Professional Documents

Culture Documents

ACC401 Chp4HW

Uploaded by

87StudentCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC401 Chp4HW

Uploaded by

87StudentCopyright:

Available Formats

ACC401 Advanced Accounting

Homework Week 3

Chapter 4

Exercise 4-2

Workpaper entries 12/31/13 Cost Method

Investment in S Co

Retained Earnings 1/1 - P Co

($160,000 $50,000)*.90)

99,000

99,000

Dividend Income

Dividends Declared - S Co

9,000

9,000

Parent

Share

Purchase price and implied value

Less: Book value:

Difference between IV and BV

Allocated to undervalued land

Balance

465,000

450,000

15,000

(15,000)

0

NonControlling

Share

51,667

50,000

1,667

(1,667)

0

Common Stock - S Co

450,000

Retained Earnings 1/1/13 - S Co

160,000

Land

16,667

Investment in S Co ($465,000 + $99,000)

Non-controlling Interest ($51,667 + .10 x ($160,000 $50,000)

Entire

Value

516,667

500,000

16,667

(16,667)

0

564,000

62,667

Exercise 4-7

a

Journal entries

Investment in sales (150,000*.85)

Retained earnings

Cash

Investment in sales (50,000*.85)

161500

161500

42500

42500

Workpaper

Equity Income

Dividends Declared

Investment in Sales

161,500

Common Stock

100,000

42,500

119,000

ACC401 Advanced Accounting

Other Contributed Capital

Retained Earnings 1/1

Difference between IV & BV

Investment in Sales ($350,000 + $83,300)

Non-controlling interest ($61,765 + $14,700)

Goodwill

Difference IV & BV

40,000

238,000

131,765

433,300

76,465

131,765

131,765

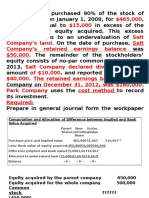

Problem 4-1

A Cost Method

2009

Investment in Singer Co.

Cash

4,972,000

Cash ($500,000*.90)

Dividend Income

450,000

Cash ($500,000*.90)

Dividend Income

450,000

Cash ($500,000*.90)

Dividend Income

450,000

Cash ($500,000*.90)

Investment in Singer Co.

Liquidating dividend

450,000

4,972,000

450,000

2010

450,000

2011

450,000

2012

450,000

B Partial Equity Method

2009

Investment in Singer Co.

Cash

Cash ($500,000*.90)

Investment in Singer Co.

Investment in Singer Co.

Equity Income

($1,997,800*.90)

4,972,000

4,972,000

450,000

450,000

1,798,020

1,798,020

2010

Cash ($500,000*.90)

Investment in Singer Co.

450,000

Investment in Singer Co.

Equity Income

($500,000*.90)

428,400

450,000

428,400

ACC401 Advanced Accounting

2011

Cash ($500,000*.90)

Investment in Singer Co.

450,000

Equity Income ($179,600*.90)

Investment in Singer Co.

161,640

Cash ($500,000*.90)

Investment in Singer Co.

450,000

Equity Income ($323,800*.90)

Investment in Singer Co.

291,420

450,000

161,640

2012

450,000

291,420

C Complete Equity Method

Difference between IV & BV

Parent

Share

Purchase price and implied value

Less: Book value:

Difference between IV & BV

Undervalued depreciable assets (15 year life)

Balance

4,972,000

4,961,160

10,840

(10,840)

0

NonEntire

Controlling

Value

Share

552,444 5,524,444

551,240 5,512,400

1,204

12,044

(1,204)

(12,044)

0

0

2009

Investment in Singer Co.

Cash

Cash ($500,000*.90)

Investment in Singer Co.

Investment in Singer Co.

Equity Income ($1,997,800*.90)

4,972,000

4,972,000

450,000

450,000

1,798,020

1,798,020

Equity Income ($10,840/15 years)

Investment in Singer Co.

723

Cash ($500,000*.90)

Investment in Singer Co.

450,000

Investment in Singer Co.

Equity Income ($476,000*.90)

428,400

723

2010

Equity Income ($10,840/15 years)

450,000

428,400

723

ACC401 Advanced Accounting

Investment in Singer Co.

723

2011

Cash ($500,000*.90)

Investment in Singer Co.

450,000

Equity Income ($179,600*.90)

Investment in Singer Co.

161,640

Equity Income ($10,840/15 years)

Investment in Singer Co.

723

Cash ($500,000*.90)

Investment in Singer Co.

450,000

Equity Income ($323,800*.90)

Investment in Singer Co.

291,420

Equity Income ($10,840/15 years)

Investment in Singer Co.

723

450,000

161,640

723

2012

450,000

291,420

723

Problem 4-10 Consolidated statements workpaper

Poco

Solo

Company Company

Income Statement

Sales

Equity in Subsidiary Income

Total Revenue

Cost of Goods Sold

Other Expenses

Total Cost and Expense

Net Income

Noncontrolling Interest

Net Income to Retained Earnings

Retained Earnings Statement

Retained Earnings 1/1

Poco Company

Solo Company

Net Income from above

Dividends Declared

Poco Company

Solo Company

Retained Earnings 12/31

Eliminating Entries

Dr.

Cr.

760,000

164,000

924,000

410,000

100,000

510,000

414,000

410,000

414,000

205,000

164,000

60,000

205,000

60,000

164,000

N-C Interest Consolidated

Balance

1,170,000

164,000

410,000

125,000

80,000

205,000

205,000

41,000

41,000

50,000

414,000

50,000

41,000

(30,000)

434,000

1,170,000

535,000

180,000

715,000

455,000

(41,000)

414,000

414,000

(30,000)

(15,000)

250,000

224,000

12,000

12,000

(3,000)

38,000

434,000

ACC401 Advanced Accounting

Balance Sheet

Cash

Inventory

Investment in Solo

Difference b/w Implied & Book

Value

Land

Goodwill

Total

Accounts Payable

Common Stock:

Poco Company

Solo Company

Other Contributed Capital

Poco Company

Solo Company

Retained Earnings from above

Noncontrolling Interest 1/1

Noncontrolling Interest 12/31

161,500

210,000

402,000

125,000

195,000

286,500

405,000

67,500

75,000

152,000

250,000

67,500

150,000

848,500

470,000

225,000

67,500

984,000

154,500

35,000

189,500

67,500

200,000

200,000

150,000

150,000

434,000

35,000

250,000

35,000

224,000

848,500

470,000

544,000

60,000

60,000

12,000

62,500

544,000

38,000

62,500

100,500

434,000

100,500

984,000

You might also like

- ch4 Solution21Document25 pagesch4 Solution21Melinda Amelia0% (1)

- Chapter 4Document25 pagesChapter 4Anonymous XOv12G67% (3)

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- Loss of ControlDocument7 pagesLoss of ControlZiyi ChenNo ratings yet

- Problem Sets Solutions 1 Accounting Statements and Cash FlowDocument5 pagesProblem Sets Solutions 1 Accounting Statements and Cash FlowYaoyin Bonnie ChenNo ratings yet

- CH 7 Vol 1 Answers 2014Document18 pagesCH 7 Vol 1 Answers 2014Jamie Catherine GoNo ratings yet

- Complete Equity Method Workpaper Entries - Year 2010Document14 pagesComplete Equity Method Workpaper Entries - Year 2010jeankoplerNo ratings yet

- Basic Consol Example RevisedDocument10 pagesBasic Consol Example RevisedCalvin LimNo ratings yet

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- Plan Your Cash Flow and Finances with These ToolsDocument4 pagesPlan Your Cash Flow and Finances with These Toolscialee100% (2)

- Chapter 17Document12 pagesChapter 17Alainne DecylleNo ratings yet

- AdvAcct Chapter04 Solutions 07.13Document35 pagesAdvAcct Chapter04 Solutions 07.13Andrew Gladue100% (1)

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyNo ratings yet

- Equity Method Workpaper Entries and Consolidated Financial Statements for Porter Company and SubsidiaryDocument8 pagesEquity Method Workpaper Entries and Consolidated Financial Statements for Porter Company and SubsidiaryIndra PramanaNo ratings yet

- Accounting For Financial ManagementDocument54 pagesAccounting For Financial ManagementEric RomeroNo ratings yet

- Use This Template To Complete The Problem 4-32 Based Upon The 3 Step Approach BelowDocument7 pagesUse This Template To Complete The Problem 4-32 Based Upon The 3 Step Approach BelowJoshua LenardsonNo ratings yet

- Zenaida Solutions To Exercises Chap 14 15 IncompleteDocument8 pagesZenaida Solutions To Exercises Chap 14 15 IncompletekonyatanNo ratings yet

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- Advanced Accounting Chapter 5Document21 pagesAdvanced Accounting Chapter 5leelee030275% (4)

- CH 04Document66 pagesCH 04Dr-Bahaaeddin AlareeniNo ratings yet

- Chapter 15 SolutionsDocument6 pagesChapter 15 SolutionshappysparkyNo ratings yet

- Ch02 SolDocument7 pagesCh02 Solalex5566No ratings yet

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainNo ratings yet

- P4-6, 10, 11, E4-6, 7Document14 pagesP4-6, 10, 11, E4-6, 7Aisyah IsnaniNo ratings yet

- Consolidated Financial Statements-Subsequent PartialDocument24 pagesConsolidated Financial Statements-Subsequent PartialJoseph SalidoNo ratings yet

- Trade Me analysis reveals stock valuationDocument20 pagesTrade Me analysis reveals stock valuationCindy YinNo ratings yet

- H.W Chapter 17Document11 pagesH.W Chapter 17Cooper89No ratings yet

- Quiz - Investment, Part 2 ANSWERDocument4 pagesQuiz - Investment, Part 2 ANSWERJaylord Reyes100% (1)

- Beams10e - Ch08 Changes in Ownership InterestDocument42 pagesBeams10e - Ch08 Changes in Ownership InterestBayoe AjipNo ratings yet

- CONSOLIDATION OF POST-ACQUISITION RESERVESDocument68 pagesCONSOLIDATION OF POST-ACQUISITION RESERVESShahrul IzwanNo ratings yet

- Salt Company's balance sheet and market values along with Pail Company's bargain purchase gainDocument3 pagesSalt Company's balance sheet and market values along with Pail Company's bargain purchase gainRafael Capunpon VallejosNo ratings yet

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakpurnamaNo ratings yet

- CH 4 - Brief Exercises - 16thDocument18 pagesCH 4 - Brief Exercises - 16thkesey100% (2)

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakFerry JohNo ratings yet

- Chapter 6 - 2013 EdDocument17 pagesChapter 6 - 2013 EdJean Palada33% (6)

- Investment Appraisal Relevant Cash Flows AnswersDocument8 pagesInvestment Appraisal Relevant Cash Flows AnswersdoannamphuocNo ratings yet

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- Nestle Lanka PLC Project Eco Packaging: 1. Capital BudgetingDocument5 pagesNestle Lanka PLC Project Eco Packaging: 1. Capital BudgetingSara100% (1)

- Chapter 2: Financial Statements and Cash Flow AnalysisDocument43 pagesChapter 2: Financial Statements and Cash Flow AnalysisshimulNo ratings yet

- Chap 6 SolutionsDocument28 pagesChap 6 SolutionslalaaprilaNo ratings yet

- Please: Solutions Guide: This Is Meant As A Solutions GuideDocument12 pagesPlease: Solutions Guide: This Is Meant As A Solutions GuideEkta Saraswat Vig0% (1)

- Transfer Pricng Solution - 2019Document3 pagesTransfer Pricng Solution - 2019chandraprakashNo ratings yet

- 2011-04-02 143336 PriceDocument3 pages2011-04-02 143336 PricechandraprakashNo ratings yet

- Transfer Pricng SolutionDocument3 pagesTransfer Pricng SolutionchandraprakashNo ratings yet

- Fischer11e Smchap04 FinalDocument28 pagesFischer11e Smchap04 FinalWilliam Omar VelezNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument27 pagesFinancial Statements, Cash Flow, and Taxeszohaib25No ratings yet

- Chapter 4 Problem 32Document9 pagesChapter 4 Problem 32morgan.bertoneNo ratings yet

- Week 4 FA Lecture BBDocument24 pagesWeek 4 FA Lecture BBkk23212No ratings yet

- Pizza Hut Starbucks Net IncomeDocument3 pagesPizza Hut Starbucks Net IncomeelainelaineNo ratings yet

- Chap. 9 - Discussion AssignmentsDocument3 pagesChap. 9 - Discussion AssignmentsEdi HermawanNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Finance 2Document7 pagesFinance 2Vũ Hải YếnNo ratings yet

- Calculate EPS and weighted average sharesDocument7 pagesCalculate EPS and weighted average sharesKarlovy DalinNo ratings yet

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachFrom EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityFrom EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityRating: 4 out of 5 stars4/5 (2)

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Ch9 Solutions ACCYDocument7 pagesCh9 Solutions ACCYShadyNo ratings yet

- AFM AssignmentDocument3 pagesAFM AssignmentAin NsrNo ratings yet

- Trian GE StakeDocument3 pagesTrian GE StakeBenzingaProNo ratings yet

- Chief Financial Officer CFO in Columbia SC Resume Robert VadenDocument2 pagesChief Financial Officer CFO in Columbia SC Resume Robert VadenRobertVadenNo ratings yet

- Strategie: Villanova School Ofbusiness Villanova UniversityDocument6 pagesStrategie: Villanova School Ofbusiness Villanova UniversitygauravNo ratings yet

- The Halal Investment Checklist V5Document21 pagesThe Halal Investment Checklist V5Mahmoud SafaaNo ratings yet

- Resume Jurnal AdelDocument5 pagesResume Jurnal AdelMuhamad SyarifNo ratings yet

- Pak Arab Fartilizers ReportDocument16 pagesPak Arab Fartilizers Reportmughees992No ratings yet

- Doctrine of TracingDocument34 pagesDoctrine of TracingAkmal SafwanNo ratings yet

- Pas 11Document2 pagesPas 11AngelicaNo ratings yet

- Employees Old Age BenifitDocument16 pagesEmployees Old Age BenifitrealsimplemusicNo ratings yet

- Hugo Axsel González Hernández: AlumnoDocument4 pagesHugo Axsel González Hernández: AlumnoHugo Axsel GonzálezNo ratings yet

- Chapter 9 - Valuation of StocksDocument27 pagesChapter 9 - Valuation of StocksAnubhab GuhaNo ratings yet

- 8 Steps To Starting Your Own BusinessDocument16 pages8 Steps To Starting Your Own BusinessJerecel Gapi VigoNo ratings yet

- What Is Behavioral FinanceDocument4 pagesWhat Is Behavioral FinanceNouman MujahidNo ratings yet

- SeaceraDocument3 pagesSeaceraAhmad Mustaqim SulaimanNo ratings yet

- Mama TheoDocument17 pagesMama TheophantomhabzicNo ratings yet

- Mao Caro by Prafful BhaleraoDocument9 pagesMao Caro by Prafful BhaleraoSonu BhaleraoNo ratings yet

- Foreign Currency TransactionsDocument49 pagesForeign Currency TransactionsGlenn TaduranNo ratings yet

- QUIZ1Document2 pagesQUIZ1Samantha CabugonNo ratings yet

- Solution Manual For Fundamentals of Investing Smart Gitman Joehnk 12th EditionDocument24 pagesSolution Manual For Fundamentals of Investing Smart Gitman Joehnk 12th EditionAnthonyEdwardsejrt100% (34)

- Soft Drink Industry in IndiaDocument11 pagesSoft Drink Industry in Indiakiransawant11No ratings yet

- ESS MarketBrochure en PDFDocument8 pagesESS MarketBrochure en PDFAnonymous rAFSAGDAEJNo ratings yet

- How To Start A Lending BusinessDocument4 pagesHow To Start A Lending BusinessJerome BundaNo ratings yet

- SwedtelDocument20 pagesSwedtelMishaNo ratings yet

- 098 Fmbo-1Document9 pages098 Fmbo-1KetakiNo ratings yet

- Simple Interest Math ModuleDocument4 pagesSimple Interest Math ModuleMaria Teresa OndoyNo ratings yet

- Value at RiskDocument18 pagesValue at RiskSameer Kumar100% (1)

- Mishkin 5ce Tif ch13Document37 pagesMishkin 5ce Tif ch13api-349011184No ratings yet

- Capital Budgeting Process and TechniquesDocument10 pagesCapital Budgeting Process and TechniquesMaha HamdyNo ratings yet