Professional Documents

Culture Documents

Cityam 2013-02-21

Uploaded by

City A.M.Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cityam 2013-02-21

Uploaded by

City A.M.Copyright:

Available Formats

...

but FTSE bucks the trends as it touches five-year high

THE FTSE 100 climbed to a five

year peak during yesterdays

trading, breaking through

another psychological barrier.

Londons main blue chip index

reached 6,412.44 points as

investors were boosted by

renewed belief that the Bank of

England could be set for more

quantitative easing.

It was the first time since

January 2008 that the FTSE had

passed the 6,400 level.

Yet the market eased later in

the day to close up by only 0.26

BY JULIAN HARRIS

per cent, at 6,395.37. Analysts were

divided over whether the FTSEs

failure to hold about the 6,400

mark could result in profit-taking,

or whether the index will have

another push at closing above

6,400 today.

There are reasons to be bullish

but we do expect a light correction

of around three per cent over the

next week, said JN Financial

trader Rick Jones, who expects the

index to retreat to around 6,200

this week.

Theres an opportunity to book

some profits.

Equities have enjoyed a strong

rally so far this year, as risk

appetite resumes on hopes of

macroeconomic recovery.

The prospect of further asset

purchases from the Bank have also

bolstered the FTSE.

Good economic data from the

UK and across Europe gave

investors yet more reason to buy

equities as even though the

current economic environment

may not look all that bright, there

are indications that things are on

the mend, commented Capital

Spreads in a note.

Another positive set of labour

market data for the UK, showing a

further jump in the level of

employment, contributed to a

rosier outlook.

Unemployment in the UK fell

once again and the number in

work reached a new record high

showing that we may not be

producing all that much, as

evidenced by recent GDP figures,

but at least jobs are being

created, Capital added.

The FTSE has been on the rise

since sinking to around 5,260 last

summer, when the Eurozone crisis

had flared up again.

It started the year around the

5,900 mark but broke through

6,000 and recorded its best

January since 1989 last month,

gaining 6.43 per cent.

FTSE 100

20Feb 18Feb 19Feb

6,400

6,360

6,380

6,320

6,340

6,420

6,395.37

20Feb

BUSINESS WITH PERSONALITY

THE POUND tumbled to an eight

month low against the dollar yester-

day, after the Bank of England

revealed that its governor Sir Mervyn

King has begun pushing for another

round of monetary stimulus.

Sterling has taken a hammering so

far this year, dropping from around

$1.63 at the start of 2013 to $1.523 by

last night.

Earlier in the day it had fallen off a

cliff as the City reacted to the publica-

tion of minutes of Februarys meeting

of the Monetary Policy Committee

(MPC), losing $0.01 in value during

just a quarter of an hour of trading.

The minutes showed that Sir

Mervyn was one of three senior Bank

officials to vote for a further 25bn in

asset purchases.

The move, which would take the

total level of quantitative easing (QE)

to 400bn, was backed by David Miles

and executive director Paul Fisher

yet defeated by the six remaining

members of the committee.

Nonetheless, the shift by two of

the Banks most senior

policymakers Miles has

been voting for more QE

www.cityam.com FREE

ANDREW SENTANCE AND DANNY BLANCHFLOWER

FTSE 100 6,395.37 +16.30 DOW13,927.54 -108.13 NASDAQ3,164.41 -49.18 /$ 1.53 -0.01 / 1.15 unc /$ 1.33 -0.01

BY JULIAN HARRIS

DOWN, DOWN, DOWN

HEAD TO HEAD

ISSUE 1,824 THURSDAY 21 FEBRUARY 2013

MARK

KLEINMAN

See Page 7

See The Forum, Page 24-25

UK JOBS FIGURES: Page 2

FED MINUTES: Page 2

ALLISTER HEATH: Page 2

Certified Distribution

from 31/12/12 to 27/01/13 is 127,008

since November prompted investors

to move even further from sterling.

The markets were also affected by

dovish noises emerging from the

MPCs minutes.

The committee agreed that it was

important to communicate clearly its

willingness to bring inflation back to

the target over a longer time horizon

than usual, the minutes said.

The MPC added: as long as domes-

tic cost and price pressures remained

consistent with inflation returning to

target in the medium term, it was

appropriate to look through the tem-

porary, albeit protracted, period of

above-target inflation.

Last June Sir Mervyn was also part of

a three-man push for more QE, on

that occasion endors-

ing another 50bn

being added to

the Banks bal-

ance sheet. The

next month,

July 2012, saw a

clear majority of

seven of the MPC

wave through

50bn of extra

QE, raising

the total

a mo unt

to 375bn.

Sir Mervyn only has four months

left in the top job before stepping

down to be replaced by Mark Carney.

His vote surprised many investors,

due to recent speeches in which the

outgoing governor indicated that the

effectiveness of the QE programme

was fading.

Incoming governor Carney may

look for new forms of stimulus, with

some investors saying that the

Canadians expected dovish stance is

already weighing on sterling.

Carney is already easing policy,

before he even takes up his post,

Danske Bank economist Lars

Christensen told City A.M.

Market forces are determined by

expectations.

Sterling slumps even further as Bank governor votes for more QE

Spot gold dipped during the days trading

7am 9am 11am 1pm 3pm 5pm

1,620

1,600

1,580

1,570.79

$/ounce

PRICE OF GOLD FALLS TO A SEVEN-MONTH LOW

GOLD dipped to a fresh seven

month low last night, as the

precious metal was dealt a triple

blow of hawkish Federal Reserve

minutes, growing risk appetite,

and speculation that a hedge

fund is having to withdraw from

its commodities positions.

Spot gold was down at

$1,570.79 an ounce, having

begun the day comfortably

above the $1,600 mark.

There are rumours that a

large commodity hedge fund

blew up and was forced to dump

its holdings, sparking a selloff

across markets, said Adam

Sarhan, chief executive at

Sarhan Capital in New York.

The yellow metal has been on

the decline since the autumn.

Having come close to the $1,800

level on 4 October 2012, it has

lost significant ground while

more funds have gravitated

towards resurgent equities

markets across the globe.

Other commodities also

showed notable declines, during

yesterdays trading.

Silver was down over three

per cent to $28.5 an ounce in the

US last night, while Brent crude

lost 1.86 per cent.

Golds dip has seen it create a

so called death cross the term

investors use for the 50 day

moving average line falling to

cross the 200 day line.

But Michael Hewson of CMC

Markets warned off enthusiastic

bears by saying the fall may not

continue. In the last 10 years

weve seen six death crosses and

only one has worked with any

degree of success, he explained.

Kings vote caused sterling to fall out of bed

7am 9am 11am 1pm 3pm 5pm

1.55

1.54

1.53

1.523

/$

Sir Mervyn King leaves his

post at the end of June

Millions 960

940

920

2012

2012

2011 2010 2009 2008 2007

2011 2010 2009 2008 2007

TOTAL WEEKLYHOURS WORKED, SEASONALLYADJUSTED

6

4

2

0

-2

-4

-6

PRICES CONTINUE TO OUTPACE WAGES

%

Consumer Prices Index

Total Pay

UNEMPLOYMENT

2.5m

156,000 OVER THE YEAR

EMPLOYMENT

29.73m*

584,000 OVER THE YEAR

EM

2

558844,000

*ALL-TIME

RECORD

MALE

FEMALE

15.93m

329,000 OVER THE YEAR

13.80m

255,000 OVER THE YEAR

3.72m

75,000 OVER THE YEAR

1.41m

127,000 OVER THE YEAR

1.09m

29,000 OVER THE YEAR

0.97m

11,900 OVER THE YEAR YOUTH (16-24)

MALE

FEMALE

YOUTH (16-24) S

O

U

R

C

E

: O

F

F

IC

E

F

O

R

N

A

T

IO

N

A

L

S

T

A

T

IS

T

IC

S

*ALL FIGURES ARE FOR Q4 OF 2012, COMPARED TO Q4 OF 2011

allister.heath@cityam.com

Follow me on Twitter: @allisterheath

Jobs boom continues but

slump in real wages bites

EMPLOYMENT soared to another

new all-time record in the final three

months of 2012, despite the econom-

ic activity rate falling to a 22-year

low.

Employment rose 154,000 between

the third and fourth quarter of 2012,

reaching 29.73m, the highest level

ever. At the same time, unemploy-

ment edged down 14,000, to 2.50m,

156,000 lower than during the

fourth quarter of 2011.

Total weekly hours worked climbed

0.2 per cent over the quarter and 2.6

per cent over the year to reach

947.1m. And economic inactivity col-

lapsed to its lowest rate since 1991

22.3 per cent with 294,000 more

looking for work than a year earlier.

Yet another set of robust figures

for the labour market, with a

chunky increase in employment and

a sharp fall in the claimant count,

said Item economist Nida Ali.

There is also pleasing evidence of

Twitter tries new tool to unlock ads

Twitter has unveiled a new automated

advertising technology that promises to

unlock the moneymaking potential of the

microblogging site. The development of a

Twitter ads API, or application-

programming interface, satisfies a

long-awaited desire of advertisers to

increase and improve the reach of their

marketing messages to Twitters 200m

active users. A similar technology

launched by Facebook in 2010 helped that

social network reach more than $3bn in

revenues the following year.

Intrade traffic plummets

The number of people using Intrade has

plummeted since a US government

crackdown late last year, calling into

doubt the online prediction markets

powers to divine the wisdom of crowds on

matters ranging from election results to

the stock market.

Accor aims to cut costs in Europe

Accor, Europes largest hotels operator,

said it would cut costs to cope with a

difficult market in southern Europe and

accelerate new openings, particularly in

Asia. The firm is moving away from

owning sites to a franchise model.

Pressure to split top job at JP Morgan

Jamie Dimon is under pressure to

relinquish one of his roles as chairman

and chief executive of JP Morgan Chase

after the bank lost $6bn last year through

a bungled trading strategy.

Google unveils its Glasses

Google has released the first video

showing what the world looks like

through the latest prototype of its smart

glasses, a computer integrated into your

field of vision.

BAE Systems warns 3,500 jobs at risk

British defence giant BAE Systems has

warned it will be forced to cut 3,500 jobs

in the US if the threat of Pentagon

spending cuts becomes reality. The

company said it had warned staff at its US

ship repair business of the possible cuts.

Over-60s told to go back to Uni

People in their sixties should go to

university to retrain because they will be

expected to work for longer, the

government has suggested.

US fights theft of trade secrets

The White House yesterday unveiled a

new strategy to exert pressure on China

and other countries that engage in

corporate espionage against the US as

part of a new push to counter

cyberattacks and commercial spying.

LivingSocial Gets a $110m boost

LivingSocial has raised $110m from

existing investors, giving its coffers a

much needed boost after the daily-deals

sites 2012 losses widened by 30 per cent.

2

NEWS

BY BEN SOUTHWOOD

To contact the newsdesk email news@cityam.com

B

RITAIN is, as ever, a country of

contradictions. On the one

hand, the pound is tumbling as

the global markets begin to

worry about our future, the budget

deficit is increasing not least

because George Osborne got 1.2bn

less than expected from the sale of 4G

licences real wages are falling at an

accelerating rate and the Bank of

England has gone soft on inflation.

On the other, the jobs market is

continuing to perform remarkably

well, confounding all of the sceptics.

While it is still very tough for

millions, and unemployment

remains at horribly elevated levels,

more people than ever before are

working in the UK, and the quality of

the new jobs is improving.

The best way to assess the strength

of the labour market, adjusted for

part time and full time jobs, is to look

EDITORS

LETTER

ALLISTER HEATH

The only great British economic success story of recent years

THURSDAY 21 FEBRUARY 2013

at the total number of hours worked

in the economy. This reached 947.1m

in the September-December 2012

quarter, up by 2.6 per cent over the

past year; the rebound since the

trough of 904m in June-August 2009

has been spectacular. We are now just

2.2m hours below the boom-time

peak of 949.3m hours worked in Jan-

March 2008. That is very encouraging

news, and reinforces the more main-

stream data which reveals that there

are now more people in work in the

UK than ever before.

There are several major caveats, of

course. The first is that the popula-

tion of working age has expanded

substantially over the past five years,

with youngsters entering the work-

force and more immigrants moving

here than emigrants leaving. So while

the employment rate for those aged

from 16 to 64 was 71.5 per cent, up 1.1

percentage points on a year earlier,

and an astonishing 584,000 net extra

jobs were added to the economy (with

the private sector contributing sub-

stantially more than that, easily off-

setting public sector cuts of 128,000

in the year to September) the employ-

ment rate remains lower that it was

at the height of the boom. It hit 73

per cent or even slightly higher sever-

al times during the good years.

The difference explains the higher

unemployment, the greater number

stack up. There is something wrong

somewhere.

The final caveat is that real wages

are continuing to fall. People are pric-

ing themselves back into work, and

companies are substituting labour for

capital. Total pay is up 1.4 per cent

over the past year; retail prices rose

3.1 per cent, translating into a real cut

of 1.7 per cent. Once again, public sec-

tor pay is going up in nominal terms

yes, there is meant to be a freeze at a

faster rate than private sector pay, at 2

per cent against just 1.3 per cent. In

that respect, though not when it

comes to jobs, austerity is being borne

more by private workers.

That said, job creation has been the

one great British success story of the

past few years. Lets hope it continues.

of under-employed workers and the

other problems in the labour market.

The total number of people on the

key out of work benefits has fallen to

4.799m, down from a recent peak of

5.098m but remains higher than the

4.314m trough of November 2007.

The second major caveat is that

while the total number of hours is

almost back to peak levels, output

remains significantly lower. If the

data is correct, it confirms that pro-

ductivity output per hour worked

is substantially lower than it used to

be. With output stagnant, it seems

that output per hour worked in the

past 12 months alone collapsed by 2.6

per cent. We added over half a million

extra workers but produced no

more than before. Some of the UKs

past productivity puzzle makes sense

but no economist on earth can con-

vincingly make the past years figures

underlying strength, with the rise in

employment almost entirely due to

increasing numbers of full-time

employees, Ali added.

The one potentially glum note was

the starkly below-inflation increase in

THE Federal Reserve last night

hinted its current third round of

quantitative easing (QE3) may come

to an end earlier than planned,

trigging a sell-off in US stock

markets.

Minutes of the last Fed meeting

show there is growing unease

within the organisation over last

Septembers pledge to keep buying

$85bn of assets a month until there

has been a substantial recover in

the US jobs market.

They reveal a number of

participants at the rate-setting

meeting expressed concern over the

open-ended nature of the latest

economic stimulus programme.

However Fed chairman Ben

Bernanke appears to still have the

backing of a majority of committee

members in the short term, with

the Fed voting 11-1 last month to

keep its bond-buying program open-

ended and at the same size.

Wall Street fell the most in three

months after the minutes.

Fed minutes

suggest QE3

could end soon

BY JAMES WATERSON

WHAT THE OTHER PAPERS SAY THIS MORNING

Find your next step at

CITYAMCAREERS.com

The route to your ISA starts here...

wages.

Average earnings growth was just

1.4 per cent over the year to

December, only just over half the

headline inflation rate of 2.7 per

cent.

But economists have brought out

these flexible real wages as one of

the main reasons so many UK work-

ers are getting jobs despite the dire

overall economic picture in the

country and across the world.

ITS CRUNCH time for Bumi co-

founder Nat Rothschild this morn-

ing, as the bitter shareholder battle

for control of the coal miner looks

set to come to an end today.

Shareholders will meet in the City

of London to vote on Rothschilds

proposals to overhaul the board.

Rothschild needs a 50 per cent

majority to push through his propos-

als, which include scrapping 12 out

of the current 14 directors including

chief executive Nick von Schirnding

and chairman Samin Tan.

His camp also wants the full disclo-

sure of the Macfarlanes legal probe

announced in September into

alleged financial irregularities at

Indonesian division Bumi Resources,

and the removal of any company offi-

cials associated with the Indonesian

shareholders the Bakrie family.

He has the support of several major

investors including Schroders and

Taube Hodson Stonex.

If his proposals are rejected, the

D-Day for Nat

Rothschild at

Bumi meeting

BY CATHY ADAMS

incumbent Bumi board will remain

in charge in an outcome that is look-

ing increasingly likely, although

sources close to the vote said it will go

down to the wire.

The Bumi board has pledged to

accelerate the divorce from

Indonesian arm Bumi Resources,

something it claims Rothschild is

unable to do. It has the support of

Standard Life Investments.

Investors should know the outcome

of the meeting tonight, although due

to the complexity of the vote it could

be tomorrow morning.

THURSDAY 21 FEBRUARY 2013

3

NEWS

cityam.com

SPANISH bank Santander slashed

bosses bonuses by one-third

yesterday after profits slumped,

and froze the directors salaries at

2009 levels.

Long-serving chairman Emilio

Botin took a 32 per cent cut,

earning just over 3m (2.6m)

though 1.4m of that is in shares,

much of which are deferred.

Profits at Spains largest lender

fell 59 per cent on the year and as

a result directors pay has been

chopped back by almost 35 per

cent as a result.

Santander bosses take pay cut

on Spanish property troubles

BY CITY A.M. REPORTER

Spains banking industry has

been crippled by the countrys

property downturn, and although

Santander is one of the strongest

banks and one of the few that

does not need a bailout, it has still

been affected by the housing bust.

Chief executive Alfredo Saenz

received 8.24m for 2012, down

almost a third on the year.

And Ana Botin, chief of the

banks UK arm, saw her pay rise

2.6 per cent to 5.14m making her

the only boss to record an increase

in compensation for the year.

The groups shares fell 1.81 per

cent on the day.

Network Rail set to be fined as

planning mistakes cause delays

NETWORK Rail is facing a multi-

million pound fine for causing

unacceptable delays over the winter,

the industry regulator warned

yesterday.

Overrunning engineering work

over Christmas and basic

operational planning mistakes

were behind the slip in punctuality

on English and Welsh railways, said

the Office of Rail Regulation.

Around 88.3 per cent of long-

BY MARION DAKERS

distance trains arrived within ten

minutes of their expected time,

slightly better than the 87.1 per cent

level seen last year but still well

adrift of the ORRs targets.

The score improved to 91.4 per

cent for London and the south east.

The group in charge of Britains

railway infrastructure can be fined

1.5m for every 0.1 percentage point

it falls below its 92 per cent

punctuality target in 2013-14.

Network Rails operational

performance on parts of Britains

rail network has been poor over

recent months, said ORR boss

Richard Price.

[We are] concerned that the

company is losing touch with key

performance targets as passengers

again suffered poor performance

during challenging weather

conditions.

The regulator called on Network

Rail to improve its performance in

bad weather, highlighting the

admirable flood recovery

responses in parts of the country.

Nat Rothschild wants to oust 12 out of 14 current Bumi directors

FOREIGN banks will be put at a

huge competitive disadvantage

when trying to sell hedging

products to EU firms, banking

groups have warned, if damaging

incoming rules are not amended

quickly.

Under the CRD4 directive plans,

banks must hold extra capital

against derivatives to cover the risk

that they may lose value in future.

The EU negotiators recognise this

makes hedging products which

firms buy from banks to protect

themselves against risks like

exchange rate moves or interest rate

rises much more expensive and so

have exempted deals between EU

banks and EU firms from the rules.

But they have not exempted non-

EU banks from the credit valuation

adjustment (CVA) charge, which

could push up prices for customers

and so damage the economy.

CVA charges in these cases

would amount to a punitive cost for

these entities and could stifle

growth in the real economy, said

Christine Brentani from the

Association of Financial Markets in

Europe (AFME).

The exemption should apply to

all non-financial entities and not

just those established in the EU.

European parliamentarians and

leaders have been fiercely debating

the proposals which are already

behind schedule.

The most high profile row so far

flared up around bank bonuses,

with French and other politicians

pushing to cap variable pay

at the same level as

salaries a change

which is likely to

come in as only

Britain now publicly

opposes the move and

banks feel unable

to defend

themselves.

Banks fear EU

rules will hit

firms hedging

BY TIM WALLACE

Bumi PLC

20Feb 14 Feb 15Feb 18Feb 19Feb

440

400

420

380

460 p

379.30

20Feb

PROFILE: THE BUMI ROW

JULY 2010

Cash shell Vallar, founded by Nat

Rothschild, oats on the LSE after raising

700m. It intends to invest in mining sector

NOVEMBER 2010

Vallar buys stakes in Indonesian Berau Coal

and Bumi Resources in a $3bn cash and

shares transaction

NOVEMBER 2011

Rothschild writes to the chief executive of

Bumi and Bumi Resources to accuse him of

mismanagement

SEPTEMBER 2012

Bumi hires City law rm Macfarlanes to inves-

tigate alleged nancial irregularities at

Indonesian arm Bumi Resources after infor-

mation is passed to the board

OCTOBER 2012

The Bakries propose a share swap, to cancel

their shareholding in Bumi in exchange for

their Indonesian assets

Rothschild quits the Bumi board, claiming the

rm was failing act in the interests of minori-

ty shareholders

DECEMBER 2012

Nick von Schirnding replaces Nalin Rathod as

Bumi chief executive

The UK Takeover Panel rules that two founder

shareholders are acting in concert with one

another, and rules that their combined viting

power is reduced to 29.9pc. It also begins

probe into the deal that put Bumi together

JANUARY 2013

Bumi conrms it has conclusions from

Macfarlanes probe, but is unable to substan-

tiate details

Nat Rothschild calls extraordinary general

meeting to remove 12 out of the current 14

directors, including chief executive von

Schirnding and chairman Samin Tan

FEBRUARY 2013

Indonesian shareholder Rosan Roeslani sells

his 10pc stake to two hedge funds and one

fund manager, freeing up the votes

TODAY

Extraordinary general meeting held to vote

on Rothschilds proposals. It looks likely that

he will be defeated

The ECs Michel

Barnier is key in

the negotiations

-St James's Master Fund & Nat

Rothschild 20.5pc

-Schroders 3.5pc

-Taube Hodson Stonex 2.5pc

Others 1.8pc

-Abu Dhabi Investment Council 4pc

-Argyle Street Management 4.1pc

-Flaming Luck Investments 1.7

-Avenue Asia Capital Management

7.6pc

-Blackrock 1.1pc

-Credit Suisse 0.4pc

-JP Morgan 1pc

-SG Asset Management 1pc

-Eton Park Capital 1.5pc

-L&G 1.8pc

N.B: Figures are estimates and for illustrative

purposes only

DECLARED SUPPORT

FOR ROTHSCHILD YET TO DECLARE

-Route One 1.2pc

-Standard Life Investments 2.1pc

-Orchard Capital 1pc

-Long Haul Holdings (the Bakries)

29.9pc

AGAINST ROTHSCHILD

THE TREASURY will bank far less

than expected from an auction of 4G

spectrum, with bidding leaving a

black hole of more than 1bn in

George Osbornes accounts.

After weeks of secret bidding, the

UKs four mobile operators, along

with BT, will spend 2.34bn on air-

waves to deliver the next generation

of mobile services, far less than the

3.5bn Osborne had banked on.

However, the end of the auc-

tion does mean that after

years of arguments and legal

threats between communi-

cations regulator Ofcom and

the operators, the UK will

have widespread 4G cover-

age in the coming months,

allowing mobile internet

speeds around five times

faster than current 3G

levels.

Some attrib-

uted the

s mal l er

Osborne hit by

1.2bn shortfall

from 4G auction

BY JAMES TITCOMB

windfall from the auction to lower

than expected bidding from EE, the

UKs largest mobile phone network.

Ofcom gave EE clearance to use its 2G

airwaves for 4G use last year, giving it

a headstart on the rivals.

EE took a smaller amount of the

higher-value 800 MHz spectrum

which allows coverage over longer

ranges and indoors than both its

main rivals O2 and Vodafone. This

also meant that the UKs smallest

operator, Three, walked away

with a slice of the 800 MHz air-

waves for the auctions

reserve price.

O2 and Vodafone will

launch 4G networks at the

end of Spring, with Threes

going live later in the year.

The lower-quality 2.6 GHz

spectrum will be used to

improve speeds in city centres. BT

will use the spectrum to top up its

wireless broadband offering.

WOULD YOU SIGN UP FOR A

4G MOBILE SERVICE?

Interviews by Amy-Jo Crowley

We're an online stock exchange, so

anything that will speed up the

process will help us. 3G never works on Oxford

Street, so if it helps with that, I'd denitely pay

more... not lots though.

These views are those of the individuals above and

not necessarily those of their company

IAN BRANAGAN

BRITDAQ

I nd 3G coverage in the City a bit

patchy - it works in some places but

not in others. If it works as advertised and

improves on coverage, stability and speed, then

I'd consider buying it.

CHRIS GASKIN

BCM

Not at the moment because of the

monthly bandwidth allowance. That

needs to expand signicantly for the expected

usage scenarios to make sense.

ROGER MORAN

HEWLETT-PACKARD

Watchdog backs Libor fine cuts

Another sort of Dutch auction from wary mobile firms

BARCLAYS deserved a multi-million

pound reduction in its Libor

manipulation fine because it

worked hard to cooperate with the

investigation, the Financial Service

Authority insisted today.

Defending itself against questions

from the Parliamentary

Commission on Banking Standards,

the FSA said it is vital to encourage

banks to be open with information.

BY TIM WALLACE

Barclays received a 30 per cent

discount for settling early, trimming

its fine from 85m to 59.5m.

Early settlement has many

potential advantages as it can result,

for example, in the saving of FSA

resources, messages getting out to

the market sooner and a public

perception of timely and effective

action, said the FSA.

We therefore consider that it is in

the public interest for matters to

settle, and settle early, if possible.

But the FSA added this discount

already came on top of another cut

awarded because Barclays had been

helpful through the investigation,

not just in the settlement process.

The benefits of co-operation with

the FSA are cumulative the fact of

a firms recognition of its own

failings and remedial steps taken

post-offending can result in a lower

than otherwise penalty, which is

then further reduced by the

settlement discount, it explained.

BOTTOM

LINE

MARC SIDWELL

CITYVIEWS

George Osborne expected

3.5bn from the auction

ADMINISTRATORS running

collapsed music and DVD retailer

HMV yesterday confirmed they

would close another 37 stores

across the UK, resulting in a

further 464 job cuts.

Deloittes Nick Edwards said the

closures, which come on top of a

previously announced wave of 66

HMV to close a further 37 stores

leaving hundreds out of work

BY JAMES WATERSON

closures, were required to

enhance the prospects of the

restructured business continuing

as a going concern.

Stores, including all four units

at Heathrow airport, will shut

over the next four to eight weeks.

This will leave HMV with just 116

shops, around half the number it

had when it was placed into

administration on 15 January.

THURSDAY 21 FEBRUARY 2013

4

NEWS

cityam.com

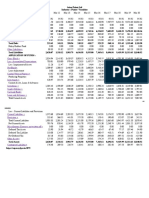

WHO WON WHAT IN THE 4G AUCTION?

OPERATOR SPECTRUM BOUGHT PRICE PAID STATE OF PLAY

10 MHz of 800 MHz,

70 MHz of 2.6 GHz

20 MHz of 800 MHz,

65 MHz of 2.6 GHz

20 MHz of

800 MHz

10 MHz of

800 MHz

50 MHz of

2.6 GHz

Launched 4G on existing spectrum

last year and will use newspectrum

to boost capacity

Will start running 4G

network in spring/summer

Will launch 4G in spring/summer with

obligation to cover 98%of

population by 2018

Will launch 4G by end of 2013

with separate spectrum from

EE and not charge extra for it

Will use spectrum to improve mobile

broadband ofering rather than

challenge other networks

588.9m

790.8m

550m

225m

186.5m

SHARE OF TOTAL SPECTRUM

BEFORE AUCTION

AFTER AUCTION

10

12

13

22

10

% %

35

29

43

25

T

HERE were five winners in the

2.3bn UK auction of fourth

generation (4G) wireless

frequencies announced

yesterday, but George Osborne was

not one of them.

The chancellor was counting on

a 3.5bn 4G windfall to provide a

figleaf of respectability over his

increasingly threadbare claims

that he is reducing the UK deficit.

The auction came up 1.2bn short,

leaving Osborne looking more

than ever like a case of all mouth

and no trousers.

However, while it is bad news

for all of us if the government

cant keep its promises to spend

less money it doesnt have, the

chancellors embarrassment has

its bright spots for the mobile

companies and their investors.

For example, it wasnt like this

in Holland. The Dutch 4G

competition last December was

anything but a Dutch auction, as a

bidding war ended up proving far

more expensive than expected for

the telecommunications firms

involved. Those companies felt the

pinch of buyers remorse as a

result. KPN, one of the three main

mobile players in the Netherlands,

cancelled its final dividend for the

year and reduced its 2013

dividend as well. Vodafones

shares fell 2.8 per cent at the time.

The hangover from a night on

the town in Holland probably fed

into more cautious bids in the

UK but it may also reflect a less

bullish view on likely consumer

interest in 4G. Thats a pity, for

Britain has been embarrassingly

laggard in its adoption of ultrafast

data on the go, and estimates of

the resulting cost to business have

been high. But slow adoption

wouldnt be too surprising. Even

now, the UK 4G picture is

confusing for consumers, with

different flavours of 4G working

with different phones. One more

thing to worry about, alongside

our ballooning national debt.

*Source: FIL LImited as at 31.12.2012. Issued by FIL Investments International, authorised and regulated in the UK by the Financial Services Authority. Fidelity, Fidelity Worldwide Investment, the Fidelity Worldwide Investment logo and F symbol are trademarks of FIL Limited. CSO4637/0413

Your 2013 ISA.

Weve everything

to get you there.

Searching for the right ISA? Its not an uphill struggle at Fidelity.co.uk/guidance.

Our brand new websites got everything to help you decide. With tools, info and

insights from Fidelitys 350 professionals.* Exclusive new funds. Model portfolios

you can mould to your needs. Plus when you come to buy, 1,200 funds from 70

providers all with no initial charge (other ongoing charges apply). So however

much (or little) help you need, now you neednt go through the hoops to get it.

Fidelity guidance: go direct to your goals.

Pleaseremember wedont giveinvestment advice. If you needarecommendation,

contact an adviser. The value of investments can go down as well as up so you

may not get back what you invested. ISA and tax rules apply.

w delity.co.uk/guidance

t 0800 368 0217

Quote CAM12

APPLEs major supplier, Chinese

company Foxconn, has frozen

recruitment at its factories,

suggesting a slowdown in demand for

the iPhone.

The news sent shares in the US

company down 2.4 per cent yesterday,

despite research showing that both

the iPhone 5 and its predecessor, the

4S, had outsold rival Samsungs

Galaxy S3 during the final quarter of

last year. According to Strategy

Analytics, the iPhone 5 sold 27.4m

units in the quarter with the iPhone

4S selling 17.4m to the S3s 15.4m.

Apple supplier

freezes hiring

BY JAMES TITCOMB

THE New York Times is putting The

Boston Globe on the auction block

for a second time as it seeks to focus

solely on growing its flagship

newspaper.

The company said it had hired

Evercore Partners to advise on the

sale, which is expected to come at a

big loss. Ken Doctor, an analyst with

Outsell Research, estimated the

Globe could fetch about $150m

(98m). The company paid $1.1bn for

the newspaper in 1993.

The New York Times is run by

Mark Thompson, the former BBC

Director-General.

NY Times to sell

Boston Globe

BY CITY A.M. REPORTER

COUNTRYWIDE Holdings, Britains

largest estate agency, is to return to

the market six years after it was taken

private, heralding a further sign of

recovery in the housing market.

The company aims to raise 200m

through the issue of new shares,

which it said it will use to repay debts

and fuel further growth.

It will be the second housebuilder to

float this year after Crest Nicholson

was admitted to the London Stock

Exchange this week.

Grenville Turner, who has been

chief executive since 2006, would not

comment on the groups expected val-

uation, although it is understood it

could be as much as 650m.

He said signs of the IPO market

operating effectively and of a recov-

ery in the housing and the mortgage

market were all reasons it decided to

return to the stock market.

Countrywide runs 46 high street

brands including John D Wood and

Churchills and specialises in all serv-

ices relating to residential property.

The company was taken private by

Countrywide in

float plan in bid

to raise 200m

BY KASMIRA JEFFORD

US buyout firm Apollo Global

Management at the height of the hous-

ing market collapse in 2007 for 1bn.

Distressed debt specialists Oaktree

Capital together with Alchemy Partner

then took control of Countrywide in

2009 in a complex deal that saw them

write-off three quarters of the debt and

inject 75m cash.

Turner has since led a restructuring

of the group that has included strip-

ping out more than 200m in costs

and expanding its lettings business.

It has bought over 40 businesses in

the last three years, including the UK

franchise of Sothebys and Hamptons

International, which have helped

expand its presence in the south east.

The group also revealed its 2012

earnings rose 12 per cent to 63m on

revenues up six per cent to 540m.

Oaktree currently has a 50 per cent

stake, Apollo 25 per cent and

Alchemys Special Opportunities Fund

has an eight per cent stake. The rest of

the shares are owned by the compa-

nys directors including Jones.

All shareholders have agreed to a

lock up period preventing them from

selling shares for at least six months.

MAGIC circle law rm Slaughter and May is

part of the legion of advisers assisting

Countrywide on its return to the London Stock

market. The law rms team is led by corpo-

rate partners Jeff Twentyman and Richard

Smith, both experts in equity capital markets

and handling mergers and acquisitions and

otations. Twentymanrecentlyadvised

Manchester Airport Group on its successful bid

to acquire Stansted Airport for 1.5bn and on

insurer Direct Lines IPO last year. On the

banking side, Goldman Sachs and Jefferies

have been hired as joint sponsors, joint global

co-ordinators andjoint bookrunners while

Credit Suisseis actingas joint global co-ordi-

nator and a joint bookrunner. Simon Taurins,

managingdirector of Credit Suisses invest-

ment banking division together with Jon

Grussing, the groups global markets solu-

tions head and Nick Williams, head of equity

capital markets are acting on the deal.

Goldman Sachs managing director of equity

capital markets Richard Cormack and Christos

Tomaras managing director of nancial spon-

sors are advisingCountrywide together with

AlexGarner, vicepresident of investment bank-

ing. Jefferies teamincludesRobert Foster

Europeanco-headof retail investment banking

andPaul Nichollsheadof HoareGovett, theUK

broker Jefferiesacquiredlast year.

ADVISERS

JEFF TWENTYMAN

SLAUGHTER & MAY

Chief executive Grenville Turner said Countrywide could list on the FTSE 250

THURSDAY 21 FEBRUARY 2013

6

NEWS

cityam.com

THURSDAY 21 FEBRUARY 2013

7

NEWS

cityam.com

Mark Kleinman is the City editor of

Sky News @MarkKleinmanSky

B

ANKS, ratings agencies, now

auditors: the firing line of

financial sub-industries

being dragged kicking and

screaming into a post-crisis world

continues to lengthen.

As soon as tomorrow, the

Competition Commission will pave

the way for an overhaul of the Big

Four accountants with a proposal

to enforce mandatory rotation of

their major audit clients at least

once a decade.

It is an overdue reform: the

average FTSE 100 company has had

the same auditor for almost half a

century.

The Financial Reporting Council

has done a limp job of addressing

concerns about the oligopoly

enjoyed by Deloitte, Ernst &

Young, KPMG and PwC.

Yet the consequence of

mandatory rotation may not be as

profound as some hope. Those who

argue that forcing FTSE companies

to switch between other Big Four

suppliers will do little to stimulate

competition beyond that closed

quartet have a point.

But there is a wider issue. Would

PwC, for example, have been happy

to approve the use of Barclays

infamous off-balance sheet

vehicle, Protium, if it had been on

the verge of being replaced by one

of its main rivals? Indeed, I

INSIDE

TRACK

MARK KLEINMAN

Plans to force firms to switch auditors dont go far enough

understand that Antony Jenkins,

Barclays chief executive, will

probably use the arrival of a new

finance director (replacing Chris

Lucas, himself a former PwC

partner) to review the banks

relationship with the audit firm.

The inability of the Big Four to

spot the looming crisis in 2007

and 2008 makes a strong case for

even more frequent mandatory

rotation, say every five years, in

the banking sector.

The Competition Commission

should go further.

ROLLS-ROYCE CHAIRMANS CLOSE TIES

Nobody doubts that Ian Davis,

named last week as the next

chairman of Rolls-Royce Holdings,

is a man of integrity. But there is

something about his appointment

to one of the most illustrious posts

in British business that is

uncomfortable.

The issue is this: Davis is among

the directors of BP responsible for

setting the pay of boardroom

colleagues including Iain Conn,

the oil groups head of refining

and marketing.

Conn was, in turn, the non-

executive director of Rolls-Royce

responsible for leading the search

for Sir Simon Robertsons

successor as chairman of the

aerospace group.

Did Davis recuse himself from

discussions about Conns pay once

he became a candidate for the

Rolls-Royce job? Did Conn hand

over the search to another Rolls

board member?

If either is the case, it should

have been made clear in the

statement announcing Daviss

appointment.

That is not to say that Davis will

or watching business news

bulletins, clearly.

Im told that at a recent meeting

with senior bankers, including

Bruce van Saun, finance director

of Royal Bank of Scotland, Sir

Jeremy professed himself to be

oblivious to industry concerns

about the eventual bill for mis-

selling payment protection

insurance and interest rate

derivatives.

Given that the 12bn already set

aside for redress by the four

biggest banks could support 10

times that sum in lending to the

real economy, it is a worrying gap

in the mandarins knowledge.

not make a fine chairman of

Britains most important

manufacturing company. His crisis

management experience, honed

after the Gulf of Mexico oil spill,

should equip him well if a similar

catastrophe were to emerge at

Rolls-Royce.

But the episode has done

nothing to assuage the widespread

impression that FTSE 100

boardrooms remain a cosseted

club where the back-scratching

suits its members just a little too

tidily.

SIR JEREMY MISSES MIS-SELLING

Where has Sir Jeremy Heywood,

the cabinet secretary and Britains

most powerful civil servant, been

for the last two years? Not reading

GLEE 2012-2013 Fox and its related entities. All rights reserved. The Following 2013 Warner Bros Entertainment Inc. Chicago Fire 2012 NBC Universal. All rights reserved. The F1 logo, F1, FORMULA 1, FORMULA ONE, FIA FORMULA ONE WORLD CHAMPIONSHIP, GRAND PRIX and related marks are

trademark of Formula One Licensing BV. All rights reserved. Box set-up times currently average 7-10 days (excludes Highlands & Islands, Channel Islands, Scottish Islands, Isle of Man and Northern Ireland). Subject to status. Upfront payment may be required. #UK weekend calls of up to an hour to

01, 02, 03 &0870numbers only (excludes Channel Islands, indirect access &dial-up internet numbers). Acceptable Use Policy applies. Sky Broadbandin Sky Network Area: Everyday Lite, monthly 2GB usage cap &no traffic management policy. External factors such as internet congestion can affect speed.

Sky BroadbandGeneral: Speeds vary significantly with location and line quality. 2.18 Sky Hub delivery charge. See sky.com for more details &our usage policies. Sky Broadbandoutside Sky Network Area: Connect is 17 per month (pm) with a monthly usage cap of 40GB &subject to a traffic management

policy. Sky Talk: Compatible line required otherwise connection charge from 39 may apply. Sky TV: Subscriptions from 21.50 pm. M&S Voucher Offer: One voucher per household. Vouchers sent within 45 days of activating viewing to email address provided when joining Sky TV online. M&S terms apply.

HDOffer: Sky TV with the HDpack from 26.50pm for the first 6 months, 31.75 pm thereafter. Excludes existing SkyHDcustomers. Offer ends 31 March 2013. HDchannels received depend on your Sky TV package. BBC HDchannels, ITV1 HD(England and Wales only), Channel 4 HDand Five HD, NHK World

HDand RT HDare available without subscription. Channel 4 HDand Five HDrequire a viewing card. Free SkyHDBox andstandardset-up when you join Sky TV: One per household. Excludes existing SkyHDcustomers. On Demand/Catch Up: Showcase content requires compatible Skybox. Downloading

content requires compatible Sky box, broadband connection (minimum recommended speed 2 Mbps) & self set-up using own cable or wireless connector (21.95). Downloads count towards 2GB monthly usage cap. Downloading a 30 minute show typically uses 0.5GB. Content depends on your Sky TV

subscription. Sky Go: Available on two registered compatible devices (content may vary). iPhone (3GS or above), iPad, iPod touch (4th generation or above), require iOS 4.3 or later, and selected HTC, Samsung and Google smartphones with OS2.2x, 2.3x or 4.0. Selected live channels available in line with your

Sky TV subscription. Some live TV programmes unavailable (see go.sky.com). General: 12 month minimum subscription. Non-standard set-up may cost extra. Sky requires two satellite feeds. Boxes must be connected to a fixed telephone line and prices may vary if you live in a flat. You must get any

consents required (e.g. landlords). Prices for Direct Debit payments only. Continuous debit/credit card mandate costs 50p pm. UK residential customers only. Offers arent available with any other offers. Calls to Sky cost 5.1p per minute (plus 13.1p connection fee) for BT customers. Calls from other

providers may vary. Further terms apply. Correct at 14 February 2013.

Sky Network areas only. Router delivery charge applies.

Believe in better

Join Sky for truly awesome value

08442 410 446 sky.com/supercharge Shopping centre

Plus Sky Line Rental 14.50 a month

Epic Sky TV

See things others cant

Fantastic Sky

The power to control time

Amazing Sky Go

Summon your heroes on the move

Brilliant Sky Broadband

The whole world at your fingertips

Enjoy incredible shows on

channels you wont find

on Freeview

Dont miss hotly anticipated

US drama The Following, on

exclusive Sky Atlantic

Pause, rewind and record live

TV plus record a whole series

Enjoy the pick of the weeks

TV when you want with On

Demand including Catch Up

Take TV from Sky with you

on the move

View on laptops, mobiles

or selected tablets using

3G or WiFi

Perfect for browsing. And well

never slow you down even at

peak times

Plus get inclusive weekend

calls to UK

#

landlines

UK/Ireland only

for 6 months, then 10.25 a month, when you join Sky TV. Offer ends 31 March 2013. 7 HD channels are available without subscription.

Experience 30 incredible HD channels including our dedicated

channel

Supercharge your Sky TV

Limited HD Pack offer for only 5 extra a month

MORE THAN 680m was wiped off

RSAs market capitalisation yesterday

as investors took flight following the

companys decision to slash its divi-

dend by a third.

Chief executive Simon Lee told City

A.M. that the unexpected decision to

cut investor payouts which forced

its share price down 14 per cent

was never going to be the most pop-

ular decision in the short term. But

he insisted that consistently low

investment returns meant RSA had

to be more realistic about what it

could offer shareholders.

If we were going to pay out that

level of earnings it would restrict

capacity to grow in the future. Our

share price is only down to where it

was three or four months ago, Lee

explained.

We have a robust balance sheet

and growing premiums. Its just that

were operating a low interest rate

environment and a conservative

investment portfolio with 90 per

cent in cash and bonds.

Shares in other insurers, including

Aviva, fell as investors feared their

Payout cut sees

680m wiped

off RSAs stock

BY JAMES WATERSON

boards may now to be tempted to

take similar action.

RSA also announced a decline in

full-year operating profit to 684m,

down from 727m, which the compa-

ny partly blamed on payouts relating

to UK floods and Italian earthquakes.

Lee said the company intends to

make up for flatlining performance

in Europe by expanding into develop-

ing markets, where he hopes organic

growth can increase premiums from

1.2bn to 2.2bn by 2015.

The company also used yesterdays

announcement to confirm it intends

to change its auditor from Deloitte to

KPMG.

David Gill led Manchester United through its controversial takeover by the Glazer family

RSA Insurance Group PLC

20Feb 14 Feb 15Feb 18Feb 19Feb

135

125

130

120

140 p 117.00

20Feb

Had the dividend cut been accompanied by a weak trading statement,

the fall of 14 per cent might be justied. However, the trading oor believes the

sell-off is harsh and applaud the boards swift reaction to low-yielding

bond incomes.

ANALYST VIEWS

Once the dust settles we urge investors to revisit the shares and indeed

we would view such weakness as a buying opportunity owing to the prospects

for the group outside the UK and the expectations for good return on

equity delivery in the coming years.

Given that 12 months ago RSA agged that the rate of dividend growth

was to reduce to circa two per cent we view the cut as very disappointing given

that nothing has materially changed over the last 12 months. We have

consequently downgraded our recommendation to Sell.

DID INVESTORS

OVERREACT TO RSAS

DIVIDEND CUT?

MARC KIMSEY ACCENDO MARKETS

EAMONN FLANAGAN SHORE CAPITAL

BARRIE CORNES PANMURE GORDON

THURSDAY 21 FEBRUARY 2013

9

NEWS

cityam.com

A TASTE OF PERU

March 12th, 6.30pm 9pm

Join us in celebrating the colour and cuisine of Peru at

our award-winning travel store on Cheapside.

A highlight will be a cooking demo by Martin Morales,

founder of Cerviche, accompanied by pisco sours.

Exclusive holiday offers will be available on the night.

We have 100 complimentary tickets up for grabs.

To apply, please visit abercrombiekent.co.uk/events

in association with

INSURER Ageas UK, best known for

its partnership with Tesco,

yesterday revealed that total

written premiums passed 2bn for

the first time in 2012.

This allowed the company to

post an 11 per cent rise in full-year

net profits to 82.9m.

Ageas managed to increase

returns at its Tesco tie-up, which

sees motor and household cover

sold under the supermarkets

brand, by focusing on more

profitable business.

Its combined ratio a measure

of underwriting profitability that

compares total premiums with

Premiums at Ageas UK pass

2bn for the first time in 2012

BY JAMES WATERSON

total claims improved slightly to

99.8 per cent.

It also booked a one-off 50.9m

gain following Septembers

purchase of Groupamas UK

business at a discount to net assets.

While the market is not

without its challenges our breadth

of distribution, strong

partnerships and reputation for

service excellence gives us

confidence that we will continue

to build momentum during 2013,

said chief executive Andy Watson.

The companys Belgian parent

group, previously known as Fortis,

yesterday beat analysts

expectations to unveil a full-year

profit of 624m (545m).

FORMER JP Morgan banker Ed

Woodward will take control of

Manchester United this summer,

replacing long-serving chief

executive David Gill.

Woodward helped the Glazer

family with their purchase of the

club in a 790m leveraged takeover

in 2005 before joining the club

shortly afterwards.

Gill piloted the club through a

difficult period which saw regular

fan protests against the Glazers. He

also oversaw the football clubs

successful float on the New York

Stock Exchange last year. Shares in

the club closed down one per cent.

Man Utd CEO

steps down

BY CITY A.M. REPORTER

TITAN International chairman

Maurice Taylor has taken a bold

stand on behalf of the Anglo-

Saxon model, not-so-politely

declining an offer to buy a French

factory that is being closed by

American tyre-maker Goodyear.

After being invited to visit the

factory in northern France, Taylor

sent a letter to French industry

minister Arnaud Montebourg,

and did not hold back on the rea-

sons behind his firms decision

not to purchase the tyre plant.

Taylor wrote: I have visited the

factory several times. The French

workforce gets paid high wages

but work only three hours. They

get one hour for breaks and

lunch, talk for three and work for

three. I told this to the French

union workers to their faces. They

told me thats the French way!

Taylor was equally frank about

what he thought of politicians:

You are a politician so you dont

want to rock the boat. The

Chinese are shipping tires into

France... and yet you do nothing.

France will lose its industrial

business, he warns. Sir, your let-

ter states that you want Titan to

start a discussion. How stupid do

you think we are? Titan is the one

with the money and the talent to

produce tires. What does the

crazy union have? It has the

French government... Titan is

going to buy a Chinese company

or an Indian one, pay less than

one euro per hour wage and ship

all the tires France needs. You can

keep the so-called workers.

It seems the Titan boss is grizzly

by name, grizzly by nature, as col-

leagues affectionately refer to him

as Morry or The Grizz. Not one

to say vive la difference.

A relaxing afternoon in the Jardin des Tuileries

Lawyer Lukas Hirst, and an elephant

Got A Story? Email thecapitalist@cityam.com

11

cityam.com

THECAPITALIST

THURSDAY 21 FEBRUARY 2013

cityam.com/the-capitalist

EDITED BY

CALLY SQUIRES

Bearish Titan says non

to French bon vivants

They say the Square

Mile is one of the safest

places in the country and

for one woman who was

having a heart attack while

driving past the Citys

Mansion House yesterday,

that proved correct. On her

way to work, The Capitalist

spotted a crowd gathered on

the doorstep of the Lord

Mayors residence. Luckily the

quick-thinking John Davies,

Keeper of Walbrook Hall, had

run outside to the rescue

defibrillator in hand and

carried out resuscitation.

Davies modestly told

colleagues afterwards that he

did what anyone else would

have done. Lucky that the

Mansion House is so well-

equipped.

READERS of this page will

remember that lucky Clifford

Chance associate Lukas Hirst

recently won a City A.M. prize

draw, and was rewarded with a

luxury holiday for two at the

beautiful Sandals hotel

in Antigua.

There is just one problem: our

lovely lawyer is single and the

resort, recently voted the

worlds most romantic is

aimed at couples in love.

Not missing an opportunity to

play Cupid, any ladies who wish

to meet an Aussie former rower,

not to mention fancy the

possibility of escaping the grey

British winter for more exotic

climes, should mark their love

notes FAO The Capitalist.

Wanted: Female, likes Antigua

S

later & Gordon employment lawyers,

on your side

For over 85 years, Slater & Gordon (formerly Russell Jones & Walker) have

been providing independent expert legal advice on all employment matters

Because we ONLY act for employees we are highly specialised to advise you

The UK legal guides consistently rate us the No.1 rm for employees and executives

We provide advice on:

s Contractual disputes

s Restrictive covenants

s Redundancy

s All forms of discrimination

s Whistleblowing

Whatever outcome you are trying to achieve, Slater & Gordon are on your side

Slater & Gordon (UK) LLP is authorised and regulated by the Solicitors Regulation Authority and the Financial Services Authority for insurance mediation activity.

For further information call 0808 175 7742 to speak to one of our lawyers or visit slatergordon.co.uk/executive

Equal Pay

& the Law

Now is the time to act

Slater & Gordon Advertisement

Legal Comment

by Samantha Mangwana

Employment Lawyer

Slater & Gordon

Statistics tell us that most

women are paid less than most

men even though this has

been outlawed since 1970

On average, men are paid a fifth

more than women in equivalent

private sector jobs, and reportedly

up to 60% more in financial services

even though this has been unlawful for

over 40 years. The problem in tackling

this is that most of us do not know how

our pay compares to colleagues.

Many women feel it is nerve-wracking

to ask the question, but presently the

law is on your side. Employers have to

tell you if you are being paid differ-

ently, and the reason why - but only if

you ask them. And they cant hold it

against you for asking - the law comes

down heavily on that.

However, the government is planning

to repeal this shortly, perhaps as early

as March, so the time to act is now:

Know Your Rights

Employers must pay women and men

equally for broadly similar work, or

work that is of the same value, unless

there is a rock-solid justification for the

pay discrimination. It really is that

simple. Employment Tribunals can

order an increase in your pay going

forward, and up to six years worth of

back pay, as compensation.

Obtain information from

your employer

Ask your employer specific questions

about what your colleagues are paid,

what they get as bonuses, and the pre-

cise reasons why, if they are paid more

than you. There is even a set form for

this purpose. Any employer who fails

to respond within eight weeks, or gives

false, or evasive responses, risks an

Employment Tribunal ruling against

them as a consequence.

Take Legal Advice

Although equal pay is a basic and

long-standing employment right, it can

seem daunting if you feel out of your

depth. Experienced independent

lawyers can help you negotiate, or take

it up on your behalf. You don't need to

feel like a second class citizen, and you

can take control of the situation.

There's no excuse in this day and age

for paying a woman less than a man.

For further details, or to handle your

case, contact Samantha Mangwana

at Slater & Gordon Lawyers on

0808 175 7742

THE CHANCELLOR should set out

specific tax objectives against

which to test tax policy, a

prominent think tank said

yesterday.

This move should come as part of

a new way of doing tax policy, the

influential Institute for Fiscal

Studies (IFS) argued, with the

Treasury facing greater scrutiny in

its policy-making. Reform is needed

because the current system is

unnecessarily inefficient, complex

and unfair and costs run into

billions of pounds in reduced

output and welfare, the IFS said.

IFS pushes for

new tax policy

BY BEN SOUTHWOOD

US NEW housing starts crashed in

January, but kept well above their

level during January last year.

Privately-owned housing starts

sunk 8.5 per cent between

December and the first month of

2013, bringing them from 973,000

in December to 890,000 but they

were still 23.6 per cent above

January 2012s 720,000 starts,

according to US Census Bureau

data. Data for completed projects

and issued building permits

showed them both racing up,

rising by over a third in just a year.

Housing starts

dip in January

BY BEN SOUTHWOOD

MORTGAGE interest rates dropped to

their lowest level ever in February,

new figures showed yesterday, six

months after the Bank of England

started offering banks cheap funding

in an effort to boost lending to the

private sector.

The average five-year fixed mort-

gage costs just 4.14 per cent, accord-

ing to finance research site

MoneyFacts.

That is down half a percentage

point from 4.64 per cent a year ago

andrepresents an enormous plunge

from 5.41 per cent in the same

month of 2011.

The Bank of Englands Funding for

Lending scheme (FLS) has allowed

banks to draw down billions of

pounds in cheap funding since

August, pushing down rates.

But even banks which are not tak-

ing state funding have increased

lending.

HSBC, the largest bank not taking

part in the FLS, published healthy

lending data yesterday.

The banking giants gross new

mortgage lending jumped 24 per

Mortgage rates

fall to new low

with state aid

BY TIM WALLACE

cent to 16.4bn in 2012, while it

approved 5bn for first time buyers,

an increase of 32 per cent on the year.

And its gross new business lending

increased two per cent to 30.4bn.

But figures across the whole indus-

try were not uniformly positive for

borrowers despite the falling inter-

est rates, mortgage lending fell in

January according to the Council of

Mortgage Lenders.

Gross home lending in the month

came in at 10.4bn, down nine per

cent on Decembers figure and three

per cent on the year.

Analysts blamed cold weather for

the fall, and remain upbeat about the

markets prospects.

Interest rates have plunged in the last year

Feb13 Nov12 Aug12 May12 Feb12 Nov11 Aug11

4.0

4.2

4.4

4.6

4.8

5.0

5.2 Average five-year fixedmortgages, %

S

o

u

r

c

e

: M

o

n

e

y

F

a

c

t

s

JAPAN recorded its deepest ever

trade deficit in January, despite a

sharp weakening in the yen due to

a raft of monetary stimulus.

Exports climbed for the first

time in eight months, helped by a

16 per cent slide in the yen, versus

the dollar, since November last

year. But this 6.4 per cent annual

rise was more than erased by a 7.3

per cent surge in imports, bringing

them to 6.43 trillion (44.9bn).

This left a balance of minus 1.63

trillion, up ten per cent on last

January, and the highest gap ever.

The record deficit came despite

Japan posts record trade deficit

as weak yen pushes up imports

BY BEN SOUTHWOOD Prime Minister Shinzo Abes

aggressive fiscal and monetary

policy to weaken the yen,

indicating a rise in exports on its

own was not enough to turn things

around.

Trade deficits could continue

for much of this year, if not into

next year, said Norio Miyagawa,

senior economist at Mizuho

Securities Research & Consulting.

This shows that on a net basis

money is leaving the country. We

need to turn this around by

increasing our earnings power

from exports. A weak yen will help,

but it wont solve all our

problems.

THURSDAY 21 FEBRUARY 2013

12

NEWS

cityam.com

Prime Minister Shinzo Abe has tasked the Bank of Japan to boost inflation up to two per cent

THE EUROPEAN Commission will get

new powers to monitor Eurozone gov-

ernments budgets and can demand

changes if they do not fit in with

European borrowing rules under a deal

struck with the European Parliament

yesterday.

But a plan to pool debts was aban-

doned after countries led by Germany

rejected the idea that they should back

other states borrowing.

The aim of the so-called two-pack deal

is to strengthen discipline over spend-

ing and taxation in an effort to stop

budget deficits ever getting out of hand

again and causing crises like those in

Greece and Spain.

Rules have already been introduced

to make sure states running deficits of

above three per cent of GDP are pun-

ished more quickly in the future, after

Brussels steps

up control over

borrowing rules

BY TIM WALLACE

governments went unchecked in run-

ning up borrowing before the crisis.

Under the new rules countries deemed

to be getting out of line will be put

under close surveillance, reporting to

the European Commission every quar-

ter and forced to correct past mistakes.

This will mean that the Eurozone can

benefit from a more integrated and

effective policy-setting framework

already for the 2014 budgetary cycle,

said commissioner Olli Rehn.

Towards the end of the year the

European Commission hopes to pro-

pose further measures to coordinate

economic reforms.

And although Germany rejected plans

for pooled borrowing as it fears high-

borrowing member states could benefit

from its prudence, the European

Commission is planning more work

towards a shared debt programme to be

implemented at a later date.

THURSDAY 21 FEBRUARY 2013

13

NEWS

cityam.com

NEW8 FROM THE

CTY OF LONDON

ADVERT8EMENT

News, info and offers at www.cityofIondon.gov.uk/eshot

Take your seat at Milton Court

Dread Poets at Keats House

Overseas business

delegation for

Lord Mayor

City Freedom for

Olympic rower

Milton Court, the new world-class performance venue for Guildhall

School of Music & Drama opens in September to provide students

with state-of-the-art facilities and outstanding training for careers

in the performing arts. Find out how you can support Milton Court

by naming a seat in the Theatre or Concert Hall by calling Amber

Bielby on 020 7382 7162 or visit www.gsmd.ac.uk/takeyourseat

Alderman Roger Gifford, Lord

Mayor of the City of London,

is leading a business

delegation this week to

Kuwait, United Arab Emirates,

Egypt, Bahrain and Qatar to

promote London and the UK's

financial services to heads of

State, key politicians and

business leaders.

Alan Campbell, who won

Bronze in the Men's Single

Scull (Rowing) at the London

2012 Olympic Games, receives

the Freedom of the City of

London tomorrow, in recognition

of his sporting achievements.

Campbell, who is a Freeman of

the Watermens' Company, will

attend a private ceremony at

Guildhall.

Keats House Film Club presents a screening of Dread Poets

Society, featuring Benjamin Zephaniah, former Keats House Poet-

in-Residence, on 23 February at 3pm. The film includes poetry and

performance, as well as Zephaniah's encounters with Keats, Byron,

Percy and Mary Shelley. FREE - with admission ticket to the House.

Top two Eurozone economies

hit by price deflation in 2013

CONSUMER prices fell into decline

in Germany and France in

January, according to figures

released yesterday.

Both countries were hit with a

0.5 per cent fall in their

consumer price indices (CPI) last

month, as the Eurozone crisis

continues, although over the year

the two Eurozone giants still saw

prices rise.

Annual inflation was 1.7 per

cent in Germany, its official

statistical body Destatis said,

BY BEN SOUTHWOOD

while French equivalent Insee put

its CPI inflation at 1.2 per cent

over the year.

Economists worry about

deflation because it can lead to

price imbalances in an economy,

which require a difficult period of

adjustment to iron out,

potentially including a large

increase in unemployment.

And with the price data came

gloomy confidence surveys from

both Insee and the European

Commission (EC), both released

separately yesterday.

Consumer confidence edged up

only 0.3 in the Eurozone during

February, the EC said, staying well

below zero at minus 23.6.

And the economic sentiment

indicator crept up 1.4 points, to

reach 89.2, still far below the long

term average of 100, and

significantly worse than for most

of the Eurozone crisis so far.

The French business climate

indicator, from Insee, did worse,

staying flat at 87 in February,

where it has been since December,

still far below the long-term

average of 100, as the countrys

economy remains depressed.

SOUTH African banking group

Nedbank yesterday said it expects

annual earnings to be between 18

and 23 per cent higher than last

year after a strong performance in

the final quarter.

Nedbank, majority owned by

London-listed Old Mutual, will

release its full-year results on

Monday.

The firm said in October that its

focus on unsecured lending while

the corporate market remained

subdued was set to deliver double-

digit growth.

Nedbank profit

rise is on track

BY MARION DAKERS

FRENCH bank Credit Agricole report-

ed record losses yesterday after a hefty

tax bill on the disposal of its Greek

arm sent costs soaring.

The bank lost 3.98bn (3.47bn) in

the fourth quarter of 2012 and

6.47bn in the year as a whole, its

worst performance since going public

11 years ago. But shares rose as

investors welcomed the banks plan to

cut costs over the next three years.

Revenue fell 15.8 per cent on the

year to 16.315bn, far more rapidly

than operating expenses which only

dipped 2.9 per cent to 12.037bn.

The bank was further hit by an

unexpectedly large 838m tax bill on

the sale of Greek unit Emporiki, as

well as a 541m charge from a revalu-

ation of its own debt and a 267m

impairment recorded on its 20 per

cent stake in Portuguese bank BES.

Tougher prudential requirements

added charges of 832m to the corpo-

rate and investment banking arm,

923m to consumer finance opera-

tions and 921m to international

retail banking.

Credit Agricole

in the red again

with record loss

BY TIM WALLACE

But underlying performance was

solid with normalised profits of 3bn

in retail banking and a contribution of

3.538bn from its regional banks.

The bank vowed to turnaround its

performance in 2013, arguing that it

has now put its Greek losses behind it

and is pushing through a programme

of 650m in cost reductions across IT,