Professional Documents

Culture Documents

HW20

Uploaded by

kayteeminiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW20

Uploaded by

kayteeminiCopyright:

Available Formats

CORPORATE FINANCIAL PLANNING

Cutting Edge B2B Inc.

Financial Plan

Key Assumptions

Sales Growth Rate

Tax Rate

Int Rate on Short-Term Debt

Int Rate on Long-Term Debt

Dividend Payout Rate

Price / Earnings

An Integrated System

2003

2004

2005

2006

2007

2008

2009

Ave Hist.

Actual

Actual

Actual

Actual

Forecast

Forecast

Forecast

% of Sales

16.0%

40.0%

7.0%

8.2%

35.0%

29.4

13.0%

40.0%

6.9%

8.1%

35.0%

29.4

11.0%

40.0%

6.8%

8.0%

35.0%

29.4

42.1%

6.5%

7.7%

33.9%

28.8

26.3%

43.5%

6.7%

7.9%

35.0%

29.3

24.3%

42.1%

6.9%

8.1%

35.0%

29.0

19.8%

37.9%

7.1%

8.3%

35.0%

29.0

Income Statement (Mil.$)

Sales

Cost of Goods Sold

Gross Margin

$73.84

$41.83

$32.01

$93.28

$58.39

$34.89

$115.93

$75.49

$40.44

$138.84

$89.83

$49.01

$161.05

$100.28

$60.77

$181.99

$113.32

$68.67

$202.01

$125.78

$76.23

Selling, Gen & Adm Expenses

Depreciation

EBIT

$6.58

$5.91

$19.52

$7.28

$6.37

$21.24

$8.56

$7.31

$24.57

$10.21

$9.86

$28.94

$12.66

$11.37

$36.74

$14.31

$12.85

$41.51

$15.88

$14.26

$46.08

No. 4

Finance 305, FALL 2012

HW 20

Page 1

CORPORATE FINANCIAL PLANNING

Cutting Edge B2B Inc.

Financial Plan

Interest Expense

Taxes

Net Income

Shares Outstanding (Millions)

Earnings Per Share

Allocation of Net Income:

Dividends

Change in Equity

An Integrated System

2003

2004

2005

2006

2007

2008

2009

Actual

$4.76

$6.21

$8.55

39.60

$0.22

Actual

$5.23

$6.96

$9.05

40.36

$0.22

Actual

$6.69

$7.52

$10.36

44.93

$0.23

Actual

Forecast Forecast Forecast % of Sales

$8.88

$11.37

$12.34

$13.62

$7.60

$10.15

$11.67

$12.98

$12.46

$15.22

$17.51

$19.48

53.91

59.87

65.22

69.02

$0.23

$0.25

$0.27

$0.28

$2.90

$5.65

$3.17

$5.88

$3.63

$6.73

$4.36

$8.10

$5.33

$9.89

$6.13

$11.38

$6.82

$12.66

$4.27

$20.58

$26.73

$51.58

$6.38

$24.39

$30.45

$61.22

$7.62

$28.77

$36.75

$73.14

$8.83

$34.11

$43.27

$86.21

$10.29

$41.63

$53.03

$104.95

$11.63

$47.05

$59.92

$118.60

$12.91

$52.22

$66.52

$131.65

$331.64

$98.72

$232.92

$423.92

$105.09

$318.83

$503.87

$112.40

$391.47

$613.28

$122.26

$491.02

$676.62

$133.63

$542.98

$760.05

$146.48

$613.57

$841.81

$160.74

$681.07

Balance Sheet (Mil.$)

Assets

Current Assets

Cash & Equivalents

Receivables

Inventories

Total Current Assets

Property, Plant & Equip. (PPE)

Accumulated Depreciation

Net PPE

Ave Hist.

No. 4

Finance 305, FALL 2012

HW 20

Page 2

CORPORATE FINANCIAL PLANNING

Cutting Edge B2B Inc.

Financial Plan

An Integrated System

2003

2004

2005

2006

2007

2008

2009

Ave Hist.

Actual

$284.50

Actual

$380.05

Actual

$464.61

Actual

$577.23

Forecast

$647.93

Forecast

$732.17

Forecast

$812.72

% of Sales

Liabilities and Shareholders' Equity

Current Liabilities

Accounts Payable

$31.83

Short-term Debt

$30.86

Total Current Liabilities

$62.69

$63.43

$43.03

$106.46

$83.84

$64.85

$148.69

$94.41

$79.49

$173.90

$101.23

$80.98

$182.21

$114.39

$91.50

$205.90

$126.98

$101.57

$228.54

Long-term Debt

Total Liabilities

$40.00

$102.69

$45.90

$152.36

$51.50

$200.19

$70.81

$244.71

$83.32

$266.53

$92.48

$298.38

$107.71

$336.26

Shareholders' Equity

Paid-in Capital

Retained Earnings

Total Shareholders' Equity

$90.00

$91.81

$181.81

$130.00

$97.69

$227.69

$160.00

$104.42

$264.42

$220.00

$112.52

$332.52

$260.00

$112.41

$362.14

$300.00

$133.79

$433.79

$330.00

$146.45

$476.45

Total Liab. & Share. Equity

$284.50

$380.05

$464.61

$577.23

$647.94

$732.17

$812.71

Total Assets

Debt / (Debt + Equity)

Market Price / Share

External Funds Needed

28.0%

$6.21

28.1%

$6.57

$58.07

30.6%

$6.68

$57.42

31.1%

$6.71

$93.95

30.1%

$7.47

$53.99

29.8%

$7.89

$59.69

30.5%

$8.30

$55.30

No. 4

Finance 305, FALL 2012

HW 20

Page 3

CORPORATE FINANCIAL PLANNING

Cutting Edge B2B Inc.

Financial Plan

An Integrated System

2003

2004

2005

2006

2007

2008

2009

Ave Hist.

Actual

Actual

Actual

Actual

Forecast

Forecast

Forecast

% of Sales

100.0%

56.6%

43.4%

100.0%

62.6%

37.4%

100.0%

65.1%

34.9%

100.0%

64.7%

35.3%

100.0%

62.3%

37.7%

100.0%

62.3%

37.7%

100.0%

62.3%

37.7%

100.0%

62.3%

37.7%

Selling, Gen & Adm Expenses

Depreciation

EBIT

8.9%

8.0%

26.4%

7.8%

6.8%

22.8%

7.4%

6.3%

21.2%

7.4%

7.1%

20.8%

7.9%

7.1%

22.8%

7.9%

7.1%

22.8%

7.9%

7.1%

22.8%

7.9%

7.1%

22.8%

Interest Expense

Taxes

Net Income

Shares Outstanding (Millions)

Earnings Per Share

6.4%

8.4%

11.6%

53.6%

0.3%

5.6%

7.5%

9.7%

43.3%

0.2%

5.8%

6.5%

8.9%

38.8%

0.2%

6.4%

5.5%

9.0%

38.8%

0.2%

7.1%

6.3%

9.5%

37.2%

0.2%

6.8%

6.4%

9.6%

35.8%

0.1%

6.7%

6.4%

9.6%

34.2%

0.1%

6.1%

7.0%

9.8%

43.6%

0.2%

3.9%

7.7%

3.4%

6.3%

3.1%

5.8%

3.1%

5.8%

3.3%

6.1%

3.4%

6.3%

3.4%

6.3%

3.4%

6.4%

5.8%

27.9%

36.2%

69.9%

6.8%

26.1%

32.6%

65.6%

6.6%

24.8%

31.7%

63.1%

6.4%

24.6%

31.2%

62.1%

6.4%

25.9%

32.9%

65.2%

6.4%

25.9%

32.9%

65.2%

6.4%

25.9%

32.9%

65.2%

6.4%

25.9%

32.9%

65.2%

Property, Plant & Equip. (PPE)

Accum Depreciation

Net PPE

449.1%

133.7%

315.4%

454.5%

112.7%

341.8%

434.6%

97.0%

337.7%

441.7%

88.1%

353.7%

420.1%

83.0%

337.1%

417.6%

80.5%

337.1%

416.6%

79.6%

337.1%

445.0%

107.8%

337.1%

Total Assets

385.3%

407.4%

400.8%

415.8%

402.3%

402.3%

402.3%

402.3%

Liabilities and Shareholders' Equity

Current Liabilities

Accounts Payable

43.1%

68.0%

72.3%

68.0%

62.9%

62.9%

62.9%

62.9%

Income Statement (% of Sales)

Sales

Cost of Goods Sold

Gross Margin

Allocation of Net Income:

Dividends

Change in Equity

Balance Sheet (% of Sales)

Assets

Current Assets

Cash & Equivalents

Receivables

Inventories

Total Current Assets

No. 4

Finance 305, FALL 2012

HW 20

Page 4

CORPORATE FINANCIAL PLANNING

Cutting Edge B2B Inc.

Financial Plan

An Integrated System

2003

2004

2005

2006

2007

2008

2009

Short-term Debt

Total Current Liabilities

Actual

41.8%

84.9%

Actual

46.1%

114.1%

Actual

55.9%

128.3%

Actual

Forecast Forecast Forecast % of Sales

57.3%

50.3%

50.3%

50.3%

50.3%

125.3%

113.1%

113.1%

113.1%

113.1%

Long-term Debt

Total Liabilities

54.2%

139.1%

49.2%

163.3%

44.4%

172.7%

51.0%

176.3%

51.7%

164.9%

50.8%

164.0%

53.3%

166.5%

49.7%

162.8%

Shareholders' Equity

Paid-in Capital

Retained Earnings

Total Shareholders' Equity

121.9%

124.3%

246.2%

139.4%

104.7%

244.1%

138.0%

90.1%

228.1%

158.5%

81.0%

239.5%

161.4%

76.0%

237.4%

164.8%

73.5%

238.4%

163.4%

72.5%

235.9%

139.4%

100.0%

239.5%

Total Liabilities and Equity

385.3%

407.4%

400.8%

415.8%

402.3%

402.3%

402.3%

402.3%

Cash Flow From Operating Activities

Net Income

+ Depreciation

- Inc in Accts Receivable

- Inc in Inventories

+ Inc in Accounts Payable

Cash Flow From Operat Act

$9.05

$6.37

($3.81)

($3.72)

$31.60

$39.49

$10.36

$7.31

($4.38)

($6.30)

$20.41

$27.40

$12.46

$9.86

($5.34)

($6.52)

$10.57

$21.03

$15.22

$11.37

($7.52)

($9.76)

$6.82

$16.13

$17.51

$12.85

($5.42)

($6.89)

$13.16

$31.21

$19.48

$14.26

($5.17)

($6.60)

$12.59

$34.56

Cash Flow From Investing Activities

- Invest in Plant and Equip

Cash Flow From Invest Act

($92.28)

($92.28)

($79.95) ($109.41)

($79.95) ($109.41)

($63.34)

($63.34)

($83.43)

($83.43)

($81.76)

($81.76)

Cash Flow Statement (Mil.$)

Ave Hist.

No. 4

Finance 305, FALL 2012

HW 20

Page 5

CORPORATE FINANCIAL PLANNING

Cutting Edge B2B Inc.

Financial Plan

An Integrated System

2003

2004

2005

2006

2007

2008

2009

Ave Hist.

Actual

Cash Flow From Financing Activities

+ Inc in Long-term Debt

+ Inc in Short-term Debt

+ Inc in Paid in Capital

- Dividends Paid

Cash Flow From Financ Act

Actual

Actual

Actual

Forecast

Forecast

Forecast

% of Sales

$5.90

$12.17

$40.00

($3.17)

$54.90

$5.60

$21.82

$30.00

($3.63)

$53.79

$19.31

$14.64

$60.00

($4.36)

$89.59

$12.51

$1.49

$40.00

($5.33)

$48.67

$9.16

$10.52

$40.00

($6.13)

$53.55

$15.23

$10.07

$30.00

($6.82)

$48.48

$2.11

$4.27

$6.38

$1.24

$6.38

$7.62

$1.21

$7.62

$8.83

$1.46

$8.83

$10.29

$1.33

$10.29

$11.62

$1.28

$11.63

$12.91

22.8%

21.2%

20.8%

Change in Cash and Equiv

Cash and Equiv, Begin of Yr

Cash and Equiv, End of Yr

Financial Ratios

Profitability

Return On Sales (ROS)

26.4%

22.8%

22.8%

22.8%

No. 4

Finance 305, FALL 2012

HW 20

Page 6

CORPORATE FINANCIAL PLANNING

Cutting Edge B2B Inc.

Financial Plan

An Integrated System

2003

2004

2005

2006

Actual

Return On Assets (ROA)

Return On Equity (ROE)

Actual

6.4%

4.4%

Actual

5.8%

4.2%

Actual

Forecast Forecast Forecast % of Sales

5.6%

6.0%

6.0%

6.0%

4.2%

4.4%

4.4%

4.3%

Asset Turnover

Receivables Turnover

Inventory Turnover

Asset Turnover

414.9%

204.2%

28.1%

436.2%

224.7%

27.5%

441.6%

224.5%

26.7%

425.3%

208.3%

26.3%

410.4%

200.7%

26.4%

407.0%

199.0%

26.2%

24.9%

410.1%

23.4%

406.1%

25.0%

367.3%

26.0%

325.9%

25.4%

323.1%

25.1%

336.5%

25.8%

338.3%

82.3%

39.6%

57.5%

28.9%

49.2%

24.5%

49.6%

24.7%

57.6%

28.5%

57.6%

28.5%

57.6%

28.5%

28.76

135.3%

29.30

116.5%

28.97

113.5%

29.03

108.8%

29.38

123.5%

29.22

118.6%

29.64

120.2%

Financial Leverage

Debt

Times Interest Earned

Liquidity

Current

Quick

Market Value

Price to Earnings

Market to Book

2007

2008

2009

Ave Hist.

No. 4

Finance 305, FALL 2012

HW 20

Page 7

CORPORATE FINANCIAL PLANNING

Cutting Edge B2B Inc.

Financial Plan

An Integrated System

2003

2004

2005

2006

2007

2008

2009

Ave Hist.

Actual

Actual

Actual

Actual

Forecast

Forecast

Forecast

% of Sales

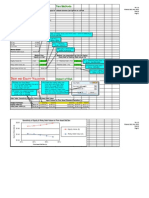

Data Table: Sensitivity of the External Funds Needed to the 2007 Sales Growth Rate

$53.99

0.0%

($19.44)

24.0%

$90.71

External Funds Needed by the Sales Growth Rate

$100

$80

External Funds Needed

Output Formula:

External Funds Needed

Input Values for 2007 Sales Growth Rate

4.0%

8.0%

12.0%

16.0%

20.0%

($1.08)

$17.28

$35.63

$53.99

$72.35

$60

$40

$20

$0

($20)

($40)

0.0%

4.0%

8.0%

12.0%

16.0%

Sales Growth Rate

20.0%

24.0%

No. 4

Finance 305, FALL 2012

HW 20

Page 8

CORPORATE FINANCIAL PLANNING

Nike, Inc.

Financial Plan

Key Assumptions

Sales Growth Rate

Tax Rate

Int Rate on Short-Term Debt

Int Rate on Long-Term Debt

Dividend Payout Rate

Price / Earnings

Full-Scale Estimation

5/31/2003 5/31/2004 5/31/2005

Actual

44.7%

1.0%

2.3%

29.1%

62.3

Actual

14.5%

34.8%

2.1%

3.9%

19.0%

39.6

Actual

12.1%

34.9%

3.4%

3.8%

19.5%

35.4

5/31/2006

Actual

8.8%

35.0%

5.1%

5.1%

20.9%

29.5

5/31/2007

Forecast

7.0%

35.0%

4.5%

5.5%

21.0%

30.0

5/31/2008

5/31/2009 Ave. %

Forecast

Forecast

6.0%

35.0%

4.5%

5.5%

22.0%

31.0

5.0%

35.0%

4.5%

5.5%

23.0%

32.0

Income Statement (Mil.$)

Sales

Cost of Goods Sold

Gross Margin

Selling, Gen & Adm Expenses

Other Expense

Accounting Change, Net

Depreciation

EBIT

$10,697.0 $12,253.1 $13,739.7

$6,072.8

$6,824.0 $7,596.3

$4,624.2

$5,429.1 $6,143.4

$3,137.6

$79.9

$266.1

$240.8

$899.8

$3,702.0

$74.7

$0.0

$177.4

$1,475.0

$14,954.9

$8,190.7

$6,764.2

$16,001.7

$8,901.8

$7,100.0

$16,961.8

$9,435.9

$7,526.0

$17,809.9

$9,907.7

$7,902.3

$4,221.7

$29.1

$0.0

$28.0

$1,864.6

$4,477.8

$4.4

$0.0

$177.2

$2,104.8

$4,809.0

$63.9

$99.5

$203.5

$1,924.0

$5,097.6

$67.8

$105.5

$215.7

$2,039.4

$5,352.5

$71.1

$110.8

$226.5

$2,141.4

Interest Expense, Net

Taxes

Net Income

Shares Outstanding (Millions)

Earnings Per Share

$42.9

$382.9

$474.0

527.2

$0.90

$25.0

$504.4

$945.6

526.2

$1.80

$4.8

$648.2

$1,211.6

522.2

$2.32

($36.8)

$749.6

$1,392.0

512.0

$2.72

$24.5

$664.8

$1,234.6

512.0

$2.41

$48.3

$696.9

$1,294.3

512.0

$2.53

$55.8

$730.0

$1,355.6

512.0

$2.65

Allocation of Net Income:

Dividends

Change in Equity

$137.8

$336.2

$179.2

$766.4

$236.7

$974.9

$290.9

$1,101.1

$259.3

$975.4

$284.7

$1,009.5

$311.8

$1,043.8

$634.0

$0.0

$2,101.1

$1,514.9

$163.7

$828.0

$400.8

$2,120.2

$1,633.6

$165.0

$1,388.1

$436.6

$2,262.1

$1,811.1

$110.2

$954.2

$1,348.8

$2,395.9

$2,076.7

$203.3

$1,110.0

$618.8

$2,777.5

$2,182.7

$201.6

$1,260.6

$655.9

$2,944.2

$2,313.7

$213.7

$1,415.4

$688.7

$3,091.4

$2,429.4

$224.3

Balance Sheet (Mil.$)

Assets

Current Assets

Cash & Equivalents

Short-term Investments

Receivables

Inventories

Deferred Income Taxes

of Sales

No. 12

Finance 305; FALL 2012

HW 24

Page 9

CORPORATE FINANCIAL PLANNING

Nike, Inc.

Financial Plan

Full-Scale Estimation

5/31/2003 5/31/2004 5/31/2005

5/31/2006

Prepaid Expenses

Total Current Assets

Actual

$266.2

$4,679.9

Actual

$364.4

$5,512.0

Actual

$343.0

$6,351.1

Actual

$380.1

$7,359.0

Property, Plant & Equip., Net

Intangible Assets, Net

Goodwill

Deferred Inc. Taxes & Other

Total Assets

$1,620.8

$118.2

$65.6

$229.4

$6,713.9

$1,586.9

$366.3

$135.4

$291.0

$7,891.6

$1,605.8

$406.1

$135.4

$295.2

$8,793.6

Liabilities and Shareholders' Equity

Current Liabilities

Current Portion of L.T. Debt

$205.7

Notes Payable

$75.4

Accounts Payable

$572.7

Accrued Liabilities

$1,054.2

Income Taxes Payable

$107.2

Total Current Liabilities

$2,015.2

$6.6

$146.0

$763.8

$974.4

$118.2

$2,009.0

Long-term Debt

Deferred Inc. Taxes & Other

Redeemable Preferred Stock

Total Liabilities

$551.6

$156.1

$0.3

$2,723.2

Shareholders' Equity

Common Stock Class A

Common Stock Class B

Capital in Excess of Stated

Unearned Stock Compen.

Accum. Other Comp. Loss

Retained Earnings

Total Shareholders' Equity

Total Liab. & Share. Equity

Debt / (Debt + Equity)

Market Price / Share

External Funds Needed

5/31/2008

5/31/2009 Ave. %

Forecast

$420.1

$7,310.6

Forecast

$445.3

$7,833.3

Forecast of Sales

$467.5

$8,316.7

$1,657.7

$405.5

$130.8

$316.6

$9,869.6

$2,035.2

$390.5

$143.2

$351.4

$10,230.9

$2,157.3

$413.9

$151.7

$372.5

$10,928.8

$2,265.2

$434.6

$159.3

$391.2

$11,567.0

$6.2

$69.8

$843.9

$984.3

$95.0

$1,999.2

$255.3

$43.4

$952.2

$1,286.9

$85.5

$2,623.3

$149.2

$107.8

$964.0

$1,343.2

$129.2

$2,693.4

$158.1

$114.3

$1,021.8

$1,423.8

$137.0

$2,855.0

$166.0

$120.0

$1,072.9

$1,495.0

$143.8

$2,997.7

$682.4

$418.2

$0.3

$3,109.9

$687.3

$462.6

$0.3

$3,149.4

$410.7

$550.1

$0.3

$3,584.4

$789.2

$476.8

$0.4

$3,959.7

$921.5

$505.4

$0.4

$4,282.2

$371.6

$530.6

$0.4

$3,900.4

$0.2

$2.6

$589.0

($0.6)

($239.7)

$3,639.2

$3,990.7

$0.1

$2.7

$887.8

($5.5)

($86.3)

$3,982.9

$4,781.7

$0.1

$2.7

$1,182.9

($11.4)

$73.4

$4,396.5

$5,644.2

$0.1

$2.7

$1,451.4

($4.1)

$121.7

$4,713.4

$6,285.2

$0.2

$2.6

$650.0

($6.4)

($63.9)

$5,688.8

$6,271.2

$0.2

$2.6

$20.0

($6.8)

($67.7)

$6,698.3

$6,646.6

$0.2

$2.6

$0.0

($7.2)

($71.1)

$7,742.1

$7,666.7

$6,713.9

$7,891.6

$8,793.6

$9,869.6

17.3%

$55.99

14.9%

$71.15

$642.9

11.9%

$82.20

$408.3

10.1%

$80.31

$650.8

5/31/2007

$10,230.9

14.3%

$72.34

($626)

$10,928.8

15.2%

$78.36

($369.5)

$11,567.0

7.9%

$84.73

($456.7)

No. 12

Finance 305; FALL 2012

HW 24

Page 10

CORPORATE FINANCIAL PLANNING

Nike, Inc.

Financial Plan

Full-Scale Estimation

5/31/2003 5/31/2004 5/31/2005

Actual

Actual

Actual

5/31/2006

Actual

5/31/2007

Forecast

5/31/2008

5/31/2009 Ave. %

Forecast

Forecast

of Sales

Income Statement (% of Sales)

Sales

Cost of Goods Sold

Gross Margin

100.0%

56.8%

43.2%

100.0%

55.7%

44.3%

100.0%

55.3%

44.7%

100.0%

54.8%

45.2%

100.0%

55.6%

44.4%

100.0%

55.6%

44.4%

100.0%

55.6%

44.4%

100.0%

55.6%

44.4%

Selling, Gen & Adm Expenses

Other Expense

Accounting Change, Net

Depreciation

EBIT

29.3%

0.7%

2.5%

2.3%

8.4%

30.2%

0.6%

0.0%

1.4%

12.0%

30.7%

0.2%

0.0%

0.2%

13.6%

29.9%

0.0%

0.0%

1.2%

14.1%

30.1%

0.4%

0.6%

1.3%

12.0%

30.1%

0.4%

0.6%

1.3%

12.0%

30.1%

0.4%

0.6%

1.3%

12.0%

30.1%

0.4%

0.6%

1.3%

12.0%

Interest Expense, Net

Taxes

Net Income

Shares Outstanding (Millions)

Earnings Per Share

0.4%

3.6%

4.4%

4.9%

0.0%

0.2%

4.1%

7.7%

4.3%

0.0%

0.0%

4.7%

8.8%

3.8%

0.0%

-0.2%

5.0%

9.3%

3.4%

0.0%

0.2%

4.2%

7.7%

3.2%

0.0%

0.3%

4.1%

7.6%

3.0%

0.0%

0.3%

4.1%

7.6%

2.9%

0.0%

0.1%

4.4%

7.6%

4.1%

0.0%

Allocation of Net Income:

Dividends

Change in Equity

0.0%

1.3%

3.1%

0.0%

1.5%

6.3%

0.0%

1.7%

7.1%

0.0%

1.9%

7.4%

0.0%

1.6%

6.1%

0.0%

1.7%

6.0%

0.0%

1.8%

5.9%

0.0%

1.6%

6.0%

5.9%

0.0%

19.6%

14.2%

1.5%

2.5%

43.7%

6.8%

3.3%

17.3%

13.3%

1.3%

3.0%

45.0%

10.1%

3.2%

16.5%

13.2%

0.8%

2.5%

46.2%

6.4%

9.0%

16.0%

13.9%

1.4%

2.5%

49.2%

6.9%

3.9%

17.4%

13.6%

1.3%

2.6%

45.7%

7.4%

3.9%

17.4%

13.6%

1.3%

2.6%

46.2%

7.9%

3.9%

17.4%

13.6%

1.3%

2.6%

46.7%

7.3%

3.9%

17.4%

13.6%

1.3%

2.6%

46.0%

Balance Sheet (% of Sales)

Assets

Current Assets

Cash & Equivalents

Short-term Investments

Receivables

Inventories

Deferred Income Taxes

Prepaid Expenses

Total Current Assets

No. 12

Finance 305; FALL 2012

HW 24

Page 11

CORPORATE FINANCIAL PLANNING

Nike, Inc.

Financial Plan

Full-Scale Estimation

5/31/2003 5/31/2004 5/31/2005

5/31/2006

5/31/2007

5/31/2008

5/31/2009 Ave. %

Forecast of Sales

12.7%

12.7%

2.4%

2.4%

0.9%

0.9%

2.2%

2.2%

64.9%

64.3%

Actual

15.2%

1.1%

0.6%

2.1%

62.8%

Actual

13.0%

3.0%

1.1%

2.4%

64.4%

Actual

11.7%

3.0%

1.0%

2.1%

64.0%

Actual

11.1%

2.7%

0.9%

2.1%

66.0%

Forecast

12.7%

2.4%

0.9%

2.2%

63.9%

Forecast

12.7%

2.4%

0.9%

2.2%

64.4%

Liabilities and Shareholders' Equity

Current Liabilities

Current Portion of L.T. Debt

1.9%

Notes Payable

0.7%

Accounts Payable

5.4%

Accrued Liabilities

9.9%

Income Taxes Payable

1.0%

Total Current Liabilities

18.8%

0.1%

1.2%

6.2%

8.0%

1.0%

16.4%

0.0%

0.5%

6.1%

7.2%

0.7%

14.6%

1.7%

0.3%

6.4%

8.6%

0.6%

17.5%

0.9%

0.7%

6.0%

8.4%

0.8%

16.8%

0.9%

0.7%

6.0%

8.4%

0.8%

16.8%

0.9%

0.7%

6.0%

8.4%

0.8%

16.8%

0.9%

0.7%

6.0%

8.4%

0.8%

16.8%

Long-term Debt

Deferred Inc. Taxes & Other

Redeemable Preferred Stock

Total Liabilities

5.2%

1.5%

0.0%

25.5%

5.6%

3.4%

0.0%

25.4%

5.0%

3.4%

0.0%

22.9%

2.7%

3.7%

0.0%

24.0%

4.9%

3.0%

0.0%

24.7%

5.4%

3.0%

0.0%

25.2%

2.1%

3.0%

0.0%

21.9%

4.6%

3.0%

0.0%

24.4%

Shareholders' Equity

Common Stock Class A

Common Stock Class B

Capital in Excess of Stated

Unearned Stock Compen.

Accum. Other Comp. Loss

Retained Earnings

Total Shareholders' Equity

0.0%

0.0%

5.5%

0.0%

-2.2%

34.0%

37.3%

0.0%

0.0%

7.2%

0.0%

-0.7%

32.5%

39.0%

0.0%

0.0%

8.6%

-0.1%

0.5%

32.0%

41.1%

0.0%

0.0%

9.7%

0.0%

0.8%

31.5%

42.0%

0.0%

0.0%

4.1%

0.0%

-0.4%

35.6%

39.2%

0.0%

0.0%

0.1%

0.0%

-0.4%

39.5%

39.2%

0.0%

0.0%

0.0%

0.0%

-0.4%

43.5%

43.0%

0.0%

0.0%

7.8%

0.0%

-0.4%

32.5%

39.9%

Total Liab. & Share. Equity

62.8%

64.4%

64.0%

66.0%

63.9%

64.4%

64.9%

64.3%

Property, Plant & Equip., Net

Intangible Assets, Net

Goodwill

Deferred Inc. Taxes & Other

Total Assets

Cash Flow Statement (Mil.$)

Cash Provided (Used) By Operating Activities

Net Income

$474.0

$945.6

Income Charges (Credits) Not Affecting Cash:

Depreciation

$239.3

$252.1

Cum Effect of Acct Change

$266.1

$0.0

Deferred Income Taxes

$50.4

$19.0

$1,211.6

$257.2

$0.0

$21.3

$1,392.0

$282.0

$0.0

($26.0)

$1,234.6

$1,294.3

$1,355.6

$322.1

$99.5

$24.3

$341.4

$105.5

$25.8

$358.5

$110.8

$27.0

No. 12

Finance 305; FALL 2012

HW 24

Page 12

CORPORATE FINANCIAL PLANNING

Nike, Inc.

Financial Plan

Full-Scale Estimation

5/31/2003 5/31/2004 5/31/2005

Actual

Actual

Amortization and other

$23.2

$58.3

Inc Tax Ben Exer Options

$12.5

$47.2

Changes in Certain Working Capital Components:

(Inc) dec in Inventories

($102.8)

($55.9)

(Inc) dec in Accounts Rec.

($136.3)

$82.5

Dec (inc) in Prepd & Ot CA

$60.9

($103.5)

Inc (dec.) in Account Pay,

Accr Liab., & Inc Tax Pay.

$30.1

$269.1

Cash Provided By Operations

$917.4

$1,514.4

Actual

$30.5

$63.1

($103.3)

($93.5)

$71.4

$112.4

$1,570.7

Actual

$8.9

$54.2

($200.3)

($85.1)

($37.2)

5/31/2007

Forecast

$39.0

$53.0

($140.4)

($74.0)

($0.2)

5/31/2008

5/31/2009 Ave. %

Forecast

$41.3

$56.1

Forecast of Sales

$43.4

$58.9

($148.8)

($78.5)

($0.2)

($156.2)

($82.4)

($0.2)

$279.4

$1,667.9

$206.6

$1,764.5

$219.0

$1,855.9

$229.9

$1,945.4

($2,619.7)

$1,709.8

($333.7)

$1.6

($30.3)

($4.3)

$0.0

($1,276.6)

($1,276.3)

$891.8

($303.5)

$11.8

($54.2)

$2.5

($108.1)

($836.1)

($1,352.9)

$945.3

($321.7)

$12.6

($57.5)

$2.6

($114.6)

($886.2)

($1,420.5)

$992.5

($337.8)

$13.2

($60.4)

$2.7

($120.3)

($930.5)

$0.0

($9.2)

($81.7)

$226.8

($556.2)

($236.7)

($657.0)

$0.0

($6.0)

($18.2)

$225.3

($761.1)

($290.9)

($850.9)

$84.0

($92.6)

($159.6)

$225.6

($576.0)

($256.8)

($775.3)

$89.1

($98.2)

($169.1)

$239.2

($610.6)

($272.2)

($821.9)

$93.5

($103.1)

($177.6)

$251.1

($641.1)

($285.8)

($863.0)

$25.7

($433.9)

$2.6

$155.8

$2.8

$150.6

$2.9

$154.8

$954.2

$1,110.0

$1,110.0

$1,260.6

$1,260.6

$1,415.4

Cash Provided (Used) By Investing Activities

Purch of short-term invest

$0.0

($400.8) ($1,527.2)

Matur of short-term invest

$0.0

$0.0 $1,491.9

Additions to PP & E

($185.9)

($213.9)

($257.1)

Disposals of PP & E

$14.8

$11.6

$7.2

Increase in Other Assets

($46.3)

($53.4)

($39.1)

Inc (dec.) in Other Liab

$1.8

($0.9)

$11.1

Acq of subs-net assets acq

$0.0

($289.1)

($47.2)

Cash Used By Investing Act

($215.6)

($946.5)

($360.4)

Cash Provided (Used) By Financing Activities

Proc from Long-term Debt

$90.4

$153.8

Reduct in Long-term Debt

($55.9)

($206.6)

Inc (dec.) in Notes Payable

($349.8)

($0.3)

Proc from Exer of Options

$44.2

$253.6

Repurchase of stock

($196.3)

($419.8)

Dividends - common & pref

($137.8)

($179.2)

Cash Used By Financing Act

($605.2)

($398.5)

5/31/2006

Effect of Exch. Rate Chgs

Net Inc (Dec.) Cash & Equiv.

($38.1)

$58.5

$24.6

$194.0

$6.8

$560.1

Cash and Equiv. Beg of Year

Cash and Equiv. End of Year

$575.5

$634.0

$634.0

$828.0

$828.0

$1,388.1

$1,388.1

$954.2

No. 12

Finance 305; FALL 2012

HW 24

Page 13

CORPORATE FINANCIAL PLANNING

Nike, Inc.

Financial Plan

Full-Scale Estimation

5/31/2003 5/31/2004 5/31/2005

Actual

Actual

Actual

5/31/2006

Actual

5/31/2007

Forecast

5/31/2008

5/31/2009 Ave. %

Forecast

Forecast

of Sales

Cash Flow Statement (% of Sales)

Cash Provided (Used) By Operating Activities

Net Income

4.4%

7.7%

Income Charges (Credits) Not Affecting Cash:

Depreciation

2.2%

2.1%

Cum Effect of Acct Change

2.5%

0.0%

Deferred Income Taxes

0.5%

0.2%

Amortization and other

0.2%

0.5%

Inc Tax Ben Exer Options

0.1%

0.4%

Changes in Certain Working Capital Components:

(Inc) dec in Inventories

-1.0%

-0.5%

(Inc) dec in Accounts Rec.

-1.3%

0.7%

Dec (inc) in Prepd & Ot CA

0.6%

-0.8%

Inc (dec.) in Account Pay,

0.0%

0.0%

Accr Liab., & Inc Tax Pay.

0.3%

2.2%

Cash Provided By Operations

8.6%

12.4%

8.8%

9.3%

7.7%

7.6%

7.6%

7.6%

1.9%

0.0%

0.2%

0.2%

0.5%

1.9%

0.0%

-0.2%

0.1%

0.4%

2.0%

0.6%

0.2%

0.2%

0.3%

2.0%

0.6%

0.2%

0.2%

0.3%

2.0%

0.6%

0.2%

0.2%

0.3%

2.0%

0.6%

0.2%

0.2%

0.3%

-0.8%

-0.7%

0.5%

0.0%

0.8%

11.4%

-1.3%

-0.6%

-0.2%

0.0%

1.9%

11.2%

-0.9%

-0.5%

0.0%

0.0%

1.3%

11.0%

-0.9%

-0.5%

0.0%

0.0%

1.3%

10.9%

-0.9%

-0.5%

0.0%

0.0%

1.3%

10.9%

-0.9%

-0.5%

0.0%

0.0%

1.3%

10.9%

-3.3%

0.0%

-1.7%

0.1%

-0.4%

0.0%

-2.4%

-7.7%

-11.1%

10.9%

-1.9%

0.1%

-0.3%

0.1%

-0.3%

-2.6%

-17.5%

11.4%

-2.2%

0.0%

-0.2%

0.0%

0.0%

-8.5%

-8.0%

5.6%

-1.9%

0.1%

-0.3%

0.0%

-0.7%

-5.2%

-8.0%

5.6%

-1.9%

0.1%

-0.3%

0.0%

-0.7%

-5.2%

-8.0%

5.6%

-1.9%

0.1%

-0.3%

0.0%

-0.7%

-5.2%

-8.0%

5.6%

-1.9%

0.1%

-0.3%

0.0%

-0.7%

-5.2%

Cash Provided (Used) By Financing Activities

Proc from Long-term Debt

0.8%

1.3%

Reduct in Long-term Debt

-0.5%

-1.7%

Inc (dec.) in Notes Payable

-3.3%

0.0%

Proc from Exer of Options

0.4%

2.1%

Repurchase of stock

-1.8%

-3.4%

0.0%

-0.1%

-0.6%

1.7%

-4.0%

0.0%

0.0%

-0.1%

1.5%

-5.1%

0.5%

-0.6%

-1.0%

1.4%

-3.6%

0.5%

-0.6%

-1.0%

1.4%

-3.6%

0.5%

-0.6%

-1.0%

1.4%

-3.6%

0.5%

-0.6%

-1.0%

1.4%

-3.6%

Cash Provided (Used) By Investing Activities

Purch of short-term invest

0.0%

Matur of short-term invest

0.0%

Additions to PP & E

-1.7%

Disposals of PP & E

0.1%

Increase in Other Assets

-0.4%

Inc (dec.) in Other Liab

0.0%

Acq of subs-net assets acq

0.0%

Cash Used By Investing Act

-2.0%

No. 12

Finance 305; FALL 2012

HW 24

Page 14

CORPORATE FINANCIAL PLANNING

Nike, Inc.

Financial Plan

Full-Scale Estimation

5/31/2003 5/31/2004 5/31/2005

5/31/2006

5/31/2007

5/31/2008

5/31/2009 Ave. %

Forecast of Sales

-1.6%

-1.6%

-4.8%

-4.8%

Dividends - common & pref

Cash Used By Financing Act

Actual

-1.3%

-5.7%

Actual

-1.5%

-3.3%

Actual

-1.7%

-4.8%

Actual

-1.9%

-5.7%

Forecast

-1.6%

-4.8%

Forecast

-1.6%

-4.8%

Effect of Exch. Rate Chgs

Net Inc (Dec.) Cash & Equiv.

-0.4%

0.5%

0.2%

1.6%

0.0%

4.1%

0.2%

-2.9%

0.0%

1.0%

0.0%

0.9%

0.0%

0.9%

0.0%

0.8%

Cash and Equiv. Beg of Year

Cash and Equiv. End of Year

5.4%

5.9%

5.2%

6.8%

6.0%

10.1%

9.3%

6.4%

6.0%

6.9%

6.5%

7.4%

7.1%

7.9%

6.5%

7.3%

8.4%

12.0%

20.2%

21.6%

13.6%

22.4%

23.2%

14.1%

22.6%

23.3%

12.0%

19.1%

19.7%

12.0%

19.3%

20.0%

12.0%

19.0%

18.9%

5.8

4.3

1.7

6.3

4.4

1.6

6.4

4.2

1.6

6.2

4.2

1.6

5.9

4.2

1.6

5.9

4.2

1.6

12.4%

21.0

10.6%

59.0

8.7%

388.5

7.2%

-57.2

10.2%

78.4

10.9%

42.3

5.7%

38.4

Liquidity

Current

Quick

232.2%

135.7%

274.4%

146.7%

317.7%

182.6%

280.5%

127.7%

271.4%

144.3%

274.4%

147.3%

277.4%

150.3%

Market Value

Price to Earnings

Market to Book

62.3

739.7%

39.6

783.0%

35.4

760.5%

29.5

654.2%

30.00

590.6%

31.00

603.7%

32.00

565.8%

Financial Ratios

Profitability

Return On Sales (ROS)

Return On Assets (ROA)

Return On Equity (ROE)

Asset Turnover

Receivables Turnover

Inventory Turnover

Asset Turnover

Financial Leverage

Debt

Times Interest Earned

No. 12

Finance 305; FALL 2012

HW 24

Page 15

CORPORATE FINANCIAL PLANNING

Global Impact P2P

Financial Plan

Key Assumptions

Sales Growth Rate

Tax Rate

Int Rate on Short-Term Debt

Int Rate on Long-Term Debt

Dividend Payout Rate

Price / Earnings

Problems

2003

2004

2005

2006

Actual

Actual

Actual

Actual

40.5%

6.3%

7.4%

26.1%

8.6

38.8%

6.3%

7.4%

25.9%

8.4

21.4%

38.2%

6.4%

7.5%

26.8%

8.7

19.3%

36.0%

6.5%

7.6%

24.4%

9.3

Income Statement (Mil.$)

Sales

Cost of Goods Sold

Gross Margin

$185.76

$109.81

$75.95

$194.29

$112.25

$82.04

$235.84

$138.97

$96.87

$281.38

$171.57

$109.81

Selling, Gen & Adm Expenses

Depreciation

EBIT

$12.73

$11.66

$51.56

$13.54

$12.39

$56.11

$16.87

$14.58

$65.42

$19.94

$18.37

$71.50

Interest Expense

Taxes

$14.23

$15.12

$15.69

$15.68

$23.88

$15.87

$24.55

$16.92

CORPORATE FINANCIAL PLANNING

Global Impact P2P

Financial Plan

Problems

2003

2004

2005

2006

Net Income

Shares Outstanding (Millions)

Earnings Per Share

Actual

$22.21

2.03

$10.94

Actual

$24.74

2.10

$11.78

Actual

$25.67

2.15

$11.94

Actual

$30.03

2.44

$12.31

Allocation of Net Income:

Dividends

Change in Equity

$5.80

$16.41

$6.41

$18.33

$6.87

$18.80

$7.33

$22.70

Assets

Current Assets

Cash & Equivalents

Receivables

Inventories

Total Current Assets

$8.56

$41.63

$52.11

$102.30

$13.97

$49.52

$60.94

$124.43

$15.34

$57.37

$73.49

$146.20

$17.75

$68.91

$86.32

$172.98

Property, Plant & Equip. (PPE)

Accumulated Depreciation

Net PPE

$663.29

$189.20

$474.09

$846.39

$201.59

$644.80

$910.34

$216.17

$694.17

$958.31

$234.54

$723.77

Total Assets

$576.39

$769.23

$840.37

$896.75

Balance Sheet (Mil.$)

Liabilities and Shareholders' Equity

Current Liabilities

CORPORATE FINANCIAL PLANNING

Global Impact P2P

Financial Plan

Problems

2003

2004

2005

2006

Accounts Payable

Short-term Debt

Total Current Liabilities

Actual

$62.46

$202.12

$264.58

Actual

$90.48

$307.87

$398.35

Actual

$134.32

$304.96

$439.28

Actual

$174.57

$312.85

$487.42

Long-term Debt

Total Liabilities

$40.00

$304.58

$55.74

$454.09

$62.15

$501.43

$17.69

$505.11

Shareholders' Equity

Paid-in Capital

Retained Earnings

Total Shareholders' Equity

$180.00

$91.81

$271.81

$205.00

$110.14

$315.14

$210.00

$128.94

$338.94

$240.00

$151.64

$391.64

Total Liab. & Share. Equity

$576.39

$769.23

$840.37

$896.75

Debt / (Debt + Equity)

Market Price / Share

External Funds Needed

47.1%

$94.58

53.6%

52.0%

$99.12 $103.47

$146.49

$8.50

45.8%

$114.95

($6.57)

You might also like

- Dell Fin. AnalaysisDocument6 pagesDell Fin. AnalaysisVoi Vạm VỡNo ratings yet

- Monmouth Case SolutionDocument19 pagesMonmouth Case SolutionAkshat Nayer40% (10)

- Financial Performance Comparison of Tobacco CompaniesDocument9 pagesFinancial Performance Comparison of Tobacco Companiesjchodgson0% (2)

- Value SpreadsheetDocument58 pagesValue SpreadsheetJitendra SutarNo ratings yet

- Case 25 Gainesboro-Exh8Document1 pageCase 25 Gainesboro-Exh8odie99No ratings yet

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashNo ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- Campbell Soup FInancialsDocument39 pagesCampbell Soup FInancialsmirunmanishNo ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- CASE-STUDY Growing PainsDocument9 pagesCASE-STUDY Growing PainsZion EliNo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaNo ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAditi KhaitanNo ratings yet

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Document18 pages1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeNo ratings yet

- DMX Technologies 3Q13 results above expectations on higher salesDocument4 pagesDMX Technologies 3Q13 results above expectations on higher salesstoreroom_02No ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAnuj SaxenaNo ratings yet

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsDocument8 pagesInvestment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsMarta RodriguesNo ratings yet

- Assignment 4Document12 pagesAssignment 4giannimizrahi5No ratings yet

- Results Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYDocument9 pagesResults Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYÁngel Josue Aguilar VillaverdeNo ratings yet

- Bmo 8.1.13 PDFDocument7 pagesBmo 8.1.13 PDFChad Thayer VNo ratings yet

- Burton Sensors SheetDocument128 pagesBurton Sensors Sheetchirag shah17% (6)

- Income Statement: Actual Estimated Projected Fiscal 2008 Projection Notes RevenueDocument10 pagesIncome Statement: Actual Estimated Projected Fiscal 2008 Projection Notes RevenueAleksandar ZvorinjiNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654No ratings yet

- Class Exercise Fashion Company Three Statements Model - CompletedDocument16 pagesClass Exercise Fashion Company Three Statements Model - CompletedbobNo ratings yet

- United Engineers - CIMBDocument7 pagesUnited Engineers - CIMBTheng RogerNo ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- Chapter09 SMDocument14 pagesChapter09 SMkike-armendarizNo ratings yet

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikNo ratings yet

- Gitman 4e Ch. 2 SPR - SolDocument8 pagesGitman 4e Ch. 2 SPR - SolDaniel Joseph SitoyNo ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- First Resources 4Q12 Results Ahead of ExpectationsDocument7 pagesFirst Resources 4Q12 Results Ahead of ExpectationsphuawlNo ratings yet

- Bicycle Shop Financial Model - CapEx ForecastDocument9 pagesBicycle Shop Financial Model - CapEx ForecastNatalieNo ratings yet

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- 04 06 Public Comps Valuation Multiples AfterDocument19 pages04 06 Public Comps Valuation Multiples AfterShanto Arif Uz ZamanNo ratings yet

- Apple & RIM Merger Model and LBO ModelDocument50 pagesApple & RIM Merger Model and LBO ModelDarshana MathurNo ratings yet

- 07 12 Sensitivity Tables AfterDocument30 pages07 12 Sensitivity Tables Aftermerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- Case Study 2Document10 pagesCase Study 2Cheveem Grace EmnaceNo ratings yet

- Discounted Cash Flow ModelDocument9 pagesDiscounted Cash Flow ModelMohammed IrfanNo ratings yet

- STJ Write UpDocument5 pagesSTJ Write Upmunger649No ratings yet

- FlashMemory SLNDocument6 pagesFlashMemory SLNShubham BhatiaNo ratings yet

- Robertson Tool Company Operating and Financial Data 1998-2002Document7 pagesRobertson Tool Company Operating and Financial Data 1998-2002dineshjn20000% (2)

- Solucion Caso Lady MDocument13 pagesSolucion Caso Lady Mjohana irma ore pizarroNo ratings yet

- Bbby 4Q2014Document3 pagesBbby 4Q2014RahulBakshiNo ratings yet

- Análisis Equipo Nutresa Lina - Caso HanssenDocument24 pagesAnálisis Equipo Nutresa Lina - Caso HanssenSARA ZAPATA CANONo ratings yet

- 24 The Elusive Cash BalanceDocument13 pages24 The Elusive Cash Balancehaqicohir100% (2)

- Facebook Working - Students - UnsolvedDocument10 pagesFacebook Working - Students - UnsolvedK Rohith ReddyNo ratings yet

- Debt Policy at UST Inc.Document47 pagesDebt Policy at UST Inc.karthikk1990100% (2)

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- Bukit Sembawang Estates FY12 Results Note Signals Higher DividendsDocument7 pagesBukit Sembawang Estates FY12 Results Note Signals Higher DividendsNicholas AngNo ratings yet

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- Collection Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueFrom EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueRating: 1 out of 5 stars1/5 (1)

- Applied Predictive Analytics: Principles and Techniques for the Professional Data AnalystFrom EverandApplied Predictive Analytics: Principles and Techniques for the Professional Data AnalystNo ratings yet

- Water, Sewage & Systems Revenues World Summary: Market Values & Financials by CountryFrom EverandWater, Sewage & Systems Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Next Generation Demand Management: People, Process, Analytics, and TechnologyFrom EverandNext Generation Demand Management: People, Process, Analytics, and TechnologyNo ratings yet

- Testing Laboratory Revenues World Summary: Market Values & Financials by CountryFrom EverandTesting Laboratory Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Two Methods: Ebt and Quity AluationDocument2 pagesTwo Methods: Ebt and Quity AluationkayteeminiNo ratings yet

- DFS AnalysisDocument8 pagesDFS AnalysiskayteeminiNo ratings yet

- Chester company R&D, debt issuance, product discontinuation strategyDocument1 pageChester company R&D, debt issuance, product discontinuation strategykayteeminiNo ratings yet

- HW16 Fig 9.11Document4 pagesHW16 Fig 9.11kayteeminiNo ratings yet

- HW14 15Document13 pagesHW14 15kayteeminiNo ratings yet

- Dividend Discount Model: Tock AluationDocument1 pageDividend Discount Model: Tock AluationkayteeminiNo ratings yet

- F A P V: IRM ND Roject AluationDocument4 pagesF A P V: IRM ND Roject AluationkayteeminiNo ratings yet

- F A P V: IRM ND Roject AluationDocument12 pagesF A P V: IRM ND Roject AluationkayteeminiNo ratings yet

- Two Methods: Ebt and Quity AluationDocument2 pagesTwo Methods: Ebt and Quity AluationkayteeminiNo ratings yet

- HW18Document3 pagesHW18kayteeminiNo ratings yet

- F A P V: Five Equivalent MethodsDocument6 pagesF A P V: Five Equivalent MethodskayteeminiNo ratings yet

- Loan Amortization ScheduleDocument1 pageLoan Amortization SchedulekayteeminiNo ratings yet

- HW19Document4 pagesHW19kayteeminiNo ratings yet

- HW16 Fig 9.6Document13 pagesHW16 Fig 9.6kayteeminiNo ratings yet

- NPV Calculation for Finance Homework Using General DiscountingDocument1 pageNPV Calculation for Finance Homework Using General DiscountingkayteeminiNo ratings yet

- NPV Using General Discounting Nominal RateDocument3 pagesNPV Using General Discounting Nominal RatekayteeminiNo ratings yet

- 305 Final ReviewDocument3 pages305 Final ReviewkayteeminiNo ratings yet

- Dynamic - Financial Statements!Document20 pagesDynamic - Financial Statements!kayteeminiNo ratings yet

- NPV Using Contstant DiscountingDocument2 pagesNPV Using Contstant DiscountingkayteeminiNo ratings yet

- NPV Calculation for Finance Homework Using General DiscountingDocument1 pageNPV Calculation for Finance Homework Using General DiscountingkayteeminiNo ratings yet

- Single Cash Flow - Present ValueDocument4 pagesSingle Cash Flow - Present ValuekayteeminiNo ratings yet

- HW2Document8 pagesHW2kayteeminiNo ratings yet

- NPV Using Contstant DiscountingDocument2 pagesNPV Using Contstant DiscountingkayteeminiNo ratings yet

- Recommended Books For RBI Grade B Exam With Bonus Online MaterialDocument15 pagesRecommended Books For RBI Grade B Exam With Bonus Online MaterialrahulNo ratings yet

- Acca Paper P5 Advanced Performance Management Final Mock ExaminationDocument20 pagesAcca Paper P5 Advanced Performance Management Final Mock ExaminationMSA-ACCANo ratings yet

- Audit ProceduresDocument14 pagesAudit ProceduresAnand Rocker100% (1)

- 032465913X 164223Document72 pages032465913X 164223March AthenaNo ratings yet

- Key Words: Small Scale Industry, Economic DevelopmentDocument15 pagesKey Words: Small Scale Industry, Economic DevelopmentBibinNo ratings yet

- WEF Alternative Investments 2020 FutureDocument59 pagesWEF Alternative Investments 2020 FutureOwenNo ratings yet

- AS 26 - 123 To 138Document16 pagesAS 26 - 123 To 138love chawlaNo ratings yet

- Lowongan Kerja Bank CIMB SecuritiesDocument3 pagesLowongan Kerja Bank CIMB SecuritiesOm 諾曼No ratings yet

- RLXF IN Research Report - Share price - 637.4 Industry - FMCGDocument7 pagesRLXF IN Research Report - Share price - 637.4 Industry - FMCGkaranNo ratings yet

- Audit Report by Four MusketeersDocument12 pagesAudit Report by Four MusketeersIubianNo ratings yet

- NPV and IRR, Payback Period, ImportantDocument5 pagesNPV and IRR, Payback Period, Important朱潇妤No ratings yet

- App eDocument14 pagesApp emorry123No ratings yet

- The Fall of Enron - Case SolutionDocument5 pagesThe Fall of Enron - Case SolutionJyotirmoy ChatterjeeNo ratings yet

- MC Donald'sDocument15 pagesMC Donald'sMuhammad TalhaNo ratings yet

- QuizDocument55 pagesQuizMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Security Analysis 6th Edition IntroductionDocument3 pagesSecurity Analysis 6th Edition IntroductionTheodor ToncaNo ratings yet

- Insurance Project SynopsisDocument3 pagesInsurance Project SynopsisYogesh Sawant100% (1)

- CheckwritingDocument2 pagesCheckwritingLiz Pasillas100% (6)

- PNB Market Analysis and Financial PerformanceDocument9 pagesPNB Market Analysis and Financial PerformancePriyadarshini TyagiNo ratings yet

- Chapter (1) The Conceptual Framework of Accounting: February 2019Document25 pagesChapter (1) The Conceptual Framework of Accounting: February 2019Vincent Angelo AutenticoNo ratings yet

- Lecture 2Document32 pagesLecture 2trannnenNo ratings yet

- Bank of Maharashtra History INFORMATIONDocument3 pagesBank of Maharashtra History INFORMATIONbharatNo ratings yet

- M6931 Legal Services in Australia Industry ReportDocument32 pagesM6931 Legal Services in Australia Industry ReportAnge OuNo ratings yet

- PDFDocument664 pagesPDFparth patelNo ratings yet

- Corporate Level StrategyDocument35 pagesCorporate Level StrategyVineeth PoliyathNo ratings yet

- Comparison in Pricing Policies - Product Pricing vs. Service PricingDocument33 pagesComparison in Pricing Policies - Product Pricing vs. Service PricingshahadatsunnyNo ratings yet

- Companies ActDocument9 pagesCompanies ActSnigdhangshu BanerjeeNo ratings yet

- Liam Mescall Swaption ProjectDocument20 pagesLiam Mescall Swaption ProjectLiam MescallNo ratings yet

- An Introduction To SwapsDocument5 pagesAn Introduction To SwapsCh RajkamalNo ratings yet