Professional Documents

Culture Documents

Nepal Tax

Uploaded by

Shailendra Uprety0 ratings0% found this document useful (0 votes)

1K views25 pagesGlimpses of provisions of tax in Nepal (focus on Income tax)

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGlimpses of provisions of tax in Nepal (focus on Income tax)

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views25 pagesNepal Tax

Uploaded by

Shailendra UpretyGlimpses of provisions of tax in Nepal (focus on Income tax)

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 25

Banskota & Co.

, Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 1

Contents

1. Heads of Income ==+ +- .......................................................................................................... 2

2. Types of Tax payer +-+ ++ ....................................................................................................... 2

3. Tax rates for individual |+= =a=: ++ - ................................................................................... 3

4. Presumptive taxation +- -+- + ................................................................................................... 8

5. Entities -+= .................................................................................................................................... 9

a. Rate of tax for entities -+=+ === =- ++ ........................................................................ 9

b. Concessional Rates of Tax =-==-+- ++ - ......................................................................... 10

c. Deductions for business +; -- +=- ...................................................................................... 14

d. Depreciation Rates -=+ - ................................................................................................. 15

6. Double Tax Avoidance Agreements (tax rates) - + =a ==~- ++ - ................................ 16

7. TDS provisions ............................................................................................................................... 16

a. TDS on employment === + +; ....................................................................................... 16

b. Tds rates + +;+ ............................................................................................................... 16

c. TDS on disposal of shares, land and buildings etc =, == :=+ -=== + +; ................. 18

d. Payments for which TDS not required to be deducted ~a- = + +; =- -+- =- .............. 19

e. Deposition of TDS += =|+ ++ ~a- .................................................................................. 20

f. Distribution of TDS certificate + +; +=-++ =+=+ ==- +- .................................................... 20

8. Due date for Returns of income == --- = =- +- =- ............................................................. 21

9. Due dates amount to be deposited while filing estimated tax

+--= =-=-- + = =- +- =- +=- ................................................................................. 21

10. Interest and Penalties -+ - == ................................................................................................. 22

11. Special Provision for women through FinanceAct. =-=+ == =+ |- : - =-- ................... 23

12. Health service tax ---= =- + ....................................................................................................... 23

13. Education service fee =- -+ ................................................................................................. 24

14. Contact .......................................................................................................................................... 25

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 2

1. Heads of Income ==+ +-

- Income from Employment === ==-

- Income from Business =-=== ==-

- Income from investment ==-= ==-

- Income from windfall gains =+-=+ =~= ==-

2. Types of Tax payer +-+ ++

Natural Person ++-+ =a Entity -+=

Individual |+= =a

Couple =+a c-= =-

++-+ =a

Sole proprietorship |+==

+=

Partnership firm =~ +=

Trust ==

Company +=+-

V.D.C. =-=

Municipality -=+=+

D.D.C. ==

Government of Nepal -+= =+

Foreign Government =+

An organization established

under any treaty or agreement

=-== ==s-

Foreign Permanent Establishment

-= =-+-

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 3

3. Tax rates for individual |+= =a=: ++ -

a. Slab For Individual/ Couple/ Sole proprietorship business

|+= =a / =+a / |+== +==: --=

For individual

|+= =a

For couple

=+a

Tax rates

++

Up to 160,000

-, ===

Up to 200,000

-, ===

1%** (SST)

Next 100,000

+ , =

Next 100,000

+ , =

15%

Balance up to Rs. 25 lacs

- = ===

Balance up to 25 lacs

- = ===

25%

Excess of Rs. 25 lacs

-,, ~ t ===

Excess of Rs. 25 lacs

-,, ~ t ===

35%

(25%+25%*40%)

** a) 1% SST to be deducted only to the extent of employment income of a

natural person having income from employment, business and

investment and not to be deducted on the income in excess of such

employment income.

==, =-== - ==-= =- == -- ++-+ =a+ -+= === ~|+

==+ ===== +-- + =- == == -~|+ =--= =a +-- +

-=-

b) Not applicable for sole proprietorship business. |+== += - ~|+

+-+ -+= =+a === |+ +-- + -=-

c) 1% tax, also called Social Security Tax, should be deposited in a

separate revenue account. === =|+ % += c; =-- -= === =- +-

b. Resident Female = =-=

In case of resident female taxpayer having employment income only, rebate

of 10% shall be allowed on the total tax liability.

+- = ++-+ =a +=+ == =+ ==- =- =-= -c ~- =-- ++-+ =a=

-- +- + +== +-- c= --c

c. Non-resident individual = = ++-+ =a

The taxable income of a non-resident individual for an income-year is taxed

at the rate of 25 percent = = ++-+ =a+ +- == -+ +== === +-==

+--+ = + =- c

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 4

d. Concessional tax rates for natural person =-==- ++

Income from special business specified in sec 11.

+ = =-=- - === ==== +- ==

20% slab rate instead

of 25%

Income from export -+== ~|+ +== == 20%

e. Gains from disposal of Non-business Chargeable Assets = =-==+

+== ==+a+ -==+ =~= +

Land and building**

== - -= ~--

- If owned for more than 5 years

- --=- - ~ t ~|+ c ~-

- If owned for less than 5 years

-=- - ~ += -+ c ~-

2.5%

5%

Gains of transaction in commodity future market

Sdf]l86L o'r/ dfs]{6df ePsf] nfe

10%

Gains on disposal of listed securities

+-++ -:= ==+- ~|+ -+=+ --+ -=== +-

=~

5%

Gains on disposal of non-listed securities

+-++ -:= ==+- -~|+ -+=+ --+ -=== +-

=~=

10%

** Private Land and building are deemed to be Non-business chargeable

assets if it has been disposed for a sum of Rs. 30 lacs or less and in case of a

private residence of an individual which has been owned by him

continuously for 3 years or more or resided by him continuously or

intermittently for 3 years or more.

== - ~--+ ==+= = =-==+ +== ==+a : +- ++-+ =a+ =--c- --

- - = ~ t =-+ --=-= -+ - = =a= =--c- - +=+ +=+ = +=

--- - = ~ t = = =+ +- -= ~--, - |+ +: += ~ += =-== -==

=+ == - -= ~--

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 5

f. Income from windfall gains =+-=+ =~ = ==-

Income from windfall gains means lottery, gift, prize, baksis, award for

wining (jitauri) and other similar types of gains. Such incomes are taxed at

the rate of 25% and are final withholding payments.

=+-=+ =~ = =ss, =+-, +-+, +==, =- - == +- +- =+-=+ +=

+- -- =~=: =-=c =-- =~= +- === - +--+ = ~a-+ ==== +

+; =- +c =-- += =-= += + +; -- ~a- =-- ~|+= =-- += ===

=== =- +-

g. Deductions ==- +=- +=-

i. Retirement contribution to an Approved Retirement fund

--+- =-+ + ==- -

Retirement contribution to an Approved Retirement fund is allowed

as a deduction subject to the limit of Rs. 300,000 or 1/3

rd

of

assessable income, whichever is lesser.

--+- =-+ ++ --++ ++ -+ =a= + - == -= = += =+

=-+ ==- =+- +== ==+ =-- =, =-+ ==- - = -

=+- -+-== ==+ |+ --:= =- = -c = - =- =+- c

ii. Donation =

Donation given to exempt organisation + c= +|+ =--=: :|+

= =+-

Donation given to an approved tax-exempt organisation is

deductible subject to a limit of Rs. 100,000 or 5% of adjustable

taxable income, whichever is lower.+- =a= +- == -= --+-

+- + c= +=- =-=: ==+- |+ += - |+ = += - =

=a+ = -+ ====- +== ==+ += +--== =- = -c = +=

=: =- =+- c

ii. Remote area allowance == + ~a -- c=

Location

+

Deductions Rs. (P.a)

c=+ +- -

Area A 50,000

Area B 40,000

Area C 30,000

Area D 20,000

Area E 10,000

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 6

iii. Foreign Allowance Deduction -+ ~a c=

75% of Foreign Allowances received by employees of diplomatic

mission of Nepal shall be deduced from the total taxable income.

-+=+ - -- +=--+ -=== +=- +==+ -+ ~a+ +=-a

+-- += +== === =: + -- +== =+ ++ =-- =- c

iv. Additional deduction for pensioners ---~- == ~|+ =

++-+ =a=: + c=

A resident individual earning pension income is allowed additional

deduction of 25% of Rs. 160,000 for individual and Rs. 200,000 for

couple or such pension income, whichever is less.

---~- == ~|+ = ++-+ =a+ == -, |+= =a+

-+= - -, =+a c-= =- ++-+ =a+ -+= + +-== +--

- ---~- == == += += === ==- +=- c-

v. Deductions for resident differently-able persons =+: =

++-+ =a=: c=

50% of the basic exemption limit (Rs. 160,000 for individual and

Rs. 200,000 for couple) is allowed as deduction incase of resident

differently-able persons.

+- = ++-+ =a =+: -c ~- =-- ++-+ =a+ == -,

|+= =a+ -+= - -, =+a c-= =- ++-+ =a+ -+= +

+== +-- + += +== === =: -+ -- +== =+ ++ =--

=- c

vi. Life insurance premium ==- =-- = =+ =a

A deduction of the amount paid by a resident natural person for life

insurance or Rs. 20,000 whichever is less is allowed while

calculating taxable income.

+- = ++-+ =a= ==- = =+ -c ~- = -+- ~a- =+

-+ +=== - -= -= += = =- = -c = += +== === =:

+ -- +== =+ ++ =-- =- c

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 7

h. Tax credit + ==-

a) Medical Tax Credit (med-claim) =+ =+= +- + ==-

A resident individual can claim a tax credit of an amount incurred for

medical expenses upto a limit of Rs. 750 or 15% of approved medical

expenses, whichever is lower.+- = ++-+ =a= =+ =+= +- +

==-+ += === --+- =+ =+= = +=+ ++ +--+ = -- += -

== =- = -c = += =: =- =+- c

b) Foreign tax Credit -+ + ==-

A resident person may claim foreign tax credit for any foreign income

tax paid during a year.

+- = =a= +- == -= = =+ +- - ==+ = =a+

-+-== - == +- = =|+ ++ -=== = == -= = -

==+ +- + ==-+ =- =+- c

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 8

4. Presumptive taxation +- -+- +

a. Small tax payers =- + -

A resident individual whose income consists exclusively from

business having source in Nepal and the income or turnover does not

exceed Rs. 200,000 or Rs. 2,000,000, as the case may be, and he

elects to apply this provision, provided he does not claim medical tax

credit and credit for TDS withheld is taxable as follows:

-+== =- ~|+ =-=== +- == =+ ~|+ |- =+ =+= = === +

+; -+- + ==- =- - -=+ |- =-=== +- == -,

=-==+ + -,, ~ t -~|+ =+-= == -= = =-- ==

-- = c-= =+ = ++-+ =a+ -+= -=- === + =- c :

Location of Business

=-== ~|+ +

Tax Amount (Rs.)p.a

++ +- -

Metropolitan or Sub- Metropolitan Cities

=--=+=+ - =+=--=+=+ +

3,500

Municipalities -=+=+ + 2,000

Other places == +- --= 1,200

b. Vehicle owners ~:+ =-=+- +--

Owners of Vehicle plying vehicle on hire shall be taxed as follows:

~:+ =-=+- +--= -= ===+ -+ + === =- c :

Type of vehicle

=- =+-+ ++

Tax Amount (Rs.)p.a

++ +- -

Mini-bus, Mini-truck, Truck and Bus

=-=, =- =+, =+ =

1,500

Car, Jeep, Van, Micro-bus

+, =+, -=-, =:+ =

1,200

Three-wheeler, Auto-rickshaw, Tempo

--=, == +=, ==+

850

Tractor, Power Tiller

=+= +- ==

750

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 9

5. Entities -+=

a. Rate of tax for entities -+=+ === =- ++

S. No Type of business

-+=+ -

Tax rates

++

1. General Business entities.

=== =-== =- -+=

25%

2. Entities involved in producing Tobacco and Alcohol related

products.

=-== === === ===- =- -+=

30%

3. Banking and Financial Institutions, and Insurance companies

+, a= =-, -= =-== =- -+=

30%

4. Entity engaged in petroleum business.

+==== += =- -+=

30%

5. Special industries.

- === ===- =- -+=

20%

6. Entities engaged in operating any road, bridge, tunnel, rope-

way, or fly-overs constructed by the entity or engaged in

operation of trolley bus and trams.

=:+, +=, =-=, +- - =+ += -=- = ===- =- -+=, - ==

= - == ===- =- -+=

20%

7. Entities engaged in Co-operative business, other than tax

exempt cooperatives.

+ c= -++ =-+ =- = ==- =- -+=

20%

8. Income derived by an entity from export having a source in

Nepal.

-+=+ =-= -+= = == +- =- -+=

20%

9. Entity wholly engaged in building public infrastructure, and

owning, operating and transferring (BOOT) it to the

Government of Nepal.

=-=-+ +-+ ==-+ -=- - ===- = -+= =+=:

----- =- ===-

20%

10. Entities engaged in generation, transmission, or distribution

of electricity.

=- =- -=-, =+- +=- == =-- -+=

20%

11. Estate of a deceased resident individual or trust of an

incapacitated resident individual.

+- =- = =a+ ==+a +- =- - =- - =a =

++-+ =a+ ==

Same rate

of tax as

was

applicable

to the

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 10

deceased

or

incapacitat

ed

individual.

b. Concessional Rates of Tax =-==-+- ++ -

S. No Type of business

-+=+ -

Tax rates

++

1. Agricultural income derived from sources in Nepal other than

the income from an agriculture business derived by a

registered firm, or company, or partnership, or a corporate

body, or through the land holding above the ceiling as

prescribed in the Land Act, 2021.

+- +=, +=+-, =~ += - ==s- =-+ += - = +

=-== = +- =+ === ~===+ |-, -- + + - + -:

z = =-= ~| ===+ === + =-==-= +- ~|+ -+

== + ==-

NIL

2. Incomes derived by cooperative societies, registered under

Cooperative Act, 2048 (1991), from business mainly based

on agriculture and forest products such as sericulture and silk

production, horticulture and fruit processing, animal

husbandry, diary industries, poultry farming, fishery, tea

gardening and processing, coffee farming and processing,

herbiculture and herb processing, vegetable seeds farming,

bee-keeping, honey production, rubber farming, floriculture

and production and forestry related business such as lease-

hold forestry, agro-forestry, cold storage established for the

storage of vegetables and business of agricultural seeds,

insecticide, fertilizer and agricultural tools (other than

machine operated)and rural community based saving &

credit cooperatives and Dividends distributed by such

societies.

=-+ |-, -= === - ~: ===- ~|+ + - -- +-=

=+- = - - = =+-, +=+= - =+- - +=+=

++-, ++=-, : ===, ++=-, =-=+=-, == - - ++-,

++ - - ++-, =:-= - - ++-, -++ -= -=-

=+-, =+=-, =- =+-, -, +-==- --, |=+ = =

NIL

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 11

=-==+ -- ==+ =-==- =-- + - --== ===-, -+

~-:+ == -+- - ~-:, +==+ -= -=-, + =-, -,

+=-+ =+, == - + = = =++ a= =---+ +

+- =- =-+ =- - ==- ==== =+- =- - =-

=-+ =- - =+ == + -=-

3. Special industries providing direct employment to following

number of Nepali citizens during each day of the year:

- ~ -=- =r== -+= -=+=: += == - ===:

300 or more - = ~ -t

1200 or more - - = ~ -t

100 or more (including 33% women, dalits and

differently-able persons) - = ~ -t = ==

+=-= =-=, =- =+:

18%

16%

16%

4. Information technology companies providing direct

employment to six hundred or more Nepali citizens during

each day of the year:

- ~ -=- =r== -+= -=+=: += == - ==- ++

===:

300 or more - = ~ -t

1200 or more - - = ~ -t

100 or more (including 33% women, dalits and

differently-able persons) - = ~ -t = ==

+=-= =-=, =- =+:

22.5%

20%

20%

5. Special industries operating in a remote area.

=- =-+- += ===- -- - ===

2% for 10

years

6. Special industries operating in an undeveloped area.

=-+=-+= ===- -- - ===

4% for 10

years

7. Special industries operating in an underdeveloped area.

=-+-+=- += ===- -- - ===

6% for 10

years

8. Industries established in special economic zones of

Mountainous districts and specified Hilly districts (industries

0% for

first 10

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 12

specified in sec.3 of Industrial Enterprises Act, 1992).

-== =-= -+= =+= -++ +-: =-=+ =+ +=

-+- === ===+ =-== |-, - + + = =-=- ===

years, and

10%

thereafter

9. Special economic zones in other areas (industries specified in

sec.3 of Industrial Enterprises Act, 1992).

== ++ =+ += -+- === ===+ =-== |-, -

+ + = =-=- ===

0% for

first 5

years, and

10%

thereafter

10. Entities engaged in the exploration and extraction of

petroleum and natural gas and operating before Chaitra 2075.

- =+=== =++ +- ===- =- +==== - ++-+ ==

=-- - =-- =- ===

0% for

first 7

years, and

50%

rebate for

the next 3

years

11. Entities engaged in software development, data processing,

cyber caf, digital mapping business in the Information

Technology parks established by Government of Nepal by

publication in the Official Gazette .

-+= =+= -+= =++= ==- ++- = - + + =+-== ++, =

=+ ++ ==- +-+ ++ ~+ =+=-= -+=, -=+ ++-, =:-

+=+, :=== ==+= ==+ ===

12.5%

12.a Entities engaged in production, or production and

transmission ,or production and transmission ,or production,

transmission and distribution of electricity, which

commercially start production, transmission, or distribution

of electricity before Chaitra 2075. (including solar, wind and

bio gas energy).

-=-+ =+-, +=-, --- =- =-=- +- =a= ==- - =+

=--=== =++ += ==-=-+ =+-, =+- +=-, =+-

--- - =+-, +=- --- == ==, -= - =-+ +=

=+- -- -=- ==-

0% for

first 7

years, and

50%

rebate for

the next 3

years

12.b Entities commencing their work within Bhadra 7, 2071 and

producing electricity by Chaitra 2075.

==- - == ~ =- ~+ -=- +=~ =- ==-=- ===-=

==- - == =+ =--=== =++ += ==-=-+ =+- =

0% for

first 10

years, and

50%

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 13

=+ ===

rebate for

the next 5

years

12.c Entities that obtained license before 2058/12/19 and

generating power by Ashad 2066.

-=- = =-=-++ +- ~|+ - --- =t ==- ~+

=+- += = =+ ===

0% for 15

years from

COD

12.d Entities generating electricity after Ashad 2066 but before

Chaitra 2075, whenever the license may be obtained.

=-=-++ =-= +| +-, --- =t ==- +c - - =+ ==- =

=+- += = =+ ===

0% for

first 7

years from

COD,

50%

rebate for

the next 3

years

12.e Entities that obtained license after 2058/12/19 and generating

power after Ashad 2066 but before Chaitra 2075.

-=- = =-=-++ +- ~|+ - --- =t ==- ~+

=+- += = =+ ===

0% for

first 7

years of

COD,

50%

rebate for

the next 3

years

12.f Entities that obtained license after 2058/12/19 and generating

power before Ashad 2066.

-=- +c =-=-++ +- ~|+ , --- =t ==- ~+ =+-

+= = =+ ===

No

concession

13. Income from export of goods manufactured by a

manufacturing industry.

=+-==+ ==== =+- =+ --- -=- == + - ===

25%

Rebate

14. Entities involved in building and operation of roads, bridges,

airports, and tunnel ways.

=:+, +=, -=--=, = = == -=- ===- == == +- ===

40%

Rebate

15. Income earned by an entity on investing and operation of

trams and trolley bus.

==, ==-== ==- = ===- == = = +- ===

40%

Rebate

16. Listed entities engaged in manufacturing sector, tourism

sector and generation, transmission and distribution

10%

Rebate

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 14

hydroelectricity and entities specified in sec 11(3d).

+-++ == ==+- ~|+ =+-==+, +==- =-, ==-=- =+-,

--- - ====- =- + + = = =-= ~|+ -+=

17. Entities established in remote areas and engaged in

production of brandy, cider and wine from fruits.

=- =-+=- += -+- +=+== =+- -:, =:: |-= -:-

=+- =- == =

40%

Rebate for

the first 10

years of

start of

business

18. Royalty earned on export of Intellectual properties.

+- =a= :+ ==+a -=- -+- +- =-= ===

18.75%

19. Income earned by sale of intellectual properties.

+- =a= -:+ ==+a+ -----: -+ = +- =+ ===

12.5%

20. Repatriation of income of a foreign permanent establishment

of a non-resident person situated in Nepal.

+- = = =a+ -+=-- - -= =-+-= - +s|+

===

5%

21. Non-residents Providing Shipping, Air Transportation or

Telecommunications Services within Nepal.

-+= =+== =+ - ==+= +- = +-- --- == =+, --:

=-=- - == =- =+=+ ==- = =+ +== ===

5%

22. Non-residents Providing Shipping, Air Transportation or

Telecommunications Services outside of Nepal.

-+= =+== =+ - ==+= +- = +-- -- == =-=-,

--:=-=- - == =- =+=+ ==- = -= =a+ -+=

2%

c. Deductions for business +; -- +=-

- General Deductions === +=

- Interest ==

- Cost of Trading Stock =+ =-+ ==-+ =

- Repair and Improvement Costs ==- - =+ =

- Pollution Control Costs +- -=+- =

- Research and Development Costs =-=+- -+= =

- Depreciation Allowances -=+= =

- Losses from a Business or Investment =-== - ==-= -+=-

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 15

d. Depreciation Rates -=+ -

Pool Details Rate

A Buildings, structures, and similar works of a permanent nature

~--, -=+= -= ++-+ =-- +++ == -=-

5%

B Computers, data handling equipment, fixtures, office furniture, and

office equipment

+===, -=: +==- =++-, +-=, ++-= +=== =++--

25%

C Automobiles, buses, and minibuses

===:-=, = - =-=-

20%

D Construction and earth-moving equipment, unabsorbed pollution

control cost and research and development cost and any depreciable

asset not included in another class of assets

-=- - =-- ==+ =++-- += -~|+ +- -=+- = =-=+-

-+= = == +- ==- --|+ -= == ==+a-

15%

E Intangible assets other than depreciable assets included in Class "D"

-= = =-= ~|+ -=== ==+a- -++ == ==+a-

**

** rate in percentage calculated as the cost of assets divided by the useful life of

the asset in the pool most recently acquired by the person and rounded down to

the nearest half year.

==+a =+ -= =a ==+a+ ==-=: ==+a+ +==-+= ~= = -+=-= =+ -=

==- = -- ==- +--=

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 16

6. Double Tax Avoidance Agreements (tax rates)

- + =a ==~- ++ -

S.No. Country Dividend tax Tax on Interest Royalty tax

1. India 10%, 15% 10%, 15% Not more than 15%

2. Norway 5%, 10%, 15% 10%, 15% Not more than 15%

3. Thailand 15% 10%, 15% Not more than 15%

4. Srilanka 15% 10%, 15% Not more than 15%

5. Mauritius 5%, 10%, 15% 10%, 15% Not more than 15%

6. Austria 5%, 10%, 15% 10%, 15% Not more than 15%

7. Pakistan 10%, 15% 10%, 15% Not more than 15%

8. China 10% 10% Not more than 15%

9. South Korea 5%, 10%, 15% 10% Not more than 15%

10. Qatar 10% 10% Not more than 15%

7. TDS provisions

a. TDS on employment === + +;

An employer shall deduct TDS on the amount payable to the employees

after allowing reduction of medical tax credit, if any. Such TDS shall be

withheld on a monthly basis as is equal to the annual tax liability divided by

12.

+- ==-= +==-= =+ =+= -+- + ==- =- +=- ~| ===: ==- =,

+ +=+= =- ++ ==-+ -=-= ==+ += === + +; =- +-

b. Tds rates + +;+

S.No. Details of payment

~a-+ +==

TDS Rate

+;+

Final or not

1. Interest having source in Nepal.

=== == ~a-

15% Non final

2. Payment for natural resources, royalty, service

fees, sales bonus.

++-+ -, =-=, =- -+, +=- - -+ --=

=

15% Non final

3. Meeting allowance, part time teaching

allowance.

15% Final

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 17

-s+ ~a, +=+ += =|+ ==+- =| +-+ ~ a-

4. Payment from approved retirement fund

exceeding the higher of 50% of retirement fund

or Rs.500,000.

-+= =+ - --+- =-+ += ~|+ =-+

~a-= ,, - +-- == =- t -c

= =: + -- ~a-

5% Final

5. Payment of commission by resident employer

company to a non resident.

-= == +=+-= = -= =a=: ~a- =+

+=-

5% Final

6. Payment relating to lease of airplane.

-==-+ == +; -+-+ += ~a-

10% Non final

7. Service fee to service provider registered in

VAT.

=-= =~-: += - ~|+ =-+=+ -= =a=:

~a- =+ =- -+

1.5% Non-final

8. Payment of rent relating to land and building,

including furnishing and fittings, to natural

person not relating to business.

++-+ =a+ =-==== ==-+- -~|+ ==

--== ==| -+-+ ~: = == -+ ==-=+

==-+ |+== ~:

10% Final

9. Payment of rent having a source in Nepal to

others.

-+== =- ~|+ ~: ==

10% Non-final

10. Dividend

=~

5% Final

11. Gain from investment insurance

==- -=+ =~

5% Final

12. Gain from unapproved insurance

--+- -=|+ =-+ += =~+ ~a-

5% Final

13. Interest, not relating to business, paid to natural

person by resident bank, financial institution,

institutions issuing debentures, or listed

companies on deposits, debentures and

government bonds.

-+== =- ~|+ =-== ===-== ==+- -~|+

-:= = +, -a= =- - =-++ = =- ==

+- -+= - +==- +-- === ==+- ~|+

+=+-= +- ++-+ =a=: -+, =-++, :-= -

5% Final

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 18

=+ --:+ +- ~a- =- ==

14. Income from windfall gains.

=+-=+ =~

25% Final

15. Contractual payment exceeding Rs. 50,000.

+ - s++ -+- , ~ -t +=+ ~a-

1.5% Non-final

16. Contractual payment made to Nonresident.

= -= =a=: ~a- -- =- ==+ s++ -

+=

15% Final

17. Repair and other contracts of airplane made to

Non-resident.

= -= =a=: ~a- -- -==- ==- - ==

s++ - +=

5% Final

18. Other payment made to non residents.

= -= =a=: -- == ~a-=

As per the

direction of

the

department

Final

c. TDS on disposal of shares, land and buildings etc

=, == :=+ -=== + +;

S.No. Details of payment

~a-+ +==

TDS Rate

+;+

Final or

not

1. Gain on transaction in commodity future market

+=:= o'r/ dfs]{6df ePsf] nfe

10% Non-final

2. Gain on disposal of listed security of a resident

entity:

+-++ -:= ==+- ~|+ -+=+ --+ -=== +-

=~

-received by natural persons

+++ -= ++-+=a+ -+=

- received by others

==+ -+=

5%

10%

Final

Non-final

3. Gains from disposal of not listed securities

+-++ -:= ==+- -~|+ -+=+ --+ -===

+- =~=

-received by natural persons +++ -= ++-+

=a+ -+=

10%

Final

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 19

- received by others

==+ -+=

15%

Non- final

4. Capital gains on disposal of land and/ or

building by a natural person

+- ++-+ =a+ - == -== -+- ~|+

+==- =~=

- If Ownership of 5 years or more --=-

- ~ t ~|+ c ~-

- If ownership is less than 5 years --=-

- ~ += -+ c ~-

2.5%

5%

Final

Final

d. Payments for which TDS not required to be deducted

~a- = + +; =- -+- =-

- Payments made by an individual other than in conducting a business, or

payment of rent for the lease of a building, including goods and equipments

therein.

++-+ =a= =+ =-== ===-== ==+- ~ a- - , == === =:- ==-

- =++- ~:= =| +- -+ ~: -++ == +- ~a-

- Payment made to person contributing articles in a newspapers and

magazines

+++++= ++- = =- -+-+ ~a-

- Payment made for preparation of question paper or checking of answer

sheets.

+-++ -= = - =a +--+ == = -+-+ ~a-

- Interest paid to resident banks or resident financial institutions.

= + - = = -a= =-=: -+ ==

- Payment of tax exempt income.

+ c= +|+ ~a-

- Inter-regional interchange fee payment to banks issuing Credit Cards.

+:= +: = =- -+=: -+ :-==-= :-=== -+

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 20

- Interest and fees payable by Government of Nepal to a Foreign Government

or an International organization as per a bilateral agreement.

-+= =+ - =+ - -+= =+ + ~|+ =-== =- -= ~|+ +- ==~-

=== -+= =+= - =+ - =-== =-=: ~a- =+ == - -+

- Interest upto Rs. 10,000 p.a. made by micro finance, cooperatives etc, based

in a rural community.

==- ==== =+- = -a =-, ==- -+= +, -=+ =- + |-+ + -

=== =-+= === =+ -+= ==- -+ -= +====+ == ~a-

- Re-insurance premium paid to Non-resident insurance company.

= -= =a=: ~a- -- +-= +===

e. Deposition of TDS += =|+ ++ ~a-

Details of TDS to be filed and the sum deposited in the designated bank

accounts within 25

th

day of the next Nepali month

=== + +; =- +- +=+ =a= +=+ =-- ==- ~|+ - - ~+, - = =-

+- + +; =|+ += ~== - =-- - = ==- -- += = =- +-

The deductor and decductee jointly and severally liable for deposition of

TDS, if TDS not deducted or if the deducted TDS is not deposited in the

prescribed manner.

+ +; -== - + +; =+ =-- += -~== = -== === + +; -- =a

= === + +; =- =a - =- ==a += c;c; += = + += -~== =

=- ===- --

f. Distribution of TDS certificate + +; +=-++ =+=+ ==- +-

In case of TDS on

employment

== === + +;

==+=

30 days after the end of the year or, where

the employee has ceased employment with

the withholding agent during the year, no

more than 30 days from the date on which

the employment ceased.

- ==- ~|+ =-= -= -~+ =+=+ =:

=+-+-c - = -= = +=== = === + +;

=- =a+= == =- c:+ ~| = ==

c:+ =-= -= -~+ = +=-++ =+=+ ==-

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 21

+-c

TDS deduction in other

cases

== + +;+ -+=

A withholding certificate shall be

delivered within 15 days after the end of

the month specifying the period for which

tax is withheld.

=== + +; =+ =-+ =: === + +; =+

=-- ==- ~|+ =-= ++ -~+ === + +;

+=-++ +- =- +-c

8. Due date for Returns of income == --- = =- +- =-

Tax return to be filed not later than 3 months (Ashoj) after the end of each

income year, which can be extended further upto 3 months (Poush) by

submitting a written request to the department

== - ==- ~|+ -- =-- === === ~+= -~== -++ --= == --- =

=- +-c -- =--=== == + =- =+-c -~= == + ==+ == =- ---

|= -~== ==--- = =- +- == =-- =+ === + =- =+- c

9. Due dates amount to be deposited while filing estimated tax

+--= =-=-- + = =- +- =- +=-

Installment

+--

Due Date

= =- +- =-

Amount

1

st

By the end of Poush

+ =--+ =====

40% of the estimated tax.

=-=-- ++ % +=

2

nd

By the end of Chaitra

=+ =--+ =====

70% of the estimated tax.

=-=-- ++ % +=

3

rd

By the end of Ashad

=t =--+ =====

100% of the estimated tax.

=-=-- ++ % +=

Where the amount of total installments to be paid is less than Rs 5,000,

estimated tax installments need not be paid.

~=- +- === +--+ === += += -= += ~ += ~|= =-- +--+ +=

~=- +- c -

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 22

10. Interest and Penalties -+ - ==

Failure to file Statements of

estimated tax

+- == -+ =-=-- == ---

= -==

Rs. 2,000 per statement

+- --- : -= +=

Failure to file Return of Income

+- == -+ == --- =

-==

For Small tax payers =- + -+ -+=

Rs. 100 per month |+ == += +- =--

For other tax payers == +-+ -+=

0.1% p.a of assessable income without

allowing for any deductions or Rs. 100 per

month, whichever is higher

+- += -+=: + - += ==- =- +- ~| =

==- = -- -+-== ==+ +=+ ==

== |+ +-- +- -+ = -- += - |+ ==

+= +- =--+ = -- +=== =- t -c =

+=

Failure to maintain required

documents

+- =a= +- == - r- +-

+==- -=

0.1% of assessable income without allowing

for any deductions or Rs. 1,000 whichever is

higher.

+- += -+=: -+-== ==+ = ==- |+

+--= -- += - |+ -= += == =- t -c

= +=

Withholding agent who fails to

file a statement

=== + +; =- +- |=-== ---

+ -==

1.5% p.a of the tax required to be withheld

for every month or part thereof during which

the failure persists.

+=+ =-- =--+ ~=+ == === + +; =-

+- + +=+ -+ :t +--+ = -- +=

Interest for Understating

Estimated Installment

+--= = =-= += =-=--

+ -- = ~|= =- ==

15% p.a on the shortfall in the payment of

estimated tax installments

+--= + ~=- +- += += ~|= = +=

~|+ +=+ -+ % +--+ = -- +=

Interest for Failure to Pay Tax

+ -~|= == =-

15% p.a of the outstanding amount for every

month or part thereof of such delay

-+ -+ +== +=+ =-- =--+ ~== -+

% +--+ = -- +=

Penalty for Making False or

Misleading Statements

~; - ~=+- --- = =-=:

=- -+

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 23

- If made without

knowingly or recklessly

=-=- - =+-+-+

-=+

- If made knowingly or

recklessly =-=- -

=+-+-+ =+

- 50% of such underpayment

= + +=+ +== +--

- 100% of such underpayment

= + +=+ |+ == +--

11. Special Provision for women through Finance Act. =-=+ == =+ |-

: - =--

Where the title of the land and building is transferred to a female, in

whatever manner, then rebate on the registration fees is allowed as follows:

=-=+ ++= =-=+ -== --=- +- -- = +- -- =-= == |- ===

==:|+ == ==- --= -=- c= --c :

- In case of municipal areas 25%

-= ++ ~| - +--

- In case of V.D.C 30%

=-= ++ ~|= +--

12. Health service tax ---= =- +

- Health service tax is levied and collected on services of entities other than

Government hospitals and Public hospitals. 5% tax is levied on the invoice

value issued by such entities.

-+= =+= +- =- ---= =- ===+ =-+-=-== +- =- ---= =- -++

== -+=-== +- =- ---= =--== = =+ =-=+ += +--+ = ---= =-

+ ==:- ====+ =-c

- Such tax shall be collected by the natural persons, instutions or entities by

issuing tax invoice.

=- + =-- =- +- =- =a, =- - -+== =+ = = ====+ =- +-c

- The details of such tax shall be filed on trimester basis within 25 days of the

end of such trimester.

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 24

=+ --- ===+ =+= +=+ ===+ =-+ ==- ~|+ +-== -~+ ==+-

=-+ =-- +==== = =- +-c

- Interest and fees -+ - ==

If tax is not deposited within the

specified time

==~+ + = -==

15% p.a

If the return is not submitted within

time.

--- = -==

Rs. 1,000 per return

13. Education service fee =- -+

- 1% Education service fee is levied and collected on admission fee and

monthly tuition fee of all Private education institutions providing education

service above Higher Secondary Level and educational institutions situated

in Kathmandu valley, sub-metropolitan cities, municipality, district

headquarters and areas specified by the IRD of respective areas.

-= += ===- ~+ =-= ===+ ~ =+ +- =- - =--=,

+s=: =+=+~+ - =+=--=+=+, -=+=+ =-= ==+=-- =-=

===+ ===+ +- =- - =--== === =- ~- -+ ==+ -

-+= |+ +--+ = =- -+==:- ====+ =-c

- Education service fee shall be collected by such educational institutions by

issuing a tax invoice.

=- -+ =-- - =--== =+ = = ====+ =- +-c

- Educational institutions collecting Education service fee shall submit the

details of such fees and deposit such fees with 25 days of the end of every

trimester in the IRD department or the in the District Treasury Office.

=- -+ === =- - =-= === =+ += =+ --- ===+ += +=+

===+ =-+ ==- ~|+ +-== -~+ =-+ =-- +=== ~|+ =-== =

+==== =-+ =-- +=== -~|+ =-== + - = -=++ +==== =

=- +-c

Banskota & Co., Chartered Accountants Nepal tax provision 2011-12

Tel: +977-1-4440935, e-mail: cauprety@gmail.com Page 25

- Interest and fees -+ - ==

If tax is not deposited within the

specified time.

==~+ + = -==

15% p.a

If return is not submitted within time.

--- = -==

Rs. 1,000 per return

- 1% Education service fee shall be levied and collected from the students

departing for abroad study at the time of providing foreign exchange.

- ===- =- =- -==: - -+ +- - =+ ==- =-+ =-- ==-

+== |+ +-- =- -+ ==:-c ====+ =-c

14. Contact

Shailendra Uprety, ACA

Partner

Banskota & Company

Chartered Accountants

46, New Plaza Road

Putalisadak Kathmandu, Nepal

P.o. Box.: 5637

Tel: +977-1-4440935

Fax:+977-1-4440928

e-mail: cauprety@gmail.com

Disclaimer: This booklet is for general information purposes only. The information on this booklet consists of

materials which have been obtained from Income Tax Act 2058, IT Rules 2059 and manuals and material from similar sources. However, this

does not constitute advice or guidance. We encourage users to cross-check the information before taking any action thereon. We accept no

liability for the results of any action taken on the basis of the Information provided in this booklet. Information in this booklet is not offered as

advice on any particular matter and must not be treated as a substitute for specific advice.

You might also like

- Marine Insurance TariffDocument65 pagesMarine Insurance TariffPaxton Walung LamaNo ratings yet

- TDS ChallanDocument2 pagesTDS ChallanRamachandran Mahendran60% (5)

- Snasea 2013 Application FormDocument7 pagesSnasea 2013 Application FormPrem Prasad PaudelNo ratings yet

- Aw©Emòã: Eco Nom IcsDocument7 pagesAw©Emòã: Eco Nom IcsDeepak KumarNo ratings yet

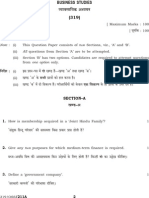

- Aw©Emòã: Note: All Questions From Section A' Are To Be AttemptedDocument6 pagesAw©Emòã: Note: All Questions From Section A' Are To Be AttemptedDeepak KumarNo ratings yet

- PSC Exam Scheme DetailsDocument48 pagesPSC Exam Scheme DetailssharmalokrajNo ratings yet

- 884110221502338RPOSDocument3 pages884110221502338RPOSVAJJHALA CHAKRAVARTHINo ratings yet

- Ï'mdgm ('H$ A ''Z: Note: All Questions From Section A' Are To Be AttemptedDocument6 pagesÏ'mdgm ('H$ A ''Z: Note: All Questions From Section A' Are To Be AttemptedAmit VermaNo ratings yet

- NRB KYC FormDocument1 pageNRB KYC FormertsetsetetNo ratings yet

- Accrued revenue, expenses, prepayments, and depreciation problemsDocument2 pagesAccrued revenue, expenses, prepayments, and depreciation problemsPromag200 Metro ManilaNo ratings yet

- Question Booklet Series: 150 Questions for ExamDocument23 pagesQuestion Booklet Series: 150 Questions for ExamHarish SharmaNo ratings yet

- US Internal Revenue Service: 062701fDocument15 pagesUS Internal Revenue Service: 062701fIRSNo ratings yet

- TDI915022500227RPOSDocument3 pagesTDI915022500227RPOSSarthak VatsaNo ratings yet

- LWR ManualDocument226 pagesLWR ManualAjeet SinghNo ratings yet

- Postal Mahasangh-April 2013Document20 pagesPostal Mahasangh-April 2013secgenbpefNo ratings yet

- US Internal Revenue Service: 043102fDocument24 pagesUS Internal Revenue Service: 043102fIRSNo ratings yet

- Comercial Jaime GuerreroDocument1 pageComercial Jaime Guerrerociber centralNo ratings yet

- 11074Document3 pages11074gupta_rakesh89No ratings yet

- 2013 10 Oct PaybillDocument101 pages2013 10 Oct Paybillapi-276412679No ratings yet

- Debt To Equity RatioDocument6 pagesDebt To Equity RatioZahidul PrinceNo ratings yet

- SD (RF/L +ro SF) If SF) Ifs L Kmff6Jf/L SF) If K - Of) HGSF) Nflu DFQDocument3 pagesSD (RF/L +ro SF) If SF) Ifs L Kmff6Jf/L SF) If K - Of) HGSF) Nflu DFQSandip TimsinaNo ratings yet

- Glo-Stick, Inc.: Financial Statement Investigation A02-11-2015Document3 pagesGlo-Stick, Inc.: Financial Statement Investigation A02-11-2015碧莹成No ratings yet

- Internal Revenue ServiceDocument10 pagesInternal Revenue ServicetaxcrunchNo ratings yet

- FAC511S - Financial Accounting 101 - 2nd Opportunity - July 2016Document7 pagesFAC511S - Financial Accounting 101 - 2nd Opportunity - July 2016Uno VeiiNo ratings yet

- Sample-Credit-ReportDocument6 pagesSample-Credit-ReportManh Tien NgoNo ratings yet

- JAIIB AFB Sample Questions For Nov 2017 PDFDocument456 pagesJAIIB AFB Sample Questions For Nov 2017 PDFLn PandaNo ratings yet

- Fixed AssetDocument11 pagesFixed AssetmithafaramitaNo ratings yet

- Ingram Micro India SeDocument2 pagesIngram Micro India SeAmit Gupta100% (1)

- CET-GOVORA-S.A. document on transport costs for construction projectDocument1 pageCET-GOVORA-S.A. document on transport costs for construction projectTalpos DanielNo ratings yet

- 1343193520346-Proforma of HBADocument6 pages1343193520346-Proforma of HBAMuzz JamNo ratings yet

- 7 Cuentas Star Plus (Kepahoo - Com) (01-10-22)Document1 page7 Cuentas Star Plus (Kepahoo - Com) (01-10-22)Daniel Silva GaleanoNo ratings yet

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyNo ratings yet

- MBA Decision Making and Corporate FinanceDocument20 pagesMBA Decision Making and Corporate FinanceRidwan IslamNo ratings yet

- Internal Revenue Service: Third Party Communication: None Date of Communication: Not ApplicableDocument10 pagesInternal Revenue Service: Third Party Communication: None Date of Communication: Not ApplicabletaxcrunchNo ratings yet

- Smaller Ascii Art RepresentationDocument2 pagesSmaller Ascii Art RepresentationRogério JuniorNo ratings yet

- Smaller Adjusted Ascii Art RepresentationDocument1 pageSmaller Adjusted Ascii Art RepresentationRogério JuniorNo ratings yet

- Depreciation Run - 10326Document2 pagesDepreciation Run - 10326revanthNo ratings yet

- Sale Tax Register 12-12-2022 PDFDocument3 pagesSale Tax Register 12-12-2022 PDFPraveen Kumar MNo ratings yet

- 8360Document1 page8360Akash RanaNo ratings yet

- Pratinidhi Sabha Prativedan FinalDocument17 pagesPratinidhi Sabha Prativedan Finalvskjodhpur9287No ratings yet

- Cálculos MentalesDocument4 pagesCálculos Mentalesmilena.petraccaNo ratings yet

- SEC Filings - Microsoft - 0001032210-98-000519Document18 pagesSEC Filings - Microsoft - 0001032210-98-000519highfinanceNo ratings yet

- Pre-Algebra - 2, 3, 4, and 5 Periods Schedule and AssignmentsDocument5 pagesPre-Algebra - 2, 3, 4, and 5 Periods Schedule and AssignmentsgregmcginnisNo ratings yet

- Suma IteradaDocument3 pagesSuma IteradaDavid Zamora JeldesNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementMisscreant EveNo ratings yet

- AG Income TaxDocument2 pagesAG Income Taxsattowal 89No ratings yet

- Section A - 20 Marks: 1. Management of Quality ControlDocument2 pagesSection A - 20 Marks: 1. Management of Quality ControlRavi DuttaNo ratings yet

- 066012509512512252345000Document3 pages066012509512512252345000InderpalMankuNo ratings yet

- TP StatDocument7 pagesTP Statமணிகண்டன் பிரியாNo ratings yet

- New Tugas COK1Document3 pagesNew Tugas COK1GerardNo ratings yet

- 2013 8 Aug Pay BillDocument118 pages2013 8 Aug Pay Billapi-276412679No ratings yet

- Ct1 Iai 0509 Sol FinalDocument12 pagesCt1 Iai 0509 Sol FinalJakub Wojciech WisniewskiNo ratings yet

- Form 16Document1 pageForm 16tdsbolluNo ratings yet

- 9 P0 RHanDocument1 page9 P0 RHanThe PandaNo ratings yet

- Intermediate Financial Accounting II 1 1Document146 pagesIntermediate Financial Accounting II 1 1natinaelbahiru74No ratings yet

- Sanjeev Mul VMDocument4 pagesSanjeev Mul VMsanjeevr811No ratings yet

- MASB7 Construction Contract7Document3 pagesMASB7 Construction Contract7hyraldNo ratings yet

- Shake Them Haters off Volume 12: Mastering Your Mathematics Skills – the Study GuideFrom EverandShake Them Haters off Volume 12: Mastering Your Mathematics Skills – the Study GuideNo ratings yet

- Sterlite Industries CSR Initiatives for StakeholdersDocument11 pagesSterlite Industries CSR Initiatives for StakeholdersDinesh GadgeNo ratings yet

- Resources On The Basis of 5MsDocument6 pagesResources On The Basis of 5Mssaksi76@gmail.com100% (3)

- Swot Analysis of A Sacco SocietyDocument7 pagesSwot Analysis of A Sacco Societymwangiky100% (1)

- CH - 17 - 11e Keown & TitmanTKM - Financial Forecasting Planning & Budgeting L-6Document47 pagesCH - 17 - 11e Keown & TitmanTKM - Financial Forecasting Planning & Budgeting L-6Adeel RanaNo ratings yet

- Project On Bankruptcy of BanksDocument60 pagesProject On Bankruptcy of BanksimdadhazarikaNo ratings yet

- Groupon Inc Case AnalysisDocument8 pagesGroupon Inc Case Analysispatrick wafulaNo ratings yet

- Regional Geography - G D ADocument2 pagesRegional Geography - G D Aapi-254098177No ratings yet

- 3 Cash - Lecture Notes PDFDocument11 pages3 Cash - Lecture Notes PDFJohn Paul EslerNo ratings yet

- Cash Flow Analysis and Recommendations for Ceres OrganicDocument6 pagesCash Flow Analysis and Recommendations for Ceres OrganicSudhakar Keshav100% (1)

- Lesson 4-2Document28 pagesLesson 4-2Alexis Nicole Joy Manatad86% (7)

- Dunn Loren Merrifield Account Opening FormDocument4 pagesDunn Loren Merrifield Account Opening FormAnthonyNo ratings yet

- A.T. Biopower Rice Husk Power Project in PichitDocument9 pagesA.T. Biopower Rice Husk Power Project in PichitDidier SanonNo ratings yet

- Development of Lifetime Bridge Management System For Expressway Bridges in JapanDocument12 pagesDevelopment of Lifetime Bridge Management System For Expressway Bridges in JapanfiyuNo ratings yet

- Extraordinary Shareholders' Meeting of 05.08.2008 - Minutes (Merger of BOVESPA Holding S.A. Shares)Document51 pagesExtraordinary Shareholders' Meeting of 05.08.2008 - Minutes (Merger of BOVESPA Holding S.A. Shares)BVMF_RINo ratings yet

- LIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentDocument11 pagesLIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentSaravanan DuraiNo ratings yet

- Other Long Term InvestmentsDocument1 pageOther Long Term InvestmentsShaira MaguddayaoNo ratings yet

- ExxonMobil Analysis ReportDocument18 pagesExxonMobil Analysis Reportaaldrak100% (2)

- 3.research MethodologyDocument10 pages3.research Methodologymokshgoyal259750% (2)

- Business CombinationDocument40 pagesBusiness CombinationJack AlvarezNo ratings yet

- Money, Measures of Money Supply, and Quantity Theory of MoneyDocument8 pagesMoney, Measures of Money Supply, and Quantity Theory of MoneyMayank AroraNo ratings yet

- How To Get A Philippine Special Investor Resident VisaDocument3 pagesHow To Get A Philippine Special Investor Resident VisaPeter Eltanal EnfestanNo ratings yet

- Financial Markets QuestionsDocument54 pagesFinancial Markets QuestionsMathias VindalNo ratings yet

- MBA: 516 Managerial Accounting - Breeden Security Part B Analysis Using ABCDocument6 pagesMBA: 516 Managerial Accounting - Breeden Security Part B Analysis Using ABCCesar Felipe Uauy100% (2)

- Auditing Theory EssentialsDocument4 pagesAuditing Theory EssentialsZvioule Ma FuentesNo ratings yet

- DLL Tle He 6 Q1 W1Document4 pagesDLL Tle He 6 Q1 W1Analiza Dequinto Balagosa100% (4)

- GL 003 14 Code of Good Practice For Life InsuranceDocument19 pagesGL 003 14 Code of Good Practice For Life InsuranceAdrian BehNo ratings yet

- Disclosure No. 1234 2021 Amended Annual Report For Fiscal Year Ended December 31 2020 SEC Form 17 ADocument609 pagesDisclosure No. 1234 2021 Amended Annual Report For Fiscal Year Ended December 31 2020 SEC Form 17 AInigo BogiasNo ratings yet

- Product ProfilingDocument9 pagesProduct Profilingpiyu_43No ratings yet

- What is a Futures ContractDocument4 pagesWhat is a Futures Contractareesakhtar100% (1)

- Micro Shots 2010Document158 pagesMicro Shots 2010arif7000No ratings yet