebsiteHuzzain PangcogaNo ratings yet

- 20091216-153551-APC Smart-UPS 1500VA USB SUA1500IDocument4 pages20091216-153551-APC Smart-UPS 1500VA USB SUA1500Ifietola1No ratings yet