Professional Documents

Culture Documents

ACCA Dec 2011 F7 Mock Paper

Uploaded by

Charles AdontengCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCA Dec 2011 F7 Mock Paper

Uploaded by

Charles AdontengCopyright:

Available Formats

Mock Examination

: ACCA Paper F7

Financial Reporting

Session Set by : December 2011 : Mr Ben Lee

Your Lecturer Mr Ben Lee Mr Goh Sher Wee Mr James Kwan Your Mailing Address : ______________________________________ ______________________________________ Your Contact Number : ______________________________________

I wish to have my script marked by my lecturer and collect the marked script at the SAA-GE Reception Counter h have th the marked k d script i t returned t dt to me b by mail il

(Please submit your script latest by 11th Nov 2011 for marking)

SAA GLOBAL EDUCATION CENTRE PTE LTD

Company Registration No. 201001206N 20 Aljunied Road, #01-04, CPA House, Singapore 389805 Tel: (65) 6744 9700 Fax: (65) 6744 9796 Website: www.saa.org.sg Email: acca@saa.org.sg

Question 1 Hyflux Ltd acquired 2.4 million shares of Sunny Ltd on 1 Oct 2011, by issuing two of its own shares for every three shares in Sunny Ltd and a deferred payment of $1.00 for every eight Sunny Ltd shares payable on 1 Oct 2013. Hyflux Ltds share was trading at a market price of $2.00 on 1 Oct 2011; the present value of the cash consideration is equal to $0.80 at a discount rate of 12% per annum. The deferred cash consideration has not been recorded as part of the investment. The following profit statements have been prepared for Hyflux Ltd and Sunny Ltd for the year ended 31 Dec 2011. Hyflux Ltd $000 Sales Cost of sales Gross profit Operating expenses Finance costs Profit before tax Taxation Profit after tax Dividends Retained profit for the year 700 (306) ____ 394 (27) (15) ____ 352 (92) _____ 260 (100) _____ 160 ______ Sunny Ltd $000 300 (188) ____ 112 (20) (12) ____ 80 (24) _____ 56 0 _____ 56 _____

Balance Sheet As at 31 Dec 2011 Hyflux Ltd $000 Assets Non Current Assets Property, plant and equipment Investments $000 3,100 3,300 ____ 6,400 1,200 1,300 800 ____ 9,700 ____ Sunny Ltd $000 $000 3,000 30 ____ 3,030 500 240 105 ____ 3,875 ____

Current assets Stock Debtors Bank and cash Total assets

Equity and liabilities Equity shares Accumulated profits Non current liabilities 10% loan Current liabilities Creditors Dividend payable Total equity and liabilities

6,000 620 ______ 6,620 2,000 980 100 _____ 9,700 ______

3,000 340 _____ 3,340 300 235 0 _____ 3,875 ______

Notes i) Hyflux Ltd made sales of $30,000 to Sunny Ltd during the year. These goods originally cost Hyflux Ltd $20,000.Only 50% of these goods had been resold by Sunny Ltd by 31 Dec 2011. Inter company balance were: Owed to Sunny in Hyfluxs book 30 Receivable from Hyflux in Sunnys book 50 The difference is due to a cash in transit, not yet received by Sunny Ltd The fair value of a plant in Sunny Ltd was $160,000 higher than the book value at the date of acquisition, it has a four years remaining life with straight line depreciation. It is estimated that the consolidated goodwill is valued at $600,000 on 31 Dec 2011 following the FRS 103 requirement. There are currently 3 million shares in Sunny Ltd.

ii)

iii)

iv)

v)

Required a) Prepare a consolidated Income Statement for Hyflux Ltd for the year ended 31 Dec 2011. (11 marks) Prepare a consolidated statement of financial position for Hyflux Ltd as at 31 Dec 2011. (14 marks)

b)

Question 2 The trial balance of Baka Ltd, a publicly listed company, at 31 March 2011 is as follows: $000 2,000 8,000 3,250 $000

Investment property Building Plant and equipment at cost Accumulated depreciation 1 April 2010 - building - plant Accumulated profits 1 April 2010 Sales revenues Purchases Construction contract costs to 31 March 2010 Construction contract progress billings received Trade Debtors Inventory Cash in bank 10% preference share Trade creditors Equity shares 6% Loan Note (issued in 2008) Property rental Distribution cost Interim dividend Administration expenses Loan interest paid

3,200 2,200 3,050 27,080 17,000 1,600 1,500 7,520 1,700 3,170 1,200 3,340 4,000 2,000 110 340 2,000 1,000 100 _______ 47,680 _______

______ 47,680 ______

The following notes are relevant: i) On 31 March 2011, the companys only remaining building was revalued at $6 million. The building had an estimated life of 25 years when it was acquired on 1 April 2000 and this has not changed as a result of the revaluation. The directors of Angelo wish to incorporate this value in the financial statements for the year ended 31 March 2011. Plant is depreciated at 20% per annum on net book value. The investment property was revaluated at $1.7 million on 31 Mar 2011. Included in the sales revenue is an amount of $1 million relating to sales made under a sales or return basis. These goods were subsequently returned in good condition after 31 Mar 2011. These goods were sold at a mark up of 25%.

ii) iii)

iv)

The figures in respect of contract balances relate to a three-year contract entered into on 1 July 2010. Details relating to this contract are: $000 Contract price 10,000 Estimated total contract costs 6,000 Agreed value of work completed and billed at 31 March 2011 3,000 Baka Ltds policy is to recognise profits on long-term construction contracts from the point that they become more than 20% complete. The percentage of completion is deemed to be the agreed value of the work completed to date as a percentage of the total contract price. Contract revenue is taken as the agreed value of the work completed to date.

v)

A provision for income tax for the year to 31 March 2011 of $400,000 is required. The directors declared a final dividend of 7c per share for 20 million ordinary shares in issue on 25 March 2011. Closing Inventory as at 31 March 2011 was stated at a cost of $3.1 million.

vi)

Required : a) Prepare the statement of comprehensive income for Baka Ltd for the year ended 31 March 2011. (10 marks) Prepare the statement of changes in equity and (5 marks) c) The statement of financial position for Baka Ltd as at 31 March 2011. (10 marks)

b)

Question 3 Allion Ltd has provided you with the balance sheets and some information for the years to 31 May 2008 and 2009. Allion Ltd Balance Sheet as at 31 May 2009 $000 $000 Non current assets Property, plant and equipment Computer software 31 May 2008 $000 $000

1,320 200 1,520

1,120 100 1,220

Current Assets Stock 520 Debtors 797 Investments Government securities 50 Cash nil Total assets

1,367 2,887

530 584 180 135

1,429 2,649

Equity and Liabilities Capital and Reserves Equity Shares of $1 each Reserves Share premium Accumulated profits

500 140 994 80 972

400

1,134 1,634

1,052 1,452

Non-current liabilities Finance lease obligation Deferred tax Plant maintenance provision Current liabilities Creditors Bank overdraft Unpaid dividends declared Taxation Finance lease obligations

280 12 nil

292

60 92 80

232

600 108 100 83 70

961 2,887

602 nil 120 213 30

965 2,649

The income statement for the year ended 31 Mar 2009 shows the following: $000 Net profit before tax 203 Income tax expenses (41) ____ Net profit after tax 162 Dividend (140) _____ Retained profit 22 _____ The following supporting information is available: i) Details relating to the non-current assets are (in $000s): 31 May 2009 Depreciation NBV nil 20 250 140 nil 480 330 510 1,320 31 May 2008 Cost Depreciation NBV 700 nil 620 150 120 nil 200 30 580 nil 420 120 1,120

Cost Freehold land and buildings nil Leasehold land and buildings 500 Purchased plant 580 Plant on finance lease 650

On 1 April Allion Ltd sold its freehold property for $700,000. The total amount of payments made in the year to 31 March 2009 in respect of finance leases was $275,000, of which $35,000 was for interest. Interest expense on bank overdraft was $10,000. During the same period purchased plant which had originally cost $190,000 was sold for $75,000 giving a profit of $14,000. ii) The plant maintenance provision was released in the income statement in the year to 31 March 2009 as such provisions are no longer permitted under the rules in FRS 37 Provisions, Contingent Liabilities and Contingent Assets. The total tax charge (including deferred tax) in the income statement for the year to 31 March 2009 was $41,000. During the year some Government securities, which are shown at cost in the balance sheet, were sold at a profit of $15,000. This profit was credited to the income statement, as was $9,000 of income received from the securities. No other Government securities were traded during the year. Allion Ltd paid an interim dividend during the year to 31 March 2009 of $40,000.

iii)

iv)

v)

Required : a) As far as the information permits, prepare a cash flow statement for Allion for the year to 31 March 2009 in accordance with FRS 7 Cash Flow Statements. (20 marks) Identify the important areas that you would draw based on the information in the question and the cash flow statement prepared in (a). You are not required to calculate ratios. (5 marks)

b)

Question 4 The IASBs framework for the preparation and presentation of financial statements sets out the concepts that underlies the preparation and presentation of financial statements that external users are likely to rely on when making economic decisions about an enterprise. a) Discuss the extent that the formulation of a conceptual framework by IASB had aided in the process of setting accounting standards? (8 marks)

On 1 January 2008 Lawson Ltd issued an 8% $10 million convertible loan at par. The loan is convertible in three year time to ordinary shares or redeemable at par in cash.The directors decided to issue the convertible loan because a non convertible loan would have required an interest rate of 10%. The directors intend to show the loan at $10 million under the non current liabilities. The following discount rates are available: 8% 0.93 0.86 0.79 10% 0.91 0.83 0.75

Year 1 Year 2 Year 3

Required: Describe how Lawson Ltd should treat the items in its financial statements for the year ended 31 Dec 2008 (7 marks)

Question 5 On 1 Jan 2008, Caterpillar acquired a profitable Game Arcade for $1.5 million, the summarized fair value of the assets reflecting the term of the acquisition was: $,000 500 400 300 300 _____ 1,500 _____

Goodwill Leasehold premise( 10 years remaining) Machines at the premise Operating license

At the dates of acquisition, the machines had an average estimated remaining life of five years and the operating licenses has an effective duration of three years. For the year ended 31 Dec 2008, the Game Arcade generated a very healthy profit of $800,000, which is higher than initial expectation, and business was looking very bright at 31 Dec 2008. But on 1 Apr 2009, the government announced a change in policy to disallow students under the age of 16 years old to enter the Game Arcade, this has seriously affected the revenue of the business, and it is felt that the fair value of the business had fallen to $400,000, taking into account future revenue. A professional assessment of the machines at the premise indicated fair value of $150,000. Required: In accordance with requirements of FRS36 Accounting for impairment of Assets, briefly describe how each of the assets should be valued at 31 Dec 2008 and 31 Dec 2009. (10 marks)

You might also like

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- ICMA. Pakistan Extra Reading Time: Writing Time: (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) 15 Minutes 02 Hours 30 MinutesMODEL PAPER FINANCIAL ACCOUNTING – (AF-301Document5 pagesICMA. Pakistan Extra Reading Time: Writing Time: (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) 15 Minutes 02 Hours 30 MinutesMODEL PAPER FINANCIAL ACCOUNTING – (AF-301Muhammad BilalNo ratings yet

- F2 March 2011Document20 pagesF2 March 2011Dhanushka SamNo ratings yet

- ICMAP Past PaperDocument4 pagesICMAP Past PaperNoman Qureshi100% (2)

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDocument8 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelSherjeel AhmedNo ratings yet

- 9706 June 2011 Paper 41Document8 pages9706 June 2011 Paper 41Diksha KoossoolNo ratings yet

- 2-5hkg 2007 Jun QDocument11 pages2-5hkg 2007 Jun QKeshav BhuckNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Winter (November) 2011 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Winter (November) 2011 ExaminationsHaseeb KhanNo ratings yet

- Financial Accounting Practice May 2009Document8 pagesFinancial Accounting Practice May 2009samuel_dwumfourNo ratings yet

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MNo ratings yet

- F7-FINANCIAL REPORTING - ACCA (INT) 2011 JunDocument9 pagesF7-FINANCIAL REPORTING - ACCA (INT) 2011 JunIrfanNo ratings yet

- 2010 LCCI Bookkeeping and Accounts Series 3Document8 pages2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- Tuition Mock D11 - F7 Questions FinalDocument11 pagesTuition Mock D11 - F7 Questions FinalRenato WilsonNo ratings yet

- Practical Accounting 1 2011Document17 pagesPractical Accounting 1 2011abbey89100% (2)

- PA1 Mock ExamDocument18 pagesPA1 Mock Examyciamyr67% (3)

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- Afa Revision - Final Session Activities QsDocument2 pagesAfa Revision - Final Session Activities Qshaddad2020No ratings yet

- 2nd Yr Midterm (2nd Sem) ReviewerDocument19 pages2nd Yr Midterm (2nd Sem) ReviewerC H ♥ N T Z60% (5)

- Solution Past Paper Higher-Series4-08hkDocument16 pagesSolution Past Paper Higher-Series4-08hkJoyce LimNo ratings yet

- Financial Reporting I - Final Exam 2Document2 pagesFinancial Reporting I - Final Exam 2MohammedBahgatNo ratings yet

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Practical Accounting Problems 1Document4 pagesPractical Accounting Problems 1Eleazer Ego-oganNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- 9706 31 Insert M J 20Document8 pages9706 31 Insert M J 20chirag mehtaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaNo ratings yet

- 2012Document21 pages2012Mohammad Salim HossainNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocument6 pagesInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacNo ratings yet

- Week 1 - P 18 - 3Document1 pageWeek 1 - P 18 - 3Shynasty WilkesNo ratings yet

- Management Control SystemDocument11 pagesManagement Control SystemomkarsawantNo ratings yet

- 120 Resource November 1991 To November 2006Document174 pages120 Resource November 1991 To November 2006Bharat MendirattaNo ratings yet

- Questions On Accounting StandardsDocument6 pagesQuestions On Accounting StandardsDEENo ratings yet

- Auditor's responsibilities for subsequent eventsDocument3 pagesAuditor's responsibilities for subsequent eventsVenniah MusundaNo ratings yet

- Institute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsDocument3 pagesInstitute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsAli SheikhNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNo ratings yet

- March, 2008. Particulars Rs. Particulars Rs. 2,000Document1 pageMarch, 2008. Particulars Rs. Particulars Rs. 2,000Sanjeev BhardwajNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Financial RportingDocument4 pagesFinancial RportingIrfanNo ratings yet

- Fa May June 2011Document3 pagesFa May June 2011xodic49847No ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenNo ratings yet

- Practice Exam Chapter 19-21Document6 pagesPractice Exam Chapter 19-21John Arvi ArmildezNo ratings yet

- Great Zimbabwe University Faculty of CommerceDocument5 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- Cash Flow Exercises Set 1Document3 pagesCash Flow Exercises Set 1chiong0% (1)

- ICMA Questions Dec 2012Document55 pagesICMA Questions Dec 2012Asadul HoqueNo ratings yet

- CAT T10 Managerial Finance Mock Examination December 2010Document7 pagesCAT T10 Managerial Finance Mock Examination December 2010Mr RizviNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNo ratings yet

- Test Series - Test No. - 5. Advanced Accounting120413115441Document5 pagesTest Series - Test No. - 5. Advanced Accounting120413115441Kansal AbhishekNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityFrom EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityRating: 4 out of 5 stars4/5 (2)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Five Rules For Successful PrayerDocument1 pageFive Rules For Successful PrayerCharles Adonteng100% (1)

- Greek Text MNTG Textbook1 7Document521 pagesGreek Text MNTG Textbook1 7Charles AdontengNo ratings yet

- Challenged To Make An ImpactDocument9 pagesChallenged To Make An ImpactCharles AdontengNo ratings yet

- GMAT Test Practice QuestionsDocument21 pagesGMAT Test Practice QuestionsAlhayyal Rashed50% (2)

- The Heroes of FaithDocument111 pagesThe Heroes of FaithpacurarNo ratings yet

- Heart Disease and Stroke StatisticsDocument20 pagesHeart Disease and Stroke StatisticsGeevine CansinoNo ratings yet

- Notes On Malachi 6Document1 pageNotes On Malachi 6Charles AdontengNo ratings yet

- What Is Faith PDFDocument13 pagesWhat Is Faith PDFCharles AdontengNo ratings yet

- Discussion Paper 07052 PDFDocument50 pagesDiscussion Paper 07052 PDFCharles AdontengNo ratings yet

- Sample Community Radio Station Business PlanDocument23 pagesSample Community Radio Station Business PlanCharles Adonteng74% (23)

- Cause Death statsSA PDFDocument33 pagesCause Death statsSA PDFCharles AdontengNo ratings yet

- Jehsquot PDFDocument142 pagesJehsquot PDFCharles Adonteng100% (1)

- Leadership PDFDocument67 pagesLeadership PDFCharles AdontengNo ratings yet

- Article For Tangible AssetDocument4 pagesArticle For Tangible AssetRamen PandeyNo ratings yet

- Keydata European-Media-Companies 2007Document1 pageKeydata European-Media-Companies 2007Charles AdontengNo ratings yet

- Internal Revenue (Amendment) Act 8590001 PDFDocument8 pagesInternal Revenue (Amendment) Act 8590001 PDFCharles AdontengNo ratings yet

- Presentation 7: Sampling Design and ProceduresDocument18 pagesPresentation 7: Sampling Design and ProceduresCharles AdontengNo ratings yet

- Fundamentals Level - Skills Module Preparation for Financial ReportingDocument21 pagesFundamentals Level - Skills Module Preparation for Financial ReportingCharles Adonteng67% (3)

- Albert - Personal Branding Service Delivery - For ProjectionDocument22 pagesAlbert - Personal Branding Service Delivery - For ProjectionCharles AdontengNo ratings yet

- McKneeley Internal ControlsDocument16 pagesMcKneeley Internal ControlsCharles AdontengNo ratings yet

- Teaching and PreachingDocument4 pagesTeaching and PreachingCharles AdontengNo ratings yet

- A Short History of The Apostles Revelation SocietyDocument15 pagesA Short History of The Apostles Revelation SocietyCharles AdontengNo ratings yet

- A Ijara Home FinanceDocument13 pagesA Ijara Home FinanceIndranil RoyNo ratings yet

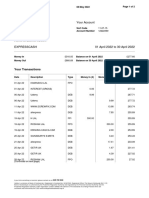

- Rental Agreement of Infra SolutionDocument3 pagesRental Agreement of Infra Solutionpraveen kittaNo ratings yet

- Magpantay-Payroll LocalDocument17 pagesMagpantay-Payroll LocalKate Catherine MatiraNo ratings yet

- Company Law - Floatation Charges, Sem 5, Pintu Babu, Roll 110Document17 pagesCompany Law - Floatation Charges, Sem 5, Pintu Babu, Roll 110Devendra DhruwNo ratings yet

- Impact of Foreign Aid on Economic DevelopmentDocument10 pagesImpact of Foreign Aid on Economic DevelopmentMazwan ManselahNo ratings yet

- Impact of Liberalisation of The Insurance Sector On The Life Insurance Corporation of IndiaDocument10 pagesImpact of Liberalisation of The Insurance Sector On The Life Insurance Corporation of IndiaBrijbhushan ChavanNo ratings yet

- CFA Level II: DerivativesDocument48 pagesCFA Level II: DerivativesCrayonNo ratings yet

- Final 2022 Budget Call CircularDocument44 pagesFinal 2022 Budget Call CircularShadreck MaxwellNo ratings yet

- Compound InterestDocument2 pagesCompound InterestEllen Mae OlaguerNo ratings yet

- Module-4: NBFCS, Micro Finance, Leasing and Hire PurchaseDocument64 pagesModule-4: NBFCS, Micro Finance, Leasing and Hire PurchaseHariprasad bhatNo ratings yet

- 11th Accounting Class Xi Short NotesDocument27 pages11th Accounting Class Xi Short NotesSibiCkNo ratings yet

- Help to Buy ISA GuideDocument4 pagesHelp to Buy ISA GuidefsdesdsNo ratings yet

- Hotel Accounting StandardsDocument38 pagesHotel Accounting StandardsCalvawell Muzvondiwa100% (1)

- Introduction to Banking Industry and Credit AppraisalDocument47 pagesIntroduction to Banking Industry and Credit AppraisalJasmine KaurNo ratings yet

- Facebook ValuationDocument13 pagesFacebook ValuationSunil Acharya100% (2)

- Group 1 - Cost Volume Profit AnalysisDocument21 pagesGroup 1 - Cost Volume Profit AnalysisPHILL BITUINNo ratings yet

- Hurun India Future Unicorn 2021 Fina Press ReleaselDocument14 pagesHurun India Future Unicorn 2021 Fina Press ReleaselnikunjbubnaNo ratings yet

- Letters of CreditDocument3 pagesLetters of CreditAndrea Ivy DyNo ratings yet

- 2022 April StatementDocument2 pages2022 April StatementAvishekNo ratings yet

- Class XII Accountancy Project AnalysisDocument41 pagesClass XII Accountancy Project AnalysisIshika BothraNo ratings yet

- Chapter 12 in Class ProblemsDocument2 pagesChapter 12 in Class Problemsamu_scribdNo ratings yet

- Cambridge O Level: Accounting 7707/22 May/June 2022Document16 pagesCambridge O Level: Accounting 7707/22 May/June 2022Kutwaroo GayetreeNo ratings yet

- SEC-v.-Prosperity - Com-Inc.Document1 pageSEC-v.-Prosperity - Com-Inc.honey samaniegoNo ratings yet

- Malaysian REITsDocument15 pagesMalaysian REITsASIKIN AZIZNo ratings yet

- Quiz I (Chapters 1 and 2Document5 pagesQuiz I (Chapters 1 and 2govt2No ratings yet

- Working capital managementDocument9 pagesWorking capital managementAbegail Ara Loren33% (3)

- PK Tax News Jun 2008Document2 pagesPK Tax News Jun 2008PKTaxServicesNo ratings yet

- Debt Settlement Letter SampleDocument13 pagesDebt Settlement Letter Samplehassan789cppNo ratings yet

- World Transfer Pricing 2016Document285 pagesWorld Transfer Pricing 2016Hutapea_apynNo ratings yet

- 2023 FAHRO Buyers Guide Final 4-18-23Document38 pages2023 FAHRO Buyers Guide Final 4-18-23Alexandra GonzálezNo ratings yet