Professional Documents

Culture Documents

Receivables Management

Uploaded by

Inocencio TiburcioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Receivables Management

Uploaded by

Inocencio TiburcioCopyright:

Available Formats

This Accounting Materials are brought to you by www.everything.freelahat.

com

CHAPTER 16 RECEIVABLES MANAGEMENT

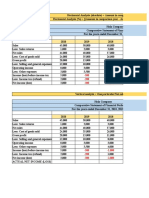

[Problem 1] Before 1. 2. 3. Receivable turnover

(360 days/60 days)

After 18x

(360 days/20 days)

6x P3.6M

A/Rec balance (P21.6M/6)

P1.2M (P21.6M/18) P360,000 (345,600) 90,000 P104,400 After 12x P2.0M

Investment income [(P3.6M - P1.2M) x 15%] Discount taken (P21.6M x 80% x 2%) Decrease in collection costs Net advantage of the new credit policy Before 8x P3.0M

[Problem 2] 1. 2. 3. Receivable turnover A/Rec balance (P24M/8) (P24M/12) P120,000 (150,000) 240,000 P210,000

Investment income [(P3.0M - P2.0M) x 12%] Increase in collection costs (P400,000 P250,000) Decrease in bad debts (1% x P24M) Net advantage of the new collection policy Before P60M 45 days 8x P7.5M P900.000

[Problem 3] Sales Collection period Receivable turnover (360 days/collection period) A/Rec. balance (Sales/Rec Turnover) Bad debts (1.5% x P60M) After P69M (P60M x 115%) 75 days 4.8x P14.375M P2.070 M (P69M x 3%) P7,200.000 (1,100,000) (1,170,000) ( 200,000) P4,730,000

Incremental CM (P9M x 80%) Opportunity costs [(P14,375,000-P7,500,000)x80%x 20%] Increase in bad debts (P2,070,000-P900,000) Increase in collection costs Incremental IBIT

This Accounting Materials are brought to you by www.everything.freelahat.com

The company is advised to extend its credit period and increase its income before income tax of P4.73 million. [Problem 4] Before After Net credit sales (P10Mx80%) P8M P8M Collection period 60 days 40 days Receivable turnover 6x 9x A/Rec balance (Net Credit Sales/Rec Turnover)P1,333,333 P888,889 Investment income (P444,444x12%) Discount taken (P8Mx60%x2%) Net disadvantage of the new policy P 53,333 (96,000) P(42,667) = = P2,500.000 2,000.000 P 500,000 Charge P20days 3x P(444,444)

[Problem 5] A/Rec (old) = [P12M/(360/75 days)] A/Rec (new) = [P12M/(360/75 days)] Decrease in A/ Rec balance Cost of fund = 20% Investment income (P500,000 x 20%) P100,000 (P500,000 x 10%) Decrease in bad debts (1% x P12 million) 120,000 Increase in collection costs (180,000) Net advantage (disadvantage) of doubling the collection personnel P 40,000

Cost of fund =10% P 50,000 120,000 (180,000) P (10,000)

[Problem 6] Bad debts expense without credit-rating information: Low risk (P2.5 million x 30% x 3%) P 22,500 Medium risk (P2.5 million x 50% x 7%) 87,500 High risk (P2.5 million x 20% x 24%) 120,000 Bad debt expense with credit-rating information (P2.5 million x 3%) Decrease in bad debt with credit-rating information Cost of credit-rating information [(P2.5M/P50)xP4]

P230.000 (75,000) 155,000 (200,000)

P2.5 million P50

This Accounting Materials are brought to you by www.everything.freelahat.com

Net disadvantage of obtaining credit information [Problem 7] Effective Discount rate 1. 2. 3. 4. 5. 6. 7. EDR EDR EDR EDR EDR EDR EDR = = = = = = = = ? = = = =

P (45,000)

(360/15) x (1%/99%) (360/10) x (1%/99%) (360/20) x (2%/98%) (360/50) x (2%/98%) 24.49% 22.67% 55.67%

24.24% 36.36% 36.73% 14.69%

[Problem 8] 1. Credit sales Allowance for bad debts Net credit sales Receivable turnover (360 days/30) A / Rec bal (2003) = (P70,400,000/12) = 2. a) b) c) Return on assets Asset turnover = = P72,000,000 1,600,000 P70,400,000 12x P5,866,667 = = 12.5% 2 times

(P5M / P40M) (P80M / P40M)

Sales (P92M + P8M) Materials and supplies [P10Mx(100/80) Labor [P40Mx(100/80)] Fixed overhead Administrative expense Variable selling expense [P8Mx(100/80)] Bad debt Income before income tax Less: Tax (50%) Net Income

P100,000,000 (12,500,000) (50,000,000) (7,400,000) (3,000,000) (10,000,000) (2,400,000) P 14,700,000 7,350,000 P 7,350,000

This Accounting Materials are brought to you by www.everything.freelahat.com

d)

Total assets before adjustments Increase in A/Rec Increase in inventory New total assets

P40,000,000 9,066,666 5,670,000 P54,736,666

New A/Rec Bal = [(P92,000,000-P2,400,000) / (360 days/60 days)] = P89,600,000 / 6 = P14,933,333 5,866,667 P 9,066,666

Old A/Rec Bal Increase in A/Rec Balance

Return on assets = P7,350,000 / P54,736,666 = 13.43% e) Yes, the company will be better off financially after the change in credit policy as indicated by an increase in ROA from 12.5% to 13.43%. However, it should be noted that the nature and cost of financing the current asset expansion have not been considered. These may have an impact on cost of doing business and eventually on the return on assets.

[Problem 9] 1. Effective discount rate [(360/14)x(1%/99%)] Effective interest rate: Amount borrowed (P99,000/85%) P116,471 EIR [(P116,471 x 85%) / P99,000] Advantage of taking the discount per year 2. Effective discount rate [(360/40) x (1%/99%)] Effective interest rate Advantage of not taking the discount 36.36%

10.00% 26.36% 9.09% 10.00 (0.91%)

3.

Using a 60-day payment period increases the length of time to avail the discount, hence, effectively reducing the discount rate. This makes answer in letter "b" in favor of not taking the discount and not borrowing from the bank to take the discount. It does not give added benefit to the National Corporation.

This Accounting Materials are brought to you by www.everything.freelahat.com

You might also like

- Chapter 5 (2) CVPDocument11 pagesChapter 5 (2) CVPInocencio TiburcioNo ratings yet

- Chapter 45 Operating Segments ProblemsDocument5 pagesChapter 45 Operating Segments ProblemsHohohoNo ratings yet

- FBTDocument4 pagesFBTRogienel ReyesNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-7 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-7 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 9 Without AnswerDocument6 pagesCHAPTER 9 Without AnswerlenakaNo ratings yet

- STRATEGIC COST MANAGEMENT: RELEVANT COSTING DECISIONSDocument6 pagesSTRATEGIC COST MANAGEMENT: RELEVANT COSTING DECISIONSMon Ram0% (1)

- 2.6. Retained EarningsDocument5 pages2.6. Retained EarningsKPoPNyx Edits100% (1)

- Baggayao WACC PDFDocument7 pagesBaggayao WACC PDFMark John Ortile BrusasNo ratings yet

- FM Second AssignmentDocument3 pagesFM Second AssignmentpushmbaNo ratings yet

- Bobadilla Reviewer MASDocument3 pagesBobadilla Reviewer MASMae CruzNo ratings yet

- Test 5Document2 pagesTest 5Kim LimosneroNo ratings yet

- Itemized Deductions & Self-Test ExercisesDocument29 pagesItemized Deductions & Self-Test ExercisesRouve BontuyanNo ratings yet

- 4 Probability AnalysisDocument11 pages4 Probability AnalysisLyca TudtudNo ratings yet

- MAS 3 SamplesDocument10 pagesMAS 3 SamplesRujean Salar AltejarNo ratings yet

- PFRS 12 Disclosure RequirementsDocument26 pagesPFRS 12 Disclosure RequirementsMeiNo ratings yet

- Income Taxation Solution Manual Banggawan 2017Document2 pagesIncome Taxation Solution Manual Banggawan 2017Iscandar Pacasum DisamburunNo ratings yet

- IA2 CH15A PROBLEMS (Vhinson)Document5 pagesIA2 CH15A PROBLEMS (Vhinson)sophomorefilesNo ratings yet

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- 9 Trade CreditDocument13 pages9 Trade CreditMohammad DwidarNo ratings yet

- Problem 14-5: Kayla Cruz & Gabriel TekikoDocument7 pagesProblem 14-5: Kayla Cruz & Gabriel TekikoNURHAM SUMLAYNo ratings yet

- Inacct3 Module 3 QuizDocument7 pagesInacct3 Module 3 QuizGemNo ratings yet

- Chapter 13 Share-Based Payments 2Document9 pagesChapter 13 Share-Based Payments 2Thalia Rhine AberteNo ratings yet

- Production and Operation Management SummaryDocument10 pagesProduction and Operation Management SummaryMarie GonzalesNo ratings yet

- Differential Analysis:: The Key To Decision MakingDocument32 pagesDifferential Analysis:: The Key To Decision MakingkimmyNo ratings yet

- Cash of Foregoing A Cash DiscountDocument3 pagesCash of Foregoing A Cash DiscountRNo ratings yet

- Chapter Two: Financing Decisions / Capital StructureDocument72 pagesChapter Two: Financing Decisions / Capital StructureMikias DegwaleNo ratings yet

- Problem 1 - 5-6Document4 pagesProblem 1 - 5-6Lowellah Marie BringasNo ratings yet

- Chapter 10 Book Value Per Share - GuideDocument7 pagesChapter 10 Book Value Per Share - GuideMike Joseph E. MoranNo ratings yet

- Chapter 40 - Teacher's ManualDocument8 pagesChapter 40 - Teacher's ManualHohohoNo ratings yet

- Group 5 Problem 7 2Document6 pagesGroup 5 Problem 7 2Shieryl BagaanNo ratings yet

- Calculate breakeven point, target sales, and safety margin for contribution margin analysisDocument5 pagesCalculate breakeven point, target sales, and safety margin for contribution margin analysisAbhijit AshNo ratings yet

- Variable and Absorption CostingDocument38 pagesVariable and Absorption CostingstarlightNo ratings yet

- Bam199 P3 ExamDocument11 pagesBam199 P3 ExamMylene HeragaNo ratings yet

- Eco Dev Chapter 3 - Growth and The Asian ExperienceDocument69 pagesEco Dev Chapter 3 - Growth and The Asian ExperienceAlyssaNo ratings yet

- Tax Chap 14 To 15Document7 pagesTax Chap 14 To 15Jea XeleneNo ratings yet

- Glo-Stick, Inc.: Financial Statement Investigation A02-11-2015Document3 pagesGlo-Stick, Inc.: Financial Statement Investigation A02-11-2015碧莹成No ratings yet

- 100 % 36 Units Per Day 50 Trucks Per Day 100 % 100 % 36 Units Per Day 40 Trucks Per Day 100 %Document6 pages100 % 36 Units Per Day 50 Trucks Per Day 100 % 100 % 36 Units Per Day 40 Trucks Per Day 100 %Cherie Soriano AnanayoNo ratings yet

- BLT 101Document14 pagesBLT 101NIMOTHI LASENo ratings yet

- E. All of The Above. A. Total Revenue Equals Total CostDocument22 pagesE. All of The Above. A. Total Revenue Equals Total CostNicole KimNo ratings yet

- Chapter 7 - Regular Output VATDocument17 pagesChapter 7 - Regular Output VATSelene DimlaNo ratings yet

- N. Cruz-Course Material For Strategic Cost ManagementDocument134 pagesN. Cruz-Course Material For Strategic Cost ManagementEmmanuel VillafuerteNo ratings yet

- TX10 - Other Percentage TaxDocument15 pagesTX10 - Other Percentage TaxKatzkie Montemayor GodinezNo ratings yet

- 01 Cost Behavior Analysis 1Document3 pages01 Cost Behavior Analysis 1JunZon VelascoNo ratings yet

- Accounting For LaborDocument1 pageAccounting For LaborkwekwkNo ratings yet

- Estate TaxDocument2 pagesEstate Taxucc second yearNo ratings yet

- Try This - Cost ConceptsDocument6 pagesTry This - Cost ConceptsStefan John SomeraNo ratings yet

- Chapter One: Cost Management and StrategyDocument35 pagesChapter One: Cost Management and Strategymeliana100% (2)

- M36 - Quizzer 1 PDFDocument8 pagesM36 - Quizzer 1 PDFJoshua DaarolNo ratings yet

- Job Costing Finished Goods InventoryDocument46 pagesJob Costing Finished Goods InventoryNavindra JaggernauthNo ratings yet

- IAS 28 Sol. Man.Document27 pagesIAS 28 Sol. Man.asher phoenixNo ratings yet

- Acct 3Document25 pagesAcct 3Diego Salazar100% (1)

- Asisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Document5 pagesAsisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Kristine Vertucio0% (1)

- Financial Planning and Forecasting Chapter 4 Learning ObjectivesDocument33 pagesFinancial Planning and Forecasting Chapter 4 Learning ObjectivesAL SeneedaNo ratings yet

- AC17-602P-REGUNAYAN-End of Chapter 2 ExercisesDocument12 pagesAC17-602P-REGUNAYAN-End of Chapter 2 ExercisesMarco RegunayanNo ratings yet

- Ch16 Receivables Management PDFDocument4 pagesCh16 Receivables Management PDFjdiaz_646247No ratings yet

- Chapter 16 2-5Document2 pagesChapter 16 2-5Angelica Anne100% (2)

- Capital BudgetingDocument24 pagesCapital BudgetingInocencio Tiburcio100% (2)

- Income Tax Deductions GuideP15,000,0005,000,000P20,000,0002,000,000P18,000,0003,300,000P5.45Document10 pagesIncome Tax Deductions GuideP15,000,0005,000,000P20,000,0002,000,000P18,000,0003,300,000P5.45Keysi02No ratings yet

- Deductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesDeductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersMichael Reyes75% (4)

- Answer Key Ch8Document12 pagesAnswer Key Ch8Zarah RoveroNo ratings yet

- ADocument2 pagesAInocencio TiburcioNo ratings yet

- Here I Am To WorshipDocument6 pagesHere I Am To WorshipInocencio TiburcioNo ratings yet

- From The Inside OutDocument24 pagesFrom The Inside OutInocencio TiburcioNo ratings yet

- Nanay at AnakDocument5 pagesNanay at AnakInocencio TiburcioNo ratings yet

- Accounting Materials Chapter 9 Short-Term Non-Routine DecisionsDocument13 pagesAccounting Materials Chapter 9 Short-Term Non-Routine DecisionsInocencio Tiburcio33% (3)

- Organic Gardening Tips for a Healthy Homegrown HarvestDocument3 pagesOrganic Gardening Tips for a Healthy Homegrown HarvestInocencio TiburcioNo ratings yet

- Chicken OathDocument16 pagesChicken OathInocencio TiburcioNo ratings yet

- Test Bank TOCDocument1 pageTest Bank TOCAkai Senshi No TenshiNo ratings yet

- Henry Sy's Success StoryDocument3 pagesHenry Sy's Success StoryInocencio Tiburcio71% (7)

- Capital BudgetingDocument24 pagesCapital BudgetingInocencio Tiburcio100% (2)

- Chapter 17Document9 pagesChapter 17Aiko E. LaraNo ratings yet

- The Hyundai GroupDocument6 pagesThe Hyundai GroupInocencio Tiburcio67% (3)

- MAS Compilation of QuestionsDocument21 pagesMAS Compilation of QuestionsInocencio Tiburcio67% (3)

- Chapter 8Document10 pagesChapter 8Christine GorospeNo ratings yet

- Daimle BenzDocument1 pageDaimle BenzInocencio TiburcioNo ratings yet

- Chapter 6 Mas Short Term BudgetingDocument18 pagesChapter 6 Mas Short Term BudgetingLauren Obrien67% (3)

- ResDocument11 pagesResInocencio TiburcioNo ratings yet

- HongenDocument3 pagesHongenInocencio TiburcioNo ratings yet

- Louderback C6 TF&MCDocument4 pagesLouderback C6 TF&MCInocencio TiburcioNo ratings yet

- HICOM Case Analysis for Management 18Document6 pagesHICOM Case Analysis for Management 18Inocencio Tiburcio100% (1)

- IFRCDocument3 pagesIFRCInocencio TiburcioNo ratings yet

- Ak - Keu (Problem)Document51 pagesAk - Keu (Problem)RAMA100% (9)

- Intermediate Accounting Quiz BeeDocument8 pagesIntermediate Accounting Quiz BeeAndy SimbreNo ratings yet

- INSTITUTE OF AGRI BUSINESS MANAGEMENT ACCOUNTSDocument34 pagesINSTITUTE OF AGRI BUSINESS MANAGEMENT ACCOUNTSSHEKHAR SUMITNo ratings yet

- Additional Practical Problems-20Document16 pagesAdditional Practical Problems-20areet2701No ratings yet

- WCM MATERIALDocument31 pagesWCM MATERIALNiña Rhocel YangcoNo ratings yet

- AC1025 Commentary 2018Document57 pagesAC1025 Commentary 2018violapoonNo ratings yet

- Test 3 Review PDFDocument8 pagesTest 3 Review PDFThomas BroadyNo ratings yet

- R12 Finance Practice GuideDocument290 pagesR12 Finance Practice Guidelraman87No ratings yet

- CMA Part 1 Unit 2 (2021)Document116 pagesCMA Part 1 Unit 2 (2021)athul16203682No ratings yet

- 6Document27 pages6JDNo ratings yet

- 41Document20 pages41Rinku PatelNo ratings yet

- Solution Manual For Financial Accounting in An Economic Context Pratt 9th EditionDocument26 pagesSolution Manual For Financial Accounting in An Economic Context Pratt 9th EditionArielCooperbzqsp100% (81)

- Assignment On Chapter 5 Cash Ad ReceivablesDocument3 pagesAssignment On Chapter 5 Cash Ad Receivablesdameregasa08No ratings yet

- Daftar Akun Ud BuanaDocument1 pageDaftar Akun Ud BuanaYusufNo ratings yet

- Management Accounting Chapter 4: Fund Flow Statement (FFS) : o o o o oDocument21 pagesManagement Accounting Chapter 4: Fund Flow Statement (FFS) : o o o o oHemantha RajNo ratings yet

- This Study Resource Was: Njpia Region 3 CouncilDocument7 pagesThis Study Resource Was: Njpia Region 3 CouncilPeachy Rose TorenaNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Model Test Paper Accounts Officer PostsDocument45 pagesModel Test Paper Accounts Officer PostsdevarajbcomNo ratings yet

- RKG Class 11 Accounts Mock 2 SolDocument13 pagesRKG Class 11 Accounts Mock 2 SolSangket MukherjeeNo ratings yet

- Bad Debt Brac BankDocument30 pagesBad Debt Brac BankAndalib KabirNo ratings yet

- CPA Review Center Pre-Board ExamDocument13 pagesCPA Review Center Pre-Board ExamJericho Pedragosa100% (1)

- China Banking Corporation Vs CADocument5 pagesChina Banking Corporation Vs CAFrancis CastilloNo ratings yet

- Audit of Allowance For Doubtful AccountsDocument4 pagesAudit of Allowance For Doubtful AccountsCJ alandyNo ratings yet

- Accounting Revision Notes 0452Document18 pagesAccounting Revision Notes 0452Hassan AsgharNo ratings yet

- Maimonides 2018 Audited FinancialsDocument52 pagesMaimonides 2018 Audited FinancialsJonathan LaMantiaNo ratings yet

- 12th Accounts Partnership Test 15 Sept.Document6 pages12th Accounts Partnership Test 15 Sept.SGEVirtualNo ratings yet

- Practice Problems AR and NotesDocument7 pagesPractice Problems AR and NotesDonna Zandueta-TumalaNo ratings yet

- Future Taxable and Deductible AmountsDocument15 pagesFuture Taxable and Deductible Amountslaale dijaanNo ratings yet

- Statement of Changes in Comprehensive IncomeDocument33 pagesStatement of Changes in Comprehensive Incomeellyzamae quiraoNo ratings yet

- Chapter 4 Receivables and Related RevenuesDocument12 pagesChapter 4 Receivables and Related Revenuesjohn condesNo ratings yet