Professional Documents

Culture Documents

Drugs Aproved 2012

Uploaded by

Tomas CalleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Drugs Aproved 2012

Uploaded by

Tomas CalleCopyright:

Available Formats

BUSINESS

A BOUNTIFUL YEAR

NEW DRUG APPROVALS soared in 2012, with treatments

for cancer and rare diseases leading the pack

LISA M. JARVIS, C&EN NORTHEAST NEWS BUREAU

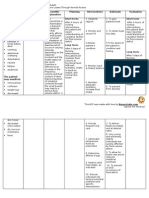

THE PHARMACEUTICAL industry might

regulators help bring to patients sooner. still be dusting itself off after its recent fall The crop of new drugs features several from the patent cliffa difficult period of firsts: a breakthrough therapy for cystic filosing exclusive brosis (Kalydeco), a LAST YEARS BOUNTY was not spread markets for bigtreatment for drugevenly. Notably, neither AstraZeneca nor STICKER SHOCK selling drugsbut resistant tubercuLilly brought a new treatment to market. companies have a losis (Sirturo), a Both companies are experiencing brutal New drugs for cancer and rare reason to stop and drug made in carrot losses to generics alongside significant setdiseases come with big price tags celebrate. Last year, cells (Elelyso), and backs to late-stage drug candidates. DRUG COST the Food & Drug 18 products with Pfizer, on the other hand, has a stake Gattexa $295,000/year Administration apnovel mechanisms in five of the drugs on the list. They are Kalydecoa $294,000/year proved 39 new prodof action. The a broad range of products that the firm Juxtapida $200,000$300,000/year ucts, a 16-year high. collection skews hopes will help recoup the billions of dola Elelyso $150,000/year In recent years, heavily toward onlars in sales that almost instantly disapa,b Iclusig $115,000/year companies have cology drugs and, in peared in late 2011 when the patent expired Zaltrapb $11,000/month faced withering a reflection of the on Lipitor, its cholesterol-lowering drug. Cometriqa,b $9,900/month Kyprolisb $9,550/month criticism from industrys recent Among Pfizers new products are two Stivargaa,b $9,350/month shareholders and interest in rare potential blockbusters: the rheumatoid arInlytab < $8,900/month industry watchers diseases, includes thritis pill Xeljanz and the blood thinner ElBosulifa,b $8,200/month about their research a number of treatiquis, which it comarkets with Bristol-Myers b Erivedge $7,500/month prowess as they ments for so-called Squibb. Xeljanz is the first JAK3 inhibitor to Xtandib $7,450/month struggle to replace orphan diseases. cross the finish line in the arthritis arena, a Drug for orphan disease. b Cancer treatment. the blockbuster But many of them and analysts are encouraged that FDA is alSOURCE: Companies drugs losing patent come at a premium, lowing the drug to be used in a wider populaprotection. The carrying price tags tion than expected. Pfizer hopes to improve temptation now is to draw conclusions that are raising red flags for governments, its competitive edge with the price: At about what the flood of new drugs could insurers, and patients. $25,000 per year, the drug costs slightly less mean about the health of the industry. In an encouraging sign for medicinal than current biologic treatments for rheuAlthough the data are impressive, it may chemists, small molecules represent the matoid arthritis such as Enbrel and Humira. be too soon to judge the R&D enterprise. lions share of the years graduating class, Meanwhile, Eliquis, a Factor Xa inhibiBut a clearer case can be made for what this with 26 productstwo-thirds of the overall tor, enters a crowded field with two similar bountiful crop means about the health of collectiongetting a green light. Despite inhibitors already on the market and several companies relationship with FDA. After several lean years, 2012 marked the second year in a row of a substantial increase in the NEW DRUG APPROVALS IN 2012 BY THE NUMBERS number of new drug approvals. Industry New The last year to Drugs Oncology New watchers see a willingness by FDA to be molecular see more NDAs: added to therapies: blood more efficient with its reviews and build entities Pfizers cancer better relationships with companies develapproved: portfolio: drugs: oping truly novel drugs. More firms are moving away from the disastrous low-risk culture that had depressed innovation and are being rewarded by drug Products with a approvals, says Bernard H. Munos, a former novel mechanism corporate strategist with Eli Lilly & Co. and Monoclonal of action: Highest annual cost among all founder of the InnoThink Center for Reantibodies new drugs, Gattex: search in Biomedical Innovation. Altogethapproved: er, we are making progress. Better leadership across much of the industry is producing SOURCES: FDA, companies better drugs that more-innovation-friendly

the industrys enchantment with monoclonal antibodies, only two were approved in 2012: Genentechs Perjeta, for HER2-positive breast cancer, and GlaxoSmithKlines antibody against inhaled anthrax. Most of the biologic drugs to reach the market are peptides or enzyme replacements. Of the 39 new products, 18 have a big pharma name attached, either through a discovery in its own labs or through a licensing deal. This compares with 19 of the 30 drugs approved in 2011.

1996

11

4 39

18

$295,000 2

WWW.CEN-ONLIN E .ORG

15

FE BRUARY 4, 20 13

BUSINESS

DRUGS APPROVED BY FDA IN 2012

DRUG NAME ACTIVE INGREDIENT MARKETER

Small molecules dominate the 39 drugs cleared for marketing last year

MODE OF ACTION INDICATION

Voraxaze Picato Inlyta 1 Erivedge 2 Kalydeco Zioptan Surfaxin Omontys 3 Amyvid Stendra Elelyso Perjeta 4 Belviq Myrbetriq Prepopik 5 Kyprolis Tudorza Pressair Zaltrap Stribild

Glucarpidase Ingenol mebutate Axitinib Vismodegib Ivacaftor Tafluprost Lucinactant Peginesatide Florbetapir F 18 Avanafil Taliglucerase alfa

Carboxypeptidase that inactivates methotrexate LEO Pharma Natural product with unknown MOA Pfizer VEGF1, VEGF2, and VEGF3 inhibitor Genentech SMO receptor antagonist Vertex Pharmaceuticals CFTR potentiator Merck & Co. Prostaglandin analog Discovery Labs Affymax Avid Radiopharmaceuticals Vivus Pfizer, Protalix Biotherapeutics Genentech Arena Pharmaceuticals Nonpyrogenic pulmonary surfactant Erythropoietin analog Radioisotope

BTG International

Methotrexate toxicity because of kidney failure Actinic keratosis Advanced kidney cancer Basal cell carcinoma Cystic fibrosis Open-angle glaucoma or ocular hypertension Prevention of respiratory distress syndrome Anemia related to chronic kidney disease PET imaging for Alzheimer's disease Erectile dysfunction Gaucher disease HER2-positive breast cancer Obesity Overactive bladder Colonoscopy preparation Multiple myeloma Chronic obstructive pulmonary disease Colorectal cancer

O

Cl

N HN

O Cl

1

H N N H O O

SO2CH3

2

H 3C N H N

OH

PDE5 inhibitor Glucocerebrosidase enzyme replacement Pertuzumab HER2 inhibitor Lorcaserin Serotonin 2C receptor agonist Mirabegron Astellas Pharma 3 adrenergic receptor activator Sodium picosulfate, Ferring Pharmaceuticals Colonic peristalsis stimulator magnesium oxide, and citric acid Carfilzomib Onyx Pharmaceuticals Proteasome inhibitor Aclidinium Forest Laboratories Muscarinic antagonist Ziv-aflibercept Elvitegravir, cobicistat, emtricitabine, tenofovir Sanofi Gilead Sciences

O O O

18F

3

NH Cl

4

O N O N H N H N H O O H N O O

VEGF-A, VEGF-B, and PlGF inhibitor Two nucleoside reverse HIV transcriptase inhibitors, an integrase inhibitor, and a liver enzyme metabolism inhibitor

5 studiesare for oncology, according to a recent report by Pharmaceutical Research & Manufacturers of America, the drug industrys main trade association. Between cancer drugs and the handful of products for rare diseases, patients may be experiencing sticker shock. This years list includes three products with a price tag of more than $200,000 per year, and many others hover around $100,000 per year. But for some drugs, soaring prices could soon hit a ceiling. Three oncologists from Memorial Sloan-Kettering Cancer Center took a stand in October against the $11,000-per-month price tag on Sanofis colorectal cancer drug Zaltrap. In a damning op-ed in the New York Times that outlined the precipitous climb in the cost of new cancer drugs, the doctors said they refused to give Zaltrap to their patients, noting that it works no better than an existing treatment. Sanofi backed down, effectively halving the cost of the drug through discounts off the list price.

more in late-stage studies. But Seamus Fernandez, a stock analyst who covers the drug industry for Leerink Swann, notes that Eliquis is effective and has a better safety profile than its competitors. He expects it could reach blockbuster status as quickly as 2014.

THE APPROVALS also marked an impor-

tant milestone for eight biotech firms Ariad Pharmaceuticals, Exelixis, Aegerion Pharmaceuticals, NPS Pharmaceuticals, ThromboGenics, Arena Pharmaceuticals, Vivus, and Affymax. Each firm scored its first-ever product approval, a critical achievement that for all was more than a decade in the making. FDA approval, however, does not mean automatic success. Exelixis, for example, struggled for years to get its multikinase inhibitor Cometriq across the finish line. Over the course of the drugs development, Exelixis won, and then lost, two different big pharma partners. Furthermore, the company sparred with FDA over how to

test the drugs efficacy in prostate cancer. In the end, Exelixis approval for Cometriq was for medullary thyroid cancer, which affects roughly 2,260 Americans each year. Although Cometriq is being studied as a treatment for other cancers with larger patient populations, including prostate cancer, data that could expand its therapeutic reach wont surface until 2014. Cometriq is one of many oncology drugs on the list. Nearly a third of the new drugs approved are for cancer, and the set includes four new treatments for blood cancers. There is lots of evidence that suggests innovation comes in waves. Thats pretty much the way science works, InnoThinks Munos says. It seems that such a wave is now carrying oncology, and many companies are trying to ride it. In fact, the industrys pursuit of new cancer treatments is likely to continue for the foreseeable future. Some 29% of the compounds in the new-product pipelineand 40% of the projects in Phase II

WWW.CEN-ONLIN E .ORG

16

FE BRUARY 4, 20 13

H 3C

DRUG NAME

N O CH3O HN N N CN OCH3 Cl

ACTIVE INGREDIENT

MARKETER

MODE OF ACTION

INDICATION

Neutroval Linzess Xtandi 6 Bosulif 7 Aubagio

Tbo-filgrastim Linaclotide Enzalutamide Bosutinib Teriflunomide Choline C 11 Regorafenib Ocriplasmin Perampanel Omacetaxine mepesuccinate Tofacitinib Cabozantinib Ponatinib

6

H N F3C O

Cl CN

Sicor Biotech, Teva Pharmaceutical Ironwood Pharmaceuticals Astellas Pharma, Medivation Pfizer Sanofi Mayo Clinic Bayer HealthCare Pharmaceuticals ThromboGenics Eisai Teva Pharmaceutical

Erythropoiesis stimulator Guanylate cyclase C agonist Androgen receptor inhibitor SRC and ABL inhibitor Pyrimidine synthesis inhibitor Radioisotope Multikinase inhibitor Proteolysis

Neutropenia in chronic kidney disease Chronic idiopathic constipation and irritable bowel syndrome Castration-resistant prostate cancer Chronic myelogenous leukemia Multiple sclerosis PET imaging agent to detect recurrent prostate cancer Colorectal cancer Symptomatic vitreomacular adhesion Epilepsy Chronic myelogenous leukemia Rheumatoid arthritis Medullary thyroid cancer Chronic myeloid leukemia and Ph+ acute lymphoblastic leukemia Inhalational anthrax Cushings disease Short bowel syndrome Cholesterol lowering in patients with homozygous familial hypercholesterolemia Anticoagulant

OH

7

N N O CN

Choline C 11 Injection Stivarga Jetrea Fycompa Synribo

H 3C N

N H

O H2N N N

8

O N O N

8 Xeljanz Cometriq Iclusig

AMPA receptor antagonist Cephalotaxine ester that inhibits protein synthesis Pfizer JAK3 inhibitor Exelixis cMet and VEGFR2 inhibitor Ariad Pharmaceuticals BCR-ABL inhibitor Human Genome Sciences, GlaxoSmithKline Novartis NPS Pharmaceuticals Aegerion Pharmaceuticals Pfizer, Bristol-Myers Squibb Johnson & Johnson Salix Pharmaceuticals

Peptide Antibody

Raxibacumab Raxibacumab

OCH3

Neutralizes toxins made by anthrax Somatostatin analog GLP-2 analog MTP inhibitor Factor Xa inhibitor

9

CH3 N CH3

Signifor Gattex Juxtapid

OH

Pasereotide Teduglutide Lomitapide Apixaban Bedaquiline Crofelemer

Small molecule

Br N O H3C

9 Eliquis 10 Sirturo Fulyzaq

10

Diarylquinolone that blocks Multi-drug-resistant tuberculosis ATP synthase tuberculosis CFTR and CaCC inhibitor Diarrhea in patients with HIV/ AIDS

Protein Botanical

Novel mode of action

NOTE: Drugs are listed in order of approval. KEY: Enzyme SOURCE: FDA

Given the sky-high prices of recently approved oncology drugs, industry watchers are worried that companies investment in this area may not be driven by scientific opportunities but by the fact that oncology is one of the few prescription areas that can carry the extreme prices some companies need to support their failing business model, Munos says. Yet, he doesnt think that strategy will succeed, since a flailing firm lacks the bold thinking and risk-taking culture needed to invent a breakthrough drug. Pricing controversies aside, industry observers are cheering the burst of new products in 2012. Glen Giovannetti, Ernst & Youngs global life sciences sector leader, cautions that using any 12-month period as a benchmark is shortsighted, but he says it is clear that the decline has reversed itself, which I think is encouraging. More important, industrys relationship with FDA appears to be improving. A good dialogue is going on, with senior leadership understanding the industrys issues and

making sure good drugs get to patients as soon as they can, Giovannetti says.

INDEED, THE 2012 numbers suggest FDA

is trying to make good on its promise to get new drugs to patients faster. When the agency accepts a New Drug Application, it sets a deadline for review and decision making based on the terms of the Prescription Drug User Fee Act. For a normal application, FDA has 10 months to give a thumbs-up or -down; if the agency grants a priority review for the drug, that window narrows to six months. For several years, notably 2008 and 2009, the agency, by its own admission, missed the normal review deadline many times. In its review of approvals for fiscal 2012, FDA noted that it now almost always makes a decision on time or even early. In fact, for some products, including the cystic fibrosis pill Kalydeco and the skin cancer drug Erivedge, approval came several months ahead of schedule.

In another signal of the agencys willingness to do better, 2012 brought the first two drugs to be granted breakthrough status, a designation meant to encourage medicines that can substantially improve the lives of people with deadly diseases. Vertex Pharmaceuticals took the honor of having the first two breakthrough drugs, for Kalydeco and VX-809, which is in Phase II trials. Both molecules address the underlying genetic defect of cystic fibrosis, a major advance given that existing drugs treat only the symptoms of the disease. FDA has yet to clarify what that status entails, but the agency has broadly suggested it means more communication and collaboration with a drugs sponsor to smooth the clinical path and facilitate the review process. Overall, the improved relationship with regulators and the high approval numbers have industry watchers cautiously optimistic for the coming years. Its very encouraging, Giovannetti says, but its fragile.

WWW.CEN-ONLIN E .ORG

17

FE BRUARY 4, 20 13

You might also like

- 2014 Drug ApprovalsDocument6 pages2014 Drug ApprovalsanunaadNo ratings yet

- Case Study 1Document16 pagesCase Study 1aleestudiando01No ratings yet

- MWEF 4112: Industrial Pharmacy & Regulatory ControlDocument51 pagesMWEF 4112: Industrial Pharmacy & Regulatory ControlKay RuzNo ratings yet

- Chemistry in The Pharmaceutical Industry Graham S. PoindexterDocument2 pagesChemistry in The Pharmaceutical Industry Graham S. PoindexterRajeswar RanjitkarNo ratings yet

- Pharmaceutical Industry Development CostsDocument13 pagesPharmaceutical Industry Development CostsrekhaNo ratings yet

- Pharmaceutical Industry Development HistoryDocument12 pagesPharmaceutical Industry Development HistoryHack MeNo ratings yet

- Case Study DR Reddy-Industry PDFDocument61 pagesCase Study DR Reddy-Industry PDFSyed0% (2)

- Pharmaceutical Industry: Drugs Licensed Medications Generic Brand Variety of Laws Patenting Marketing of DrugsDocument15 pagesPharmaceutical Industry: Drugs Licensed Medications Generic Brand Variety of Laws Patenting Marketing of DrugsSunil SainiNo ratings yet

- Drugs Industry (Pharmaceutical Industry) : HistoryDocument35 pagesDrugs Industry (Pharmaceutical Industry) : Historyadityatiwari333No ratings yet

- Marketing Strategy of Indian Pharmaceutical IndustryDocument61 pagesMarketing Strategy of Indian Pharmaceutical Industryvijayendar421No ratings yet

- Drug Information Bulletin 50 05Document4 pagesDrug Information Bulletin 50 05amritaryaaligarghNo ratings yet

- 5Fs CaseDocument2 pages5Fs CaseLinh Thai ThuyNo ratings yet

- An Introduction To The Pharmaceutical IndustryDocument11 pagesAn Introduction To The Pharmaceutical IndustryRaviraj Singh ChandrawatNo ratings yet

- Chemistry's Role in Drug Discovery and DevelopmentDocument27 pagesChemistry's Role in Drug Discovery and DevelopmentUsi Nur PamilianiNo ratings yet

- Company and Industry BackgroundDocument4 pagesCompany and Industry BackgroundVũ SơnNo ratings yet

- A.J. Waskey Pharmaceutical IndustryDocument9 pagesA.J. Waskey Pharmaceutical IndustryViktar BrundukouNo ratings yet

- In Vogue With VentureDocument3 pagesIn Vogue With VenturebasyedNo ratings yet

- Strategy AssignmentDocument12 pagesStrategy AssignmentGarry StephenNo ratings yet

- Pharmaceutical IndustryDocument21 pagesPharmaceutical IndustryDheeraj Sati100% (1)

- Compilation Global Pharma Industry PrintDocument16 pagesCompilation Global Pharma Industry PrintRasool AsifNo ratings yet

- Eli Lilly's Development of Cymbalta to Replace ProzacDocument11 pagesEli Lilly's Development of Cymbalta to Replace ProzacemanuelariobimoNo ratings yet

- PfizerDocument28 pagesPfizerrohitghulepatil100% (1)

- Newsletter 2013-10Document13 pagesNewsletter 2013-10PharmaPackaging SolutionsNo ratings yet

- EthicsDocument21 pagesEthicsamitshahco50% (2)

- Why Is Pharma Industry So ProfitableDocument2 pagesWhy Is Pharma Industry So Profitablerohan_m67% (3)

- Villar Assignment-Case StudyDocument3 pagesVillar Assignment-Case StudyAra VillarNo ratings yet

- Term Paper On Business Environment Topic: Pharmaceuticals:-PESTLE AnalysisDocument15 pagesTerm Paper On Business Environment Topic: Pharmaceuticals:-PESTLE Analysissarangk87No ratings yet

- Glaxo Smith KlineDocument3 pagesGlaxo Smith KlineDarshan MeghjiNo ratings yet

- Raj Sekhar PfizerDocument53 pagesRaj Sekhar PfizerRaj Sekhar67% (3)

- Pfizer - Robin Business SchoolDocument20 pagesPfizer - Robin Business SchoolMade Wikananda Supartha100% (1)

- Cipla AidsDocument12 pagesCipla Aidstanushree26No ratings yet

- Strategy of Pharmacitical IndustryDocument3 pagesStrategy of Pharmacitical IndustrysukeshNo ratings yet

- Accenture A Strategy For Focused GrowthDocument16 pagesAccenture A Strategy For Focused GrowthSayan DasNo ratings yet

- Unilab Case Study-Libre PDFDocument27 pagesUnilab Case Study-Libre PDFShane RealinoNo ratings yet

- Pharmaceuticals Executive SummaryDocument10 pagesPharmaceuticals Executive SummaryPradyot78No ratings yet

- Growth Strategies in The Pharmaceutical Industry: Strategic AcquisitionDocument13 pagesGrowth Strategies in The Pharmaceutical Industry: Strategic AcquisitionSuganthi AnnamalaiNo ratings yet

- Assessing Risk and Return: Personalized Medicine Development and New Innovation ParadigmDocument34 pagesAssessing Risk and Return: Personalized Medicine Development and New Innovation ParadigmThe Ewing Marion Kauffman Foundation100% (1)

- Pharmaceuticals Executive Summary PDFDocument10 pagesPharmaceuticals Executive Summary PDFPaes C. MarceloNo ratings yet

- Bad Pharma - Fraud in Clinical Trials DataDocument27 pagesBad Pharma - Fraud in Clinical Trials DataSimran WaghelaNo ratings yet

- Top 100 Drugs in CanadaDocument25 pagesTop 100 Drugs in CanadaMohamed Omer100% (1)

- Beyond The Patent CliffDocument2 pagesBeyond The Patent CliffPriyamvada ChouhanNo ratings yet

- LIPITOR From A Blockbuster To A GenericDocument1 pageLIPITOR From A Blockbuster To A GenerickailinsNo ratings yet

- The Pharmaceutical Industry: Presented To Geoffrey Poitras Bus 417 Thursday, March 16, 2006Document40 pagesThe Pharmaceutical Industry: Presented To Geoffrey Poitras Bus 417 Thursday, March 16, 2006syedNo ratings yet

- Pharmaceutical IndustryDocument2 pagesPharmaceutical IndustryUjjwal SharmaNo ratings yet

- Second Medical Use CountriesDocument5 pagesSecond Medical Use CountriesAnonymous AWcEiTj5u0No ratings yet

- Summer Internship ReportDocument48 pagesSummer Internship ReportRohitSinghNo ratings yet

- 33-Pharmaceutical Business Models RasmussenDocument19 pages33-Pharmaceutical Business Models RasmussenPranjayNo ratings yet

- Labiotech Medpace A Toolkit For Emerging Biotechs White PaperDocument14 pagesLabiotech Medpace A Toolkit For Emerging Biotechs White PaperpepeNo ratings yet

- Pharmacy Daily For Wed 11 Dec 2013 - Australians Drop Statins, Chemo Review Report Out, Mylan Acquisition, HealthDocument3 pagesPharmacy Daily For Wed 11 Dec 2013 - Australians Drop Statins, Chemo Review Report Out, Mylan Acquisition, HealthpharmacydailyNo ratings yet

- Top 15 Cancer Drugs Expected to Reach $90 Billion by 2022Document16 pagesTop 15 Cancer Drugs Expected to Reach $90 Billion by 2022Soma YasaswiNo ratings yet

- W19390 PDF EngDocument17 pagesW19390 PDF EngAshish KumarNo ratings yet

- Pharma Spectrum Highlights Indian Pharma Patents and Drug ApprovalsDocument17 pagesPharma Spectrum Highlights Indian Pharma Patents and Drug ApprovalsAnirudh Jain ChampawatNo ratings yet

- Political, Legal, Ethical Dilemmas in Global Pharma IndustryDocument6 pagesPolitical, Legal, Ethical Dilemmas in Global Pharma IndustryLinh Tống MỹNo ratings yet

- The Ones To Watch: A Pharma Matters ReportDocument12 pagesThe Ones To Watch: A Pharma Matters ReportatuldmNo ratings yet

- Bristol-Meyers Squibb 2011Document17 pagesBristol-Meyers Squibb 2011len dizonNo ratings yet

- A 9001428Document48 pagesA 9001428erampalNo ratings yet

- Drug Information Bulletin 02 07Document4 pagesDrug Information Bulletin 02 07amritaryaaligarghNo ratings yet

- Pharmaceutical IndustryDocument8 pagesPharmaceutical IndustryShashwat VaishNo ratings yet

- The Future of Drug Discovery: Who Decides Which Diseases to Treat?From EverandThe Future of Drug Discovery: Who Decides Which Diseases to Treat?No ratings yet

- 2001 NASA MarsSurfaceReferenceMissionDocument114 pages2001 NASA MarsSurfaceReferenceMissionTomas CalleNo ratings yet

- Space Colonization Using Space-Elevators From Phobos: Leonard M. WeinsteinDocument9 pagesSpace Colonization Using Space-Elevators From Phobos: Leonard M. WeinsteinTomas CalleNo ratings yet

- Market. The L1 Propellant Market Includes 100Document1 pageMarket. The L1 Propellant Market Includes 100Tomas CalleNo ratings yet

- Annual Report 2011 Cell Biology and Molecular Biology UnitsDocument68 pagesAnnual Report 2011 Cell Biology and Molecular Biology UnitsTomas CalleNo ratings yet

- NASA Mars Human Mission Planning 19502000Document151 pagesNASA Mars Human Mission Planning 19502000Lin CornelisonNo ratings yet

- Two Couple Therapies for Infertile PairsDocument4 pagesTwo Couple Therapies for Infertile PairsTomas CalleNo ratings yet

- Mars Human Exploration StudyDocument237 pagesMars Human Exploration StudyAviation/Space History LibraryNo ratings yet

- NASA Mars Human Mission Planning 19502000Document151 pagesNASA Mars Human Mission Planning 19502000Lin CornelisonNo ratings yet

- Neonates: Clinical Syndromes and Cardinal Fea-Tures of Infectious Diseases: Approach To Diagnosis and Initial ManagementDocument7 pagesNeonates: Clinical Syndromes and Cardinal Fea-Tures of Infectious Diseases: Approach To Diagnosis and Initial ManagementFatma ElzaytNo ratings yet

- Common Types of Tests On Human CognitionDocument9 pagesCommon Types of Tests On Human CognitionNesrin MemedNo ratings yet

- Iliotibial Band Syndrome - FannyDocument13 pagesIliotibial Band Syndrome - FannyAlfiani Rosyida Arisanti Syafi'iNo ratings yet

- Neonatal Glycaemia and Neurodevelopmental Outcomes A Systematic Review and Meta Analysis.Document11 pagesNeonatal Glycaemia and Neurodevelopmental Outcomes A Systematic Review and Meta Analysis.Alma Iris Rodriguez D PadillaNo ratings yet

- Training of Medical Personnel CBRN Nato StandardDocument40 pagesTraining of Medical Personnel CBRN Nato StandardAn Bo0% (1)

- Posterior Stabilization of Wedge Compression Fractures with Pedicle Screw FixationDocument7 pagesPosterior Stabilization of Wedge Compression Fractures with Pedicle Screw FixationAlla Yeswanth Dilip KumarNo ratings yet

- How To Take Your Blood Pressure at HomeDocument1 pageHow To Take Your Blood Pressure at HomePratyush VelaskarNo ratings yet

- Managing Rheumatic and Musculoskeletal Diseases - Past, Present and FutureDocument6 pagesManaging Rheumatic and Musculoskeletal Diseases - Past, Present and FutureNICOLASNo ratings yet

- Miasm IntroductionDocument11 pagesMiasm IntroductionsurabhiNo ratings yet

- Deficient Fluid Volume (AGEDocument2 pagesDeficient Fluid Volume (AGENursesLabs.com83% (6)

- Drug Study - Cimetidine (Tagamet)Document3 pagesDrug Study - Cimetidine (Tagamet)mikErlh100% (3)

- AdhdDocument5 pagesAdhdPapuc AlinaNo ratings yet

- Treatment Planning in Dentistry (Second Edition)Document476 pagesTreatment Planning in Dentistry (Second Edition)cahya100% (1)

- Peginesatide For Anemia in Patients With Chronic Kidney Disease Not Receiving DialysisDocument21 pagesPeginesatide For Anemia in Patients With Chronic Kidney Disease Not Receiving DialysisEdi Kurnawan TjhaiNo ratings yet

- Laryngeal Cancer: Anh Q. Truong MS-4 University of Washington, SOMDocument33 pagesLaryngeal Cancer: Anh Q. Truong MS-4 University of Washington, SOMSri Agustina0% (1)

- Ampicillin drug profileDocument2 pagesAmpicillin drug profileRenz Ivan FuntilonNo ratings yet

- Discharge PlanDocument2 pagesDischarge PlanabraNo ratings yet

- Herboboost Capsules: Kutki, Chandan)Document3 pagesHerboboost Capsules: Kutki, Chandan)Snehal AshtekarNo ratings yet

- Rayne Yu 16-323 Workout Fitness Training Program AssignmentDocument2 pagesRayne Yu 16-323 Workout Fitness Training Program AssignmentRayne Andreana YuNo ratings yet

- Medifocus April 2007Document61 pagesMedifocus April 2007Pushpanjali Crosslay HospitalNo ratings yet

- Bacteria Viruses Lesson PlanDocument7 pagesBacteria Viruses Lesson Planapi-665322772No ratings yet

- Oil Spill Clean Up TBTDocument1 pageOil Spill Clean Up TBTVaqas KhanNo ratings yet

- Are Gadgets and Technology Good or Bad For Students?Document2 pagesAre Gadgets and Technology Good or Bad For Students?Angel C.No ratings yet

- Table 2: Endocrine Disorders Disorders Symptoms Lab Test ResultsDocument3 pagesTable 2: Endocrine Disorders Disorders Symptoms Lab Test ResultsRamil BondadNo ratings yet

- (DR Schuster, Nykolyn) Communication For Nurses H (BookFi)Document215 pages(DR Schuster, Nykolyn) Communication For Nurses H (BookFi)Ariefatun Nisa100% (1)

- Pediatric Dentistry Consent For Dental ProceduresDocument2 pagesPediatric Dentistry Consent For Dental ProceduresNishtha KumarNo ratings yet

- Ovitrelle Epar Medicine Overview - enDocument3 pagesOvitrelle Epar Medicine Overview - enPhysics with V SagarNo ratings yet

- Study On The Incidence of Urinary Tract Infections, Organisms Causing It and Antibiotic Susceptibility in Patients With DIABETES MELLITUS IN AJIMS, MLORE" For The Registration of Dissertation To RajivDocument26 pagesStudy On The Incidence of Urinary Tract Infections, Organisms Causing It and Antibiotic Susceptibility in Patients With DIABETES MELLITUS IN AJIMS, MLORE" For The Registration of Dissertation To RajivR Hari0% (1)

- How To Gain Muscle Workout and Diet Tips PDFDocument1 pageHow To Gain Muscle Workout and Diet Tips PDFSebastian ZuniniNo ratings yet

- List of Chyawanprash Manufacturers in IndiaDocument3 pagesList of Chyawanprash Manufacturers in Indiaplacementducat63No ratings yet