Professional Documents

Culture Documents

Karrer V US

Uploaded by

sushicat0925Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Karrer V US

Uploaded by

sushicat0925Copyright:

Available Formats

Karrer v US (1957) Income tax of foreign persons ER:

Karrer was a chemist in Switzerland who discovered how to synthetically produce Vit B2 and E. He made this discoveries with the help of Basle, a chemical manufacturing firm who also provided him with lab equipment, raw materials, and helped him develop the process. They entered into a contract whereby Karrer would share in the profits of the sale of the vitamins Consequently, a similar chemical manufacturing firm in the US (Nutley), became the agent of Basle in the manufacturing and sale of the vitamins of Karrer. Nutley, the US firm, them made payments to Karrer as royalty for his discoveries Nutley withheld and paid United States income taxes on behalf of Karrer in the sum of $92,978.22 Karrer is now asking for a refund representing the total amount of United States taxes paid and withheld from him on account of the payments made by Nutley ISSUE: WON Karrers income was sourced from the US and is thus subjected to tax? NO. It was compensation for services rendered outside the US thus exempted from tax. In the instant case the vitamin B-2 and vitamin E patents, together with the right to use and sell their commercial values were income producing property and thus a "source" of income. o Nutley for such use or for the privilege of such use, would be clearly taxable to the recipient of such payments However, we are of the opinion that the payment made by Nutley to Karrer were not payments for the right of Nutley to use any income producing property or interest therein belonging to Karrer What Nutley paid Karrer were amounts due on an obligation owing to Karrer by Basle for services performed for Basle by Karrer in Switzerland. THUS, they do not represent payments for Karrer's rights or interest in property located in the United States, but rather payments for services performed outside the United States, and are therefore exempt from taxation. Nutley's denomination of the payments as royalties on its books cannot change the true character of these payments.

FACTS: Paul Karrer (KARRER) a chemistry professor at the University of Zurich, Switzerland, winner of Nobel Prize in 1937, Director of the Chemical Institute in the University of Zurich He has not been back to the US since 1933 He researched on the synthesis of Vit B2 and Vit E for commercial production Thus, he contacted F. Hoffmann-LaRoche & Co. Ltd. of Basle (BASLE) for assistance in his research (manufacturing of whey where he extracted the vitamins, use of laboratory equipment, development of the synthesizing process) For this, Basle suggested that Karrer grant Basle the sole right to exploit the manufacturing processes resulting from his investigations if his research proved to be of commercial value. Also, that if the process would lead to a patent, it would grant Karrer participation in the net proceeds. Karrer accepted. Under Swiss law the exchange of letters between plaintiff and Basle constituted a contract which may be designated as a special employment contract under the terms of which all patents resulting from Karrers discoveries belonged to Basle, the employer Eventually, Karrer successfully discovered how synthetically produce vitamin B-2 and vitamin E The parties entered into a formal contract specifying the percentage of net proceeds to be paid by Basle to the plaintiff as 5%. Additionally, Karrer was only allowed to participate in the profits for 12 years. 1941, Basle and Hoffmann-LaRoche, Inc., of Nutley, New Jersey, (NUTLEY) a New Jersey corporation doing business in the United States as a chemical manufacturing firm, entered into a contract whereby Nutley was granted the exclusive enjoyment and use within the United States of all of Basle's secret processes and scientific developments pertaining to certain products, including the vitamins which had been synthesized by Karrer. In return, Nutley agreed to pay Basle 4% of the net proceeds of sales made by Nutley. Karrer, who had no contractual relationship with Nutley, was not a party to the contract between Basle and Nutley

In the United States a patent application can be filed only by a natural person, the inventor, and Basle therefore required Karrer to file the applications on his vitamin B-2 and vitamin E discoveries Also at Basle's request, Karrer assigned the vitamin B-2 and vitamin E United States patent applications to Nutley before the patents were granted. Nutley, produced and marketed vitamin B-2 and vitamin E products and, although Nutley had no contract of any kind with Karrer, it paid him a percentage of all its sales of products containing vitamin B-2 and vitamin E o These payments made to plaintiff by Nutley were characterized on the books of Nutley as royalties. Nutley withheld and paid United States income taxes on behalf of Karrer in the sum of $92,978.22 for the years 1941 through 1945. Karrer timely filed United States income tax returns for the years 1941 through 1946 and paid a balance shown to be due thereon of $108,526.66. o filed claims for refund amounting to $201,504.88, representing the total amount of United States taxes paid and withheld from plaintiff on account of the payments made by Nutley to plaintiff with respect to the sale in the United States of vitamin B-2 and vitamin E products US denied refund US contends: payments from Nutley to Karrer were subject to Federal income tax because they were fixed, periodical income to plaintiff from sources within the United States falling within the provisions of section 211(a) (1) (A) of the Internal Revenue Code of 1939. Karrer: payments made to him by Nutley were for services performed outside of the United States and are therefore not from sources within the United States so as to provide a basis for the imposition of a United States income tax

ISSUE: WON Karrers income was sourced from the US and is thus subjected to tax? NO. It was compensation for services rendered outside the US thus exempted from tax. HELD: It is the opinion of the court that the payments received by Karrer from Nutley were income from sources without the United States and were not taxable under the internal revenue laws in effect during the period in suit. Karrer is entitled to judgment in the amount of $201,504.88, together with interest provided by law. RATIO:

According to the Sec 119 of Revenue Code of the US:

"Income from sources within the United States(a) Gross income from sources in the United States. The following items of gross income shall be treated as income from sources within the United States: ****** "(4) Rentals and royalties. Rentals or royalties from property located in the United States or from any interest in such property, including rentals or royalties for the use of or for the privilege of using in the United States, patents, copyrights, secret processes and formulas, good will, trade-marks, trade brands, franchises, and other like property; and ****** (c) Gross income from sources without the United States. The following items of gross income shall be treated as income from sources without the United States: ****** "(3) Compensation for labor or personal services performed without the United States." The fact that the payments here in question were made by a United States corporation is not determinative of the right to tax the nonresident alien who is the recipient of such payments. The only criterion for imposing the tax is that the "source" of the income to be taxed must be within the United States. The "source" of income in this connection is not necessarily the payor, but may be the property or the services from which the particular income is derived as indicated in section 119 of the Internal Revenue Code. In the instant case the vitamin B-2 and vitamin E patents, together with the right to use and sell their commercial values were income producing property and thus a "source" of income.

Nutley for such use or for the privilege of such use, would be clearly taxable to the recipient of such payments However, we are of the opinion that the payment made by Nutley to Karrer were not payments for the right of Nutley to use any income producing property or interest therein belonging to Karrer. o The right to use and exploit in the United States the patents granted on the discoveries of Karrer was granted to Nutley by Basle pursuant to the terms of the contract of January 27, 1941, and not by Karrer. o Basle was the owner of the commercial rights in Karrer's discoveries and it alone could convey this right to another o Karrers only interest in the sales of the vitamins produced and sold arose out of his contractual relationship with Basle It does not appear that there ever existed between Basle and Karrer any relationship other than that of special employment. o Payments made to such an employee, even though based on a percentage of the proceeds of the sales of the invented process or object, would be compensation for the employee's services rather than royalties, because the employee's right to such payments derives from his services to his employer and not from any rights in inventions owned by the employee. o Thus, it does not come under the above-quoted Sec 119 of the Code o Since Nutley paid Karrer amounts due on an obligation owing to Karrer by Basle for services performed for Basle by Karrer in Switzerland, they do not represent payments for Karrer's rights or interest in property located in the United States, but rather payments for services performed outside the United States, and are therefore exempt from taxation. Nutley's denomination of the payments as royalties on its books cannot change the true character of these payments.

You might also like

- CIR vs TSC VAT Refund DisputeDocument2 pagesCIR vs TSC VAT Refund DisputeTheodore0176No ratings yet

- CIR V PalancaDocument1 pageCIR V PalancaKatrinaNo ratings yet

- Cesarini Vs USDocument2 pagesCesarini Vs USKTNo ratings yet

- Conflicts Missing2Document102 pagesConflicts Missing2lex libertadoreNo ratings yet

- 12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFDocument8 pages12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFEmelie Marie DiezNo ratings yet

- People Vs MagdadaroDocument2 pagesPeople Vs MagdadaroBirthday NanamanNo ratings yet

- Rohm Apollo vs. CIRDocument6 pagesRohm Apollo vs. CIRnikkisalsNo ratings yet

- BIR Rul. 57-83Document2 pagesBIR Rul. 57-83Robynne LopezNo ratings yet

- CREBA vs. RomuloDocument29 pagesCREBA vs. RomuloCharish DanaoNo ratings yet

- Train Law 2018Document55 pagesTrain Law 2018Mira Mendoza100% (1)

- Balmaceda Vs CorominasDocument9 pagesBalmaceda Vs Corominaskoey100% (1)

- Right to Repurchase PropertyDocument4 pagesRight to Repurchase PropertyXsche XscheNo ratings yet

- Landmark VAT Cases on Zero-Rated Sales and Franchise OperationsDocument12 pagesLandmark VAT Cases on Zero-Rated Sales and Franchise OperationsJudeRamosNo ratings yet

- CTA Requires Donors to Prove Donee Compliance for Deduction of DonationsDocument1 pageCTA Requires Donors to Prove Donee Compliance for Deduction of DonationsArdy Falejo FajutagNo ratings yet

- Case DigestsDocument20 pagesCase DigestsDenise Michaela YapNo ratings yet

- CIR Vs ReyesDocument16 pagesCIR Vs Reyes123456789No ratings yet

- Human Rights Assignement 3Document9 pagesHuman Rights Assignement 3ADNo ratings yet

- Republic v. GonzalesDocument1 pageRepublic v. GonzalesfranzadonNo ratings yet

- Dan - Case Digests - 2021-05-07Document15 pagesDan - Case Digests - 2021-05-07Dan MilladoNo ratings yet

- #169 City Lumber vs. Domingo DigestDocument2 pages#169 City Lumber vs. Domingo DigestNisa Sango OpallaNo ratings yet

- 13) DEUTCHE KNOWLEDGE Vs CIR - J Perlas - BernabeDocument3 pages13) DEUTCHE KNOWLEDGE Vs CIR - J Perlas - BernabejdonNo ratings yet

- CIR v. Fisher ADocument30 pagesCIR v. Fisher ACE SherNo ratings yet

- American Home Assurance v. Tantuco Scire LicetDocument2 pagesAmerican Home Assurance v. Tantuco Scire LicetJetJuárezNo ratings yet

- Tiu Corpo C Case SummaryDocument1 pageTiu Corpo C Case SummaryCleinJonTiuNo ratings yet

- 14 Aznar vs. Cta (58 Scra 519)Document29 pages14 Aznar vs. Cta (58 Scra 519)Alfred GarciaNo ratings yet

- 3 CIR V SEAGATEDocument15 pages3 CIR V SEAGATEjahzelcarpioNo ratings yet

- Taxation Law 1 Selected JurisprudenceDocument7 pagesTaxation Law 1 Selected JurisprudenceStradivariumNo ratings yet

- Cir vs. Aichi Forging G.R. No. 184823Document14 pagesCir vs. Aichi Forging G.R. No. 184823Eiv AfirudesNo ratings yet

- Coral Bay Vs CIR Cross Border DoctrineDocument7 pagesCoral Bay Vs CIR Cross Border DoctrineAira Mae P. LayloNo ratings yet

- Tax Deductions Upheld for Professional Services Despite Accrual of Expenses in Prior YearsDocument2 pagesTax Deductions Upheld for Professional Services Despite Accrual of Expenses in Prior YearsDee ObriqueNo ratings yet

- Commissioner of Internal Revenue vs. Sekisui JushiDocument6 pagesCommissioner of Internal Revenue vs. Sekisui Jushivince005No ratings yet

- 15 Republic Vs AblazaDocument5 pages15 Republic Vs AblazaYaz CarlomanNo ratings yet

- Bpi vs. Cir, GR No. 139736Document11 pagesBpi vs. Cir, GR No. 139736Ronz RoganNo ratings yet

- Hawaiian Philippine Company v. GulmaticoDocument2 pagesHawaiian Philippine Company v. GulmaticoCielo ZamudioNo ratings yet

- Eisner V MacomberDocument40 pagesEisner V MacomberDario G. TorresNo ratings yet

- Corporation Law Case OutlineDocument13 pagesCorporation Law Case OutlineSammy HammyNo ratings yet

- Philippine Amusement and Gaming Corporation vs. Bureau of Internal Revenue, 782 SCRA 402, January 27, 2016Document16 pagesPhilippine Amusement and Gaming Corporation vs. Bureau of Internal Revenue, 782 SCRA 402, January 27, 2016j0d3No ratings yet

- Eisner v. Macomber (252 U.S. 189 (1920) ), Which Held That Dividends in The Form ofDocument3 pagesEisner v. Macomber (252 U.S. 189 (1920) ), Which Held That Dividends in The Form ofKim GuevarraNo ratings yet

- Joel C. Mendez vs. People of The PhilippinesDocument19 pagesJoel C. Mendez vs. People of The PhilippinesKirby HipolitoNo ratings yet

- Law On PartnershipDocument31 pagesLaw On PartnershipRouise Gagalac100% (1)

- Silkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Document3 pagesSilkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Vince LeidoNo ratings yet

- OPT, Excise, DST, Tax RemediesDocument11 pagesOPT, Excise, DST, Tax RemediesLou Brad Nazareno IgnacioNo ratings yet

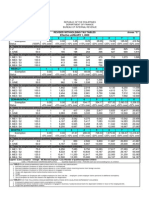

- Revised Withholding Tax TablesDocument1 pageRevised Withholding Tax TablesJonasAblangNo ratings yet

- Republic V GonzalesDocument1 pageRepublic V GonzalesKen SagumNo ratings yet

- Jurisdiction and Labor Laws Cited in Pentagon Steel Corp vs CADocument2 pagesJurisdiction and Labor Laws Cited in Pentagon Steel Corp vs CAjovani emaNo ratings yet

- Supreme Court Rules on Taxation of Airlines Under FranchiseDocument18 pagesSupreme Court Rules on Taxation of Airlines Under Franchisemceline19No ratings yet

- VAT Refund CaseDocument1 pageVAT Refund Casekaira marie carlosNo ratings yet

- Borthwick v. Castro Nouvion v. FreemanDocument2 pagesBorthwick v. Castro Nouvion v. FreemanMeg SembranoNo ratings yet

- VALUE ADDED TAX and EXCISE TAXDocument18 pagesVALUE ADDED TAX and EXCISE TAXTrisha Nicole Flores0% (1)

- Republic of The Philippines Manila First Division: Supreme CourtDocument4 pagesRepublic of The Philippines Manila First Division: Supreme CourtJil Mei IV100% (1)

- CIR v. RTN 1992Document2 pagesCIR v. RTN 1992Aiken Alagban LadinesNo ratings yet

- GR 122480 BpiDocument1 pageGR 122480 BpiNaomi InotNo ratings yet

- CIR v. CA (Jan. 20, 1999)Document14 pagesCIR v. CA (Jan. 20, 1999)Crizza RondinaNo ratings yet

- Republic v. Rovency Realty and Development Corp PDFDocument11 pagesRepublic v. Rovency Realty and Development Corp PDFAnnieNo ratings yet

- Interest Republicae Ut Sit Finis LitiumDocument25 pagesInterest Republicae Ut Sit Finis LitiumAnthea Louise RosinoNo ratings yet

- CIR v. Puregold Duty Free Tax CaseDocument4 pagesCIR v. Puregold Duty Free Tax CaseCelina Marie Panaligan0% (1)

- CIR v. Isabela Cultural CorporationDocument1 pageCIR v. Isabela Cultural Corporationthirdy demaisipNo ratings yet

- Republic v. Marcos Sandiganbayan Civil Case No 0141 (No Footnotes)Document28 pagesRepublic v. Marcos Sandiganbayan Civil Case No 0141 (No Footnotes)Fortunato MadambaNo ratings yet

- Case Digest 1-4Document10 pagesCase Digest 1-4Patricia Ann Sarabia ArevaloNo ratings yet

- Karrer v. USDocument4 pagesKarrer v. USAdi CruzNo ratings yet

- Notice: SEC Form 17-LC SEC Form 17-LCDocument1 pageNotice: SEC Form 17-LC SEC Form 17-LCsushicat0925No ratings yet

- SEC Notice - Re - ASM 2020Document1 pageSEC Notice - Re - ASM 2020sushicat0925No ratings yet

- 2020 MCNo 06Document9 pages2020 MCNo 06Karren de ChavezNo ratings yet

- PHL Grid Code 2016edition (ResolutionNo22Seriesof2016) PDFDocument180 pagesPHL Grid Code 2016edition (ResolutionNo22Seriesof2016) PDFJerry MateoNo ratings yet

- GISDocument25 pagesGISnatalieNo ratings yet

- Notice To All Non-Stock Corporations: Deadline For Submission of The Mandatory Disclosure Form (MDF)Document1 pageNotice To All Non-Stock Corporations: Deadline For Submission of The Mandatory Disclosure Form (MDF)sushicat0925No ratings yet

- AO No 07 s'2011 Revised Rules Procedures Governing The Acquisition and DistributionDocument43 pagesAO No 07 s'2011 Revised Rules Procedures Governing The Acquisition and DistributionGlenn TaduranNo ratings yet

- Makati Commercial Estate Association Dues CaseDocument8 pagesMakati Commercial Estate Association Dues Casesushicat0925No ratings yet

- Rules and regulations for electric power industry reformDocument100 pagesRules and regulations for electric power industry reformBong PerezNo ratings yet

- G.R. No 170406Document10 pagesG.R. No 170406sushicat0925No ratings yet

- Uniwide Vs CruzDocument2 pagesUniwide Vs Cruzsushicat0925No ratings yet

- Karrer V USDocument3 pagesKarrer V USsushicat0925No ratings yet

- Super Mega DigestsDocument88 pagesSuper Mega Digestssushicat0925No ratings yet

- Ballb SyllabusDocument74 pagesBallb SyllabusRaza KhanNo ratings yet

- User Guide Tp600 and Tp400 Standard MenusDocument25 pagesUser Guide Tp600 and Tp400 Standard MenusjkasmireNo ratings yet

- The Importance of Management TechnologyDocument17 pagesThe Importance of Management Technologysoundarya gayathri100% (1)

- 6th Symbiosis B Krishna Moot BrochureDocument35 pages6th Symbiosis B Krishna Moot Brochureanne leeNo ratings yet

- Guidelines For Keeping Laboratory NotebooksDocument13 pagesGuidelines For Keeping Laboratory NotebooksBhavya NarangNo ratings yet

- Introduction To Patent LawDocument8 pagesIntroduction To Patent Lawsharma kushaNo ratings yet

- Smith Kline Beckman Corporation Vs Court of AppealsDocument2 pagesSmith Kline Beckman Corporation Vs Court of AppealsNovi Mari Noble100% (1)

- Aquence LG 75S-EnDocument1 pageAquence LG 75S-Enalguna54No ratings yet

- Agricultural-Biological-Technology Patent DebateDocument5 pagesAgricultural-Biological-Technology Patent DebateEzekiel PatrickNo ratings yet

- Alvin M. Marks v. Polaroid Corporation, 237 F.2d 428, 1st Cir. (1956)Document13 pagesAlvin M. Marks v. Polaroid Corporation, 237 F.2d 428, 1st Cir. (1956)Scribd Government DocsNo ratings yet

- WenzhouFuruisi v. Xing - ComplaintDocument10 pagesWenzhouFuruisi v. Xing - ComplaintSarah BursteinNo ratings yet

- Tda 9379Document5 pagesTda 9379dinspekNo ratings yet

- G.R. No. 75067 - Puma Vs IacDocument3 pagesG.R. No. 75067 - Puma Vs IacArmand Patiño AlforqueNo ratings yet

- SUBJECT: Intellectual Property Rights: Sanjeev Kumar Dr. S.C. RoyDocument23 pagesSUBJECT: Intellectual Property Rights: Sanjeev Kumar Dr. S.C. RoyAnonymous IDhChBNo ratings yet

- Module 4 - INTACC2 Intangible AssetsDocument20 pagesModule 4 - INTACC2 Intangible AssetsKhan TanNo ratings yet

- Legal Prof Bwesit DigestDocument10 pagesLegal Prof Bwesit DigestKarl Rainier BarcenasNo ratings yet

- Don't Get High... Get Well: Medical Cannabis Blog Provides Natural ReliefDocument268 pagesDon't Get High... Get Well: Medical Cannabis Blog Provides Natural ReliefSteve PetersonNo ratings yet

- Spaces pQx3Sex1V1mpQ54zINRe PDF ExportDocument405 pagesSpaces pQx3Sex1V1mpQ54zINRe PDF ExportStefan SalvatoreNo ratings yet

- Start-Up HandbookDocument36 pagesStart-Up HandbookUIUCOTM100% (6)

- V. Knapp Logistics & AutomationDocument8 pagesV. Knapp Logistics & AutomationPriorSmartNo ratings yet

- Vouching and VerificationDocument31 pagesVouching and VerificationsamyogforuNo ratings yet

- Aatcc 173-2015 PDFDocument4 pagesAatcc 173-2015 PDFHernando Andrés Ramírez GilNo ratings yet

- Compulsory Licensing Provisions and Royalty RatesDocument5 pagesCompulsory Licensing Provisions and Royalty RatesRona TumaganNo ratings yet

- GENENTECH INC 10-K (Annual Reports) 2009-02-20Document224 pagesGENENTECH INC 10-K (Annual Reports) 2009-02-20http://secwatch.comNo ratings yet

- Case Number Patent 984753Document65 pagesCase Number Patent 984753Johan CornelissenNo ratings yet

- IPL CasesDocument17 pagesIPL CasesSheera Laine V. ManzanoNo ratings yet

- Oneida v. Bon ChefDocument5 pagesOneida v. Bon ChefPriorSmartNo ratings yet

- FGL-Due Diligence Checklist PDFDocument17 pagesFGL-Due Diligence Checklist PDFPrinces SnehaNo ratings yet

- Consolidated TrademarkDocument185 pagesConsolidated TrademarkJeffrey L. OntangcoNo ratings yet

- Cooper Lighting v. Cree Et. Al.Document7 pagesCooper Lighting v. Cree Et. Al.PriorSmartNo ratings yet