Professional Documents

Culture Documents

IAS1

Uploaded by

nicoletab81Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS1

Uploaded by

nicoletab81Copyright:

Available Formats

The objective of IAS 1 Welcome to the module on IAS 1: Presentation of Financial Statements, the Standard that governs the

presentation of general purpose financial statements.

Since 2009, the International Accounting Standard Board made several amendments to IAS 1 as follows:

Amendment made as part of Improvements to IFRSs 2008/09 relating to the current/non-current classification of convertible instruments. The amendment was effective for annual periods beginning on or after 1 January 2010 with earlier application permitted.

Amendment made as part of the Improvements to IFRSs 2009/10 to clarify that an entity may present the analysis of other comprehensive income by item either in the statement of changes in equity or in the notes to the financial statements. The amendment was effective for annual periods beginning on or after 1 January 2011 with earlier application permitted. Amendments made in June 2011 to provide guidance on the presentation of items contained in other comprehensive income and their classification within other comprehensive income. The amendment is effective for annual periods beginning on or after 1 July 2012 with earlier application permitted. The content of this module reflects these amendments. The scope of IAS 1IAS 1 prescribes accounting treatment for all general purpose financial statements that are prepared in accordance with International Financial Reporting Standards (IFRS).

General purpose financial statements are aimed at users who do not have the authority to demand financial reports that are tailored to their own needs.

What you will learn from this moduleThere are two scenarios in this module. Heres what youll learn in each:

Click each item to find out more. Scenario 1: Purpose and overall considerations of financial statements

Scenario 2: Structure, content and disclosure of financial statements

What's a scenario? When do I use the Message Centre? What's the Toolkit for?

Each scenario will introduce you to a situation at work that requires your understanding of and ability to apply the Standard. You'll receive your work via colleagues and clients through all the office communications that you're used to: email, letter, fax and memo, phone call, voicemail and 'face-to-face'.

Each scenario requires a contribution from you. You'll deal with the work at hand by answering questions, providing assistance to clients and colleagues, writing documents and preparing for meetings. To help you complete the tasks you should use the Toolkit. To move through the scenario you must answer the questions correctly. But don't worry, if you get stuck there's always a Clue; and if you answer incorrectly, you'll get help with where to look for the information you need.

Now click another tab. The Message Centre is to the right of your screen, and is above your Toolkit. It alerts you to one of the following:

email letter fax memo phone call voicemail a 'face-to-face' interruption The Message Centre provides you with essential supporting material to the scenario as it develops. You should always click the appropriate icon when prompted. Each scenario has an accompanying Toolkit, located to the right of your screen, to help you tackle each of the challenges set out.

You'll need to use your own initiative to research the necessary topics in the Toolkit to answer these challenges. It may include any of the following:

Background about your client References where you can find your inbox and links to other DTT and IFRS resources

a Coach me facility to help you with specific areas that you may have difficulty with a Clue to point your research in the right direction relevant Examples to reflect how IFRS works in the real world any necessary software to help you achieve your goals, such as Word and Excel IAS 1 sets out the:

purpose and overall considerations of financial statements guidelines for the structure of financial statements minimum requirements for the content of financial statements Note: It is recommended that you have worked through the Framework module before looking at IAS 1: Presentation of Financial Statements. The Framework provides guidance on the preparation and presentation of financial statements.

Lets now look at the scope of IAS 1.

The components of a set of financial statementsRebekkah wants to know what a complete set of financial statements comprises, besides the statement of profit or loss and other comprehensive income and statement of financial position. What will you tell her?

Click and drag each option into the correct column and click Submit.Management risk analysis reportA directors reportExplanatory notesAccounting policesStatement of cash flowsA statement of changes in equityIncluded in the set of financial statements Not included in the set of financial statements Well done. Youve given Rebekkah the right information.

A complete set of financial statements should comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity, a statement of cash flows, notes, comprising a summary of accounting policies and other explanatory notes and a statement of financial position as at the beginning of the earliest comparative period (if applicable).

Many entities present, outside the financial statements, a management risk analysis report and a directors report which may be required by regulatory frameworks. Reports and statements that are presented outside the financial statements are outside the scope of IFRSs.

Click Next to continue. Compare your responseYou want to check you gave Rebekkah the right response so you power up your laptop and consult the Standard online...Here is the relevant section of IAS 1:

"...financial statements shall present fairly the financial position, financial performance and cash flows of an entity. Fair presentation requires the faithful representation of the effects of transactions, other events and conditions in accordance with the definitions and recognition criteria for assets, liabilities, income and expenses set out in the Framework. The application of IFRSs, with additional disclosure when necessary, is presumed to result in financial statements that achieve a fair presentation. An entity whose financial statements comply with IFRSs shall make an explicit and unreserved statement of such compliance in the notes. An entity shall not describe financial statements as complying with IFRSs unless they comply with all requirements of IFRSs.

In the extremely rare circumstances What response should you give Rebekkah?Which of the expenses in the trial balance should be shown separately in the financial statements due to their materiality, and which can be aggregated with other immaterial items? How will you respond to Rebekkah?

Tip: Click Ref in the Toolkit to refer to the trial balance if you need to. Well done. A good answer to Rebekkahs question.

Each material class of similar items shall be presented separately in the financial statements. However, immaterial amounts do not need to be presented separately and so can be aggregated with amounts of classes of different items.

In this context information is material if its omission or misstatement could, individually or collectively, influence the economic decisions of users taken on the basis of the financial statements. Materiality depends on the size and nature of the omission or misstatement judged in the surrounding circumstances. The concept of materiality means that the specific disclosure requirements of IFRS need not be met if the resulting information is not material. Due to its immateriality, the conference expenses and legal fees do not need to be separately presented.

Conference expenses and Legal fees are used as examples of immaterial amounts for the purpose of this learning unit. Judgment should be exercised in determining immaterial items for each entity. Can Rebekkah offset her assets against her liabilites?

Click the one correct option, and then click Submit Yes, because IAS 1 permits it No, because IAS 1 does not permit offsetting of assets and liabilities unless offsetting is required or permitted by another IFRS No, because the asset and liability are with the same entity (supplier and debtor) Thats a good answer.

Assets and liabilities cannot be offset except when offsetting is required or permitted by another IFRS. It is important that material assets and liabilities are reported separately.

Click Next to SummaryAs Rebekkah leaves the table to pay the bill she asks you to check the notes shes made. They read:

a complete set of financial statements comprises a statement of financial position (in certain cases both an opening and closing statement), a statement of profit or loss and other comprehensive income, a statement of changes in equity, a statement of cash flows and notes, comprising a summary of significant accounting policies and other explanatory notes the application of IFRS should result in financial statements that achieve fair presentation. Its extremely rare for an entity to not apply all IFRS when claiming compliance with IFRS material classes of similar income and expenses cannot be aggregated assets and liabilities cannot be offset, except when offsetting is required or permitted by another IFRS Rebekkahs questions have helped to refresh your knowledge of IAS 1 - and she treated you to dinner to say thank you, so not a bad day in all.

Identification of financial statementsWhich of the following items of information in Environmends financial statements are correct in terms of the requirements of IAS 1 concerning identification of financial statements, and which item/s are missing?

Tip: Click Ref in your Toolkit if you want to refer to the email Glen sent you again.

Click and drag each option into the correct column and click Submit.Each component of the financial statement is identified clearlyThe name of the reporting entity is identified clearlyThe level of precision used in the presentation of amountsWhether the financial statements cover the group or an individual entityThe date of the end of reporting period or period covered by the financial periodThe presentation currencyCorrectly included Missing information

Sorry, that's not right. Before you can make your second and final attempt at this question, ask about 'The statement of financial position' in Coach me. You can also click Clue for additional help. 1 requires that:

financial statements must be clearly identifiable financial statements must be easily distinguishable from any other information in the same published document These regulations only apply to the financial statements and not to other information thats presented in the annual report. The following information must be prominently displayed:

name of the reporting entity and any change in that information from the date of the end of the reporting period whether the statements cover a single entity or a group of entities date of the end of the reporting period, or period covered by the financial statements presentation currency level of rounding used in the presentation of amounts If necessary, this detail should also be repeated later in the document to ensure that the user properly understands all the information The five items of financial statementsThere are five items that comprise the structure and content of financial statements. These are the:

1. Statement of financial position 2. Statement of profit or loss and other comprehensive income 3. Statement of changes in equity 4. Statement of cash flows 5. Notes

This Coach me focuses on the first item the statement of financial position. Here is an example of a standard statement of financial position.

For more information, you can also look at the paragraphs on 'Statement of financial position' in the Standard.

Current and non-current distinctionsAn entity must present current and non-current assets and liabilities as separate classifications on the face of the statement of financial position. The only exception is when a liquidity presentation (presenting all assets and liabilities broadly in order of liquidity) will provide more relevant and reliable information. This might arise in circumstances where a company has a variety of assets and liabilities that are of a similar nature, such as financial instruments.

A good example of an entity that would consider a liquidity presentation would be a financial institution. The reason for this is that the entity does not supply goods or services within a clearly defined operating cycle. Regardless of which method is selected, if an asset or liability line item combines amounts expected to be recovered or settled within less than 12 months and more than 12 months after the reporting period, then the entity must disclose the amount expected to be recovered or settled after more than 12 months.

Click Next to continue. Current assetsHere you can see when assets are classified as current.

Click each item to find out more. When assets are classified as current

Types of current assets An asset is classified as current when it is:

expected to be realised in, or is held for sale or consumption in, the normal course of the entitys operating cycle held primarily for trading purposes expected to be realised within 12 months after the reporting period cash or a cash equivalent asset that is not restricted from being exchanged or used to settle a liability for at least 12 months after the reporting period All other assets should be classified as non-current. The operating cycle of an entity is the time between the acquisition of assets for processing and their realisation in cash or cash equivalents Current assets include:

inventories and receivables that are sold, consumed and realised as part of the normal operating cycle, even when they are not expected to be realised within 12 months after the reporting period

current portion of non-current financial assets such as the portion of a lease receivable to be received in the next twelve months assets held primarily for the purpose of being traded such as some financial assets classified as held for trading in accordance with IAS 39 A liability shall be classified as current when it is expected to be settled in the entity's normal operating cycle or held primarily for the purpose of being traded. It is also classified as current if it is due to be settled within 12 months after the reporting period, or the entity does not have an unconditional right to defer settlement of the liability for at least 12 months after the reporting period. Terms of a liability that could at the option of the counterparty, result in its settlement by the issue of equity instruments do not affect its classification. All other liabilities are classified as non-current. Current liabilities could include:

bank overdrafts dividends payable income taxes payable other non-trade payables current portion of non-current financial liabilities True or false?

Look at the statements on current assets and liabilities below. Which are true in general circumstances?

Select one or more options and click Confirm. An asset is classified as current when held primarily for trading purposes An asset is classified as current when it is expected to be realised within 18 months of the end of the reporting period A liability is classified as current when it is due to be settled within 12 months of the end of the reporting period Items that could be classified as current liabilities are marketable securities, bank overdrafts and income taxes payable Sorry, thats not quite right. In general circumstances, the three true statements are that:

When an entity breaches an undertaking under a long-term loan agreement on or before the end of the reporting period with the effect that the liability becomes payable on demand, the liability is classified as current, even if the lender has agreed, after the end of the reporting period and before the authorisation of the financial

statements for issue, not to demand payment as a consequence of the breach. An entity classifies the liability as current because, at the end of the reporting period, it does not have an unconditional right to defer its settlement for at least twelve months after that date.

However, an entity classifies the liability as non-current if the lender agreed by the end of the reporting period to provide a period of grace ending at least twelve months after the reporting period, within which the entity can rectify the breach and during which the lender cannot demand immediate repayment.

Therefore, if there was no grace period, Environmends liability would appear to be current. Statement of profit or loss and other comprehensive income presentation by function

Having looked through the trial balance and the related notes, what will you tell Glen in response to his question of whether the expenses have been correctly classified in the statement of profit or loss and other comprehensive income? Remember, Angus McKay, Environmends financial director, used the by function method. Click the one correct option, and then click Submit. Yes, all the expenses have been correctly classified No, Angus McKay has made a mistake. Cost of sales should be aggregated with other operating expenses No, Angus McKay has made a mistake. Distribution and administra tion costs can be grouped with other operating expenses "An entity shall disclose information about the assumptions it makes about the future, and other major sources of estimation uncertainty at the end of the reporting period, that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year. In respect of those assets and liabilities, the notes shall include details of:

(a) their nature, and

(b) their carrying amount as at the end of the reporting period.

The assumptions and other sources of estimation uncertainty relate to the estimates that require managements most difficult, subjective or complex judgements. Examples of the types of disclosures an entity makes are:

(a) the nature of the assumption or other estimation uncertainty;

(b) the sensitivity of carrying amounts to the methods, assumptions and estimates underlying their calculation, including the reasons for the sensitivity;

(c) the expected resolution of an uncertainty and the range of reasonably possible outcomes within the next financial year in respect of the carrying amounts of the assets and liabilities affected; and

(d) an explanation of changes made to past assumptions concerning those assets and liabilities, if the uncertainty remains unresolved."

So, examples would be assumptions concerning discount rates used, future changes in salaries and future changes in prices affecting other costs. All Anguss queries have been answered and the financial statements have been sent back to Environmend. As well as helping Glen out, the two days work have consolidated your knowledge of IAS 1. You now know:

certain information that must be included in order to identify financial statements the distinction between current and non-current assets and liabilities how to reclassify a non-current liability how to assess the classification of expenses in the statement of profit or loss and other comprehensive income prepared using the by function method what information must be included in the statement of changes in equity the structure of notes the key points and disclosure requirements of the assumptions concerning the future and other sources of estimation uncertainty

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assignment Accounting 2023Document8 pagesAssignment Accounting 2023teddy100% (1)

- 2012 WPA by R.r.ocampo - Check FiguresDocument23 pages2012 WPA by R.r.ocampo - Check FiguresjaseyNo ratings yet

- Daily Report 192 27-08-2021Document176 pagesDaily Report 192 27-08-2021jay ResearchNo ratings yet

- Yahoo Inc!: Financial Statement For The Year Ended As atDocument16 pagesYahoo Inc!: Financial Statement For The Year Ended As atRohail AmjadNo ratings yet

- CFAS.101 - Diagnostic Test Part 2Document2 pagesCFAS.101 - Diagnostic Test Part 2Mika MolinaNo ratings yet

- CH 05 - Consolidation of Less-than-Wholly Owned Subsidiaries PDFDocument71 pagesCH 05 - Consolidation of Less-than-Wholly Owned Subsidiaries PDFjonjon111No ratings yet

- Module 7 HW SolutionsDocument7 pagesModule 7 HW SolutionsJeff MercerNo ratings yet

- ARB 51: Consolidated Financial StatementsDocument20 pagesARB 51: Consolidated Financial Statementspijej25153No ratings yet

- Dashboard Template 2 CompleteDocument2 pagesDashboard Template 2 CompleteKshitize GuptaNo ratings yet

- BUS101 Working PapersDocument388 pagesBUS101 Working PapersftcuserNo ratings yet

- Reinforcement Activity 1 Financial Statement Amp WorksheetsDocument29 pagesReinforcement Activity 1 Financial Statement Amp Worksheetsapi-33564620681% (16)

- Aicpa 040212far SimDocument118 pagesAicpa 040212far SimHanabusa Kawaii IdouNo ratings yet

- Interim Financial Reporting: International Accounting Standard 34Document16 pagesInterim Financial Reporting: International Accounting Standard 34humnarviosNo ratings yet

- Pas 1Document52 pagesPas 1Justine VeralloNo ratings yet

- Paper F7 Financial Reporting: Revision Mock Examination June 2017 Answer GuideDocument102 pagesPaper F7 Financial Reporting: Revision Mock Examination June 2017 Answer GuideakbossNo ratings yet

- Graded Exam #1Document14 pagesGraded Exam #1RamsyNo ratings yet

- 4-Accrual Accounting ConceptsDocument115 pages4-Accrual Accounting Conceptstibip12345100% (5)

- Financials Plaza Del PradoDocument14 pagesFinancials Plaza Del PradoSteve WilliamNo ratings yet

- Similaires and Diferencies IFRS US GAAP 2005Document92 pagesSimilaires and Diferencies IFRS US GAAP 2005Bader Akarkoune100% (1)

- Chapter 3: An Introduction To Consolidated Financial StatementsDocument44 pagesChapter 3: An Introduction To Consolidated Financial StatementsMUHAMMAD ARIFNo ratings yet

- LKFS BR 31 March 0908 (Final)Document116 pagesLKFS BR 31 March 0908 (Final)wdr80No ratings yet

- Multiple Choice QuestionsDocument25 pagesMultiple Choice QuestionsJohn Remar Lavina70% (20)

- Basic Accounting Quizbee 2013Document8 pagesBasic Accounting Quizbee 2013MarlouieV.Batalla100% (2)

- Principle of AccountingDocument105 pagesPrinciple of Accountinglemma4aNo ratings yet

- Balance SheetDocument28 pagesBalance SheetrimaNo ratings yet

- 2Document4 pages2Dip PerNo ratings yet

- Bad Debt Expense $ 7,100 Allowance For Doubtful Accounts ......................... 7,100Document4 pagesBad Debt Expense $ 7,100 Allowance For Doubtful Accounts ......................... 7,100Miccah Jade CastilloNo ratings yet

- Chapter 4 Homework (April 22)Document6 pagesChapter 4 Homework (April 22)Sugim Winata EinsteinNo ratings yet

- Tugas Week 8Document6 pagesTugas Week 8Carissa WindyNo ratings yet

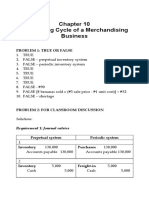

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)