Professional Documents

Culture Documents

Accounting For Management

Uploaded by

Zahid HassanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Management

Uploaded by

Zahid HassanCopyright:

Available Formats

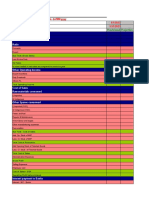

Proforma of Trading Account Trading Account (for the year ending)

Particulars To opening stock or Stock in the beginning or To Stock: Raw material Work in progress Finished goods To Purchases Less: Purchases return or Returns outward To Carriage or cartage or Carriage on purchases To Octrol or local taxes To Import duty, customs, landing charges, clearing charges To wages or productive wage or manufacturing wages or direct wages or wages and salaries To Coal gas and water To Fuel To power or motive power To manufacturing expenses To consumable stores To packing charges To manufacturing expenses To Direct expenses To Factory expenses To Productive expenses To Royalty To Gross Profit (If credit side exceeds the debit side)

Rs.

Particulars By Sales Less: Sales return or Returns inward By Closing stock or Stock at the end of the year

Rs.

By Stock: Raw material.. Work in progress Finished goods By Gross loss (IF debit side exceeds the credit side)

Proforma of Profit & Loss Account

Particulars To Gross loss-transferred from trading Account To Salaries or salaries and wages To Rent, rates and taxes or office rent To Godown rent or storage, or warehousing To Office expenses, or establishment To Miscellaneous, or sundry expenses To Insurance To Stationary To Printing and stationery To Postage and telegrams To Telephone expenses To General expenses To Selling expenses To Carriage, or fright outward To Carriage on sales To Indirect or unproductive wages To Audit fee To Interest paid, or interest (debit) or interest on overdraft, or interest on loans borrowed To Discount allowed, or discount on debtors To Bad debts, or bad debts written off To Depreciation To Interest on capital To Discounting charges To Bank charges, or collection charges To Export charges

Rs.

Particulars By Gross profit transferred from trading account By Interest received, or Interest on investment, or Interest on fixed deposits, or Interest on loans advanced, or By Rent received, or Rent (credit) By Discount received, or Discount (credit) By Commission received By Dividends received By Profit from sale of assets By Refund of tax By Compensation received By Income from Investment By Apprenticeship premium By Difference in exchange (credit) By Interest on drawings By Discount on creditors By Bad debts recovered By Miscellaneous receipts By Appreciation or increase in the value of assets By reserve for bad and doubtful debts (old reserve- if not treated at the debit side of P/L Account) By Net loss-transferred to Capital Account (if debit side exceeds credit side)

Rs.

Liabilities Current Liabilities: Bank Overdraft Bills Payable Outstanding Expenses Sundry Creditors Income received on advance Long-term Liabilities: Loan Capital: Opening balance Add: Net Profit (less net loss) Less: Drawings

Rs.

Assets Current Assets Cash in-hand Cash-at-bank Bill Receivable Sundry Debtors Prepaid Expenses Accrued income Closing stock

Rs.

Investment: Fixed Assets: Furniture and fixtures Plant and machinery Building Land Goodwill

You might also like

- Accounting Cheat SheetDocument7 pagesAccounting Cheat Sheetopty100% (14)

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Ratio AnalysisDocument27 pagesRatio AnalysisPratik Thorat100% (1)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Cheat Sheet For AccountingDocument4 pagesCheat Sheet For AccountingshihuiNo ratings yet

- BCG MatrixDocument2 pagesBCG MatrixZahid HassanNo ratings yet

- Capital and RevenueDocument21 pagesCapital and RevenueVishal BhardwajNo ratings yet

- Final Account BBADocument37 pagesFinal Account BBAgrivand100% (1)

- Venture CapitalDocument7 pagesVenture CapitalZahid Hassan0% (1)

- Tally Group Lists for Accounts, Expenses, Assets & LiabilitiesDocument7 pagesTally Group Lists for Accounts, Expenses, Assets & Liabilitieskrishna7852100% (2)

- Mergers and AcquisitionsDocument33 pagesMergers and AcquisitionsjinenNo ratings yet

- Liabilities ExplainedDocument5 pagesLiabilities ExplainedShantalNo ratings yet

- TALLY LEDGER ACCOUNTSDocument12 pagesTALLY LEDGER ACCOUNTSDeepak GoswamiNo ratings yet

- Preparation of Final Accounts - With Regard To OrganisationDocument24 pagesPreparation of Final Accounts - With Regard To OrganisationsureshNo ratings yet

- Trading and Profit and Loss AccountDocument5 pagesTrading and Profit and Loss AccountDanish Azmi100% (1)

- IFS International BankingDocument39 pagesIFS International BankingVrinda GargNo ratings yet

- Board of Directors Project ReportDocument25 pagesBoard of Directors Project ReportAnubhuti Varma100% (1)

- Cash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareDocument135 pagesCash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareMariel de Lara100% (2)

- Workbook On Ratio AnalysisDocument9 pagesWorkbook On Ratio AnalysisZahid HassanNo ratings yet

- Chapter 10 Income From Business or ProfessionDocument14 pagesChapter 10 Income From Business or ProfessionMd. Rayhanul IslamNo ratings yet

- Behavioral FinanceDocument184 pagesBehavioral FinanceSatya ReddyNo ratings yet

- Unit V: Financial AccountingDocument31 pagesUnit V: Financial AccountingAbhishek Bose100% (2)

- Final AccountDocument47 pagesFinal Accountsakshi tomarNo ratings yet

- For Balance Sheet and Retained Earnings Statement - Follow The Format in The BookDocument7 pagesFor Balance Sheet and Retained Earnings Statement - Follow The Format in The Booknhtsng123No ratings yet

- Accounting EquationDocument36 pagesAccounting EquationZainon Idris100% (1)

- Format of Cash Flow StatementDocument5 pagesFormat of Cash Flow Statementilyas2sapNo ratings yet

- Class Notes: Class: XI Topic: Financial StatementDocument3 pagesClass Notes: Class: XI Topic: Financial StatementRajeev ShuklaNo ratings yet

- Classification of Trial Balance ItemsDocument4 pagesClassification of Trial Balance Itemsnimit playzNo ratings yet

- Cash Flow Statement AnalysisDocument2 pagesCash Flow Statement Analysispadmanabha1979No ratings yet

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- Standardized Financial Statements: Accounting Analysis GuideDocument3 pagesStandardized Financial Statements: Accounting Analysis GuideJonathanChanNo ratings yet

- Ratio Analysis of Colgate-Palmolive Company Financial Statements (2007-2015Document18 pagesRatio Analysis of Colgate-Palmolive Company Financial Statements (2007-2015Zohaib AhmedNo ratings yet

- Cash Flow Statement AnalysisDocument2 pagesCash Flow Statement AnalysisSakshi GuptaNo ratings yet

- Ruchi Soya Cash Flow Statement AnalysisDocument2 pagesRuchi Soya Cash Flow Statement AnalysisShreyansh Sanat JoshiNo ratings yet

- Crest 2015fd AppraisalDocument22 pagesCrest 2015fd Appraisalcountryhomes03No ratings yet

- Cashflow FormatDocument2 pagesCashflow FormatShubham BawkarNo ratings yet

- Cash Flow Statement Classification of ActivitiesDocument4 pagesCash Flow Statement Classification of ActivitiesAanchal MahajanNo ratings yet

- Particulars Amt Amt Amt: Net Cash From Operating Activities II) Cash Flow From Investing ActivitiesDocument3 pagesParticulars Amt Amt Amt: Net Cash From Operating Activities II) Cash Flow From Investing Activitiesrohan_jangid8No ratings yet

- Data DictionaryDocument6 pagesData DictionarySecret PsychologyNo ratings yet

- acc questions PDFDocument4 pagesacc questions PDFneharajt06061No ratings yet

- Partnership QuestionsDocument21 pagesPartnership QuestionsashNo ratings yet

- Trial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesDocument24 pagesTrial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesChintan PatelNo ratings yet

- Exhibit 6.3 Margin Money For Working CapitalDocument12 pagesExhibit 6.3 Margin Money For Working Capitalanon_285857320No ratings yet

- Cash Flow Analysis Direct Method GuideDocument33 pagesCash Flow Analysis Direct Method GuideNikki Coleen SantinNo ratings yet

- Financial Statements SummaryDocument53 pagesFinancial Statements Summaryrachealll100% (1)

- Income Statement & Balance Sheet-1Document18 pagesIncome Statement & Balance Sheet-1Shreyasi RanjanNo ratings yet

- Financial Accounting and AnalysisDocument8 pagesFinancial Accounting and AnalysisRia LapizNo ratings yet

- Performa of Final AccountDocument3 pagesPerforma of Final AccountIndu GuptaNo ratings yet

- Accounts FormatDocument25 pagesAccounts FormatAnushka DharangaonkarNo ratings yet

- Final Accounts PPT by Priyanka BhayanaDocument11 pagesFinal Accounts PPT by Priyanka BhayanaNona SinglaNo ratings yet

- Exam 2 ReviewDocument14 pagesExam 2 ReviewSam WinsteadNo ratings yet

- Final Accounts Preparation and ImportanceDocument12 pagesFinal Accounts Preparation and ImportancePraveenNo ratings yet

- Final AcccountDocument20 pagesFinal Acccountbtamilarasan88No ratings yet

- Cma Format - 29.08.2022 - 12.13PMDocument12 pagesCma Format - 29.08.2022 - 12.13PMShreeRang ConsultancyNo ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- Proforma Statement of Cash Flow 3Document1 pageProforma Statement of Cash Flow 3Praveena RavishankerNo ratings yet

- Statement of Comprehensive IncomeDocument33 pagesStatement of Comprehensive IncomeZalvy Gwen RecimoNo ratings yet

- Financial StatementsDocument8 pagesFinancial Statementsmanthansaini8923No ratings yet

- Capital & Revenue ExpenditureDocument18 pagesCapital & Revenue Expenditure072 Yasmin AkhtarNo ratings yet

- Profit and Loss AccountDocument15 pagesProfit and Loss AccountLogesh Waran100% (1)

- Cash Flow Cheat SheetsDocument2 pagesCash Flow Cheat SheetsSarah SafiraNo ratings yet

- Accounting BasicDocument16 pagesAccounting BasicKarthik HariNo ratings yet

- Tally HistoryDocument26 pagesTally HistoryvimalnandiNo ratings yet

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNo ratings yet

- Ed Module 2Document4 pagesEd Module 2Zahid HassanNo ratings yet

- POM Module 4Document1 pagePOM Module 4Zahid HassanNo ratings yet

- Determing The Factors of Industrial RelationsDocument2 pagesDeterming The Factors of Industrial RelationsZahid HassanNo ratings yet

- HistoryDocument6 pagesHistoryZahid HassanNo ratings yet

- Chess RulesDocument8 pagesChess RulesZahid HassanNo ratings yet

- GKDocument1 pageGKZahid HassanNo ratings yet

- Customer-Defined Service Standards: Presented by IsmailayazruknuddinDocument18 pagesCustomer-Defined Service Standards: Presented by IsmailayazruknuddinZahid HassanNo ratings yet

- Should Euthalesia (Mercy Killing) Be LegalisedDocument3 pagesShould Euthalesia (Mercy Killing) Be LegalisedZahid HassanNo ratings yet

- Statistical Presentation Tools Descriptive StatisticsDocument3 pagesStatistical Presentation Tools Descriptive StatisticsZahid HassanNo ratings yet

- Fund Sbi Mutual Fund Scheme Sbi Pharma Fund (G)Document31 pagesFund Sbi Mutual Fund Scheme Sbi Pharma Fund (G)Zahid HassanNo ratings yet

- Flow ChartDocument1 pageFlow ChartZahid HassanNo ratings yet

- Module 2 LearningDocument27 pagesModule 2 LearningZahid HassanNo ratings yet

- IhrmDocument1 pageIhrmZahid HassanNo ratings yet

- Share Debenture HolderDocument45 pagesShare Debenture HoldergetstockalNo ratings yet

- BCMC Mod 07Document55 pagesBCMC Mod 07Zahid HassanNo ratings yet

- Presentation TopicsDocument1 pagePresentation TopicsZahid HassanNo ratings yet

- Careers and Career ManagementDocument18 pagesCareers and Career ManagementZahid HassanNo ratings yet

- Papc SyllabusDocument2 pagesPapc SyllabusZahid HassanNo ratings yet

- Statistical Presentation Tools Descriptive StatisticsDocument3 pagesStatistical Presentation Tools Descriptive StatisticsZahid HassanNo ratings yet

- BCMC Mod 07Document55 pagesBCMC Mod 07Zahid HassanNo ratings yet

- Anjuman Institute of Technology and Management Department of Manegement Studies Mba 1 Sem 1 Internal Assessment TestDocument1 pageAnjuman Institute of Technology and Management Department of Manegement Studies Mba 1 Sem 1 Internal Assessment TestZahid HassanNo ratings yet

- All PG DiplomaDocument20 pagesAll PG DiplomaZahid HassanNo ratings yet

- HistoryDocument6 pagesHistoryZahid HassanNo ratings yet

- Simplify: (I) 8888+888+88+8 (Ii) 11992-7823-456 2. (A+b)Document1 pageSimplify: (I) 8888+888+88+8 (Ii) 11992-7823-456 2. (A+b)Zahid HassanNo ratings yet

- Anjuman Institute of Technology and Management Department of Management StudiesDocument2 pagesAnjuman Institute of Technology and Management Department of Management StudiesZahid HassanNo ratings yet

- American Depositary Receipts and Global Depository Receipts: Presented BY Kirti GargDocument14 pagesAmerican Depositary Receipts and Global Depository Receipts: Presented BY Kirti Gargmemeenusaini100% (1)

- CBET financial records analysisDocument3 pagesCBET financial records analysisKristine Esplana ToraldeNo ratings yet

- Accounting Notes: Static Vs Flexible BudgetsDocument5 pagesAccounting Notes: Static Vs Flexible BudgetsRohit BajpaiNo ratings yet

- ACC201-Intermediate Accounting IDocument11 pagesACC201-Intermediate Accounting ItucchelNo ratings yet

- Capital Budgeting PPT 1Document75 pagesCapital Budgeting PPT 1Sakshi SharmaNo ratings yet

- Corp Law DiscussionDocument20 pagesCorp Law DiscussionGia Tuệ Nguyễn TrầnNo ratings yet

- IQRA UNIVERSITY (AIRPORT CAMPUS) ANALYSIS OF FINANCIAL STATEMENT ASSIGNMENTDocument4 pagesIQRA UNIVERSITY (AIRPORT CAMPUS) ANALYSIS OF FINANCIAL STATEMENT ASSIGNMENTafaq ahmedNo ratings yet

- Drivers of Shareholder ValueDocument19 pagesDrivers of Shareholder Valueadbad100% (1)

- Abuscom Final Output 4Document3 pagesAbuscom Final Output 4Mac b IBANEZNo ratings yet

- Prelec 4 ReviewerDocument15 pagesPrelec 4 ReviewerLorieline OcampoNo ratings yet

- AR Jawattie 2019 PDFDocument233 pagesAR Jawattie 2019 PDFSyafira AdeliaNo ratings yet

- FAR 4.2MC ReceivablesDocument8 pagesFAR 4.2MC ReceivableschristineNo ratings yet

- Answer 1 (1) : The Insolvency and Bankruptcy Code, 2016 Innoventive Industries Ltd. vs. ICICI Bank & Anr (2017) 1 SCC 356Document6 pagesAnswer 1 (1) : The Insolvency and Bankruptcy Code, 2016 Innoventive Industries Ltd. vs. ICICI Bank & Anr (2017) 1 SCC 356Usmaa HashmiNo ratings yet

- AFSIC Marketing Brochure 2023Document17 pagesAFSIC Marketing Brochure 2023Memory Shonge RutsitoNo ratings yet

- CHAPTER 2 Statement of Comprehensive IncomeDocument13 pagesCHAPTER 2 Statement of Comprehensive IncomeJM MarquezNo ratings yet

- COST OF CAPITAL - Basic FinanceDocument21 pagesCOST OF CAPITAL - Basic FinanceAqib IshtiaqNo ratings yet

- 4 Inventory Estimation Intermediate Accounting Reviewer 4 Inventory Estimation Intermediate Accounting ReviewerDocument4 pages4 Inventory Estimation Intermediate Accounting Reviewer 4 Inventory Estimation Intermediate Accounting ReviewerDalia ElarabyNo ratings yet

- What Is A Balance Sheet AuditDocument6 pagesWhat Is A Balance Sheet AuditSOMOSCONo ratings yet

- Tax Q2Document3 pagesTax Q2mijareschabelita2No ratings yet

- What Is The Main Function of Financial Markets?: Tutorial 1 Overview of Financial System Part 1. Questions For ReviewDocument16 pagesWhat Is The Main Function of Financial Markets?: Tutorial 1 Overview of Financial System Part 1. Questions For ReviewViem AnhNo ratings yet

- 05_Quiz_2Document3 pages05_Quiz_2prettyboiy19No ratings yet

- Zeta Spenza Project: GivenDocument26 pagesZeta Spenza Project: GivenMashaal FNo ratings yet

- ACCT 2010: Principles of Accounting I Mini Exam 1 Monday September 26, 2016 8-9 P.M. LTADocument6 pagesACCT 2010: Principles of Accounting I Mini Exam 1 Monday September 26, 2016 8-9 P.M. LTAPak HoNo ratings yet

- Business FinanceDocument22 pagesBusiness FinancenattoykoNo ratings yet

- NISM Series XX Taxation in Securities Markets Workbook June 2021Document353 pagesNISM Series XX Taxation in Securities Markets Workbook June 2021Karthick S NairNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelHaroon khanNo ratings yet