Professional Documents

Culture Documents

Customer Relationship

Uploaded by

aman.4uOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Relationship

Uploaded by

aman.4uCopyright:

Available Formats

Delhi Business Review ? Vol. 2, No.

2, July - December 2001

CUSTOMER-RELATIONSHIP MANAGEMENT

A CASE STUDY OF COMMERCIAL BANKS IN JAMMU AND KASHMIR

S. Tandon

USTOMER satisfaction is one of the formidable challenges in marketing of services in banking industry in our country. The thrust on customer service has increased after liberalisation of Indian economy. Customer satisfaction is an urgent need of the hour. This can be achieved by efficient customer service and immediate tactful handling of customers grievances. Better customer-management relationship leads to customer satisfaction and a good public image is to win over the customers. Hence, public relations should be one of the strategies to achieve customer satisfaction. Banking system has a significant role to play in the rapid growth of the economy. Effectiveness of Banking system depends upon the customers satisfaction and in fact customer is the kingpin of the banking industry. No industry can afford to ignore its customers and banks are required to give top priority in providing satisfactory and efficient service to their customers. The purpose of this paper was to study the actual level of customer satisfaction in four commercial Banks in Jammu and to make a comparative analysis of the level of customer satisfaction through five point likert scale. Study has revealed that customers are highly satisfied with the employees and the management of the banks. Comparative analysis of level of customer satisfaction in four banks shows that employees in the Central Bank of India are the most satisfied lot. The paper provides an opportunity to the employees of the all the four banks to understand the requirement of providing prompt and quality service to their customers. Effort should be made to raise the level of customers satisfaction amongst all the Banks.

Background

Customer satisfaction is one of the formidable challenges in marketing of services in Banking Industry in our Country. The thrust on customer service has increased after liberalisation of Indian Economy. Thus customer satisfaction is an urgent need of the hour. This can be achieved by efficient customer service and immediate tactful handling of customers grievances. Better Customer-Management relationship leads to customer satisfaction and a good public image is to win over the customers. Hence, Public relations should be one of the strategies to achieve customer satisfaction (Ambastha 1999). The new organisations emphasis is on partnerships between firms; multiple types of ownership and partnership and partnering within the organisation (divisions, wholly owned subsidiaries, licences, franchises, joint ventures etc.); teamwork among members of the organisation, often with team members from two or more cooperating firms; sharing of responsibility for developing, converging and overlapping technologies; and often less emphasis on formal contracting and managerial reporting, evaluation, and control systems. The best visual image of these organisations may be a wheel instead of a pyramid, where the spokes are knowledge links between (focal) organisation at the hub and strategic partners around the rim (Badaracco 1991). These forms

S. Tandon

were pioneered in such industries as heavy construction, fashion, and computers, where markets often span geographic boundaries, technology is complex, products change quickly, and doing everything oneself is impossible. These confederations of specialists are called by many names including networks (Miles and snow 1986; Thorelli 1986), value-adding partnerships (Johnston and Lawrence 1988), alliances (Ohmae 1989), and shamrocks (Handy 1990). All are characterised by flexibility, specialisation, and an emphasis on Relationship Management instead of market transactions. They depend upon administrative processes but they are not hierarchies (Thorelli 1986); they engage in interactions within ongoing relationships and they depend on negotiation, rather than market-based process, as a principal basis for conducting business and determining prices.

Managing Customer Loyalty and Development

Managing customer-development process is one of the critical dimensions of relationship marketing. Basically it involves a twin focus-customer catching, and customer keeping. Customer catching is the process of attracting new customers (inviting new blood), while the customer keeping aims at the process of retaining the existing customers (encouraging old blood). Customer catching process will have to effectively deal with the suspects, prospects, and disqualified prospects. To start with, suspects include everyone who might possibly buy the organisations product or service. But the firm is interested in sensing, serving, and satisfying the prospects who possess both the ability and willingness to buy the product or service. Accordingly, the marketer must be available to precisely assess and identify the prospects among the suspects in the market and at the same time exclude the disqualified prospects who are unprofitable for the organisation to serve. The relationship centered organisation should undertake proper and adequate efforts to convert many of its qualified prospects into first-time customers, satisfied first-time customers into repeat customers, repeat customers into clients. Commitment and trust lead directly to cooperative behaviour. This is conducive to relationship marketing success. This is precisely due to the following main reasons: 1. Relationship commitment and trust encourage marketers to work at preserving relationship investments by cooperating with exchange partners; Resist attractive short-term alternatives in favour of the expected long-term benefits of staying with existing partners, and View potentially high-risk actions as being prudent because of the belief that their partners will not act opportunistically (Yodapadithaya, 1999).

2.

3.

Banking system has a significant role to play in the rapid growth of economy. The banks that do well in 1990s and 2000 A.D. will be those which rediscover the customer through cutting the edge known as relationship banking (Vaishnar, 2000). Effectiveness of banking system depends upon the customers satisfaction and infact, customer is the kingpin of the banking industry. Customer satisfaction is dependant on the climate in which contacts between customers and the bank take place. Healthy climate promotes pleasant transactions for both the parties. No industry in the service sector can afford to ignore its customers and as Banks are required to give top priority in providing satisfactory and efficient service to their customers.

Delhi Business Review ? Vol. 2, No. 2, July - December 2001

Objectives

The main objectives of the paper are: 1. To study the actual level of customers satisfaction in four commercial banks i.e., State Bank of India, Punjab National Bank, Central Bank of India and Jammu & Kashmir Bank Ltd; by analysing their attitude towards: a) b) c) 2. Bank Employees Management

To make a comparative analysis of level of customers satisfaction in four banks.

Methodology

For preparing the present paper 111 customers were selected with stratified random sampling method which formed a sample of more than 20% of the employees, taken up for study. Customers have been split up in three categories viz. businessmen, service-class and practitioners. 33 customers from State Bank of India, 26 from Punjab National Bank, 20 from Central Bank of India and 32 from Jammu & Kashmir Bank Ltd. were selected.

Findings

Customers Satisfaction In State Bank Of India

Table 1 shows that a total of 33 customers of the bank have reported overall highest satisfaction which is evident from the mean score of 3.20, which is above average, out of these, service class is the highest satisfied lot (3.47) while businessmen have put up the lowest mean score (2.86). It falls in the below average range. Practitioners seems to be moderately satisfied as they are showing mean score of 3.27. Table further shows that mean scores of Service class, customers and practitioners are higher than the overall average for the bank. Comparative analysis of the three variables for the study shows that customers are showing good response towards management of the bank which is clear from the mean score of 3.22, which is higher than those of other two variables i.e. Attitude towards Bank-(3.20) and attitude towards Employees (3.17). Thus table makes it clear that staff of the bank has not been able Table-1: Customers Satisfaction in Banks State Bank Of India Number of Category-I Category-II Category-III Average Mean Customers Attitude towards Attitude towards Attitude towards Score Bank Employees Management *B=11 *S=11 *P=11 Average Mean Score 2.91 3.43 3.26 3.20 2.61 3.55 3.35 3.17 3.04 3.42 3.19 3.22 2.86 3.47 3.27 3.20

*B- Businessmen. S- Service Class. P- Practitioners.

S. Tandon

to make customers happy with their behaviour. That is why table is showing the lowest mean score (3.17) regarding this particular variable. A comparative analysis of overall mean score and actual means of different variables shows that regarding customers attitude towards bank, mean score of service class (3.43) and practitioners (3.26) are higher than overall average. Mean score of 2.91 is lower than the overall mean score. As regards second variable i.e., attitude towards Employees except businessmen (2.62), other two categories of customers have responded well i.e. 3.55 of service class and 3.35 of practitioners. Customers have reported highest mean score of 3.22 towards management of the bank. It is also higher than actual average of Businessmen (3.04) and practitioners (3.19). To sum up, it may be stated businessmen, though having the frequent dealings with the bank, still is the least satisfied lot especially with the behaviour of employees.

Customers Satisfaction In Punjab National Bank

An overall mean score of 3.06 has been shown in the table 2 comparing the actual responses with the overall response, it may be stated that it is lower than those of service class customers (3.33) and practitioners (3.14). Conversely, it is higher than that of businessmen (2.71). Table-2: Customers Satisfaction In Punjab National Bank Number of Category-I Category-II Category-III Average Mean Customers Attitude towards Attitude towards Attitude towards Score Bank Employees Management B=8 S=9 P=9 Average Mean Score 2.60 3.32 3.23 3.05 2.52 3.45 3.04 3.00 3.01 3.21 3.16 3.13 2.71 3.33 3.14 3.06

A comparative analysis of overall averages with the actual mean score, table under reference shows that overall mean score (3.05) is lower than averages for service class (3.32) and practitioners (3.23) but higher than that of business class (2.60), so far as attitude towards bank is concerned. Customers do not seem happy with the staff of the bank which is clear from the mean score of 3.00, which is just average. It is again higher than that of businessmen responses (2.52) while it is lower than those of service class (3.45) and practitioners (3.04). Highest degree of satisfaction has been shown towards management of the bank (3.13) which is lower than those of service class and practitioners i.e. 3.21 and 3.16 respectively, but higher than of businessmen (3.01).

Customers Satisfaction In Central Bank Of India

Table 3 signifies almost similar position as that of two banks discussed above. Though Central Bank is a small bank, still its customers are most satisfied i.e. 3.30. This when

Delhi Business Review ? Vol. 2, No. 2, July - December 2001

Table-3: Customers Satisfaction In Central Bank of India Number of Category-I Category-II Category-III Customers Attitude towards Attitude towards Attitude towards Bank Employees Management B=8 S=6 P=6 Average Mean Score 3.18 3.51 3.25 3.31 3.01 3.55 3.28 3.28 2.92 3.96 3.04 3.31 Average Mean Score 3.04 3.67 3.19 3.30

compared to actual averages shown by different categories of customers, it becomes clear from the table under reference that it is higher than those of businessmen responses (3.04) and practitioners (3.9) but lower than that of service class (3.67). Table further shows that comparing the variable wise position of the bank regarding Ist variable i.e. attitude towards Bank, overall average (3.31) is higher than that of businessmen and practitioners (3.25) while lower than service class.. It clarifies the fact that businessmen and practitioners are more satisfied with the bank. Same is the position regarding variable attitude towards management i.e. (3.31). As regards third category i.e. attitude towards management overall mean is lower than that of service class customers (3.96) and higher than in case of practitioners (3.04) very poor response has been shown by businessmen as clear from the below average mean score of 2.92. second variable i.e. attitude towards employees shows lowest mean score of 3.28 which is lower than that of service class customers (3.55) but higher than that of businessmen (3.01). It is equal to that of practitioners (3.28).

Customers Satisfaction In Jammu & Kashmir Bank Ltd.

The position of Jammu and Kashmir Bank Ltd. is different from other banks so far as mean score of practitioners is concerned. Their mean score has been estimated at 2.90 which is below average range. Lowest overall mean score of 3.01 has been worked out against which mean score of service class customers is the highest (3.41) as compared to businessmen (2.71) and practitioners (2.90) as shown in Table-4. Table-4: Customers Satisfaction In Jammu and Kashmir Bank Ltd. Number of Category-I Category-II Category-III Customers Attitude towards Attitude towards Attitude towards Bank Employees Management B=12 S=10 P=10 Average Mean Score 2.93 3.45 3.11 3.16 2.75 3.01 2.87 2.88 2.44 3.78 2.71 3.03 Average Mean Score 2.71 3.41 2.90 3.01

S. Tandon

Comparative analysis of the actual mean score of customers with the overall mean scores, variable wise, reveals that the highest degree of satisfaction lies in case of their attitude towards Bank (3.16). As against this overall average, mean scores of business class customers (2.93) and practitioners (2.71). Customers responses regarding employees are very poor as is evident from the mean score of 2.88 which is lower than that of majority of service class customers (3.01) employees show dissatisfaction towards bank. Table-5: Customers Satisfaction In Four Commercial Banks A Comparative Analysis Between 3 Categories Bank Category-I Category-II Category-III Average Mean (Attitude towards (Attitude towards (Attitude towards Score Bank) Employees) Management) 3.20 3.05 3.31 3.16 3.18 3.17 3.00 3.28 2.88 3.08 3.22 3.13 3.31 3.03 3.17 3.20 3.06 3.30 3.01 3.14

SBI PNB CBI J&K Average Mean Score

Above table shows the customers satisfaction in all the four commercial banks through judging their attitude towards three categories viz. attitude towards bank, attitude towards employees, attitude towards customers. Comparative analyses of the level of customers satisfaction in four banks shows that overall average mean score has been estimated at 3.14 which is little above average. This shows that the customers are not fully satisfied with the services offered by the banks. On comparing it with the actual mean scores of four Banks, table shows that customers of Central Bank of India have shown a highest level of satisfaction i.e. 3.20, whereas, State Bank of India has been ranked second in order of satisfaction amongst customers. Customers of Punjab National Bank and Jammu and Kashmir Bank are showing almost same mean score i.e. 3.06 and 3.0 respectively which is lower than the overall average mean score. It shows the dissatisfaction is prevailing in these two banks. Though Central Bank of India, being a bank with few number of branches is having good relations with its customers. Likewise other three banks should also try to raise the level of customers satisfaction by providing maximum facilities to them.

Suggestions

To improve the level of customers satisfaction following suggestions are made: 1. 2. 3. 4. Bank personnel should be willing and ready to serve the customers. They should be quick and prompt in offering the services. Personnel should be knowledgeable and Skillful and the same should be reflected in their behaviour. Quality Service should be maintained consistently.

Delhi Business Review ? Vol. 2, No. 2, July - December 2001

5. 6. 7. 8. 9.

All the risks and side-effects, if any, should be conveyed to customers. Banks should be conveniently located. All dealings with customers must be kept confidential. Employees should be properly equipped with communication facilities for easy access. Physical facilities should be attractive.

10. Personnel should be polite, respectful, flexible, friendly and accommodating.

References

Ambastha, Manoj Kumar and Kumari Sunita, (1999). Customer Satisfaction in Banking Industry Marketing strategy and challenges. Indian Journal of Commerce Vol.52, p.60, Oct-Dec. Yadapadithaya, P., (1999). Relationship Marketing: Emerging issues and challenges in the New Millennium, The Indian Journal of Commerce, Vol 52, p.23 Oct-Dec. Vaishnav, B.L., (2000). Services Marketing: Global Perspectives, The Indian Journal of Commerce, Vol 53, JulySeptember, p.3.

You might also like

- Agustinus Hartono, Amrin Fauzi and Beby Karina Fawzeea SembiringDocument8 pagesAgustinus Hartono, Amrin Fauzi and Beby Karina Fawzeea SembiringaijbmNo ratings yet

- Impact of Determinants Involved in Retail Banking and Its UsersDocument6 pagesImpact of Determinants Involved in Retail Banking and Its UsersSanaNo ratings yet

- Evaluating Customer Satisfaction in Banking Services: January 2010Document9 pagesEvaluating Customer Satisfaction in Banking Services: January 2010Raazim AhamedNo ratings yet

- Research 1 2022Document16 pagesResearch 1 2022Claire LumbayNo ratings yet

- Print OutDocument53 pagesPrint OutdhankawdiNo ratings yet

- Customer Satisfaction On Services of Private Sector Banks in Erode District of TamilnaduDocument5 pagesCustomer Satisfaction On Services of Private Sector Banks in Erode District of TamilnaduJithinNo ratings yet

- Customer Relationship Management in Banking IndustryDocument36 pagesCustomer Relationship Management in Banking IndustryTusharJoshiNo ratings yet

- A Study of Customer Relationship Management in Iranian Banking IndustryDocument7 pagesA Study of Customer Relationship Management in Iranian Banking IndustryonedademaNo ratings yet

- Services Rendered by Commercial Bank: A Customer Oriented Empirical Evidence From State Bank of IndiaDocument20 pagesServices Rendered by Commercial Bank: A Customer Oriented Empirical Evidence From State Bank of IndiaprathuprathapNo ratings yet

- SBI Bank FD and ATM Services OverviewDocument44 pagesSBI Bank FD and ATM Services OverviewNITHYANANTHAM KNo ratings yet

- Banker's Inconvenience Salient Factors Analysis To Mitigate It Conclusively Paper in UGC Care 3Document13 pagesBanker's Inconvenience Salient Factors Analysis To Mitigate It Conclusively Paper in UGC Care 3Sudhanshu VermaNo ratings yet

- CRM IMPACT ON CUSTOMER LOYALTY AND RETENTION IN HOTEL INDUSTRYDocument37 pagesCRM IMPACT ON CUSTOMER LOYALTY AND RETENTION IN HOTEL INDUSTRYDba ApsuNo ratings yet

- Term Paper: Research MethodologyDocument10 pagesTerm Paper: Research MethodologySarb GillNo ratings yet

- Obc Bank PDFDocument11 pagesObc Bank PDFVamsi KrishNo ratings yet

- Banking Customer Satisfaction FactorsDocument22 pagesBanking Customer Satisfaction FactorsHaryour Bar MieyNo ratings yet

- Chapter-1 Introduction and Design of The StudyDocument32 pagesChapter-1 Introduction and Design of The StudyAshish TagadeNo ratings yet

- Table of Contents 1Document15 pagesTable of Contents 1RIYA TRADINGNo ratings yet

- Customer Expectations and Perceptions Across The Indian Banking Industry and The Resultant Financial ImplicationsDocument20 pagesCustomer Expectations and Perceptions Across The Indian Banking Industry and The Resultant Financial ImplicationsAradha SharmaNo ratings yet

- A Study On Customer Relationship Management Practices in Selected Private Sector Banks With Reference To Coimbatore DistrictDocument7 pagesA Study On Customer Relationship Management Practices in Selected Private Sector Banks With Reference To Coimbatore DistrictarcherselevatorsNo ratings yet

- CRM in Banking SectorDocument17 pagesCRM in Banking Sectorkshiti ahire100% (2)

- Research and ConclusionDocument8 pagesResearch and ConclusionAsh SiNghNo ratings yet

- EJMCM Volume 7 Issue 4 Pages 999-1009Document11 pagesEJMCM Volume 7 Issue 4 Pages 999-1009Reem Alaa AldinNo ratings yet

- Comparative Study of Customer Satisfaction in Public Sector and Private SECTOR BANKS IN INDIA (A Case Study of Meerut Region of U.P.)Document8 pagesComparative Study of Customer Satisfaction in Public Sector and Private SECTOR BANKS IN INDIA (A Case Study of Meerut Region of U.P.)VIKASH GARGNo ratings yet

- Impact of Internal Marketing On Service Quality and Customers Satisfaction A Case Study of Equity Bank, Kengeleni BranchDocument11 pagesImpact of Internal Marketing On Service Quality and Customers Satisfaction A Case Study of Equity Bank, Kengeleni BranchCaecilia Ayu LarasatiNo ratings yet

- Customer Service of Banking. DUDocument19 pagesCustomer Service of Banking. DUkaiumNo ratings yet

- Customer Relationship Management CRM in Banking Sector Ijariie9022Document5 pagesCustomer Relationship Management CRM in Banking Sector Ijariie9022S K SahooNo ratings yet

- PROJECTDocument44 pagesPROJECTaagambarawaNo ratings yet

- Customer Relationship Managementin Banking Sector Thiruvannamali TNIndiaDocument8 pagesCustomer Relationship Managementin Banking Sector Thiruvannamali TNIndiaVivek bishtNo ratings yet

- Research ProposalDocument29 pagesResearch ProposalNitesh KhatiwadaNo ratings yet

- A Study On Customer Relationship Management Practices in Selected Private Sector Banks With Reference To Coimbatore DistrictDocument6 pagesA Study On Customer Relationship Management Practices in Selected Private Sector Banks With Reference To Coimbatore DistrictthesijNo ratings yet

- The impact of CRM on organizational performanceDocument110 pagesThe impact of CRM on organizational performanceJayagokul SaravananNo ratings yet

- The Impact of TQM On Banks PerformanceDocument7 pagesThe Impact of TQM On Banks Performancesuad550No ratings yet

- Final Thesis File Uplode by View GlobalDocument67 pagesFinal Thesis File Uplode by View GlobalBishnu Prasad Bhattarai - BhimNo ratings yet

- Sbi Customers Perception On CRM: A Study: M. Malla Reddy A. SureshDocument11 pagesSbi Customers Perception On CRM: A Study: M. Malla Reddy A. SureshPooja Singh SolankiNo ratings yet

- 246 655 1 SMDocument20 pages246 655 1 SMsarthakNo ratings yet

- Kahsay Edited 2 ProposalDocument29 pagesKahsay Edited 2 Proposalkahissay berihunNo ratings yet

- AlemDocument19 pagesAlemKALID MUNIRNo ratings yet

- Managing Service Quality: A Differentiating Factor For Business FirmDocument5 pagesManaging Service Quality: A Differentiating Factor For Business FirmthesijNo ratings yet

- Comparative Study of Customer Satisfacti PDFDocument27 pagesComparative Study of Customer Satisfacti PDFRAJKUMAR CHETTUKINDANo ratings yet

- Chapter 1Document6 pagesChapter 1Fakir TajulNo ratings yet

- A Conceptual Framework For Understanding Customer Satisfaction in Banking Sector: The Mediating in Uence of Service Quality and Organisational OathDocument11 pagesA Conceptual Framework For Understanding Customer Satisfaction in Banking Sector: The Mediating in Uence of Service Quality and Organisational OathSweety RoyNo ratings yet

- JETIR2004427Document10 pagesJETIR2004427rubal gargNo ratings yet

- Project ReportDocument69 pagesProject ReportAnonymous K8SKcbLBdr50% (2)

- The Impact of Customer Relationship ManaDocument15 pagesThe Impact of Customer Relationship Manalocopoco0755No ratings yet

- RESEARCH PAPER BCOM (H) TitikshaDocument16 pagesRESEARCH PAPER BCOM (H) TitikshaAkhilesh kumarNo ratings yet

- ProjectDocument57 pagesProjectRIYA TRADINGNo ratings yet

- Customer Awareness Towards Banking Services With The Special Reference To ATM and Mobile Banking Services - A Comparative Study of Public and Private Banks in TricityDocument20 pagesCustomer Awareness Towards Banking Services With The Special Reference To ATM and Mobile Banking Services - A Comparative Study of Public and Private Banks in TricitymanuurmaliyaNo ratings yet

- CRM Practices in Banking SectorDocument14 pagesCRM Practices in Banking SectorParvathy AdamsNo ratings yet

- 71 M461Document7 pages71 M461Shivani NidhiNo ratings yet

- Related Papers: IOSR JournalsDocument9 pagesRelated Papers: IOSR JournalsMavani snehaNo ratings yet

- Customer Satisfaction in Banking Sector: A Case Study On Janata Bank LimitedDocument11 pagesCustomer Satisfaction in Banking Sector: A Case Study On Janata Bank LimitedJannatul FerdousNo ratings yet

- CRM Influence on Bank Customer RetentionDocument20 pagesCRM Influence on Bank Customer RetentionahmedbaloNo ratings yet

- Customer Satisfaction & Loyalty LiteratureDocument49 pagesCustomer Satisfaction & Loyalty LiteraturemahsanioNo ratings yet

- Chapter 1Document7 pagesChapter 1nishaNo ratings yet

- Customer Satisfaction in Indian Banking ServicesDocument13 pagesCustomer Satisfaction in Indian Banking ServicesSiva Venkata RamanaNo ratings yet

- R M S B S: A R: Elationship Arketing Trategies in Anking Ector EviewDocument10 pagesR M S B S: A R: Elationship Arketing Trategies in Anking Ector EviewPrasenjit SahaNo ratings yet

- CRM - Strategies and Practices in Selected Banks of PakistanDocument16 pagesCRM - Strategies and Practices in Selected Banks of PakistanAngelboy23No ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- Measuring Customer Satisfaction: Exploring Customer Satisfaction’s Relationship with Purchase BehaviorFrom EverandMeasuring Customer Satisfaction: Exploring Customer Satisfaction’s Relationship with Purchase BehaviorRating: 4.5 out of 5 stars4.5/5 (6)

- LibroEMarketing PDFDocument305 pagesLibroEMarketing PDFtelerambal100% (1)

- Understanding Digital MarketingDocument6 pagesUnderstanding Digital MarketingNitesh Laguri0% (1)

- Big Book of Digital MarketingDocument80 pagesBig Book of Digital MarketingMaria Voloh100% (4)

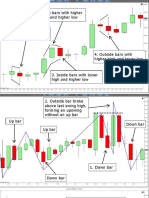

- Trading in Intraday Using AstrologyDocument6 pagesTrading in Intraday Using Astrologydositheus1169% (13)

- Field Expert - Plastics - Exterior - PuneDocument2 pagesField Expert - Plastics - Exterior - Puneaman.4uNo ratings yet

- Powerful Methods For Increasing Traffic Through An Optimized BlogDocument2 pagesPowerful Methods For Increasing Traffic Through An Optimized Blogaman.4uNo ratings yet

- Why Digital Marketing Is Important For Small BusinessDocument2 pagesWhy Digital Marketing Is Important For Small Businessaman.4uNo ratings yet

- NGO Search PDFDocument2 pagesNGO Search PDFaman.4uNo ratings yet

- Guidelines Capturing Photos Minors Under 4Document2 pagesGuidelines Capturing Photos Minors Under 4Shailvi MaheshwariNo ratings yet

- Blogging Goals PDFDocument1 pageBlogging Goals PDFaman.4uNo ratings yet

- Traders Self Supremacy PDFDocument1 pageTraders Self Supremacy PDFaman.4uNo ratings yet

- Unlocking the Secrets of Eclipses: A Systematic Approach to Forecasting MarketsDocument5 pagesUnlocking the Secrets of Eclipses: A Systematic Approach to Forecasting MarketsHmt Nmsl100% (4)

- Why Digital Marketing Is Important For Small BusinessDocument2 pagesWhy Digital Marketing Is Important For Small Businessaman.4uNo ratings yet

- Field Expert – Plastics (Electrical) Pune JobDocument2 pagesField Expert – Plastics (Electrical) Pune Jobaman.4uNo ratings yet

- Galen Woods All ChartsDocument172 pagesGalen Woods All Chartsvisakh s80% (15)

- PARA - Medical Device Software Development - Fda Guidelines - 0Document11 pagesPARA - Medical Device Software Development - Fda Guidelines - 0aman.4uNo ratings yet

- Field Expert - Plastics - Exterior - PuneDocument2 pagesField Expert - Plastics - Exterior - Puneaman.4uNo ratings yet

- Field Expert – Plastics (Electrical) Pune JobDocument2 pagesField Expert – Plastics (Electrical) Pune Jobaman.4uNo ratings yet

- Powerful Methods For Increasing Traffic Through An Optimized BlogDocument2 pagesPowerful Methods For Increasing Traffic Through An Optimized Blogaman.4uNo ratings yet

- Traders Self Supremacy PDFDocument1 pageTraders Self Supremacy PDFaman.4uNo ratings yet

- CMM Goals&ObjectivesDocument14 pagesCMM Goals&Objectivesaman.4uNo ratings yet

- Nimblr TA: Technical Analysis Breakouts On Intraday Breakouts On IntradayDocument8 pagesNimblr TA: Technical Analysis Breakouts On Intraday Breakouts On Intradayaman.4uNo ratings yet

- Blogging Goals PDFDocument1 pageBlogging Goals PDFaman.4uNo ratings yet

- Why Digital Marketing Is Important For Small BusinessDocument2 pagesWhy Digital Marketing Is Important For Small Businessaman.4uNo ratings yet

- Guidelines Capturing Photos Minors Under 4Document2 pagesGuidelines Capturing Photos Minors Under 4Shailvi MaheshwariNo ratings yet

- Interpret AstrologyDocument314 pagesInterpret AstrologyArvind YaduvanshiNo ratings yet

- Medical Devices Rules India PDFDocument178 pagesMedical Devices Rules India PDFaman.4uNo ratings yet

- Edu Rules Reg InstructionsDocument2 pagesEdu Rules Reg Instructionsaman.4uNo ratings yet

- Kannur International Airport Limited (Kial) : Rank ListDocument4 pagesKannur International Airport Limited (Kial) : Rank Listaman.4uNo ratings yet

- Efficient Retrieval of Temporal Patterns Using Signature IndexingDocument11 pagesEfficient Retrieval of Temporal Patterns Using Signature IndexingKumarecitNo ratings yet

- Brand Awareness Image Physical Quality and Employee - 2019 - Journal of Hospi PDFDocument11 pagesBrand Awareness Image Physical Quality and Employee - 2019 - Journal of Hospi PDFIoana-Nely MilitaruNo ratings yet

- Factors Affecting Customer SatisfactionDocument11 pagesFactors Affecting Customer SatisfactionPurparkerz Takia'genjy Emo'VanquizherNo ratings yet

- Customer Satisfaction and Consumer Buying Behaviour PPT MarketingDocument20 pagesCustomer Satisfaction and Consumer Buying Behaviour PPT Marketingyo vkNo ratings yet

- A Survey of Passengers Satisfaction On Service Quality of APSRTC: The Case of Prakasam District, A.PDocument5 pagesA Survey of Passengers Satisfaction On Service Quality of APSRTC: The Case of Prakasam District, A.PEditor IJTSRDNo ratings yet

- TQMDocument40 pagesTQMJoyce Elaine Cariño83% (6)

- Retail Management Multiple Choice QuestionsDocument8 pagesRetail Management Multiple Choice Questionsshilpashree_mbaNo ratings yet

- Applied Marketing Session 6 Final NotesDocument14 pagesApplied Marketing Session 6 Final NotesMobeen KhanNo ratings yet

- Simpu - Building A Customer Centric Culture - Lessons From Paystack & PiggyvestDocument53 pagesSimpu - Building A Customer Centric Culture - Lessons From Paystack & PiggyvestOgbu VincentNo ratings yet

- Ramada Demonstrates Its Personal BestDocument4 pagesRamada Demonstrates Its Personal BestCyn SyjucoNo ratings yet

- China LodgingsDocument2 pagesChina LodgingsMaryam ZafarNo ratings yet

- IBM Route To Market StrategyDocument18 pagesIBM Route To Market StrategybullsomersNo ratings yet

- Factors Influencing Brand Loyalty For Samsung Mobile User in Nepal - With QuestionnaireDocument70 pagesFactors Influencing Brand Loyalty For Samsung Mobile User in Nepal - With QuestionnairevictorNo ratings yet

- OPM Lecture 2Document22 pagesOPM Lecture 2Mohammad BabarNo ratings yet

- A Study On Customer Satisfaction at Bajaj Auto LTD: Swadin Kumar MohanthyDocument9 pagesA Study On Customer Satisfaction at Bajaj Auto LTD: Swadin Kumar MohanthyAbhishek DhimanNo ratings yet

- Human Resource Management in The Hospitality and Tourism SectorDocument37 pagesHuman Resource Management in The Hospitality and Tourism SectorH ChâuNo ratings yet

- Chapter 1s - Marketing in Changing World Creating Customer Value and EngagementDocument10 pagesChapter 1s - Marketing in Changing World Creating Customer Value and EngagementEllyriana QistinaNo ratings yet

- The Relationship Between Service Quality and Customer Satisfaction A Factor Specific ApproachDocument17 pagesThe Relationship Between Service Quality and Customer Satisfaction A Factor Specific ApproachCH Subhani GujjarNo ratings yet

- Customer Satisfaction On Library ServicecsDocument101 pagesCustomer Satisfaction On Library ServicecsNamoAmitofouNo ratings yet

- (CB) HighlandsDocument61 pages(CB) HighlandsYến LâmNo ratings yet

- Customer Centricity: Focusing on Positive Customer ExperiencesDocument7 pagesCustomer Centricity: Focusing on Positive Customer Experienceskartikay GulaniNo ratings yet

- Maxham 2008Document22 pagesMaxham 2008Sabiha ChouraNo ratings yet

- Analyzing The Attributes in Customer Purchase Decision of Apartments Towards Technicraft DevelopersDocument73 pagesAnalyzing The Attributes in Customer Purchase Decision of Apartments Towards Technicraft DevelopersNischith GowdaNo ratings yet

- Performance Management in WiproDocument11 pagesPerformance Management in WiproSahajada Alam100% (1)

- Quality Management Creating A Customer FocusDocument46 pagesQuality Management Creating A Customer FocusSultan Kudarat Doctors HospitalNo ratings yet

- A Project Report: Customer Satisfaction On Hyundai Motors Lakshmi Hyundai India LTDDocument72 pagesA Project Report: Customer Satisfaction On Hyundai Motors Lakshmi Hyundai India LTD2562923No ratings yet

- A Comparative Study On Customer Satisfaction With Reference To Vodafone and Airtel in Lucknow CityDocument6 pagesA Comparative Study On Customer Satisfaction With Reference To Vodafone and Airtel in Lucknow CityChandan SrivastavaNo ratings yet

- Mule First Draft ThesisDocument102 pagesMule First Draft ThesisKasim MergaNo ratings yet

- A Thesis Proposal Presented To The Area of Business Administration College Department San Sebastian College-Recoletos, ManilaDocument26 pagesA Thesis Proposal Presented To The Area of Business Administration College Department San Sebastian College-Recoletos, ManilaINLONG JOHN KEVIN PUNZALANNo ratings yet

- Partner - Strategy ExternalDocument18 pagesPartner - Strategy ExternalDon CarlosNo ratings yet

- Sde101 PDFDocument4 pagesSde101 PDFAnupama rocksssNo ratings yet