Professional Documents

Culture Documents

Moil PDF

Uploaded by

Darshan MaldeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Moil PDF

Uploaded by

Darshan MaldeCopyright:

Available Formats

IndiaEquityResearch

Mining

February6,2013

ADD

MOIL

Target(INR)288

Cutinorepricesfor4QFY13fleadstoearningsdowngrade

Rating

MOILs Dec12 EBITDA was in line with estimates at INR1.14bn.

However, higher other income boosted net profit, which stood at

INR1.13bn compared to our estimates of INR1.07bn. Manganese ore

prices have been reduced for the quarter ended Mar13f by 5%

compared to our estimates of remaining stable. This has led us to

lowerourFY13fFY15fEBITDAby5%andnetprofitestimatesby3.5%.

WecutourDec13TPtoINR288basedonthehistoricalaverage(Jan12

Feb13) P/E and EV/EBITDA multiple. Cash and cash equivalents of

INR145/share, as on Dec12, cushions a downside. Correction in the

stockpriceduringthelastonemonthledustomaintainanAddrating.

LastPrice(INR)

253.3

Bloombergcode

MOILIN

Reuterscode

MOIL.BO

Avg.Vol.(3m)

80,522

Avg.Val.(3m)(INRmn)

20.7

52wkH/L(INR)

300/226

19,660

Sensex

MCAP(INRbn/USDmn)

42.55/801

Shareholding(%)

09/12

12/12

Promoters

80.0

80.0

MFs,FIs,Banks

2.8

2.8

Cutinorepricesfor4QFY13fby5%leadstoearningsdowngrade

FIIs

5.7

6.1

Public

Others

9.4

2.1

9.2

1.9

Reduction in the manganese ore prices by 5% for Jan13Mar13f against our

expectationofremainingstablehasledustocutourFY13fFY15frevenueby

2.5%andEBITDA estimatesby 5%.The reduction inthedomesticmanganese

ore prices has been despite a 4% increase in international ore prices. We

forecastthemanganeseorepricestorise5%from1QFY14ftorealigndomestic

priceswithinternationalprices.

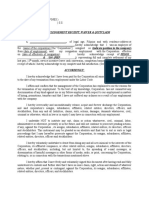

StockChart(RelativetoSensex)

325

EBITDAinlinewithestimates,netprofitboostedbyotherincome

300

EBITDA for the quarter ended Dec12 stood at INR1.14bn in line with our

estimates. Sales volume declined 0.9% yoy, whereas realisations rose 1.4%

due to better manganese ore prices. Other income increased 28.6% yoy to

INR640mn, against our estimates of INR550mn, due to higher cash and bank

balanceaswellasimprovedyieldoninvestments.Thenetprofitwentup11.9%

yoytoINR1.13bn.

275

250

225

Feb12

Jun12

Oct12

MOIL

Feb13

Sensex Rebased

MaintainAddratingwithDec13TPofINR288

WecutourEPSforecastforFY13fFY15fby3.5%,aswereduceourrealisation

estimatesby2.5%.Wevaluethestockbasedonthehistoricalaverage(Jan12

Feb13)EV/EBITDAof4.3xandP/Emultipleof10x.OurDec13targetofINR288

is the average of the fair values arrived based on these historical multiples.

CashandcashequivalentsofINR24bn(INR145/share),asonDec12,islikelyto

restrictthedownsideinstock.WemaintainourAddrating.Riskfactorsinclude

adeclineininternationalmanganeseorepricesandlowersalesvolume.

StockPerfm.(%)

1m

3m

1yr

Absolute

3.7

2.0

7.8

Rel.toSensex

3.1

2.7

19.5

Financials(INRmn)

03/12

03/13f

03/14f

Sales

8,996

9,189

9,879

21

48.2

46.7

47.6

4,108

4,246

4,555

Sho/s(diluted)

168

168

168

A.EPS(INR)

24.5

25.3

27.1

YoY(%)

EBITDA(%)

A.PAT

YoY(%)

30

D/E(x)

0.9

0.9

0.8

P/E(x)

11.0

10.7

9.9

EV/E(x)

5.4

4.7

4.2

RoCE(%)

RoE(%)

18

18

16

16

16

16

QuarterlyTrends

Sales(INRmn)

PAT(INRmn)

03/12

06/12

09/12

12/12

2,016

2,426

2,295

2,283

993

994

1,087

1,136

Pleaserefertothedisclaimertowardstheendofthedocument.

Earningsrevisionsummary

(INRmn)

Revenue

EBITDA

PAT

EPS(INR)

FY13f FY14f FY15f

Old

New Var(%)

Old

New Var(%)

Old

New Var(%)

9,428 9,189

2.5 10,136

9,879

2.5 10,737 10,464

2.5

4,521 4,291

5.1

4,949

4,701

5.0 5,276 5,013

5.0

4,400 4,246

3.5

4,721

4,595

2.7 4,964 4,882

1.7

26.2

25.3

3.5

28.1

27.4

2.7

29.5

29.1

1.7

Source:Company,AvendusResearch

JimeshSanghvi,+9102266842859

Jimesh.sanghvi@avendus.com

India Equity Research

MOIL

Exhibit1: ResultsnapshotfortheDec12quarter

(INRmn)

Dec11

Sep12

Qoq(%)

Dec12

Yoy(%)

Totaloperatingincome

2,395.4

2,294.6

0.5

2,282.7

4.7

Totaloperatingexpenses

1,300.8

1,213.5

6.5

1,134.5

12.8

EBITDA

1,094.6

1,081.1

6.2

1,148.2

4.9

498.0

588.0

8.9

640.4

28.6

72.8

83.8

0.5

84.2

15.7

1,519.8

1,585.3

7.5

1,704.4

12.1

Otherincome

Depreciation

EBIT

Interest

RecurringPBT

Netextraordinaryitems

PBT(reported)

Totaltaxes

0.0

0.0

0.0

1,519.8

1,585.3

7.5

1,704.4

0.0

0.0

0.0

1,519.8

1,585.3

7.5

1,704.4

12.1

504.8

498.7

14.0

568.6

12.6

11.9

1,015.0

1,086.5

4.5

1,135.8

(+)Shareinassoc.earnings

0.0

0.0

0.0

Less:Minorityinterest

0.0

0.0

0.0

Priorperioditems

0.0

0.0

0.0

1,015.0

1,086.5

4.5

1,135.8

6.0

6.5

4.5

6.8

PAT(reported)

Netincome(reported)

EPS(INR)

Operatingratios(%)

12.1

11.9

11.9

EBITDAmargin

45.7

47.1

3.2

50.3

4.6

EBITmargin

52.5

55.0

3.3

58.3

5.8

Netprofitmargin

35.1

37.7

1.2

38.9

3.8

Source:Company,AvendusResearch

Exhibit2: Financialsandvaluations

Incomestatement(INRmn)

Balancesheet(INRmn)

Fiscalyearending

Totaloperatingincome

EBITDA

Otherincome

Depreciation

EBIT

Interest

Netextraordinaryitems

PBT(reported)

Totaltaxes

PAT(reported)

(+)Shareinassoc.earnings

Less:Minorityinterest

Priorperioditems

Netincome(reported)

Avendusnetincome

Avendusdil.shares(mn)

AvendusEPS(INR)

Fiscalyearending

Networth

Minorityinterest

Totaldebt

Deferredtaxliability

Totalliabilities

Netblock

CWIP

Goodwill

Investments

Cash

Inventories

Debtors

Loansandadvances

less:Currentliabilities

less:Provisions

Networkingcapital

Totalassets

03/12

03/13f

03/14f

03/15f

8,996

9,189

9,879

10,464

4,332

4,291

4,701

5,013

2,033

2,440

2,684

2,952

299

394

526

679

6,066

6,337

6,859

7,286

0

0

0

0

6,066

6,337

6,859

7,286

1,959

2,091

2,263

2,404

4,108

4,246

4,595

4,882

0

0

0

0

4,108

4,246

4,595

4,882

4,108

4,246

4,595

4,882

168

168

168

168

24.5

25.3

27.4

29.1

Cashflowstatement(INRmn)

Fiscalyearending

Netprofit+Depreciation

Deferredtax

Workingcapitalchanges

Less:Otherincome

Cashflowfromoperations

Capitalexpenditure

Others

Cashflowfrominvesting

Equityraised

Changeinborrowings

Dividendspaid(incl.tax)

03/12

4,407

0

621

2,033

KeyRatios

03/13f

4,640

0

1,074

2,440

03/14f

5,121

0

77

2,684

03/15f

5,561

0

91

2,952

1,753

3,274

2,515

2,700

364

1,410

1,930

1,952

1,806

2,832

2,639

2,914

1,442

1,422

709

962

0

0

0

0

978

1,369

1,369

1,369

Others

Cashflowfromfinancing

Netchangeincash

130

1,108

2,088

03/12

03/13f

03/14f

03/15f

24,413

27,290

30,517

34,030

0

0

0

0

67

67

67

67

24,347

27,224

30,450

33,963

2,070

3,067

4,451

5,702

390

410

430

452

42

42

42

42

20,884

24,212

26,066

28,359

813

504

541

573

993

629

677

717

2,173

1,792

1,849

1,899

1,698

1,718

1,794

1,874

1,321

1,714

1,812

1,908

21,844

23,705

25,526

27,767

24,347

27,224

30,450

33,963

0

1,369

3,327

0

1,369

1,854

0

1,369

2,293

Fiscalyearending

P/E(onAvendusEPS)

P/BV

EV/Sales

EV/EBITDA

03/12

10.3

1.7

2.3

4.7

03/13f

10.0

1.6

1.9

4.1

03/14f

9.2

1.4

1.6

3.3

03/15f

8.7

1.2

1.3

2.7

ROCE

ROE

EBITDAmargin

Netprofitmargin

Operatingincomeyoy

AvendusEPSyoy

Grossassetturnover

18.0

18.0

48.2

37.2

21.1

30.1

2.1

16.5

16.4

46.7

36.5

2.1

3.4

1.6

15.9

15.9

47.6

36.6

7.5

8.2

1.3

15.2

15.1

47.9

36.4

5.9

6.2

1.1

Workingcapitalcycle(days)

Netdebttoequity

NetdebttoEBITDA

13.8

0.9

0.0

22.5

0.9

0.0

42.2

0.9

0.0

42.8

0.9

0.0

Source:Company,AvendusResearch

Mining

India Equity Research

MOIL

Exhibit3: OneyearforwardP/E(x)

Exhibit4: OneyearforwardEV/EBITDA(INR)

11.75

6.00

ActualP/E

EV/EBITDA

AverageP/E

11.00

5.25

10.25

4.50

9.50

3.75

8.75

Jan12

May12

Aug12

Dec12

Source:Bloomberg,AvendusResearch

Apr13

Aug13

Dec13

3.00

Jan12

May12

Aug12

Dec12

AverageEV/EBITDA

Apr13

Aug13

Dec13

Source:Bloomberg,AvendusResearch

Exhibit5: Pertonneanalysis

Dec11

Sep12

Qoq(%)

Dec12

Yoy(%)

285,554

238,405

18.7

282,909

0.9

Realisations(INR/tonne)

7,623

8,874

12.9

7,730

1.4

EBITDA(INR/tonne)

3,833

4,535

10.5

4,059

5.9

Salesvolumes(tonnes)

Source:Company,AvendusResearch

Mining

India Equity Research

MOIL

AnalystCertification

Thefollowinganalyst(s)is(are)primarilyresponsibleforthisreportand,certifies(y)thattheopinion(s)onthesubjectcompany(ies)anditssecurity(ies)andanyotherviewsor

forecastsexpressedhereinaccuratelyreflecttheirpersonalview(s).Theyfurthercertifythatnopartoftheircompensationwas,isorwillbedirectlyorindirectlyrelatedtothe

specificrecommendation(s)orviewscontainedinthisresearchreport:JimeshSanghvi

Disclosures

MeaningofAvendusSecuritiesPrivateLimitedsequityresearchratings

Theratingrepresentstheexpectedchangeinthepriceofthestockoverahorizonof12months.

Buy:morethan+20%

Add:+10%to+20%

Hold:10%to+10%

Reduce:10%to20%

Sell:lessthan20%

Proportionofratingsineachcategoryandinvestmentbankingrelationships(%)

AttheendofDec2012

Buy

Add

Hold Reduce

Sell

NR

Total

Proportionofratingsineachcategory

30.3

34.2

18.4

10.5

0.0

6.6

100.0

16.67

66.67

0.00

0.00

0.00

Proportionofcompaniestowhommaterialinvestmentbankingserviceswereofferedduringtheprevious12months

16.67 100.00

Analystdisclosures

None of the analysts involved in the preparation of this research report or a member of his/her household is an officer, director or supervisory board member of any of the

company(ies)thatis/arethesubjectofthisresearchreport.Noneoftheanalystsinvolvedinthepreparationofthisresearchreportormembersofhis/herhouseholdholdany

financialinterestinthesecuritiesofthecompany(ies)thatis/arethesubjectofthisresearchreport.Noneoftheanalystsinvolvedinthepreparationofthisresearchreporthave

receivedorpurchasedsharesofthesubjectcompanypriortothepublicofferingofthoseshares.

DisclosuresonpotentialconflictsofinterestforAvendusSecuritiesPrivateLimitedand/oritsassociatecompanies(Avendus)asonFebruary6,2013

Asontheabovementioneddate,theshareholdingsofAvendusdoesnotexceed5%ofthetotalissuedsharecapitalofMOILLimited(MOIL).Avendusdoesnotholdanyother

financialinterestinMOILthatissignificantwithregardtotheresearchrecommendation.Asontheabovementioneddate,theshareholdingsofMOILdoesnotexceed5%ofthe

totalissuedsharecapitalofAvendus.Avendusisnotamarketmakerorliquidityproviderinthesecuritiesoftherelevantissuerorinanyrelatedderivatives.Avendushasnotbeen

aleadmanagerorcoleadmanagerofapubliclydisclosedofferofsecuritiesofMOILorinanyrelatedderivativesoverthepast12months.Overthepast12months,Avendushas

notbeenpartytoanagreementwithMOILwithregardtotheprovisionofotherinvestmentbankingservicesthatdonotentailthedisclosureofanyconfidentialcommercial

information.Avendusisnotpartytoanagreementwiththesubjectcompany(ies)ofthisresearchreportwithregardtotheproductionofthisresearchreport.

Sharepricehistoryandratingchanges

305

MOIL(InitiatedonJul04,11)

Rating,Date,TP(INR)

Add,10Aug,297

Add,06Feb,288

280

Hold,28May,270

255

Reduce,07Feb,249

230

205

Feb12

Mar12

May12

Jul12

Sep12

Oct12

Dec12

Feb13

Mining

India Equity Research

MOIL

Disclaimer

ThisdocumenthasbeenpreparedbyAvendusSecuritiesPrivateLimited(ASPL).Thisdocumentismeantfortheuseoftheintendedrecipientonly.Thoughdisseminationtoall

intendedrecipientsissimultaneous,notallintendedrecipientsmayreceivethisdocumentatthesametime.Thisdocumentisneitheranoffernorsolicitationforanoffertobuy

and/orsellanysecuritiesmentionedhereinand/orofficialconfirmationofanytransaction.Thisdocumentisprovidedforassistanceonlyandisnotintendedtobe,andmustnot

betakenas,thesolebasisforaninvestmentdecision.Theuserassumestheentireriskofanyusemadeofthisinformation.Eachrecipientofthisdocumentshouldmakesuch

investigationashedeemsnecessarytoarriveatanindependentevaluation,includingthemeritsandrisksinvolved,forinvestmentinthesecuritiesreferredtointhisdocument

andshouldconsulthisownadvisorstodeterminethemeritsandrisksofsuchinvestment.Theinvestmentdiscussedorviewsexpressedmaynotbesuitableforallinvestors.This

documenthasbeenpreparedonthebasisofinformationobtainedfrompubliclyavailable,accessibleresources.ASPLhasnotindependentlyverifiedalltheinformationgivenin

thisdocument.Accordingly,norepresentationorwarranty,expressorimplied,ismadeastoaccuracy,completenessorfairnessoftheinformationandopinioncontainedinthis

document.Theinformationgiveninthisdocumentisasofthedateofthisdocumentandtherecanbenoassurancethatfutureresultsoreventswillbeconsistentwiththis

information. Though ASPL endeavors to update the information contained herein on reasonable basis, ASPL, its associate companies, their directors, employees, agents or

representatives(ASPLanditsaffiliates)areundernoobligationtoupdateorkeeptheinformationcurrent.Also,theremayberegulatory,complianceorotherreasonsthatmay

preventusfromdoingso.ASPLanditsaffiliatesexpresslydisclaimanyandallliabilitiesthatmayarisefrominformation,errororomissioninthisconnection.ASPLanditsaffiliates

shallnotbeliableforanydamageswhetherdirect,indirect,specialorconsequential,includinglostrevenueorlostprofits,whichmayarisefromorinconnectionwiththeuseof

thisdocument.Thisdocumentisstrictlyconfidentialandisbeingfurnishedtoyousolelyforyourinformation.Thisdocumentand/oranyportionthereofmaynotbeduplicatedin

anyformand/orreproducedorredistributedwithoutthepriorwrittenconsentofASPL.Thisdocumentisnotdirectedorintendedfordistributionto,oruseby,anypersonor

entity who is a citizen or resident of the United States or Canada or is located in any other locality, state, country or other jurisdiction, where such distribution, publication,

availability or use would be contrary to law or regulation or which would subject ASPL and its affiliates to any registration or licensing requirements within such jurisdiction.

Personsinwhosepossessionthisdocumentcomesshouldinformthemselvesaboutandobserveanysuchrestrictions.ASPLanditsaffiliatesmaybeperformingorseekingto

performinvestmentbankingandotherservicesforanycompanyreferredtointhisdocument.AffiliatesofASPLmayhaveissuedotherreportsthatareinconsistentwithandreach

adifferentconclusionfromtheinformationpresentedinthisdocument.

Thiscommunicationisexemptfromthefinancialpromotionrestriction(inSection21oftheFinancialServicesAndMarketsAct,2000(FSMA))relatingtothecommunicationofan

invitationorinducementtoengageininvestmentactivityonthegroundsthatitismadetoaninvestmentprofessional.Anyinvestmenttowhichthiscommunicationrelatesisonly

availabletoinvestmentprofessionals.Anypersonswhodonothaveprofessionalexperienceinsuchinvestmentsshouldnotrelyonthiscommunication.

ASPLanditsaffiliatesmayhaveinterest/positions,financialorotherwise,inthecompaniesmentionedinthisdocument.Inordertoprovidecompletetransparencytoourclients,

wehaveincorporateddisclosuresaboutinterestsofanalystsandaboutpotentialconflictsofinterestofASPLanditsassociatecompaniesinthisdocument.Thisshould,however,

notbetreatedasanendorsementoftheviewexpressedinthedocument.ASPLiscommittedtoprovidinghighquality,objectiveandunbiasedresearchtoourinvestors.Tothis

end,wehavepoliciesinplacetoidentify,considerandmanagepotentialconflictsofinterestandprotecttheintegrityofourrelationshipswithinvestingandcorporateclients.

Employeecompliancewiththesepoliciesismandatory.AnycommentorstatementmadehereinaresolelythoseoftheanalystanddonotnecessarilyreflectthoseofASPL.

OUROFFICES

AvendusSecuritiesPrivateLimited

Mumbai: 6thFloor,BQuadrant,IL&FSFinancialCentre,BandraKurlaComplex,Bandra(E),Mumbai400051 T:+912266480050F:+912266842870

AvendusCapitalPrivateLimited

Mumbai: 5thFloor,BQuadrant,IL&FSFinancialCentre,BandraKurlaComplex,Bandra(E),Mumbai400051 T:+912266480050F:+912266480040

Bangalore: TheMilleniaTower,A10thFloor,No1&2MurphyRoad,Ulsoor,Bangalore560008,India

T:+918066483600F:+918066483636

NewDelhi: Suite22A/B,TheAmanResort,LodhiRoad,NewDelhi110003,India

T:+911145357500F:+911145357540

London:

AvendusCapital(U.K.)PrivateLimited,33,StJames'sSquare,London,SW1Y4JS

T:+442031594353F:+442076619400

AvendusSecuritiesPrivateLimited

SEBIRegistrationNo:BSECMINB011292639|NSECMINB231294639|NSEF&OINF231294639

Mining

You might also like

- Epbabi Iim RanchiDocument6 pagesEpbabi Iim RanchiDarshan MaldeNo ratings yet

- Epbabi Iim RanchiDocument6 pagesEpbabi Iim RanchiDarshan MaldeNo ratings yet

- Hinduja Ventures - Consolidated Profit & Loss AccountDocument1 pageHinduja Ventures - Consolidated Profit & Loss AccountDarshan MaldeNo ratings yet

- Bhagwati Banquets and Hotels LTD 110213 RSTDocument1 pageBhagwati Banquets and Hotels LTD 110213 RSTDarshan MaldeNo ratings yet

- Thermax: Hold Target Price (INR) 564 Revenue Decelerates, Order Inflows SteadyDocument6 pagesThermax: Hold Target Price (INR) 564 Revenue Decelerates, Order Inflows SteadyDarshan MaldeNo ratings yet

- National Peroxide - Q3FY13 Result UpdateDocument2 pagesNational Peroxide - Q3FY13 Result UpdateDarshan MaldeNo ratings yet

- South Indian Bank - Management Interaction - Centrum 20122012Document5 pagesSouth Indian Bank - Management Interaction - Centrum 20122012Darshan MaldeNo ratings yet

- Sesa GoaDocument5 pagesSesa GoaDarshan MaldeNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Unity Infra Projects, 15th February 2013Document11 pagesUnity Infra Projects, 15th February 2013Angel BrokingNo ratings yet

- Colgate - IDFC PDFDocument8 pagesColgate - IDFC PDFDarshan MaldeNo ratings yet

- JK Cement - MicrosecDocument3 pagesJK Cement - MicrosecDarshan MaldeNo ratings yet

- Prestige Estates-MoST PDFDocument10 pagesPrestige Estates-MoST PDFDarshan MaldeNo ratings yet

- National Peroxide - Q3FY13 Result UpdateDocument2 pagesNational Peroxide - Q3FY13 Result UpdateDarshan MaldeNo ratings yet

- PC Tata Chem 202890446Document9 pagesPC Tata Chem 202890446Darshan MaldeNo ratings yet

- Rec - Ar PDFDocument9 pagesRec - Ar PDFDarshan MaldeNo ratings yet

- Nifty Derivatives Analysis and Stock Futures OutlookDocument6 pagesNifty Derivatives Analysis and Stock Futures OutlookDarshan MaldeNo ratings yet

- Money Trend - 1 Jan - 12 - 0101130948Document6 pagesMoney Trend - 1 Jan - 12 - 0101130948Darshan MaldeNo ratings yet

- Geometric Stock Note PDFDocument13 pagesGeometric Stock Note PDFDarshan MaldeNo ratings yet

- DailymarketOutlook 1january2013Document3 pagesDailymarketOutlook 1january2013Darshan MaldeNo ratings yet

- Ecoscope PDFDocument10 pagesEcoscope PDFdarshanmaldeNo ratings yet

- Panditvani (Astrological View On Market)Document2 pagesPanditvani (Astrological View On Market)Darshan MaldeNo ratings yet

- NIFTY TECHNICAL OUTLOOK AND KEY LEVELSDocument5 pagesNIFTY TECHNICAL OUTLOOK AND KEY LEVELSDarshan MaldeNo ratings yet

- Bharti Airtel LTD - LKP.Document17 pagesBharti Airtel LTD - LKP.Darshan MaldeNo ratings yet

- Panditvani (Astrological View On Market)Document2 pagesPanditvani (Astrological View On Market)Darshan MaldeNo ratings yet

- Axisdirect Dms 01-01-13Document3 pagesAxisdirect Dms 01-01-13Darshan MaldeNo ratings yet

- Geometric Stock Note PDFDocument13 pagesGeometric Stock Note PDFDarshan MaldeNo ratings yet

- Money Morning-010113 - 10 - 0101130901 PDFDocument7 pagesMoney Morning-010113 - 10 - 0101130901 PDFDarshan MaldeNo ratings yet

- Money Weekly - 281212 - 10 - 2812120615Document11 pagesMoney Weekly - 281212 - 10 - 2812120615Darshan MaldeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Corporate Law Project - Duties of DirectorsDocument18 pagesCorporate Law Project - Duties of DirectorsVishwajeet SinghNo ratings yet

- PEG 2024 Press Release March 2024 37thDocument3 pagesPEG 2024 Press Release March 2024 37thCerio DuroNo ratings yet

- Strategies of Unrelated DiversificationDocument11 pagesStrategies of Unrelated DiversificationVikram Falor0% (1)

- Corp Law Her BosaDocument7 pagesCorp Law Her BosaMigs GayaresNo ratings yet

- Chapter 1: Corporation and Corporate Governance IdentificationDocument4 pagesChapter 1: Corporation and Corporate Governance IdentificationJOHN FRANCIS SAMILLANO100% (1)

- 562 Spring2003Document5 pages562 Spring2003Emmy W. RosyidiNo ratings yet

- DividendDocument5 pagesDividendAkash79No ratings yet

- Business CombinationDocument51 pagesBusiness CombinationsfatimahimahNo ratings yet

- Insurance Amendment Act 2015Document9 pagesInsurance Amendment Act 2015Anonymous yoWp5Yi5No ratings yet

- 17897V1 MGT501 Assessment2Document16 pages17897V1 MGT501 Assessment2bitet100% (1)

- SEx 2Document20 pagesSEx 2Amir Madani100% (3)

- Prospectus FundamentalsDocument31 pagesProspectus Fundamentalssuvansh majmudarNo ratings yet

- Literature Review - Shareholder ActivismDocument28 pagesLiterature Review - Shareholder ActivismRishabhRathoreNo ratings yet

- Pengaruh Profitabilitas, Time Interest Earned, Pertumbuhan Aset, Pertumbuhan Penjualan, Dan Operating Leverage Terhadap Struktur ModalDocument22 pagesPengaruh Profitabilitas, Time Interest Earned, Pertumbuhan Aset, Pertumbuhan Penjualan, Dan Operating Leverage Terhadap Struktur ModalDebbie Cynthia WijayaNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document9 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- IM Corporate YTLDocument51 pagesIM Corporate YTLjtmo1955No ratings yet

- Ulink Agritech Private Limited Aoc-2018Document253 pagesUlink Agritech Private Limited Aoc-2018anon_680922917No ratings yet

- Adjudication Order in Respect of Gazi Financial Services and Investments Ltd. (In The Matter of Investor Grievance Case)Document5 pagesAdjudication Order in Respect of Gazi Financial Services and Investments Ltd. (In The Matter of Investor Grievance Case)Shyam SunderNo ratings yet

- The Intelligent Investor Chapter 8Document3 pagesThe Intelligent Investor Chapter 8Michael PullmanNo ratings yet

- Chapter 6 Business Formation Sections 3-4Document25 pagesChapter 6 Business Formation Sections 3-4kparsons938512No ratings yet

- Theories of Venture Capital and Capital Market ImperfectionDocument32 pagesTheories of Venture Capital and Capital Market ImperfectionДр. ЦчатерйееNo ratings yet

- APPLEDocument12 pagesAPPLEenockNo ratings yet

- IBBL Dividend Policy AnalysisDocument20 pagesIBBL Dividend Policy AnalysisSISkobir100% (1)

- Corporation AccountingDocument71 pagesCorporation AccountingUmar Zahid100% (1)

- Development Bank of The Philippines vs. Sta. Ines Melale Forest Products CorporationDocument6 pagesDevelopment Bank of The Philippines vs. Sta. Ines Melale Forest Products CorporationFrancis Coronel Jr.No ratings yet

- Financial Ratio AnalysisDocument4 pagesFinancial Ratio AnalysisJennineNo ratings yet

- Spice Land CH 12 InvestmentDocument23 pagesSpice Land CH 12 InvestmentTuongVNguyenNo ratings yet

- Acknowledgement Receipt, Waiver & QuitclaimDocument2 pagesAcknowledgement Receipt, Waiver & Quitclaimjowel clomaNo ratings yet

- Ladang Perbadanan-Fima Berhad Annual Report 2006Document67 pagesLadang Perbadanan-Fima Berhad Annual Report 2006ibn Abdillah100% (4)

- Virtual Shareholder Meeting A Feasible FutureDocument3 pagesVirtual Shareholder Meeting A Feasible FutureSagnik AdityaNo ratings yet