Professional Documents

Culture Documents

The Accounting Equation and The Balance Sheet

Uploaded by

Muhammad Ben Mahfouz Al-ZubairiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Accounting Equation and The Balance Sheet

Uploaded by

Muhammad Ben Mahfouz Al-ZubairiCopyright:

Available Formats

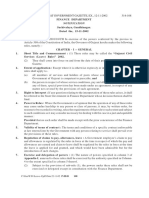

Chapter 1 The Accounting Equation and the Balance Sheet

Accounting involves the recording of transactions to explain the financial position of the business. The actual record of accounting is called Book-Keeping which records and classifies transactions so as to find whether the business is making a profit or a loss in its trading operations. Accounting involves: The recording of business transactions in financial terms. Reporting and presenting financial information to the owner of the business and other interested parties. Advising the owner and other parties how to use the financial reports to assess the business past performance. To help the owner and accountant for decision making. Possible users of Accounting can be: Owner of a business; Prospective buyer; Commercial Banks; Tax Departments Inland Revenue Department; Prospective partners; Shareholders; Managers. Assets: These are the possessions of the business, namely: 1) Fixed Assets are those Assets that will provide service to the business for a longer period than one year. These are: Land and Buildings or Premises Plant and Machinery or Equipment Fixtures and Fittings or Furniture Motor Vehicles or Motor Vans. 2) Current Assets are those Assets which can easily be changed into money. Stock of goods Debtors (people who owe money to the business). Cash at Bank Cash in Hand. Liabilities: These are all the obligations of the business, namely: 1) Long Term Liabilities are obligations that are generally paid by the business in more than one year. Bank and Private Loans

Pg.1

2) Current Liabilities are those obligations that are generally paid by the business within one year. Creditors (people to whom the business owes money). Bank Overdraft (this is when the business is allowed to write cheques in excess of the balance at bank). 3) Capital is the money owed by the business to the owner. Capital is what the owner invests in money and moneys worth. A Balance Sheet is a statement showing the assets owned and the liabilities owed by the business as at a certain date. The totals of this statement must agree. Example: M.Zammit has the following Assets and Liabilities as at 31 December 2000: Land and Buildings Lm40,500, Plant and Machinery Lm15,000, Fixtures and Fittings Lm5,500, Bank Loan Lm10,000, Creditors Lm2,900, Motor Vehicles Lm20,000, Stock of goods Lm5,000, Debtors Lm8,500, Cash at Bank Lm6,300, Loan from A.Callus Lm5,000, Cash in Hand Lm2,100 and Capital Lm85,000. Balance Sheet as at 31 December 2000 Lm Liabilities Assets Land and Buildings 40,500 Capital Plant and Machinery 15,000 Bank Loan Fixtures and Fittings 5,500 Loan - A.Callus Motor Vehicles 20,000 Creditors Stock of goods 5,000 Debtors 8,500 Cash at Bank 6,300 Cash in Hand 2,100 102,900

Lm 85,000 10,000 5,000 2,900

102,900

Balance Sheet Equations 1) Capital = Assets - Liabilities 85,000 = 102,900 - 17,900

2)

Assets = Capital + Liabilities 102,900 = 17,900 + 85,000

3)

Liabilities = Assets - Capital 17,900 = 102,900 - 85,000

Pg.2

The effect of business transactions on the Balance Sheet Started business with Lm50,000 in the bank. Cash at bank + Lm50,000 Capital + Lm 50,000

Bought a motor van by cheque Lm6,000. Motor Van + Lm6,000 Cash at Bank - Lm6,000

Bought stock of goods on credit from our suppliers Lm2,000. Stock of goods + Lm2,000 Creditors + Lm2,000

Sold stock of goods on credit to our customers Lm600. Stock of goods - Lm600 Debtors + Lm600

Received a loan from A.Smith Lm10,000 by cheque. Cash at Bank + Lm10,000 A debtor paid us by cash Lm200. Cash in hand + Lm200 Debtors - Lm200 Loan (A.Smith) + Lm10,000

The proprietor introduced another Lm2,000 in the business bank account. Cash at Bank + Lm2,000 Capital + Lm2,000

The owner takes out Lm500 cash for his personal use. Cash in Hand - Lm500 Capital - Lm200

Pg.3

Exercises: Q.1 You are to complete the gaps in the following table: Liabilities Capital Assets Lm Lm Lm (a) 12,000 4,000 ? (b) 15,000 6,000 ? (c) 30,000 ? 8,000 (d) 45,000 ? 20,000 (e) ? 5,000 15,000 (f) ? 10,000 30,000 Distinguish from the following list the items that are Liabilities from those that are Assets. (a) Loan from C.Borg (b) Motor Vehicles (c) Office Furniture (d) Bank Overdraft (e) Debtors (f) Creditors (g) Cash in Hand (h) Cash at Bank (i) Premises (j) Equipment Mario Borg sets up a new business. Before he actually sells anything, he has bought motor vehicle Lm2,500; premises Lm5,000 and stock of goods Lm1,500. He has Lm150 cash in hand and Lm850 in the bank. He had borrowed Lm2,000 from S.Galea and creditors totalled Lm3,000. Calculate Mario Borgs Capital ? Distinguish between the following: (i) Fixed Assets and Current Assets; (ii) Long Term Liabilities and Current Liabilities Q.5 Draw up M Zammits Balance Sheet as at 31 December 1999 (Show clearly the necessary Headings) : Bank overdraft Lm600; Debtors Lm550, Delivery Van Lm2,700; Stock Lm7,250; Furniture and Fittings Lm3,850; Creditors Lm1,340; Premises Lm 48,000; Loan Lm42,000; Cash in hand Lm150; Capital? Q.6 Draw up G Galeas Balance Sheet as at 31 December 1999 (Show clearly the necessary Headings) : Motor Vehicles Lm7,830; Furniture and Fittings Lm5,585; Debtors Lm1,980; Stock Lm12,240; Cash in hand Lm240; Cash at Bank Lm4,670; Creditors Lm2,605; Loan from M Spiteri Lm20,000; Premises Lm68,250; Mortgage on premises Lm35,800; Capital?

Q.2

Q.3

Q.4

Pg.4

Q.7

Show the effects of the following transactions upon Assets, Liabilities and Capital. Ex. We pay a creditor Lm100 in cash. Assets Cash - Lm100 (a) (b) (c) (d) (e) (f) Liabilities Creditors - Lm100 Capital No effect

Started business with Lm50,000 in cash. Bought stock of goods on credit Lm3,000. Bought fixtures Lm1,000 paying by cheque. Mario Gatt lends the business Lm500 in cash. Owner puts further money by cash in the business Lm2,500. Bought premises paying Lm1,500 by cheque.

Q.8)

Show the effects of the following transactions upon Assets, Liabilities and Capital : i. Started business with Lm5000 cash. ii. We pay a creditor Lm70 cash. iii. Bought goods on credit Lm275. iv. J Vella lends the firm Lm200 in Cash. v. Bought fixtures paying by cheque Lm300 vi. A debtor pays us Lm50 by cheque. vii. The owner puts a further Lm2000 cash into the business. viii. A debtor returns to us Lm80 goods. ix. We return goods Lm60 to a supplier. x. The owner takes out Lm100 cash for his personal use. Lino Callus has the following Assets and Liabilities as at 31 March 1999: Buildings Lm6,000; Creditors Lm1,600; Motor Vehicles Lm4,000; Stock Lm2,000; Loan from L Mallia Lm2,000; Debtors Lm2,800; Cash at Bank Lm3,200; Capital? During the first week of April, Lino Callus: i. Paid a cheque of Lm500 to a creditor; ii. Bought some goods on credit for Lm900; iii. Bought fixtures Lm800 by cheque; iv. Received Lm300 by cheque from one of the Debtors. v. Repaid part of the loan by cheque Lm1,000.

Q.9)

You are required to : a) Calculate the amount of Capital as at 31 March 1999. b) Show the effect of the transactions which occurred during the first week of April ; c) Draw up a Balance Sheet as at 7 April 1999.

Pg.5

You might also like

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- Accounting ProcessesDocument80 pagesAccounting ProcessesTikMoj Tube100% (1)

- Midterm 1 Fall 19Document17 pagesMidterm 1 Fall 19shaimaaelgamalNo ratings yet

- Accounting Problem Book 2011 PDFDocument103 pagesAccounting Problem Book 2011 PDFViệt Đức Lê67% (3)

- Business Purchase - Principles of AccountingDocument5 pagesBusiness Purchase - Principles of AccountingAbdulla MaseehNo ratings yet

- Accounting Problem Book 2011Document103 pagesAccounting Problem Book 2011Sveta Chernica100% (1)

- The Opening Balance of Some Accounts of A Company On 31/12/N Is Listed As Following: (Unit 1.000VND)Document4 pagesThe Opening Balance of Some Accounts of A Company On 31/12/N Is Listed As Following: (Unit 1.000VND)pham thienNo ratings yet

- 003 ExDocument14 pages003 ExanandhuNo ratings yet

- Assignment of Fundamental of Accounting IDocument12 pagesAssignment of Fundamental of Accounting IibsaashekaNo ratings yet

- BALANCE SHEET INFORMATIONDocument5 pagesBALANCE SHEET INFORMATIONShar KhanNo ratings yet

- MBA Financial Accounting Exercises SolutionsDocument17 pagesMBA Financial Accounting Exercises SolutionsRasanjaliGunasekeraNo ratings yet

- ACCT 110-Foundations of Accounting I Class Notes Week TwoDocument9 pagesACCT 110-Foundations of Accounting I Class Notes Week Twovictor kimutaiNo ratings yet

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- 1ACC - The Purpose and Functions of AccountingDocument4 pages1ACC - The Purpose and Functions of Accountingw_i_n_n_i_eNo ratings yet

- Chapter 2Document30 pagesChapter 2nadima behzadNo ratings yet

- Activity in Basic Accounting - Analysis of TransactionsDocument10 pagesActivity in Basic Accounting - Analysis of TransactionsKyleZapantaNo ratings yet

- Final Transaction BankDocument33 pagesFinal Transaction BankAsif Bashir80% (5)

- Basic Accounting Final - QuestionDocument6 pagesBasic Accounting Final - QuestionEdaNo ratings yet

- Assignment 1 FaDocument29 pagesAssignment 1 FaAsif Bashir50% (10)

- Problem Solving. Provide Your Solutions at The Back of This PaperDocument2 pagesProblem Solving. Provide Your Solutions at The Back of This PaperErykaNo ratings yet

- Accounting EquationDocument8 pagesAccounting EquationIanah AlvaradoNo ratings yet

- Lec. 4 - Debit Credit - PRMG 030Document15 pagesLec. 4 - Debit Credit - PRMG 030Ahmad SharaawyNo ratings yet

- Accounts Assignment - 041915Document5 pagesAccounts Assignment - 041915Peter irunaNo ratings yet

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Accounting Principles Pilot TestDocument6 pagesAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNo ratings yet

- ACT301 Assignment-1.docx FinalDocument2 pagesACT301 Assignment-1.docx FinalPapon SarkerNo ratings yet

- SInversions T2 1 Part1 Exercicis PreguntesDocument9 pagesSInversions T2 1 Part1 Exercicis PreguntesjoanNo ratings yet

- Assignment OneDocument6 pagesAssignment OneUser50% (2)

- Basic Accountingch3Document87 pagesBasic Accountingch3Janine RiofloridoNo ratings yet

- Starting a Business: Accounting BasicsDocument64 pagesStarting a Business: Accounting BasicsRenmar CruzNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Receivable 1Document2 pagesReceivable 1Laura OliviaNo ratings yet

- Course Name 9Document6 pagesCourse Name 9Revise PastralisNo ratings yet

- Bram Wear CaseDocument2 pagesBram Wear CaseHabtamu Ye Asnaku Lij89% (9)

- Quiz BowlDocument2 pagesQuiz Bowlaccounting probNo ratings yet

- Student financial accounts portfolioDocument5 pagesStudent financial accounts portfolioKevin PhạmNo ratings yet

- Accounting EquationDocument2 pagesAccounting EquationVaibhav GuptaNo ratings yet

- Lecture 1 - Seminar QuestionsDocument5 pagesLecture 1 - Seminar Questionsbehzadji7No ratings yet

- Accounting Principles 1Document27 pagesAccounting Principles 1shaza jocarlos100% (1)

- Tutorial Questions: Topic 1: Introduction To AccountingDocument28 pagesTutorial Questions: Topic 1: Introduction To AccountingBernard OwusuNo ratings yet

- Sole Traders Final Account-QuestionsDocument11 pagesSole Traders Final Account-QuestionsHarsh VoraNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Question Bank (1)Document17 pagesCBSE Class 11 Accountancy Worksheet - Question Bank (1)Umesh JaiswalNo ratings yet

- Chapter Four - Books of Original EntryDocument5 pagesChapter Four - Books of Original EntryHezel GreationNo ratings yet

- Principles of Accounting Code 8401 Assignments of Spring 2023Document13 pagesPrinciples of Accounting Code 8401 Assignments of Spring 2023zainabjutt0303No ratings yet

- ABM 1 Transactions IllustrationDocument29 pagesABM 1 Transactions IllustrationMarilou EustaquioNo ratings yet

- Chapter 1 - Some Basic QuestionsDocument6 pagesChapter 1 - Some Basic QuestionsBracu 2023No ratings yet

- Transaction & Tabular AnalysisDocument18 pagesTransaction & Tabular AnalysisMahmudul Hassan RohidNo ratings yet

- Basic Accounting Reviewer Step 1 To 3Document12 pagesBasic Accounting Reviewer Step 1 To 3Mary Gleyne100% (1)

- Bus 211 - Introduction To Accounting / Handout 2Document2 pagesBus 211 - Introduction To Accounting / Handout 2ebrarrsevimmNo ratings yet

- Problem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalDocument2 pagesProblem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalMadeeha KhanNo ratings yet

- Accounting Equation, Transaction Analysis and Preparation of Financial StatementDocument10 pagesAccounting Equation, Transaction Analysis and Preparation of Financial Statementশুভ MitraNo ratings yet

- General Accounting TutorialDocument3 pagesGeneral Accounting TutorialMiocnou Didier chautyNo ratings yet

- Lec. 3 - Transactions Recording - PRMG 030Document9 pagesLec. 3 - Transactions Recording - PRMG 030Ahmad SharaawyNo ratings yet

- Maf5101 Fa CatDocument13 pagesMaf5101 Fa CatClinton MugendiNo ratings yet

- General JournalDocument5 pagesGeneral Journalmuhammad.16032.acNo ratings yet

- DM 2 223 The Statement of Financial PositionDocument3 pagesDM 2 223 The Statement of Financial PositionLee SeokminNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Accounting Worksheet Number OneDocument4 pagesAccounting Worksheet Number OneJevoun Tyrell100% (1)

- Water Treatment and Storage Behavior Tracking Sheet - 0Document1 pageWater Treatment and Storage Behavior Tracking Sheet - 0Muhammad Ben Mahfouz Al-ZubairiNo ratings yet

- The Impact of Operations Management On Organizational CultureDocument10 pagesThe Impact of Operations Management On Organizational CultureMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Key Lessons Learned by NGOs in The Water and Sanitation SectorDocument6 pagesKey Lessons Learned by NGOs in The Water and Sanitation SectorMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- ME Framework Basic For MDT FinalDocument19 pagesME Framework Basic For MDT FinalMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- QuestionnaireDocument8 pagesQuestionnaireMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Wash 4w TemplateDocument17 pagesWash 4w TemplateMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Effect of Project InovationDocument66 pagesEffect of Project InovationMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Project Position StructureDocument1 pageProject Position StructureMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Loss/Damage Report: 1. Units Damaged (Potential Loss) 2. Qunatity RecoveredDocument2 pagesLoss/Damage Report: 1. Units Damaged (Potential Loss) 2. Qunatity RecoveredMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Document of WORLD BANLDocument19 pagesDocument of WORLD BANLMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- C2-03 Who PHCDocument2 pagesC2-03 Who PHCMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Achieving Success Through Effective Business CommunicationDocument3 pagesAchieving Success Through Effective Business Communicationpearl_1469No ratings yet

- Cover Letter SampleDocument1 pageCover Letter SampleMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- EE Industrial Training Monthly Report GuidDocument6 pagesEE Industrial Training Monthly Report GuidMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Uncertainty Budget TemplateDocument4 pagesUncertainty Budget TemplateMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- QuizDocument55 pagesQuizMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Balance of Payment2Document1 pageBalance of Payment2Muhammad Ben Mahfouz Al-ZubairiNo ratings yet

- UN Personal History Form for Civil EngineerDocument4 pagesUN Personal History Form for Civil EngineerMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- TurkeyDocument3 pagesTurkeyMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- 1 - 1 - Introduction (07-28)Document4 pages1 - 1 - Introduction (07-28)Muhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Creating A Bibliography Using MLA StandardsDocument19 pagesCreating A Bibliography Using MLA StandardsMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Exploring Further: Comparative Advantage in Money TermsDocument11 pagesExploring Further: Comparative Advantage in Money TermsMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- 《Human Resource Management》 Lecture Outline: Course NO. Credit hour Grade Staff room TeacherDocument12 pages《Human Resource Management》 Lecture Outline: Course NO. Credit hour Grade Staff room TeacherMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- PrivateDocument2 pagesPrivateMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Sales 23,414 Purchases 16,111 4,344 11,767 Gross Profit 11,647 Wages 1,900 Sundries 456 Rent 500Document1 pageSales 23,414 Purchases 16,111 4,344 11,767 Gross Profit 11,647 Wages 1,900 Sundries 456 Rent 500Muhammad Ben Mahfouz Al-ZubairiNo ratings yet

- From This Ledger Prepare The Trial BalanceDocument1 pageFrom This Ledger Prepare The Trial BalanceMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Barrick Anti Bribery and Anti Corruption PolicyDocument4 pagesBarrick Anti Bribery and Anti Corruption PolicyMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Europe: building a vivid e-commerce market amid regional dividesDocument3 pagesEurope: building a vivid e-commerce market amid regional dividesMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Argentina: ArgensunDocument3 pagesArgentina: ArgensunMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- MRDocument1 pageMRMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- California Complaint for Wrongful Foreclosure, Fraud, 17200 Violations, Violation of California Civil Code Section 2924j and 2924k, Violation of Rosenthal Fair Debt Collection Act, Negligence and Conversiont FormDocument31 pagesCalifornia Complaint for Wrongful Foreclosure, Fraud, 17200 Violations, Violation of California Civil Code Section 2924j and 2924k, Violation of Rosenthal Fair Debt Collection Act, Negligence and Conversiont FormCameron Totten88% (16)

- Pergerakan Valuasi Saham LQ45 - 021323Document1 pagePergerakan Valuasi Saham LQ45 - 021323Agus SNo ratings yet

- SEC Form AuF-002-R renewalDocument2 pagesSEC Form AuF-002-R renewalLet it be100% (1)

- Clay McCormack IndictmentDocument13 pagesClay McCormack IndictmentThe Jackson SunNo ratings yet

- NPA - RBI CircularDocument46 pagesNPA - RBI CircularSivasankar RampaNo ratings yet

- Working Capital MGMT Practice Manual PDFDocument75 pagesWorking Capital MGMT Practice Manual PDFPankaj PandeyNo ratings yet

- Apy Chart PDFDocument1 pageApy Chart PDFUmang BhokanNo ratings yet

- Wikipedia 3d PasswordDocument1 pageWikipedia 3d PasswordAmutha ArunNo ratings yet

- Accounting for Share Capital TransactionsDocument6 pagesAccounting for Share Capital TransactionsJessa Mae Banse50% (2)

- Project Financial and Investment Criteria AnalysisDocument29 pagesProject Financial and Investment Criteria Analysislealem100% (1)

- Rule-Eng 6 2014-2-13 298Document63 pagesRule-Eng 6 2014-2-13 298utsavgautamNo ratings yet

- Good Info CapsimDocument11 pagesGood Info Capsimmstephens1No ratings yet

- CFA Level 1 Ethical Standards NotesDocument23 pagesCFA Level 1 Ethical Standards NotesAndy Solnik100% (7)

- Form VAT ReturnDocument3 pagesForm VAT ReturnYf WoonNo ratings yet

- Liquidating Partnership DistributionsDocument2 pagesLiquidating Partnership DistributionsMaria LopezNo ratings yet

- CA IPCC Group 2 Accounting StandardsDocument53 pagesCA IPCC Group 2 Accounting Standardskisan83% (23)

- Mba Thapar University Fee Structure 2019 21-18-02 2019 New 2Document5 pagesMba Thapar University Fee Structure 2019 21-18-02 2019 New 2ManyataChauhanNo ratings yet

- MODULE 1 Lecture Notes (Jeff Madura)Document4 pagesMODULE 1 Lecture Notes (Jeff Madura)Romen CenizaNo ratings yet

- Fun Facts About The History of PrudentialDocument2 pagesFun Facts About The History of PrudentialJoin RiotNo ratings yet

- Article On MGT FeesDocument62 pagesArticle On MGT FeesYong Swee ChingNo ratings yet

- Bank Statement Template 16 PDFDocument2 pagesBank Statement Template 16 PDFBara CreativesNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Radio Corp v. Roa CaseDocument8 pagesRadio Corp v. Roa CaseJet GarciaNo ratings yet

- Clearbanc: The EntrepreneurDocument8 pagesClearbanc: The EntrepreneurShubham SehgalNo ratings yet

- EY Could Uncertainty Be Your Best Opportunity For GrowthDocument6 pagesEY Could Uncertainty Be Your Best Opportunity For GrowthShreyas RajanNo ratings yet

- How To Use Financial StatementsDocument80 pagesHow To Use Financial StatementsNguyễn Trung ĐứcNo ratings yet

- Ncert Sol Class 12 Accountancy Chapter 4 PDFDocument41 pagesNcert Sol Class 12 Accountancy Chapter 4 PDFAnupam DasNo ratings yet

- SBI Noc Format (Builder)Document2 pagesSBI Noc Format (Builder)desibanda73100% (3)

- The Statement of Cash Flows: Short Exercises S 14-1Document119 pagesThe Statement of Cash Flows: Short Exercises S 14-1Syed Huzayfah FaisalNo ratings yet

- Reforms in The Banking SectorDocument20 pagesReforms in The Banking Sectorhii_bhartiNo ratings yet