Professional Documents

Culture Documents

Axis Bank

Uploaded by

Felipe Marques LimaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Axis Bank

Uploaded by

Felipe Marques LimaCopyright:

Available Formats

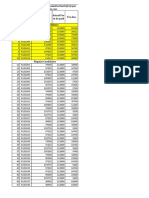

Savings Account Deposit Interest Rate - 4% (for all amounts). Rates effective 25th October 2011.

Domestic deposits - less than 1 crore W.E.F. October 8, 2012 Domestic deposits - 1 crore to less than 5 crores W.E.F. October 8, 2012 Domestic deposits - Senior Citizen - less than 5 crore W.E.F. October 8, 2012 INTEREST RATES ON DOMESTIC DEPOSITS (%) (p.a.) Low Value Term Deposits Senior Citizen on on on on on on Deposits Deposits on Deposits DEPOSITS Deposits Deposits Deposits of Rs 1 of Rs 3 Deposits of Rs. 50 of Rs 15 of Rs 50 Below Rs Crore < Crore < below Rs. Lakhs < lakhs < Rs lakhs < Rs 15 lakhs Rs 3 Rs 5 50 lakhs Rs.5 50 Lakhs 1 Crore Crore Crore Crore 7 days to 14 3.50 3.50 3.50 4.00 4.00 3.50 3.50 days 15 Days to 3.50 3.50 3.50 4.00 4.00 3.50 3.50 29 Days 30 days to 45 5.00 5.00 5.00 7.00 7.00 5.00 5.00 days 46 days to 60 6.25 6.25 6.25 7.00 7.00 6.25 6.25 days 61 days to less than 3 6.50 6.50 6.50 7.00 7.00 6.50 6.50 months 3 months to less than 4 7.00 7.00 7.00 8.00 8.00 7.00 7.00 months 4 months to less than 5 7.00 7.00 7.00 8.00 8.00 7.00 7.00 months 5 months to less than 6 7.00 7.00 7.00 8.50 8.50 7.00 7.00 months 6 months to less than 7 7.50 7.50 7.50 8.50 8.50 8.25 8.25 months 7 months to less than 8 7.50 7.50 7.50 8.50 8.50 8.25 8.25 months 8 months to less than 9 7.50 7.50 7.50 8.50 8.50 8.25 8.25 months PERIOD

9 months to less than 10 months 10 months to less than 11 months 11 months to less than 1 year 1 year to less than 13 months 13 months to less than 14 months 14 months to less than 15 months 15 months to less than 16 months 16 months to less than 17 months 17 months to less than 18 months 18 months to less than 2 years 2 years to less than 30 months 30 months to less than 3 years 3 years to less than 5 years 5 years up to 10 years

7.50

7.50

7.50

8.50

8.50

8.25

8.25

7.50

7.50

7.50

8.50

8.50

8.25

8.25

7.50

7.50

7.50

8.50

8.50

8.25

8.25

8.50

8.50

8.50

8.50

8.50

9.25

9.25

8.50

8.50

8.50

8.50

8.50

9.25

9.25

8.50

8.50

8.50

8.50

8.50

9.25

9.25

8.50

8.50

8.50

8.50

8.50

9.25

9.25

8.50

8.50

8.50

8.50

8.50

9.25

9.25

8.50

8.50

8.50

8.50

8.50

9.25

9.25

9.00

9.00

9.00

9.00

9.00

9.75

9.75

9.00

9.00

9.00

9.00

9.00

9.75

9.75

9.00

9.00

9.00

9.00

9.00

9.75

9.75

9.00 8.50

9.00 8.50

9.00 8.50

9.00 8.50

9.00 8.50

9.75 9.25

9.75 9.25

For interest rates on Fixed Deposits of Rs. 5 crore and above, please contact your nearest Axis Bank branch.

Rates Effective from: Monday, October 15, 2012 INTEREST RATES ON TAX SAVER DEPOSITS 5 years only (Amount Capped at Rs. 1 lac per customer per INTEREST RATES(%) Financial Year) (p.a.) Regular Depositor (Individual & HUF) 8.25 Senior Citizen (Individual) 9.00

Our Home Loan Rates

Sr. No Type Base Rate + Mark Up Base Rate + Less than Rs. 25 Lac 0.75% Loans greater than Rs.25 lac - Base Rate + Rs. 75 lac 1.00% Base Rate + Loans greater than Rs. 75 lac 1.25% Top Up - All loans, Renovations Base Rate + 2% Loan amount (Rs.) Effective Rate Of Interest 10.75% p.a. 11.00% p.a. 11.25% p.a. 12.00% p.a.

Floating Rate

Base Rate - 10.00% NISHCHINT - Home Loan with Fixed Rate of Interest Type Fixed Rate

CAR LOAN

Effective Rate Of Interest 11.75% p.a.

Rates of Interest 12.50% - 15.00%

Processing Fee Rs. 3500 to Rs. 5500

EDUCATION

Sr. Type No 1 Education Loan

Base Rate + Mark Up Base rate + Upto Rs. 4 lacs 7.00% Loans greater than Rs. 4 lacs Base rate + and upto Rs. 7.5 lac 8.00% Base rate + Loans greater than 7.5 lacs 6.00% Base rate + Education Loan for Upto Rs. 4 lacs 6.50% Girl Child Loans greater than Rs. 4 lacs Base rate + and upto Rs. 7.5 lacs 7.50% Base rate + Loans greater than 7.5 lacs 5.50% Loan amount (Rs.)

Effective Rate Of Interest 17.00% 18.00% 16.00% 16.50% 17.50% 15.50%

Base Rate - 10.00% Charges for changing from floating to fixed rates of interest NA

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Axis BankDocument5 pagesAxis BankFelipe Marques LimaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word DocumentFelipe Marques LimaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- AIEEE 2012 Information BrochureDocument53 pagesAIEEE 2012 Information Brochuresd11123No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Tutorials Point, Simply Easy Learning: Java TutorialDocument17 pagesTutorials Point, Simply Easy Learning: Java TutorialAli Elsayed SalemNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- BRU MSMPP WP Mar2012 Construction IndustryDocument12 pagesBRU MSMPP WP Mar2012 Construction IndustryFelipe Marques LimaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Index Numbers (Maths)Document12 pagesIndex Numbers (Maths)Vijay AgrahariNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Simple and Reliable Way To Compute Option-Based Risk-Neutral DistributionsDocument42 pagesA Simple and Reliable Way To Compute Option-Based Risk-Neutral Distributionsalanpicard2303No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- MKT 101 Chap 10Document21 pagesMKT 101 Chap 10বহুব্রীহি আর একটা দাঁড়কাকNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Demand, Supply and ElasticityDocument39 pagesDemand, Supply and ElasticityRia Gupta100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Midterm 1 Vrs 1Document12 pagesMidterm 1 Vrs 1Papa FrankuNo ratings yet

- Abraham's Strategy: Split StealDocument6 pagesAbraham's Strategy: Split StealSwati JainNo ratings yet

- Duty Credit Scrip: Sahil Chhabra - 39ADocument8 pagesDuty Credit Scrip: Sahil Chhabra - 39AsahilchhabraNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Chapter 2 Macro SolutionDocument14 pagesChapter 2 Macro Solutionsaurabhsaurs100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- CBSE Class 12 Economics Full Study MaterialDocument85 pagesCBSE Class 12 Economics Full Study Materialsakshamkohli97No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Aid For Trade & NepalDocument36 pagesAid For Trade & NepalJaydeep PatelNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Accept Thomson Division Bid for New Box DesignDocument2 pagesAccept Thomson Division Bid for New Box Designruchika vartakNo ratings yet

- Chapter 19 Financial CalculationsDocument30 pagesChapter 19 Financial Calculationsaihr78No ratings yet

- Stochastic Volatility Models With Closed-Form SsolutionsDocument99 pagesStochastic Volatility Models With Closed-Form SsolutionsSolomon AntoniouNo ratings yet

- Implied Volatility PDFDocument14 pagesImplied Volatility PDFAbbas Kareem SaddamNo ratings yet

- Why The ISDA SIMM Methdology Is Not What I ExpectedDocument5 pagesWhy The ISDA SIMM Methdology Is Not What I Expected남상욱No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Semi-Analytic Valuation of Credit Linked Swaps in A Black-Karasinski FrameworkDocument20 pagesSemi-Analytic Valuation of Credit Linked Swaps in A Black-Karasinski Frameworkstehbar9570No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Instructions On How To Create A Units of Production Depreciation ScheduleDocument2 pagesInstructions On How To Create A Units of Production Depreciation ScheduleMary100% (3)

- Chapter 4: The Market Forces of Supply and Dem... : What Is A Market?Document5 pagesChapter 4: The Market Forces of Supply and Dem... : What Is A Market?Savannah Simone PetrachenkoNo ratings yet

- Basics of Capital BudgetingDocument26 pagesBasics of Capital BudgetingChaitanya JagarlapudiNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Cost Acctg ReviewerDocument106 pagesCost Acctg ReviewerGregory Chase83% (6)

- Fee Details 2013-14 Admitted Batch (E2Document18 pagesFee Details 2013-14 Admitted Batch (E2hariNo ratings yet

- Container Transshipment and Port Competition PDFDocument30 pagesContainer Transshipment and Port Competition PDFMohamed Salah El DinNo ratings yet

- Econ 1101 Practice Questions CompleteDocument79 pagesEcon 1101 Practice Questions Completepeter kong33% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Answers To Quiz 10Document3 pagesAnswers To Quiz 10George RahwanNo ratings yet

- Property Registration Website in India - E-Stamp Duty Ready Reckoner PDFDocument9 pagesProperty Registration Website in India - E-Stamp Duty Ready Reckoner PDFSelvaraj VillyNo ratings yet

- Pertemuan IDocument54 pagesPertemuan IArsdy NovalentioNo ratings yet

- How Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentDocument2 pagesHow Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentbootybethathangNo ratings yet

- Og1 8 Batch Sample Paper r3Document5 pagesOg1 8 Batch Sample Paper r3Anonymous ZiVCT1VlD100% (1)

- Document #10B.2 - FY2017 Operating Budget Report - January 25, 2017Document5 pagesDocument #10B.2 - FY2017 Operating Budget Report - January 25, 2017Gary RomeroNo ratings yet

- Industry Structure, Competition, and Firm PerformanceDocument11 pagesIndustry Structure, Competition, and Firm Performancer G100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)