Professional Documents

Culture Documents

Crazy Eddie Auditing Case

Uploaded by

Brad FarberCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crazy Eddie Auditing Case

Uploaded by

Brad FarberCopyright:

Available Formats

Brad

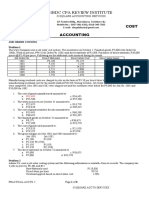

Farber Professor Dignam May 2nd 2013 Case 1.8 Crazy Eddie 1) During the years of 1984 thru 1987, Crazy Eddies financial statements showed a handful of red flags which should have led to auditors raising questions to the companies numbers that were be inflated by Crazy Eddie and the rest of his executive board (which was mostly his family). KEY RATIOS March 1st 1987 March 2nd 1986 March 3rd 1985 May 31 1984 Current Ratio Quick Ratio Account Rec. Turnover Inventory Turnover Debt to Assets 2.40% 1.40% 32 1.35% 0.59% 116 1.56% 0.76% 49 0.01% 0.14% 52 1.95 0.82%

4.98 0.68%

3.55 0.66%

1.89 0.63%

Debt to Equity 2.00% 1.97% 1.74% 4.97% One of the first things that pops out to me when evaluating the ratios is the drastic change in the Accounts Receivables Turnover from 1986-1987. It is just an outlier from the other 3 years and does not make much sense due to the disintegrating market conditions. The inventory turnover differential also might have drawn a red flag. Just if the auditors would have looked at these figures this might have led them to realize that Crazy Eddy overstated inventory by $2M and $9M one year later. This was a domino effect because accounts payable was understated and profits and gross profit majorly overstated to meet investors expectations. Over the 4 years, the cash, inventory accounts were constantly changing drastically year to year which was in large part due to the crazy accounting practices that were used by Eddie and his family. 2) Below is a list of specific audit procedures that might have led to the detection of some of the fraud that occurred in Crazy Eddies books. The code section that refers to proper testing is AU 318. a) The falsification of inventory counts sheets Audit Procedures: If the auditors were ever skeptical of what was going on they could have physically come onto the Crazy Eddy premises and done physical inventory counts periodically without giving the store any warning/time to allow them to conceal wrong an wrong doings.

b) Bogus debit memos for accounts payable Audit Procedures: Substantive testing should have been performed. The auditors should have sent out for confirmations to confirm with the supplier/client the validity of the phony accounts. They should have tested and traced the payable statements to the financials and see if the checks were actually written. Internal controls should have also been looked at. The internal auditor for crazy Eddie was not only doing the internal audit work but was also acting as the controller, and director of accounts payable. c) The recording of transshipping transactions as retail sales Audit Procedures: Eddie used this tactic to overstate inventory. The use of analytics could have been applied to helping the auditors discover this fraud. Peat Marwick and Hurdman could have done a better job observing the gross profit figures, sales, and inventory. All of which were heavily inflated and affected by the transshipping transactions. Cash and receipts should have also been looked over with a closer eye. d) Inclusion of consigned merchandise at year end Audit Procedures: The auditors should have looked more closely at year end inventory physical counts and asked to see documentation to where this inventory came from. If they would have looked into the proper documentation they would have found the evidence that would show that the inventory that they were recording did not in fact belong to them, but to the consignor. This could have been done my matching/tracing the vendor receipts to the financial statements and realizing that they items were never paid for but merely on consignment and should not have been recorded as inventory. 3) A good audit team well looks at internal and external market factors during the stages of planning the audit (Auditing Standard 9). During the later part of the 1980s the boom days for the electronic industries were in the past. The bubble on the industry had burst, NYC had become a saturated market, and increased competition had made things much harder for those retail stores that were still in business. The auditors should have been aware of the market situation, and realized that in times like these, a company which is showing record amounts of profit , should be looked at with a closer eye of professional skepticism. The audit risk should have been raised when that type of market condition existed. 4) The term lowballing relates to an independent audit firm giving a potential new audit client a ridiculously low price on the audit work. The motivation behind this is retain a audit client and charge them little for the audit services in hopes to them hiring you to do the consulting work for the firm as well. This is done with the hopes that they can overcharge the firm for consulting fees and bring in not only audit revenues to the practice, but consulting as well. By a firm doing both the audit and consulting work for a business, it can potentially affect the quality of the work and most definitely the independence of the audit. When a company does the audit work and consulting work it definitely creates a conflict of interest and affects the integrity and objectivity of the audit. As we saw in the case of Enron, this can lead to huge problems and can affect the independent auditor have an objective viewpoint.

5) If I were unable to find 10 out of 60 randomly selected I would immediately reach out to my supervisor and let him know about the dilemma that I was in. If I could not find the invoices, but did see the sales order or the money going out, it could be possible that they were misplaced and therefore I would not automatically assume fraud had occurred. Besides reaching out to my supervisor, I might also reach out to the member of the client that I was in touch with and have him look into the situation. If after doing further research, an I was to found out that the invoices were non-existent and there was a potential for fraud, the partner on the engagement would be notified as well as the firms management group. 6) I personally do not feel that companies should be allowed to hire individuals who had served as their independent auditors in the past. One of the biggest disadvantages to this practice is that the person that is hired already has an advantage if they were to try to commit fraud and conceal it. After the Enron debacle and Sarbanes Oxley, tighter standards have been set into place regarding this situation. I think that it is important for people in public accounting to make the transition into the private sector, I am do not think it would be in anyone best interest for the that person to make the switch to go work for a former client. This situation might create a conflict and the cons out weighs the pros.

You might also like

- Crazy EddieDocument5 pagesCrazy EddieAmos N. SandoNo ratings yet

- Leslie Fay Companies Audit RisksDocument7 pagesLeslie Fay Companies Audit Riskslumiradut70100% (2)

- Case 1.7 Crazy Eddy, IncDocument6 pagesCase 1.7 Crazy Eddy, IncMutiara HapsariNo ratings yet

- Question 1Document2 pagesQuestion 1Doris WuNo ratings yet

- Best Company, Inc.: LASE 1.4Document15 pagesBest Company, Inc.: LASE 1.4davidwijaya1986No ratings yet

- Vertical and Horizontal Analysis of ZZZZ Best Co FinancialsDocument12 pagesVertical and Horizontal Analysis of ZZZZ Best Co Financialsasma100% (2)

- Case Study - Crazy Eddie Inc (550 Words)Document5 pagesCase Study - Crazy Eddie Inc (550 Words)blablaNo ratings yet

- Rhode Island Hospital Trust National Bank v. Swartz, Bresenoff, Yavner & Jacobs, A Virginia Partnership, 455 F.2d 847, 4th Cir. (1972)Document9 pagesRhode Island Hospital Trust National Bank v. Swartz, Bresenoff, Yavner & Jacobs, A Virginia Partnership, 455 F.2d 847, 4th Cir. (1972)Scribd Government DocsNo ratings yet

- Soal Ujian KompreDocument26 pagesSoal Ujian KompreVania Dewi UtamiNo ratings yet

- CBI Holding Company, Inc. / Case 2.6Document3 pagesCBI Holding Company, Inc. / Case 2.6octaevia50% (4)

- CasesDocument24 pagesCasesXuan LieuNo ratings yet

- ZZZZ Best Company Inc SummaryDocument1 pageZZZZ Best Company Inc SummaryNovah Mae Begaso Samar100% (1)

- Module B Professional Ethics Learning ObjectivesDocument26 pagesModule B Professional Ethics Learning ObjectivesHashim Zaman100% (1)

- Chapter 14 Audit of The Inventory and Distribution Cycle: Auditing, 14e (Arens)Document23 pagesChapter 14 Audit of The Inventory and Distribution Cycle: Auditing, 14e (Arens)Miruna CiteaNo ratings yet

- Auditing The Art and Science of Assurance Engagements Canadian Twelfth Edition Canadian 12th Edition Arens Test BankDocument18 pagesAuditing The Art and Science of Assurance Engagements Canadian Twelfth Edition Canadian 12th Edition Arens Test Banka442240445No ratings yet

- The 10 Worst Corporate Accounting Scandals of All Time..Document5 pagesThe 10 Worst Corporate Accounting Scandals of All Time..Tamirat Eshetu Wolde100% (1)

- TB 21Document37 pagesTB 21Hasan100% (1)

- Chap005-Consolidation of Less-Than-Wholly Owned SubsidiariesDocument71 pagesChap005-Consolidation of Less-Than-Wholly Owned Subsidiaries_casals100% (3)

- Chap 006Document51 pagesChap 006kel458100% (1)

- Exam 1 Review Sheet GuideDocument12 pagesExam 1 Review Sheet GuidejhouvanNo ratings yet

- Ocean Manufacturing Inc. CaseDocument4 pagesOcean Manufacturing Inc. CaseHafizah MardiahNo ratings yet

- Solution To Assignment 1 Winter 2017 ADM 4348Document19 pagesSolution To Assignment 1 Winter 2017 ADM 4348CodyzqzeaniLombNo ratings yet

- Audit evidence limitations for ZZZZ Best insurance contractsDocument4 pagesAudit evidence limitations for ZZZZ Best insurance contractsNovah Mae Begaso SamarNo ratings yet

- Cash & Internal ControlDocument17 pagesCash & Internal Controlginish12No ratings yet

- Case 2.3 HanauerDocument10 pagesCase 2.3 HanauerAlexa RodriguezNo ratings yet

- Case 5-2 ZZZZ Best 3eDocument11 pagesCase 5-2 ZZZZ Best 3easmaNo ratings yet

- Case No. 1Document2 pagesCase No. 1Ma Elhen Jane AutajayNo ratings yet

- Hit Scripts Is A Service Type Enterprise in The Entertainment FieldDocument1 pageHit Scripts Is A Service Type Enterprise in The Entertainment Fieldtrilocksp SinghNo ratings yet

- Understanding Materiality, Audit Risk, and Applying the Audit Risk ModelDocument34 pagesUnderstanding Materiality, Audit Risk, and Applying the Audit Risk Modelaliza tharaniNo ratings yet

- Accounting QuizDocument3 pagesAccounting QuizMisty Tranquil0% (1)

- Audit Case14-33 CompleteDocument9 pagesAudit Case14-33 CompleteShamsul Annwar75% (4)

- Sample Audit ReportsDocument44 pagesSample Audit Reportsyeosuf100% (1)

- Chapter 9 Governmental and Non-For-profit Accounting Test BankDocument16 pagesChapter 9 Governmental and Non-For-profit Accounting Test BankAngelo Mendez100% (2)

- AIS - Chapter 3 ReviewerDocument10 pagesAIS - Chapter 3 ReviewerEllaNo ratings yet

- A Review of The Ledger of Obi Company at December PDFDocument1 pageA Review of The Ledger of Obi Company at December PDFAnbu jaromiaNo ratings yet

- Corporate DisclosureDocument46 pagesCorporate DisclosureSameerLalakiyaNo ratings yet

- Data Modeling and Database Design: Accounting Information SystemsDocument23 pagesData Modeling and Database Design: Accounting Information SystemsNatasha GraciaNo ratings yet

- Case 1.1 Enron CorporationDocument13 pagesCase 1.1 Enron CorporationAlexa RodriguezNo ratings yet

- Completing The Tests in The Acquisition and Payment Cycle Verification of Selected AccountsDocument4 pagesCompleting The Tests in The Acquisition and Payment Cycle Verification of Selected Accountsmrs leeNo ratings yet

- Acc423 Final Exam 100+ Questions Included 2 ExamsDocument102 pagesAcc423 Final Exam 100+ Questions Included 2 ExamsMaria Aguilar0% (1)

- Wiley - Intermediate Accounting, 17th Edition - 978-1-119-50366-8Document3 pagesWiley - Intermediate Accounting, 17th Edition - 978-1-119-50366-8Jawad Amin0% (3)

- Chapter 19 - Test BankDocument48 pagesChapter 19 - Test Bankjuan100% (2)

- NYTDigitalDocument21 pagesNYTDigitalRuchi SainiNo ratings yet

- Financial Accounting I Final Practice Exam 1Document14 pagesFinancial Accounting I Final Practice Exam 1misterwaterr100% (1)

- Auditing - Hook Chapter 8 SolutionsDocument35 pagesAuditing - Hook Chapter 8 SolutionsZenni T XinNo ratings yet

- Quiz3 HolyeDocument35 pagesQuiz3 HolyegoamankNo ratings yet

- Trevor Blevin Case ScenarioDocument4 pagesTrevor Blevin Case ScenarioJeffrey Quan NgoNo ratings yet

- Accounting For Business Combinations: Learning ObjectivesDocument41 pagesAccounting For Business Combinations: Learning Objectivesmohammad.mamdooh94720% (1)

- Acc 412 Case 3 5 Goodner Brothers Inc 1Document6 pagesAcc 412 Case 3 5 Goodner Brothers Inc 1mrreza85No ratings yet

- Crazy Eddie OringinalDocument4 pagesCrazy Eddie OringinalIan ChenNo ratings yet

- Mid Term 2 Sent 2023Document5 pagesMid Term 2 Sent 2023Linh NguyễnNo ratings yet

- Audit Case Crazy Eddie IncDocument14 pagesAudit Case Crazy Eddie IncceciliaNo ratings yet

- Crazy Eddie Financial Fraud Case Audit ErrorsDocument7 pagesCrazy Eddie Financial Fraud Case Audit ErrorsYang SongNo ratings yet

- Module 2, Case 5Document7 pagesModule 2, Case 5Gabriela Lueiro100% (1)

- FULL SOLUTION TO AUDITING TUTORIAL QUESTIONSsDocument17 pagesFULL SOLUTION TO AUDITING TUTORIAL QUESTIONSsGabriel KorleteyNo ratings yet

- Case 2.2 and 2.5 AnswersDocument4 pagesCase 2.2 and 2.5 AnswersHeni OktaviantiNo ratings yet

- Case 1.1 EnronDocument4 pagesCase 1.1 EnronGracia GunawanNo ratings yet

- Frequent Asked Questions in ExaminationDocument30 pagesFrequent Asked Questions in ExaminationAmandeep Singh Manku100% (1)

- Case 1.1 Mattel IncDocument14 pagesCase 1.1 Mattel IncAlexa Rodriguez100% (1)

- Principle of Auditing AssignmentDocument6 pagesPrinciple of Auditing AssignmentranjinikpNo ratings yet

- 1 s2.0 S0148296322009407 MainDocument12 pages1 s2.0 S0148296322009407 MainudararockNo ratings yet

- BME01.HM3C.chapter 1. Roa, GiovanniDocument3 pagesBME01.HM3C.chapter 1. Roa, Giovannigiovanni roaNo ratings yet

- Safety Gate ContactsDocument8 pagesSafety Gate ContactsinigoNo ratings yet

- Finance Lafargeholcim Annual Report 2016 enDocument306 pagesFinance Lafargeholcim Annual Report 2016 enYohanes Beato DionisiusNo ratings yet

- Administrative Management TheoryDocument3 pagesAdministrative Management TheoryDam Tuan Anh100% (1)

- Gold Loan About Samarth FinanceDocument48 pagesGold Loan About Samarth FinanceshaileshNo ratings yet

- Implementation of MIS in Wipro: Group 9Document17 pagesImplementation of MIS in Wipro: Group 9Satyam SharmaNo ratings yet

- Achieve Asset Management Objectives Through Effective PlanningDocument2 pagesAchieve Asset Management Objectives Through Effective PlanningSumayyia QamarNo ratings yet

- Foreign Trade Policy FTP 2023 Concepts Notes Questions With MCQsDocument27 pagesForeign Trade Policy FTP 2023 Concepts Notes Questions With MCQscadkmarwahNo ratings yet

- R YHv E7 H 1 U Ew 1 MLR SDocument3 pagesR YHv E7 H 1 U Ew 1 MLR SNaveen MaheshNo ratings yet

- BSZ IM Ch08 4eDocument8 pagesBSZ IM Ch08 4emohitv_18No ratings yet

- BA 2802 - Principles of Finance Solutions To Problems For Recitation #1Document8 pagesBA 2802 - Principles of Finance Solutions To Problems For Recitation #1Eda Nur EvginNo ratings yet

- Chapter 6 Human Resource PlanningDocument7 pagesChapter 6 Human Resource PlanningDiluxshy MariyanNo ratings yet

- Human Resource Development in INDIADocument22 pagesHuman Resource Development in INDIAGangadharNo ratings yet

- Beverly Bird and Carol KoppDocument4 pagesBeverly Bird and Carol KoppAil BrutoNo ratings yet

- Logistics Management PJT GLS VS VRJDocument20 pagesLogistics Management PJT GLS VS VRJSHABNAMH HASANNo ratings yet

- AC3101 PresentationsDocument21 pagesAC3101 PresentationsAngie Koh Ann Ping100% (1)

- Green Accounting FinalDocument23 pagesGreen Accounting Finalyesh cyberNo ratings yet

- JAWABAN SOAL UAS PENGANTAR AKUNTANSI 2Document4 pagesJAWABAN SOAL UAS PENGANTAR AKUNTANSI 2Givania RahmadhaniNo ratings yet

- ACCOUNTING AND FINANCIAL ResearchDocument34 pagesACCOUNTING AND FINANCIAL ResearchAboma Mekonnen86% (7)

- Estate TaxDocument9 pagesEstate TaxHafi DisoNo ratings yet

- Customer AnalysisDocument9 pagesCustomer AnalysisShanu Kabeer100% (1)

- Quiz 1Document4 pagesQuiz 1soldiersmithNo ratings yet

- 1Bdc Cpa Review Institute: Cost AccountingDocument8 pages1Bdc Cpa Review Institute: Cost AccountingJason BautistaNo ratings yet

- Fraud Taxonomies and ModelsDocument14 pagesFraud Taxonomies and ModelsVaibhav Banjan100% (1)

- Single Entry SystemDocument16 pagesSingle Entry Systemmmuneebsda67% (9)

- UdyamDocument1 pageUdyamsnehal bhosaleNo ratings yet

- Departments in An Office OrganizationDocument4 pagesDepartments in An Office OrganizationBARKHANo ratings yet

- Tax Incentives for Manufacturing and AgricultureDocument8 pagesTax Incentives for Manufacturing and AgricultureKY LawNo ratings yet

- Backflush Costing, Kaizen Costing, and Strategic CostingDocument9 pagesBackflush Costing, Kaizen Costing, and Strategic CostingShofiqNo ratings yet