Professional Documents

Culture Documents

Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index Components

Uploaded by

Q.M.S Advisors LLCCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index Components

Uploaded by

Q.M.S Advisors LLCCopyright:

Available Formats

This material does not constitute investment advice and should not be

viewed as a current or past recommendation or a solicitation of an

offer to buy or sell any securities or to adopt any investment strategy.

Fundamental Analysis &

Analyst Recommendations

STOXX Europe Small 200 Index

March 2012

Q M S Advisors

.

Q.M.S Advisors | Avenue de la Gare, 1 1003 Lausanne | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

28.02.2013

Aalberts Industries NV

Aalberts Industries N.V. provides industrial services and flow control systems.

The Company manufactures extrusion tooling, precision parts, bimetallic barrels,

and other industrial products. Aalberts also develops and produces valves,

dispensing systems for beer and soft drinks, and other distribution systems for

water, gas, and energy.

Price/Volume

.6 M

.5 M

12

.4 M

10

8

Latest Fiscal Year:

LTM as of:

52-Week High (04.02.2013)

52-Week Low (27.06.2012)

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 31.12.2012

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AALB NA EQUITY YTD Change

AALB NA EQUITY YTD % CHANGE

12/2012

01/yy

16.89

11.40

322'539.00

16.72

-1.01%

46.67%

96.90%

109.4

1'829.60

541.60

0.0

11.1

0.10

2'382.20

.3 M

.2 M

.1 M

2

0

f-12

.0 M

m-12

a-12

m-12

j-12

j-12

a-12

s-12

o-12

n-12

d-12

j-13

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

.7 M

16

14

Valuation Analysis

31.12.2008

1'750.8

0.74x

251.6

5.16x

92.8

4.96x

18

31.12.2009

31.12.2010

1'404.9

1'682.8

1.22x

1.36x

168.8

248.2

10.14x

9.23x

41.5

104.4

19.78x

14.34x

Profitability

31.12.2011

1'937.4

1.04x

279.4

7.22x

131.3

10.64x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

31.12.2012

2'024.5

1.12x

296.1

7.67x

135.1

12.66x

296.10

202.10

9.98%

8.98%

6.95%

14.86%

1.04%

14.6%

10.0%

6.7%

1.10

0.34

27.70%

55.90%

10.02

-

Price/ Cash Flow

LTM-4Q

LTM

01/yy

01/yy

-

FY+1

-

1.20

84.06

12.65%

6.50%

1.197

12

4.417

246'672

184'675

171'517

FY+2

12/13 Y

12/14 Y

2'087.7

2'167.7

1.09x

0.99x

312.9

330.0

7.61x

7.22x

154.3

166.5

11.38x

10.58x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

FQ+1

FQ+2

10.21

6.63

1.83

1.83

55.9%

35.6%

1.04

3.50

36.51

-

Sales/Revenue/Turnover

12.00

2'500.0

10.00

2'000.0

8.00

1'500.0

6.00

1'000.0

4.00

500.0

2.00

0.00

01.01.2010

0.0

01.07.2010

01.01.2011

01.07.2011

01.01.2012

01.07.2012

01.01.2013

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

28.02.2013

Aalberts Industries NV

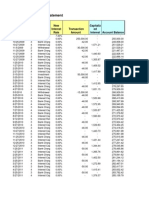

Holdings By:

All

Holder Name

AALBERTS BEHEER BV

FMR LLC

OPPENHEIMERFUNDS INC

FORTIS UTRECHT NV

NIB CAPITAL NV

COLUMBIA WANGER ASSE

CANTILLON CAPITAL MA

AALBERTS J

AALBERTS-VEEN J A M

MAWER INVESTMENT MAN

PICTET & CIE

FRANKLIN RESOURCES

LANDESBANK BERLIN IN

VANGUARD GROUP INC

BANQUE DE LUXEMBOURG

SEB

BLACKROCK

AMERIPRISE FINANCIAL

ALLIANZ ASSET MANAGE

MANULIFE ASSET MANAG

Firm Name

KBC Securities

Rabobank International

Kepler Capital Markets

Kempen & Co

SNS Securities(ESN)

Berenberg Bank

ING Bank

ABN Amro Bank N.V.

Theodoor Gilissen Securities

EVA Dimensions

CA Cheuvreux

Petercam

Portfolio Name

n/a

n/a

Multiple Portfolios

n/a

n/a

n/a

n/a

n/a

n/a

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

n/a

Multiple Portfolios

n/a

Multiple Portfolios

Analyst

MICHAEL ROEG

DAVID TAILLEUR

PETER OLOFSEN

DIRK VERBIESEN

GERT STEENS

FELIX WIENEN

TIJS HOLLESTELLE

MAARTEN BAKKER

TOM MULLER

CRAIG STERLING

ROBERT VAN OVERBEEK

LUUK VAN BEEK

Source

Research

ULT-AGG

MF-AGG

EXCH

EXCH

Research

Research

Research

Research

MF-AGG

MF-AGG

ULT-AGG

MF-AGG

MF-AGG

MF-AGG

ULT-AGG

ULT-AGG

MF-AGG

ULT-AGG

MF-AGG

Recommendation

buy

buy

hold

hold

hold

buy

buy

buy

buy

overweight

outperform

add

Amt Held

14'542'716

11'315'498

7'259'676

6'022'588

5'836'642

5'511'788

5'340'054

2'402'582

2'402'582

1'333'741

1'297'544

1'067'214

1'048'738

996'333

626'561

609'896

596'362

506'042

449'200

436'065

% Out

13.29

10.34

6.63

5.5

5.33

5.04

4.88

2.2

2.2

1.22

1.19

0.98

0.96

0.91

0.57

0.56

0.54

0.46

0.41

0.4

Weighting

Change

5

5

3

3

3

5

5

5

5

5

5

4

M

M

D

M

M

M

M

M

M

M

M

M

Latest Chg

(164'650)

16'023

203'806

1'200

25'900

Target Price

20

19

17

17

17

18

19

19

20

#N/A N/A

17

17

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

Inst Type

20.05.2011

Unclassified

30.09.2012

Investment Advisor

30.12.2012

Investment Advisor

09.04.2009

Other

09.04.2009

Venture Capital

20.05.2011

Investment Advisor

07.10.2010 Hedge Fund Manager

03.02.2011

n/a

03.02.2011

Other

30.11.2012

Investment Advisor

31.08.2012 Mutual Fund Manager

31.12.2012

Investment Advisor

31.01.2013 Mutual Fund Manager

31.12.2012

Investment Advisor

31.12.2012

Investment Advisor

31.12.2012

Unclassified

26.02.2013

Investment Advisor

31.12.2012

Investment Advisor

31.01.2013

Investment Advisor

31.12.2012

Investment Advisor

Date

Not Provided

12 month

Not Provided

12 month

12 month

Not Provided

12 month

Not Provided

Not Provided

Not Provided

Not Provided

Not Provided

Date

27.02.2013

27.02.2013

27.02.2013

26.02.2013

26.02.2013

26.02.2013

26.02.2013

26.02.2013

22.01.2013

15.01.2013

26.10.2012

24.10.2012

28.02.2013

Acciona SA

Acciona S.A. is a global developer and service provider of solutions in

renewable energy, large civil infrastructures and water treatment and reverse

osmosis desalination. The Company has sustainable development at the heart of

its strategy.

Price/Volume

70

2.5 M

60

2.0 M

50

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (09.01.2013)

52-Week Low (25.07.2012)

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.09.2012

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

ANA SQ EQUITY YTD Change

ANA SQ EQUITY YTD % CHANGE

12/2011

09/yy

65.00

29.46

184'826.00

46.52

-28.43%

57.91%

48.00%

57.3

2'663.71

8'897.97

0.0

301.0

1'963.00

10'649.71

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

1.5 M

30

1.0 M

20

.5 M

10

0

f-12

.0 M

m-12

a-12

m-12

j-12

j-12

a-12

s-12

o-12

n-12

d-12

j-13

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.12.2007

7'952.6

4.24x

1'406.8

23.97x

950.4

14.92x

40

31.12.2008

31.12.2009

7'207.8

6'512.3

3.52x

2.03x

1'069.3

1'043.0

23.70x

12.68x

464.5

1'263.2

23.18x

39.19x

Profitability

LTM-4Q

31.12.2010

6'263.0

1.61x

1'211.2

8.35x

167.2

19.41x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

31.12.2011

6'646.0

1.67x

1'312.0

8.46x

202.0

19.64x

1'312.00

595.00

8.95%

3.37%

0.17%

0.63%

0.34%

20.1%

9.3%

3.0%

1.07

0.69

43.77%

166.50%

3.30

-

Price/ Cash Flow

09/yy

6'489.0

6.87x

1'331.2

8.21x

380.2

9.87x

LTM

09/yy

7'015.0

6.08x

1'418.0

7.42x

2.0

0.00x

FY+1

1.04

23.34

-16.15%

-16.03%

1.042

23

2.652

287'745

379'770

254'713

FY+2

FQ+1

FQ+2

12/12 Y

12/13 Y

12/12 Q4 03/13 Q1

6'820.6

6'861.3

1'816.2

1'744.0

1.54x

1.52x

1'399.7

1'348.2

375.8

567.0

7.61x

7.90x

5.89x

7.73x

160.6

101.4

42.5

247.0

16.96x

26.95x

5.21x

26.89x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

2.62

0.66

5.36

6.70

166.5%

61.2%

0.34

0.68

110.83

-

Sales/Revenue/Turnover

30.00

9'000.0

8'000.0

25.00

7'000.0

6'000.0

20.00

5'000.0

15.00

4'000.0

3'000.0

10.00

2'000.0

5.00

0.00

02.01.2009

1'000.0

0.0

02.07.2009

02.01.2010

02.07.2010

02.01.2011

02.07.2011

02.01.2012

02.07.2012

02.01.2013

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

28.02.2013

Acciona SA

Holdings By:

All

Holder Name

TUSSEN DE GRACHTEN B

ENTREAZCA BV

JELICO NETHERLANDS B

VANGUARD GROUP INC

BLACKROCK

EGERTON CAPITAL LIMI

ACCRUED EQUITIES INC

DIMENSIONAL FUND ADV

DOMECQ DANIEL ENTREC

DNB NOR ASSET MANAGE

SANTANDER ASSET MGMT

ABANTE ASESORES GEST

ENTRECANALES D JOSE

STATE STREET BANQUE

BBVA PATRIMONIOS GES

CASTELLANOS BORREGO

CREDIT SUISSE ASSET

ACCIONA SA

NATIONWIDE FUND ADVI

ESPIRITO SANTO GESTI

Firm Name

Portfolio Name

n/a

n/a

n/a

Multiple Portfolios

n/a

n/a

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Analyst

BPI

FLORA TRINDADE

Banesto Bolsa SA Sociedad

ANTONIO CRUZ

Banco Sabadell

MARIA CEBOLLERO

Grupo Santander

JOAQUIN FERRER

NMAS 1 Agencia de Valores

JOSE RAMON OCINA

Day by Day

VALERIE GASTALDY

Espirito Santo Investment Bank Research

FERNANDO GARCIA GARCIA

Exane BNP Paribas

MANUEL PALOMO

Goldman Sachs

MANUEL LOSA

Bankia Bolsa (ESN)

RAFAEL FERNANDEZ DE HEREDIA

Macquarie

SHAI HILL

CA Cheuvreux

JOSE PORTA SAUDAN

Ahorro Corporacion Financiera SA

JUAN MORENO

La Caixa

FERNANDO MURILLO GUIRAO

EVA Dimensions

AUSTIN BURKETT

HSBC

SEAN D MCLOUGHLIN

Deutsche Bank

VIRGINIA SANZ DE MADRID

Interdin Bolsa

PABLO ORTIZ DE JUAN

Intermoney Valores

ALVARO NAVARRO

Kepler Capital Markets

EMILIO ROTONDO-INCLAN

BBVA

ISIDORO DEL ALAMO

Nomura

MARTIN YOUNG

AlphaValue

VINCENT DOARE

Renta 4 SA SVB

NURIA ALVAREZ

Source

EXCH

EXCH

EXCH

MF-AGG

ULT-AGG

Short

MF-AGG

MF-AGG

EXCH

MF-AGG

MF-AGG

MF-AGG

EXCH

MF-AGG

MF-AGG

EXCH

MF-AGG

Research

MF-AGG

MF-AGG

Recommendation

neutral

buy

sell

underweight

neutral

hold

sell

underperform

sell/attractive

hold

outperform

underperform

sell

underweight

overweight

neutral

hold

buy

buy

hold

market perform

suspended coverage

reduce

overweight

Amt Held

% Out

15'920'109

27.8

15'706'109 27.43

2'005'686

3.5

479'860

0.84

474'972

0.83

(297'750) -0.52

110'000

0.19

101'022

0.18

88'450

0.15

86'717

0.15

84'113

0.15

79'720

0.14

63'983

0.11

45'611

0.08

41'614

0.07

41'000

0.07

39'879

0.07

35'833

0.06

31'120

0.05

28'991

0.05

Weighting

3

5

1

1

3

3

1

1

1

3

5

1

1

1

5

3

3

5

5

3

3

#N/A N/A

2

5

Change

M

M

M

M

M

D

M

M

M

M

M

D

D

D

M

D

M

M

M

D

M

M

U

M

Latest Chg

32'626

75

(25'000)

(4'272)

(12'077)

8'297

(500)

7'000

7'591

(600)

Target Price

70

123

60

60

55

#N/A N/A

39

41

33

66

62

51

51

65

#N/A N/A

66

53

#N/A N/A

#N/A N/A

49

47

#N/A N/A

67

#N/A N/A

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

Inst Type

27.06.2012

Holding Company

27.06.2012

Holding Company

27.06.2012

Other

31.12.2012

Investment Advisor

26.02.2013

Investment Advisor

20.02.2013 Hedge Fund Manager

31.12.2012

Investment Advisor

31.07.2012

Investment Advisor

27.06.2012

n/a

31.01.2013

Investment Advisor

30.09.2012 Mutual Fund Manager

31.12.2012

Investment Advisor

27.06.2012

n/a

31.01.2013

Investment Advisor

29.02.2012

Investment Advisor

16.03.2012

n/a

28.12.2012 Mutual Fund Manager

27.06.2012

Corporation

30.11.2012

Investment Advisor

31.12.2012

Investment Advisor

Date

Not Provided

12 month

12 month

Not Provided

6 month

Not Provided

Not Provided

Not Provided

12 month

12 month

12 month

Not Provided

Not Provided

Not Provided

Not Provided

Not Provided

12 month

Not Provided

Not Provided

Not Provided

Not Provided

Not Provided

6 month

Not Provided

Date

25.02.2013

22.02.2013

21.02.2013

18.02.2013

18.02.2013

15.02.2013

13.02.2013

13.02.2013

08.02.2013

08.02.2013

05.02.2013

04.02.2013

04.02.2013

28.01.2013

17.01.2013

10.01.2013

15.11.2012

14.11.2012

14.11.2012

22.10.2012

04.10.2012

11.02.2012

05.05.2010

02.03.2010

28.02.2013

Acerinox SA

Acerinox, S.A. manufactures and distributes hot and cold-rolled stainless steel

products including slabs, billets, and bars. The Company operates plants in

Spain, the United States and South Africa, and piers used to ship raw

materials. The Company markets its products primarily in Europe, Asia, and the

Americas.

Price/Volume

12

6.0 M

12/2011

09/yy

10.82

7.39

834'311.00

8.244

-23.78%

11.62%

25.02%

249.3

2'055.27

1'051.23

0.0

160.2

181.88

3'135.18

4.0 M

3.0 M

2.0 M

2

0

f-12

1.0 M

.0 M

m-12

a-12

m-12

j-12

j-12

a-12

s-12

o-12

n-12

d-12

j-13

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.12.2008

31.12.2009

5'050.6

2'993.4

0.76x

1.61x

169.8

(194.1)

22.59x

(10.5)

(229.2)

Profitability

LTM-4Q

31.12.2010

4'500.5

1.00x

379.9

11.82x

122.7

26.79x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

31.12.2011

4'672.2

0.75x

339.2

10.32x

73.7

33.03x

339.22

192.44

4.12%

2.84%

-0.49%

-1.10%

1.10%

4.3%

1.1%

1.6%

1.51

0.58

25.82%

61.08%

8.90

-

Price/ Cash Flow

09/yy

4'773.6

3.52x

410.1

7.70x

128.0

16.58x

LTM

09/yy

4'568.6

3.01x

197.7

16.47x

(20.4)

0.00x

FY+1

0.84

120.90

-19.97%

-1.25%

0.844

24

3.250

1'124'419

1'031'388

994'987

FY+2

FQ+1

FQ+2

12/12 Y

12/13 Y

12/12 Q4 03/13 Q1

4'569.9

4'997.2

1'053.0

1'235.0

0.67x

0.65x

2.66x

186.1

334.0

14.3

16.85x

9.39x

(19.0)

87.3

(29.2)

24.68x

80.04x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

5.33

2.54

5.46

6.83

61.1%

35.8%

1.10

41.11

-

Sales/Revenue/Turnover

20.00

8'000.0

18.00

7'000.0

16.00

6'000.0

14.00

5'000.0

12.00

10.00

4'000.0

8.00

3'000.0

6.00

2'000.0

4.00

1'000.0

2.00

0.00

02.01.2009

5.0 M

Latest Fiscal Year:

LTM as of:

52-Week High (02.03.2012)

52-Week Low (23.07.2012)

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.09.2012

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

ACX SQ EQUITY YTD Change

ACX SQ EQUITY YTD % CHANGE

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

7.0 M

Valuation Analysis

31.12.2007

6'900.9

0.78x

654.8

8.17x

312.3

14.03x

8.0 M

10

0.0

02.07.2009

02.01.2010

02.07.2010

02.01.2011

02.07.2011

02.01.2012

02.07.2012

02.01.2013

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

28.02.2013

Acerinox SA

Holdings By:

All

Holder Name

ALBA PARTICIPACIONES

NISSHIN STEEL CO LTD

FEYNMAN CAPITAL SL

CASA GRANDE CARTAGEN

METAL ONE CORP

MARATHON ASSET MANAG

INDUSTRIAL DEVELOPME

LUXOR CAPITAL GROUP

PENNANT CAPITAL MANA

BBVA PATRIMONIOS GES

VANGUARD GROUP INC

AGF INVESTMENTS INC

SANTANDER ASSET MGMT

BLACKROCK

MARCH GESTION DE FON

RENTA 4 GESTORA SGII

BPI FUNDOS GFIM SA/P

IBERCAJA GESTION, S.

BARCLAYS WEALTH MANA

ABANTE ASESORES GEST

Firm Name

Portfolio Name

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Analyst

Societe Generale

ALAIN WILLIAM

JPMorgan

ALESSANDRO ABATE

Exane BNP Paribas

SYLVAIN BRUNET

Espirito Santo Investment Bank Research

RUI DIAS

BPI

MANUEL DIAS COELHO

Kepler Capital Markets

ROCHUS BRAUNEISER

Intermoney Valores

ANTONIO PAUSA RODRIGUEZ

Banesto Bolsa SA Sociedad

ROBERT JACKSON

Goldman Sachs

STEPHEN BENSON

Ahorro Corporacion Financiera SA

CESAR SANCHEZ-GRANDE

NMAS 1 Agencia de Valores

FRANCISCO RIQUEL

Day by Day

VALERIE GASTALDY

Interdin Bolsa

JAIME OJEDA DE DIEGO

Bankia Bolsa (ESN)

INIGO RECIO PASCUAL

Grupo Santander

PATRICIA LOPEZ DEL RIO

Banco Sabadell

FRANCISCO JOSE RODRIGUEZ

Credit Suisse

MICHAEL SHILLAKER

CA Cheuvreux

INIGO EGUSQUIZA CASTELLANOS

Deutsche Bank

BASTIAN SYNAGOWITZ

EVA Dimensions

CRAIG STERLING

La Caixa

ICIAR GOMEZ BOTAS

BBVA

LUIS DE TOLEDO

Link Securities

JUAN JOSE FERNANDEZ FIGARES

Mirabaud Finanzas Sociedad de ValoresGONZALO

S

SANZ

Nomura

NEIL SAMPAT

Renta 4 SA SVB

IVAN SAN FELIX

Source

Co File

Co File

Co File

Co File

Co File

Co File

Co File

Short

Short

MF-AGG

MF-AGG

MF-AGG

MF-AGG

ULT-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

Recommendation

hold

underweight

neutral

buy

strong buy

hold

buy

Under Review

neutral/neutral

hold

buy

hold

buy

buy

buy

buy

neutral

select list

sell

sell

underweight

underperform

buy

underweight

neutral

overweight

Amt Held

% Out

60'437'949 24.24

38'144'820

15.3

29'533'292 11.85

12'465'247

5

9'361'560

3.76

7'785'588

3.12

7'733'332

3.1

(5'285'255) -2.12

(4'736'786)

-1.9

1'926'059

0.77

1'277'694

0.51

1'073'600

0.43

690'488

0.28

546'599

0.22

475'399

0.19

388'499

0.16

341'777

0.14

335'250

0.13

324'015

0.13

297'350

0.12

Weighting

3

1

3

5

5

3

5

#N/A N/A

3

3

5

3

5

5

5

5

3

5

1

1

1

1

5

1

3

5

Change

M

M

M

M

M

M

M

M

M

M

M

D

U

M

M

M

M

U

M

M

M

D

M

D

D

M

Latest Chg

(299'165)

(249'305)

1'066'022

(420'796)

(285'300)

48'257

3'072

32'454

(82'485)

71'400

103'000

60'000

62'300

Target Price

8

9

8

11

11

11

11

#N/A N/A

9

8

10

#N/A N/A

10

11

11

10

8

11

6

#N/A N/A

8

9

10

9

10

16

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

31.12.2011

31.12.2011

31.12.2011

31.12.2011

31.12.2011

31.12.2011

31.12.2011

13.02.2013

21.02.2013

29.02.2012

31.12.2012

28.09.2012

30.09.2012

26.02.2013

31.05.2012

30.11.2011

30.11.2012

31.12.2012

30.11.2011

31.12.2012

Date

12 month

9 month

Not Provided

Not Provided

Not Provided

Not Provided

Not Provided

Not Provided

12 month

Not Provided

12 month

Not Provided

Not Provided

12 month

Not Provided

Not Provided

Not Provided

Not Provided

12 month

Not Provided

Not Provided

Not Provided

Not Provided

12 month

Not Provided

Not Provided

Inst Type

Other

Corporation

Other

Other

Corporation

Investment Advisor

Unclassified

Hedge Fund Manager

Hedge Fund Manager

Investment Advisor

Investment Advisor

Investment Advisor

Mutual Fund Manager

Investment Advisor

Mutual Fund Manager

Investment Advisor

Mutual Fund Manager

Mutual Fund Manager

Investment Advisor

Investment Advisor

Date

27.02.2013

27.02.2013

27.02.2013

26.02.2013

25.02.2013

22.02.2013

22.02.2013

21.02.2013

20.02.2013

20.02.2013

20.02.2013

15.02.2013

05.02.2013

04.02.2013

01.02.2013

30.01.2013

25.01.2013

16.01.2013

15.01.2013

15.01.2013

27.11.2012

09.10.2012

26.09.2012

18.09.2012

11.10.2011

28.04.2010

28.02.2013

Ackermans & van Haaren NV

Ackermans & van Haaren NV is an industrial holding company. The Company's

holdings are in the contracting-dredging environmental services, financial

services, staffing services, and private equity investing.

Price/Volume

80

.1 M

.1 M

.1 M

.1 M

.1 M

.1 M

.0 M

.0 M

.0 M

.0 M

.0 M

70

60

50

40

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (28.01.2013)

52-Week Low (28.06.2012)

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.06.2012

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

ACKB BB EQUITY YTD Change

ACKB BB EQUITY YTD % CHANGE

12/2012

01/yy

70.49

59.00

29'210.00

68.49

-2.84%

16.08%

82.59%

33.5

2'294.20

529.78

0.0

482.4

187.36

3'237.64

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

20

10

0

f-12

31.12.2009

31.12.2010

423.7

375.5

6.28x

8.67x

159.8

161.3

16.64x

20.17x

117.5

160.8

14.69x

12.86x

Profitability

31.12.2011

422.4

6.47x

167.2

16.35x

177.5

10.75x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

31.12.2012

432.5

167.5

12.45x

167.22

19.58%

53.11%

2.31%

8.33%

4.01%

0.07%

38.7%

8.13%

28.14%

-

Price/ Cash Flow

a-12

m-12

j-12

j-12

a-12

s-12

o-12

n-12

d-12

j-13

Market Data

1.01

12.92%

9.99%

1.008

8

3.625

31'309

30'161

29'840

LTM-4Q

LTM

FY+1

FY+2

FQ+1

FQ+2

01/yy

01/yy

12/13 Y

12/14 Y

03/12 Q1

06/12 Q2

203.0

231.0

11.66x

10.46x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

28.1%

18.3%

0.07

4.36

-

Sales/Revenue/Turnover

30.00

600.0

25.00

500.0

20.00

400.0

15.00

300.0

10.00

200.0

5.00

100.0

0.00

01.01.2010

m-12

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.12.2008

503.5

3.77x

258.0

7.36x

114.6

10.55x

30

0.0

01.07.2010

01.01.2011

01.07.2011

01.01.2012

01.07.2012

01.01.2013

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

28.02.2013

Ackermans & van Haaren NV

Holdings By:

All

Holder Name

SCALDIS INVEST

UNIVERSAL INVEST CON

ACKERMANS & VAN HAAR

VANGUARD GROUP INC

BNP PARIBAS INV PART

DEXIA ASSET MANAGEME

ING ASSET MANAGEMENT

BLACKROCK

DIMENSIONAL FUND ADV

PETERCAM SA

THIRD AVENUE MANAGEM

INVESCO LTD

KBC GROUP NV

ALPS MUTUAL FUNDS SE

INVESCO GESTION

LOMBARD ODIER DARIER

DEGROOF GESTION INST

BANK DELEN SA

BRINVEST

PETERCAM SA

Firm Name

KBC Securities

ABN Amro Bank N.V.

Exane BNP Paribas

Bank Degroof(ESN)

Petercam

ING Bank

Rabobank International

Kempen & Co

Portfolio Name

n/a

Multiple Portfolios

n/a

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Analyst

TOM SIMONTS

MAURITS HELDRING

DAVID VAGMAN

HANS D'HAESE

MARC DEBROUWER

MATTHIAS MAENHAUT

COR KLUIS

ERWIN DUT

Source

Co File

MF-AGG

Co File

MF-AGG

ULT-AGG

MF-AGG

MF-AGG

ULT-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

Co File

MF-AGG

Recommendation

accumulate

hold

outperform

hold

hold

hold

buy

hold

Amt Held

11'054'000

477'867

341'700

251'627

216'340

163'009

155'000

137'982

119'468

104'684

98'729

81'406

79'357

71'986

68'093

65'000

56'000

54'500

51'300

42'962

% Out

33

1.43

1.02

0.75

0.65

0.49

0.46

0.41

0.36

0.31

0.29

0.24

0.24

0.21

0.2

0.19

0.17

0.16

0.15

0.13

Weighting

Change

4

3

5

3

3

3

5

3

Latest Chg

6'404

3'423

38'750

2'110

32'950

(37'788)

486

1'526

6'946

34'707

50'000

(5'000)

Target Price

M

M

M

M

M

M

M

M

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

74

61

74

72

70

64

75

64

File Dt

Inst Type

31.12.2010

Other

31.01.2013

Investment Advisor

31.12.2010

Holding Company

31.12.2012

Investment Advisor

31.12.2012

Investment Advisor

28.12.2012

Investment Advisor

28.09.2012

Investment Advisor

26.02.2013

Investment Advisor

31.07.2012

Investment Advisor

30.12.2011 Mutual Fund Manager

31.10.2012 Hedge Fund Manager

27.02.2013

Investment Advisor

31.01.2013

Investment Advisor

30.09.2012

Investment Advisor

31.01.2013

Investment Advisor

31.07.2012 Mutual Fund Manager

29.03.2012

Investment Advisor

31.12.2012

Investment Advisor

31.12.2010

Other

30.12.2011

Investment Advisor

Date

Not Provided

Not Provided

Not Provided

12 month

Not Provided

Not Provided

Not Provided

12 month

Date

27.02.2013

27.02.2013

26.02.2013

28.01.2013

28.01.2013

28.01.2013

26.10.2012

10.06.2012

28.02.2013

Afren PLC

Afren PLC is an independent oil and gas company. The Company conducts

exploration, appraisal, and development operations. Afren is currently

producing from its assets in offshore Nigeria and Cote d'Ivoire. The Company

has interests in the Kurdistan region of Iraq, Ghana, Congo Brazzaville, Kenya,

Ethiopia, Madagascar, Seychelles, Tanzania and South Africa.

Price/Volume

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (04.02.2013)

52-Week Low (27.06.2012)

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 01.02.2013

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AFR LN EQUITY YTD Change

AFR LN EQUITY YTD % CHANGE

12/2011

09/yy

162.00

92.85

2'495'442.00

143.1

-11.67%

54.12%

72.67%

1'088.6

1'557.84

975.53

0.0

0.0

291.69

2'863.16

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

45.0 M

160

40.0 M

140

35.0 M

120

30.0 M

100

25.0 M

80

20.0 M

60

15.0 M

40

10.0 M

20

5.0 M

0

f-12 m-12

31.12.2008

31.12.2009

42.5

335.8

10.75x

3.47x

(14.0)

200.6

5.81x

(56.1)

(16.8)

Profitability

LTM-4Q

31.12.2010

319.4

7.39x

184.6

12.80x

45.3

45.12x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

31.12.2011

596.7

3.54x

429.3

4.92x

121.7

10.81x

429.34

269.21

45.12%

37.10%

6.15%

14.62%

9.91%

0.46%

50.7%

74.0%

49.5%

20.4%

0.66

0.56

33.29%

80.80%

8.08

Price/ Cash Flow

j-12

j-12

a-12

s-12

o-12

n-12

d-12

j-13

09/yy

396.8

19.81x

285.1

0.00x

71.0

0.00x

LTM

09/yy

1'361.4

7.78x

1'007.2

2.94x

181.5

13.23x

FY+1

0.00

1.76

1'040.52

6.95%

9.15%

1.763

32

4.375

4'315'082

7'320'910

5'140'602

FY+2

FQ+1

FQ+2

12/12 Y

12/13 Y

12/12 Q4 03/13 Q1

1'569.1

1'529.9

1.80x

1.76x

1'132.8

1'124.2

513.0

2.53x

2.55x

302.2

287.9

8.51x

8.07x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

23.12.2011

B

STABLE

4.13

0.10

0.50

0.94

80.8%

44.7%

0.46

0.95

45.30

94.70

Sales/Revenue/Turnover

9.00

700.0

8.00

600.0

7.00

500.0

6.00

5.00

400.0

4.00

300.0

3.00

200.0

2.00

100.0

1.00

0.00

02.01.2009

.0 M

a-12 m-12

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.12.2007

0.0

(35.1)

(39.0)

-

180

0.0

02.07.2009

02.01.2010

02.07.2010

02.01.2011

02.07.2011

02.01.2012

02.07.2012

02.01.2013

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

28.02.2013

Afren PLC

Holdings By:

All

Holder Name

STANDARD LIFE INVEST

SKAGEN FUNDS

VAN ECK ASSOCIATES C

JP MORGAN

HSBC CLIENT HOLDINGS

SKAGEN AS

VAN ECK GLOBAL

LANSDOWNE PARTNERS L

GLG PARTNERS LP

LEGAL & GENERAL

BLACKROCK

DEUTSCHE BANK AG

LGT BANK IN LIECHTEN

UBS

NORGES BANK INVESTME

NEUBERGER BERMAN LLC

BNP PARIBAS INV PART

CARMIGNAC GESTION

CARMIGNAC GESTION S

SCOTTISH WIDOWS

Firm Name

FirstEnergy Capital Corp

Canaccord Genuity Corp

RBC Capital Markets

Exane BNP Paribas

Macquarie

Finncap

Investec

HSBC

JPMorgan

SBG Securities

Oriel Securities Ltd

Liberum Capital Ltd

Global Hunter Securities

Morgan Stanley

Nomura

Tudor Pickering & Co

EVA Dimensions

Deutsche Bank

VSA Capital Ltd

Barclays

Goldman Sachs

Mirabaud Securities

CSL

N+1 Singer Ltd

Jefferies

Fox-Davies Capital

Credit Suisse

Merrion Stockbrokers

Renaissance Capital

Westhouse Securities

Portfolio Name

Multiple Portfolios

Multiple Portfolios

n/a

n/a

n/a

Multiple Portfolios

Multiple Portfolios

n/a

n/a

n/a

n/a

n/a

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

n/a

Analyst

GERRY F DONNELLY

THOMAS MARTIN

JAMES HOSIE

ALEJANDRO DEMICHELIS

MARK WILSON

WILLIAM ARNSTEIN

STUART JOYNER

PETER HITCHENS

JAMES THOMPSON

LIONEL THEROND

RICHARD GRIFFITH

ANDREW WHITTOCK

JOHN MALONE

JAMIE MADDOCK

TOM ROBINSON

ANISH KAPADIA

CRAIG STERLING

PHIL CORBETT

DOUGIE YOUNGSON

ALESSANDRO POZZI

CHRISTOPHOR JOST

TEAM COVERAGE

DAVID G STEDMAN

SIMON HAWKINS

LAURA LOPPACHER

STEPHANE FOUCAUD

THOMAS YOICHI ADOLFF

MUNA MULEYA

DRAGAN TRAJKOV

PETER BASSETT

Source

REG

REG

RNS-MAJ

ULT-AGG

Co File

MF-AGG

REG

RNS-MAJ

Co File

ULT-AGG

ULT-AGG

Co File

REG

ULT-AGG

REG

REG

ULT-AGG

MF-AGG

REG

ULT-AGG

Recommendation

market perform

buy

outperform

outperform

neutral

hold

hold

overweight

neutral

buy

buy

hold

buy

Overwt/Attractive

neutral

hold

overweight

buy

buy

overweight

buy/attractive

neutral

buy

buy

buy

buy

neutral

buy

buy

buy

Amt Held

84'499'588

62'409'542

54'041'493

54'037'599

52'931'686

52'905'498

52'009'659

43'806'532

38'651'941

38'620'343

33'707'211

32'317'318

29'442'634

26'382'092

25'311'996

23'891'511

23'127'394

22'476'440

22'448'383

21'667'551

% Out

7.76

5.73

4.96

4.96

4.86

4.86

4.78

4.02

3.55

3.55

3.1

2.97

2.7

2.42

2.33

2.19

2.12

2.06

2.06

1.99

Weighting

Change

3

5

5

5

3

3

3

5

3

5

5

3

5

5

3

3

5

5

5

5

5

3

5

5

5

5

3

5

5

5

M

M

N

M

M

M

M

M

D

M

M

M

M

M

M

M

M

M

M

M

M

M

N

M

M

M

M

N

M

M

Latest Chg

(1'842'426)

5'838'087

11'485'677

4'130'195

(1'992'400)

(28'244'649)

(918'691)

4'281'295

(20'000)

(2'180'739)

4'029'053

2'555'815

2'267'133

623'034

1'276'818

Target Price

145

200

210

201

148

150

138

200

195

170

#N/A N/A

123

190

220

175

180

#N/A N/A

165

245

210

224

#N/A N/A

210

160

155

250

170

218

170

#N/A N/A

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

Inst Type

01.02.2013

Investment Advisor

01.02.2013

Investment Advisor

31.12.2012

Investment Advisor

01.02.2013

Unclassified

26.03.2012

Holding Company

31.01.2013 Mutual Fund Manager

01.02.2013

Unclassified

22.01.2010 Hedge Fund Manager

26.03.2012 Hedge Fund Manager

01.02.2013

Unclassified

26.02.2013

Investment Advisor

26.03.2012

Bank

01.02.2013

Investment Advisor

01.02.2013

Unclassified

01.02.2013

Government

01.02.2013

Investment Advisor

01.02.2013

Investment Advisor

31.12.2012

Investment Advisor

01.02.2013

Unclassified

01.02.2013

Unclassified

Date

12 month

12 month

12 month

Not Provided

12 month

12 month

12 month

Not Provided

9 month

12 month

Not Provided

Not Provided

12 month

12 month

12 month

Not Provided

Not Provided

12 month

Not Provided

Not Provided

12 month

Not Provided

Not Provided

12 month

12 month

Not Provided

Not Provided

Not Provided

12 month

Not Provided

Date

27.02.2013

25.02.2013

21.02.2013

11.02.2013

08.02.2013

05.02.2013

01.02.2013

01.02.2013

30.01.2013

28.01.2013

25.01.2013

22.01.2013

22.01.2013

21.01.2013

21.01.2013

17.01.2013

17.01.2013

10.01.2013

10.01.2013

08.01.2013

17.12.2012

12.12.2012

21.11.2012

07.11.2012

24.10.2012

24.10.2012

25.09.2012

24.09.2012

23.08.2012

25.01.2012

28.02.2013

Air France-KLM

Air France-KLM offers air transportation services. The Company operates

airlines and offers travel booking, catering, freight transportation, aircraft

maintenance, and pilot training services.

Price/Volume

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (25.01.2013)

52-Week Low (14.06.2012)

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 31.12.2012

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AF FP EQUITY YTD Change

AF FP EQUITY YTD % CHANGE

12/2012

12/yy

8.95

3.01

3'584'360.00

7.976

-10.88%

164.90%

83.60%

300.2

2'394.55

11'256.00

0.0

56.0

3'420.00

10'286.55

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

18.0 M

16.0 M

14.0 M

12.0 M

10.0 M

8.0 M

6.0 M

4.0 M

2.0 M

.0 M

a-12 m-12

j-12

j-12

a-12

s-12

o-12

n-12

d-12

j-13

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.03.2009

23'970.0

0.32x

1'475.0

5.27x

(814.0)

-

10

9

8

7

6

5

4

3

2

1

0

f-12 m-12

31.03.2010

31.03.2011

23'310.0

24'363.0

0.49x

0.39x

1'695.0

1'344.0

6.72x

7.07x

289.0

(809.0)

13.91x

Profitability

LTM-4Q

31.12.2011

24'363.0

0.39x

1'344.0

7.07x

(809.0)

-

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

31.12.2012

25'633.0

0.39x

1'448.0

6.88x

(1'192.0)

1'448.00

-300.00

-1.17%

-4.53%

-4.35%

-21.74%

0.94%

5.3%

-1.2%

-4.7%

0.77

0.54

40.97%

228.59%

14.11

-

Price/ Cash Flow

LTM

12/yy

24'363.0

0.39x

2'109.0

4.50x

(809.0)

0.00x

12/yy

25'633.0

1.48x

1'356.0

7.35x

(1'192.0)

0.00x

FY+1

1.21

216.15

79.76%

13.96%

1.210

34

3.235

5'935'102

4'061'500

3'559'668

FY+2

FQ+1

FQ+2

12/13 Y

12/14 Y

12/12 Q4 03/13 Q1

26'363.8

27'046.5

6'182.4

0.33x

0.31x

1'982.2

2'510.1

5.19x

4.10x

(26.9)

329.1

(123.9)

35.7

6.97x

30.33x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

3.32

-0.06

5.78

8.30

228.6%

69.3%

0.94

2.07

25.94

-

Sales/Revenue/Turnover

3.50

30'000.0

3.00

25'000.0

2.50

20'000.0

2.00

15'000.0

1.50

10'000.0

1.00

5'000.0

0.50

0.00

03.04.2009

0.0

03.10.2009

03.04.2010

03.10.2010

03.04.2011

03.10.2011

03.04.2012

03.10.2012

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

28.02.2013

Air France-KLM

Holdings By:

All

Holder Name

FRENCH STATE

CAPITAL GROUP COMPAN

CREDIT SUISSE

SMITH DONALD

PRIGEST

AIR FRANCE-KLM

UBS LONDRES

DIMENSIONAL FUND ADV

LONE CYPRESS LTD

NORGES BANK INVESTME

ROTHSCHILD & COMPAGN

NATIXIS ASSET MANAGE

DNCA FINANCE

DNCA

HSBC HOLDINGS PLC

BNP PARIBAS SA

ING INVESTMENT MANAG

BLACKROCK

AMUNDI

FEDERAL GESTION

Firm Name

Portfolio Name

n/a

n/a

n/a

n/a

n/a

n/a

n/a

Multiple Portfolios

n/a

n/a

Multiple Portfolios

n/a

Multiple Portfolios

n/a

n/a

n/a

Multiple Portfolios

n/a

n/a

Multiple Portfolios

Analyst

RBC Capital Markets

DAMIAN BREWER

Goldman Sachs

OLIVER NEAL

HSBC

ANDREW DAVID LOBBENBERG

Cantor Fitzgerald

ROBIN BYDE

Goodbody Stockbrokers Ltd

DONAL O'NEILL

EVA Dimensions

CRAIG STERLING

Societe Generale

PATRICK JOUSSEAUME

Oddo & Cie

YAN DEROCLES

Nomura

ANDREW EVANS

Investec

JAMES HOLLINS

Credit Suisse

NEIL GLYNN

CM - CIC Securities(ESN)

HARALD LIBERGE-DONDOUX

S&P Capital IQ

JAWAHAR HINGORANI

AlphaValue

HELENE COUMES

Deutsche Bank

MICHAEL KUHN

Commerzbank Corporates & Markets FRANK SKODZIK

Morgan Stanley

PENNY BUTCHER

Theodoor Gilissen Securities

JOS VERSTEEG

CA Cheuvreux

BEAT KEISER

Macquarie

SAM DOBSON

Davy

STEPHEN FURLONG

Kepler Capital Markets

PIERRE BOUCHENY

Main First Bank AG

LOIC SABATIER

Espirito Santo Investment Bank Research

GERALD KHOO

Barclays

DAVID E FINTZEN

JPMorgan

DAVID PITURA

Day by Day

VALERIE GASTALDY

Natixis

SARAH EMSELLEM

Liberum Capital Ltd

ALEXIA DOGANI

Redburn Partners

TIM MARSHALL

Raymond James

JULIEN RICHER

Source

Co File

ULT-AGG

Co File

Co File

Co File

Co File

Co File

MF-AGG

Short

Co File

MF-AGG

Co File

MF-AGG

Co File

Co File

Co File

MF-AGG

ULT-AGG

Co File

MF-AGG

Recommendation

sector perform

neutral/neutral

overweight

buy

hold

hold

hold

buy

neutral

sell

neutral

buy

sell

add

hold

hold

Equalwt/In-Line

buy

underperform

underperform

neutral

reduce

outperform

sell

equalweight

underweight

hold

buy

buy

neutral

outperform

Amt Held

% Out

48'035'088

16

16'321'440

5.44

7'771'575

2.59

7'350'155

2.45

6'150'000

2.05

6'004'386

2

5'572'841

1.86

3'722'804

1.24

(3'122'281) -1.04

3'055'759

1.02

3'046'000

1.01

2'993'609

1

2'925'000

0.97

2'664'300

0.89

2'633'420

0.88

2'276'699

0.76

2'119'316

0.71

(1'879'889) -0.63

1'740'484

0.58

1'618'171

0.54

Weighting

Change

3

3

5

5

3

3

3

5

3

1

3

5

1

4

3

3

3

5

1

1

3

2

5

1

3

1

3

5

5

3

5

M

M

M

M

M

U

M

M

M

M

M

M

D

D

M

M

M

M

M

M

M

M

M

M

M

M

D

M

M

M

M

Latest Chg

(201'147)

(95'000)

95'000

2'291

(2'489)

-

Target Price

9

9

10

10

8

#N/A N/A

8

10

8

7

9

10

8

10

9

9

8

9

6

6

#N/A N/A

7

9

4

6

7

#N/A N/A

9

9

#N/A N/A

8

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

31.12.2011

31.12.2012

08.03.2012

31.03.2011

23.09.2011

31.12.2011

24.02.2012

31.07.2012

19.04.2012

05.09.2011

31.12.2012

29.11.2011

28.09.2012

14.04.2010

01.07.2011

31.03.2011

31.12.2012

26.02.2013

05.01.2012

30.11.2012

Date

12 month

12 month

Not Provided

Not Provided

12 month

Not Provided

12 month

Not Provided

12 month

12 month

Not Provided

12 month

12 month

6 month

12 month

6 month

12 month

Not Provided

Not Provided

12 month

Not Provided

Not Provided

12 month

Not Provided

Not Provided

9 month

Not Provided

Not Provided

Not Provided

Not Provided

Not Provided

Inst Type

Government

Investment Advisor

Unclassified

n/a

Unclassified

Corporation

Other

Investment Advisor

Other

Government

Investment Advisor

Investment Advisor

Investment Advisor

Other

Investment Advisor

Bank

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Date

27.02.2013

26.02.2013

26.02.2013

26.02.2013

26.02.2013

26.02.2013

25.02.2013

25.02.2013

25.02.2013

22.02.2013

22.02.2013

22.02.2013

22.02.2013

21.02.2013

18.02.2013

14.02.2013

12.02.2013

15.01.2013

14.01.2013

17.12.2012

11.12.2012

03.12.2012

03.12.2012

26.11.2012

22.11.2012

15.11.2012

07.11.2012

01.11.2012

01.11.2012

29.10.2012

19.03.2012

28.02.2013

Aixtron SE NA

Aixtron SE engineers and manufactures metal organic chemical vapor deposition

(MOCVD) equipment for the semiconductor industry. The Company's customers use

its equipment to produce compound semiconductor layer structures for use in

LED, laser, solar cell, transistor, telecommunications, and other applications.

Aixtron markets its products worldwide.

Price/Volume

16

4.0 M

10

12/2012

12/yy

14.85

8.38

1'035'491.00

9.292

-37.43%

10.95%

14.16%

102.0

947.55

0.00

0.0

0.0

295.22

738.53

3.0 M

2.0 M

4

1.0 M

2

0

f-12

.0 M

m-12

a-12

m-12

j-12

j-12

a-12

s-12

o-12

n-12

d-12

j-13

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

5.0 M

12

8

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (02.05.2012)

52-Week Low (12.12.2012)

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.11.2012

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AIXA GY EQUITY YTD Change

AIXA GY EQUITY YTD % CHANGE

31.12.2008

274.4

1.30x

43.2

8.24x

23.0

18.31x

6.0 M

14

31.12.2009

31.12.2010

302.9

783.8

6.73x

3.03x

75.3

288.9

27.09x

8.23x

44.8

192.5

47.96x

14.30x

Profitability

LTM-4Q

31.12.2011

611.0

1.14x

127.3

5.47x

79.5

12.47x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

31.12.2012

227.8

(145.4)

127.27

115.01

18.82%

18.82%

-15.59%

-19.67%

0.40%

37.9%

-39.1%

-44.0%

-63.8%

3.91

2.52

0.00%

0.00%

8.09

1.43

Price/ Cash Flow

12/yy

611.0

10.08x

127.3

5.47x

79.5

12.31x

LTM

12/yy

227.8

12.14x

(101.6)

0.00x

(145.4)

0.00x

FY+1

0.88

90.49

-24.01%

4.65%

0.878

31

3.000

879'775

925'686

791'407

FY+2

FQ+1

FQ+2

12/13 Y

12/14 Y

03/13 Q1 06/13 Q2

305.6

445.1

60.8

66.3

2.46x

1.59x

11.1

78.4

(4.4)

(5.8)

63.76x

9.04x

10.9

50.7

(6.1)

(2.9)

89.35x

19.85x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

97.45

76.63

0.00

0.0%

0.0%

0.40

3.10

45.25

255.66

48.17

191.38

Sales/Revenue/Turnover

35.00

900.0

30.00

800.0

700.0

25.00

600.0

20.00

500.0

15.00

400.0

300.0

10.00

200.0

5.00

0.00

01.01.2010

100.0

0.0

01.07.2010

01.01.2011

01.07.2011

01.01.2012

01.07.2012

01.01.2013

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

28.02.2013

Aixtron SE NA

Holdings By:

All

Holder Name

MAVERICK CAPITAL LTD

CAMMA GMBH

ALLIANZ GLOBAL INVES

BAILLIE GIFFORD AND

VANGUARD GROUP INC

BLACKROCK

ADIG INVESTMENT

GENERATION INVESTMEN

AMERIPRISE FINANCIAL

CAPITAL GROUP INTERN

NORGES BANK

DWS INVESTMENT GMBH

JUPITER ASSET MANAGE

PENNANT CAPITAL MANA

BARRINGTON WILSHIRE

PENNANT WINDWARD MAS

ALLIANZ ASSET MANAGE

T ROWE PRICE ASSOCIA

ING INVESTMENT MANAG

AQR CAPITAL MANAGEME

Firm Name

Hauck & Aufhaeuser

Bankhaus Lampe

Sterne, Agee & Leach

CA Cheuvreux

Societe Generale

Baader Bank

Landesbank Baden-Wuerttemberg

M.M. Warburg Investment Research

Commerzbank Corporates & Markets

Equinet Institutional Services(ESN)

Bankhaus Metzler

DZ Bank AG

HSBC

Deutsche Bank

Exane BNP Paribas

Berenberg Bank

EVA Dimensions

JPMorgan

Barclays

Canaccord Genuity Corp

Goldman Sachs

Maxim Group LLC

Morgan Stanley

Liberum Capital Ltd

Hamburger Sparkasse

Independent Research GmbH

Close Brothers Equity Markets

Natixis

Main First Bank AG

Redburn Partners

National Bank AG

Portfolio Name

n/a

n/a

#N/A N/A

#N/A N/A

Multiple Portfolios

n/a

Multiple Portfolios

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

Multiple Portfolios

Multiple Portfolios

n/a

Analyst

TIM OLIVER WUNDERLICH

KARSTEN ILTGEN

ANDREW HUANG

KLAUS RINGEL

PETER KNOX

GUENTHER MICHAEL HOLLFELDER

WALTER SCHNEIDER

MALTE SCHAUMANN

THOMAS M BECKER

ADRIAN PEHL

STEPHAN BAUER

HARALD SCHNITZER

CHRISTIAN DOMINIK RATH

UWE SCHUPP

JEROME RAMEL

ALI FARID KHWAJA

ANDREW S ZAMFOTIS

SANDEEP S DESHPANDE

ANDREW M GARDINER

JONATHAN E DORSHEIMER

SIMON F SCHAFER

AARON CHEW

ANDREW HUMPHREY

JANARDAN MENON

INGO SCHMIDT

MARKUS FRIEBEL

VEYSEL TAZE

MAXIME MALLET

JUERGEN WAGNER

SUMANT WAHI

SVEN PAULSEN

Source

Short

Research

Research

Research

MF-AGG

ULT-AGG

MF-AGG

Research

Research

Research

Research

Research

Research

Short

Short

Short

ULT-AGG

MF-AGG

MF-AGG

Short

Recommendation

buy

buy

neutral

underperform

sell

buy

hold

sell

add

reduce

sell

hold

neutral

buy

outperform

hold

sell

neutral

equalweight

sell

Buy/Neutral

sell

Equalwt/Cautious

buy

buy

sell

buy

neutral

underperform

neutral

buy

Amt Held

% Out

(7'969'268) -7.81

7'650'000

7.5

5'035'959

4.94

4'973'896

4.88

4'421'020

4.34

4'221'361

4.14

3'982'352

3.91

3'089'151

3.03

3'010'974

2.95

2'896'348

2.84

2'858'380

2.8

2'818'556

2.76

2'613'333

2.56

(2'313'312) -2.27

(1'896'735) -1.86

(1'579'574) -1.55

1'403'808

1.38

1'230'347

1.21

1'186'736

1.16

(1'040'145) -1.02

Weighting

Change

5

5

3

1

1

5

3

1

4

2

1

3

3

5

5

3

1

3

3

1

5

1

3

5

5

1

5

3

1

3

5

M

M

M

M

M

M

M

M

M

M

M

M

M

M

M

D

M

M

M

M

M

M

M

M

M

M

M

M

M

M

M

Latest Chg

(635'351)

(104'296)

97'000

(163'160)

101'908

90'004

538'825

57'205

(81'580)

Target Price

13

14

#N/A N/A

8

9

15

#N/A N/A

9

11

8

8

9

10

14

15

9

#N/A N/A

10

10

8

13

6

12

13

#N/A N/A

8

12

11

8

#N/A N/A

35

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

02.11.2012

12.10.2012

20.02.2013

19.02.2013

31.12.2012

26.02.2013

31.10.2012

30.05.2012

29.04.2011

15.10.2010

17.05.2011

17.08.2012

18.10.2011

01.11.2012

26.02.2013

29.10.2012

31.01.2013

31.12.2012

31.12.2012

25.02.2013

Date

12 month

12 month

Not Provided

Not Provided

12 month

12 month

Not Provided

12 month

6 month

12 month

12 month

12 month

Not Provided

12 month

Not Provided

Not Provided

Not Provided

9 month

Not Provided

Not Provided

12 month

12 month

12 month

Not Provided

Not Provided

12 month

12 month

Not Provided

12 month

Not Provided

Not Provided

Inst Type

Hedge Fund Manager

Corporation

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Government

Investment Advisor

Investment Advisor

Hedge Fund Manager

Hedge Fund Manager

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Hedge Fund Manager

Date

26.02.2013

25.02.2013

25.02.2013

22.02.2013

21.02.2013

21.02.2013

21.02.2013

21.02.2013

19.02.2013

19.02.2013

18.02.2013

18.02.2013

13.02.2013

08.02.2013

04.02.2013

18.01.2013

17.01.2013

14.01.2013

14.01.2013

13.01.2013

11.01.2013

19.11.2012

16.11.2012

02.11.2012

29.10.2012

26.10.2012

26.10.2012

26.10.2012

25.10.2012

14.03.2012

28.07.2011

28.02.2013

Allreal Holding AG

Allreal Holding AG develops and manages real estate. The Company operates as a

general contractor offering planning, architect, and construction management

services. Allreal also provides renovation services and manages a portfolio of

apartment, office, and commercial buildings.

Price/Volume

160

.1 M

140

.1 M

120

.1 M

100

80

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (10.04.2012)

52-Week Low (11.02.2013)

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.06.2012

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

ALLN SE EQUITY YTD Change

ALLN SE EQUITY YTD % CHANGE

12/2012

01/yy

143.48

131.80

19'017.00

135.1

-5.84%

2.50%

28.24%

15.9

2'153.72

1'352.00

0.0

0.0

33.90

3'560.62

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

31.12.2009

31.12.2010

215.8

723.8

13.28x

4.02x

137.9

170.3

20.78x

17.07x

88.6

116.4

15.75x

15.48x

Profitability

31.12.2011

251.7

13.74x

173.4

19.95x

140.8

13.20x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

31.12.2012

.0 M

20

0

f-12

.0 M

m-12

a-12

LTM-4Q

LTM

01/yy

01/yy

98.0

22.29x

170.30

135.30

18.69%

20.86%

3.83%

8.12%

4.34%

0.16%

30.6%

16.1%

42.00%

86.32%

-

Price/ Cash Flow

m-12

j-12

j-12

a-12

s-12

o-12

n-12

d-12

j-13

FY+1

-

0.54

15.30

-1.38%

-4.25%

0.544

4

2.500

20'382

20'510

17'295

FY+2

FQ+1

FQ+2

12/13 Y

12/14 Y

03/12 Q1 06/12 Q2

292.7

295.0

13.62x

13.84x

194.5

211.5

18.31x

16.84x

130.7

134.0

18.97x

16.95x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

4.98

1.77

8.10

8.31

86.3%

46.3%

0.16

-

Sales/Revenue/Turnover

50.00

800.0

45.00

700.0