Professional Documents

Culture Documents

Dream's Trade Ideas by Dreamytrader: Stock Name

Uploaded by

dreamytraderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dream's Trade Ideas by Dreamytrader: Stock Name

Uploaded by

dreamytraderCopyright:

Available Formats

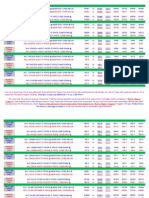

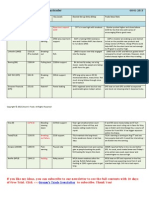

Dreams Trade Ideas by Dreamytrader

Stock Name

last Close Price Status Key Levels Desired Set-up Entry &Stop Trade Ideas Note

05-29-2013

Current Watch-list

S&P500 Index ETF (SPY) $165.22 Rally under pressure Near-term support $163.50-$165 SPY under serious selling pressure as fearful sentiment mounting around the global. Market in mixed sentiment after last weeks QE comments from Feds Chairman Ben, that Fed could start reducing the bond buying program sooner than most people expected. Now, QE program still intact. AAPLs recent price action is back to quit as many encouraging news about the company became old-news. Strong last earning numbers spiked NKE into all-time high and it has been a very strong retail stock among the sector. The up-trend is intact for NKE despite recent market chills. UPS is lucky and delivered a nice earning package to investors, reported EPS beat and REV in-line, reaffirmed guidance. This helped stock to stable. MCD reported EPS and REV in-line with the market, and guided very softly for its outlook. Marco environment still tough for growth but company is gaining its influence. LNKDs BEAT both EPS and REV with strong numbers, HOWEVER, Co issued a lower guidance. As a growth company, company has little room below consensus report.

Apple(AAPL)

$444.98

Nike (NKE)

$62.93

Tried to keep downside limited Reversing the trend

$450ish area nearterm resistance.

$62ish lower support

AAPLs halo recently get stolen buy TSLA and AAPLs Bear Flag looking pattern under $450 not so good.. Long-term in Bullish mode. Time to take some profit for this runner. Stock needs to find support amid this scary selling situation. UPS testing the support area of $86 and fail to hold this level could see lower price as buying dried up for now. MCDs range building under pressure as selling came in to visit. Upside looking not likely as stock struggling to stay high. LNKD sees money out flow as buyers could not push the stock back. Downside likely if support failed to hold.

UPS (UPS)

$86.34

Pulling back

$86 support $90 resistance

McDonalds (MCD)

$99.05

Losing basing ability Testing support

$97.50-$98ish support

LinkedIn (LNKD)

$168.02

$165ish support zone

Copyright 2013 Dream's Trade. All Rights Reserved

Boeing (BA)

$99.12

Traded higher

$100 area resistance.

BAs fly impacted by market sentiment. Long Entry on $95.25 mentioned before. Now, $100 area showing big resistance. $74 was the desired entry for long, mentioned on earlier reports. Now is time to take some profit off the table as HD is showing sign of weakness. MON is testing support zone and longs not desirable for now.

Boeings strong earning with huge beat on EPS and REV helped stock to close higher. Proved that Dreamliner didnt impact BA that much like people feared before. With more and more news about how housing market is recovering, HD certainly found reasons to go higher in this not so decisive market sentiment. Or, another housing bubble inflated by QE. MON reported EPS and REV beat on its Q2 earning and raised its guidance. Stock was in leading position before the earning and best among the sector. Agricultural sector lost its leadership a while ago. Long way to go. GPS reported a better than expected earning and its playing come back show as its business show sign of life again. DFS had very good last earning report and its business continue to grow and competing with the V and MA. V is leading the credit card business now.

Home Depot (HD)

$79.53

Short-term topping

$80 resistance

Monsanto (MON)

$105.43

Ranging

$103-$105 lower support

GAP.INC (GPS)

$39.37

Breaking down

Breach of shortterm support

GPS is losing ground for now. Could test lower price.

Discover Financial. (DFS)

$47.49

Ranging

In defense mode

DFS broken to new high last week and get sold with market but still showing sign of defense.

If you like my ideas, you can subscribe to our newsletter to see the full contents with 10 days of Free Trial. Click >>>Dream's Trade Newsletter to subscribe. Thank You!

Copyright 2013 Dream's Trade. All Rights Reserved

Current Watch-list Featured Chart: Financial ETF (XLF)

Financials is defending the selling pressure and best sector out there.

Copyright 2013 Dream's Trade. All Rights Reserved

You might also like

- Simple one-indicator trading method for currency trendsDocument14 pagesSimple one-indicator trading method for currency trendsfuraitoNo ratings yet

- Rising Wedge Article PDFDocument13 pagesRising Wedge Article PDFKiran KrishnaNo ratings yet

- Trading ManualDocument12 pagesTrading ManualMatthew MalliaNo ratings yet

- A Trader CheckList - ActiveTraderIQ ArticleDocument3 pagesA Trader CheckList - ActiveTraderIQ ArticleHussan MisthNo ratings yet

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocument10 pagesForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Richard's Candlestick Cheat SheetDocument5 pagesRichard's Candlestick Cheat SheetsumitdalalNo ratings yet

- 2011 08 05 Migbank Daily Technical Analysis Report+Document15 pages2011 08 05 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- View Our You Tube Video To Know How To Trade Using Below LevelsDocument3 pagesView Our You Tube Video To Know How To Trade Using Below LevelsNANDHA KUMARNo ratings yet

- The Dow Powers Above Its 200-Day Simple Moving Average at 10,321Document5 pagesThe Dow Powers Above Its 200-Day Simple Moving Average at 10,321ValuEngine.comNo ratings yet

- Newspaper Scavenger Hunt GuideDocument47 pagesNewspaper Scavenger Hunt GuideSubathara PindayaNo ratings yet

- 4X Pip Snager Trading Systems-PAGE 28Document69 pages4X Pip Snager Trading Systems-PAGE 28orangeray21No ratings yet

- 142a Banknifty Weekly Options StrategyDocument6 pages142a Banknifty Weekly Options StrategyudayNo ratings yet

- Open Forex Trading AccountDocument8 pagesOpen Forex Trading AccountZulkifle Md YunusNo ratings yet

- Daily Morning Update 30 Sept 2011Document2 pagesDaily Morning Update 30 Sept 2011Devang VisariaNo ratings yet

- Buyers Sellers VolumeDocument8 pagesBuyers Sellers Volumesandip_exlNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Amazing Market SetupDocument9 pagesAmazing Market SetupongkeNo ratings yet

- Superscalper PDFDocument27 pagesSuperscalper PDFNguyễn VươngNo ratings yet

- TA-Bar Chart InterpretationDocument12 pagesTA-Bar Chart InterpretationPaulo IlustreNo ratings yet

- Bursa Malaysia Technology Index extends gainsDocument3 pagesBursa Malaysia Technology Index extends gainsfendy100% (1)

- Plan 415Document20 pagesPlan 415Eduardo Dutra100% (1)

- EMA Chronicles - The MagnetsDocument22 pagesEMA Chronicles - The MagnetsStellamaris MutukuNo ratings yet

- 50 steps traders journeyDocument3 pages50 steps traders journeyShawn RaSk RaSk100% (1)

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierDocument5 pagesUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888No ratings yet

- 16.volatility Calculation (Historical) - Zerodha VarsityDocument24 pages16.volatility Calculation (Historical) - Zerodha Varsityravi4paperNo ratings yet

- Trading System ExpectancyDocument3 pagesTrading System Expectancyrafa manggala100% (1)

- Harmonic Pattern Trading Strategy - Best Way To Use The Harmonic Patterns IndicatorDocument24 pagesHarmonic Pattern Trading Strategy - Best Way To Use The Harmonic Patterns IndicatorKiongboh AngNo ratings yet

- Institutional Order Flow and The Hurdles To Superior PerformanceDocument9 pagesInstitutional Order Flow and The Hurdles To Superior PerformanceWayne H WagnerNo ratings yet

- Example: Crude CMP 5000 Than 1 % SL Is 50/ PointDocument4 pagesExample: Crude CMP 5000 Than 1 % SL Is 50/ PointTrading IdeasNo ratings yet

- Wyckoff Trading Method SummaryDocument2 pagesWyckoff Trading Method SummaryGuilherme OliveiraNo ratings yet

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Document23 pagesThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNo ratings yet

- Ichimoku Kinko Hyo StrategiesDocument3 pagesIchimoku Kinko Hyo StrategiesCarlos Jose MárquezNo ratings yet

- TradeBuilder - Classic Edition MANUALDocument19 pagesTradeBuilder - Classic Edition MANUALGabriel BlakeNo ratings yet

- Division of Mzone Financial Services PVT LTDDocument19 pagesDivision of Mzone Financial Services PVT LTDMzone SalesNo ratings yet

- Falcon Somali PDFDocument12 pagesFalcon Somali PDFMoha Fx100% (1)

- Trade Details: Half-Position of GBPDocument4 pagesTrade Details: Half-Position of GBPImre GamsNo ratings yet

- Dividend Stock Metrics WorksheetDocument2 pagesDividend Stock Metrics WorksheetklbjcbNo ratings yet

- SwingTrading Pro Strategy Long Only Example 9p05f1Document1 pageSwingTrading Pro Strategy Long Only Example 9p05f1jamshidNo ratings yet

- Strategize Your Investment In 30 Minutes A Day (Steps)From EverandStrategize Your Investment In 30 Minutes A Day (Steps)No ratings yet

- Craig Harris MethodDocument5 pagesCraig Harris MethodEngr Fazal AkbarNo ratings yet

- 5 Important Roles of Relative Strength IndexDocument6 pages5 Important Roles of Relative Strength Indexvijay talwarNo ratings yet

- The Forex Options Course: A Self-Study Guide to Trading Currency OptionsFrom EverandThe Forex Options Course: A Self-Study Guide to Trading Currency OptionsNo ratings yet

- 1-Support and ResistanceDocument14 pages1-Support and ResistanceBonnieNo ratings yet

- Hidden Divergence - Chamane's GuidelinesDocument13 pagesHidden Divergence - Chamane's GuidelinesFabioSantosNo ratings yet

- How Just One 'Odd' Market Phenomenon Made Me: by David VallieresDocument17 pagesHow Just One 'Odd' Market Phenomenon Made Me: by David VallieresananthankrishnanNo ratings yet

- A Day Trading Strategy: The Gap System: Michael Tan, PH.D., CFADocument13 pagesA Day Trading Strategy: The Gap System: Michael Tan, PH.D., CFAtudorNo ratings yet

- Liquidity Management Through Sukuk Report 2016Document24 pagesLiquidity Management Through Sukuk Report 2016Miaser El MagnoonNo ratings yet

- Agrawal Technical Analysis Gurukul Reversal PatternsDocument5 pagesAgrawal Technical Analysis Gurukul Reversal PatternsvvpvarunNo ratings yet

- Trading MethodDocument3 pagesTrading MethodkanannnNo ratings yet

- 5-22-12 Another Hike For GoldDocument2 pages5-22-12 Another Hike For GoldThe Gold SpeculatorNo ratings yet

- We Care For You - Please Check Before You InvestDocument21 pagesWe Care For You - Please Check Before You InvestVishnupriya VinothkumarNo ratings yet

- Using The Fibonacci Retracement Tool To Identify Support and ResistanceDocument26 pagesUsing The Fibonacci Retracement Tool To Identify Support and ResistanceCoba CobaNo ratings yet

- Everything You Need To Know About Moving AveragesDocument24 pagesEverything You Need To Know About Moving Averagesmohd haiqalNo ratings yet

- Fundamentals 2. COT 3. Technicals: Idea GenerationDocument1 pageFundamentals 2. COT 3. Technicals: Idea GenerationIsaac Osabu AnangNo ratings yet

- How To Use RSI (Relative Strength Index)Document3 pagesHow To Use RSI (Relative Strength Index)paoloNo ratings yet

- Pay Attention To What The Market Is SayingDocument11 pagesPay Attention To What The Market Is SayingEmmy ChenNo ratings yet

- Only Α- Sniper Shot 3: MyfnoDocument10 pagesOnly Α- Sniper Shot 3: MyfnoPhani KrishnaNo ratings yet

- Dream's Trade Ideas 07.25.2013Document3 pagesDream's Trade Ideas 07.25.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.08.2013Document3 pagesDream's Trade Ideas 07.08.2013dreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas 07.29.2013Document3 pagesDream's Trade Ideas 07.29.2013dreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas 07.15.2013Document3 pagesDream's Trade Ideas 07.15.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.22.2013Document3 pagesDream's Trade Ideas 07.22.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.24.2013Document3 pagesDream's Trade Ideas 07.24.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.23.2013Document3 pagesDream's Trade Ideas 07.23.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.15.2013Document3 pagesDream's Trade Ideas 07.15.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.17.2013Document3 pagesDream's Trade Ideas 07.17.2013dreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas 07.18.2013Document3 pagesDream's Trade Ideas 07.18.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.16.2013Document3 pagesDream's Trade Ideas 07.16.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.22.2013Document3 pagesDream's Trade Ideas 07.22.2013dreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas 05.19.2013Document3 pagesDream's Trade Ideas 05.19.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 05.14.2013Document3 pagesDream's Trade Ideas 05.14.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 07.07.2013Document3 pagesDream's Trade Ideas 07.07.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 05.28.2013Document3 pagesDream's Trade Ideas 05.28.2013dreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas 04.30.2013Document9 pagesDream's Trade Ideas 04.30.2013dreamytraderNo ratings yet

- Dream's Trade Ideas 04.30.2013Document9 pagesDream's Trade Ideas 04.30.2013dreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas 05.06.2013Document4 pagesDream's Trade Ideas 05.06.2013dreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Checklist ISO 20000-2018Document113 pagesChecklist ISO 20000-2018roswan83% (6)

- Description of Empirical Data Sets: 1. The ExamplesDocument3 pagesDescription of Empirical Data Sets: 1. The ExamplesMANOJ KUMARNo ratings yet

- Act 51 Public Acts 1951Document61 pagesAct 51 Public Acts 1951Clickon DetroitNo ratings yet

- YMCA 2010 Annual Report - RevisedDocument8 pagesYMCA 2010 Annual Report - Revisedkoga1No ratings yet

- Assumptions in EconomicsDocument9 pagesAssumptions in EconomicsAnthony JacobeNo ratings yet

- Impacts of Globalization on Indian AgricultureDocument2 pagesImpacts of Globalization on Indian AgricultureSandeep T M SandyNo ratings yet

- Extra Oligopolio PDFDocument17 pagesExtra Oligopolio PDFkako_1984No ratings yet

- AGI3553 Plant ProtectionDocument241 pagesAGI3553 Plant ProtectionDK White LionNo ratings yet

- Dissertation NikhilDocument43 pagesDissertation NikhilSourabh BansalNo ratings yet

- Industrial Sector in BDDocument30 pagesIndustrial Sector in BDImtiaz AhmedNo ratings yet

- Mahanagar CO OP BANKDocument28 pagesMahanagar CO OP BANKKaran PanchalNo ratings yet

- 2013 Factbook: Company AccountingDocument270 pages2013 Factbook: Company AccountingeffahpaulNo ratings yet

- Contem ReviewerDocument9 pagesContem ReviewerKenNo ratings yet

- Germany Vs Singapore by Andrew BaeyDocument12 pagesGermany Vs Singapore by Andrew Baeyacs1234100% (2)

- 10A. HDFC Jan 2021 EstatementDocument10 pages10A. HDFC Jan 2021 EstatementNanu PatelNo ratings yet

- Aviation EconomicsDocument23 pagesAviation EconomicsAniruddh Mukherjee100% (1)

- The Young Karl Marx ReviewDocument2 pagesThe Young Karl Marx ReviewTxavo HesiarenNo ratings yet

- Encyclopedia of American BusinessDocument863 pagesEncyclopedia of American Businessshark_freire5046No ratings yet

- IptspDocument6 pagesIptspMD ABUL KHAYERNo ratings yet

- Monitoring Local Plans of SK Form PNR SiteDocument2 pagesMonitoring Local Plans of SK Form PNR SiteLYDO San CarlosNo ratings yet

- IIP - Vs - PMI, DifferencesDocument5 pagesIIP - Vs - PMI, DifferencesChetan GuptaNo ratings yet

- Financial Planning For Salaried Employee and Strategies For Tax SavingsDocument8 pagesFinancial Planning For Salaried Employee and Strategies For Tax SavingsNivetha0% (2)

- COCO Service Provider Detailed Adv. Madhya PradeshDocument5 pagesCOCO Service Provider Detailed Adv. Madhya PradeshdashpcNo ratings yet

- Fixed DepositDocument16 pagesFixed DepositPrashant MathurNo ratings yet

- Module 8 Benefit Cost RatioDocument13 pagesModule 8 Benefit Cost RatioRhonita Dea AndariniNo ratings yet

- NSE ProjectDocument24 pagesNSE ProjectRonnie KapoorNo ratings yet

- Marico Over The Wall Operations Case StudyDocument4 pagesMarico Over The Wall Operations Case StudyMohit AssudaniNo ratings yet

- Equity vs. EqualityDocument5 pagesEquity vs. Equalityapi-242298926No ratings yet

- "Tsogttetsii Soum Solid Waste Management Plan" Environ LLCDocument49 pages"Tsogttetsii Soum Solid Waste Management Plan" Environ LLCbatmunkh.eNo ratings yet

- Punjab University exam fee receiptDocument1 pagePunjab University exam fee receiptmalik awanNo ratings yet