Professional Documents

Culture Documents

Stores and Spare Parts

Uploaded by

Walid SonjiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stores and Spare Parts

Uploaded by

Walid SonjiCopyright:

Available Formats

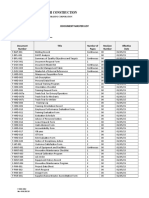

Stores & Spare Parts Audit Program

Workpaper Reference 1. Review the perpetual inventory records system to ensure: 1) an audit trial of transactions recorded is available, 2) input into the computer system is controlled, 3) significant items are reported on an exception basis, 4) results of cycle counts are recorded to the perpetual records, and 5) any alterations or changes are properly approved. 2. Evaluate the issues and reliability of perpetual inventory records in the overall materials management system which may include: Basis for cycle count. Aid in identifying surplus and obsolete inventory. Basis for issuance of purchase requisitions. Aid in production scheduling. Monetary as well as quantity control. Basis for calculating inventory restandardization. Reference in determining location of material. 3. Determine that employees maintaining stock records do not have conflicting duties. 4. Verify the accuracy of perpetual inventory records: a. Select a representative sample (at least 20) of source documents including; customer invoices, receiving reports, scrap tickets, production reports, stock orders, bills of lading and material requisitions. Trace to posting in records. b. Review routines over returned material for approvals, preparation of receiving reports, etc. and trace a number of items to perpetual records. c. Review routines related to stock transfers between stockrooms, warehouses, etc. and trace a number of items to perpetual records. d. Review alterations or adjustments to perpetual records for propriety and approval by supervisory personnel. Auditor

CH4

Workpaper Reference e. Investigate write-offs or adjustments. f. Test check footings. 5. Generally, movement from stores should be covered by proper authorization. Test 25 authorizations to posting to perpetual records and charging to appropriate jobs. 6. Perform test counts of at least 25 high dollar items to determine the accuracy of perpetual records. Prior to making test counts, ensure that proper cutoffs can be made for the recording of transactions. If material is shown as stored in several locations, ensure quantities at each location agree with the locator listing. 7. Randomly select 10 inventory locations and identify item and perform physical count. Trace results to perpetual records and determine item, quantity, and location agree. 8. Review results of recent cycle counts and verify that appropriate changes were made to the stock status. Obtain reasons for any items not adjusted. 9. If material is kept at outside locations (warehouses, vendors, customers, etc.) complete the following: a. Determine that material is in this category and what records are kept to control it. b. Review the method of periodic confirmation of this material. 10. Review the physical layout of the stores area. Determine the following: a. Whether inventories are stored in a systematic manner. b. Whether or not materials are under the direct control of storekeepers who are held responsible for quantities on hand. c. What controls there are over access to storage areas for persons other than storekeepers? d. The adequacy of the control procedures for goods returned by customers.

Auditor

CH5

Workpaper Reference 11. Review procedures and controls over requisitions and determine the following: a. Prepared by someone other than storekeepers. b. Signed by a duly authorized person whose signature and authority are known by the storekeepers. c. Controlled, e.g. by number, with all forms eventually being accounted for. d. Manually signed by person receiving the material. 12. Request the following reports from EDP Audit and use to review for possible obsolescence: a. Stores and spare parts by last issue date. ("CULSTISD") b. Stores and spare parts never issued. ("CULSTNEV") c. Stores and spare parts by last order date. ("CULSTORD") 13. Request the following reports from EDP Audit and use to review for possible valuation errors: a. Parts with average cost > last price paid by 10%. ("CULTYPEA") b. Parts with average cost < last price paid by 10%. ("CULTYPEB") c. Parts with negative quantities or values. ("CULTYPEN") d. Parts with zero units and a value. ("CULTYPEZ") e. Parts with units on hand, no extended value. ("CULUNTNC") 14. Review the most recent three months reconciliations between the stores and spare parts dollarization reports and the general ledger.

Auditor

CH6

You might also like

- Production Planning and Monitoring AuditDocument3 pagesProduction Planning and Monitoring Auditshiuh chyngNo ratings yet

- Audit Schedule - Department WiseDocument10 pagesAudit Schedule - Department WiseashishvaidNo ratings yet

- SM - ChecklistDocument17 pagesSM - ChecklistAdeline MokNo ratings yet

- 34 Internal Audit ChecklistDocument31 pages34 Internal Audit ChecklistMudit Kothari100% (3)

- Inventory Audit Work ProgramDocument19 pagesInventory Audit Work ProgramAdnan MohammedNo ratings yet

- Internal Audit of Procurement Activity - A Case StudyDocument5 pagesInternal Audit of Procurement Activity - A Case StudyGurvinder Mann Singh PradhanNo ratings yet

- Utilities Audit ChecklistDocument2 pagesUtilities Audit Checklistandruta1978100% (1)

- Production Audit ChecklistDocument2 pagesProduction Audit Checklistandruta197833% (3)

- T-ENG CardDocument14 pagesT-ENG CardViswaChaitanya NandigamNo ratings yet

- Internal Audit Planning and Scheduling Sample FormatDocument3 pagesInternal Audit Planning and Scheduling Sample Formatsameh100% (2)

- Internal Audit Checklist of Administration DepartmentDocument6 pagesInternal Audit Checklist of Administration DepartmentRojan ShresthaNo ratings yet

- Internal Audit CharterDocument7 pagesInternal Audit CharterSritrusta Sukaridhoto100% (1)

- INTERNAL AUDITS ENSURE QMS COMPLIANCEDocument2 pagesINTERNAL AUDITS ENSURE QMS COMPLIANCELuke J LandryNo ratings yet

- Procurement Audit SampleDocument13 pagesProcurement Audit SampleCyrile Dianne Therese Ablir-BaliolaNo ratings yet

- Fixed Asset VeificationDocument12 pagesFixed Asset Veificationnarasi64No ratings yet

- IA Audit Report - SampleDocument6 pagesIA Audit Report - SampleMounirDridi100% (1)

- Supplier Audit ChecklistDocument21 pagesSupplier Audit ChecklistAnonymous W2gdmMVhoM100% (2)

- Audit Objectives & Risks Work Done With Observations Observations Noted Management's Response ObjectiveDocument3 pagesAudit Objectives & Risks Work Done With Observations Observations Noted Management's Response Objectiveusmanafzalacca100% (2)

- Key Performance Indicators For Internal Audit FunctionDocument10 pagesKey Performance Indicators For Internal Audit FunctionarfianNo ratings yet

- Complete Warehouse Inventory Audit ChecklistDocument4 pagesComplete Warehouse Inventory Audit ChecklistClaire Charess AjiasNo ratings yet

- Internal Audit Charter and StandardsDocument7 pagesInternal Audit Charter and Standardssinra07No ratings yet

- Internal Audit Checklist PurchaseDocument4 pagesInternal Audit Checklist Purchasedhir.ankur100% (2)

- Internal Audit Annual Report and 2017 Audit Plan (PDFDrive)Document29 pagesInternal Audit Annual Report and 2017 Audit Plan (PDFDrive)samirNo ratings yet

- AUdit ReportDocument95 pagesAUdit ReportSASIKUMAR100% (1)

- The Biggest Internal Audit Challenges in The Next Five YearsDocument3 pagesThe Biggest Internal Audit Challenges in The Next Five YearsBagusNo ratings yet

- Risk Based Internal Auditing in Taiwanese Banking Industry Yung MingDocument40 pagesRisk Based Internal Auditing in Taiwanese Banking Industry Yung MingGaguk M. GupronNo ratings yet

- BASIC AUDIT PROGRAMDocument46 pagesBASIC AUDIT PROGRAMCA Gourav Jashnani67% (3)

- 3-YR Internal Audit PlanDocument9 pages3-YR Internal Audit PlanJb LavariasNo ratings yet

- Catella Bank Internal Audit Report 2015-3 - Branch in SwedenDocument14 pagesCatella Bank Internal Audit Report 2015-3 - Branch in Swedenmaryam100% (1)

- Internal Audit ChecklistDocument1 pageInternal Audit Checklistkarthik_ia2000No ratings yet

- Audit Methodology As Per ISO 9000:2000Document45 pagesAudit Methodology As Per ISO 9000:2000sbsharmaNo ratings yet

- Internal Audit ISO 9001-2008 Checklist 1-20-12Document43 pagesInternal Audit ISO 9001-2008 Checklist 1-20-12TravisNo ratings yet

- Stores and Spares Audit ChecklistDocument4 pagesStores and Spares Audit Checklistandruta197840% (5)

- Audit Checklist For ManufacturingDocument2 pagesAudit Checklist For ManufacturingRenganathan IyengarNo ratings yet

- Importance of Audit PlanningDocument12 pagesImportance of Audit PlanningRahul KadamNo ratings yet

- St. Paul Hospital of Tuguegarao, Inc.: Audit ProgramDocument4 pagesSt. Paul Hospital of Tuguegarao, Inc.: Audit ProgramDarlene Andres Ponce100% (1)

- Entity-Level Risk Assessment WorksheetsDocument26 pagesEntity-Level Risk Assessment WorksheetsChinh Lê ĐìnhNo ratings yet

- Internal Audit ChecklistDocument26 pagesInternal Audit Checklistjimmydomingojr100% (1)

- Process Audit QuestionsDocument8 pagesProcess Audit QuestionsTracy TreacherNo ratings yet

- Internal Audit Procedures ManualDocument11 pagesInternal Audit Procedures ManualLeizza Ni Gui DulaNo ratings yet

- Maintenance AuditDocument16 pagesMaintenance AuditJaikishan Kumaraswamy100% (1)

- EnergyAustralia NSW Internal Audit Form OptimizedDocument17 pagesEnergyAustralia NSW Internal Audit Form Optimizederrywiguna100% (1)

- Internal Control and Tests of Control For Inventory and Production CycleDocument6 pagesInternal Control and Tests of Control For Inventory and Production Cyclecriselda salazar100% (1)

- Steps of An Internal AuditDocument3 pagesSteps of An Internal AuditDownload100% (1)

- 9001 Planning Checklist - Production ProcessDocument14 pages9001 Planning Checklist - Production ProcessMowheadAdelNo ratings yet

- Internal Audit Plan - ExampleDocument11 pagesInternal Audit Plan - ExampleMA. CHRISTINA BUSAING100% (1)

- Audit procedures and documentationDocument15 pagesAudit procedures and documentationTaremba MushatiNo ratings yet

- IQA Checklist - SmpleDocument16 pagesIQA Checklist - SmpleHarits As Siddiq100% (1)

- I General: Internal Audit ChecklistDocument33 pagesI General: Internal Audit ChecklistHimanshu GaurNo ratings yet

- InternalAuditSOP 012413Document8 pagesInternalAuditSOP 012413zubair90No ratings yet

- Questionnaire For Internal AuditDocument3 pagesQuestionnaire For Internal Auditm2mpant100% (1)

- Vendor Registeration FormDocument6 pagesVendor Registeration FormParik AnandNo ratings yet

- Internal Controls QuestionnaireDocument5 pagesInternal Controls QuestionnaireCarlos Eduardo C. da SilvaNo ratings yet

- Accounting Controls: What Are Internal Controls and Why Are They Important?Document18 pagesAccounting Controls: What Are Internal Controls and Why Are They Important?sueernNo ratings yet

- Inventory Audit ProgramDocument7 pagesInventory Audit ProgramKevinNo ratings yet

- Audit Program Physical InventoryDocument7 pagesAudit Program Physical InventoryAditya Bist100% (3)

- InventoryDocument4 pagesInventoryPrio DebnathNo ratings yet

- Purchasing Cycle: PurposeDocument4 pagesPurchasing Cycle: PurposeEtnadia SuhartonoNo ratings yet

- Audit and AssuranceDocument9 pagesAudit and Assurancej amadiNo ratings yet

- Audit of InventoriesDocument35 pagesAudit of InventoriesPau100% (2)

- Escalators and Moving Walkways: Safety Standards ForDocument4 pagesEscalators and Moving Walkways: Safety Standards ForWalid SonjiNo ratings yet

- cd3b76aa219f5c926732d143a3db0a9fDocument143 pagescd3b76aa219f5c926732d143a3db0a9fWalid SonjiNo ratings yet

- Ch13 ISO 9000Document19 pagesCh13 ISO 9000Walid SonjiNo ratings yet

- 9 Reference Documents: 9-1 Office Extension WorksDocument2 pages9 Reference Documents: 9-1 Office Extension WorksWalid SonjiNo ratings yet

- Ch02 Quality AdvocatesDocument14 pagesCh02 Quality AdvocatesWalid SonjiNo ratings yet

- 2 Description of The WorksDocument2 pages2 Description of The WorksWalid SonjiNo ratings yet

- Ch03 Problem SolvingDocument16 pagesCh03 Problem SolvingWalid SonjiNo ratings yet

- Waste Water Treatment PlantsDocument234 pagesWaste Water Treatment PlantsAmr Adel Saleh100% (3)

- Ch04 MeasurementsDocument14 pagesCh04 MeasurementsWalid SonjiNo ratings yet

- Priority Area ChecklistDocument20 pagesPriority Area ChecklistWalid SonjiNo ratings yet

- Areanotes1Quality Manual and Document Levels Level 1: Quality Manual Addresses Each Iso RequirementDocument3 pagesAreanotes1Quality Manual and Document Levels Level 1: Quality Manual Addresses Each Iso RequirementWalid SonjiNo ratings yet

- 2 Health and SafetyDocument4 pages2 Health and SafetyWalid SonjiNo ratings yet

- 17 - CHPT C2 - 01 26 11Document56 pages17 - CHPT C2 - 01 26 11Walid SonjiNo ratings yet

- 5 Hazardous MaterialsDocument1 page5 Hazardous MaterialsWalid SonjiNo ratings yet

- 4 Key Structural PrinciplesDocument1 page4 Key Structural PrinciplesWalid SonjiNo ratings yet

- 6 Removal and DismantlingDocument2 pages6 Removal and DismantlingWalid SonjiNo ratings yet

- 3 Residual RisksDocument2 pages3 Residual RisksWalid SonjiNo ratings yet

- ChyDocument17 pagesChyWalid SonjiNo ratings yet

- 5 Maintenance ProceduresDocument2 pages5 Maintenance ProceduresWalid Sonji100% (1)

- Operation and Main Aux GensetDocument123 pagesOperation and Main Aux GensetMd Rodi BidinNo ratings yet

- Step 19Document5 pagesStep 19Walid SonjiNo ratings yet

- FB 3Document8 pagesFB 3Walid SonjiNo ratings yet

- 1 Introduction and GuideDocument14 pages1 Introduction and GuideWalid SonjiNo ratings yet

- Volkswagen Touareg Maintenance Guide - Lubricate Turbocharger LinkagesDocument105 pagesVolkswagen Touareg Maintenance Guide - Lubricate Turbocharger LinkagesWalid Sonji100% (4)

- Priority Area ChecklistDocument20 pagesPriority Area ChecklistWalid SonjiNo ratings yet

- 1NZ FE EngineDocument59 pages1NZ FE Engineimtiaz_masud_175% (4)

- Barge Safety and Health RequirementsDocument977 pagesBarge Safety and Health RequirementsDockDiverNo ratings yet

- Commercial Fire Safety ChecklistDocument3 pagesCommercial Fire Safety ChecklistWalid SonjiNo ratings yet

- MATRIX CLF Installation and Operation ManualDocument38 pagesMATRIX CLF Installation and Operation ManualWalid SonjiNo ratings yet

- Huawei CommandsDocument2 pagesHuawei CommandsRade Pralica100% (1)

- L6 Systems of InequalitiesDocument25 pagesL6 Systems of InequalitiesFlorence FlorendoNo ratings yet

- GHG Protocol Guidance for Assessing Emissions from ICT Products and ServicesDocument6 pagesGHG Protocol Guidance for Assessing Emissions from ICT Products and ServicesNikhil AnandNo ratings yet

- UsbFix ReportDocument10 pagesUsbFix Reporttufan demirelNo ratings yet

- Planning Advertising Campaign to Maximize New CustomersDocument4 pagesPlanning Advertising Campaign to Maximize New CustomersAdmin0% (1)

- hw2 AnsDocument5 pageshw2 AnsJIBRAN AHMEDNo ratings yet

- VW-Audi Remote Key AdaptationDocument16 pagesVW-Audi Remote Key AdaptationBrian_denhaagNo ratings yet

- IGCSE Matrices Index:: Please Click On The Question Number You WantDocument17 pagesIGCSE Matrices Index:: Please Click On The Question Number You WantNad HsNo ratings yet

- OTRSMaster SlaveDocument22 pagesOTRSMaster Slaveing_llenkiNo ratings yet

- Hotel Management Source CodeDocument11 pagesHotel Management Source CodeDARK JOKERNo ratings yet

- Basic Computer Organization and Design Lecture OverviewDocument38 pagesBasic Computer Organization and Design Lecture OverviewTaranvir KaurNo ratings yet

- Auto LispDocument22 pagesAuto LispWin ThanNo ratings yet

- 7cb VBDocument36 pages7cb VBGunjan GuptaNo ratings yet

- Chapter 4 Unsupervised Learning Dimensionality Reduction and Learning TheoryDocument32 pagesChapter 4 Unsupervised Learning Dimensionality Reduction and Learning TheoryShefali DigikarNo ratings yet

- InstnwndDocument284 pagesInstnwndjwooNo ratings yet

- PDFDocument19 pagesPDFपोटैटो शर्मा0% (1)

- Viewshed Calculation AlgoDocument8 pagesViewshed Calculation AlgoYasirNo ratings yet

- Computer Programming Using C & Numerical MethodsDocument1 pageComputer Programming Using C & Numerical MethodsSanjana XavierNo ratings yet

- Storage Classes in PL1Document12 pagesStorage Classes in PL1Shaswata Choudhury100% (1)

- C Book IndexDocument4 pagesC Book IndexAtinderpal SinghNo ratings yet

- Project Report Course Registration SystemDocument70 pagesProject Report Course Registration SystemImran Khan Mewati36% (14)

- Bhaardwaj New ResumeDocument3 pagesBhaardwaj New Resumek deviNo ratings yet

- Object Oriented Programming C++ GuideDocument43 pagesObject Oriented Programming C++ GuideSumant LuharNo ratings yet

- PhonologicalDocument363 pagesPhonologicalakbar mekka hamiduNo ratings yet

- Scilab Recipe 3 - Xcos Blocks Seasoning - Scilab NinjaDocument8 pagesScilab Recipe 3 - Xcos Blocks Seasoning - Scilab NinjaWendell Kim LlanetaNo ratings yet

- GROUP 3 Image CompressionDocument31 pagesGROUP 3 Image CompressionPrayerNo ratings yet

- ME9F DocumentDocument8 pagesME9F DocumentSagnik ChakravartyNo ratings yet

- Reshma Resume RaysDocument5 pagesReshma Resume RaysReshmaNo ratings yet

- 01 Document MasterlistDocument3 pages01 Document MasterlistHorhe SmithNo ratings yet

- Scientist ProjectDocument1 pageScientist ProjectEamon BarkhordarianNo ratings yet