Professional Documents

Culture Documents

Labour Laws

Uploaded by

srimant kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Labour Laws

Uploaded by

srimant kumarCopyright:

Available Formats

Employee State Insurance

Coverage - Act is applicable to non-seasonal factories using power and employing 10 or more persons and non-power using factories 20 or more persons. Earning wages limit- Gross Salary Rs. 10,000/- w. e. f. 01.04.2006. Contribution : By Employer By Employee @ 4.75% @ 1.75%

Registration and number allotment- Duly filled Form-01 For Employees Form 01 & Declaration Form no. 03 within 10 days of joining, kept one copy of Form-3 for record. Identity Cards : Form 4 the ESI Office will issue the same. Register for ESI Record : Every employer shall maintain a register in Form-6 which is prescribed in rule-32. Contribution periods 1st : 1st April to 30th September 2nd : 1st October to 31st March Challans Deposit : Deposit in bank by 21st of every month. Returns of contribution : On Form no. 5 in quadruplicate with Six Challans within or before 11 May & 12 Nov of every year mandatory certified by the Chartered Accountant if the member are 40 nos. or more w. e f. 01.04.2008. Special Provision : (i) (ii) (iii) Within 42 days of the termination of the contribution period to which it related. Within 21 days of the date of permanent closure of the factory. Within 7 days of the date f receipt of requisition in that behalf from the appropriate office.

Notice of Accident : As soon as practicable after the accident. Maintenance of Accident Book : Form-15 any injury to an insured person. Report to Accident : 1. Immediately if the injury is serious. i.e. is likely to be cause to death or permanent disablement or loss of a member. 2. In any other case within 24 hours after the receipt of the notice or when the accident came to his notice or to his foremen or other official under whose supervision the insured person was employed at the time of accident.

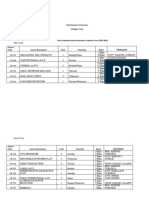

3. If the injury result in the death at the place of employment, the report to IMO and Local Office should be sent through a special messenger. Every Employer shall send a report in Form-16 to the nearest Local Office and to the nearest Insurance Medical Officer in triplicate i.e. (1) One deposit to Local Office (2) Second deposit to IMO (3) Kept for their records. Benefit Period : If the person joined insurable employment for the first time say 5 th January, but his contribution period will be 5th Jan to 31st March and his corresponding first benefit will be from 5 th October to 31st December. Sr. No. 1 2 3 4 5 6 7 8 9 10 11 To be deemed as a wages Basic Allowance Dearness Allowance House Rent Allowance City Compensatory Allowance OT Wages Production Incentive Payment for day of rest Night Shift Allowance Meal / Food Allowance Suspension Allowance Conveyance Allowance Not to be deemed as a wages Contribution paid by employer on any pension / PF or ESI Daily Allowance paid for period spent on tour Encashment of leaves Washing Allowance Amount towards reimbursement for duty related journey Gratuity payable on discharge Benefit paid under ESI Payment of Inam which does not form part of the terms of employment

Damages or contribution or any other amount due but not paid in timeSr. No. 1 2 3 4 Period of delay Less than 2 months Grater than 2 but less than 4 months Grater than 4 but less than 6 months Grater than 6 months Maximum rate of damages in % per annum of the amount due 5% 10 % 15 % 25 %

Penalties : Different punishment have been prescribed for different types of offences in terms of section 85 : (i) (ii) Six month imprisonment and fine Rs. 5000/One year imprisonment and fine

And under section 85-A

(i)

Five year imprisonment and not less than 2 years

And under section 85-C(2) of the ESI Act which are self explanatory Besides these provisions, action also can be taken under section 406 of the IPC in case where an employer deduct contribution from the wages of his employees but does not pay the same to the corporation which amounts to criminal breach of trust.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- AFCC Court Cancer Metastacizes: A Guide To Destroying ChildrenDocument10 pagesAFCC Court Cancer Metastacizes: A Guide To Destroying ChildrenJournalistABC100% (3)

- Stewart Title Warning To Maryland Title CompaniesDocument9 pagesStewart Title Warning To Maryland Title CompaniesTodd WetzelbergerNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Nestle Philippines, Inc. vs. NLRC (209 SCRA 834 (1992) ) - DigestedDocument2 pagesNestle Philippines, Inc. vs. NLRC (209 SCRA 834 (1992) ) - DigestedKornessa ParasNo ratings yet

- Victoria v. COMELEC Rules on Ranking Sanggunian MembersDocument4 pagesVictoria v. COMELEC Rules on Ranking Sanggunian MembersChristian Villar0% (1)

- Revised Rules On Criminal ProceduresDocument28 pagesRevised Rules On Criminal ProceduresMilagros Aguinaldo100% (4)

- Lewin Model of Change ManagementDocument3 pagesLewin Model of Change ManagementIla Mehrotra AnandNo ratings yet

- Court Hearing on Recovery SuitDocument23 pagesCourt Hearing on Recovery SuitimachieverNo ratings yet

- The Role of A Manager in An OrganisationDocument10 pagesThe Role of A Manager in An OrganisationSwarup MishraNo ratings yet

- Real Estate Exam 4 Practice QuestionsDocument3 pagesReal Estate Exam 4 Practice QuestionsJuan Carlos NocedalNo ratings yet

- Organisational Culture & Values Guide Recovery-Oriented DevelopmentDocument10 pagesOrganisational Culture & Values Guide Recovery-Oriented Developmentsrimant kumarNo ratings yet

- Julio Sales Vs SecDocument2 pagesJulio Sales Vs SecanailabucaNo ratings yet

- Quierete Mucho Maricon Spanish Edition - vOJRPYCDocument2 pagesQuierete Mucho Maricon Spanish Edition - vOJRPYCSantiago Medina0% (1)

- Competency MappingDocument30 pagesCompetency MappingSameera Syed100% (4)

- Assessment TechniqueDocument54 pagesAssessment Techniquesrimant kumarNo ratings yet

- Motion For Postponement HearingDocument3 pagesMotion For Postponement Hearingfranceslim24No ratings yet

- Self - Owned CarDocument1 pageSelf - Owned Carsrimant kumarNo ratings yet

- Chemistry Paper For CBSE AspirantDocument2 pagesChemistry Paper For CBSE Aspirantsrimant kumarNo ratings yet

- CPCD Project-Srimant JhaDocument94 pagesCPCD Project-Srimant Jhasrimant kumarNo ratings yet

- The Toyota Production SystemDocument46 pagesThe Toyota Production Systemprakash_tushiNo ratings yet

- Shiv Khera's Life Lessons from 'You Can WinDocument11 pagesShiv Khera's Life Lessons from 'You Can Winsrimant kumarNo ratings yet

- Shiv Khera's Life Lessons from 'You Can WinDocument11 pagesShiv Khera's Life Lessons from 'You Can Winsrimant kumarNo ratings yet

- Training Manager Cover LetterDocument1 pageTraining Manager Cover Lettersrimant kumarNo ratings yet

- Cultural ChangeDocument5 pagesCultural Changesrimant kumarNo ratings yet

- Purification PDFDocument16 pagesPurification PDFsrimant kumarNo ratings yet

- Test For Cbse ExamDocument1 pageTest For Cbse Examsrimant kumarNo ratings yet

- IGNOU Examination FormDocument2 pagesIGNOU Examination FormShashank VashisthaNo ratings yet

- The Colloidal State: (I) Crystalloids (Ii) ColloidsDocument12 pagesThe Colloidal State: (I) Crystalloids (Ii) Colloidssrimant kumarNo ratings yet

- CounsellingDocument7 pagesCounsellingsrimant kumarNo ratings yet

- Cbse Test Paper-04 CLASS - XI CHEMISTRY (Basic Concepts of Chemistry)Document1 pageCbse Test Paper-04 CLASS - XI CHEMISTRY (Basic Concepts of Chemistry)Gopal VenkatramanNo ratings yet

- Case Study - JetBlue Airways Organizational Development - Partners For ChangeDocument6 pagesCase Study - JetBlue Airways Organizational Development - Partners For ChangeShiningscorpion Zq100% (1)

- Maruti Suzuki's Customer Relationship Management StrategiesDocument9 pagesMaruti Suzuki's Customer Relationship Management Strategiessrimant kumarNo ratings yet

- Case Study - JetBlue Airways Organizational Development - Partners For ChangeDocument6 pagesCase Study - JetBlue Airways Organizational Development - Partners For ChangeShiningscorpion Zq100% (1)

- Motivation The Nick WayDocument14 pagesMotivation The Nick Waysrimant kumarNo ratings yet

- MPC Ist Year AssignmentsDocument12 pagesMPC Ist Year AssignmentsAlok ThakkarNo ratings yet

- Shiv Khera's Life Lessons from 'You Can WinDocument11 pagesShiv Khera's Life Lessons from 'You Can Winsrimant kumarNo ratings yet

- Checklist - Under Contract Labour ActDocument2 pagesChecklist - Under Contract Labour Actbittoo84No ratings yet

- Admmbawk 080811Document7 pagesAdmmbawk 080811srimant kumarNo ratings yet

- Core CompetenceDocument12 pagesCore Competencesrimant kumarNo ratings yet

- Shiv Khera's Life Lessons from 'You Can WinDocument11 pagesShiv Khera's Life Lessons from 'You Can Winsrimant kumarNo ratings yet

- IEBC Petition by Wafula BukeDocument6 pagesIEBC Petition by Wafula BukeDeep CogitationNo ratings yet

- Accounting For Decision Making and Control 9th Edition Zimmerman Test BankDocument15 pagesAccounting For Decision Making and Control 9th Edition Zimmerman Test BankMichelleHarrisjspr100% (53)

- People vs. Quinto Jr. Decision CarnappingDocument4 pagesPeople vs. Quinto Jr. Decision Carnappinghermione_granger10No ratings yet

- 3.1 Joint AffidavitDocument2 pages3.1 Joint AffidavitAya NamuzarNo ratings yet

- Amity National Moot Court CompetitionDocument3 pagesAmity National Moot Court CompetitionMohd AqibNo ratings yet

- Samar Judge Acquitted of Libel for Sharing Newspaper ArticleDocument7 pagesSamar Judge Acquitted of Libel for Sharing Newspaper ArticleOlga Pleños ManingoNo ratings yet

- ERISA Employee Benefits Paralegal in Dallas, TX ResumeDocument2 pagesERISA Employee Benefits Paralegal in Dallas, TX ResumeRCTBLPONo ratings yet

- Santos v. Santos rules on dead man's statuteDocument3 pagesSantos v. Santos rules on dead man's statuteKaira Marie CarlosNo ratings yet

- Fact Opinion QuizDocument57 pagesFact Opinion QuizAffirahs NurRaijeanNo ratings yet

- SPiT Baniqued Cases March 14Document41 pagesSPiT Baniqued Cases March 14Charles David IcasianoNo ratings yet

- Nallakaruppan (1999) 1 MLJ 96Document23 pagesNallakaruppan (1999) 1 MLJ 96Ahmad Azlan100% (1)

- NC Attorney ComplaintDocument5 pagesNC Attorney ComplaintDon BetoNo ratings yet

- Assignment Subject: Law of Taxation TOPIC: "Advocates Welfare Act, 2001"Document7 pagesAssignment Subject: Law of Taxation TOPIC: "Advocates Welfare Act, 2001"Rajput ShobhitNo ratings yet

- Interpretation of StatutesDocument13 pagesInterpretation of StatutesDisha PathakNo ratings yet

- Lok Sabha SpeakerDocument6 pagesLok Sabha Speakerashok mehtaNo ratings yet

- Mock Test August 2018Document5 pagesMock Test August 2018Suzhana The WizardNo ratings yet

- R.A. No. 10022Document47 pagesR.A. No. 10022Sonny MorilloNo ratings yet

- Northwestern University College of LawDocument5 pagesNorthwestern University College of LawNorma ArquilloNo ratings yet

- Aratuc Vs ComelecDocument19 pagesAratuc Vs ComelecKyle JamiliNo ratings yet

- Political Law Digests - CommsarDocument27 pagesPolitical Law Digests - CommsarMickey ONo ratings yet