Professional Documents

Culture Documents

Forward Exchange Rate

Uploaded by

Phillip DominguezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forward Exchange Rate

Uploaded by

Phillip DominguezCopyright:

Available Formats

Forward exchange rate

From Wikipedia, the free encyclopedia Jump to: navigation, search Not to be confused with forward rate or forward price.

The forward exchange rate (also referred to as forward rate or forward price) is the exchange rate at which a bank agrees to exchange one currency for another at a future date when it enters into a forward contract with an investor.[1][2][3] Multinational corporations, banks, and other financial institutions enter into forward contracts to take advantage of the forward rate for hedging purposes.[1] The forward exchange rate is determined by a parity relationship among the spot exchange rate and differences in interest rates between two countries, which reflects an economic equilibrium in the foreign exchange market under which arbitrage opportunities are eliminated. When in equilibrium, and when interest rates vary across two countries, the parity condition implies that the forward rate includes a premium or discount reflecting the interest rate differential. Forward exchange rates have important theoretical implications for forecasting future spot exchange rates. Financial economists have put forth a hypothesis that the forward rate accurately predicts the future spot rate, for which empirical evidence is mixed.

Contents

1 Introduction 2 Relation to covered interest rate parity 3 Forward premium or discount 4 Forecasting future spot exchange rates

o

4.1 Unbiasedness hypothesis

5 See also 6 References

Introduction

The forward exchange rate is the rate at which a commercial bank is willing to commit to exchange one currency for another at some specified future date.[1] The forward exchange rate is a type of forward price. It is the exchange rate negotiated today between a bank and a client upon entering into a forward contract agreeing to buy or sell some amount of foreign currency in the future.[2][3] Multinational corporations and financial institutions often use the forward market to hedge future payables or receivables denominated in a foreign currency against foreign exchange risk by using a forward contract to lock in a forward exchange rate. Hedging with forward

contracts is typically used for larger transactions, while futures contracts are used for smaller transactions. This is due to the customization afforded to banks by forward contracts traded overthe-counter, versus the standardization of futures contracts which are traded on an exchange.[1] Banks typically quote forward rates for major currencies in maturities of one, three, six, nine, or twelve months, however in some cases quotations for greater maturities are available up to five or ten years.[2]

Relation to covered interest rate parity

Covered interest rate parity is a no-arbitrage condition in foreign exchange markets which depends on the availability of the forward market. It can be rearranged to give the forward exchange rate as a function of the other variables. The forward exchange rate depends on three known variables: the spot exchange rate, the domestic interest rate, and the foreign interest rate. This effectively means that the forward rate is the price of a forward contract, which derives its value from the pricing of spot contracts and the addition of information on available interest rates.[4] The following equation represents covered interest rate parity, a condition under which investors eliminate exposure to foreign exchange risk (unanticipated changes in exchange rates) with the use of a forward contract the exchange rate risk is effectively covered. Under this condition, a domestic investor would earn equal returns from investing in domestic assets or converting currency at the spot exchange rate, investing in foreign currency assets in a country with a different interest rate, and exchanging the foreign currency for domestic currency at the negotiated forward exchange rate. Investors will be indifferent to the interest rates on deposits in these countries due to the equilibrium resulting from the forward exchange rate. The condition allows for no arbitrage opportunities because the return on domestic deposits, 1+id, is equal to the return on foreign deposits, F/S(1+if). If these two returns weren't equalized by the use of a forward contract, there would be a potential arbitrage opportunity in which, for example, an investor could borrow currency in the country with the lower interest rate, convert to the foreign currency at today's spot exchange rate, and invest in the foreign country with the higher interest rate.[4]

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Speed Reading: From Wikipedia, The Free EncyclopediaDocument5 pagesSpeed Reading: From Wikipedia, The Free EncyclopediaPhillip DominguezNo ratings yet

- Reward Management and SystemDocument55 pagesReward Management and SystemPhillip Dominguez100% (1)

- Reward Management and SystemDocument55 pagesReward Management and SystemPhillip Dominguez100% (1)

- Pygmalion EffectDocument2 pagesPygmalion EffectPhillip DominguezNo ratings yet

- Organizational System in The Global EnvironmentDocument17 pagesOrganizational System in The Global EnvironmentPhillip DominguezNo ratings yet

- Job Satisfaction SIP Report UploadedDocument51 pagesJob Satisfaction SIP Report UploadedPhillip DominguezNo ratings yet

- Final Insurance Project PDFDocument17 pagesFinal Insurance Project PDFAnand Yadav100% (1)

- Intermediate Accounting 1 First Grading Examination: Name: Date: Professor: Section: ScoreDocument20 pagesIntermediate Accounting 1 First Grading Examination: Name: Date: Professor: Section: ScoreJulia Andrea Yting100% (2)

- Fundamentals of Accountancy 1Document2 pagesFundamentals of Accountancy 1Glaiza Dalayoan FloresNo ratings yet

- 1570101857217reosH6fgOGw5BaZw PDFDocument5 pages1570101857217reosH6fgOGw5BaZw PDFmanikandan rajendranNo ratings yet

- Admin Assistant Skills and Tips On Handling Admin Assistant DutiesDocument3 pagesAdmin Assistant Skills and Tips On Handling Admin Assistant DutiesPhillip DominguezNo ratings yet

- PEST AnalysisDocument4 pagesPEST AnalysisPhillip DominguezNo ratings yet

- Conceptual Model For Organizational BehaviourDocument19 pagesConceptual Model For Organizational BehaviourPhillip Dominguez100% (1)

- International BusinessDocument8 pagesInternational BusinessPhillip DominguezNo ratings yet

- Standard Operating ProcedureDocument1 pageStandard Operating ProcedurerwrtyNo ratings yet

- HR's Strategic Role in Business SuccessDocument35 pagesHR's Strategic Role in Business SuccessPhillip DominguezNo ratings yet

- MicroeconomicsDocument21 pagesMicroeconomicsPhillip DominguezNo ratings yet

- Introduction To Organizational BehaviourDocument18 pagesIntroduction To Organizational BehaviourPhillip DominguezNo ratings yet

- CH 04Document44 pagesCH 04ashrafgo100% (1)

- Personal DevelopmentDocument13 pagesPersonal DevelopmentPhillip DominguezNo ratings yet

- Employee Satisfactory and Assessment Form For Printing PressDocument2 pagesEmployee Satisfactory and Assessment Form For Printing PressPhillip DominguezNo ratings yet

- Organization DevelopmentDocument12 pagesOrganization DevelopmentPhillip DominguezNo ratings yet

- More Literature Review On Job SatisfactionDocument27 pagesMore Literature Review On Job SatisfactionPhillip DominguezNo ratings yet

- Industerial RelationsDocument34 pagesIndusterial RelationsPhillip DominguezNo ratings yet

- Performance ManagementDocument4 pagesPerformance ManagementPhillip DominguezNo ratings yet

- Test AssessmentDocument12 pagesTest AssessmentPhillip DominguezNo ratings yet

- A Short History of Performance Management V1Document46 pagesA Short History of Performance Management V1Phillip Dominguez100% (2)

- Financial AssetDocument2 pagesFinancial AssetPhillip DominguezNo ratings yet

- Control ManagementDocument11 pagesControl ManagementPhillip DominguezNo ratings yet

- More Literature Review On Job SatisfactionDocument27 pagesMore Literature Review On Job SatisfactionPhillip DominguezNo ratings yet

- Human ResourcesDocument2 pagesHuman ResourcesPhillip DominguezNo ratings yet

- MNCsDocument2 pagesMNCsPhillip DominguezNo ratings yet

- Asset: Financial Accounting Economic Value Ownership CashDocument5 pagesAsset: Financial Accounting Economic Value Ownership CashPhillip DominguezNo ratings yet

- What Is International Human Resource ManagementDocument2 pagesWhat Is International Human Resource ManagementPhillip DominguezNo ratings yet

- BDO Business Online Banking - Standard Services (No Workflow)Document14 pagesBDO Business Online Banking - Standard Services (No Workflow)July FermiaNo ratings yet

- Merchant Banking Research PaperDocument3 pagesMerchant Banking Research PaperSajid ShaikhNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusScribbydooNo ratings yet

- Tme 2020 WB ch13 AnswersDocument4 pagesTme 2020 WB ch13 AnswersBlakeTambNo ratings yet

- Thanh Toan Dien TuDocument348 pagesThanh Toan Dien TuPhương Trần Thị AnhNo ratings yet

- Credit Analysis Cohort - AssessmentDocument2 pagesCredit Analysis Cohort - AssessmentKrishiv AgrawalNo ratings yet

- MurabahaDocument32 pagesMurabahagoodfriend123499No ratings yet

- HSBC Credit Card Cashback PDFDocument1 pageHSBC Credit Card Cashback PDFSampath ReddyNo ratings yet

- Blueprint Banking and Cash ManagementDocument56 pagesBlueprint Banking and Cash ManagementChris LoureyNo ratings yet

- On January 1 2018 Marshall Company Acquired 100 Percent ofDocument1 pageOn January 1 2018 Marshall Company Acquired 100 Percent ofAmit PandeyNo ratings yet

- Questions & Answers: Cbse Economic Studies Grade 11Document7 pagesQuestions & Answers: Cbse Economic Studies Grade 11MonahVallenosMirandaNo ratings yet

- NBP Internship UOGDocument39 pagesNBP Internship UOGAhsanNo ratings yet

- Corporate Finance: Chapter 3: Time Value of MoneyDocument26 pagesCorporate Finance: Chapter 3: Time Value of Moneynaila FaizahNo ratings yet

- Mba Project For FinalisationDocument75 pagesMba Project For FinalisationrgkusumbaNo ratings yet

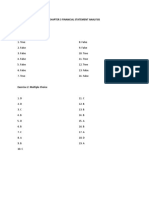

- Chapter 3 Financial Statement Analysis ExercisesDocument6 pagesChapter 3 Financial Statement Analysis ExercisesCatherine VenturaNo ratings yet

- Chapter 5 - Worksheet and The Financial StatementsDocument21 pagesChapter 5 - Worksheet and The Financial StatementsFrancis MateosNo ratings yet

- Exercises: 1) Acme Borrowed $100,000 From A Local Bank, Which Charges Them An Interest Rate of 7% PerDocument4 pagesExercises: 1) Acme Borrowed $100,000 From A Local Bank, Which Charges Them An Interest Rate of 7% PerIslam MomtazNo ratings yet

- Bank Branch Copy Bank Challan Form Applicant's Copy Bank Challan FormDocument1 pageBank Branch Copy Bank Challan Form Applicant's Copy Bank Challan FormALAKESH GAYENNo ratings yet

- Timber CreekDocument113 pagesTimber CreeksladurantayeNo ratings yet

- Loan Account Statement Details: Generated byDocument7 pagesLoan Account Statement Details: Generated byMd. Shahidul Islam PkNo ratings yet

- Asset Liability Management in BanksDocument10 pagesAsset Liability Management in BanksSwarnalata DashNo ratings yet

- JPMorgan SmurfitKappaH1resultswrap-accelerationfromhereasboxpricescomethrough Jul 28 2021Document15 pagesJPMorgan SmurfitKappaH1resultswrap-accelerationfromhereasboxpricescomethrough Jul 28 2021Camila CalderonNo ratings yet

- Gordon College: Detailed Learning ModuleDocument3 pagesGordon College: Detailed Learning ModuleAnnalyn ArnaldoNo ratings yet

- Fixed Deposit Account Opening Form (For New Customers) PDFDocument8 pagesFixed Deposit Account Opening Form (For New Customers) PDFAli AldosNo ratings yet

- Are Non - Performing Assets Gloomy or Greedy From Indian Perspective?Document9 pagesAre Non - Performing Assets Gloomy or Greedy From Indian Perspective?Mohit JainNo ratings yet

- Welcome Guide 2017 enDocument44 pagesWelcome Guide 2017 enKaushik SadhuNo ratings yet