Professional Documents

Culture Documents

401K Roth Plan

Uploaded by

Anand RishiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

401K Roth Plan

Uploaded by

Anand RishiCopyright:

Available Formats

401K Roth plan

Added by Sarah Debza, last edited by Marcio Leoni on May 07, 2010 (view change)

401k Roth plan

Is it a new type of plan?

No, it is not a new type of plan. Designated Roth contributions are a new type of contribution that can be accepted by a new or existing 401(k) plan. This feature is permitted under a Code section added by the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), effective contributions for years beginning on or after January 1, 2006. If a plan adopts this feature, employees can designate some or all of their elective as Roth 401(k) post-tax contributions as part of their existing elective deferral plan offering.

Can I make both pre-tax elective and 401K Roth post-tax contributions in the same year?

Yes, you can make contributions to both a Roth 401K account and a traditional, pre-tax account in the same year in any proportion you choose. An eligible employee may contribute post-tax dollars only towards the Roth 401(k) plan and pre- and post-tax dollars towards their 401(k) plan. However, the combined amount contributed in any one year is limited by the 402(g) limit - $15,000 for 2006 (plus an additional $5,000 in catch-up contributions if age 50 or older).

Are there any limits as to how much I may contribute to my Roth 401K account?

Yes, the combined amount contributed to all 401K Roth accounts and traditional, pre-tax accounts in any one year for any individual is limited by the 402(g) limit - $15,000 for 2006 (plus an additional $5,000 in catch-up contributions if age 50 or older).

Can the employer make matching contributions on the Roth 401K contributions?

The employer can make matching contributions on 401K Roth contributions. The matching contributions made on account of 401K Roth contributions must be allocated to a pre-tax account, just as matching contributions on traditional, pre-tax elective contributions are.

How can I configure my system to allow Roth 401K contributions?

A step by step guide is provided to configure the system for Roth 401K post-tax contributions. a) Create a new Roth 401K plan in the system under a benefits area using IMG configuration step: Personnel Management -> Benefits -> Plans -> Savings Plans -> Define SavingsPlan General Data. b) Enter the required details for the plan. Select the 'Roth Plan' and 'Qualified Plan' checkbox. c) Create an employee contribution variant as per the requirement with IMG configuration step: Personnel Management -> Benefits -> Plans -> Savings Plans -> Define Employee Contribution Variants. d) Assign employee contribution rule to the employee contribution variant with the IMG configuration step: Personnel Management -> Benefits -> Plans -> Savings Plans ->Define Employee Contribution Rules. Check only post tax contributions for Roth 401K plan. e) Create an employer contribution variant as per the requirement with IMG configuration step: Personnel Management -> Benefits -> Plans -> Savings Plans -> Define Employer Contribution Variants. f) Assign employer contribution rule to the employer contribution variant with the IMG configuration step: Personnel Management -> Benefits -> Plans -> Savings Plans ->Define Employer Contribution Rules. g) Assign the variants to the Roth 401K plan with IMG configuration step: Personnel Management -> Benefits -> Plans -> Savings Plans -> Assign Savings Plan Attributes. h) Assign the wage types to Roth 401K plan in the payroll with IMG configuration step: Payroll -> Payroll USA -> Benefit Integration -> Enter Wage types for plan. i) If the plan allows catch-up contribution, configure the catch-up wage types using the IMG configuration step: Payroll -> Payroll USA -> Benefit Integration -> Set up catch up contribution Note: BT40 is the model wage type provided by SAP to configure the post-tax catch-up wage type for Roth 401k plan.

You might also like

- 02 Conf Personnal AdministrationDocument12 pages02 Conf Personnal AdministrationAnand RishiNo ratings yet

- SAP OverviewDocument109 pagesSAP OverviewGeorgeNiharikaNo ratings yet

- Local Tax Qatar SapDocument8 pagesLocal Tax Qatar SapAnand RishiNo ratings yet

- Country ReassignmentDocument1 pageCountry ReassignmentAnand RishiNo ratings yet

- Project 1Document88 pagesProject 1Anand RishiNo ratings yet

- Table NamesDocument5 pagesTable NamesAnand RishiNo ratings yet

- Pre Tax - Post SGJGTaxDocument1 pagePre Tax - Post SGJGTaxAnand RishiNo ratings yet

- Plan VersionsDocument12 pagesPlan VersionsAnand RishiNo ratings yet

- Sap HR MaterialDocument94 pagesSap HR MaterialAnand Rishi0% (1)

- ChocyDocument81 pagesChocyAnand RishiNo ratings yet

- Plan VersionsDocument12 pagesPlan VersionsAnand RishiNo ratings yet

- EHFGJKZGIZDDocument4 pagesEHFGJKZGIZDAnand RishiNo ratings yet

- Maruthi Suzuki LTDDocument70 pagesMaruthi Suzuki LTDTns Reddy50% (2)

- Cigarette IndustryDocument276 pagesCigarette IndustryAnand Rishi0% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Province Authority to Levy Amusement TaxDocument11 pagesProvince Authority to Levy Amusement TaxPaolo Antonio EscalonaNo ratings yet

- Scope and DelimitatonDocument3 pagesScope and DelimitatonTirso Jr.No ratings yet

- Summary of Fund Perf - Sept 2012 LIFE ACCOUNTDocument4 pagesSummary of Fund Perf - Sept 2012 LIFE ACCOUNTJohn SmithNo ratings yet

- Receipt for Redmi Note 7 purchaseDocument1 pageReceipt for Redmi Note 7 purchaseRubhan kumarNo ratings yet

- Macroeconomics - Notes 12thDocument28 pagesMacroeconomics - Notes 12thReddyNo ratings yet

- 24 - CIR v. Filipinas Compaña de SegurosDocument4 pages24 - CIR v. Filipinas Compaña de SegurosBernadette PedroNo ratings yet

- CIR vs. Cebu Portland Cement Company and CTA, G.R. No. L-29059, December 15, 1987Document6 pagesCIR vs. Cebu Portland Cement Company and CTA, G.R. No. L-29059, December 15, 1987Emil BautistaNo ratings yet

- Laws Relating To Finance and Support Services of TESDA, CHED, Dep-EdDocument51 pagesLaws Relating To Finance and Support Services of TESDA, CHED, Dep-EdEron Roi Centina-gacutan100% (1)

- EB No. 2489Document4 pagesEB No. 2489jamNo ratings yet

- When Is A Notice of Donation Needed?: NEDA - National Economic Development AuthorityDocument4 pagesWhen Is A Notice of Donation Needed?: NEDA - National Economic Development AuthorityJonabelle BiliganNo ratings yet

- AIOU Business Taxation Assignment GuideDocument4 pagesAIOU Business Taxation Assignment GuideUsman Shaukat Khan100% (1)

- Credit 243112012575 12 2023Document2 pagesCredit 243112012575 12 2023bhawesh joshiNo ratings yet

- (4525) Rashtriya Ispat Nigam Limited (211101006626)Document1 page(4525) Rashtriya Ispat Nigam Limited (211101006626)Dontha VenkateshNo ratings yet

- TAX EXEMPTION RULESDocument44 pagesTAX EXEMPTION RULESCyril John RamosNo ratings yet

- Updated Arrears Estimator Clerical StaffDocument8 pagesUpdated Arrears Estimator Clerical Staffkmuraleedharan09No ratings yet

- ManagementLetter - Possible PointsDocument103 pagesManagementLetter - Possible Pointsaian joseph100% (3)

- Rajdhani Exp Third Ac (3A)Document2 pagesRajdhani Exp Third Ac (3A)BabuRao Ganpatrao AapteNo ratings yet

- Rihaab - Fat TaxDocument4 pagesRihaab - Fat Taxapi-269947511No ratings yet

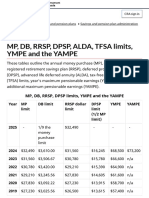

- MP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - CaDocument4 pagesMP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - Caag9004282No ratings yet

- Edmonton Provincial Budget SubmissionDocument4 pagesEdmonton Provincial Budget SubmissionCTV News EdmontonNo ratings yet

- MBA - Total Quality ManagementDocument40 pagesMBA - Total Quality ManagementJignesh PatelNo ratings yet

- BasicchartofaccountsDocument6 pagesBasicchartofaccountsPanith MeasNo ratings yet

- MIT43RMNHDocument180 pagesMIT43RMNHexecutive engineerNo ratings yet

- BIR Form No. 1601E - Guidelines and InstructionsDocument4 pagesBIR Form No. 1601E - Guidelines and InstructionsJinefer ButohanNo ratings yet

- Marketing Management - Group Project ReportDocument32 pagesMarketing Management - Group Project ReportChandan BhartiNo ratings yet

- Quotation: FOR SK350 EXCAVATOR (L-172) LAST ISSUE DATE:-30/07/2023 Req by Kelum/FathuDocument1 pageQuotation: FOR SK350 EXCAVATOR (L-172) LAST ISSUE DATE:-30/07/2023 Req by Kelum/FathuVimal RajNo ratings yet

- Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDocument2 pagesDate of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDaniel HollandsNo ratings yet

- p5 2007 Dec QDocument12 pagesp5 2007 Dec QJacqueline NashNo ratings yet

- Chapter 14 IllustrationsDocument8 pagesChapter 14 IllustrationsE.D.JNo ratings yet

- Income Tax Authorities (Chapter 4)Document11 pagesIncome Tax Authorities (Chapter 4)Fahim Shahriar MozumderNo ratings yet