Professional Documents

Culture Documents

Cost Flow

Uploaded by

Mahmoud HabeebOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Flow

Uploaded by

Mahmoud HabeebCopyright:

Available Formats

Cost Flow Introduction 1-Control account: is found in general ledger and include aggregate of many sub -homogeneous accounts.

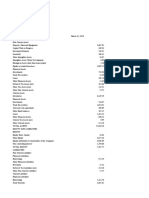

EX. inventory control account. Cost flow- General Fact Pattern Lippy Company's beginning and ending inventories for the month of November are as follows: Description Stores control (D.M) Work-in-process control (WIP) Finished goods control (F.G) Indirect materials control November,1 $ 67,000 145,000 85,000 10,000 November,30 $ 62,000 171,000 78,000 5,000

Other data for the month of November follows: Description Direct labor (D.L) Actual factory overhead (actual factory O.H) (see details later) Direct materials purchased on credit Transportation in Purchase returns and allowances Indirect materials purchased during November Amount $200,000 132,000 163,000 4,000 2,000 45,000

Lippy uses two factory overhead accounts, one for actual O.H (called factory O.H control) and the other for O.H applied and charges factory overhead to production (DR WIP & CR factory O.H applied) at 70% of direct labor cost (D.L is considered the factory O.H cost driver in this case). The company does not formally recognize over/under applied factory overhead until year-end. Assume also sales revenue during November amounted to $750,000 also selling expenses $80,000 detailed later, Administration Expenses $29,000 detailed later and income tax rate is 30%

Description Utilities expense-heat , light and air

Factory O.H 2,750

Marketing Administrative and selling Expenses expenses 3,000 1,250

Total 7,000

conditioning Depreciation expense-equipments and vehicles Depreciation expense- buildings Property taxes and insurance expenses Fringe benefits Maintenance and repairs expense Rent expense Power Indirect materials used Wages and salaries (other than D.L) Total

13,400 5,600 2,250 4,500 6,500 2,000 50,000 45,000 132,000

23,000 4,000 7,000 26,000 3,500 3,000 500 10,000 80,000

9,600 400 2,750 7,000 1,800 700 500 5,000 29,000

46,000 10,000 12,000 33,000 9,800 10,200 3,000 50,000 60,000 241,000

Direct labor are wages paid to machine operators only, but factory supervisors salary is considered indirect labor and included in factory O.H. Also wages paid to all production service workers like machinery mechanics are considered indirect labor and included in factory O.H Direct labor costs are assumed to be variable, unless otherwise stated specifically. Direct Costs: are costs that can be feasibly and specifically identified with specific cost object. Accordingly: A) Direct materials used and direct labor both are direct costs because they can be specifically identified with the production of finished goods. B) Direct materials used and direct labor costs can be associated with specific product (traceable) hence, D.M. used and D.L. costs are product costs. C) Prime Costs = D.M. used + Direct Labor costs Thus both D.M. used and D.L costs are Variable costs, direct costs, product costs and prime costs

Factory O.H. includes all indirect costs (both variable components and fixed components) related to manufacturing activity and total factory O.H is considered product cost under full absorption costing approach, while fixed factory O.H is considered period cost under variable costing approach.

On the other hand total marketing costs such as salaries of sales personnel, commissions, advertising and total administrative expenses are period costs and are expensed in income statement as incurred. Cost of D.M. used= Beg. D.M. Plus Net D.M. purchased Minus Ending D.M. Cost of D.M used = 67 Plus 165 Minus 62 = 170 Prime cost = D.M used 170 Plus D.L 200 = 370 Conversion cost (C.C) = D.L 200 Plus Factory O.H applied 140 =340 Total Factory O.H applied to production = $200 70% = $140 Over applied O.H = $8 Manufacturing costs during the period =D.M used 170 Plus D.L 200 Plus Factory O.H applied 140 = 510 Total manufacturing costs (T.M.C) = BWIP 145 Plus Manufacturing costs during the period 510 = 655 Cost of goods Manufactured (COGM) = Total manufacturing costs (T.M.C) 655 Minus EWIP 171 = 484 Cost of goods available for sale = beginning F.G 85 Plus COGM 484 = 569 Cost of goods sold (COGS) = Cost of goods available for sale569 Minus Ending F.G inventory 78 = 491 Gross profit (gross Margin) = sales revenue 750 Minus COGS 491 = 259

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Wage Type ConceptsDocument7 pagesWage Type ConceptsMahmoud HabeebNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Sap Internal OrderDocument21 pagesSap Internal OrderJayanth Maydipalle100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Accounting Basics in SapDocument6 pagesAccounting Basics in SapMahmoud HabeebNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Step-Wise Employee Loans ConfigurationDocument9 pagesStep-Wise Employee Loans ConfigurationMahmoud HabeebNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Sap Internal OrderDocument21 pagesSap Internal OrderJayanth Maydipalle100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Enhancement Technique On How To Use ValidationsDocument20 pagesEnhancement Technique On How To Use ValidationsJuluri Syam MaheshNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- SAP FI Table NamesDocument2 pagesSAP FI Table NamesharibabuNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- SAP FI Table NamesDocument2 pagesSAP FI Table NamesharibabuNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- SAP FI Table NamesDocument2 pagesSAP FI Table NamesharibabuNo ratings yet

- SAP Modules: AccountingDocument8 pagesSAP Modules: AccountingMahmoud HabeebNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 53955556asset User ManualDocument77 pages53955556asset User ManualMahmoud HabeebNo ratings yet

- Cash Flow Statement ConfigDocument1 pageCash Flow Statement ConfigMahmoud HabeebNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- SAP FI Table NamesDocument2 pagesSAP FI Table NamesharibabuNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- A Step-By-Step Guide On IDoc-ALE Between Two SAP ServersDocument22 pagesA Step-By-Step Guide On IDoc-ALE Between Two SAP ServersRavindra Chowdary Gokina100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Cross Company Code Business ScenarioDocument12 pagesCross Company Code Business ScenarioMahmoud HabeebNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- IMAN SAP FICO Configuration SummaryDocument2 pagesIMAN SAP FICO Configuration SummaryMahmoud HabeebNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- How To Develop A LSMW For Data Migration For Va01 or xk01 Transaction?Document3 pagesHow To Develop A LSMW For Data Migration For Va01 or xk01 Transaction?Koyel BanerjeeNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- IMAN SAP FICO Configuration SummaryDocument2 pagesIMAN SAP FICO Configuration SummaryMahmoud HabeebNo ratings yet

- GL End UserDocument7 pagesGL End UserMahmoud HabeebNo ratings yet

- LSMW For Functional Consultants in Simple Step-By-step WayDocument42 pagesLSMW For Functional Consultants in Simple Step-By-step WayMahmoud HabeebNo ratings yet

- v2 Uploads C TFIN52 65 Sample QuestionsDocument4 pagesv2 Uploads C TFIN52 65 Sample Questionsaamv10No ratings yet

- SAP TcodesDocument22 pagesSAP TcodesMahmoud Habeeb0% (1)

- BDCDocument1 pageBDCMahmoud HabeebNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cash Flow Statement ConfigDocument1 pageCash Flow Statement ConfigMahmoud HabeebNo ratings yet

- Prepare Cross-Company Code Transactions - SAP FIDocument19 pagesPrepare Cross-Company Code Transactions - SAP FIBhagyaraj Arunachalam100% (3)

- SAP SD, FI, MM and PP Business Blueprint DocumentDocument252 pagesSAP SD, FI, MM and PP Business Blueprint Documentdilmeetd91% (127)

- Cash Flow Reports Direct Indirect Method Config SettingsDocument2 pagesCash Flow Reports Direct Indirect Method Config SettingsMahmoud HabeebNo ratings yet

- Checks (Fi GL, Fi Ar, Fi AP)Document3 pagesChecks (Fi GL, Fi Ar, Fi AP)Mahmoud HabeebNo ratings yet

- Cross Company-Code Invoice Posting and ConfigurationDocument9 pagesCross Company-Code Invoice Posting and ConfigurationMahmoud HabeebNo ratings yet

- 09 Intro ERP Using GBI Slides HCM en v2.01Document19 pages09 Intro ERP Using GBI Slides HCM en v2.01Mahmoud HabeebNo ratings yet

- Personal Financial PlanningDocument33 pagesPersonal Financial Planningvenky99437100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Quiz I. Problem Solving: Property of STIDocument2 pagesQuiz I. Problem Solving: Property of STIarisuNo ratings yet

- IntAcc3 Final Departmental Examination 2nd Sem AY 2020 2021Document39 pagesIntAcc3 Final Departmental Examination 2nd Sem AY 2020 2021Mika MolinaNo ratings yet

- Accounting-Income Statement MCQDocument19 pagesAccounting-Income Statement MCQHaniyaAngel0% (2)

- Engineering Economics Lecture 1Document36 pagesEngineering Economics Lecture 1NavinPaudelNo ratings yet

- Prentice Halls Federal Taxation 2016 Individuals 29th Edition Pope Test Bank 1Document36 pagesPrentice Halls Federal Taxation 2016 Individuals 29th Edition Pope Test Bank 1angelamayqbygsdmeki96% (26)

- Project - Viva On Financial Analysis of Indian BankDocument36 pagesProject - Viva On Financial Analysis of Indian Banksanthoshni100% (5)

- Data Sampoerna PDFDocument3 pagesData Sampoerna PDFaldo saragihNo ratings yet

- Consolidated Balance Sheet: Godrej Industries LimitedDocument6 pagesConsolidated Balance Sheet: Godrej Industries LimitedAjjay AmulNo ratings yet

- Quiz 1-CfasDocument8 pagesQuiz 1-CfasRizelle ViloriaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CA Final DT Q MTP 1 May 23Document10 pagesCA Final DT Q MTP 1 May 23Mayur JoshiNo ratings yet

- Problems - Income TaxationDocument4 pagesProblems - Income Taxationpedrosagucio44% (9)

- Account CodesDocument35 pagesAccount CodesKarenNo ratings yet

- Car Loan and PTPTN Repayment AnalysisDocument14 pagesCar Loan and PTPTN Repayment AnalysisFaid AmmarNo ratings yet

- Deductions From Gross Income QuizDocument7 pagesDeductions From Gross Income Quizwind snip3r reojaNo ratings yet

- TG - FundaofABM-Lesson 2Document9 pagesTG - FundaofABM-Lesson 2HLeigh Nietes-Gabutan60% (5)

- Great Wall Motor Company Limited: Announcement of Interim Results For The Six Months Ended 30 June 202 1Document261 pagesGreat Wall Motor Company Limited: Announcement of Interim Results For The Six Months Ended 30 June 202 1Yan PaingNo ratings yet

- Taxation Laws Contents Jan 2017Document4 pagesTaxation Laws Contents Jan 2017charvinNo ratings yet

- Agor Oil IndustryDocument17 pagesAgor Oil IndustryNirankar SinghNo ratings yet

- Working Capital ManagementDocument32 pagesWorking Capital ManagementrutikaNo ratings yet

- Henas Shoes & Footwear Manufacturing Business PlanDocument23 pagesHenas Shoes & Footwear Manufacturing Business PlanMega SandalsNo ratings yet

- Accounts - TATA GroupDocument66 pagesAccounts - TATA GroupluvjandialNo ratings yet

- School Mooe RevisitedDocument35 pagesSchool Mooe RevisitedKyla Michelle Daguison100% (2)

- Tugas Kelompok 2-W4-S5-R3-Grub4Document6 pagesTugas Kelompok 2-W4-S5-R3-Grub4amanda aprilNo ratings yet

- Financial Analysis and Accounting RecordsDocument11 pagesFinancial Analysis and Accounting RecordsRobert HamiltonNo ratings yet

- Income TaxDocument14 pagesIncome Taxanjuu2806No ratings yet

- Acquisition and Disposition of Property, Plant, and Equipment - Amjad O. Asfour1Document58 pagesAcquisition and Disposition of Property, Plant, and Equipment - Amjad O. Asfour1amjad asfourNo ratings yet

- Nirmal Bang On United SpiritsDocument6 pagesNirmal Bang On United SpiritsamsukdNo ratings yet

- Gurughasidas Central University, Bilaspur: "Power and Duties of Income-Tax Authorities"Document20 pagesGurughasidas Central University, Bilaspur: "Power and Duties of Income-Tax Authorities"Kishori PatelNo ratings yet

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)