Professional Documents

Culture Documents

Accounting For Investments in Associates in Consolidated Financial Statements

Uploaded by

sks0865Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Investments in Associates in Consolidated Financial Statements

Uploaded by

sks0865Copyright:

Available Formats

Limited Revision to Accounting Standard (AS) 23 (issued 2001)

The following is the text of the limited revision to AS 23, Accounting for Investments in Associates in Consolidated Financial Statements, issued by the Institute of Chartered Accountants of India.

In view of Accounting Standard (AS) 30, Financial Instruments: Recognition and Measurement, AS 23 (issued 2001) is modified as under (modifications are shown as doubleunderline/ strike-through):

1.

The name of the Standard is modified as below:

Accounting for Investments in Associates in Consolidated Financial Statements

2. The Applicability paragraph of the Standard is amended as follows:

Accounting Standard (AS) 23 (issued 2001), Accounting for Investments in Associates in Consolidated Financial Statements, issued by the Council of the Institute of Chartered Accountants of India, comes came into effect in respect of accounting periods commencing on or after 1-4-2002. This limited revision to the Standard comes into effect in respect of accounting periods commencing on or after the date on which Accounting Standard (AS) 30, Financial Instruments: Recognition and Measurement, comes into effect. In respect of separate financial statements of an enterprise, this limited revision comes into effect from the same date. In respect of consolidated financial statements, this Standard is mandatory1 where the enterprise prepares and presents consolidated financial statements. In other words, if An an enterprise prepares and that presents consolidated financial statements, for a period commencing on or after the date on

This implies that, while discharging their attest function, it will be the duty of the members of the Institute to examine whether this Accounting Standard is complied with in the presentation of financial statements covered by their audit. In the event of any deviation from this Accounting Standard, it will be their duty to make adequate disclosures in their audit reports so that the users of financial statements may be aware of such deviations.

Page251

which this Standard first came into effect, i.e., 1-4-2002, it should account for investments in associates in the consolidated financial statements in accordance with this Standard.2 The following is the text of the Accounting Standard.

3.

The Objective paragraph of the Standard is amended as follows:

The objective of this Statement is to set out principles and procedures for recognising, in the consolidated financial statements, the effects of the investments in associates on the financial position and operating results of a groupin the consolidated financial statements of a group and for accounting for investments in associates in the separate financial statements of an investor.

4.

The Scope paragraphs of the Standard are amended as follows:

1. This Statement should be applied in accounting for investments in associates in the preparation and presentation of separate as well as consolidated financial statements by an investor. However, it does not apply to investments in associates held by: (a) (b) venture capital organisations, or mutual funds, unit trusts and similar entities including investment-linked insurance funds

that upon initial recognition are designated as at fair value through profit or loss and accounted for in accordance with AS 30, Financial Instruments: Recognition and Measurement. Such investments should be measured at fair value in accordance with AS 30, with changes in fair value recognised in the statement of profit and loss in the period of the change. 2. The requirements relating to accounting for investments in associates in consolidated financial statements, contained in this Statement, are applicable only where consolidated financial statements are prepared and presented by the investor. This Statement does not deal with accounting for investments in associates in the preparation and presentation of separate financial statements by an investor.3

It is clarified that AS 23 is mandatory if an enterprise presents consolidated financial statements. In other words, if an enterprise presents consolidated financial statements, it should account for investments in associates in the consolidated financial statements in accordance with AS 23 from the date of its coming into effect, i.e., 1-4-2002 (see The Chartered Accountant, July 2001, page 95).

3

Accounting Standard (AS) 13, Accounting for Investments, is applicable for accounting for investments in associates in the separate financial statements of an investor.

Page252

5.

Paragraph 7 is amended as follows:

7. An investment in an associate should be accounted for in consolidated financial statements under the equity method except when: (a) the investment is acquired and held exclusively with a view to its subsequent disposal in the near future4; or the associate operates under severe long-term restrictions that significantly impair its ability to transfer funds to the investor.

(b)

Investments in such associates should be accounted for in accordance with Accounting Standard (AS) 1330, Accounting for InvestmentsFinancial Instruments: Recognition and Measurement. The reasons for not applying the equity method in accounting for investments in an associate should be disclosed in the consolidated financial statements.

6. 9.

Paragraph 9 is amended as follows: An investor should discontinue the use of the equity method from the date that: (a) it ceases to have significant influence in an associate but retains, either in whole or in part, its investment; or the use of the equity method is no longer appropriate because the associate operates under severe long-term restrictions that significantly impair its ability to transfer funds to the investor.

(b)

From the date of discontinuing the use of the equity method, investments in such associates should be accounted for in accordance with Accounting Standard (AS) 1330, Accounting for InvestmentsFinancial Instruments: Recognition and Measurement. For this purpose, the carrying amount of the investment at that date should be regarded as its cost thereafteron initial measurement as a financial asset in accordance with AS 30.

7. The existing paragraph 20 is deleted. After the existing paragraph 19, new paragraphs 20, 20A, 20B and 20C under the heading Impairment Loss and new paragraphs 20D and 20E under the heading Separate Financial Statements of an Investor are added. New paragraphs are as follows:

See also Accounting Standards Interpretation (ASI) 8.

Page253

20. The carrying amount of investment in an associate should be reduced to recognise a decline, other than temporary, in the value of the investment, such reduction being determined and made for each investment individually.

Impairment losses

20. After applying the equity method, including recognising the associates losses in accordance with paragraph 18, the investor applies the requirements of AS 30 to determine whether it is necessary to recognise any additional impairment loss with respect to the investors net investment in the associate. 20A. The investor also applies the requirements of AS 30 to determine whether any additional impairment loss is recognised with respect to the investors interest in the associate that does not constitute part of the net investment and the amount of that impairment loss. 20B. Because goodwill included in the carrying amount of an investment in an associate is not separately recognised, it is not tested for impairment separately by applying the requirements for testing of impairment of goodwill in AS 28, Impairment of Assets. Instead, the entire carrying amount of the investment is tested under AS 28 for impairment, by comparing its recoverable amount (higher of net selling price and value in use) with its carrying amount, whenever application of the requirements in AS 30 indicates that the investment may be impaired. In determining the value in use of the investment, an enterprise estimates: (a) its share of the present value of the estimated future cash flows expected to be generated by the associate, including the cash flows from the operations of the associate and the proceeds on the ultimate disposal of the investment; or the present value of the estimated future cash flows expected to arise from dividends to be received from the investment and from its ultimate disposal.

(b)

Under appropriate assumptions, both methods give the same result. 20C. The recoverable amount of an investment in an associate is assessed for each associate, unless the associate does not generate cash inflows from continuing use that are largely independent of those from other assets of the enterprise.

Separate Financial Statements of an Investor

20D. In an investors separate financial statements, investments in associates, except investments in associates covered under paragraph 7 of this Statement, should be accounted for either:

Page254

(a) at cost, or (b) in accordance with AS 30, Financial Instruments: Recognition and Measurement. The same accounting should be applied for each category of investments. Investments in associates covered under paragraph 7 of this Statement should be accounted for in accordance with Accounting Standard (AS) 30, Financial Instruments: Recognition and Measurement. 20E. To determine whether an investment in an associate accounted for at cost in accordance with paragraph 20D is impaired, an enterprise applies AS 28, Impairment of Assets. AS 28 which explains how an enterprise reviews the carrying amount of its assets, how it determines the recoverable amount of an asset, and when it recognises, or reverses the recognition of, an impairment loss is also applicable to impairment of an investment in an associate.

8.

Paragraph 21 is amended as follows:

21. In accordance with Accounting Standard (AS) 429, Provisions, Contingent Liabilities and Contingent AssetsContingencies and Events Occurring After the Balance Sheet Date5, the investor discloses in the separate as well as the consolidated financial statements: (a) its share of the contingencies and capital commitments contingent liabilities of an associate incurred jointly with other investorsfor which it is also contingently liable; and those contingencies contingent liabilities that arise because the investor is severally liable for all or part of the liabilities of the associate.

(b)

9. The name of AS 21, appearing in paragraph 10 of the Standard, is changed to reflect the proposed new name of AS 21, viz., the following: AS 21, Consolidated Financial Statements and Accounting for Investments in Subsidiaries in Separate Financial Statements

Pursuant to AS 29, Provisions, Contingent Liabilities and Contingent Assets, becoming mandatory in respect of accounting periods commencing on or after 1.4.2004, all paragraphs of AS 4 that deal with contingencies stand withdrawn except to the extent they deal with impairment of assets not covered by other Indian Accounting Standards.

Page255

You might also like

- Limited Revision To As 21, Consolidated Financial StatementsDocument4 pagesLimited Revision To As 21, Consolidated Financial StatementsVivek ReddyNo ratings yet

- Accounting For Investments in Associates in Consolidated Financial StatementsDocument10 pagesAccounting For Investments in Associates in Consolidated Financial StatementsCelo KingNo ratings yet

- 69251asb55316 As23Document9 pages69251asb55316 As23cheyam222No ratings yet

- Accounting of Insurance CompaniesDocument8 pagesAccounting of Insurance CompaniesShishir DhamijaNo ratings yet

- Consolidation Procedures of Accounting StandardDocument5 pagesConsolidation Procedures of Accounting Standardsalehin1969No ratings yet

- Icai Differences Between Ifrss and Ind AsDocument21 pagesIcai Differences Between Ifrss and Ind AsdhuvadpratikNo ratings yet

- Ind AS 27 Exposure Draft on Separate Financial StatementsDocument9 pagesInd AS 27 Exposure Draft on Separate Financial StatementsratiNo ratings yet

- Ias 28Document2 pagesIas 28Foititika.netNo ratings yet

- ' Consolidated Financial Statements"Document17 pages' Consolidated Financial Statements"MeenakshiMohanDangeNo ratings yet

- Module 36.2 - Separate Financial StatementsDocument1 pageModule 36.2 - Separate Financial StatementsJoshua DaarolNo ratings yet

- Separate Financial Statements: International Accounting Standard 27Document10 pagesSeparate Financial Statements: International Accounting Standard 27babylovelylovelyNo ratings yet

- List of Accounting StandardsDocument5 pagesList of Accounting StandardsPraneeth SaiNo ratings yet

- Accounting Standard 21Document10 pagesAccounting Standard 21Rahul kumar sinhaNo ratings yet

- ASI 151 - Consolidated Financial Statements Notes GuidanceDocument4 pagesASI 151 - Consolidated Financial Statements Notes GuidanceratiNo ratings yet

- Important Notes on Business CombinationsDocument10 pagesImportant Notes on Business CombinationsSajib Kumar DasNo ratings yet

- Accounting Standard - 23: CA Mehul Shah CA Mehul ShahDocument26 pagesAccounting Standard - 23: CA Mehul Shah CA Mehul ShahsoumyatmgmtNo ratings yet

- Separate Financial Statements: Final PronouncementDocument15 pagesSeparate Financial Statements: Final Pronouncementiced jaipurNo ratings yet

- Auditing FinalsDocument29 pagesAuditing FinalsZymelle Princess FernandezNo ratings yet

- RBI Regulatory Guidance On Ind AS Implementing NBFCs and ARCs - Taxguru - In-1Document4 pagesRBI Regulatory Guidance On Ind AS Implementing NBFCs and ARCs - Taxguru - In-1Irfan ShaikhNo ratings yet

- SMEs SummaryDocument10 pagesSMEs SummaryGloria BeltranNo ratings yet

- Illustration 2 - CFS - Ind As Auditor's Report - Listed - Unqualified - 201904Document14 pagesIllustration 2 - CFS - Ind As Auditor's Report - Listed - Unqualified - 201904Vrinda AgrawalNo ratings yet

- List of ICAI's Mandatory Accounting Standards (AS 1 29)Document3 pagesList of ICAI's Mandatory Accounting Standards (AS 1 29)Nishant bhardwajNo ratings yet

- Accounting Kewal Garg: List of Accounting Standards (AS 1 32) of ICAI: Download PDFDocument2 pagesAccounting Kewal Garg: List of Accounting Standards (AS 1 32) of ICAI: Download PDFDedhia Vatsal hiteshNo ratings yet

- Comparison of IFRS and Indian Accounting StandardsDocument25 pagesComparison of IFRS and Indian Accounting StandardsAnu AnandNo ratings yet

- Full Download Advanced Financial Accounting 11th Edition Christensen Solutions ManualDocument35 pagesFull Download Advanced Financial Accounting 11th Edition Christensen Solutions Manuallienanayalaag100% (23)

- IAS 27 Consolidatedand Separate Financial StatementsDocument8 pagesIAS 27 Consolidatedand Separate Financial Statementsthanhha1985No ratings yet

- ICV Supplier Certification Guidelines OCT 2023Document30 pagesICV Supplier Certification Guidelines OCT 2023Noori Zahoor KhanNo ratings yet

- AS-01 Financial Statement StandardsDocument9 pagesAS-01 Financial Statement StandardsAtaulNo ratings yet

- HK Inland Revenue Department profits tax losses guideDocument17 pagesHK Inland Revenue Department profits tax losses guideLam Wing ManNo ratings yet

- AP15-eliminations-gains-arising-from-downstream-transactions - Juillet 2013Document21 pagesAP15-eliminations-gains-arising-from-downstream-transactions - Juillet 2013Neji HergliNo ratings yet

- Ias 27Document2 pagesIas 27Foititika.netNo ratings yet

- Indian Accounting Standards: Manish B TardejaDocument45 pagesIndian Accounting Standards: Manish B TardejaManish TardejaNo ratings yet

- Fa 534Document11 pagesFa 534Sonia MakwanaNo ratings yet

- Acc Business Combination NotesDocument118 pagesAcc Business Combination NotesTheresaNo ratings yet

- Acc 411 NotesDocument115 pagesAcc 411 NotesPANASHE MARTIN MASANGUDZANo ratings yet

- Ind ASDocument48 pagesInd ASmohit pandeyNo ratings yet

- CAS 800 Special Purpose FrameworksDocument14 pagesCAS 800 Special Purpose FrameworkszelcomeiaukNo ratings yet

- IFRS AND IAS of AuditDocument11 pagesIFRS AND IAS of AuditAvinash KumarNo ratings yet

- Adv Aud Final May08Document16 pagesAdv Aud Final May08Fazi HaiderNo ratings yet

- Accounting Policies SummaryDocument6 pagesAccounting Policies SummaryCaptain ObviousNo ratings yet

- Significant Influence - The Key To Accounting For Investments in AssociateDocument3 pagesSignificant Influence - The Key To Accounting For Investments in Associateஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- Unit 3: Separate Financial StatementsDocument3 pagesUnit 3: Separate Financial Statementsaman vermaNo ratings yet

- ITFG Clarifies DDT Treatment in Consolidated FSDocument7 pagesITFG Clarifies DDT Treatment in Consolidated FSTanviNo ratings yet

- Ias 27Document44 pagesIas 27Mariana Mirela0% (1)

- Auditing FinalsDocument62 pagesAuditing FinalsPrin CessNo ratings yet

- EY-IFRS-FS-20 - Part 2Document50 pagesEY-IFRS-FS-20 - Part 2Hung LeNo ratings yet

- Summary of IND As 110 and IFRS 10 Consolidated Financial Statements - Taxguru - inDocument7 pagesSummary of IND As 110 and IFRS 10 Consolidated Financial Statements - Taxguru - inalok kumarNo ratings yet

- GHGGHDocument9 pagesGHGGHFahim FaysalNo ratings yet

- As 23Document4 pagesAs 23api-3705645No ratings yet

- Ascertainment of ProfitDocument18 pagesAscertainment of ProfitsureshNo ratings yet

- Companies Act 2014 Financial Statement ChangesDocument3 pagesCompanies Act 2014 Financial Statement ChangesmentinfusionNo ratings yet

- Accounting Policies, Estimates and ErrorsDocument25 pagesAccounting Policies, Estimates and ErrorsMohammed AlashiNo ratings yet

- 8 As 21 Consolidated Financial StatementsDocument26 pages8 As 21 Consolidated Financial StatementssmartshivenduNo ratings yet

- Consolidated Financial Statement HandoutDocument9 pagesConsolidated Financial Statement HandoutMary Jane BarramedaNo ratings yet

- Indian and International Accounting StandardsDocument13 pagesIndian and International Accounting StandardsBhanu PrakashNo ratings yet

- Tamam Finance Company Financial Statements for 2020Document27 pagesTamam Finance Company Financial Statements for 2020Dhanviper NavidadNo ratings yet

- 31170sm DTL Finalnew-May-Nov14 Cp10Document16 pages31170sm DTL Finalnew-May-Nov14 Cp10gvcNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Bhartiya Jyotish Vigyan PDFDocument134 pagesBhartiya Jyotish Vigyan PDFprastacharNo ratings yet

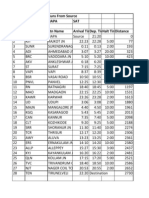

- Train Runs From HAPA to TENDocument1 pageTrain Runs From HAPA to TENsks0865No ratings yet

- List of BooksDocument14 pagesList of Booksrajnish222550% (2)

- STD 10 EnglishDocument83 pagesSTD 10 EnglishMayur ParmarNo ratings yet

- Advanced Company Law & Practice: NoteDocument4 pagesAdvanced Company Law & Practice: NoteabhinandNo ratings yet

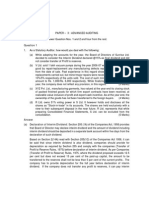

- 331 7Document4 pages331 7sks0865No ratings yet

- 1st Birth Day Pooja - SamagriDocument4 pages1st Birth Day Pooja - Samagrisks0865No ratings yet

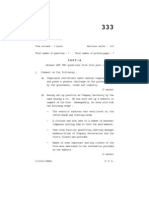

- 334Document10 pages334sks0865No ratings yet

- Roll No.......................... : Part-ADocument7 pagesRoll No.......................... : Part-Asks0865No ratings yet

- Strategic Management Alliances and International Trade: Roll No.........................Document3 pagesStrategic Management Alliances and International Trade: Roll No.........................sks0865No ratings yet

- 331 7Document4 pages331 7sks0865No ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Document4 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4JasbinderNeelaNo ratings yet

- NoteDocument4 pagesNotesks0865No ratings yet

- 232Document4 pages232sks0865No ratings yet

- Governance, Business Ethics and Sustainability: Part-ADocument5 pagesGovernance, Business Ethics and Sustainability: Part-AMosam DoshiNo ratings yet

- 236 2Document8 pages236 2abhinandNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8total Number of Printed Pages: 6Document6 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8total Number of Printed Pages: 6sks0865No ratings yet

- Due Diligence and Corporate Compliance Management: Roll No.........................Document5 pagesDue Diligence and Corporate Compliance Management: Roll No.........................sks0865No ratings yet

- Financial Treasury and Forex Management: NoteDocument7 pagesFinancial Treasury and Forex Management: Notesks0865No ratings yet

- Corporate Restructuring and Insolvency: NoteDocument6 pagesCorporate Restructuring and Insolvency: Notesks0865No ratings yet

- Due Diligence and Corporate Compliance Management: NoteDocument5 pagesDue Diligence and Corporate Compliance Management: Notesks0865No ratings yet

- Governance, Business Ethics and Sustainability: Part-ADocument5 pagesGovernance, Business Ethics and Sustainability: Part-AMosam DoshiNo ratings yet

- Due Diligence and Corporate Compliance Management: Roll No.........................Document5 pagesDue Diligence and Corporate Compliance Management: Roll No.........................sks0865No ratings yet

- Strategic Management Alliances and International Trade: Roll No.........................Document3 pagesStrategic Management Alliances and International Trade: Roll No.........................sks0865No ratings yet

- Advanced Tax Laws and Practice: Concise TitleDocument8 pagesAdvanced Tax Laws and Practice: Concise Titlesks0865No ratings yet

- Governance Business Ethics and Sustainability: Part-ADocument3 pagesGovernance Business Ethics and Sustainability: Part-Asks0865No ratings yet

- Company Secretarial Practice-IDocument4 pagesCompany Secretarial Practice-IManasvi MehtaNo ratings yet

- 334Document10 pages334sks0865No ratings yet

- Due Diligence and Corporate Compliance Management: NoteDocument5 pagesDue Diligence and Corporate Compliance Management: Notesks0865No ratings yet

- Secretarial Practice Relating To Economic Laws and Drafting & ConveyancingDocument4 pagesSecretarial Practice Relating To Economic Laws and Drafting & Conveyancingsks0865No ratings yet

- Ratio Analysis Formulas Guide Under 40 CharactersDocument6 pagesRatio Analysis Formulas Guide Under 40 CharactersSri Royal100% (1)

- Literature Review - Shareholder ActivismDocument28 pagesLiterature Review - Shareholder ActivismRishabhRathoreNo ratings yet

- Symfonie Angel Ventures AML 20130715Document13 pagesSymfonie Angel Ventures AML 20130715Symfonie CapitalNo ratings yet

- Restriction on stock transfers upheldDocument1 pageRestriction on stock transfers upheldDiane ヂエンNo ratings yet

- Section 5 Registration PDFDocument2 pagesSection 5 Registration PDFAnonymous YBBpXPb7VNo ratings yet

- PinoyInvestor Academy - Technical Analysis Part 3Document18 pagesPinoyInvestor Academy - Technical Analysis Part 3Art JamesNo ratings yet

- Stocks Question and AnswersDocument6 pagesStocks Question and AnswersIrfan ShakeelNo ratings yet

- Sld20 External Growth Through MergerDocument14 pagesSld20 External Growth Through MergerSasi RekaNo ratings yet

- IBM Annual Report 2004 PDFDocument100 pagesIBM Annual Report 2004 PDFSangamesh BagaliNo ratings yet

- Equity Assets - LiabilitiesDocument6 pagesEquity Assets - LiabilitiesAcca IsdcNo ratings yet

- Financial Management Shetty Et Al (1995)Document6 pagesFinancial Management Shetty Et Al (1995)Cesar FurioNo ratings yet

- Horizontal and Vertical Ratio AnalysisDocument21 pagesHorizontal and Vertical Ratio AnalysismrnttdpnchngNo ratings yet

- HDFC ShareholdingDocument11 pagesHDFC ShareholdingCHINMOY PADHINo ratings yet

- Chapter 6 Business Formation Sections 3-4Document25 pagesChapter 6 Business Formation Sections 3-4kparsons938512No ratings yet

- CH 3Document24 pagesCH 3Eric YaoNo ratings yet

- BSNL Annual Report 2014-15 FinancialsDocument5 pagesBSNL Annual Report 2014-15 Financialsvivek singhNo ratings yet

- Working Capital Management in Steel IndustryDocument54 pagesWorking Capital Management in Steel IndustryPrashant Singh50% (2)

- Week 10 12 Corporation Retained EarningsDocument3 pagesWeek 10 12 Corporation Retained EarningsSimonPeter RodriguezNo ratings yet

- 1st Mid Term Exam Fall 2015 AuditingDocument5 pages1st Mid Term Exam Fall 2015 AuditingSarahZeidatNo ratings yet

- Project Report 2 TatasteelDocument2 pagesProject Report 2 TatasteelOperation KoldamNo ratings yet

- TOMCODocument2 pagesTOMCORicha KothariNo ratings yet

- Institut Pasteur and Pasteur Sanofi Diagnostics v. Cambridge Biotech Corporation, 104 F.3d 489, 1st Cir. (1997)Document10 pagesInstitut Pasteur and Pasteur Sanofi Diagnostics v. Cambridge Biotech Corporation, 104 F.3d 489, 1st Cir. (1997)Scribd Government DocsNo ratings yet

- Sec Form 12-1 Registration Statement With Prospectus PDFDocument53 pagesSec Form 12-1 Registration Statement With Prospectus PDFIrwin Ariel D. MielNo ratings yet

- Dividends and Other Payouts: Chapter NineteenDocument53 pagesDividends and Other Payouts: Chapter NineteenAli AhmadNo ratings yet

- Accounting Level 3/series 2 2008 (Code 3012)Document16 pagesAccounting Level 3/series 2 2008 (Code 3012)Hein Linn Kyaw100% (2)

- Financial Statement Analysis Mid-Year Examination Food Empire: Valuation and InvestmentDocument16 pagesFinancial Statement Analysis Mid-Year Examination Food Empire: Valuation and InvestmentJessa JanisNo ratings yet

- Chapter 3 Ethics and StakeholdersDocument25 pagesChapter 3 Ethics and StakeholdersSharar Ashraf ShoumikNo ratings yet

- CH 6Document5 pagesCH 6pinoNo ratings yet

- Minority InterestDocument1 pageMinority Interestankur4042007No ratings yet

- Corporate Finance Academic Year 2011-2012 TutorialsDocument21 pagesCorporate Finance Academic Year 2011-2012 TutorialsSander Levert100% (1)