Professional Documents

Culture Documents

Cost Analysis of Amul Company

Uploaded by

niravpatel13Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Analysis of Amul Company

Uploaded by

niravpatel13Copyright:

Available Formats

Amul

Amul ("priceless" in Sanskrit. The brand name "Amul," from the Sanskrit "Amoolya," (meaning Precious) formed in 1946, is a dairy cooperative in India. It is a brand name managed by an apex cooperative organisation, Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF) The Gujarat Cooperative Milk Marketing Federation Ltd, Anand (GCMMF) is the largest food products marketing organisation of India. In 1997, Amul ice creams entered Mumbai followed by Chennai in 1998 and Kolkata and Delhi in 2002. The portfolio consisted of impulse products like sticks, cones, cups as well as take home packs and institutional/catering packs. It achieved the No 1 position in the country. This position was achieved in 2001 and it has continued to remain at the top. Today the market share of Amul ice cream is 38% share against the 9% market share of HLL (Kwality Walls), thus making it 4 times larger than its closest competitor. Not only has it grown at a phenomenal rate but has added a vast variety of flavours to its ever growing range. In January 2007, Amul introduced SUGAR FREE & ProLife Probiotic Wellness Ice Cream, which was a first in India. Amuls entry into ice creams is regarded as successful due to the large market share it was able to capture within a short period of time due to price differential, quality of products and of course the brand name.

FACTS The portfolio consisted of impulse products like sticks, cones, cups as well as take home packs and institutional/catering packs. In 1997, Amul ice creams entered Mumbai followed by Chennai in 1998 and Kolkata and Delhi in 2002. Nationally it was rolled out across the country in 1999. Has combated competition like Walls, Mother Dairy and achieved the No 1 position in the country. Today the market share of Amul ice cream is 38%. Amuls entry into ice creams is regarded as successful due to the large market share it was able to capture within a short period of time.

Ice Cream Industry in India: Industry Snapshot: Market Size - 1200 Crores Ice Cream market is growing at 26%

Major players: Amul - Market Leader with share of 36% HLL - Kwality Walls - 2nd biggest player Mother Diary Arun - Chennai Based Hatsun Agro Product

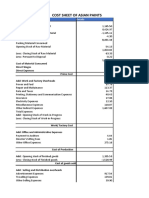

Particulars Opening stock Raw materials Dry fruits Milk Flavors Other ingridents Sugar Cup Cutlery Seasonal fruit Waffle Cocoa Carriage inward Raw material consumed Direct expense Direct labour Prime cost Factory overheads Fixed Depreciation Rent Power Insurance Supervisors salary Variable Electricity Running expense of machine Work cost Office overhead Employee cost Other expenditure Computer Telephone Taxes Carriage outward Cost of production Opening stock (Closing stock) Cost of goods sold Selling and distribution Advertisement Delivery vehicles Petrol Packaging rate Cost of sales Profit Sales

Cost per unit 10 3 2.5 3.0 3.5 2.0 2.5 1.5 1.0 0.5 1.0 1.5 1.845 33.845 2.2 5.3 40.045

Amount 1000000 300000 250000 300000 350000 200000 250000 150000 100000 50000 100000 150000 184500 3384500 220000 530000 4134500

2.5 1.0 1.75 1.5 0.7 1.0 9.05 50.395 10.00 1.2 0.1 0.4 0.2 62.295 2.0 64.295 4.0 3.5 1.75 0.505 74.05 18.5 92.5625

250000 100000 175000 150000 70000 100000 905000 5039500 1000000 120000 10000 40000 20000 6229500 200000 6429500 400000 350000 175000 50500 7405000 1851250 9256250

Marginal cost sheet

Sales Variable cost Purchase Raw material consumed contribution Fixed cost Factory expense employee cost Depreciation Other expenditure Profit 9256250 3200000 3384500 2671750 905000 1000000 100000 190000 476750

Cost sheet analysis

The company is producing 100000 units of ice cream at Rs. 74.05 for which the total cost incurred is Rs. 7405000 and the total sales is Rs. 9256250 which implies that that the profit being made is Rs. 1851250. The company is producing a single cup of ice cream at Rs. 92.5625 which includes the cost of a cup ice cream at Rs. 74.05 which again implies that the profit of Rs. 18.5125 is earned on a single unit of Amul ice cream. Since the company is earning some percentage of profit above the cost, it means a slight increase in the cost will not have too much of an effect on the profit since there is a large margin of safety. Since the company is earning some amount of profit, the business is capable to expand and diversify over a period of time.

PVR = C/S = 2671750/9256250 = 28.86% BEP (in Rs.) = FC/PVR = 2195000/28.86 = Rs.760568.26

BEP (in units) = FC/C = 2195000/2.67175 = 821558.9 = 821559 MOS = Profit/PVR = 476750/28.86 = 16519.404

Determination of selling price

Amul Ice Cream has marked the selling price of their product roughly 20% above the cost price. This implies that they are making a profit on each unit of output that is sold. These profits can be ploughed into the business again to create more output.

You might also like

- Amul Unit Costing ReportDocument7 pagesAmul Unit Costing Reportsweety thakkarNo ratings yet

- Cost Sheet of AmulDocument18 pagesCost Sheet of AmulJemish Je75% (4)

- Cost Sheet of Laxmi Soap FactoryDocument12 pagesCost Sheet of Laxmi Soap FactorySanket Aiya60% (5)

- Amul Cost AnalysisDocument2 pagesAmul Cost AnalysisKaran ChauhanNo ratings yet

- Cost Sheet of Cadbury MilkDocument6 pagesCost Sheet of Cadbury Milkamya_sinha1157% (7)

- Cost Sheet of AmulDocument7 pagesCost Sheet of AmulKhushi DaveNo ratings yet

- Amul Cost SheetDocument28 pagesAmul Cost SheetKishori KediaNo ratings yet

- Cost Sheet Analysis of Britannia BreadDocument27 pagesCost Sheet Analysis of Britannia BreadSagar Yadav89% (9)

- Cost SheetDocument4 pagesCost Sheetvidhicool1360% (5)

- Cost Analysis of Britania BreadDocument20 pagesCost Analysis of Britania Breadatulkmk77% (26)

- DoveDocument11 pagesDovekattyperrysherryNo ratings yet

- Cost Analysis of PepsiDocument13 pagesCost Analysis of PepsiMuhammad Furqan Zeb75% (20)

- Reliance Industries Cost Sheet Ver. 1.0Document2 pagesReliance Industries Cost Sheet Ver. 1.0hiteksha62% (13)

- M&M Cost Sheet AnalysisDocument2 pagesM&M Cost Sheet Analysisshravan suvarna-mangalore43% (7)

- AmulDocument28 pagesAmulhiralnmehta5502100% (3)

- Cost Sheet of Nexgen TextilesDocument2 pagesCost Sheet of Nexgen TextilesPooja Bhavar0% (1)

- Cost Sheet Analysis of Dabur India LtdDocument11 pagesCost Sheet Analysis of Dabur India LtdAjay Abraham Anathanam100% (3)

- Cost Analysis On Cadbury India LTDDocument21 pagesCost Analysis On Cadbury India LTDSurya Deepak Goud80% (20)

- Cost Analysis of NestleDocument8 pagesCost Analysis of NestleKiran Virk75% (4)

- Cost Analysis Sheet DaburDocument11 pagesCost Analysis Sheet DaburrohitNo ratings yet

- Cost Sheet HULDocument1 pageCost Sheet HULMohan PathakNo ratings yet

- Cost Sheet of Cadbury Dairy Milk: A Project Report ONDocument5 pagesCost Sheet of Cadbury Dairy Milk: A Project Report ONAtharv GulavaniNo ratings yet

- A Project Report ON Cost Sheet Analysis OF Coca - Cola: Institute of Technology and ManagementDocument11 pagesA Project Report ON Cost Sheet Analysis OF Coca - Cola: Institute of Technology and Managementkattyperrysherry33% (3)

- Cost Analysis-Tata MotorsDocument6 pagesCost Analysis-Tata MotorsSubhrajyoti Sarkar57% (7)

- Cost Analysis of Asian Paints LTD PDFDocument16 pagesCost Analysis of Asian Paints LTD PDFAnonymous mZAs5lfwy33% (3)

- Marginal Costing Analysis of Dabur India LtdDocument9 pagesMarginal Costing Analysis of Dabur India Ltdabhisek senapatiNo ratings yet

- Cost Sheet of ParleDocument3 pagesCost Sheet of Parlesucheta menon20% (5)

- Reliance Industries Cost Sheet Ver. 1.0Document2 pagesReliance Industries Cost Sheet Ver. 1.0Samiksha BhargavNo ratings yet

- Cost Analysis of NestleDocument6 pagesCost Analysis of NestleBiya Butt68% (19)

- Cost Sheet of Laxmi Soap FactoryDocument12 pagesCost Sheet of Laxmi Soap FactorykattyperrysherryNo ratings yet

- Cost Sheet of Berger: Particulars Details Amounts (In CR)Document3 pagesCost Sheet of Berger: Particulars Details Amounts (In CR)Nitesh KirarNo ratings yet

- Cost Sheet Analysis: A Project ReportDocument10 pagesCost Sheet Analysis: A Project ReportVarun SalianNo ratings yet

- Cost Sheet Analysis:: Dabur India LimitedDocument10 pagesCost Sheet Analysis:: Dabur India LimitedDishari Poddar100% (1)

- Cost Sheet AnalysisDocument72 pagesCost Sheet Analysisaashu01275% (32)

- Reliance Industries Cost Sheet Ver. 1.0Document2 pagesReliance Industries Cost Sheet Ver. 1.0Pratik SinghNo ratings yet

- Cost Sheet of Nerolac: Particulars Details Amounts (In CR)Document3 pagesCost Sheet of Nerolac: Particulars Details Amounts (In CR)Nitesh Kirar100% (1)

- Cost Sheet Project Tata and HPCLDocument15 pagesCost Sheet Project Tata and HPCLmonish14785267% (3)

- Costing Maggi PDFDocument3 pagesCosting Maggi PDFPoorvi Singhal33% (3)

- Kapbros Finance Department ProjectDocument50 pagesKapbros Finance Department ProjectAnkit Raj50% (10)

- GCPL Cost Sheet AnalysisDocument8 pagesGCPL Cost Sheet Analysisshreyansh naharNo ratings yet

- Cost Sheet of PotatoDocument12 pagesCost Sheet of Potato1059 DêEpNo ratings yet

- Cost Sheet of Asian Paints: Particulars DetailsDocument4 pagesCost Sheet of Asian Paints: Particulars DetailsNitesh KirarNo ratings yet

- Cost AccountingDocument21 pagesCost Accountingdevashree.gedam261033% (3)

- Cost Analysis of Nestle's Standard Costing SystemDocument6 pagesCost Analysis of Nestle's Standard Costing SystemPoorvi SinghalNo ratings yet

- A Presentation On Cost Analysis of CadburyDocument11 pagesA Presentation On Cost Analysis of CadburyHarsh JainNo ratings yet

- COST SHEET OF RelianceDocument16 pagesCOST SHEET OF Reliancejaskirat100% (1)

- Cadbury ProjectDocument46 pagesCadbury Projectchinmay parsekarNo ratings yet

- Asian Paints Cost and Revenue AnalysisDocument12 pagesAsian Paints Cost and Revenue AnalysisKriti ShahNo ratings yet

- Amul Cost SheetDocument18 pagesAmul Cost Sheetmahendrabpatel0% (1)

- Extra Component - Amul Ice CreamDocument7 pagesExtra Component - Amul Ice CreamSantanu DasNo ratings yet

- Amul Ice Cream Cost Sheet AnalysisDocument10 pagesAmul Ice Cream Cost Sheet AnalysisParamveer PatelNo ratings yet

- Project On Amul CheeseDocument30 pagesProject On Amul CheeseStewart Serrao0% (1)

- Ethics CSR ReportDocument22 pagesEthics CSR ReportMayank palNo ratings yet

- AMUL: The Success in The Ice-Cream SegmentDocument27 pagesAMUL: The Success in The Ice-Cream SegmentTerri AnthonyNo ratings yet

- Study of The Present and Acceptance of Amul Ice-Cream in ShillongDocument73 pagesStudy of The Present and Acceptance of Amul Ice-Cream in ShillongManish KumarNo ratings yet

- Retail Penetration of Amul Ice Cream in LucknowDocument85 pagesRetail Penetration of Amul Ice Cream in Lucknowvipultandonddn0% (1)

- Executive summary of Amul ice cream marketing strategyDocument34 pagesExecutive summary of Amul ice cream marketing strategyWilliam CruzNo ratings yet

- Operations Management-Dairy Industry-ReportDocument13 pagesOperations Management-Dairy Industry-ReportPOOJA 2127250No ratings yet

- Case of Natural's Ice Cream Marketing StrategyDocument27 pagesCase of Natural's Ice Cream Marketing Strategyjay_shah070% (1)

- Case of Natural's Ice Cream: Group MembersDocument27 pagesCase of Natural's Ice Cream: Group MembersPriyesh67% (3)

- Exercise No. 7: AIM: To Prepare STATE CHART DIAGRAM For Weather Forecasting System. Requirements: Hardware InterfacesDocument4 pagesExercise No. 7: AIM: To Prepare STATE CHART DIAGRAM For Weather Forecasting System. Requirements: Hardware InterfacesPriyanshu SinghalNo ratings yet

- Broschuere Unternehmen Screen PDFDocument16 pagesBroschuere Unternehmen Screen PDFAnonymous rAFSAGDAEJNo ratings yet

- The Essence of Success - Earl NightingaleDocument2 pagesThe Essence of Success - Earl NightingaleDegrace Ns40% (15)

- RCA - Mechanical - Seal - 1684971197 2Document20 pagesRCA - Mechanical - Seal - 1684971197 2HungphamphiNo ratings yet

- Racial and Ethnic Challenges in the UAE vs UKDocument16 pagesRacial and Ethnic Challenges in the UAE vs UKATUL KORINo ratings yet

- Lab - Activity CCNA 2 Exp: 7.5.3Document13 pagesLab - Activity CCNA 2 Exp: 7.5.3Rico Agung FirmansyahNo ratings yet

- Rtlo 18918B 1202Document42 pagesRtlo 18918B 1202gustavomosqueraalbornozNo ratings yet

- PaySlip ProjectDocument2 pagesPaySlip Projectharishgogula100% (1)

- 13 Daftar PustakaDocument2 pages13 Daftar PustakaDjauhari NoorNo ratings yet

- ProkonDocument57 pagesProkonSelvasatha0% (1)

- PDF Problemas Ishikawa - Free Download PDF - Reporte PDFDocument2 pagesPDF Problemas Ishikawa - Free Download PDF - Reporte PDFNewtoniXNo ratings yet

- ITIL - Release and Deployment Roles and Resps PDFDocument3 pagesITIL - Release and Deployment Roles and Resps PDFAju N G100% (1)

- Research Grants Final/Terminal/Exit Progress Report: Instructions and Reporting FormDocument13 pagesResearch Grants Final/Terminal/Exit Progress Report: Instructions and Reporting FormBikaZee100% (1)

- Best Homeopathic Doctor in SydneyDocument8 pagesBest Homeopathic Doctor in SydneyRC homeopathyNo ratings yet

- Marketing Management NotesDocument115 pagesMarketing Management NotesKajwangs DanNo ratings yet

- Evan Gray ResumeDocument2 pagesEvan Gray Resumeapi-298878624No ratings yet

- DEFCON ManualDocument13 pagesDEFCON Manualbuyvalve100% (1)

- Fluke - Dry Well CalibratorDocument24 pagesFluke - Dry Well CalibratorEdy WijayaNo ratings yet

- Resona I9 Neuwa I9 FDADocument2 pagesResona I9 Neuwa I9 FDAMarcos CharmeloNo ratings yet

- JIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test MethodsDocument43 pagesJIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test Methodsbignose93gmail.com0% (1)

- Recommended lubricants and refill capacitiesDocument2 pagesRecommended lubricants and refill capacitiestele123No ratings yet

- Acknowledgment: George & Also To Our Group Guide Asst. Prof. Simy M Baby, For Their Valuable Guidance and HelpDocument50 pagesAcknowledgment: George & Also To Our Group Guide Asst. Prof. Simy M Baby, For Their Valuable Guidance and HelpKhurram ShahzadNo ratings yet

- For-tea Tea Parlour Marketing Strategy Targets 40+ DemographicDocument7 pagesFor-tea Tea Parlour Marketing Strategy Targets 40+ Demographicprynk_cool2702No ratings yet

- Mosaic Maker - Instructions PDFDocument4 pagesMosaic Maker - Instructions PDFRoderickHenryNo ratings yet

- HW3Document3 pagesHW3Noviyanti Tri Maretta Sagala0% (1)

- Upgrade DB 10.2.0.4 12.1.0Document15 pagesUpgrade DB 10.2.0.4 12.1.0abhishekNo ratings yet

- Safety interlock switches principlesDocument11 pagesSafety interlock switches principlesChristopher L. AlldrittNo ratings yet

- Enhancing reliability of CRA piping welds with PAUTDocument10 pagesEnhancing reliability of CRA piping welds with PAUTMohsin IamNo ratings yet

- Model Paper 1Document4 pagesModel Paper 1Benjamin RohitNo ratings yet

- Scenemaster3 ManualDocument79 pagesScenemaster3 ManualSeba Gomez LNo ratings yet