Professional Documents

Culture Documents

IT Result Review, 15th February 2013

Uploaded by

Angel BrokingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT Result Review, 15th February 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

3QFY2013 Result Review | IT

February 14, 2013

IT 3QFY2013 Result Review

Large-caps lead growth momentum

Modest revenue growth but volume growth subdued: For 3QFY2013, the overall results of large cap IT companies were better than their mid-cap peers. The tier-I IT pack under our coverage posted a better-than-expected revenue growth. Volumes were soft during the quarter, which is partly attributable to lower billing days. Moderate realization improvement coupled with subdued volume growth led to better-than-expected revenue growth, with tier-I firms USD revenue posting 3.9% qoq growth (3.4% excluding Lodestone). BFSI performance surprises positively but telecom continues to be a laggard: During 3QFY2013, tier-I IT companies witnessed better-than-expected revenue growth from the BFSI industry vertical despite the impact from furloughs and Hurricane Sandy, which could be an indication of consolidation in gains and improvement in discretionary spends. The telecom vertical continued to be a laggard. Verticals such as lifesciences & healthcare, manufacturing and retail maintained their revenue growth momentum. Initial signs of divergence in commentary fading away: The commentaries given by the Managements of the top four Indian IT players suggest pockets of optimism for the sector. Initial signs show that CY2013 IT budgets are expected to remain flat. Infosys Management indicated that the environment remains almost as same as where it was a few months back, however, Infosys signed eight large deals with TCV worth US$750mn during 3QFY2013. Infosys Management indicated at flat to declining IT budgets for CY2013 with more clarity coming in by February 2013. TCS Management sounded confident of FY2014 being a better year than FY2013 as clients seem to have a better handle on the kind of projects they want to execute, and are aware of the challenging macro environment. They have planned their IT spending considering these challenges. Cognizant has issued CY2013 guidance of at least 17% yoy growth in revenues. Outlook and Valuation: Nasscom has recently issued guidance of 12-14% yoy growth for the Indian IT exports and estimates the industry to reach ~US$8487bn in FY2014. We believe demand for IT offshore services would continue to be strong due to the need for operational efficiency & cost rationalization and regulatory compliance & risk management. Given the current economic situation, we see IT budgets to remain largely flat for CY2013 and expect volume growth of tier-I Indian IT companies to be 9% plus. We expect TCS and HCL Tech to lead growth in the tier-I IT pack by growing higher than the industry average in FY2014. TCS stock price has run up significantly and is currently trading at 18.3x FY2014E EPS, which leaves little room for upside in the stock price. The PE premium between TCS and Infosys has reduced now given Infosys outperformance during 3QFY2013 after six quarters of disappointment. We believe, a couple of quarters of outperformance is required from Infosys for its stock to get re-rated further. HCL Tech is trading at 13.4x FY2014E EPS; we maintain Accumulate rating on the stock with a target price of `765. Among mid-caps, we recommend Buy rating on Hexaware with a target price of `113. Tech Mahindra remains one of our preferred picks in the entire IT space as the company has recently acquired two companies which will give it inorganic boost. Also, post its merger with Mahindra Satyam, the risks which the company is facing right now such as client concentration and industry concentration will be curtailed.

Please refer to important disclosures at the end of this report

Ankita Somani

+91 22 3935 7800 Ext: 6819 ankita.somani@angelbroking.com

IT | 3QFY2013 Result Review

Modest revenue growth but volume growth subdued

During 3QFY2013, overall results of large cap companies were better than midcap firms as factors such as demand pressures, limited pricing power, high client concentration and limited bench sizes restricted profits of mid-tier IT companies. This is contrary to the trend seen in the past few quarters, when tier-2 firms comprehensively outperformed their tier-1 counterparts. The entire tier-I IT companies under our coverage posted better-than-expected revenue growth. Volumes were soft during the quarter for both tier-I and tier-II companies, which is partly attributable to lower billing days. Among tier-1 firms, Wipro reported a 1% qoq decline in overall volumes while HCL Tech reported the highest volume growth of 3% qoq. Overall realisation improved for almost all the tier-I IT companies but this was because of change in business mix (slightly more discretionary spending, which has higher bill rates) and a higher proportion of fixed-price projects which brought in productivity gains. Based on comments from company Managements, prices are likely to remain stable in the near term, indicating that the growth will be led by volumes. Discretionary spending showed initial signs of revival during 3QFY2013, which have led to expectations of a demand recovery in the IT sector.

Exhibit 1: Trend in volume growth (qoq)

6 4.9 4 3.2 3.1 1.8 3.3 2.0 0.8 0 (1.5) 3QFY12 4QFY12 Infosys TCS 1QFY13 HCL Tech 2QFY13 Wipro* 2.7 1.8 0.8 0.2 5.3 5.0 4.5 3.8 3.0 2.0 1.3

(%)

(1.0) 3QFY13

(2)

Source: Company, Angel Research; Note: *For IT services segment

Moderate realization improvement coupled with subdued volume growth led to better-than-expected revenue growth with tier-I firms USD revenue posting a 3.9% qoq growth (3.4% excluding Lodestone). For tier-II IT companies, USD revenue came in the range of (0.4)-10.1% with Tech Mahindra leading the pack aided by revenues from two acquisitions done recently. The incremental revenue addition is higher during 3QFY2013 in the last four quarters.

February 14, 201

IT | 3QFY2013 Result Review

Exhibit 2: Trend in USD revenue growth (qoq) Tier I

7 6 5 4

(%)

6.3 4.6 3.4 2.4 2.2 2.0 2.4 2.5 2.0 3.0 3.0 3.2 2.6 1.7 3.6 3.3 2.4

3 2 1 0 (1) (2)

3QFY12

4QFY12 (1.9) Infosys

1QFY13 (1.1) TCS (1.4) HCL Tech

2QFY13

3QFY13

Wipro*

Source: Company, Angel Research; Note: *For IT services segment

Exhibit 3: Trend in USD revenue growth (qoq) Tier II

12 10 8 6 10.1

(%)

4 2 0 (2) (4) Tech Mahindra Mahindra Satyam MindTree Persistent 4QFY12 1QFY13 2QFY13

2.5 0.6 1.2

0.5

(0.4) 3QFY13

Hexaware

Infotech

Source: Company, Angel Research

BFSI performance surprises positively but telecom continues to be a laggard

During 3QFY2013, tier-I IT companies witnessed better-than-expected revenue growth from the BFSI industry vertical despite the impact from furloughs and Hurricane Sandy, which could be an indication of consolidation gains and improvement in discretionary spends. Tier-II companies, however, reported weak performance in the BFSI industry vertical. TCS Management was optimistic about the growth prospects from BFSI vertical, while Infosys Management guided for a declining budget. Wipros Management indicated pressure in the capital markets segment. The telecom vertical continued to be a laggard during the quarter with TCS and HCL Tech reporting 4.7% and 1.9% qoq decline in revenues. Infosys, on the other hand, reported a 3.1% qoq growth in revenues from the telecom vertical but the same was largely driven by inorganic revenues.

February 14, 201

IT | 3QFY2013 Result Review

Verticals such and lifesciences & healthcare, manufacturing and retail maintained their revenue growth momentum. Managements of IT companies indicated that retail industry vertical is likely to lead growth with opportunities coming in from areas like digitization, cloud and data analytics. In addition, healthcare is believed to be an emerging vertical in terms of IT spend.

Exhibit 4: Trend in USD revenue growth from the BFSI industry

12 10 8 6 5.0 3.4 3.0 2.0 2.8 (0.2) (0.6) (2.7) (4.7) 3QFY12 4QFY12 Infosys TCS 1QFY13 Wipro 2QFY13 HCL Tech 3QFY13 (1.1) 2.2 0.8 6.3 4.14.04.5 3.8 2.0 10.9

(%)

4 2 0

(2) (4) (6)

(2.1)

Source: Company, Angel Research

Margins mixed

On an average basis, the EBIDTA margin of tier-I IT companies remained almost flat on a sequential basis with Infosys being the biggest laggard by posting 60bp qoq decline in EBIDTA margin because of offshore wage hike. TCS and HCL Tech posted 53bp and 40bp qoq increase in their respective EBITDA margins led by productivity improvements. During 3QFY2013, tier-II IT companies disappointed in terms of EBITDA margin due to muted volume growth with almost flat utilization level. Tech Mahindra surprised positively on the EBITDA margin front with margin growing by 30bp qoq to 21.0%.

Exhibit 5: Trend in EBITDA margin Tier I

35 31.0 30 29.1 31.0 29.5 29.1 24.0 23.2 20 17.1 15 2QFY12 3QFY12 Infosys 4QFY12 TCS 1QFY13 HCL Tech 2QFY13 Wipro* 3QFY13 18.5 23.9 23.8 18.4 22.0 33.7 32.6 30.6 29.1 28.4 23.7 22.2 29.0 28.5 23.5 22.6

Source: Company, Angel Research; Note: *For IT services segment

February 14, 201

(%)

25

IT | 3QFY2013 Result Review

Exhibit 6: Trend in EBITDA margin Tier II

29 25 21 26.8 21.7 21.4 20.9 22.9 27.2 21.5 22.1 20.7 24.8 21.6 21.0 20.4 16.9 15.7

21.6 16.7

(%)

17 13 9 5 1QFY13

15.1

2QFY13 MindTree Persistent

3QFY13 Hexaware KPIT Cummins

Tech Mahindra

Mahindra Satyam

Source: Company, Angel Research

Initial signs of divergence in commentary fading away

The Managements of tier-I IT companies have been giving divergent commentary on the growth outlook since last three quarters. However the commentaries given by the Managements of the top four Indian IT players, at the time of 3QFY2013 results, suggest pockets of optimism for the sector. Initial signs show that CY2013 IT budgets are expected to remain flat. Infosys Management indicated that the environment remains almost as same as where it was a few months back. The company continues to see a challenging macro environment and delays in decision making from clients ends. However, Infosys signed eight large deals (six large deals signed in 2QFY2013) with TCV worth US$750mn during 3QFY2013. Infosys Management indicates flat to declining IT budgets for CY2013 with more clarity coming in by February 2013. TCS Management sounded confident of FY2014 being a better year than FY2013 as clients seem to have a better handle on the kind of projects they want to execute and are aware of the challenging macro environment. They have planned their IT spending considering these challenges. Factors like a healthy pipeline, broadbased deal signings and upturn in discretionary spending have collectively lent confidence to TCS in estimating FY2014 to be a better year than FY2013. The company continues to receive deals in transformation projects. The company bagged seven large deals in 3QFY2013. Wipros Management indicated that CY2013 IT budgets are expected to remain stable and anticipates a positive demand environment ahead. Prospects of growth revival remain healthy on the back of 1) better deal closures in 3QFY2013 as against in 2QFY2013, 2) 1.7x increase in the deal pipeline yoy and 3) ~2x increase in the number of large deals in the pipeline, yoy. HCL Tech signed 12 multi-year, multi-million dollar deals during 2QFY2013 on top of 12 deals signed in 1QFY2013. The Management sounded confident of sustaining revenue growth within the top-tier league and has been focusing a lot of effort in the US and Europe geographies to chase the rebid opportunity with its recent win ratios of ~50%. Its Management cited that the re-bid renewal market

February 14, 201

IT | 3QFY2013 Result Review

continues to be strong, whether it's in the US or in Europe and in specific countries across Asia as well. Cognizant has issued CY2013 guidance of at least 17% yoy growth in revenues (includes anticipated acquisition revenue of US$90mn). The 1QCY2013 guidance (~2.6% qoq growth) implies ~4% CQGR over 2Q-4QFY2013 to meet the lower end of the CY2013 organic revenue guidance of ~16%. Its Management indicated that the deal pipeline is better as compared to what it was at the start of CY2012. Within industry verticals, the company is positive on BFSI as it sees pent up demand and strength in insurance driving growth, while it remained cautious on healthcare, considering contraction in IT budgets within pharma clients.

Outlook and Valuation

Nasscom has recently issued guidance of 12-14% yoy growth for the Indian IT exports industry and estimates it to reach ~US$84-87bn in FY2014. Nasscom estimates 10.2% yoy growth in IT service exports to US$75.8bn in FY2013, ie in the mid range of its lowered guidance of 9-12% (Nasscom lowered its guidance from 11-14% growth in February 2012 to 9-12% in November 2012). Given the lower base of FY2013, some rebound was bound to happen in FY2014. Nasscom is optimistic about growth in CY2013 for Indian IT vendors. Gartner has recently indicated an optimistic outlook and has increased IT spending growth forecast for CY2013 to 4.2%, up from the prior forecast of 3.8%, mentioning that uncertainty around the globe is coming to end and the same is likely to lead to an increase in IT spending. In addition, International Data Corporation (IDC) also predicts worldwide IT spending to exceed US$2.1tr, up 5.7% yoy in CY2013. After a gap of almost a year, commentary from Managements of various IT companies on growth is turning positive. The incremental revenue addition on a qoq basis in 3QFY2013 was also the highest in the last four quarters as economic conditions in developed economies have stabilized and clients are now spending prudently, keeping in mind the challenging business environment. IT stocks have reacted positively post 3QFY2013 results commentary on the back of factors such as: 1) pick up in discretionary spending, 2) FY2014 deal pipeline looking better than FY2013, 3) less cautious commentary from Managements, 4) upbeat revenue by tier-I IT companies in a lull quarter and 5) revenue growth seen from BFSI industry vertical suggesting that weakness in BFSI is abating, which is the highest revenue generator for IT companies. An uptick in discretionary spending is clearly visible as the incremental revenue additions from consulting and system integration services have picked up in the last two quarters and are higher on a yoy basis for the first time in the last five quarters. Further, Oracle and SAP license sales have been better-than-expected with positive commentary going ahead. 3QFY2013 witnessed slight revival in discretionary spending which has led to expectations of a demand recovery and convergence between erstwhile leaders and laggards. We believe demand for IT offshore services would continue to be strong due to the need for operational efficiency & cost rationalization and regulatory compliance & risk management. From a longer term perspective, IT companies are now investing in areas of cloud, mobility and analytics.

February 14, 201

IT | 3QFY2013 Result Review

Policy and economic recovery coupled with clarity on fiscal cliff and containment of Europe crisis, will likely result in higher IT spending and increase in demand for discretionary spend. Given the current economic situation, we see IT budgets to remain largely flat for CY2013 and expect volume growth of tier-I Indian IT companies to be 9% plus. However, we do not foresee any price erosion as of now. In terms of mid-cap IT companies, we expect challenges to persist due to factors such as high client concentration, demand pressures, restricted pricing power, limited margin levers, and limited bench sizes. Most of the tier-II companies started CY2012 with a strong outlook on growth. But as the year progressed, the Management commentary on growth has moderated. We expect TCS and HCL Tech to lead the growth in tier-I IT pack by growing higher than the industry average in FY2014. TCS stock price has run up significantly and is currently trading at 18.3x FY2014E EPS, which leaves little room for upside in the stock price. The PE premium between TCS and Infosys has reduced now, given Infosys outperformance during 3QFY2013 after six quarters of disappointment. Infosys is currently trading at 16.3x FY2014E EPS which is at a premium to the Sensex. We believe, a couple of quarters of outperformance is required from the company for it to get its stock re-rated further. HCL Tech is trading at 13.4x FY2014E EPS; we maintain Accumulate rating on the stock with a target price of `765. Among mid-caps, we recommend a Buy rating on Hexaware with a target price of `113, owing to steep correction in the stock price despite expectations of the company posting revenue growth at par with the industry average. In addition, we like KPIT and have a Buy rating on it with a target price `140 on the back of its niche position. Tech Mahindra remains one of our preferred picks in the entire IT space as the company has recently acquired two companies which will give it inorganic boost. Also, post its merger with Mahindra Satyam, the risks which the company is facing right now such as client concentration and industry concentration will be curtailed and the company will be able to reap benefits from Mahindra Satyams capability in enterprise services.

February 14, 201

IT | 3QFY2013 Result Review

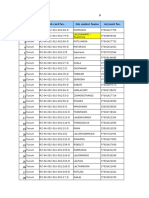

Exhibit 7: Recommendation summary

Company HCL Tech Hexaware Infosys Infotech Enterprises KPIT Cummins Mahindra Satyam MindTree Mphasis NIIT^ Persistent TCS Tech Mahindra* Wipro Reco Accumulate Buy Neutral Accumulate Buy Accumulate Accumulate Accumulate Buy Neutral Neutral Accumulate Accumulate CMP (`) 705 81 2,813 163 108 116 795 344 25 535 1,447 1,002 396 Tgt Price (`) 765 113 184 140 126 868 396 36 1,105 429 Upside (%) 8.5 39.9 13.0 29.4 8.7 9.1 14.9 44.9 10.3 8.3 FY2014E EBITDA (%) 20.7 18.3 28.8 17.4 15.2 19.8 19.3 17.5 10.9 24.1 28.9 19.6 19.4 FY2014E P/E (x) 13.4 8.0 16.3 8.4 8.4 10.2 9.2 9.1 4.0 9.9 18.3 9.1 14.3 FY2011-14E EPS CAGR (%) 13.6 4.1 5.9 10.3 16.9 3.7 17.4 0.0 (2.7) 15.1 13.3 7.9 6.8 FY2014E RoCE (%) 1.6 0.8 2.9 0.5 0.7 1.2 0.9 0.6 0.1 1.1 3.7 1.7 1.6 FY2014E RoE (%) 22.9 21.2 21.3 13.6 20.5 23.7 21.7 13.5 14.1 18.0 29.7 22.3 17.9

Source: Company, Angel Research; Note: ^Valued on SOTP basis

February 14, 201

IT | 3QFY2013 Result Review

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement

Analyst ownership of the stock HCL Tech Hexaware Infosys No No No No No No No No No No No No No Angel and its Group companies ownership of the stock No No No No No No No No No No No No No Angel and its Group companies' Directors ownership of the stock No No No No No No No No No No No No No Broking relationship with company covered No No No No No No No No No No No No No

Infotech Enterprises

KPIT Cummins Mahindra Satyam MindTree MphasiS NIIT Persistent TCS Tech Mahindra Wipro

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

February 14, 201

IT | 3QFY2013 Result Review

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team Fundamental: Sarabjit Kour Nangra Vaibhav Agrawal Bhavesh Chauhan Viral Shah Sharan Lillaney V Srinivasan Yaresh Kothari Ankita Somani Sourabh Taparia Bhupali Gursale Vinay Rachh Amit Patil Shareen Batatawala Twinkle Gosar Tejashwini Kumari Technicals: Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Derivatives: Siddarth Bhamre Institutional Sales Team: Mayuresh Joshi Hiten Sampat Meenakshi Chavan Gaurang Tisani Akshay Shah Production Team: Tejas Vahalia Dilip Patel Research Editor Production tejas.vahalia@angelbroking.com dilipm.patel@angelbroking.com VP - Institutional Sales Sr. A.V.P- Institution sales Dealer Dealer Sr. Executive mayuresh.joshi@angelbroking.com hiten.sampat@angelbroking.com meenakshis.chavan@angelbroking.com gaurangp.tisani@angelbroking.com akshayr.shah@angelbroking.com Head - Derivatives siddarth.bhamre@angelbroking.com Sr. Technical Analyst Technical Analyst Technical Analyst shardul.kulkarni@angelbroking.com sameet.chavan@angelbroking.com sacchitanand.uttekar@angelbroking.com VP-Research, Pharmaceutical VP-Research, Banking Sr. Analyst (Metals & Mining) Sr. Analyst (Infrastructure) Analyst (Mid-cap) Analyst (Cement, FMCG) Analyst (Automobile) Analyst (IT, Telecom) Analyst (Banking) Economist Research Associate Research Associate Research Associate Research Associate Research Associate sarabjit@angelbroking.com vaibhav.agrawal@angelbroking.com bhaveshu.chauhan@angelbroking.com viralk.shah@angelbroking.com sharanb.lillaney@angelbroking.com v.srinivasan@angelbroking.com yareshb.kothari@angelbroking.com ankita.somani@angelbroking.com sourabh.taparia@angelbroking.com bhupali.gursale@angelbroking.com vinay.rachh@angelbroking.com amit.patil@angelbroking.com shareen.batatawala@angelbroking.com gosar.twinkle@angelbroking.com tejashwini.kumari@angelbroking.com

CSO & Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai - 93. Tel: (022) 3083 7700. Angel Broking Pvt. Ltd: BSE Cash: INB010996539 / BSE F&O: INF010996539, CDSL Regn. No.: IN - DP - CDSL - 234 2004, PMS Regn. Code: PM/INP000001546, NSE Cash: INB231279838 / NSE F&O: INF231279838 / NSE Currency: INE231279838, MCX Stock Exchange Ltd: INE261279838 / Member ID: 10500. Angel Commodities Broking (P) Ltd.: MCX Member ID: 12685 / FMC Regn. No.: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn. No.: NCDEX / TCM / CORP / 0302.

February 14, 201

10

You might also like

- Moving up the Value Chain: The Road Ahead for Indian It ExportersFrom EverandMoving up the Value Chain: The Road Ahead for Indian It ExportersNo ratings yet

- It 20230331 Mosl RP PG014Document14 pagesIt 20230331 Mosl RP PG014Aditya HalwasiyaNo ratings yet

- Ims Securities LTD.: Company ReportDocument10 pagesIms Securities LTD.: Company ReportSatyanarayana Murthy MandavilliNo ratings yet

- It 20211001 Mosl RP PG014Document14 pagesIt 20211001 Mosl RP PG014Prajwal WakhareNo ratings yet

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Software Sector Analysis ReportDocument8 pagesSoftware Sector Analysis ReportpintuNo ratings yet

- Big Tech's Revenue Soars, Indian IT PlummetsDocument7 pagesBig Tech's Revenue Soars, Indian IT PlummetsOsman NasirNo ratings yet

- Information TechnologyDocument4 pagesInformation TechnologySheetal IyerNo ratings yet

- 4QFY2012 Result Review - ITDocument8 pages4QFY2012 Result Review - ITAngel BrokingNo ratings yet

- IT Sector ReviewDocument16 pagesIT Sector ReviewPratik RambhiaNo ratings yet

- Jom 05 03 006Document9 pagesJom 05 03 006kureshia249No ratings yet

- Relative Valuation RepoDocument4 pagesRelative Valuation RepoPrasanth TalluriNo ratings yet

- Wipro Technologies LTD.: Sapm Project Submission Submitted byDocument18 pagesWipro Technologies LTD.: Sapm Project Submission Submitted byManoj ThadaniNo ratings yet

- Analysis of Tech Mahindra's Annual ReportDocument12 pagesAnalysis of Tech Mahindra's Annual ReportUtsabChakrabortyNo ratings yet

- IT/ITES Sector in India: An Analysis of Revenue, Employment & GrowthDocument30 pagesIT/ITES Sector in India: An Analysis of Revenue, Employment & GrowthSabitavo DasNo ratings yet

- Indian It SectorDocument6 pagesIndian It SectorRoshankumar S PimpalkarNo ratings yet

- Research Report - InfosysDocument4 pagesResearch Report - InfosysDishant KhanejaNo ratings yet

- Technical Analysis ReportDocument8 pagesTechnical Analysis ReportManikantaNo ratings yet

- IT BPO Industry Insights Sep 2012 FinalDocument17 pagesIT BPO Industry Insights Sep 2012 FinalRemiNo ratings yet

- Summer ReportDocument45 pagesSummer ReportAnkit GargNo ratings yet

- Business Strategy-IT Industry-Tata Consultancy ServicesDocument21 pagesBusiness Strategy-IT Industry-Tata Consultancy Servicessdhamangaonkar726483% (12)

- Financial Meltdown: Threats & Opportunities for Indian IT SectorDocument2 pagesFinancial Meltdown: Threats & Opportunities for Indian IT SectorNitesh NigamNo ratings yet

- FM AssignmentDocument30 pagesFM AssignmentHemendra GuptaNo ratings yet

- Chapter-3 Porter's Five ForcesDocument8 pagesChapter-3 Porter's Five Forcesdenin joyNo ratings yet

- Itsm Tun-Anan PrefiDocument12 pagesItsm Tun-Anan Prefiirishmaejovita9No ratings yet

- Annual Report Analysis For FMCG CompaniesDocument5 pagesAnnual Report Analysis For FMCG CompaniesJyoti GuptaNo ratings yet

- Security Analysis and Portfolio Management: CMC Limited Assignment 1 (Part B)Document17 pagesSecurity Analysis and Portfolio Management: CMC Limited Assignment 1 (Part B)dipanshurustagiNo ratings yet

- MBA INTERNSHIP REPORT ON INDIA'S GROWING IT INDUSTRYDocument46 pagesMBA INTERNSHIP REPORT ON INDIA'S GROWING IT INDUSTRYShilpa SharmaNo ratings yet

- Information Technology: of Non-Linearity, Scale and ProfitabilityDocument34 pagesInformation Technology: of Non-Linearity, Scale and ProfitabilityAbhishek SinghNo ratings yet

- It Sector in India PDFDocument77 pagesIt Sector in India PDFAnish NairNo ratings yet

- Infosys ReportDocument7 pagesInfosys ReportNITINNo ratings yet

- Industry Analysis of ItDocument6 pagesIndustry Analysis of ItDurgesh KumarNo ratings yet

- Chapter 2 & 3: "Industry Overview, Literature Review & Research Methodology"Document18 pagesChapter 2 & 3: "Industry Overview, Literature Review & Research Methodology"A KNo ratings yet

- Sip Report Rough DraftDocument32 pagesSip Report Rough DraftAnuraag KulkarniNo ratings yet

- Final Project WorkDocument100 pagesFinal Project WorkRaja SekharNo ratings yet

- Bharti Airtel, 4th February, 2013Document14 pagesBharti Airtel, 4th February, 2013Angel BrokingNo ratings yet

- IT-ITes - Beacon Sector Special 2021Document32 pagesIT-ITes - Beacon Sector Special 2021Mammen Vergis PunchamannilNo ratings yet

- IT Industry - Q2FY09 UpdateDocument7 pagesIT Industry - Q2FY09 Updateca.deepaktiwariNo ratings yet

- Financial Analysis On TcsDocument28 pagesFinancial Analysis On TcsBidushi Patro20% (5)

- Full Project Ashok ADocument73 pagesFull Project Ashok AKhan SultanNo ratings yet

- Business Process OutsourcingDocument21 pagesBusiness Process OutsourcingAnsarAnsariNo ratings yet

- Industry AnalysisDocument9 pagesIndustry AnalysisNitesh Kr SinghNo ratings yet

- A Report On MindTreeDocument19 pagesA Report On MindTreeBhaskar Chatterjee100% (1)

- IT services market share, BPM trends, semiconductor assembly forecastDocument5 pagesIT services market share, BPM trends, semiconductor assembly forecastJyotsna AisiriNo ratings yet

- IT Sector Update Q1FY2017 Earnings Review Aug18 16Document5 pagesIT Sector Update Q1FY2017 Earnings Review Aug18 16Manish SoniNo ratings yet

- Lead Generation and Sales Study of Business Management Systems in PuneDocument57 pagesLead Generation and Sales Study of Business Management Systems in PunesurajNo ratings yet

- Wireless Tele Services-Sep11 - BNP ParibasDocument67 pagesWireless Tele Services-Sep11 - BNP ParibassachinrshahNo ratings yet

- IT & ITes Industry Sector Report by Finance Club, JBIMSDocument19 pagesIT & ITes Industry Sector Report by Finance Club, JBIMSRajendra BhoirNo ratings yet

- Indian Information Technology Services Sector and The Domestic User Industry - An Uneasy Partnership?Document17 pagesIndian Information Technology Services Sector and The Domestic User Industry - An Uneasy Partnership?Sachin GargNo ratings yet

- Wipro Case StudyDocument8 pagesWipro Case Studysumaya parveenNo ratings yet

- Name: Chintada - Pradeep 1226113112 Information Technology Outsourcing SummaryDocument7 pagesName: Chintada - Pradeep 1226113112 Information Technology Outsourcing SummaryPradeep ChintadaNo ratings yet

- Analyzing Growth of India's IT IndustryDocument7 pagesAnalyzing Growth of India's IT IndustryMandar KulkarniNo ratings yet

- MMMMDocument28 pagesMMMMJayanth KumarNo ratings yet

- IT CompendiumDocument19 pagesIT CompendiumKolapalli AkhilNo ratings yet

- IITD DMS PI KitDocument207 pagesIITD DMS PI KitBrian MayNo ratings yet

- Performance Highlights: NeutralDocument13 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- FM Assignment 2Document20 pagesFM Assignment 2Earl FarragoNo ratings yet

- Infosys Technologies: Cautious in The Realm of Rising UncertaintyDocument7 pagesInfosys Technologies: Cautious in The Realm of Rising UncertaintyAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- (Sem.-VI) Examination Oct - Nov.-2019 Indian Economy - (NEW)Document2 pages(Sem.-VI) Examination Oct - Nov.-2019 Indian Economy - (NEW)Manoj ValaNo ratings yet

- EY MJL - S4HANA - Final - Commercial - Proposal - 01sep2019Document17 pagesEY MJL - S4HANA - Final - Commercial - Proposal - 01sep2019Sharif RaziNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Front Page On Challenges and Prospects of Hotel Industries in IlaroDocument4 pagesFront Page On Challenges and Prospects of Hotel Industries in IlaropeterNo ratings yet

- Regulating Oil Prices and the Oil Price Stabilization FundDocument143 pagesRegulating Oil Prices and the Oil Price Stabilization FundMaria Muryel ClerigoNo ratings yet

- G.R. No. L-1927 - Roño Vs GomezDocument4 pagesG.R. No. L-1927 - Roño Vs GomezMaria Lourdes Nacorda GelicameNo ratings yet

- An Analysis of The Impact of Imports of Steel From China On Indian Steel Industry 2167 0234 1000340Document7 pagesAn Analysis of The Impact of Imports of Steel From China On Indian Steel Industry 2167 0234 1000340SANTOSH KUMARNo ratings yet

- ACC4213 Self-Learning Week1Document2 pagesACC4213 Self-Learning Week1Amanda AlanNo ratings yet

- Food Safety AssignmentDocument10 pagesFood Safety AssignmentMeha RajNo ratings yet

- Financial Analysis - WalmartDocument3 pagesFinancial Analysis - WalmartLuka KhmaladzeNo ratings yet

- Dwnload Full Marketing An Introduction Canadian 6th Edition Armstrong Test Bank PDFDocument36 pagesDwnload Full Marketing An Introduction Canadian 6th Edition Armstrong Test Bank PDFahrdyawtelq100% (9)

- Project 2 Engl 202dDocument7 pagesProject 2 Engl 202dapi-660606149No ratings yet

- Nee Balance 550 - Google Search PDFDocument1 pageNee Balance 550 - Google Search PDFBlack OatmealNo ratings yet

- Municipality of San Clemente - Citizens CharterDocument155 pagesMunicipality of San Clemente - Citizens CharterFree FlixnetNo ratings yet

- Merchant Shipping Notice No.09 of 2014: Sub: International Safety Management (ISM) Code On Indian Ships-RegDocument38 pagesMerchant Shipping Notice No.09 of 2014: Sub: International Safety Management (ISM) Code On Indian Ships-RegVaibhav MoreNo ratings yet

- Woven Capital Associate ChallengeDocument2 pagesWoven Capital Associate ChallengeHaruka TakamoriNo ratings yet

- Tuirum Adhaar Update Tur ListDocument4 pagesTuirum Adhaar Update Tur ListLalthlamuana MuanaNo ratings yet

- Economic Evaluation in Health Care,,,,,Methods - Handout.Document8 pagesEconomic Evaluation in Health Care,,,,,Methods - Handout.Wenwa TracyNo ratings yet

- Islamic Marketing: Strategy For Marketing Islamic Agro Products in Islamic Banking Institutions in MalaysiaDocument25 pagesIslamic Marketing: Strategy For Marketing Islamic Agro Products in Islamic Banking Institutions in MalaysiaMuhammad Ridhwan Ab. Aziz50% (2)

- Swot Analysis: Presented by Piyush Aggarwal Bba - Vi EDocument9 pagesSwot Analysis: Presented by Piyush Aggarwal Bba - Vi Epiyush aggarwalNo ratings yet

- The New Context For Specialty CoffeeDocument8 pagesThe New Context For Specialty CoffeeSpecialtyCoffee100% (2)

- 2024 02 HCI 221 Lecture 1Document29 pages2024 02 HCI 221 Lecture 1lovelydistor26No ratings yet

- AVEVA World Magazine 2012Document44 pagesAVEVA World Magazine 2012vb_pol@yahooNo ratings yet

- SAP S4hana SD - How To Configure MTO in Easy WayDocument11 pagesSAP S4hana SD - How To Configure MTO in Easy WayANIMESH DAS Animesh DasNo ratings yet

- Buyer Behavior: HP Pavilion Dv6 - 1222TX LAPTOPDocument12 pagesBuyer Behavior: HP Pavilion Dv6 - 1222TX LAPTOPDevika PadmanabhanNo ratings yet

- Role of Nbfcs and Hfcs in Driving Sustainable GDP Growth in IndiaDocument44 pagesRole of Nbfcs and Hfcs in Driving Sustainable GDP Growth in IndiaVivek BandebucheNo ratings yet

- LGSF ANNEX B Sample OnlyDocument2 pagesLGSF ANNEX B Sample OnlyRen Mathew QuitorianoNo ratings yet

- MAT explainedDocument20 pagesMAT explainedmuskan khatriNo ratings yet

- Mighty Digits - Cash Out Dashboard KPeE5DGDocument6 pagesMighty Digits - Cash Out Dashboard KPeE5DGHilyah AuliaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Devan ShahNo ratings yet

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1632)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessFrom EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessRating: 4.5 out of 5 stars4.5/5 (327)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesFrom EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesRating: 4.5 out of 5 stars4.5/5 (273)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)

- SUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)From EverandSUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)Rating: 4.5 out of 5 stars4.5/5 (14)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (708)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsFrom EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsRating: 4.5 out of 5 stars4.5/5 (382)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessFrom EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNo ratings yet

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningFrom EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningRating: 4.5 out of 5 stars4.5/5 (55)

- Summary of 12 Rules for Life: An Antidote to ChaosFrom EverandSummary of 12 Rules for Life: An Antidote to ChaosRating: 4.5 out of 5 stars4.5/5 (294)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryFrom EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryRating: 5 out of 5 stars5/5 (555)

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaFrom EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaRating: 4.5 out of 5 stars4.5/5 (266)

- Summary of Slow Productivity by Cal Newport: The Lost Art of Accomplishment Without BurnoutFrom EverandSummary of Slow Productivity by Cal Newport: The Lost Art of Accomplishment Without BurnoutRating: 1 out of 5 stars1/5 (1)

- Summary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionFrom EverandSummary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionNo ratings yet

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsFrom EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsNo ratings yet

- Essentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessFrom EverandEssentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessRating: 4.5 out of 5 stars4.5/5 (187)

- We Were the Lucky Ones: by Georgia Hunter | Conversation StartersFrom EverandWe Were the Lucky Ones: by Georgia Hunter | Conversation StartersNo ratings yet

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (61)

- Summary of Bad Therapy by Abigail Shrier: Why the Kids Aren't Growing UpFrom EverandSummary of Bad Therapy by Abigail Shrier: Why the Kids Aren't Growing UpRating: 5 out of 5 stars5/5 (1)

- Book Summary of The Subtle Art of Not Giving a F*ck by Mark MansonFrom EverandBook Summary of The Subtle Art of Not Giving a F*ck by Mark MansonRating: 4.5 out of 5 stars4.5/5 (577)

- The 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageFrom EverandThe 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageRating: 4.5 out of 5 stars4.5/5 (329)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeFrom EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeRating: 4.5 out of 5 stars4.5/5 (128)

- Summary of Atomic Habits by James ClearFrom EverandSummary of Atomic Habits by James ClearRating: 5 out of 5 stars5/5 (168)

- Crucial Conversations by Kerry Patterson, Joseph Grenny, Ron McMillan, and Al Switzler - Book Summary: Tools for Talking When Stakes Are HighFrom EverandCrucial Conversations by Kerry Patterson, Joseph Grenny, Ron McMillan, and Al Switzler - Book Summary: Tools for Talking When Stakes Are HighRating: 4.5 out of 5 stars4.5/5 (97)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindFrom EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindRating: 4.5 out of 5 stars4.5/5 (57)

- Blink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingFrom EverandBlink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingRating: 4.5 out of 5 stars4.5/5 (114)

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursFrom EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursNo ratings yet

- Psycho-Cybernetics by Maxwell Maltz - Book SummaryFrom EverandPsycho-Cybernetics by Maxwell Maltz - Book SummaryRating: 4.5 out of 5 stars4.5/5 (91)