Professional Documents

Culture Documents

Primary Role of Company Auditor

Uploaded by

Ashutosh GoelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Primary Role of Company Auditor

Uploaded by

Ashutosh GoelCopyright:

Available Formats

Name: Ashutosh Goel

Student ID: 100091

Course Title: ACF 100-BE

Course Teacher: Kushal Kataria

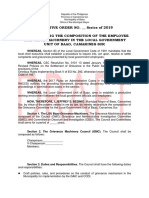

Title of the Essay: After discussing briefly the primary role of a company auditor, consider why ethics is important to auditors. Evaluate how significant the contribution of auditors is to the effective corporate governance of large Indian companies.

Word Count: 1358 Words

Date of Submission: 06/01/2011

Business Environment Essay

After discussing briefly the primary role of a company auditor, consider why ethics is important to auditors. Evaluate how significant the contribution of auditors is to the effective corporate governance of large Indian companies

A qualified person, who inspects the accounting records and the practices of an organization, is the basic definition of a Company Auditor. In financial accounting, an audit is categorized by the self-governing evaluation of the justice by which a company's financial statements are presented and prepared by and to its supervisor. This task is largely performed by the trained, experienced, self-governed and intent persons, known as accountants or auditors. Auditors are on the whole very informed with every characteristic of auditing and they in turn matter a report known as auditors report. Since, the auditor acquire immense knowledge in their company and the marketplace in which the company operates, auditors are highly practiced to grant information outside their part of auditing to the company. Other services that they can offer are successions planning, management consulting, planning taxes and deregulation preparation. There are generally two types of auditors: External Auditors: These auditors visit from outside the company to access and weigh up the financial statements of their clients or to carry out essential evaluation than necessary. They are usually appointed for a time span of 1 year. Internal Auditors: They are hired by the companies as employees to access and assess the internal direction necessary in the company. They testify directly to BODs or the highest management. They are answerable to have a through view on related issues of the frauds and conflicts that are visible in a companys record. As a common statement, audits are always supposed to be an independent evaluation which includes few degrees of both quantitative and qualitative analysis; whereas a judgment requires more dependent and more counseling approach. The reason being, the purpose of a judgment is to assume something or calculate the worth for it. Although the process producing a judgment may involve an audit as an independent professional, its aim is to give a measurement instead of expressing an opinion for the accuracy of statements or the level of excellence in their performance.

Ethics may be defined as the actions showed by an individual on himself to ensure his continued survival across the dynamics. It is a personal thing. A person individually performs a task according to his style of work; then he considers himself ethical because he does that with a reason. Ethics role in accounting is a law for all the accountants to follow certain regulations for conducting their jobs of accounting in a justified way. It is followed just to aid public reliance in their accounting. There are a set of regulations which have been set by the AICPA (he American Institute of Certified Public Accountants) for the issue in publics accounts. The IIA (Institute of Internal Auditors) and IMA (Institute of Management Accounts) as well have presented their specific code of ethics to pound the set of ethics in accounting as a field. It is the duty of every professional accounting organization to direst all the members of the organization to follow the fixed set of ethical paths. The most common and searched question that has been asked to the accounting professionals is whether ethics can be successfully taught. The professionals will face the answer at one of time or the other in ones life span as there is no person in this entire world who came with ethics in their soul or mind. So, we can argue that it is the environment, in which the person grew up or spent his past in, that should be held responsible for the ethics embedded on that person which he is following today. We can see that it is the same case for every accounting professional; the codes of conduct which the professional organization requires all the members to build an ideology of ethics in them. Ethics are a major need of today in the accounting as profession. Accounting ethics in the field of accounting refers to the guiding principles (it contains decisions and ethical values) that officials are required to follow while preparing the accounts. Similar to the officials in law or medical field, the accounting officials also need to strongly stick to the ethics which have become a rule in accounting. The companies which opt for the services of an accounting official do not only rely on his skills and abilities but also on his professional uprightness. People using such accounting service from the skilled officials depend on their officials capability to take part in decision making and also depends on the ethics followed. It is because of the above reasons which have made the accounting officials to develop a code of conduct which is required to be followed by all the accountants. The fundamental nature of the ethics is defined by the way it is used. The ethical values or code of conduct entails an accounting official to maintain his high degrees of self discipline which makes it greater than legal boundaries. Whenever an accounting official is opted as a member of organizations such as IMA, IIA and CIA, they are expected to strictly work by the code of conduct and ethics followed.

The accounting officials are to be held responsible to stick to their code of ethics, in other words it is the role of ethics in accounting, which does not let anyone lose confidence on their career. The fundamental nature of ethics in accounts can be found in the maintenance of their reliability and aims in the career. Corporate governance is a deposit of processes, laws, institutions, etc. affecting the way an organization is being directed, controlled or asked to follow. Another major component of corporate governance is the relationship maintained with most of the stakeholders of the organization and the targets for which the organization is concerned about. The most important stakeholders are the shareholders, board of directors, customers, creditors, employees, suppliers, and the community with a large share. A good corporate-governance practice allows the management to assign resources more efficiently, which develops the opportunities for the investors to obtain a better rate of return from their investment. Finally, the leading indices show the developing countries which have good governance structures without fail surpass the poor countrys corporate-governance structure. Thus, in a competent capital market, investors will give their money to the firms with better corporate-governance structures because it has low risks and the more chances of receiving higher returns. At macro level, if organizations in developing countries receive investment, they will help growth in the local economy. If they are not able to attract equity capital, then they are condemned to remain on a small and less efficient scale, and they will not be able to stimulate growth in their own country. Good corporate governance profits developing countries in a number of ways. As per the study, good corporate-governance practice can reduce the chances of major financial crisis and the also reduces effect of the financial crisis if occurred. Research also shows that the well governed organizations are valued considerably higher than the organizations with flawed corporategovernance practices followed. Good corporate governance also helps in reducing the inefficient behavior and results in over passing the difficulties to the growth in organizations productivity. Corporate governance plays a vital role in reducing corruption from the organizations management because the officials will have to face strict punishments if the laws are flawed. Reduced corruption drastically enhances the organization's developmental prospects as it creates a good image or good will for the organization. What happens when the company does not follow the ethics or the corporate governance? The answer lies in the example of scandal filed in the export transaction between the ITC and Chitalia group of industries in the year 1996. ED had started the FERA (Foreign Exchange Regulation Act) investigation in this matter and exposed their scam from the year 1990 to 1995. The violations were recorded to a scam of 80 million us dollars. If the company auditors had not forgotten their ethics or followed the corporate governance then both the companies would not

have lost their market value and incurred losses. Due to the same reason ITCs chairman (KL Chugh) along with many directors of Chitalia were detained but released on bail later.

Bibliography

Accounting Learning Resources. (n.d.). Retrieved January 3, 2011, from Role Of Ethics In Accounting: http://www.bookkeeping-financial-accounting-resources.com/role-of-ethics-inaccounting.html Bhat, V. (2007, May 1). High beam research. Retrieved January 5, 2011, from Article: Corporate governance in India: past, present, and suggestions for the future.: http://www.highbeam.com/doc/1G1-167305801.html Cutting, T. (2008, January 12). PM Hut. Retrieved January 4, 2011, from How to survive an audit: http://www.pmhut.com/how-to-survive-an-audit Entrepreneur. (1997). Retrieved December 25, 2010, from The role of the auditor as a business advisor: http://www.entrepreneur.com/tradejournals/article/20127275.html Jackson, R. (2006, December). Entrepreneur. Retrieved January 4, 2011, from Keeping the company clean: http://www.entrepreneur.com/tradejournals/article/156577790.html The Economic Times. (n.d.). Retrieved January 5, 2011, from India's top accounting scandals til Satyam: http://economictimes.indiatimes.com/quickiearticleshow/3959731.cms

You might also like

- The Certified Executive Board SecretaryFrom EverandThe Certified Executive Board SecretaryRating: 5 out of 5 stars5/5 (2)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- NCC Bank-A New LookDocument31 pagesNCC Bank-A New LookNazmulBDNo ratings yet

- Sources of international financing and analysisDocument6 pagesSources of international financing and analysisSabha Pathy100% (2)

- The Trolley Dodgers: Case Study Group Albancis, Rodante Fuertes, Kate Rowie Patayan, DarleneDocument9 pagesThe Trolley Dodgers: Case Study Group Albancis, Rodante Fuertes, Kate Rowie Patayan, DarleneDarlene PatNo ratings yet

- Working Capital Management 15Document75 pagesWorking Capital Management 15Vany AprilianiNo ratings yet

- FM Class Notes Day1Document5 pagesFM Class Notes Day1febycvNo ratings yet

- Core Risks in BankingDocument9 pagesCore Risks in BankingVenkatsubramanian R IyerNo ratings yet

- Unit - 1 Introduction To AuditingDocument10 pagesUnit - 1 Introduction To AuditingDarshan PanditNo ratings yet

- Accounting For Management - Unit IVDocument87 pagesAccounting For Management - Unit IVSELVARAJ SNNo ratings yet

- Financial Assets and Their Role in the EconomyDocument51 pagesFinancial Assets and Their Role in the Economyjaelou09100% (1)

- Startegic Management NotesDocument155 pagesStartegic Management NotesVimal Saxena100% (1)

- Introduction to Auditing - Meaning, Importance and DifferencesDocument56 pagesIntroduction to Auditing - Meaning, Importance and Differencesanon_696931352No ratings yet

- MBA Accounting QuestionsDocument4 pagesMBA Accounting QuestionsbhfunNo ratings yet

- Motive of Holding CashDocument8 pagesMotive of Holding CashkhandeliavivekNo ratings yet

- Central Bank Functions and ResponsibilitiesDocument16 pagesCentral Bank Functions and ResponsibilitiesAyesha Parvin RubyNo ratings yet

- Auditing and Accounting DifferencesDocument65 pagesAuditing and Accounting DifferencesTushar GaurNo ratings yet

- Notes - MARKETING - OF - FINANCIAL SERVICES - 2020Document69 pagesNotes - MARKETING - OF - FINANCIAL SERVICES - 2020Rozy SinghNo ratings yet

- Working CapitalDocument39 pagesWorking CapitalHema LathaNo ratings yet

- Receivables ManagementDocument11 pagesReceivables ManagementPuneet JindalNo ratings yet

- ConclusionDocument2 pagesConclusionMuthu Kumaran100% (1)

- It Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesDocument24 pagesIt Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesAnonymous KN4pnOHmNo ratings yet

- Financial Management QuestionsDocument3 pagesFinancial Management Questionsjagdish002No ratings yet

- Banking Diploma Bangladesh Law Short NotesDocument19 pagesBanking Diploma Bangladesh Law Short NotesNiladri HasanNo ratings yet

- Assignment of Management of Working Capital: TopicDocument13 pagesAssignment of Management of Working Capital: TopicDavinder Singh BanssNo ratings yet

- Note 08Document6 pagesNote 08Tharaka IndunilNo ratings yet

- Measuring Collections Performance: Understanding and Using Key Accounts Receivable Metrics: Dso, Add and CeiDocument11 pagesMeasuring Collections Performance: Understanding and Using Key Accounts Receivable Metrics: Dso, Add and CeibabuplusNo ratings yet

- Case Study Pakistan Model Shariah Governance Framework PDFDocument17 pagesCase Study Pakistan Model Shariah Governance Framework PDFsyedtahaali100% (3)

- TCI Financial Services Commission Loan Classification GuidanceDocument6 pagesTCI Financial Services Commission Loan Classification Guidancetanim7No ratings yet

- Audit & Assurance 2012Document13 pagesAudit & Assurance 2012S M Wadud TuhinNo ratings yet

- Q. 16 Functions of A Merchant BankerDocument3 pagesQ. 16 Functions of A Merchant BankerMAHENDRA SHIVAJI DHENAKNo ratings yet

- Forex Numericals PDFDocument8 pagesForex Numericals PDFprashant kaushikNo ratings yet

- Stock Broking, Custodial Service, Depository and Service Lending Scheme Submitted By: Kanwarpal Singh Richa PahujaDocument53 pagesStock Broking, Custodial Service, Depository and Service Lending Scheme Submitted By: Kanwarpal Singh Richa PahujanavaggNo ratings yet

- Development of Credit and Collection Policy PDFDocument35 pagesDevelopment of Credit and Collection Policy PDFJimuel Faigao100% (1)

- Bank Audit and InspectionDocument2 pagesBank Audit and InspectionD. BharadwajNo ratings yet

- Short Essay 1: UnrestrictedDocument8 pagesShort Essay 1: UnrestrictedSatesh KalimuthuNo ratings yet

- How Companies Turn Cost Centers Into Profitable Business UnitsDocument8 pagesHow Companies Turn Cost Centers Into Profitable Business UnitschandanshaktiNo ratings yet

- Foreign Exchange Risk ManagementDocument12 pagesForeign Exchange Risk ManagementDinesh KumarNo ratings yet

- Rise in Bank NPAs Due to External and Internal FactorsDocument10 pagesRise in Bank NPAs Due to External and Internal FactorsRakesh KushwahNo ratings yet

- Portfolio ManagementDocument40 pagesPortfolio ManagementSayaliRewaleNo ratings yet

- Foundations of Accounting-2Document89 pagesFoundations of Accounting-2SWAPNIL BHISE100% (1)

- Retail Question Bank Mid TermDocument2 pagesRetail Question Bank Mid TermAbhishek Shekhar100% (1)

- Module IIIDocument18 pagesModule IIISumit KumarNo ratings yet

- CA Inter SM Chapter 7 Nov.21Document37 pagesCA Inter SM Chapter 7 Nov.21vipulNo ratings yet

- International Working Capital Management TechniquesDocument16 pagesInternational Working Capital Management TechniquesNancy DsouzaNo ratings yet

- Functional Areas of IBDocument27 pagesFunctional Areas of IBAbhinav KumarNo ratings yet

- Credit Management PartsDocument5 pagesCredit Management Partsdarma bonarNo ratings yet

- Security Analysis - Oct 08Document17 pagesSecurity Analysis - Oct 08lokeshgoyal200175% (4)

- Asset Backed SecuritiesDocument179 pagesAsset Backed SecuritiesShivani NidhiNo ratings yet

- JAIBB SyllabusDocument7 pagesJAIBB SyllabuszubishuNo ratings yet

- Time Value of MoneyDocument24 pagesTime Value of MoneyShoaib Ahmed (Lecturer-EE)No ratings yet

- Economic Significance of Retailing in India & WorldwideDocument15 pagesEconomic Significance of Retailing in India & WorldwideModassar Nazar91% (11)

- Raising Capital: A Survey of Non-Bank Sources of CapitalDocument34 pagesRaising Capital: A Survey of Non-Bank Sources of CapitalRoy Joshua100% (1)

- Integrated Marketing Communication Unit 1Document63 pagesIntegrated Marketing Communication Unit 1pecmbaNo ratings yet

- Export Finance: A Study on Working Capital Solutions for International TradeDocument7 pagesExport Finance: A Study on Working Capital Solutions for International TradeSynonyms Booii100% (1)

- Working Capital Management of SectrixDocument50 pagesWorking Capital Management of SectrixsectrixNo ratings yet

- The History of Origin and Growth of Merchant Banking Throughout The WorldDocument18 pagesThe History of Origin and Growth of Merchant Banking Throughout The WorldJeegar Shah0% (1)

- To Study On Financial Functions of Benco OilDocument15 pagesTo Study On Financial Functions of Benco OilsumiNo ratings yet

- New Edited Cash ManagementDocument59 pagesNew Edited Cash Managementdominic wurdaNo ratings yet

- Abs Journal RankingDocument52 pagesAbs Journal Rankingrizwan1001No ratings yet

- Financial Ratios Between HUL ITC P&GDocument5 pagesFinancial Ratios Between HUL ITC P&GAshutosh GoelNo ratings yet

- Maggi Still Rules The Roost: HUL and GSK Consumer Still Have To Get Their Act Right in Instant Noodles CategoryDocument2 pagesMaggi Still Rules The Roost: HUL and GSK Consumer Still Have To Get Their Act Right in Instant Noodles CategoryAshutosh GoelNo ratings yet

- Basic Distribution ChannelDocument1 pageBasic Distribution ChannelAshutosh GoelNo ratings yet

- Basic Distribution ChannelDocument1 pageBasic Distribution ChannelAshutosh GoelNo ratings yet

- Economic Article AnalysisDocument11 pagesEconomic Article AnalysisAshutosh GoelNo ratings yet

- ACF213 CourseWork Ashutosh GoelDocument6 pagesACF213 CourseWork Ashutosh GoelAshutosh GoelNo ratings yet

- Cash Flow of ITC, P&G and HUL.Document3 pagesCash Flow of ITC, P&G and HUL.Ashutosh GoelNo ratings yet

- Importance of Talent Management TodayDocument9 pagesImportance of Talent Management TodayAshutosh GoelNo ratings yet

- Primary Role of Company AuditorDocument5 pagesPrimary Role of Company AuditorAshutosh GoelNo ratings yet

- Integrated Marketing Communication of DishTvDocument11 pagesIntegrated Marketing Communication of DishTvAshutosh GoelNo ratings yet

- Medina VS CIR Case DigestDocument1 pageMedina VS CIR Case DigestHopey100% (1)

- Reconstituting LGU Baao's Employee Grievance MachineryDocument3 pagesReconstituting LGU Baao's Employee Grievance MachineryRyiel LoveNo ratings yet

- Legal Issues For Legal Technique and Logic - JD 1BDocument3 pagesLegal Issues For Legal Technique and Logic - JD 1BkayeNo ratings yet

- Construction Project SpecificationsDocument191 pagesConstruction Project SpecificationstehtehtehNo ratings yet

- Cheng v. Sy, G.R. No. 174238, July 7, 2009: Rule 111Document4 pagesCheng v. Sy, G.R. No. 174238, July 7, 2009: Rule 111Faye Christine May AmacnaNo ratings yet

- PIDI v. NLRCDocument2 pagesPIDI v. NLRCLouie VenezuelaNo ratings yet

- Pre-Employment Undertaking & Declaration: Part-1: Applicant DetailsDocument3 pagesPre-Employment Undertaking & Declaration: Part-1: Applicant DetailsMAMATHANo ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument188 pagesF8 Workbook Questions & Solutions 1.1 PDFLinkon PeterNo ratings yet

- EC Safety Data Sheet: Armaflex HT625Document10 pagesEC Safety Data Sheet: Armaflex HT625Ferencz ZsoltNo ratings yet

- Well Services QHSE Standard 23 Guideline 12: Bull Plugs, Sensors, Sensor Wings, and Other Unions Inspection and TestDocument13 pagesWell Services QHSE Standard 23 Guideline 12: Bull Plugs, Sensors, Sensor Wings, and Other Unions Inspection and TestCiprianHnNo ratings yet

- LTD Salao v. SalaoDocument3 pagesLTD Salao v. SalaoademanabatNo ratings yet

- The Limitation Act, 1908 PDFDocument92 pagesThe Limitation Act, 1908 PDFMimi mekiNo ratings yet

- Pretrial Brief - Defendants Buhawe, Et AlDocument3 pagesPretrial Brief - Defendants Buhawe, Et AlJeddox La ZagaNo ratings yet

- Case Digest For Human Rights-2Document20 pagesCase Digest For Human Rights-2ADNo ratings yet

- Privileged Class DevianceDocument21 pagesPrivileged Class DevianceBharti dubeNo ratings yet

- Documents Services Building Code Compliance Certificate ApplicationDocument2 pagesDocuments Services Building Code Compliance Certificate ApplicationnathanhoughNo ratings yet

- Blank Letter Bank LetterDocument8 pagesBlank Letter Bank LetterBINGE TV EXCLUSIVENo ratings yet

- Itt NoticeDocument1 pageItt Noticeaftab khanNo ratings yet

- Political Sci NewDocument11 pagesPolitical Sci NewMAGOMU DAN DAVIDNo ratings yet

- Full Download Human Biology 13th Edition Mader Test BankDocument13 pagesFull Download Human Biology 13th Edition Mader Test Banksheathe.zebrinny.53vubg100% (24)

- Virm Light Vehicle Repair CertificationDocument134 pagesVirm Light Vehicle Repair CertificationMat TjsNo ratings yet

- Hijacking IC 814 Case StudyDocument24 pagesHijacking IC 814 Case StudyraaziqNo ratings yet

- Manual of OperationsDocument67 pagesManual of OperationsHana Tsukushi100% (1)

- People Vs MorenoDocument13 pagesPeople Vs MorenoMilette Abadilla AngelesNo ratings yet

- Feinberg, Joel - Harm To Others (1984)Document259 pagesFeinberg, Joel - Harm To Others (1984)Nicolas SepulvedaNo ratings yet

- D. Applicant-Owned: GREEN 7 - Manulearn MOCK ExamDocument23 pagesD. Applicant-Owned: GREEN 7 - Manulearn MOCK ExamAlron Dela Victoria AncogNo ratings yet

- Visa Check ListDocument27 pagesVisa Check ListChandrashekar Hosakere Matt100% (1)

- State and Its ElementsDocument33 pagesState and Its Elementsanzala noorNo ratings yet

- Readings in Philippine History ReviewerDocument3 pagesReadings in Philippine History ReviewerArjay Reyes Maligaya100% (1)