Professional Documents

Culture Documents

Costing Solutions Guide

Uploaded by

প্রদীপ হালদারOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costing Solutions Guide

Uploaded by

প্রদীপ হালদারCopyright:

Available Formats

Solutions Guide: Please do not present as your own.

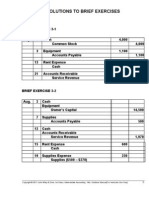

This is only meant as a solutions guide for you to answer the problem on your own. I recommend doing this with any content you buy online whether from me or from someone else. PROBLEM 221 Schedule of Cost of Goods Manufactured; Income Statement; Cost Behavior [ LO2 , LO3 , LO4 , LO5 , LO6 ] Selected account balances for the year ended December 31 are provided below for Superior Company: Selling and administrative salaries 110,000 Purchases of raw materials 290,000 Direct labor ? Advertising expense 80,000 Manufacturing overhead 270,000 Sales commissions 50,000 Inventory balances at the beginning and at the end of the year as follows: Beginning of year End of year Raw Materials 40,000 10,000 Work in process ? 35,000 Finished goods 50,000 ? The total manufacturing costs for the year were $683,000; the goods available for sale totaled $740,000; and the cost of goods sold totaled $660,000. Required: 1. Prepare a schedule of cost of goods manufactured and the cost of goods sold section of the companys income statement for the year. 2. Assume that the dollar amounts given above are for the equivalent of 40,000 units produced during the year. Compute the average cost per unit for direct materials used and the average cost per unit for manufacturing overhead. 3. Assume that in the following year the company expects to produce 50,000 units and manufacturing overhead is fi xed. What average cost per unit and total cost would you expect to be incurred for direct materials? For manufacturing overhead? (Assume that direct materials is a variable cost.) 4. As the manager in charge of production costs, explain to the president the reason for any difference in average cost per unit between (2) and (3) above. 1. Superior Company Schedule of Cost of Goods Manufactured For the Year Ended December 31 Direct materials: Raw materials inventory, beginning (given).................... Add: Purchases of raw materials (given)......................... Raw materials available for use....................................... Deduct: Raw materials inventory, ending (given)........... Raw materials used in production.................................... Direct labor.......................................................................... Manufacturing overhead (given)......................................... Total manufacturing costs (given)....................................... $40,000 290,000 330,000 10,000 $320,000 93,000 * 270,000 683,000

Add: Work in process inventory, beginning........................ Deduct: Work in process inventory, ending (given)............ Cost of goods manufactured................................................ The cost of goods sold section of the income statement follows: Finished goods inventory, beginning (given)...................... Add: Cost of goods manufactured....................................... Goods available for sale (given).......................................... Deduct: Finished goods inventory, ending.......................... Cost of goods sold (given)..................................................

42,000 * 725,000 35,000 $690,000

$50,000 690,000 * 740,000 80,000 * $660,000

* These items must be computed by working backwards up through the statements. 2. Direct materials: $320,000 40,000 units = $8.00 per unit. Manufacturing overhead: $270,000 40,000 units = $6.75 per unit. 3. Direct materials: $8.00 per unit. Manufacturing overhead: $270,000 50,000 units = $5.40 per unit. 4. The average cost per unit for manufacturing overhead dropped from $6.75 to $5.40 because of the increase in production between the two years. Because fixed costs do not change in total as the activity level changes, the average cost per unit will decrease as the activity level rises.

You might also like

- CH 02, 03 NewDocument14 pagesCH 02, 03 NewIqra AliNo ratings yet

- Assignment No 1 - Cost ClassificationDocument7 pagesAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- Make-Up AssignmentDocument5 pagesMake-Up AssignmentRileyNo ratings yet

- Assignment CH 4Document17 pagesAssignment CH 4Svetlana100% (2)

- Income statement and schedule of cost of goods manufacturedDocument3 pagesIncome statement and schedule of cost of goods manufacturedMarjorie PalmaNo ratings yet

- 202E03Document29 pages202E03Ariz Joelee ArthaNo ratings yet

- Cost of Production Report for Dept 2Document2 pagesCost of Production Report for Dept 2Melody BautistaNo ratings yet

- Managerial AccountingDocument38 pagesManagerial AccountingLEA100% (1)

- Review Questions, Exercises and ProblemsDocument5 pagesReview Questions, Exercises and ProblemsChen HaoNo ratings yet

- Cost Added in Department 2:: Cost of Production ReportDocument12 pagesCost Added in Department 2:: Cost of Production ReporttayyabNo ratings yet

- Ma Assignment 2Document7 pagesMa Assignment 2Osama YaqoobNo ratings yet

- Chap02 Rev. FI5 Ex 2Document18 pagesChap02 Rev. FI5 Ex 2Khate KDb100% (1)

- Cost Accounting Assignment BreakdownDocument10 pagesCost Accounting Assignment BreakdownlifernNo ratings yet

- Problems: 2-58. Cost ConceptsDocument16 pagesProblems: 2-58. Cost ConceptsChristy HabelNo ratings yet

- Practice Material On Cost of Goods Manufectured and Sold Statement. MGT402Document34 pagesPractice Material On Cost of Goods Manufectured and Sold Statement. MGT402Syed Ali HaiderNo ratings yet

- Foxwood Company Income Statement and Cost of Goods ManufacturedDocument3 pagesFoxwood Company Income Statement and Cost of Goods Manufacturedbharteshdas100% (2)

- Process AssignmentDocument11 pagesProcess AssignmentSumit Kumar100% (1)

- Exercise 3-1 Fixed and Variable Cost Behavior (LO1)Document10 pagesExercise 3-1 Fixed and Variable Cost Behavior (LO1)Real Estate Golden TownNo ratings yet

- Khurasan University Faculty of Economics (BBA) : Cost AccountingDocument47 pagesKhurasan University Faculty of Economics (BBA) : Cost AccountingTalaqa Sam Sha100% (2)

- Chapter 17 Standard Costing Setting Standards and Analyzing VariancesDocument23 pagesChapter 17 Standard Costing Setting Standards and Analyzing VariancesHashir AliNo ratings yet

- Cost of Production Reports for Assembly and Other DepartmentsDocument6 pagesCost of Production Reports for Assembly and Other DepartmentssajjadNo ratings yet

- CH 5 - 1Document25 pagesCH 5 - 1api-251535767No ratings yet

- Principle MaterialDocument35 pagesPrinciple MaterialHay JirenyaaNo ratings yet

- IUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Document9 pagesIUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Muhammad ZubairNo ratings yet

- 2-17 ProbabilityDocument5 pages2-17 ProbabilityJeniela EmpleoNo ratings yet

- Chapter 1 & 2 Introduction To Cost AccountingDocument57 pagesChapter 1 & 2 Introduction To Cost AccountingizzahkjNo ratings yet

- Lecture 5.2-General Cost Classifications (Problem 2)Document2 pagesLecture 5.2-General Cost Classifications (Problem 2)Nazmul-Hassan Sumon75% (4)

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- LKAS 02 & LKAS 16 DiscussionDocument2 pagesLKAS 02 & LKAS 16 DiscussionKogularamanan NithiananthanNo ratings yet

- LABOUR COSTING With AnswersDocument53 pagesLABOUR COSTING With AnswersHafsa Hayat100% (2)

- Standard Costing ProblemsDocument12 pagesStandard Costing ProblemsKUNAL GOSAVINo ratings yet

- Exercise 1 - 12: Product Cost Flows Product Versus Period CostsDocument4 pagesExercise 1 - 12: Product Cost Flows Product Versus Period Costsmmdinar100% (3)

- CVP Analysis of Shirt StoreDocument16 pagesCVP Analysis of Shirt StoreChamrith SophearaNo ratings yet

- Exercise 3 5Document1 pageExercise 3 5ismail880% (1)

- Test Bank For Managerial Accounting 6th Edition Weygandt, Kimmel, KiesoDocument7 pagesTest Bank For Managerial Accounting 6th Edition Weygandt, Kimmel, Kiesoa131409420No ratings yet

- Anya's Cleaning ServiceDocument12 pagesAnya's Cleaning ServiceVirginia Concepcion Jobli100% (1)

- Cost Sheet ProblemsDocument7 pagesCost Sheet ProblemsApparao ChNo ratings yet

- Chapter 2 Problem SolutionsDocument14 pagesChapter 2 Problem Solutionscamd1290100% (6)

- Cost Accounting FundamentalsDocument5 pagesCost Accounting FundamentalsCris VillarNo ratings yet

- Self Study Solutions Chapter 3Document27 pagesSelf Study Solutions Chapter 3flowerkmNo ratings yet

- ACC 557 Week 1 Chapter 1Document11 pagesACC 557 Week 1 Chapter 1acurashah100% (1)

- Estimate Variable and Fixed Costs of Truck Operation Using High-Low MethodDocument2 pagesEstimate Variable and Fixed Costs of Truck Operation Using High-Low MethodTanvir Ahmed ChowdhuryNo ratings yet

- Lucky Products Markets Two Computer Games - Predato...Document4 pagesLucky Products Markets Two Computer Games - Predato...DuDuWarNo ratings yet

- Absorption Costing Reconciliation StatementDocument4 pagesAbsorption Costing Reconciliation Statementali_sattar15No ratings yet

- CHAPTER 2 Basic Cost Management ConceptsDocument23 pagesCHAPTER 2 Basic Cost Management ConceptsMudassar Hassan100% (1)

- Cost Volume Profit (CVP) AnalysisDocument12 pagesCost Volume Profit (CVP) AnalysisShan rNo ratings yet

- Cost Accounting QUIZDocument4 pagesCost Accounting QUIZMJ YaconNo ratings yet

- Activity No 1Document2 pagesActivity No 1Makeyc Stis100% (1)

- Principles of Accounting Assignment 1 Question 1Document1 pagePrinciples of Accounting Assignment 1 Question 1amir azamNo ratings yet

- Chapter 3 SolutionDocument71 pagesChapter 3 SolutionAatif KahloonNo ratings yet

- Cost Accounting CHPTR 2Document6 pagesCost Accounting CHPTR 2Keisha Lynch75% (4)

- Solutions To ExercisesDocument21 pagesSolutions To ExercisesGauatam ToshNo ratings yet

- Managerial Accounting Chapter 8 & 9 SolutionsDocument8 pagesManagerial Accounting Chapter 8 & 9 SolutionsJotham NyanjeNo ratings yet

- Module 2 - Methods of Segregating Mixed CostDocument4 pagesModule 2 - Methods of Segregating Mixed CostEmma Mariz GarciaNo ratings yet

- KisikisiDocument7 pagesKisikisijalunasaNo ratings yet

- Cost SheetDocument29 pagesCost Sheetnidhisanjeet0% (1)

- Practice Exercise - Job Order CostingDocument1 pagePractice Exercise - Job Order CostingDennis AleaNo ratings yet

- Man Acc Qs 1Document6 pagesMan Acc Qs 1Tehniat Zafar0% (1)

- Brewer Chapter 2 Alt ProbDocument6 pagesBrewer Chapter 2 Alt ProbAtif RehmanNo ratings yet

- Chapter 2 HandoutDocument7 pagesChapter 2 HandoutAnonymous jm4quoNo ratings yet

- Word List 05Document5 pagesWord List 05Nirmal Kumar Misra100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Economic InfoDocument2 pagesEconomic Infoপ্রদীপ হালদারNo ratings yet

- Caso Quil Icis MyersDocument2 pagesCaso Quil Icis MyersMarioNo ratings yet

- Suppress Evade Fiction Cripple Crutch Inferior Stink Crave ContagiousDocument11 pagesSuppress Evade Fiction Cripple Crutch Inferior Stink Crave Contagiousপ্রদীপ হালদারNo ratings yet

- Basic BankDocument1 pageBasic Bankপ্রদীপ হালদারNo ratings yet

- Level Up 2 Year Schemeofwork Levels 48Document6 pagesLevel Up 2 Year Schemeofwork Levels 48প্রদীপ হালদারNo ratings yet

- Curriculum VitaeDocument2 pagesCurriculum Vitaeপ্রদীপ হালদারNo ratings yet

- Internship Report Format AIUBDocument6 pagesInternship Report Format AIUBRaju FlyNo ratings yet

- 1302580761news Apr 12Document3 pages1302580761news Apr 12প্রদীপ হালদারNo ratings yet

- Basics in Social Science-Course Outline-SecA-JDocument4 pagesBasics in Social Science-Course Outline-SecA-Jপ্রদীপ হালদারNo ratings yet

- Financial SystemDocument9 pagesFinancial Systemপ্রদীপ হালদারNo ratings yet

- SampleFullPaperforaBusinessPlanProposalLOKAL LOCADocument279 pagesSampleFullPaperforaBusinessPlanProposalLOKAL LOCANicole SorianoNo ratings yet

- Ethics in Advertising and Marketing: Presenting byDocument54 pagesEthics in Advertising and Marketing: Presenting byParihar BabitaNo ratings yet

- Icaew Mi - WorkbookDocument452 pagesIcaew Mi - WorkbookDương Ngọc100% (2)

- Contract LetterDocument5 pagesContract LetterprashantNo ratings yet

- WEEK 10-Compensating Human Resources and Employee Benfeits and ServicesDocument8 pagesWEEK 10-Compensating Human Resources and Employee Benfeits and ServicesAlfred John TolentinoNo ratings yet

- Hippo Case StudyDocument3 pagesHippo Case StudyAditya Pawar 100100% (1)

- Payables Selected Installments Report: Payment Process Request PPR Selection CriteriaDocument10 pagesPayables Selected Installments Report: Payment Process Request PPR Selection Criteriaootydev2000No ratings yet

- Effective Talent Management & Succession Planning OptimizationDocument4 pagesEffective Talent Management & Succession Planning OptimizationdaabhiNo ratings yet

- Leslie BoniDocument48 pagesLeslie BonicmkxforumNo ratings yet

- Financial Planning & ForecastingDocument44 pagesFinancial Planning & Forecastingnageshalways503275% (4)

- SKF Group10Document21 pagesSKF Group10Shashikumar UdupaNo ratings yet

- CFAS Chapter 2 Problem 3Document1 pageCFAS Chapter 2 Problem 3jelou ubagNo ratings yet

- Valeura Hse Management System PDFDocument19 pagesValeura Hse Management System PDFAbdelkarimNo ratings yet

- JO - AkzoNobel - Intern HSE HDocument2 pagesJO - AkzoNobel - Intern HSE HudbarryNo ratings yet

- Steel Erection Method Statement-Exit.10 - Rev-01 (AutoRecovered)Document106 pagesSteel Erection Method Statement-Exit.10 - Rev-01 (AutoRecovered)Syed Mohammed ZakariaNo ratings yet

- Orca Share Media1547030319812Document523 pagesOrca Share Media1547030319812Maureen Joy Andrada80% (10)

- SAP Plant Maintenance Training PDFDocument5 pagesSAP Plant Maintenance Training PDFRAMRAJA RAMRAJANo ratings yet

- Planning Strategies: Production PlanningDocument22 pagesPlanning Strategies: Production Planningpprasad_g9358No ratings yet

- Haystack Syndrome (Eliyahu M. Goldratt) (Z-Library)Document270 pagesHaystack Syndrome (Eliyahu M. Goldratt) (Z-Library)jmulder1100% (3)

- SMM Test 20Document94 pagesSMM Test 20Vũ Thị Thanh ThảoNo ratings yet

- Sponsorship Proposal TemplateDocument11 pagesSponsorship Proposal TemplateMichaell Moore100% (2)

- Procurement Reminders (Prebid 02072018)Document12 pagesProcurement Reminders (Prebid 02072018)mr. oneNo ratings yet

- C - 12 LCNRV - Multiple Choice Problem-1 PDFDocument2 pagesC - 12 LCNRV - Multiple Choice Problem-1 PDFJeza Mae Carno FuentesNo ratings yet

- XenArmor Software LicenseDocument4 pagesXenArmor Software LicenseAle RoqueNo ratings yet

- SME Masterplan 2012-2020 Executive SummaryDocument132 pagesSME Masterplan 2012-2020 Executive SummaryMuhammad FadilNo ratings yet

- Asm1 - Bee - Ha Thi VanDocument25 pagesAsm1 - Bee - Ha Thi VanVân HàNo ratings yet

- Parivarthane - Campus 2 Corporate Modules - IntroDocument5 pagesParivarthane - Campus 2 Corporate Modules - IntrocbooklenNo ratings yet

- Examination Warehouse SCM Profit 2023 (1) Muhammad Hafizh Al Ahsan (22b505041182)Document5 pagesExamination Warehouse SCM Profit 2023 (1) Muhammad Hafizh Al Ahsan (22b505041182)Muhammad hafizhNo ratings yet

- HGS Launches New Customer Experience Solution in U.S. (Company Update)Document2 pagesHGS Launches New Customer Experience Solution in U.S. (Company Update)Shyam SunderNo ratings yet

- Queen's MBA Operations Management CourseDocument9 pagesQueen's MBA Operations Management CourseNguyen Tran Tuan100% (1)