Professional Documents

Culture Documents

Irish Economy Post Crisis, Not Yet Ok

Uploaded by

crosstheevilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Irish Economy Post Crisis, Not Yet Ok

Uploaded by

crosstheevilCopyright:

Available Formats

The Economist January 5th 2013 The Irish economy

Finance and economics

55

Fitter yet fragile

Denominator debate

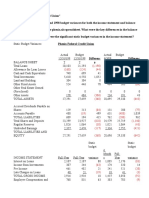

Ire land,s debt as % of:

- GNP

-GNP/GDP hybrid*

-GOP

160

Ireland,s success in attracting foreign investment has its drawbacks 2012 was of calm IFreturned tothe year when a sensemarkets, euro-zone financial 2013 will be when Europe needs to show that its recipe of austerity and reforms can work. Strong evidence for that would be if a bailed-out country could finance itself again. Hence the hopes invested in Ireland, which entered its rescue programme in

2010 and is scheduled to make a full return

maceuticals, information technology and

financial services. The number of new fdi

projects in 2012 has been similar to that in 2011, itself the highest for a decade, says Barry O'Leary, the boss of Ireland,s inward-investment agency. The foreign presence is now a towering one, so much so that Irish exports actually

exceed the value of gdp. The contribution

i-u-1

2008

09

10

11

12t

13t

Sou rce: Irish Fiscal

* GN P+0.4(GD P-GN P)

Advisory Council

tEstfmate Forecast

to the bond markets at the end of 2013.

from net trade-exports less imports-has

more than offset falls in domestic demand,

The markets seem to be signalling it can be done. Yields on Irish government bonds maturing in 2020 fell from 8.5% at the start of 2012 to 4.5% by the end of the year. Renewed appetite for Irish debt allowed the government to regain partial access to

bond markets in 2012. Ireland,s debt-man -

which remains traumatised by excessive debt (households owe 209% of disposable income), continuing austerity and a financial squeeze as the now well-capitalised

Another concern is that Irish progress, both economic and fiscal, is typically measured using gdp, the output generated within Ireland. But for an economy where foreign firms are so dominant, gnp, or the income that goes to residents, is more relevant. Irish gnp is lower than gdp because

but unprofitable Irish banks limp along.

But this brightening picture is not all

that it appears. Take Ireland>s reliance on

of the big profits made by foreign firms. The gap between the two has been widening, fromi4% in 2007 to 20% in 2011,

agement agency plans to raise 10 billion ($13.2 billion) by issuing bonds in 2013. That

will leave it with 19 billion of cash re-

That widening shortfall reflects the fact

that the Irish people have fared much

worse than the Irish economy. National

serves, sufficient to cover the government

,

s needs for 2014.

There are stirrings of life in the battered Irish economy. Although gdp is thought by the imf to have grown by only 0.4% in

2012, that compares well with deep reces-

sions in Italy and Spain and followed a

1.4%

rise in 2011. The current account has

been in surplus since 2010, Underlying

foreign firms. That gears the Irish economy to global growth SO that it suffers when world trade falters, says Simon Hayes of Barclays. Exports have been growing at only 2% a year since last spring, the slowest since they started to recover in early 2010. It also makes the economy vulnerable to shocks affecting specific sectors. Ireland,s success in attracting global drugs firms-pharmaceuticals made up half of goods exports in 2on-means that it is be-

output measured by gdp was 7% smaller

in 2011 than in 2007, whereas national in-

come measured by gnp was 11% smaller. This matters not just for living standards

but also for Ireland,s fiscal situation: it is

gnp that does the heavy lifting on the pub-

lic finances, since multinational profits are

taxedso lightly.

If measuring Ireland,s debt as a share of

competitiveness has improved sharply,

judging by unit labour costs. Helped by a low corporate-tax rate of 12.5%, Ireland continues to attract foreign direct investment (fdi), especially from American firms and particularly in phar-

ing affected by the "patent cliff", the expiry

of patents on many blockbuster drugs. In 2on the value of Irish pharmaceutical exports rose by almost 7%, but in the first ten months of 2012 it fell by 3% compared with the same period a year earlier.

gdp understates the burden, measuring it

as a share of gnp overstates it because it

neglects the contribution that foreign firms

do make to taxes. The Irish Fiscal Advisory Council, a watchdog, has suggested a hybrid measure in which 40% of the excess of

gdp over gnp is added to gnp. This offers

a better gauge of fiscal sustainability for the Irish economy, says John McHale, who

chairs the council. On this basis, the debt

burden, which is expected to peak in 2013 at around 120% of gdf, would really be

close to 140% (see chart).

3 austerity

j5 AND COMMUNITIES!

Yes to more help from Europe

E TAXES!- STOP THE CUT!

Ireland's vulnerabilities explain why the imf wants Ireland's European creditors to give it more help. In particular it advocates lightening the debt-servicing charges on promissory notes, a sort of iou, which the Irish government issued in 2010 mainly to prop up the collapsed Anglo Irish Bank. It also wants the European Stability Mechanism, a euro-zone rescue fund, to relieve Ireland's public-debt burden by taking an equity stake in banks which have had state help. A lot has gone right for Ireland (which has just begun its

six-month stint in the eu s rotating presi'

dency). But it wouldn't take much for the euro zone s model pupil to fail to graduate

'

from its rescue programme.

You might also like

- GE's Digital EvolutionDocument13 pagesGE's Digital EvolutioncrosstheevilNo ratings yet

- Greek CrisisDocument4 pagesGreek CrisiscrosstheevilNo ratings yet

- Exam Review - Question 1: T-Table F-Table 5% F-Table 2.5% Chi-Table Durbin-Watson Z-Table Z-Table Alt AcronymsDocument1 pageExam Review - Question 1: T-Table F-Table 5% F-Table 2.5% Chi-Table Durbin-Watson Z-Table Z-Table Alt AcronymscrosstheevilNo ratings yet

- How Zara Grew Into The World of FashionDocument9 pagesHow Zara Grew Into The World of FashioncrosstheevilNo ratings yet

- China Exchange PolicyDocument1 pageChina Exchange PolicycrosstheevilNo ratings yet

- Systems Thinking - Loop DiagramDocument1 pageSystems Thinking - Loop DiagramcrosstheevilNo ratings yet

- Is Your Private Company Return On Investment Adequate-How To Correctly Measure Adn Significantly Improve ROI - Long VersionDocument12 pagesIs Your Private Company Return On Investment Adequate-How To Correctly Measure Adn Significantly Improve ROI - Long Versionsakron100% (1)

- Acer Globalisation ProcessDocument10 pagesAcer Globalisation ProcesscrosstheevilNo ratings yet

- 31 Practice Statistics Test Hypothesis TestingDocument17 pages31 Practice Statistics Test Hypothesis TestingcrosstheevilNo ratings yet

- Average and MarginalDocument2 pagesAverage and MarginalcrosstheevilNo ratings yet

- Managing Current AssetsDocument13 pagesManaging Current AssetscrosstheevilNo ratings yet

- WTO VietnamDocument108 pagesWTO VietnamcrosstheevilNo ratings yet

- WTO Educational ServicesDocument4 pagesWTO Educational ServicescrosstheevilNo ratings yet

- WTO Distribution ServicesDocument10 pagesWTO Distribution ServicescrosstheevilNo ratings yet

- Leasing ServicesDocument2 pagesLeasing ServicescrosstheevilNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chap 002Document26 pagesChap 002dbjnNo ratings yet

- Rose Packing Co Vs CADocument6 pagesRose Packing Co Vs CAMalolosFire BulacanNo ratings yet

- P & A DepartmentDocument52 pagesP & A DepartmentbhagtoNo ratings yet

- Heizer - Om10 - ch01 - As of July 13 2015Document88 pagesHeizer - Om10 - ch01 - As of July 13 2015RarajNo ratings yet

- BFI 1 IntroductionDocument40 pagesBFI 1 IntroductionImran MjNo ratings yet

- BillingStatement - GENEVIEVE G. ANDAS PDFDocument2 pagesBillingStatement - GENEVIEVE G. ANDAS PDFGenevieve AndasNo ratings yet

- Bajaj Finance Digital Strategy Executive SummaryDocument5 pagesBajaj Finance Digital Strategy Executive Summarypunya.trivedi2003No ratings yet

- Finance and Capital MarketsDocument53 pagesFinance and Capital MarketsMUNAWAR ALINo ratings yet

- Income TaxDocument57 pagesIncome TaxDenis FernandesNo ratings yet

- REM Appraisal ProcessDocument2 pagesREM Appraisal ProcessPebbles PuzonNo ratings yet

- Farming Biz PlanDocument22 pagesFarming Biz Plansilasodhiambo100% (7)

- Campus Transfer FormDocument3 pagesCampus Transfer FormgauriwastNo ratings yet

- Kisan DBT Swap Scheme 373Document12 pagesKisan DBT Swap Scheme 373khetaramNo ratings yet

- China Banking Corporation V Sps Lozada DigestDocument2 pagesChina Banking Corporation V Sps Lozada DigestJanice D Original100% (1)

- Distinguish Exclusion vs Deductions from Gross IncomeDocument149 pagesDistinguish Exclusion vs Deductions from Gross IncomeMaanNo ratings yet

- Intermediate Acc Answer KeyDocument4 pagesIntermediate Acc Answer Keyemman neriNo ratings yet

- Evaluated Receipt SettlementDocument1 pageEvaluated Receipt SettlementSaurav SharmaNo ratings yet

- Cooperative Societies Act: Historical Development and Present SituationDocument32 pagesCooperative Societies Act: Historical Development and Present SituationdulNo ratings yet

- F4MYS 2014 Jun QDocument5 pagesF4MYS 2014 Jun QKaito KirinoNo ratings yet

- Research - Loan To EmployeeDocument5 pagesResearch - Loan To Employeewzulhafiz85100% (1)

- G.R. No. 215910Document12 pagesG.R. No. 215910Anonymous KgPX1oCfrNo ratings yet

- Compound InterestDocument9 pagesCompound Interestdivya1587No ratings yet

- March 22nd, Just Amazing by Martin ArmstrongDocument4 pagesMarch 22nd, Just Amazing by Martin ArmstrongmomentumtraderNo ratings yet

- Dec 2006 - AnsDocument13 pagesDec 2006 - AnsHubbak Khan75% (4)

- Winding Up Banking Company ProcedureDocument13 pagesWinding Up Banking Company ProcedureVinay KumarNo ratings yet

- Land Bank of The Philippines vs. MusniDocument18 pagesLand Bank of The Philippines vs. MusniHyacinthNo ratings yet

- MAN ACC ProjectDocument7 pagesMAN ACC ProjectNurassylNo ratings yet

- E - Banking in ICICI BankDocument70 pagesE - Banking in ICICI Bankanon_260285864100% (1)

- Quijano Vs DBP, GR No. L-26419Document7 pagesQuijano Vs DBP, GR No. L-26419AddAllNo ratings yet

- Mobilizing Islamic Finance For Infrastructure PPPs FINALDocument97 pagesMobilizing Islamic Finance For Infrastructure PPPs FINALsuwailemNo ratings yet