Professional Documents

Culture Documents

Tax and Legal Alert No - 68 - Profit Tax

Uploaded by

Maria ElizaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax and Legal Alert No - 68 - Profit Tax

Uploaded by

Maria ElizaCopyright:

Available Formats

Profit tax and dividend tax

Taxation regime applicable to a legal person set up in accordance with European legislation The Tax code introduces the concept of legal person set up in accordance with European legislation. Such legal persons will now become tax residents if they establish (or transfer) their registered office in Romania. As a result, such entities will be subject to the same tax treatment as Romanian legal persons for taxation of profits and dividends. Implementation of certain provisions of the Cross-border mergers Directive As a result of the Ordinance, if a Romanian company has a permanent establishment in another Member State, and the Romanian company is dissolved as a result of a cross-border reorganisation, the Romanian tax authorities will not have the right to tax the former permanent establishment. In addition, in the case of a relocation of the registered office of a European Company (SE) and European Cooperative Society (SCE) from Romania to another EU Member State, if certain conditions are met there will not be a tax on the difference between the market value of the transferred assets and liabilities and their fiscal value. There will also be no tax on such movements at the shareholder level, and thus in the case of Romanian shareholders a tax basis step-up may be achieved. Changes related to the taxation of dividends The following will not be deemed as taxable dividends: The acquisition of the company's own shares without changing the percentage of holding of shareholders; The distribution of share premium to shareholders, if done in proportion to their holdings of shares; Any amount paid by companies to their shareholders for goods and services above market prices, provided that the amount is being subjected to taxation at the level of the seller (participant).

If dividends are declared but not paid by the end of the financial year, the payment of the dividend tax will be extended and will have to be paid by 25 January of the following year (as opposed to 31 December of the year declared). This new deadline also applies to dividends paid to non-residents. Tax depreciation changes The calculation of depreciation of fixed assets for tax purposes will now in all cases be based on the tax value, including adjustments resulting from revaluations according to accounting rules. The concept of entry value has been removed from the tax code. Expenses of all intangible assets recognised for accounting purposes, with the exception of start-up costs and goodwill, will now be amortizable. Changes regarding expenses deductibility when calculating the taxable base The following expenses will no longer be considered non-deductible: expenses incurred under a collective labour agreement, if they fall within the overall limit of 2% of staff salary costs incurred for social expenses;

fines, interest, penalties and other increased payments due under commercial contracts concluded with non-residents.

For taxpayers engaged in the exploration of underground natural resources, the basis for calculating the tax deductible provision for land restoration is narrowed. The limit of 1% will now be applied only on the difference between revenues and expenses recorded in connection with the exploitation of these natural resources (whereas previously it was based on overall revenues and expenses). Changes regarding the declaration and payment of profit tax The deadlines for the annual declaration and payment of profit tax have been extended by 10 days. As such, companies will generally now be required to file and pay their final profits tax by 25 April (as opposed to 15 April) of the following year with the following exceptions: non-profit organisations and taxpayers that obtain income mainly from crop production are required to declare and pay annual profit tax by 25 February (as opposed to 15 February) of the following year; taxpayers, other than banking companies, which have elected to close the previous financial year by 25 February also have to file and pay profit by 25 February.

For income earned by foreign companies from disposal of real estate and shares in Romanian companies (or other participation titles), the buyer (as opposed to seller) is obliged to withhold and pay the tax if the buyer is a Romanian legal person or a foreign legal person that has a permanent establishment in Romania.

You might also like

- Anexa 5 Evoluţia Bugetului Asigurarilor Sociale de Stat 2009 - 2014Document1 pageAnexa 5 Evoluţia Bugetului Asigurarilor Sociale de Stat 2009 - 2014Maria ElizaNo ratings yet

- Structuri ModelDocument1 pageStructuri ModelMaria ElizaNo ratings yet

- Anexa 5 Evoluţia Bugetului Asigurarilor Sociale de Stat 2009 - 2014Document1 pageAnexa 5 Evoluţia Bugetului Asigurarilor Sociale de Stat 2009 - 2014Maria ElizaNo ratings yet

- Romania's anti-crisis tax measuresDocument2 pagesRomania's anti-crisis tax measuresMaria ElizaNo ratings yet

- Anexa 5 Evoluţia Bugetului Asigurarilor Sociale de Stat 2009 - 2014Document1 pageAnexa 5 Evoluţia Bugetului Asigurarilor Sociale de Stat 2009 - 2014Maria ElizaNo ratings yet

- 1131C Orar RaduDocument2 pages1131C Orar RaduMaria ElizaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Executive Order No. 398: DteiacDocument2 pagesExecutive Order No. 398: DteiacDanNo ratings yet

- Mini Case ToyotaDocument4 pagesMini Case ToyotahkNo ratings yet

- Govt ch3Document21 pagesGovt ch3Belay MekonenNo ratings yet

- BCG Matrix ModelDocument10 pagesBCG Matrix ModelGiftNo ratings yet

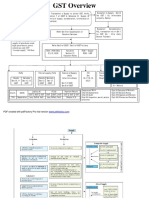

- GST OverviewDocument17 pagesGST Overviewprince2venkatNo ratings yet

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- A Study of Training Program Characteristics and Training Effectiveness Among Organizations Receiving Services From External Training ProvidersDocument193 pagesA Study of Training Program Characteristics and Training Effectiveness Among Organizations Receiving Services From External Training ProvidersbhuvaneshkmrsNo ratings yet

- Downsizing Best PracticesDocument26 pagesDownsizing Best PracticescorfrancescaNo ratings yet

- Palm Heights Tower Web BrochureDocument19 pagesPalm Heights Tower Web BrochureGaurav RaghuvanshiNo ratings yet

- Article On Investors Awareness in Stock Market-1Document10 pagesArticle On Investors Awareness in Stock Market-1archerselevatorsNo ratings yet

- Accounting Standard As 1 PresentationDocument11 pagesAccounting Standard As 1 Presentationcooldude690No ratings yet

- Chapter 01 Introduction To OMDocument31 pagesChapter 01 Introduction To OMmehdiNo ratings yet

- TRINIDAD MUNICIPAL COLLEGE OFC AD 8: SALES LAWDocument3 pagesTRINIDAD MUNICIPAL COLLEGE OFC AD 8: SALES LAWLaura RodriguezNo ratings yet

- General Administration, HR, IR, and Operations ExperienceDocument4 pagesGeneral Administration, HR, IR, and Operations ExperienceDeepak MishraNo ratings yet

- Business Plan Step by StepDocument147 pagesBusiness Plan Step by StepJason MartinNo ratings yet

- Summit County Sewer Rates StudyDocument18 pagesSummit County Sewer Rates Studyemills11No ratings yet

- Enhance Financial Reports with a Proper Chart of AccountsDocument16 pagesEnhance Financial Reports with a Proper Chart of AccountsSaleem MaheenNo ratings yet

- International Business: Prof Bharat NadkarniDocument29 pagesInternational Business: Prof Bharat NadkarnisarveshaNo ratings yet

- Cephas Thesis FinalDocument53 pagesCephas Thesis FinalEze Ukaegbu100% (1)

- PS3 SolutionDocument8 pagesPS3 Solutionandrewlyzer100% (1)

- Volkswagen AG PresentationDocument29 pagesVolkswagen AG PresentationBilly DuckNo ratings yet

- Marketing AssignmentDocument23 pagesMarketing AssignmentGUTA HAILE TEMESGENNo ratings yet

- HSTM CatalogDocument10 pagesHSTM CatalogcccheelNo ratings yet

- Joijamison 2019taxes PDFDocument26 pagesJoijamison 2019taxes PDFrose ownes100% (1)

- DMA Capital Africa Finance Series - Sovereign Wealth Funds Global Insight For African StatesDocument10 pagesDMA Capital Africa Finance Series - Sovereign Wealth Funds Global Insight For African StatesDMA Capital GroupNo ratings yet

- KijamiiDocument16 pagesKijamiiRawan AshrafNo ratings yet

- MaheshkhaliDocument4 pagesMaheshkhalimail2ferdoushaqNo ratings yet

- Central Bank of SudanDocument12 pagesCentral Bank of SudanYasmin AhmedNo ratings yet

- Ias 40 Icab AnswersDocument4 pagesIas 40 Icab AnswersMonirul Islam MoniirrNo ratings yet