Professional Documents

Culture Documents

Fraud 101 For Accounting

Uploaded by

deryckwayze13Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fraud 101 For Accounting

Uploaded by

deryckwayze13Copyright:

Available Formats

Fraud 101

12/7/2012 6:31:00 PM

Definition of Fraud In Legal Dictionary, fraud is false representation of a matter of fact whether by words or by conduct, by false or misleading allegations, or by concealment of what should have been disclosed that deceives and is intended to deceive another so that the individual In criminal law, a fraud is an intentional deception made for personal gain or to damage another individual. Corporate world the use of ones occupation for personal enrichment through the deliberate misuse or misapplication of the employing organizations resources or assets. Gross negligence may be considered as frauds Elements of Fraud 1. Fraudster 2. Victim 3. Object 4. Intentional misrepresentation or deceit 5. Gain for the fraudster 6. Loss for the victim 7. Applicable laws civil and criminal **only the courts can declare the existence of fraud, before it is declared as fraud by the courts, it is only an allegation Fraud Triangle widely accepted model for why people commit fraud key components: pressure, opportunity (most crucial), rationalization (all 3 need to exist for fraud to flourish) Fraud Dimensions Criminal/Legal o Deceit o Trickery o Breach of Trust o Perpetrated for profit or to gain some unfair or dishonest advantage

o Circumvention of the law (especially if the fraudster is the corporation itself) o Violation of the law Psychological, Social, Behavioral o Greed o Shame o Fear o Thrill o **Fraud thrives on human weaknesses Moral/Ethical o Principles o Values o Culture o **What is legal is not always moral and ethical Financial/Economic o Loss of lifetime savings, investment o Loss of promised future benefits o Loss of employment, livelihood o Impact to economic growth and development

Profiling a Fraudster Male College educated Over the age of 35 Occupies position of authority and trust Often well respected in the organization Often in same role for a long time As women and other minorities move into more positions of authority, this profile is changing. Fraud is an equal opportunity activity Fraud Statistics What is the most common method for detecting fraud? The most common method for detecting fraud is a tip from an employee, customer, vendor, or anonymous source

According to the Association of Certified Fraud Examiners, companies lose value equivalent to 6-7% of sales annually to fraud

Common Types of Fraud Public Fraud o Ponzi Scheme o Internet Fraud o Text Fraud Institutional Fraud o Asset Theft cash, inventory, and other assets, fraudulent disbursements o Financial Statement Fraud includes revenue recognition issues, inappropriate reserves, inappropriate year-end spending o Corruption includes conflicts of interest, bribery, economic extortion Early Warning Signals Purchases and Procurement o Payments to a vendor post office box o Lack of competitive bidding o Single vendor o Delivery location not the office, plant or job site o Invoices with minimal information o Vendors that pick up payments Personnel o Unexplained employee absences o Excessive overtime o Significant life-style changes o Refusal to take vacation o Excessive or unjustified changes in accounting personnel o High rate of employee turnover o Turning down promotions or transfers o Lack of segregation of duties Records o Refusal to produce records, files or documents

o Missing documentation o No original source documents o No exceptions or errors o Premature or excessive destruction of controlled documents Inventory/Assets o Inventory that is slow to turnover Others o Excessive cash transactions o Customer complaints o Cant talk to people (protection) o Consistent cash flow problems o Dramatic changes in key ratios or ratios too good o Failure to reconcile bank statements or a conflict of duties on the part of performing reconciliations o Receivable grows substantially faster than sales

Fraud is a reality of life. If the offer is too good to be true..think and think again If ever you are defrauded, speak up! Print instead of using script Use a permanent marker Write as large as possible Fill in all unused space Enron using hidden subsidiaries, hiding losses Qwest using swap deals to inflate revenues Worldcom treating business costs as assets Bristol-Myers loading the trade, then forced to restate Olympus (Japan)

12/7/2012 6:31:00 PM

12/7/2012 6:31:00 PM

You might also like

- Consumer & Investor Fraud PresentationDocument18 pagesConsumer & Investor Fraud PresentationAmit GuptaNo ratings yet

- Fraud InvestigationDocument23 pagesFraud InvestigationRichard Gitaga100% (2)

- Rogue Employees: How Your Most Prized Asset Can Be Your Worst LiabilityFrom EverandRogue Employees: How Your Most Prized Asset Can Be Your Worst LiabilityNo ratings yet

- Fraud Triangle and Red Flags For FraudDocument2 pagesFraud Triangle and Red Flags For Fraudbsw0997No ratings yet

- Intro To Skip TracingDocument33 pagesIntro To Skip Tracinggoosebumps1942100% (2)

- One Twist Is All It Takes: Avoiding the Mistake That Will Define YouFrom EverandOne Twist Is All It Takes: Avoiding the Mistake That Will Define YouNo ratings yet

- Brand Awareness Questionnaire SampleDocument2 pagesBrand Awareness Questionnaire SampleYogesh Sangani77% (13)

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaNo ratings yet

- FinancialcrimesDocument32 pagesFinancialcrimestyrwerNo ratings yet

- Malfunction: 3. Unintentional Acts-Are Caused by 2. Investment Fraud - Misrepresenting orDocument11 pagesMalfunction: 3. Unintentional Acts-Are Caused by 2. Investment Fraud - Misrepresenting orJoanne Ario BillonesNo ratings yet

- Fraud Prevention, Detection & ControlDocument16 pagesFraud Prevention, Detection & ControlRavindra A. KamathNo ratings yet

- Week 2Document7 pagesWeek 2CancelynshrnpNo ratings yet

- Jimmy de Vera Roldan, MsitDocument43 pagesJimmy de Vera Roldan, MsitCindy BartolayNo ratings yet

- Thief Economic CrimeDocument17 pagesThief Economic CrimeMatt LocardNo ratings yet

- Fraud in Banks An OverviewDocument7 pagesFraud in Banks An OverviewtareqNo ratings yet

- The Psychology of A FraudsterDocument9 pagesThe Psychology of A FraudsterStella AkpalabaNo ratings yet

- SubtitleDocument3 pagesSubtitleAkash RafiNo ratings yet

- AIS05Document46 pagesAIS05mengistu jiloNo ratings yet

- Fraud Investigation Manager Job Description: Skills RequiredDocument2 pagesFraud Investigation Manager Job Description: Skills RequiredMonykZuluagaNo ratings yet

- Fraud IndicatorsDocument2 pagesFraud Indicatorsbishum786No ratings yet

- Topic 1 - Nature of FraudDocument27 pagesTopic 1 - Nature of FraudJom De Los SantosNo ratings yet

- Chapter 9 Advocacy Against CorruptionDocument3 pagesChapter 9 Advocacy Against CorruptionMarienella MarollanoNo ratings yet

- UHY Government Contractor Newsletter - November 2011Document2 pagesUHY Government Contractor Newsletter - November 2011UHYColumbiaMD100% (1)

- Recognizing The Symptoms of FraudDocument12 pagesRecognizing The Symptoms of FraudlieselenaNo ratings yet

- WEEK 1 DAN 2 Introduction To FraudDocument33 pagesWEEK 1 DAN 2 Introduction To Frauddea AudreylaNo ratings yet

- Effective Fraud Management: Fraud - Its Extent, Patterns and CausesDocument40 pagesEffective Fraud Management: Fraud - Its Extent, Patterns and CausesAfan AliNo ratings yet

- Management FraudsDocument21 pagesManagement Fraudsksmann88100% (7)

- Chap 4 AISDocument5 pagesChap 4 AISmejaneisip479No ratings yet

- The ConsequencesDocument13 pagesThe ConsequencesBasirNo ratings yet

- Fraudulent ReportingDocument39 pagesFraudulent ReportingBulelwa HarrisNo ratings yet

- Faransic AccountingDocument70 pagesFaransic AccountingAhtishamNo ratings yet

- Fraud IndicatorsDocument26 pagesFraud IndicatorsIena SharinaNo ratings yet

- Chapter 2 - Audit PrinciplesDocument6 pagesChapter 2 - Audit PrinciplesSalsa ArdilaNo ratings yet

- Business Ethics Session 2 19.08Document22 pagesBusiness Ethics Session 2 19.08nasreencristianoNo ratings yet

- 01 Forensic AuditingDocument30 pages01 Forensic AuditingSRIVISHNU BNo ratings yet

- Fraud & Corruption FinalDocument99 pagesFraud & Corruption FinalHossein DavaniNo ratings yet

- Decoding Fraud and Profiling The FraudsterDocument23 pagesDecoding Fraud and Profiling The FraudsterAnn Margarette SambilayNo ratings yet

- Fraud and Risk ManagementDocument13 pagesFraud and Risk Managementcsamkelisiwe32No ratings yet

- Chapter 8 - INTERNAL AUDIT AND FRAUD RISK AutosavedDocument80 pagesChapter 8 - INTERNAL AUDIT AND FRAUD RISK Autosaved--bolabolaNo ratings yet

- Identity Theft PaperDocument10 pagesIdentity Theft PaperRohit Singh100% (1)

- Chapter 17Document21 pagesChapter 17Talia AdaNo ratings yet

- Smart Money For Older Adults - A Resource GuideDocument105 pagesSmart Money For Older Adults - A Resource GuideChristopher MillerNo ratings yet

- Forensic Accounting and Fraud Investigation CH 1 QuestionDocument7 pagesForensic Accounting and Fraud Investigation CH 1 QuestionAnastasia Stella HannyNo ratings yet

- Don’T Let Your Clients Eat Dog Food When They’Re Old!: A Financial Professional’S Guide to Retirement Cash Flow ManagementFrom EverandDon’T Let Your Clients Eat Dog Food When They’Re Old!: A Financial Professional’S Guide to Retirement Cash Flow ManagementNo ratings yet

- Banking FraudDocument18 pagesBanking Fraudvandana_daki3941No ratings yet

- Week 12Document49 pagesWeek 12Gino BriñasNo ratings yet

- OUMH3203Document12 pagesOUMH3203Ibrahim Drahman100% (1)

- CHAPTER 8 Investigation of FraudDocument45 pagesCHAPTER 8 Investigation of FraudHanis ZahiraNo ratings yet

- Advocacy Against CorruptionDocument6 pagesAdvocacy Against CorruptionEy GuanlaoNo ratings yet

- Possibly: Black's Law DictionaryDocument3 pagesPossibly: Black's Law DictionaryAlexander GarciaNo ratings yet

- Alya Tugas BinggrisDocument6 pagesAlya Tugas BinggrisMira SusantiNo ratings yet

- Fraud Management in The Banking Sector PDocument31 pagesFraud Management in The Banking Sector PAzim Ul AhsanNo ratings yet

- Fraud Management in The Banking SectorDocument18 pagesFraud Management in The Banking Sectorvandana_daki3941No ratings yet

- Final Assessment 1Document16 pagesFinal Assessment 1Mamphasa MoetiNo ratings yet

- Living Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)From EverandLiving Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)Rating: 5 out of 5 stars5/5 (3)

- StoppingDocument6 pagesStoppingDanNo ratings yet

- FFSC Oct. 2011 NewsletterDocument4 pagesFFSC Oct. 2011 NewsletterMAG49DetCHMLA773DetANo ratings yet

- SRGG Topic 11 ReportDocument33 pagesSRGG Topic 11 ReportDanNo ratings yet

- HW 2Document7 pagesHW 2Trung DaoNo ratings yet

- The Importance of Forensic AuditDocument6 pagesThe Importance of Forensic AuditkharismaNo ratings yet

- Legacy 2012Document5 pagesLegacy 2012deryckwayze13No ratings yet

- GE Financial Management ProgramDocument1 pageGE Financial Management Programderyckwayze13No ratings yet

- Selected Provisions On Philippine LawDocument3 pagesSelected Provisions On Philippine Lawderyckwayze13No ratings yet

- List of Ge Courses For UP DilimanDocument11 pagesList of Ge Courses For UP DilimanAda Suarez0% (1)

- IFRIC 12 - DeloitteDocument59 pagesIFRIC 12 - Deloittederyckwayze13No ratings yet

- Global Risks and VulnerabilitiesPhilippinesDocument9 pagesGlobal Risks and VulnerabilitiesPhilippinesderyckwayze13No ratings yet

- 05 SalesDocument28 pages05 SalesVHine CabSaba BiBatNo ratings yet

- UntitledDocument2 pagesUntitledderyckwayze13No ratings yet

- Rilina Basu BanerjeeDocument8 pagesRilina Basu BanerjeeStuti PaulNo ratings yet

- SaloniiiiDocument35 pagesSaloniiiiGAURAVNo ratings yet

- Evaluating The Identity of Purchasing Amp Supply - 2021 - Journal of PurchasiDocument12 pagesEvaluating The Identity of Purchasing Amp Supply - 2021 - Journal of PurchasiRoshanNo ratings yet

- PTS-6-adventure Tourism MechukaDocument32 pagesPTS-6-adventure Tourism Mechukajoram kakuNo ratings yet

- Om Shrivastava-1Document22 pagesOm Shrivastava-1juggernautjhaNo ratings yet

- Warehouse and Inventory Management: UNIT-1Document29 pagesWarehouse and Inventory Management: UNIT-1Amitrajeet kumarNo ratings yet

- Halal Industry Master Plan (2008 - 2020) : The Evolution of The Halal Industry in MalaysiaDocument2 pagesHalal Industry Master Plan (2008 - 2020) : The Evolution of The Halal Industry in MalaysiaEko SupriyantoNo ratings yet

- Place of Supply of Goods or Services or BothDocument38 pagesPlace of Supply of Goods or Services or BothHarshit GuptaNo ratings yet

- Prop TigerDocument3 pagesProp TigerPrasamNo ratings yet

- Macroeconomic Activity and The Malaysian Stock Market: Emperical Evidence of Dynamic RelationsDocument2 pagesMacroeconomic Activity and The Malaysian Stock Market: Emperical Evidence of Dynamic RelationsHitesh BalNo ratings yet

- Jepretan Layar 2024-01-02 Pada 21.04.17Document41 pagesJepretan Layar 2024-01-02 Pada 21.04.17dewipuspita1900No ratings yet

- Foreign Trade: Indian Economic Development Indian Economy On The Eve of IndependenceDocument2 pagesForeign Trade: Indian Economic Development Indian Economy On The Eve of IndependenceRashi RastogiNo ratings yet

- Nation With Namo Cover Letter - Abhay GuptaDocument1 pageNation With Namo Cover Letter - Abhay GuptaAbhay GuptaNo ratings yet

- AAOIFI FAS 25 - Quiz (MBL To BIBF)Document3 pagesAAOIFI FAS 25 - Quiz (MBL To BIBF)AL-HAMD GROUPNo ratings yet

- Money Maker-Ed Sheeran: Ed Sheeran's Net Worth Versus The Richest Musicians Under 30 (UK and Ireland)Document2 pagesMoney Maker-Ed Sheeran: Ed Sheeran's Net Worth Versus The Richest Musicians Under 30 (UK and Ireland)Marian PîrjolNo ratings yet

- The Role of Law in Business DevelopmentDocument4 pagesThe Role of Law in Business DevelopmentPsy GannavaramNo ratings yet

- Labour LawDocument17 pagesLabour LawbernardNo ratings yet

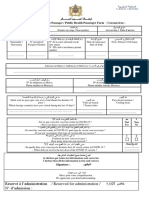

- رفاـــــسملل ةيحـــــصلا ةقاـــــطبلا Fiche Sanitaire du Passager / Public Health Passenger Form - CoronavirusDocument1 pageرفاـــــسملل ةيحـــــصلا ةقاـــــطبلا Fiche Sanitaire du Passager / Public Health Passenger Form - CoronavirusBLED PRESSNo ratings yet

- SiemensDocument9 pagesSiemensCam SNo ratings yet

- Annual HSE Performance Evaluation FormDocument1 pageAnnual HSE Performance Evaluation Formsadia_murshad171No ratings yet

- Shibbu Parmar CV 2022Document2 pagesShibbu Parmar CV 2022rohitNo ratings yet

- Develop Wilmont's Pharmacy Drone Delivery Project Work Breakdown Structure (WBS)Document2 pagesDevelop Wilmont's Pharmacy Drone Delivery Project Work Breakdown Structure (WBS)Shkjndfhbiana dygwqNo ratings yet

- Fabm 1: Accounting For Merchandising ConcernDocument29 pagesFabm 1: Accounting For Merchandising ConcernJan Vincent A. LadresNo ratings yet

- InterestDocument41 pagesInterestClariza Mae BaisaNo ratings yet

- CPI Trac Nghiem 30 CâuDocument6 pagesCPI Trac Nghiem 30 Câunessyhen6No ratings yet

- EXTRAJUDICIAL SETTLEMENT W. WAIVER OF RIGHTS Onofre PaguiaDocument4 pagesEXTRAJUDICIAL SETTLEMENT W. WAIVER OF RIGHTS Onofre PaguiaJorge M. GarciaNo ratings yet

- Ffi, W& Dared:: - No. No. DatedDocument1 pageFfi, W& Dared:: - No. No. DatedNikhil PabuwalNo ratings yet

- Certificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Document1 pageCertificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Rohit YadavNo ratings yet