Professional Documents

Culture Documents

FBLP VDA Newsletter

Uploaded by

Gonzalo Cabrillo LosadaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FBLP VDA Newsletter

Uploaded by

Gonzalo Cabrillo LosadaCopyright:

Available Formats

FLASH

N E WS

1 February 2010

TAX

INCENTIVES

TO

INVESTMENT

IN

MOZAMBIQUE:

PERSPECTIVES AND OPPORTUNITIES

A favourable context to investment is being experienced nowadays in Mozambique and it deserves an especial attention. As a matter of fact, the local regulator, determined to encourage the national entrepreneurship and to attract foreign investment, has been making efforts in order to create incentives that enable such investment in the economy in general and in some particular areas thereof, where the country is still in very need or on which there is a great potential of development, such as agriculture, tourism, big projects, infrastructures, industry and energy. Once the beginning of the year is a time to make decisions and weigh and plan available investments, we propose to revisit, even though briefly, the more relevant aspects of the recent tax benefits package approved by the Parliament and by the Government of Mozambique, through Law nr 4/2009, of 12th January (Code of Fiscal Benefits or CFB) and Decree nr 56/2009, of 7th October (Regulation of the Code of Fiscal Benefits or RCFB). 1. Tax Benefits The CFB and RCFB provide the following tax benefits:

Tax deductions; Deductions to the taxable income; Accelerated amortizations and reintegration; Tax credit per investment; and Exemption and reduction of tax rates and deferral of the respective payment.

2. Addressees of Tax Benefits As far as the addressees of the tax benefits in question are concerned, it is expressly foreseen that the same are available to the following investments:

Approved under the Law nr 3/93, of 24th June (Law of Investments) and the relevant regulation approved by the Decree nr 14/93, dated 21st July, amended by the Decree nr 43/2009, of 21st August; Performed in wholesale and retail commerce operations, provided they are undertaken within new infrastructures constructed for the purpose; Performed in commerce and industry activities developed in rural areas; Performed in assembly and transforming industry.

Lisboa Porto Madeira Maputo mozambique@vda.pt | fblp@fblp.co.mz

This is a limited distribution flash news and should not be considered to constitute any kind of advertising. The reproduction or circulation thereof is prohibited. All information contained herein and all opinions expressed are of a general nature and are not intended to substitute recourse to expert legal advice for the resolution of real cases.

TAX

INCENTIVES

TO

INVESTMENT

IN

MOZAMBIQUE:

PERSPECTIVES AND OPPORTUNITIES

3. Categories of Tax Benefits

Under the CFB, tax benefits can be generic and specific, applying to the first category all those investments that may not expressly be object of the second.

a) Generic Fiscal Benefits

Generic tax benefits include benefits on import of goods and benefits on income. i.

Fiscal benefits on import of goods

Regarding benefits on import of goods, it is prescribed that investments made within the Law of Investments are exempted from payment of customs duties and of Value Added Tax (IVA) over the equipment goods classified in the class K of the Customs Tariff 1 and the relevant accessory parts thereof. This exemption is granted during the first 5 years of the investment project implementation. Tax Benefits on Income

ii.

Regarding the benefits on income, the following categories should to be taken into account:

Tax Credit per Investment Investments carried out in Maputo city benefit, during the 5 fiscal years, from 5% reduction of the total investment effectively undertaken, within the taxable income of corporate income tax (IRPC) up to its turnout, in relation to that part of the developed activity that is carried out within the project. The percentage in question is 10%, for the investment projects carried out in the remaining country s provinces. The share of tax credit not used in a fiscal year can be deducted over the subsequent years, and its use will expire in the fifth fiscal year, as from the date on which the investment begins (for the projects already implemented), and the beginning of activity (for the new projects). For this purpose, there shall only be considered the investment in corporeal immobilized assets related to the operation of the project within the national territory and which has been acquired in a new state. Accelerated Amortizations and Reintegration In regard to accelerated amortizations and reintegration, the accelerated reintegration of new real estate properties, used in the prosecution of the investment project, is allowed and it consists of incrementing in 50% the ordinary rates legally fixed for calculation of amortization and reintegration deemed as imputable costs to the fiscal exercise, in determination of taxable income for IRPC purposes or for personal income tax (IRPS) purposes. This rule also applies, in the same terms, to refurbished real estate properties, machinery and equipment for industrial and/or agro-industrial activities. Incentives to Modernization, new Technologies and Professional Training In order to encourage the modernization and the use of new technologies, CFB foresees that the invested amount on the specialized equipment, using new technologies for development of investment projects will benefit, over the first 5 years as from the beginning of an activity, of the deduction to the taxable income, for IRPC calculation purposes, up to a maximum limit of 10% of the taxable income. Furthermore, and with the aim of promoting professional training, it is forecasted that the costs of investments relating to professional training of Mozambican employees, are deducted from the taxable income, for purposes of IRPC calculation, during the first 5 years, as from the beginning of the activity, up to a maximum limit of 5% of the taxable income. When the professional training refers to training for the use of equipment considered as new technologies, deduction to taxable income for IRPC calculation purposes, shall be made by 10% maximum limit of the taxable income material.

1 This class includes, amongst others, equipment, vehicles and furniture.

F LASH N EWS

1 February 2010

TAX

INCENTIVES

TO

INVESTMENT

IN

MOZAMBIQUE:

PERSPECTIVES AND OPPORTUNITIES

Expenses to be Considered as Fiscal Costs During a 5 fiscal years period, as from the beginning of the respective activity, the investments eligible for tax benefits can, when determining the taxable income for IRPC purposes, consider the following limits as costs:

For investments in Maputo city: it should be considered the amount corresponding to 110% of the total spent in construction and rehabilitation of roads, railways, airports, post offices, telecommunications, water supply, electricity, schools, hospitals and other works as long as they are considered as being of public utility by the competent authorities; For investments in the rest of provinces: it should be considered the amount corresponding 120% of the total spent in construction and rehabilitation of roads, railways, airports, post offices, telecommunications, water supply, electricity, schools, hospitals and other works as long as they are considered as being of public utility by the competent authorities; For expenses related to the purchase, for own assets purposes, of works considered as art and other Mozambican culture representative objects, as well as acts that contribute to its development, under the terms of the Law of Cultural Patrimony Defence, only 50% of the spent amounts.

b) Specific Fiscal Benefits Clearly aiming at granting benefits to some sectors which are of material importance within the national economic policy, the specific tax benefits target investments on specific activities. The following table, although not comprehensive,, summarizes the activities and benefits in question. Activity

Creation of basic infrastructures Commerce and industry in rural areas Reduction of rates applied for IRPC and IRPS purposes Exemption from payment of customs duties and VAT on import of goods which are essential for the development of the activity at stake Exemption from payment of customs duties on import of raw material and materials for industrial production Exemption from payment of customs duties and VAT on import of equipment Reduction of applicable rates for IRPC and IRPS purposes Generic benefit over professional training

Specific Fiscal Benefits

Exemption from payment of customs duties and VAT on import of equipment

Transforming and assembly industry 2

Agriculture and fishery

Possibility of costs

treating

particular expenses as tax

2 Tax benefits can only be granted to investment projects, which demonstrate and are committed to maintain annual invoicing of an amount not less than

3.000.000,00 MT, the added value to the final product of which corresponds to a minimum of 20%.

F LASH N EWS

1 February 2010

TAX

INCENTIVES

TO

INVESTMENT

IN

MOZAMBIQUE:

PERSPECTIVES AND OPPORTUNITIES

Activity

Hotel and catering, and tourism

Specific Fiscal Benefits

Exemption from payment of customs duties and VAT on import of equipment Tax credit per investment Accelerated reintegration of new immovable assets, vehicles, automobiles and other corporeal immobilized equipment when related to the activity at stake Possibility of treating some particular expenses as tax costs Incentives to modernization and use of new technologies Exemption from payment of customs duties and VAT on import of equipment Reduction of rates applicable for IRPC and IRPS purposes Exemption from payment of customs duties and VAT on import of construction material, machinery, equipment, accessories, parts and other goods Tax credit per investment Accelerated amortizations and reintegration Incentives to modernization and use of new technologies Generic benefit over professional training Possibility of treating some particular expenses as tax costs Exemption from payment of customs duties and VAT on import of goods Tax credit per investment for IRPC and IRPS purposes Possibility of deducting tax credit which has not been used in subsequent years Incentives over professional training Possibility of treating some particular expenses as tax costs

Exemption from payment of customs duties and VAT on import of construction material, machinery, equipment, accessories, parts and other goods

Science and technology parks Big projects 3 Developed in Quick Development Areas (ZRD) 4

Developed in Industrial Free Zones (ZFI) and Special Economic Zones (ZEE)5

Total exemption of charges applicable for IRPC purposes during 10 (ZFI), 5 or 3 (ZEE) fiscal exercises and reduction of such charges in the subsequent fiscal exercises

3 Authorized

investments of which investment exceeds the amount equivalent to 12.500.000.000MT, as well as investments in infrastructures of public domain carried out under concession regime. 4 ZRD geographic areas of national territory, characterized by big potentialities in natural resources, lacking, however, infrastructures and having poor level of economic activity (actually in the area of Zambezi valley, Niassa Province, Nacala District, Mozambique and Ibo Islands). 5 Now, theres only Beluluane ZFI and Nacala ZFI.

F LASH N EWS

1 February 2010

TAX

INCENTIVES

TO

INVESTMENT

IN

MOZAMBIQUE:

PERSPECTIVES AND OPPORTUNITIES

Specific tax benefits provided in CFB are neither cumulative amongst them, nor with generic benefits, except in cases expressly envisaged by the regulator.

4.

Assumptions and Procedures

Both the CFB and the RCFB contain a set of rules referring to the assumptions, documents and procedures required to obtain the tax benefits as foreseen therein. Amongst those we would stress the following general assumptions:

Having made fiscal registration, by obtaining the relevant Nmero nico de Identificao Tributria (NUIT); Having organised accountancy, in accordance with the General Accountancy Plan and the requirements set forth in Corporate Income Tax Code (IRPC) (Cdigo do Imposto sobre o Rendimento das Pessoas Colectivas) and Personal Income Tax Code (IRPS) (Cdigo do Imposto sobre o Rendimento das Pessoas Singulares); Having not committed a tributary offense; For project investment holders, presenting the Dispatch and Terms of Authorization or any other legal instrument certifying the same, issued by a competent authority from the Fiscal Area Department, attaching thereto a copy of the statement referring to the beginning of activity.

5. Expansion Investment An important innovation of the RCFB and that should also be called upon is the expansion investment.

In fact, duly authorized investments which aim at expanding existing projects will benefit from tax benefits as foreseen in the CFB, provided that the expansion investments amount is equal to, or higher than, 50% of the initial investments. This prerogative is important to all investors whose tax benefits have already come to end, once it entitles them to benefit from such benefits once again.

6. Assignment of Tax Benefits Finally, a note on the possible assignment of tax benefits during their validity period. Such assignment is indeed possible under the authorisation of the Minister supervising the investment s promotion, provided that the benefits at stake remain unchanged and the assignor fulfils the necessary assumptions in respect thereof.

F LASH N EWS

1 February 2010

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2016 - Pilipinas Shell V Commissioner of Customs - 195876Document3 pages2016 - Pilipinas Shell V Commissioner of Customs - 195876Anonymous sgEtt467% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Quiz On Percentage Tax and Documentary Stamps TaxDocument4 pagesQuiz On Percentage Tax and Documentary Stamps Taxncllpdll100% (4)

- Doing Business Guide OmanDocument12 pagesDoing Business Guide OmanhazimNo ratings yet

- International Business - Pulses Export BPLAN PDFDocument30 pagesInternational Business - Pulses Export BPLAN PDFSangram Jagtap100% (1)

- Introduction to SAP Global Trade Services (GTSDocument3 pagesIntroduction to SAP Global Trade Services (GTSGuru PrasadNo ratings yet

- Value Added Tax-Summary LectureDocument18 pagesValue Added Tax-Summary LectureUy SamuelNo ratings yet

- PD 1464 Tariff and Customs Code of The Philippines - Vol 1&2Document120 pagesPD 1464 Tariff and Customs Code of The Philippines - Vol 1&2Renz Ruiz100% (2)

- Farolan Vs CTADocument1 pageFarolan Vs CTAKat Jolejole100% (2)

- Joint Admin OrderDocument53 pagesJoint Admin OrderBelle MadrigalNo ratings yet

- Thematic Activities On TradeDocument24 pagesThematic Activities On TradeMaleehaNo ratings yet

- Meaning: Customs DutyDocument2 pagesMeaning: Customs DutySOBICA KNo ratings yet

- Bureau of Customs Draft Order On Compulsory Acquisition For Undervalued GoodsDocument6 pagesBureau of Customs Draft Order On Compulsory Acquisition For Undervalued GoodsPortCallsNo ratings yet

- Services & Surcharges GUIDE 2019 DHL Express IndiaDocument2 pagesServices & Surcharges GUIDE 2019 DHL Express IndiasanjeevNo ratings yet

- Oyu Tolgoi Purchase Order General Conditions For The Supply of Goods (October 2022)Document25 pagesOyu Tolgoi Purchase Order General Conditions For The Supply of Goods (October 2022)Undral NatsagNo ratings yet

- LEU 3 Customs Union & Fiscal Barriers To Trade Final PPT 20Document47 pagesLEU 3 Customs Union & Fiscal Barriers To Trade Final PPT 20izzamarisaNo ratings yet

- Deferred Inspection Sites 111915Document12 pagesDeferred Inspection Sites 111915AJNo ratings yet

- 2 - CBNC vs. CIRDocument13 pages2 - CBNC vs. CIRJeanne CalalinNo ratings yet

- Ghana Revenue Authority Customs GuideDocument8 pagesGhana Revenue Authority Customs Guidejose300No ratings yet

- Customs Duty or VAT dispute formDocument1 pageCustoms Duty or VAT dispute formEva Fitch KnottNo ratings yet

- Guide to Preshipment Inspection AppealsDocument8 pagesGuide to Preshipment Inspection Appealsابوالحروف العربي ابوالحروفNo ratings yet

- Economics - Commerce - Capsule - Part - II PDFDocument12 pagesEconomics - Commerce - Capsule - Part - II PDFSumera SoomroNo ratings yet

- Ijcepa Basic AgreementDocument1,083 pagesIjcepa Basic AgreementgeorgevoommenNo ratings yet

- SudanDocument2 pagesSudanKelz YouknowmynameNo ratings yet

- Royal Mail Our Prices 25 March 2019 46305575 PDFDocument9 pagesRoyal Mail Our Prices 25 March 2019 46305575 PDFZakiur Rahman KhanNo ratings yet

- Systems, Processes and Challenges of Public Revenue Collection in ZimbabweDocument12 pagesSystems, Processes and Challenges of Public Revenue Collection in ZimbabwePrince Wayne SibandaNo ratings yet

- Kapatiran Vs TanDocument3 pagesKapatiran Vs TanWinnie Ann Daquil LomosadNo ratings yet

- Tamil Nadu Tnvat ActDocument63 pagesTamil Nadu Tnvat ActsamaadhuNo ratings yet

- Ibc 2 Pager PDFDocument2 pagesIbc 2 Pager PDFsam yadavNo ratings yet

- Bir Ruling (Da-031-07)Document2 pagesBir Ruling (Da-031-07)Stacy Liong BloggerAccountNo ratings yet

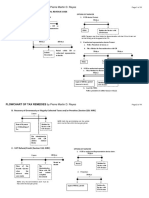

- Flowchart of Tax Remedies 2017 Update PRDocument11 pagesFlowchart of Tax Remedies 2017 Update PRMarjorie Kate CresciniNo ratings yet