Professional Documents

Culture Documents

Chap 019

Uploaded by

dbjnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 019

Uploaded by

dbjnCopyright:

Available Formats

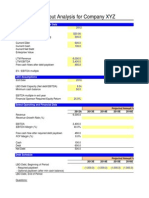

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 19-06 Requirement 1: WALTERS AUDIO VISUAL, INC.

Total Compensation Cost ($ in millions, except "per option" amounts) At January 1, 2011, the estimated value of the award is: Estimated fair value per option Options granted Total compensation

$ $

Correct!

2 40 80

WALTERS AUDIO VISUAL, INC. General Journal ($ in millions) Account Requirement 2: Compensation expense Paid-in capital - stock options Deferred tax asset Tax expense Requirement 3: Compensation expense Paid-in capital - stock options Deferred tax asset Tax expense Requirement 4: Cash Paid-in capital - stock options Common stock (40 million shares at $1 par per share) Paid-in capital - excess of par Income taxes payable Deferred tax asset Paid-in capital - tax effect of stock options Debit 40 40 16 16

- Correct! - Correct!

Credit

40 40 16 16

- Correct! - Correct!

320 80 40 360 64 32 32

- Correct! - Correct!

Requirement 5: Compensation expense 40 Paid-in capital - stock options No deferred tax asset is recorded because an incentive plan does not provide the employer a tax deduction. Requirement 6: Cash Paid-in capital -stock options Common stock (40 million shares at $1 par per share)

40

- Correct!

320 80 40

Paid-in capital - excess of par No tax effect because an incentive plan does not provide the employer a tax deduction.

360

- Correct!

Given Data P19-06: WALTERS AUDIO VISUAL, INC. $1 par common share options granted Exercise price Fair value Income tax rate 40,000,000 shares 8.00 per share 2.00 per option 40%

$ $

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 19-10 RENN-DEVER CORPORATION Earnings (Net Loss) per Share 2009 Net Loss Shares Net Loss Per Share 2010 Net Income Shares at Jan. 1 Retired Shares Earnings Per Share 2011 Net Income Shares at Jan. 1 Stock Dividend Adjustment Earnings Per Share

(160,500) 1,855,000 $ (0.09)

Correct!

$ 2,240,900 1,855,000 27,500 $ 1.23

Correct!

$ 3,308,700 1,745,000 1.02 $ 1.86

Correct!

Given Data P19-10: RENN-DEVER CORPORATION Statements of Retained Earnings For the Years ended December 31, Balance at beginning of year Net income (loss) Deductions: Stock dividend (34,900) shares Common shares retired, 9/30, (110,000 shares) Common stock dividends Balance at end of year 2011 $ 6,794,292 3,308,700 242,000 889,950 $ 8,971,042 212,660 698,000 $ 6,794,292 5,464,052 2010 $ 5,464,052 2,240,900 2009 5,624,552 (160,500)

At December 31, 2008, paid-in capital consisted of the following: Common stock, 1,855,000 shares at $1 par $ 1,855,000 Paid-in capital - excess of par $ 7,420,000

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 19-11 LOCK INTERTECHNOLOGY CORPORATION Earning Per Share ($ in millions, except per share amounts) 209 Net Income Preferred Dividends Shares at Jan. 1 New Shares Earnings Per Share 2010 Net Income Preferred Dividends Shares at Jan. 1 Retired Shares Stock Split Adjustment Earnings Per Share 2011 Net Income Preferred Dividends Shares at Jan. 1 Stock Dividend Adjustment New Shares Earnings Per Share

$ $

290 1.00 55 4.50 4.86

Correct!

$ $

380 1.00 64 3.00 1.50 4.14

Correct!

$ $

412 2.00 90 1.10 1.00 4.10

Correct!

Given Data P19-11: LOCK INTERTECHNOLOGY CORPORATION Statements of Shareholders' Equity For the Years Ended December 31, 2009, 2010, and 2011 ($ in millions)

Preferred Stock, $10 par Balance at Jan. 1, 2009 Sale of preferred shares Sale of common shares, 7/1 Cash dividend, preferred Cash dividend, common Net income Balance at Dec. 31, 2009 Retirement of common shares, 4/1 Cash dividend, preferred Cash dividend, common 3-for-2 split, 8/12 Net income Balance at Dec. 31, 2010 10% common stock dividend, 5/1 Sale of common shares, 9/1 Cash dividend, preferred Cash dividend, common Net income Balance at Dec. 31, 2011 10

Common Stock, $1 par 55 9

Additional Paid-in Capital 495 470 81

Retained Earnings 1,878

10

64 (4)

1,046 (36)

(1) (16) 290 2,151 (20) (1) (20) 380 2,490 (99) (2) (22) 412 2,779

30 10 90 9 3

(30) 980 90 31

10

102

1,101

ERTECHNOLOGY CORPORATION ments of Shareholders' Equity ded December 31, 2009, 2010, and 2011 ($ in millions) Total Shareholders' Equity 2,428 480 90 (1) (16) 290 3,271 (60) (1) (20) 380 3,570 34 (2) (22) 412 3,992

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 19-13 DOW STEEL CORPORATION Earnings Per Share (amounts in thousands, except per share amount) Basic EPS Net Income Preferred Dividends Shares at Jan. 1 New Shares Shares Retired Stock Dividend Adjustment Earnings Per Share Diluted EPS Net Income Preferred Dividends Shares at Jan. 1 New Shares Shares Retired Stock Dividend Adjustment Exercise of Options Earnings Per Share

$ $

2,100 75 600 50 1 1.04 3.00

Correct!

$ $ $ $

2,100 75 600 50 1 1.04 2 2.99

Correct!

Given Data P19-13: DOW STEEL CORPORATION Common stock, 12/31/10 Preferred stock, 12/31/10 Common stock dividends paid, 12/15/11 Preferred stock dividends paid, 12/15/11 Common shares sold, 2/28/11 Shares retired, 7/1/11 Net income, 12/31/11 Income tax rate Options grated and common share prices: Date granted December 31, 2009 December 31, 2010 December 31, 2011 Average common stock market price, 2011 Options granted Share price 8,000 $24 3,000 $33 6,500 $32 $32 600,000 shares 300,000 shares $ 400,000 $ 75,000 60,000 2,000 $ 2,100,000 40%

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Secured Transaction - Cornell ArticleDocument89 pagesSecured Transaction - Cornell ArticleFitBody IndiaNo ratings yet

- ACCT551 Week 7 Quiz AnswersDocument3 pagesACCT551 Week 7 Quiz AnswersDominickdad100% (2)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Raj MehtaNo ratings yet

- Bloomberg ExcelDocument52 pagesBloomberg Exceldbjn100% (2)

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityFrom EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityNo ratings yet

- Advanced Acct PP CH08Document42 pagesAdvanced Acct PP CH08Jose TNo ratings yet

- Survey Questionnier For Startup BarriersDocument5 pagesSurvey Questionnier For Startup BarriersSarhangTahir100% (4)

- Accounting Concepts: Fair Presentation Going ConcernDocument12 pagesAccounting Concepts: Fair Presentation Going Concernkim_oun09No ratings yet

- Brealey. Myers. Allen Chapter 17 TestDocument13 pagesBrealey. Myers. Allen Chapter 17 TestMarcelo Birolli100% (2)

- AaaaamascpaDocument12 pagesAaaaamascpaRichelle Joy Reyes BenitoNo ratings yet

- Financial Distress: Mcgraw-Hill/Irwin Corporate Finance, 7/EDocument26 pagesFinancial Distress: Mcgraw-Hill/Irwin Corporate Finance, 7/EMutiara Inas SariNo ratings yet

- Introduction To Variance SwapsDocument6 pagesIntroduction To Variance Swapsdbjn100% (1)

- Chap 018Document19 pagesChap 018dbjnNo ratings yet

- Chap 012Document7 pagesChap 012dbjnNo ratings yet

- Kellogg Company and SubsidiariesDocument7 pagesKellogg Company and SubsidiariesAlejandra DiazNo ratings yet

- Def 14aDocument3 pagesDef 14aAnonymous Feglbx5No ratings yet

- Quiz 2 - Chapter 3Document2 pagesQuiz 2 - Chapter 3Quincy VoNo ratings yet

- Wiper Inc Financial AnalysisDocument3 pagesWiper Inc Financial AnalysisMoayaid Al-HumoodNo ratings yet

- Practice Exam Chapter 19-21Document6 pagesPractice Exam Chapter 19-21John Arvi ArmildezNo ratings yet

- Chap 004Document9 pagesChap 004dbjnNo ratings yet

- 2010-10-22 003512 Yan 8Document19 pages2010-10-22 003512 Yan 8Natsu DragneelNo ratings yet

- Dilutive Securities and Earnings Per Share: Learning ObjectivesDocument35 pagesDilutive Securities and Earnings Per Share: Learning ObjectivesAntony OjowiNo ratings yet

- ACC-423 Learning Team B Week 2 Textbook ProblemsDocument10 pagesACC-423 Learning Team B Week 2 Textbook ProblemsdanielsvcNo ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- Review Sw4tgession 5 TEXTDocument9 pagesReview Sw4tgession 5 TEXTMelissa WhiteNo ratings yet

- Chapter 4-6 Advanced Accounting 5009: Roger Mayer 7:00 PM & 8:30 PMDocument43 pagesChapter 4-6 Advanced Accounting 5009: Roger Mayer 7:00 PM & 8:30 PMalejandra_giraldo_3No ratings yet

- SasgerDocument48 pagesSasgerbillyNo ratings yet

- Pryor Company Receives Net Proceeds ofDocument4 pagesPryor Company Receives Net Proceeds ofAulia HidayatiNo ratings yet

- Butterfield Reports 2011 Net Income of $40.5 Million: For Immediate ReleaseDocument10 pagesButterfield Reports 2011 Net Income of $40.5 Million: For Immediate Releasepatburchall6278No ratings yet

- AC551 Quiz Week 7Document3 pagesAC551 Quiz Week 7Natasha DeclanNo ratings yet

- Book-Keeping and Accounts/Series-4-2011 (Code2007)Document16 pagesBook-Keeping and Accounts/Series-4-2011 (Code2007)Hein Linn Kyaw100% (1)

- F2 March 2011Document20 pagesF2 March 2011Dhanushka SamNo ratings yet

- CH 07Document29 pagesCH 07varunragav85No ratings yet

- Accounting For and Presentation of Owners' EquityDocument26 pagesAccounting For and Presentation of Owners' EquitydanterozaNo ratings yet

- Case 3 and 4Document4 pagesCase 3 and 4Syed Osama0% (1)

- 011510Document211 pages011510Ann Arbor Government DocumentsNo ratings yet

- Butew5isn3edcess 76tgv33y6hnj592wsx5Document1 pageButew5isn3edcess 76tgv33y6hnj592wsx5Kia PottsNo ratings yet

- Lecture 1 CHP 1 No SolutionsDocument20 pagesLecture 1 CHP 1 No SolutionsHarry2140No ratings yet

- Analysis of Financial StatementDocument9 pagesAnalysis of Financial StatementSums Zubair MoushumNo ratings yet

- Stock Dividend: Date of PaymentDocument6 pagesStock Dividend: Date of PaymentmercyvienhoNo ratings yet

- AC 551 Final ExamDocument2 pagesAC 551 Final ExamNatasha Declan100% (2)

- Chapter 4 Problem 32Document9 pagesChapter 4 Problem 32morgan.bertoneNo ratings yet

- ExercisesDocument5 pagesExercisesSandip GhoshNo ratings yet

- Company financial statements under IFRSDocument20 pagesCompany financial statements under IFRSThương ĐỗNo ratings yet

- Answers For Quantitative Questions (Exam 3)Document3 pagesAnswers For Quantitative Questions (Exam 3)Tsentso NaNo ratings yet

- CH 1 - TemplatesDocument7 pagesCH 1 - TemplatesadibbahNo ratings yet

- Chapter 3. Financial Statements, Cash Flows, and Taxes: The Annual ReportDocument4 pagesChapter 3. Financial Statements, Cash Flows, and Taxes: The Annual Reporttri wulungganiNo ratings yet

- Ifrint Jun 2011 QuDocument9 pagesIfrint Jun 2011 QuRochak ShresthaNo ratings yet

- Accounting HW Chapter 15Document4 pagesAccounting HW Chapter 15chiaraar88No ratings yet

- Financial Management: PortfolioDocument22 pagesFinancial Management: Portfolioapi-100770959No ratings yet

- LEGT2751 Tutorial Program S2 2012Document19 pagesLEGT2751 Tutorial Program S2 2012jianghua135No ratings yet

- 2010 AFM 101 Final+ExamDocument18 pages2010 AFM 101 Final+ExamminNo ratings yet

- Albion Technology & General VCT PLC 2009 Annual ReportDocument70 pagesAlbion Technology & General VCT PLC 2009 Annual ReportalbionventuresNo ratings yet

- Solutions To EPS Examples 1-7 For PostingDocument12 pagesSolutions To EPS Examples 1-7 For Postingvir1672No ratings yet

- CAM Annual Report 2011Document52 pagesCAM Annual Report 2011ashkanfashamiNo ratings yet

- ACC 291 Week 4 ProblemsDocument8 pagesACC 291 Week 4 ProblemsGrace N Demara BooneNo ratings yet

- University of Wales and Mdis: Introduction To Accounting (Hk004)Document11 pagesUniversity of Wales and Mdis: Introduction To Accounting (Hk004)Muhd RizdwanNo ratings yet

- 2011 LCCI Accounting IAS Level-3 Series 2 (Code 3902)Document17 pages2011 LCCI Accounting IAS Level-3 Series 2 (Code 3902)Hon Loon Seum100% (6)

- Wright - Otelco Research 2012Document40 pagesWright - Otelco Research 2012Salman TajuddinNo ratings yet

- Evaluate Earnings Per ShareDocument1 pageEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Calculate percentage ownership, goodwill, income from investmentsDocument2 pagesCalculate percentage ownership, goodwill, income from investmentsSutamiCandraKasihPartINo ratings yet

- Earnings Per Share: Final Lecture 3Document30 pagesEarnings Per Share: Final Lecture 3linkin soyNo ratings yet

- Colgate Palmolive Edos. Financieros 2009 A 2011Document11 pagesColgate Palmolive Edos. Financieros 2009 A 2011manzanita_2412No ratings yet

- Quick LBO ModelDocument10 pagesQuick LBO ModeldbjnNo ratings yet

- Smiles, Bid-Ask Spreads and Option Pricing ModelsDocument24 pagesSmiles, Bid-Ask Spreads and Option Pricing ModelsdbjnNo ratings yet

- Risk-Neutral Skewness - Evidence From Stock OptionsDocument24 pagesRisk-Neutral Skewness - Evidence From Stock OptionsdbjnNo ratings yet

- Extra Credit Fall '12Document4 pagesExtra Credit Fall '12dbjnNo ratings yet

- Dynamics of Implied Volatility SurfacesDocument16 pagesDynamics of Implied Volatility SurfacesdbjnNo ratings yet

- Option Hapiness and LiquidityDocument53 pagesOption Hapiness and LiquiditydbjnNo ratings yet

- Of Smiles and SmirksDocument30 pagesOf Smiles and SmirksdbjnNo ratings yet

- Answer Key QuizDocument4 pagesAnswer Key QuizdbjnNo ratings yet

- Final Exam Fall '12Document7 pagesFinal Exam Fall '12dbjnNo ratings yet

- BMA TB 33 8eDocument8 pagesBMA TB 33 8edbjnNo ratings yet

- Chap 002Document75 pagesChap 002dbjnNo ratings yet

- BMA 20 8eDocument11 pagesBMA 20 8edbjnNo ratings yet

- Chap 006Document95 pagesChap 006dbjnNo ratings yet

- On The Properties of Equally-Weighted Risk Contributions PortfoliosDocument23 pagesOn The Properties of Equally-Weighted Risk Contributions PortfoliosdbjnNo ratings yet

- Chap 011Document81 pagesChap 011dbjnNo ratings yet

- Annual Report 2011 Current OPECDocument65 pagesAnnual Report 2011 Current OPECdbjnNo ratings yet

- EXCEL TEMPLATES OPERATIONS GUIDEDocument31 pagesEXCEL TEMPLATES OPERATIONS GUIDEmondew99No ratings yet

- 2013 World Economic Situation and ProspectsDocument37 pages2013 World Economic Situation and ProspectsdbjnNo ratings yet

- Chap 020Document10 pagesChap 020dbjnNo ratings yet

- Excel Short CutsDocument42 pagesExcel Short CutsdbjnNo ratings yet

- Erc SlidesDocument56 pagesErc SlidesdbjnNo ratings yet

- Acadian Portfolio RiskDocument14 pagesAcadian Portfolio RiskdbjnNo ratings yet

- Chap 021Document122 pagesChap 021dbjnNo ratings yet

- Chap 011Document14 pagesChap 011dbjnNo ratings yet

- Chap 021Document18 pagesChap 021dbjnNo ratings yet

- Reservation Form: (For Incoming Freshmen, Transferees & Returnees)Document1 pageReservation Form: (For Incoming Freshmen, Transferees & Returnees)LesterNo ratings yet

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocument3 pagesExamination: Subject SA3 General Insurance Specialist Applicationsdickson phiriNo ratings yet

- Mansa-X KES Fact Sheet Q1 2023Document1 pageMansa-X KES Fact Sheet Q1 2023KevinNo ratings yet

- ACC For LEASEDocument11 pagesACC For LEASETanya PiaNo ratings yet

- Financial ForecastingDocument52 pagesFinancial ForecastingNoemie DelgadoNo ratings yet

- Project Report On Study of Mutual Funds IndustryDocument65 pagesProject Report On Study of Mutual Funds Industryananthakumar100% (1)

- Fundamental Analysis of Public Sector Banks in India (SBI)Document81 pagesFundamental Analysis of Public Sector Banks in India (SBI)Meraj Ansari60% (5)

- Review of The Literature: Ajit and BangerDocument18 pagesReview of The Literature: Ajit and BangertejasparekhNo ratings yet

- Assessment 3 SolutionsDocument3 pagesAssessment 3 SolutionsMmaleema LedwabaNo ratings yet

- FO LDO Bitumen 01 10 2023Document1 pageFO LDO Bitumen 01 10 2023HAVI KADALINo ratings yet

- Uts Epii 2022Document17 pagesUts Epii 2022Ranessa NurfadillahNo ratings yet

- Girnar Insurance Brokers Private Limited: Salary Slip For The Month of November - 2022Document2 pagesGirnar Insurance Brokers Private Limited: Salary Slip For The Month of November - 2022karanmitroo1No ratings yet

- ONGC Standalone Balance SheetDocument6 pagesONGC Standalone Balance SheetSHUBHI MAKHIJANINo ratings yet

- Fort Bonifacio Development Corp. v. CIR (CTA 7696 & 7728, July 15, 2015)Document120 pagesFort Bonifacio Development Corp. v. CIR (CTA 7696 & 7728, July 15, 2015)Kriszan ManiponNo ratings yet

- Yes Bank Project ReportDocument61 pagesYes Bank Project ReportAditya100% (3)

- Bioscan Group 2 11062023Document4 pagesBioscan Group 2 11062023Aditi KathinNo ratings yet

- Business FinanceDocument2 pagesBusiness FinancejonaNo ratings yet

- Evaluating Properties with Positive Cash FlowDocument23 pagesEvaluating Properties with Positive Cash FlowChadNo ratings yet

- Chapter 1. L1.4 Nature of Securities and Risks InvolvedDocument3 pagesChapter 1. L1.4 Nature of Securities and Risks InvolvedvibhuNo ratings yet

- The Beginners Guide To Investing in The Nigerian Stock MarketDocument50 pagesThe Beginners Guide To Investing in The Nigerian Stock MarketMuhammad Ghani100% (1)

- Security Regional (LMP, PLB, MDN)Document18 pagesSecurity Regional (LMP, PLB, MDN)Biyan FarabiNo ratings yet

- Economic Crisis in Pakistan and Its Remedial MesauresDocument27 pagesEconomic Crisis in Pakistan and Its Remedial MesauresQarsam IlyasNo ratings yet

- ICICI Bank Moratorium FAQsDocument8 pagesICICI Bank Moratorium FAQsCNBCTV18 DigitalNo ratings yet

- Chen 2020Document20 pagesChen 2020KANA BITTAQIYYANo ratings yet

- Government Budget and Its ComponentsDocument7 pagesGovernment Budget and Its ComponentsRitesh Kumar SharmaNo ratings yet

- HDFC BANK CREDIT CARD CASH BACK REDEMPTION FORMDocument1 pageHDFC BANK CREDIT CARD CASH BACK REDEMPTION FORMDEBARAJ MOHAPATRANo ratings yet