Professional Documents

Culture Documents

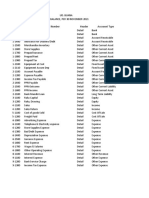

Financial Statements

Uploaded by

Shaheen MahmudCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statements

Uploaded by

Shaheen MahmudCopyright:

Available Formats

Financial Statements and its components: A financial statement is a formal record of the financial activities of a business, person, or other

entity. For a business enterprise, all the relevant financial information, presented in a structured manner and in a form easy to understand, are called the financial statements. They typically include four basic financial statements, accompanied by a management discussion and analysis: i) Statement of Financial Position: also referred to as a balance sheet, reports on a company's assets, liabilities, and ownership equity at a given point in time. An Interpretation of the balance sheet is that on one side are the assets that have been purchased to be used to increase the profit of the firm. The other side indicates how these assets were acquired, either by borrowing or by investing the owners money. ii) Statement of Comprehensive Income: also referred to as Profit and Loss statement (or a "P&L"), reports on a company's income, expenses, and profits over a period of time. A Profit & Loss statement provides information on the operation of the enterprise. These include sale and the various expenses incurred during the processing state. iii) Statement of Changes in Equity: explains the changes of the company's equity throughout the reporting period. iv) Statement of cash flows:statement of cash flows provides a summary of the firms operating, investment, and financing cash flows and reconciles them with changes in its cash and marketable securities during the period. v) Notes & disclosures:includes a summary of significant accounting policies and other explanatory notes.The notes typically describe each item on the balance sheet, income statement and cash flow statement in further detail. Notes to financial statements are considered an integral part of the financial statements. The purpose of Financial Statements: The financial statements are a structured representation of financial position andfinancial performance of the entity. The objective of financial statements information is to provide information about the financial position, financial performance and cash flows of the entity; that is useful to a wide variety of users to take their economic decisions. The financial statements also show the results of managements stewardship of the resources entrusted to it. To meet this objective, the financial statements provide information about the following elements of the entity: (a) assets; (b) liabilities; (c) equity; (d) income and expenses including gains and losses; (e) contributions by and distributions to owners in their capacity as owners; (f) cash flows. This information, along with that contained in the notes, will help users predict future cash flows, and in particular, their timing and certainty. Importance of financial statements: The information given in the financial statements is very useful to a number of parties as given bellow: 1) Owners: The owners provide funds for the operations of a business and they want to know whether their funds are being properly utilized or not. The financial statements prepared from time to time satisfy their curiosity. 2) Creditors: Creditors want to know the financial position of a concern before giving loans on granting credit. The financial statements help them in judging such position. 3) Investors: Prospective investors, who want to invest money in a firm, would like to make an analysis of the financial statements of that firm to know how safe proposed investment will be. 4) Employees: Employees are interested in the financial position of a concern they serve, particularly when payment of bonus depends upon the size of the profits earned. They would like to know that the bonus being paid to them is correct; so they become interested in the preparation of correct profit and loss account. 5) Government: Governments are interested in the financial statements because they reflect the earnings for a particular period for purposes of taxation. 6) Research

Scholars: The financial statements, being a mirror of the financial position of a firm, are of immense value to the research scholar who wants to make a study into financial operations of a particular firm. 7) Consumers: Consumers are interested in the establishment of good accounting control so that cost of production may be reduced with the resultant reduction of the prices of goods they buy. 8) Managers: Management is the art of getting things done through others. This requires that the subordinates are doing work properly. Financial statements are an aid in this respect because they serve the manager is appraising the performance of the subordinates. Limitations of financial statements: The following are the main limitations of the financial statements: 1) Interim and not final reports: FSs do not depict the exact position and are essentially interim reports. The exact position can be only known if the business is closed. 2) Lack of precision and definiteness:Financial statements may not be realistic because these are prepared by following certain basic concepts and conventions. For example, going concern concept gives us an idea that business will continue and assets are to be recorded at cost but the book value at which the asset is shown may not be actually realizable. 3) Lack of objective judgment: FSs are influenced by the personal judgment of the accountant. He may select any method of depreciation, valuation of stock, amortization of fixed assets and treatment of deferred revenue expenditure. Such judgment if based on integrity and competency of the accountant will definitely affect the preparation of the financial statements. 4) Record only monetary facts: FSs disclose only monetary facts, i.e., those transactions recorded in the books of accounts which can be measured in monetary terms. 5) Historical in nature: These statements are drawn after the actual happening of the events. They attempt to present a view of the past performance and have nothing to do with the accounting for the future as the modern management deserves. 6) Artificial view:These statements do not give a real and correct report about the worth of the assets and their loss of value as these are shown on historical cost basis. Thus these statements provide artificial view as market or replacement value and the effect of the changes in the price level are completely ignored. 7) Scope of manipulations:These statements are sometimes prepared according to the needs of the situation or the whims of the management. For this reason under or over valuation of inventory, over or under charge of depreciation, excessive or inadequate provision for anticipated losses and other such manipulations may be resorted to. Window dressing also may occur. 8) Inadequate information:There are many parties who are interested in the information given in the financial statements but their objectives and requirements differ. The financial statements under the provisions of the Companies Act fail to meet the needs of all. The above limitations of FSs must be taken into consideration before making their analysis. Main features of the entitys financial performance and position: Many entities present, outside the financial statements, a financial reviewby management that describes and explains the main features of the entitys financial performance and position, and the principal uncertainties it faces. This report may include a review of: (a) The main factors and influences determining financial performance, including changes in the environment in which the entity operates, the entitys response that to those changes and their effect, and the entitys policy for investment to maintain and enhance financial performance, including its dividend policy; (b) The entitys sources of funding and its targeted ratio of liabilities to equity; (c) The entitys resources not recognized in the statement of financial positionin accordance with IFRS. What is asset? What are the criteria to be an asset? Asset:Asset is a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.

There are 3 criteria to be an asset: i) Future economic benefits (received):The probable present benefit involves a capacity, singly or in combination with other assets, in the case of profit oriented enterprises, to contribute directly or indirectly to future net cash flows, and, in the case of not-for-profit organizations, to provide services. ii) Controlled by a particular entity:The entity can control access to the benefit. iii) Past transaction or events: The transaction or event giving rise to the entity's right to, or control of, the benefit has already occurred. @ Employees are not considered as assets, like machinery is, even though they are capable of generating future economic benefits. This is because an entity does not have sufficient control over its employees to satisfy the Framework's definition of an asset. What is liability and criterion to be a liability? Liability:It is a company's legal debts or obligations that arise during the course of business operations. Liabilities are settled over time through the transfer of economic benefits including money, goods or services. Three criteria to be a liability: i) Future economic benefit given ii) Obligation of the company iii) Past transaction or events. Materiality: Omissions and misstatements of items are material if they could, individually or collectively; influence the economic decisions that users make on the basis of the financial statements. Materiality depends on the size and nature of the omissions and misstatements judged in the surrounding circumstances. The size or nature of the item, or a combination of both, could be the determining factor. What is comprehensive income? Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available for sale securities and foreign currency translation gains or losses. For example, assume that the actual value of land is Tk. 40000 and market value is Tk. 100000. Company shows only Tk. 40000 in Financial Statement. Additional Tk. 60000 is unrealized and it is comprehensive income for the company. The difference between net income and comprehensive income is known as other comprehensive income.Net income is reported on the income statement and is included in the retained earnings section of stockholders equity. Other comprehensive income items are not reported on the income statement, and are included in the accumulated other comprehensive income section of stockholders equity. The components of other comprehensive income include: i) Changes in revaluation surplus ii) Actuarial gains and losses on defined benefit plans iii) Gains and losses arising from translating the financial statements of a foreign operation iv) Gains and losses on remeasuring available-for-sale financial assets v) The effective portion of gains and losses on hedging instruments in a cash flow hedge. Users of financial statements/FS analysis: Financial statements are intended to be understandable by readers who have "a reasonable knowledge of business and economic activities and accounting and who are willing to study the information diligently." There are different kinds of users of financial statements. The various users of financial statements are classified and detailed as follows: A. Internal Users:The internal users of financial statements are individuals who have direct bearing with the organization. They may include: 1) Managers and Owners: For the smooth operation of the organization, the managers and owners need the financial reports essential to make business decisions. So as to provide a more comprehensive view of the financial position of an organization, financial analysis is performed with the information supplied in the financial statements. The financial statement is used to formulate contractual terms between the company and other organizations. 2) Employees: The financial reports or the financial statements are of immense use to the employees of the company for making

collective bargaining agreements. Such statements are used for discussing matters of promotion, rankings and salary hike. B. External Users: The external users comprise of: 1) Institutional Investors: The external users of financial statements are basically the investors who use the financial statements to assess the financial strength of a company. This would help them to make logical investment decisions. 2) Financial Institutions: The users of financial statements are also the different financial institutions like banks and other lending institutions who decide whether to help the company with working capital or to issue debt security to it. 3) Government: The financial statements of different companies are also used by the government to analyze whether the tax paid by them is accurate and is in line with their financial strength. 4) Vendors: The vendors who extend credit to a business require financial statements to assess the creditworthiness of the business. 5) General Mass and Media: The common people as well as media also make part of the users of financial statements. Parties Demanding financial Statement Information: A. Shareholders, Investors, and Security Analysts: Shareholders and other investors are major recipients of the financial statements of corporations. The decisions made by these parties include not only which shares to buy, retain, or sell, but also the timing of purchases or sales of those shares. Typically, these decisions will have either an investment focus or a stewardship focus; in some cases, both will occur simultaneously. In an investment focus, the emphasis is on choosing a portfolio of securities that is consistent with the preferences of the investor for risk, return, dividend yield, liquidity, and so on. In decisions with a stewardship focus, the concern of shareholders is with monitoring the behavior of management and attempting to affect its behavior in a way deemed appropriate. B. Managers: One source of the demand for financial statement information by managers arises from contracts that include provisions based on financial statement variables. One example is management incentive contracts. C. Employees: The demand for financial statements by employees can arise from several motivations. Employees have a vested interest in the continued and profitable operations of their firm; financial statements are an important source of information about current potential future profitability and solvency. Employees can also demand financial statements to monitor the viability of their pension plans. D. Lenders and Other Suppliers: In the ongoing relationship that exists between suppliers and a firm, financial statements can play several roles. E. Customers: Customers have a vested interest in monitoring the financial viability of firms with which they have long-term relationships. This interest is likely to increase when concerns develop about possible bankruptcy. F. Government/Regulatory Agencies:Demand for financial statements information by government/regulatory agencies can arise in a diverse set of areas such as revenue rising, govt. contracting, rate determination, regulatory intervention etc. G. Other Parties: The set of parties that make demands on corporation is open-ended. Diverse parties such as academics, environmental protection organizations, and other special interest lobbying groups approach corporations for details relating to their financial and other affairs. Factors affecting demand for financial statement information: The demand for financial statement information is derived from the improvement in decision making or monitoring that arises with its use. Factors that determine whether such an improvement is expected to occur include: 1) The potential of the information to reduce uncertainty: An important element in many decisions is uncertainty. For instance, there may be uncertainty over the future profitability of

a firm, the quality of its management, or ability of a supplier to fulfill obligations under a warranty agreement. In this context, there are two related issues: a) What level of uncertainty is faced by the decision maker and what are the expected gains from reducing it? b) What role can financial statement information play in revising beliefs about uncertainty? In some situations, financial statements can play an important role in revising such situations. In other situations, uncertainty may arise from sources about which financial statements provide little insight. 2) Availability of competing information sources: Financial statement information is one of many information sources available to the parties outlined in the previous point. Other sources include: a) company-oriented releases such as dividend releases and production report b) industry-oriented releases such as new wage contracts with unions, and c) economy-oriented releases such as money supply announcements. There are several grounds on which financial statements may have a comparative advantage over these competing sources: (i) Financial statements have a comparative advantage vis-vis other information sources as they report the variable of direct interest to the parties to the contract. ii) Financial statement information is a more reliable information source. iii) It is a lower cost information source. iv) Financial statement information is a lower-cost information source. Difference between Fundamental and technical analysis: 1) A fundamental analysis approach examines firm, industry and economy-related information. An important aspect is predicting the timing, amounts and uncertainties of the future cash flows of the firm. In contrast, technical analysis aims to detect mispriced securities by examining trends in security prices, security trading volume, and other related variables. 2) Financial statements play a major role in fundamental approach/ financial statement information typically is not examined. 3) Fundamental analysts look at economic factors affecting a stock. On the other hand, technical analysts will rely on the price movements of the stocks. 4) Fundamental analysts will take a relatively long-term approach to stock trading than Technical analysts. 5) Fundamental analysts usually average down when there's value. Technical analysts usually average up on breakouts. 6) Fundamental analysis tries to estimate the intrinsic value of a security by evaluating the fundamental factors affecting the economy, industry and company. Technical analysis studies the price and volume movements in the market and by carefully examining the pattern of these movements, the future price of the stock is predicted. 7) FA is a tedious process and takes a rather long time to complete the process/ Since the whole process involves much less time and data analysis, compared to fundamental analysis, it facilitates timely decision. 8) Fundamental analysis helps in identifying undervalued or overvalued securities/ Technical analysis helps in identifying the best timing of an investment. What is agency problem? The agency problem usually refers to a conflict of interest between a company's management and the company's stockholders. The manager, acting as the agent for the shareholders, or principals, is supposed to make decisions that will maximize shareholder wealth. However, it is in the manager's own best interest to maximize his own wealth. While it is not possible to eliminate the agency problem completely, the manager can be motivated to act in the shareholders' best interests through incentives such as performance-based compensation, direct influence by shareholders, the threat of firing and the threat of takeovers.

Conflicts among Diverse Parties: Users of financial data have diversity of interests. These interests sometimes conflict. 1) Owners/Shareholders: The interest of these parties in financial statement information lies in the fact that it is their money that is invested in the firm. They would like to ensure that they are getting a good return on their investment. This is assessed by how much profit the firm is making and whether their investment is increasing in value. For shareholders in companies this means they will get good dividend and the market value of their shares will increase and they can make capital gains if these were sold. 2) Management:They are responsible to the owners/shareholders in carrying out policies and directives, and in running the business efficiently and effectively. Theyhowever, need to be paid well and this increases expenses and thus reduces returns to shareholders. Banks/Loan companies: This group is interested not only in the firm's profitability but also in its ability to repay loans. Managers would prefer using loaned funds for a longer period. 3) Employees:They are part of the organization and feel that their efforts contributed to the firm's profits. They would therefore prefer to be given bonuses and salary increases. This also increases expenses to the firm. 4) Suppliers:Suppliers usually extend credit to the firm for goods supplied and they want to be assured of timely payments of accounts due. Their interest will be similar to that of the banks and loan companies. 5) Prospective Investors/Analysts:These are interested in a firm's profitability and potential for growth. Prospective investors rely on financial statements information in making their investment decisions. In giving advice to prospective and existing investors, analysts also make use of financial statements information. 6) Government:Various ministries and departments have interest in the firm's payments of taxes. Also see the enactment of laws for the industry and provision of social services to the public. The government may also want to ensure that the firm complies with laws on, for example, wage payments and employee benefits. Stewardship: Stewardship refers to the responsibility that companies have to understand and manage their impacts on the environment in any number of ways. Practicing stewardship can help a business find sustainable practices, improve its reputation among consumers and even save money. Math: The plan requires a minimum 2.3% pre-tax return on sales before any profits are shared. After the minimum return is reached, the total profit share is equal to the sum of the following calculations: 1) 10% profits above the minimum 2.3% return on sales, but below a 4.6% return on sales; 2) plus 12.5% profits above a 4.6% return on sales, but below a 6.9% return on sales; 3) plus 15% of profits above a 6.9% return on sales. Profits = $1.8 billion, Sales = $ 36 billion Return on sales = $1.8 billion/$36 billion = 5% Minimum return = 36 billion x 2.3% = 0.828 billion = 828 million [As 1000 million = 1 billion] Total profit share: (36 billion x 4.6% - 36 billion x 2.3%) x 10% = 828 million x 10% = 82.8 million Plus (36 billion x 5% - 36 billion x 4.6%) x 12.5% = 144 million x 12.5% = 18 million Total profit share = (82.8 + 18) = 100.8 million

You might also like

- Group 7 Section BDocument25 pagesGroup 7 Section BShaheen MahmudNo ratings yet

- Statistical InformationDocument1 pageStatistical InformationShaheen MahmudNo ratings yet

- DocDocument1 pageDocShaheen MahmudNo ratings yet

- CSR in Bangladesh BankingDocument3 pagesCSR in Bangladesh BankingShaheen MahmudNo ratings yet

- Guide EngDocument219 pagesGuide EngShaheen MahmudNo ratings yet

- Bank Credit Trends in BangladeshDocument259 pagesBank Credit Trends in BangladeshShaheen MahmudNo ratings yet

- Succession Planning Ensures Optimum ProductivityDocument12 pagesSuccession Planning Ensures Optimum ProductivityShaheen MahmudNo ratings yet

- Accrual PrincipleDocument3 pagesAccrual PrincipleShaheen MahmudNo ratings yet

- Phrase and IdiomsDocument14 pagesPhrase and IdiomsShaheen MahmudNo ratings yet

- HRMDocument57 pagesHRMShaheen MahmudNo ratings yet

- Final ReportDocument210 pagesFinal ReportShaheen MahmudNo ratings yet

- Report For SirDocument57 pagesReport For SirMostafizur RahmanNo ratings yet

- Report For SirDocument57 pagesReport For SirMostafizur RahmanNo ratings yet

- AssumptionsDocument3 pagesAssumptionsShaheen MahmudNo ratings yet

- Android Tutorial PDFDocument34 pagesAndroid Tutorial PDFThế AnhNo ratings yet

- OrganogramDocument1 pageOrganogramShaheen MahmudNo ratings yet

- Managerial AssaignmentDocument20 pagesManagerial AssaignmentShaheen MahmudNo ratings yet

- Bank Head Office AddressesDocument6 pagesBank Head Office AddressesShaheen MahmudNo ratings yet

- Job Circular of Different OrganizationDocument1 pageJob Circular of Different OrganizationShaheen MahmudNo ratings yet

- OMDocument8 pagesOMShaheen MahmudNo ratings yet

- Annual Report ComparisonDocument7 pagesAnnual Report ComparisonShaheen MahmudNo ratings yet

- Slide of ProductivityDocument15 pagesSlide of ProductivityShaheen MahmudNo ratings yet

- Responsibility AccountingDocument39 pagesResponsibility AccountingShaheen MahmudNo ratings yet

- Last Four Years Activities of BKBDocument4 pagesLast Four Years Activities of BKBShaheen MahmudNo ratings yet

- Operations ManagementDocument175 pagesOperations ManagementAnurag Saikia100% (2)

- MBA SyllabusDocument18 pagesMBA SyllabusShaheen MahmudNo ratings yet

- Target Market Segmentation and Positioning StrategiesDocument5 pagesTarget Market Segmentation and Positioning StrategiesShaheen MahmudNo ratings yet

- DocumentDocument1 pageDocumentShaheen MahmudNo ratings yet

- Transfer PricingDocument17 pagesTransfer PricingShaheen MahmudNo ratings yet

- College LevelDocument42 pagesCollege LevelShaheen MahmudNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter Consignment For B Com Ist YrDocument5 pagesChapter Consignment For B Com Ist YrhanumanthaiahgowdaNo ratings yet

- Financial ManagementDocument96 pagesFinancial ManagementAngelaMariePeñarandaNo ratings yet

- ChapterDocument3 pagesChapterLê UyênNo ratings yet

- Bir - Train Tot - Transfer TaxesDocument14 pagesBir - Train Tot - Transfer TaxesGlo GanzonNo ratings yet

- Project ManagementDocument10 pagesProject ManagementcleousNo ratings yet

- Department of Education Region III Schools Division of Zambales Municipality of Sta. CruzDocument5 pagesDepartment of Education Region III Schools Division of Zambales Municipality of Sta. CruzNhatz Gallosa MarticioNo ratings yet

- Case Study AUSCISEDocument2 pagesCase Study AUSCISEsharielles /No ratings yet

- Pairs Trading Cointegration ApproachDocument82 pagesPairs Trading Cointegration Approachalexa_sherpyNo ratings yet

- Multiple Choice Questions on Accounting FundamentalsDocument10 pagesMultiple Choice Questions on Accounting FundamentalsChinmay Sirasiya (che3kuu)No ratings yet

- Project Financial AnalysisDocument79 pagesProject Financial AnalysisAngel CastilloNo ratings yet

- PERE - Mar24 22 29Document8 pagesPERE - Mar24 22 29simblante.nl166No ratings yet

- TOV - Buyout Millionaires LaunchDocument45 pagesTOV - Buyout Millionaires LaunchVic SpeaksNo ratings yet

- Knust Thesis TopicsDocument5 pagesKnust Thesis TopicsSteven Wallach100% (1)

- Marcellus Little-Champs Presentation DIRECTDocument19 pagesMarcellus Little-Champs Presentation DIRECTBijoy RaghavanNo ratings yet

- ABM - Specialized Subject: Fundamentals of Accountancy, Business and Management 1Document14 pagesABM - Specialized Subject: Fundamentals of Accountancy, Business and Management 1Jupiter Whiteside100% (6)

- Cindy MYOB 2Document1 pageCindy MYOB 2SMK NusantaraNo ratings yet

- Guide To Retail Math Key Formulas PDFDocument1 pageGuide To Retail Math Key Formulas PDFYusuf KandemirNo ratings yet

- Jaiib Previous Year Question PapersDocument3 pagesJaiib Previous Year Question PapersAbhijeet RawatNo ratings yet

- Upgrade MID Non HNW Classic Customer Version PDFDocument2 pagesUpgrade MID Non HNW Classic Customer Version PDFRamboNo ratings yet

- L.3 (Indemnity & Guarantee, Bailment & Pledge)Document16 pagesL.3 (Indemnity & Guarantee, Bailment & Pledge)nomanashrafNo ratings yet

- NOTESDocument12 pagesNOTESBhea Irish Joy BuenaflorNo ratings yet

- Mba Projects ListDocument22 pagesMba Projects ListPayal MishraNo ratings yet

- DBP v. Arcilla Ruling on Loan Disclosure ComplianceDocument3 pagesDBP v. Arcilla Ruling on Loan Disclosure ComplianceKarenliambrycejego RagragioNo ratings yet

- Inventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialDocument5 pagesInventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialMimiNo ratings yet

- Investor Prospectus QuinateDocument9 pagesInvestor Prospectus QuinateRichard WestermannNo ratings yet

- Reformulated Chatbot Framework: 1. Account ManagementDocument2 pagesReformulated Chatbot Framework: 1. Account Managementakash paulNo ratings yet

- FADocument46 pagesFANishant JainNo ratings yet

- Intengan v. CA DigestDocument2 pagesIntengan v. CA DigestCaitlin KintanarNo ratings yet

- TerraPower Case PDFDocument7 pagesTerraPower Case PDFKaustav DeyNo ratings yet

- BRM ProjectDocument23 pagesBRM ProjectimaalNo ratings yet