Professional Documents

Culture Documents

CH 11

Uploaded by

amu_scribdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 11

Uploaded by

amu_scribdCopyright:

Available Formats

Depreciation- accounting process of allocating the cost of the tangible asset to expense in a systematic and rational manner- to those

e periods expected to benefit from the use of the asset. Why done? Value of asset may fluctuate between time bought and sold or junked. Measuring these interim period values wont give objective results. Hence cos. do not attempt to value asset at fair value between acquisition and disposition. Accounting principle that it fulfillsThe cost allocation approach fulfills- Matching principle as costs are matched with the revenues Cos use this because uncertainties in fair value are diff to measure. Terms used:Depreciation- writing off the costs of long-lived assets Depletion- reduction in the cost of natural resources Amortization- Expiration of the intangible assets like Patents and copyrights DEPRECIATION PROCESS Imp to know: 1) depreciable base 2) useful life 3) method of deprn. Deprn. base function of 2 factors a) original cost b) salvage value = cost- salvage value

Salvage value is the estimated amount that will be received at the time the asset is sold or removed from service. There is a diff between ECONOMIC life and PHYSICAL life of an asset. These two factors affect the determination of useful life of an asset . Economic factors - inadequacy, supersession or obsolescence Phy factors- wear and tear, decay and casualties that make it difficult for the asset to perform indefinitely. *Whenever physical factor of the asset primarily determine useful life, maintenance plays a very imp role. Other ways to determine useful life: 1) based on past experience with same /similar asset 2) sophisticated statistical methods 3) arbitrary selection 4) technological factors- where research and innovation are prominent What does GAAP require in regard to deprn method a co. uses? It should be rational and systematic

DEPRECIATION METHODS: 1) Straight line 2) Activity method Accelerated methods: 3) Sum of digits 4) Double declining Special methods: 5) Group & composite methods 6) Hybrid & combination methods

Straight line method Considers deprn as a function of time rather than usage. Used because of its simplicity, most often conceptually appropriate too Major objection: It assumes that the assets economic usefulness remains same each year. AND repair & Maint. Exp is the same each period. Other objection: Distortion occurs in determining the rate of return analysis Cost - salvage value depreciable base ( we want to depreciate that portion of cost) Useful life @ end of assets useful life, Book value = Salvage value We estimated what the asset would fetch at the time of disposaland hence the remaining part of the cost is being depreciated. Salvage value also called: Scrap value, residual value, recycle value or end of life sales value Activity method Also called variable charge or units of production method Considers deprn as a function of usage or productivity and NOT of time. Co considers the useful life in terms of Either output or input measure Major limitation: method is inappropriate where deprn is a function of time Also difficult in estimating the output /input units Best used when: loss of service results from the activity or productivity- this method best matched the expenses with the revenues of the period Cos that desire low deprn during period of low productivity either adopt of switch to activity method 2 steps- first calculate deprn rate (cost-salvage)/units next rate X units in this period

Decreasing charge methods Provides for higher deprn in the earlier years and lower later Why this method? Rationale is that cos should charge more deprn in the earlier years because the asset is more productive in its earlier years. Also his method provides a CONSTANT COST because the deprn charge is lower in the later periods, when the repair & Maint. Cost goes higher. Two methods: sum of years digits: no. of yrs. of useful life remaining at beginning of yeardecreases Sum of digits of year constant n(n+1)/2use formula !!! At end of useful life, balance remaining = salvage value. Declining balance: Utilizes percentage that is some multiple of SL method. Unlike other methods, DDB method does not deduct salvage value in computing the depreciation base. The DDB rate is multiplied by BV @ beginning of each period. This fetches lower deprn charge towards the end Cos switch from DDB to SL method towards end of assets useful life- to ensure that they depreciate only up to the salvage value, and not more.

Special depreciation methods May be used when cos assets have unique characteristics or depends on nature of industry. 2 methods: group & composite method---used when assets have similar nature of have similar useful lives Composite approach - when assets have dissimilar nature & diff useful lives

Change in estimate No retrospective changes Changes only in current period an future Get V as on date and then calculate new deprn exp. If no method is mentioned, use SL.

IMPAIREMENTS When the carrying value of the asset is not recoverable, the company writes down its asset to its fair value. This write off Impairment Situations in which impairment occurs: a) When there is decrease in market value of asset b) There is significant change in the way the asset is going to be used c) There are legal factors affecting the way the business functions d) When more cost is accumulated than originally expected e) When continuing future losses are forecasted form the use of the asset To see if impairment has occurred, 2 steps: 1) Recoverability test: determine whether impairment or not Co. will estimate future C/f undiscounted. Compare that with CV If CV> future c/f impairment YES 2) FV test: determine how much impairment Compare CV with FV If CV> FV then CV-FV= impairment los Journal entry: Loss due to impairment DR Accu. Deprn . CR GAAP versus IFRS: Reversal of impairment not allowed under IFRS allows reversal sometimes when the US GAAP underlying economic conditions have GAAP appears more conservative here changed US GAAP follows 2 step process IFRS follows FV comparison step 1) comparing CV to future undiscounted onlyCV compared to lesser amount. C/f which can still be high IFRS appears more conservative here GAAP more conservative in AFTERFACT IFRS more conservative in TESTING reversal It only appears that one may be more conservative than the other. But it differs in context.

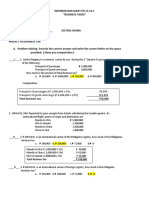

Example: Cost 9000k Accu deprn 1000k Exepected future C/f 7000k Fair value 4400k As of Dec 2012 the remaining useful lie was 4 years 1) Journal for impairment in 2012 if any 2) Journal for depreciation exp 2013 3) FV of asset revised to 5100k on Dec 31 2013. Journal entry to record increase in FV Carrying value = cost- accu deprn = 9000k-1000k=8000k Test 1: recoverability test CV versus future C/F 8000k versus 7000k CV> future C/f Therefore Impairment has occurred. . .How much is the impairment loss? . Test 2: FV test: CV versus fair value 9000k-1000k=8000k versus 4400k CV-FV= 8000-4400k = 3600 Impairment loss: 3600 1) Journal for impairment in 2012 if any Loss due to impairmentDR..3600k Accu. Deprn. CR 3600k 2) Journal for depreciation exp 2013 Accumulated deprn at end of 2013= 1000k + 3600K =4600k BV at the end of 2013: 9000k-4600k=4400k Deprn for 2013: by SL method (4400-0)/4= 1100k Deprn expense..DR..1100k Accu deprn CR1100k 3) Revision in Fair value Not allowed under US GAAPno journal!

DEPLETION Use activity approach/ unit of production method Depletion is a function of the no. of units extracted during the period

Depletion for natural resources (also called wasting resources) They have 2 featuresa) They can be completely exhausted b) They can be replaced only by act of nature Establishing a Depletion base difficult. Includes: Acquisition cost Cost to acquire right to search undiscovered/already discovered resource Includes lease paid for property containing the resource Includes royalty paid to owner of property Exploration cost After acquiring right to search, actual process to search the resource If costs are substantial some companies capitalize the cost If cost to find resource is high and risk is uncertain most large co. expense it Development costs Includes tangible equipment cost and intangible development cost. Tangible costs include cost of all transportation and other heavy equipment needed to extract the resource and get it ready for market Because co can move equip from one place to another co normally do not include equipment costs in depletion base. Intangible development costs are considered part of depletion base. Restoration costs Costs to bring the land back to natural state after extraction has occurred.==> part of depletion base.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- auditing-CH 2 NotesDocument4 pagesauditing-CH 2 Notesamu_scribdNo ratings yet

- Chapter 1 - Test Bank Auditing UICDocument15 pagesChapter 1 - Test Bank Auditing UICLana Bustami100% (4)

- CH 11Document6 pagesCH 11amu_scribdNo ratings yet

- Chap 00183Document29 pagesChap 00183amu_scribdNo ratings yet

- Outline of Important Points For Chapter 13Document1 pageOutline of Important Points For Chapter 13amu_scribdNo ratings yet

- Chapter 11 Quiz Sect 903 SolutionsDocument4 pagesChapter 11 Quiz Sect 903 Solutionsamu_scribdNo ratings yet

- Chapter 17 OutlineDocument2 pagesChapter 17 Outlineamu_scribdNo ratings yet

- CH 1Document8 pagesCH 1amu_scribdNo ratings yet

- Solutions CH 18Document65 pagesSolutions CH 18amu_scribdNo ratings yet

- Chapter 12 in Class ProblemsDocument2 pagesChapter 12 in Class Problemsamu_scribdNo ratings yet

- auditing-CH 2 NotesDocument4 pagesauditing-CH 2 Notesamu_scribdNo ratings yet

- CH 3-AuditDocument2 pagesCH 3-Auditamu_scribdNo ratings yet

- Chapter 15 OutlineDocument2 pagesChapter 15 Outlineamu_scribdNo ratings yet

- Chapter 13 In-Class PracticeDocument3 pagesChapter 13 In-Class Practiceamu_scribdNo ratings yet

- Solutions CH 18Document65 pagesSolutions CH 18amu_scribdNo ratings yet

- US GAAP Vs IFRSDocument52 pagesUS GAAP Vs IFRSSumair ShahidNo ratings yet

- Chapter 10 Quiz SolutionsDocument3 pagesChapter 10 Quiz Solutionsamu_scribd100% (1)

- CH 12Document4 pagesCH 12amu_scribd100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 34 48 48 39 66 64 46 24 53 64 54 56 83 31 Total Result 442 268 710 38%Document89 pages34 48 48 39 66 64 46 24 53 64 54 56 83 31 Total Result 442 268 710 38%Agus MaulanaNo ratings yet

- Business Plan of Agricultural MechanizationDocument32 pagesBusiness Plan of Agricultural MechanizationTarik Kefale86% (90)

- Brand Management: Group 13 Procter & Gamble CompanyDocument11 pagesBrand Management: Group 13 Procter & Gamble CompanyAbhishekKumarNo ratings yet

- 1 - Understanding Marketing Management PDFDocument8 pages1 - Understanding Marketing Management PDFVincent CariñoNo ratings yet

- Human Resource ManagementDocument66 pagesHuman Resource ManagementMwanza MaliiNo ratings yet

- Foundations of Economics 6th Edition Bade Test Bank 1Document89 pagesFoundations of Economics 6th Edition Bade Test Bank 1james100% (39)

- Chapter 2 - External Environment AnalysisDocument23 pagesChapter 2 - External Environment Analysismuhammad naufalNo ratings yet

- Term Paper of Retail Management ON (Retail Store Business Plan in Chandhigarh)Document13 pagesTerm Paper of Retail Management ON (Retail Store Business Plan in Chandhigarh)10805997No ratings yet

- Instrument Loan Agreement FormDocument2 pagesInstrument Loan Agreement FormBrianNo ratings yet

- Yash - i5M&P - YASH KALA PGP 2021-23 BatchDocument5 pagesYash - i5M&P - YASH KALA PGP 2021-23 BatchkshiNo ratings yet

- Sudha Milk DairyDocument62 pagesSudha Milk Dairyimamitanand83% (6)

- The Complete Guide To Financial PlanningDocument160 pagesThe Complete Guide To Financial PlanningVikas Acharya100% (2)

- Case Study On The Rational of Multi-Channel Platform As A Management Information System in The Banking SectorDocument11 pagesCase Study On The Rational of Multi-Channel Platform As A Management Information System in The Banking SectorHurul AinNo ratings yet

- Trade Finance Presentation - 24-01-2024Document22 pagesTrade Finance Presentation - 24-01-2024Anup KhanalNo ratings yet

- Project in Business TaxDocument5 pagesProject in Business TaxJemalyn PiliNo ratings yet

- Discuss The Nexus Between Corporate Governance and Prevention of Corporate FraudDocument14 pagesDiscuss The Nexus Between Corporate Governance and Prevention of Corporate FraudLindiwe Makoni100% (4)

- MC SP Module 06 - Supply Planning Process DesignDocument44 pagesMC SP Module 06 - Supply Planning Process Designsamah sNo ratings yet

- Certificate of Residency Requirements For IndividualsDocument2 pagesCertificate of Residency Requirements For IndividualsViAnne ReyesNo ratings yet

- Claim MGT - FIDIC ClausesDocument3 pagesClaim MGT - FIDIC Clausesමනෝජ් තුඩුගලNo ratings yet

- Indonesia, 8.50% 12oct2035, USDDocument1 pageIndonesia, 8.50% 12oct2035, USDFreddy Daniel NababanNo ratings yet

- CPM PertDocument17 pagesCPM Pert39SEAShashi KhatriNo ratings yet

- Task 13 Present Tense Grammar Economic ExamplesDocument2 pagesTask 13 Present Tense Grammar Economic ExamplesOsmar Braulio Quino RamirezNo ratings yet

- MGT657 Chapter 7Document49 pagesMGT657 Chapter 7adamNo ratings yet

- Interviews Value InvestingDocument87 pagesInterviews Value Investinghkm_gmat4849100% (1)

- American ConnectorDocument4 pagesAmerican ConnectorHarshal WankhedeNo ratings yet

- Casus Omissus Pro Omisso Habendus Est - A Person, Object, or Thing Omitted FromDocument3 pagesCasus Omissus Pro Omisso Habendus Est - A Person, Object, or Thing Omitted FromCP LugoNo ratings yet

- Quick Response LogisticsDocument18 pagesQuick Response LogisticsPrasad Chandran100% (7)

- Fountil BriefDocument28 pagesFountil BriefRAJYOGNo ratings yet

- Business PlanDocument57 pagesBusiness Plankim john SiaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSandesh Pujari100% (1)