Professional Documents

Culture Documents

Aviva's Working Lives Infographic - February 2013

Uploaded by

Aviva GroupOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviva's Working Lives Infographic - February 2013

Uploaded by

Aviva GroupCopyright:

Available Formats

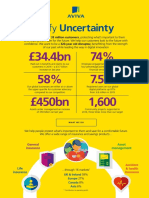

Working Lives

second report

February 2013

Working life in the UK today

Employees enjoyment of work

I dont like where I work 4% I only come to work for the money 13% I dont mind coming to work, but would rather not 22% I enjoy my work 60%

Employees key workplace concerns

Working in unsafe or unhygienic conditions Bullying in the workplace 9% 7%

Lack of a pension / inadequate pension provision 18% Lack of development opportunities 33% Lack of opportunity for promotion 32% Stress of the job 38% Uncertainty about job security 43% Level of pay compared to the cost of living 65%

Employers key business concerns (Q1 - 2013)

All businesses

Uncertainty about the businesss ability to survive in the economic downturn

29%

Adopting more efficient systems / processes / technology

24%

Cutting jobs

19%

Keeping up with employees pay / benefits 13% package expectations Keeping up with new legislation, e.g. pension changes

14%

Keeping ahead of the competition / innovating

42%

Employers confidence in the financial situation of their business vs. employees confidence in their own financial situation

All businesses

15% 3% 52% 34%

Employees

18% 26% 12% 29% 4% 8%

Extremely confident

Quite confident

Neither confident or unconfident

Not very confident

Not at all confident

Top five benefits employers offer vs. those most valued by employees

Annual/performance related bonus Money purchase/defined contribution pension scheme Health Insurance Life insurance/death in service Company car/car scheme

1 2 3 4 5 1 2 3 4 5

Annual/performance related bonus Money purchase/defined contribution pension scheme Health Insurance Life insurance/death in service Company car/car scheme

Top five benefits valued by male and female employees

Annual/performance related bonus Money purchase/defined contribution pension scheme Life insurance/death in service Health Insurance Company car/car scheme Annual/performance related bonus Money purchase/defined contribution pension scheme Health Insurance Life insurance/death in service Company share scheme/free shares

Employees in private sector firms report their pension situation as follows: 2% say they pay into the

pension their employer offers, but their employer doesnt say their employer pays into their pension but they dont

say they pay into the pension their employer offers, as does their employer

36%

4%

say their employer offers a pension but neither of them contribute

11%

5%

believe they are not eligible to join their company pension

say their employer does not offer a pension

35%

Employers awareness of the new auto-enrolment pension regulations (by business size)

Small businesses Medium businesses Large businesses

Aware

83% Not aware

89%

90%

17%

11%

10%

Employers readiness for introducing auto-enrolment

7%

START

20%

1

7%

No plans

2%

1%

Need to start discussion

13% 27%

13% 22%

6%

16% 19% 21%

Well advanced

23%

Started planning

9%

25% 36%

21%

FINISH

27%

Fully prepared

48%

All businesses

Small businesses

Medium businesses

Large businesses

Employees intentions regarding auto-enrolment

I will stay in the scheme and contribute more than the basic amount 19% I will opt out of the scheme immediately as I cannot afford to make the contributions

17%

I will stay in the scheme and be very pleased that I have a pension

16% I will stay in the scheme as I wouldnt bother to opt out Leave the scheme when I get around to it

11% I will opt out of the scheme as I prefer to make my own arrangements 6% 4%

Dont know

28%

How often employers review their employee benefits packages

Small businesses Medium businesses

55% 49% 36% 26% 14% 10% 6% 16% 17% 19% 19%

Large businesses

11% 10%

7% 3% Every year Every 2 years Less often Never

Every 6 months

When employers communicate with workers about their pensions

All businesses

38% 29% 23% 21% 26% 18%

When we Along with The benefits The pension make changes the annual provider/ are explained to the scheme statement trustee when staff of the funds communicates join the value with them company

When legislative changes happen

We tend not to communicate with people about their pensions

How often employees want to hear about workplace savings

24% 7%

Once a year is enough in my 19% annual statement On a regular basis, similar to my payslip details As part of an on-going discussion with my employer about what is available and why I should save

Accessible at all times via a secure intranet site

15%

When something changes (e.g. I get promoted)

6%

Less than once a year (2-3 years)

5%

Dont know

14%

I dont want to know (Im not interested)

11%

How employers communicate with workers about their pensions

We have an intranet site with regularly updated information available We have a query point (e.g. a nominated person or intranet site) so people can raise questions As part of regular line manager conversations When people are promoted or have salary increases On a regular basis via email We use social media to encourage discussion All businesses Small businesses

20% 2% 12% 37%

15%

8%

16%

21%

17%

14%

17%

20%

10%

8%

11%

10%

18%

9%

14%

26%

1%

0%

2%

2%

Medium businesses

Large businesses

Most difficult and challenging aspects of automatic enrolment for very large employers

Very large employers Managing the cost On-going compliance management Communicating automatic enrolment to employees Updating the existing pension Total UK employers 43% 33% 32% 30% 42% 25% 23% 24%

How different communications approaches would encourage employees to save more

If someone showed me what I personally need to save for retirement

9%

If someone showed me how to save more

23%

If someone showed me what the benefits of saving are 14%

If someone showed me what I might lose if I didnt save

12%

12%

If someone showed me how to manage my money better

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2017 Preliminary Results AnnouncementDocument143 pages2017 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Aviva 2018 Interim Results AnnouncementDocument10 pagesAviva 2018 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva 2018 Key Metrics InfographicDocument1 pageAviva 2018 Key Metrics InfographicAviva GroupNo ratings yet

- Aviva PLC - at A Glance March 2018Document2 pagesAviva PLC - at A Glance March 2018Aviva GroupNo ratings yet

- Aviva 2017 Interim Results Analyst PresentationDocument64 pagesAviva 2017 Interim Results Analyst PresentationAviva GroupNo ratings yet

- Enabling Europe To Compete in The Global World of FinTechDocument2 pagesEnabling Europe To Compete in The Global World of FinTechAviva GroupNo ratings yet

- Aviva 2017 Interim Results AnnouncementDocument131 pagesAviva 2017 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva PLC Capital Markets DayDocument2 pagesAviva PLC Capital Markets DayAviva GroupNo ratings yet

- Aviva Half Year 2015 AnnouncementDocument163 pagesAviva Half Year 2015 AnnouncementAviva GroupNo ratings yet

- Aviva HY16 Results Summary - InfographicDocument1 pageAviva HY16 Results Summary - InfographicAviva GroupNo ratings yet

- Aviva PLC 2016 ResultsDocument71 pagesAviva PLC 2016 ResultsAviva GroupNo ratings yet

- Aviva PLC 2016 Results InfographicDocument2 pagesAviva PLC 2016 Results InfographicAviva GroupNo ratings yet

- Aviva PLC 2016 Interims Results AnnouncementDocument127 pagesAviva PLC 2016 Interims Results AnnouncementAviva GroupNo ratings yet

- Mark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptDocument4 pagesMark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptAviva GroupNo ratings yet

- What Are We in Business For? Being A Good AncestorDocument22 pagesWhat Are We in Business For? Being A Good AncestorAviva GroupNo ratings yet

- Aviva at A Glance InfographicDocument2 pagesAviva at A Glance InfographicAviva GroupNo ratings yet

- Aviva 2015 Results InfographicDocument1 pageAviva 2015 Results InfographicAviva GroupNo ratings yet

- Aviva 2015 Full Year Results TranscriptDocument3 pagesAviva 2015 Full Year Results TranscriptAviva GroupNo ratings yet

- 2015 Half Year Results Interview With Group CEO Mark WilsonDocument4 pages2015 Half Year Results Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva 2015 Preliminary AnnouncementDocument10 pagesAviva 2015 Preliminary AnnouncementAviva GroupNo ratings yet

- Aviva Half Year 2015 Analyst PresentationDocument30 pagesAviva Half Year 2015 Analyst PresentationAviva GroupNo ratings yet

- Aviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsDocument4 pagesAviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsAviva GroupNo ratings yet

- 2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonDocument7 pages2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallDocument5 pagesInflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallAviva GroupNo ratings yet

- Aviva 2014 Results PresentationDocument26 pagesAviva 2014 Results PresentationAviva GroupNo ratings yet

- Aviva PLC 2014 Preliminary Results AnnouncementDocument9 pagesAviva PLC 2014 Preliminary Results AnnouncementAviva GroupNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Module 7 - Ia2 Final CBLDocument22 pagesModule 7 - Ia2 Final CBLErika EsguerraNo ratings yet

- Pension Reform in India - A Social Security Need (D. Swarup, Chairman, PFRDA)Document16 pagesPension Reform in India - A Social Security Need (D. Swarup, Chairman, PFRDA)Andre NoortNo ratings yet

- Report - ResilDocument46 pagesReport - ResilNamrata NagarajNo ratings yet

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGNo ratings yet

- Example Exercise - Postemployment BenefitsDocument5 pagesExample Exercise - Postemployment BenefitsYhana SarmientoNo ratings yet

- Chapter 5 Employee Benefits Part 1Document7 pagesChapter 5 Employee Benefits Part 1christianNo ratings yet

- Employee Benefits Part 1 PDFDocument21 pagesEmployee Benefits Part 1 PDFHerald JoshuaNo ratings yet

- PCOA Module 4 - For LMSDocument5 pagesPCOA Module 4 - For LMSJan JanNo ratings yet

- Dysas Center For Cpa Review (Dccpar) : Financial AccountingDocument19 pagesDysas Center For Cpa Review (Dccpar) : Financial AccountingJessie jorgeNo ratings yet

- Investors RequirementDocument21 pagesInvestors Requirementumesh ramchandaniNo ratings yet

- DGT Conflicts of Interest FMADocument60 pagesDGT Conflicts of Interest FMAGhulam NabiNo ratings yet

- Chapter 8 - Accounting For Governmental and Nonprofit Entities - 16th - SMDocument19 pagesChapter 8 - Accounting For Governmental and Nonprofit Entities - 16th - SMmaylee0105No ratings yet

- Module 11 - Employee BenefitsDocument8 pagesModule 11 - Employee BenefitsLuiNo ratings yet

- Saratoga 05-06 Metric ListDocument38 pagesSaratoga 05-06 Metric Listluis_alberto_perez100% (2)

- Pas 26 Accounting and Reporting by Retirement Benefit PlansDocument2 pagesPas 26 Accounting and Reporting by Retirement Benefit PlansR.A.No ratings yet

- Employee Benefits Part 1.1Document5 pagesEmployee Benefits Part 1.1Shanelle SilmaroNo ratings yet

- Employer Benefit - Part !Document11 pagesEmployer Benefit - Part !Julian Adam PagalNo ratings yet

- NB05-01 PVW Final1Document33 pagesNB05-01 PVW Final1Jessica MirandaNo ratings yet

- Ias 26 Accounting and Reporting by Retirement Benefit PlansDocument2 pagesIas 26 Accounting and Reporting by Retirement Benefit PlansAbdulHameedAdamNo ratings yet

- Solution Manual For Essentials of Accounting For Governmental and Not For Profit Organizations 14th Edition Paul CopleyDocument14 pagesSolution Manual For Essentials of Accounting For Governmental and Not For Profit Organizations 14th Edition Paul CopleyCameronHerreracapt100% (39)

- Objectives: Chapter 5 - Employee Benefits - Ias 19Document82 pagesObjectives: Chapter 5 - Employee Benefits - Ias 19Tram NguyenNo ratings yet

- Four Decades of Senior Household Income Growth: New Evidence From The Survey of Consumer FinancesDocument16 pagesFour Decades of Senior Household Income Growth: New Evidence From The Survey of Consumer FinancesHoover InstitutionNo ratings yet

- Intermediate Acctg 2 - MillanDocument6 pagesIntermediate Acctg 2 - MillanJuliana Ipo100% (1)

- FINANCIAL - MANAGEMENT Solution BookDocument170 pagesFINANCIAL - MANAGEMENT Solution BookWajahat SadiqNo ratings yet

- Lecture Notes Employee Benefits: Page 1 of 16Document16 pagesLecture Notes Employee Benefits: Page 1 of 16fastslowerNo ratings yet

- Contributory, Funded (Managed by A Trustee) or Unfunded (Managed by The Employer), and Defined Contribution Plan or Defined Benefit PlanDocument5 pagesContributory, Funded (Managed by A Trustee) or Unfunded (Managed by The Employer), and Defined Contribution Plan or Defined Benefit PlanJustine VeralloNo ratings yet

- Corporate Reporting Homework (Day 4)Document8 pagesCorporate Reporting Homework (Day 4)Sara MirchevskaNo ratings yet

- Pension Finance AssingmentDocument3 pagesPension Finance AssingmentFridah ApondiNo ratings yet

- Employee Benefits Part 1Document12 pagesEmployee Benefits Part 1Khiks ObiasNo ratings yet

- Employee BenefitsDocument83 pagesEmployee BenefitsArlene Rose GonzaloNo ratings yet