Professional Documents

Culture Documents

Buffett Vanderbilt Notes

Uploaded by

Sarah RamirezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buffett Vanderbilt Notes

Uploaded by

Sarah RamirezCopyright:

Available Formats

Meeting with Warren Buffett 28Jan05 synthesized notes by topic On investing How Warren spends his day: - Wakes

s up at 6:45, reads paper at home, often doesnt make it into the office until after the market opens - No set schedule, WB hates having a full calendar - Always takes reading material home - Spends 80% of the day reading, 20% talking on the phone (he then said it might be more like 90/10) - Phone conversations are generally short Investment process: - In the past some things were cheap enough WB could decide in a day (this was somewhat a function of a time period where companies would sell at 2-3x earnings) - Decisions should be obvious to onlookers. You should be able to explain why you bought something in a paragraph. - I dont do DCF (WB says he does a rough approximation in his mind) - Finding ideas is a function of cumulative knowledge over time. Something just comes along usually an event takes place, like a good management team screwing up that creates the opportunity (WB seems to imply here that his reading isnt specifically targeted at finding ideas, but rather that ideas jump out at him as a natural consequence of vociferous reading) - You must be patientgood ideas tend to be clustered together, and may not come at even time intervalswhen you dont find anything for a while it can be irritating - WB isnt bothered by missing something outside his circle of competence - Missing things inside the circle is nerve rackingexamples include WMT, FNM Advice for new investors: - Dont worry too much about your mistakes - Dont learn too much from your mistakes o Dont become Mark Twains frog that never sat again on a stove after being burned o BUTnever be willing to play a fatal game - Dont confuse social progress with the chance to make money look at airlines and autos for examples - Law degree is not essential, but good if you think it will help in your specific career - Learning to think like a lawyer is a valuable trait - Allocate even more of your day to reading than he does - Read lots of Ks and Qs there are no good substitutes for these - Read every page - Ask business managers the following question: If you could buy the stock of one of your competitors, which one would you buy? If you could short, which one would you short? - Always read source (primary) data rather than secondary data - If you are interested in one company, get reports for competitors. You must act like you are actually going into that business, and if you were, youd want to know what your competitors were doing.

Why more people dont follow his advice: - The advice doesnt promise enoughits not a get rich quick scheme, which is what a lot of other philosophies promise - WB mentioned that when he was really young he started investing using technical analysis, but found that he never could make any money with it - I realized that technical analysis didnt work when I turned the chart upside down and didnt get a different answer. - After seeing that charting didnt work, he switched to Grahamit made sense and it worked What Warren reads: - Most of reading includes Ks, Qs and 5 newspapers daily - Hasnt found much worthwhile book reading outside of Graham and Fisher Advice to non-professional investors: - If you like spending 6-8 hours per week working on investments, do it - If you dont, then dollar cost average into index funds. This accomplishes diversification across assets and time, two very important things. - There is nothing wrong with a know nothing investor who realizes it. The problem is when you are a know nothing investor but you think you know something. o NOTE: this is analogous to the concept of metaknowledge that Mauboussin talked abouttheres also a Confucius quote on this Avoiding human misjudgment: - WB said repeatedly that it doesnt take above a 125 IQ to do thisin fact, IQ over this amount is pretty much wasted. Its not really about IQ. - Staying within circle of competence is paramount - When you are within the circle, keep these things in mind: o Dont get in a hurry o You are better off not talking to others o Just keep looking until you find something (dont give up) o Good ideas come in clumps by time, by sector, by asset class Discount rates used for valuation: - Use a long term normalized interest rate for Treasuriese.g. 6% - Dont use different discount rates for different businessesit doesnt really matter what rate you use as long as you are being intellectually honest and conservative about future cash flows. - Only want one variable to compare in order to assess the viability of an investment price versus value. If we allowed discount rates to change it would lead to more than one variable. - WBs assessment of the risk of a company is baked into the probabilities for future cash flow scenarios of the company - I dont know what the true cost of capital is for a business unless we own it Starting a fund from scratch today: - Probably would do the same thing he did before

On Berkshire Managing Berkshire: - Focused hard on creating a company over time that he would like todaybuilt the company around the way he likes to work - Hates meetings, managing people, and company rituals - BRK has no general counsel or IR - Directors meet in person only once per year - 17 people employed at HQ - I dont call managers of my businesses, they call me Buying businesses: - The first question I ask is: Does the owner love the business or does he/she love the money? Its very easy to tell the difference. - I am proud to be able to provide a good home for many businesses. It is like finding a home for a painting. Business owners who are looking to sell can either sell their businesses to Berkshire (like putting painting in the Metropolitan Museum of Art) or sell to an LBO and let them tear it up, dress up the accounting, and resell it (like selling a painting to a porn shop). Why he has a large cash position: - Cant find things to buy - In the past there were times it was like shooting fish in a barrelsometimes even like shooting idle fish in a barrelits not like that now, but there will be times in the future when it will be like that again - Berkshire is currently putting a few billion to work buying a stock, but it wouldnt trouble him deeply if they were not able to take the position On specific industries or companies Subprime mortgage industry: - There are similarities between subprime and manufactured housing financing - The most important factor for the subprime industry is the health of the economy, which has been good of late - Securitization moves the ultimate lender farther away from borrower, which is what causes problems - A shock will probably not occur unless we see materially higher long interest rates200300bps - As long as participants in that industry are charging a high enough interest rate to account for the inherent credit risk, it should be okay. - As far as housing prices go, there wont be a problem until the collateral value falls below the value of the loan - We havent played in that [the subprime industry] yet, but we do own H&R Block, which does some of those loans, although they dont keep the paper. - REIT structures in the subprime industry arent necessarily a bad thing - The economy is going to be far more important than the structure used

Competitive advantage and business model in banking: - Banking is a good business - many banks earn high returns on tangible equity - Charlie and I have been surprised at how much profitability banks have, given that it seems like a commodity business. - Underestimated how sticky customers are and how unaware they are of fees banks charge them - WFC - $4.00 per share after full taxes on $15 of tangible equity - If you have a well run bank, you dont need to be the #1 bank in an area - Bank ROA is not highly correlated to size - You may have to pay 3x tangible equity to buy a bank - Only problem with banks is that sometimes they get crazy and do dumb things91 was a good example - If a bank doesnt do dumb things on the asset side, it will make good money Auto industry outlook (especially GM): - GM bonds are currently selling at B spreads - Auto industry is a very tough business - In the 60s GM had over 50% of the US car marketpeople thought they were impenetrable - GM did dumb labor deals when the accounting didnt require accruals for costs - GM is now a terrible life/health benefits company with an auto business attached o Auto business is well managed, but labor issues are just killer - 2000 auto companies were started after Henry Ford there are now 3 left in the US no money has been really made over time Musings on Coke: - The chance that Coke is not the leader in the carbonated beverage business in the future is very small - Candy bars become very entrenched in their markets and are hard to unseatthey dont travel well into new markets - Coke travels well into new markets - One of the most important thing about Coke as a consumer product is that Coke does not have a taste memory. In other words, the taste of Coke doesnt accumulate in your mouth. This is what makes it easy for some people to have 3,4,5+ Cokes each day. They never tire of it because there is no taste residue. Orange or grape soda accumulates and you get sick of it. Same thing with chocolate. There is no diminishing marginal utility of taste for Coke. WB doesnt believe there has ever been a word written about this phenomenon. On currencies Bet against the dollar / currency hedging: - Currently owns over $20B in foreign currency - No strong feeling on which currencies will do best against the dollar - Increasing interest rates will also add to debt service burden to foreigners

Every day US consumes 5% more than we produceUS is like an enormously wealthy family with a very large farm, and we keep mortgaging larger and larger pieces of it to foreigners Foreigners own net $3T of US securitiesgoes up $2B per day This is no a doom and gloom bet on the US still a great country with great infrastructure Formulated thesis after reading Bureau of Economic Analysis data In November trade imbalance with China was $16B ($190B annualized) This is not a short term betdont know where the dollar is going over the next yearthis is a five year bet Typical investor should not make the same bet unless one found a foreign stock that was attractivecould buy the stock and leave the currency risk unhedged WB never hedges currency risk when he buys a foreign security because he likes the extra diversification it provides

Impacts of the potential revaluation of the Yuan: - If it revalues 10-20% it probably wont have a material impact because the discrepancy between labor costs in China and US is so large - It is unlikely that China will remove the peg - Wal-Mart is opening up big in China The future of the Euro: - There will be strains, but it should be fine over the long term - WB believes it has been a good thing for Europe and the world On inflation Inflation and the CPI: - CPI is flawed as a measure of inflation - Average persons CPI has a very different composition than the weighted CPI used to calculate inflation - CPI understates human consumption - Businesses often have contracts that range from 90 to 360 days, therefore inflation lags substantially - Eventually higher raw material costs will get passed through to the consumer - Health care is 6% of CPI, but 14% of GDP - Home ownership was taken out of the CPI 20 years ago and replaced by an imputed rent amount o Rental rates have not risen since then but home prices havethe increased burden of higher home prices has been fortunately offset for a while by lower interest rates On commodities Oil and natural gas: - Everyone thinks oil has moved a lotyou have to consider the weakening of the dollarif you look at oil priced in Euros it has not moved a lotsame situation with gold

We have seen a real increase in many raw materialscoal is a good example; very scarce right now WB doesnt play the game of betting on the price of oil or commodities often Natty MidAmerican is looking at an Alaskan pipeline Alaska has 80T-90T cubic feet of natural gas (a lot) Trouble with Alaska opportunity: o $2/mcf transport costs o Takes 6-7 years to build pipeline hard to make 6-7 year commitment with uncertain future price outlook o Same issue with LNG terminal build-out Most commodity companies dont trust current prices because theyve been burned too many times on price Oil exploration in the US is tough Today our onshore production is 6MM barrels/day We used to be self-sufficient in oil production, to the point where we had to periodically shut down because we were producing too much US is the most explored oil province in the world havent found a real elephant in the lower 48 states in 30-40 years BRK is not tempted to bet in the oil exploration business in any material way

Aluminum: - No real opinion on it - The problem with raw materials businesses is that theres no brand identityno one ever says, I want a Coke only if it comes in an Alcoa aluminum can - Aluminum, to a large degree, is just stored up electricity, because power is such a huge component of its production cost On public policy Privatizing social security: - We must remember that social security is not for you or me - 10-20 million people will not be able to support themselves when they are old - A rich society like the US should provide that support for its citizens (before one is productive a society should provide good schools, and after one is productive, a society should provide financial support). - Dont think its good to let less competent investors do it on their ownthey need help, they are not wired to be good investors, and its our responsibility to help provide them with the highest SS base possible - Privatization plan would lower the base and require you to invest to make up the difference

Miscellaneous Impact of emerging economies on US: - Dont think it will be anything dramatic Social activities: - Spends 1-2 hours 4-5 times per week playing bridge Charity: - Doing charity work is the opposite of investing with charity, we look for the most difficult problem to solve and the ones that have the lowest probability of success - WB is giving guidelines to trustees (see above), but hes not dictating exactly where he wants to give. WB realizes that he will have no idea what the big problems will be in the distant future after hes gone Warrens success: - I was born wired to allocate capital well. If I was born in Bangladesh and I walked down the street explaining that I allocate capital well, the townspeople would say get a job. - Bill Gates says that if I was born 1000 years ago, I wouldnt survive because I am not fast or strong. I would find myself running from a lion screaming I allocate capital well!!

You might also like

- 1976 Buffett Letter About Geico - FutureBlindDocument4 pages1976 Buffett Letter About Geico - FutureBlindPradeep RaghunathanNo ratings yet

- Interviews Value Investing Guru Roger Montgomery About ValueableDocument3 pagesInterviews Value Investing Guru Roger Montgomery About Valueableqwerqwer123100% (1)

- Robert P. Miles' Warren Buffett FAQ'sDocument4 pagesRobert P. Miles' Warren Buffett FAQ'sNigthstalkerNo ratings yet

- BerkshireHandout2012Final 0 PDFDocument4 pagesBerkshireHandout2012Final 0 PDFHermes TristemegistusNo ratings yet

- Warren E Buffett 2008 CaseDocument9 pagesWarren E Buffett 2008 CaseAnuj Kumar GuptaNo ratings yet

- CNBC Transcript 2006 2019 02Document1,575 pagesCNBC Transcript 2006 2019 02N BNo ratings yet

- Warren Buffett's Mini Unofficial) BiographyDocument8 pagesWarren Buffett's Mini Unofficial) Biographydeepak150383No ratings yet

- Charlie Munger's ArticleDocument20 pagesCharlie Munger's Articlesrinivasan9No ratings yet

- Ruane, Cunniff Investor Day 2016Document25 pagesRuane, Cunniff Investor Day 2016superinvestorbulletiNo ratings yet

- Jean Marie Part 1Document5 pagesJean Marie Part 1ekramcalNo ratings yet

- Safal Niveshak Stock Analysis Excel GuideDocument32 pagesSafal Niveshak Stock Analysis Excel Guidejitintoteja_82No ratings yet

- Print Article on Value Investor Seth KlarmanDocument2 pagesPrint Article on Value Investor Seth KlarmanBolsheviceNo ratings yet

- PremWatsaFairfaxNewsletter7 12-20-11Document6 pagesPremWatsaFairfaxNewsletter7 12-20-11able1No ratings yet

- RV Capital June 2015 LetterDocument8 pagesRV Capital June 2015 LetterCanadianValueNo ratings yet

- Interview With Warren BuffettDocument2 pagesInterview With Warren BuffettAdii BoaaNo ratings yet

- Tiananmen Square To Wall Street - ArticleDocument3 pagesTiananmen Square To Wall Street - ArticleGabe FarajollahNo ratings yet

- Hedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersDocument184 pagesHedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersHedge Clippers100% (2)

- Jean Marie Part 2 - The InterviewsDocument5 pagesJean Marie Part 2 - The Interviewsekramcal100% (1)

- Buffett On Valuation PDFDocument7 pagesBuffett On Valuation PDFvinaymathew100% (1)

- Sellers 24102004Document6 pagesSellers 24102004moneyjungleNo ratings yet

- Chou LettersDocument90 pagesChou LettersLuke ConstableNo ratings yet

- Warren Buffett CNBC Transcript Feb-29-2016 PDFDocument92 pagesWarren Buffett CNBC Transcript Feb-29-2016 PDFAndri ChandraNo ratings yet

- Here Are A Few Relevant ExamplesDocument6 pagesHere Are A Few Relevant ExamplesTeddy RusliNo ratings yet

- Charlie Munger Unplugged WSJDocument22 pagesCharlie Munger Unplugged WSJthushanthaNo ratings yet

- Goodreads - Books Recommended by Warren Buffett (30 Books)Document4 pagesGoodreads - Books Recommended by Warren Buffett (30 Books)Achint KumarNo ratings yet

- Return On Equity:: A Compelling Case For InvestorsDocument15 pagesReturn On Equity:: A Compelling Case For InvestorsPutri LucyanaNo ratings yet

- Geico Case Study PDFDocument22 pagesGeico Case Study PDFMichael Cano LombardoNo ratings yet

- Sears Holdings - Eddie Lampert Is The Shareholders Most Valuable Asset - Sears Holdings Corporation (NASDAQ - SHLD) - Seeking AlphaDocument6 pagesSears Holdings - Eddie Lampert Is The Shareholders Most Valuable Asset - Sears Holdings Corporation (NASDAQ - SHLD) - Seeking AlphaEric MooreNo ratings yet

- Owner Earnings vs. Free Cash Flow ExplainedDocument20 pagesOwner Earnings vs. Free Cash Flow ExplainedRudra Goud100% (1)

- Jim Rogers On CurrenciesDocument5 pagesJim Rogers On CurrenciesBisto MasiloNo ratings yet

- Ragupati Chandrasekaran's Notes From The Biglari Holdings 2012 Annual MeetingDocument10 pagesRagupati Chandrasekaran's Notes From The Biglari Holdings 2012 Annual MeetingThe Manual of Ideas100% (1)

- The 400 Richest Americans" List, and What Is The Source of His WealthDocument16 pagesThe 400 Richest Americans" List, and What Is The Source of His WealthCindy MingNo ratings yet

- Boyar ValueInvestingCongress 131609Document71 pagesBoyar ValueInvestingCongress 131609vikramb1No ratings yet

- Michael Kao The Tao of Asymmetric InvestingDocument18 pagesMichael Kao The Tao of Asymmetric InvestingValueWalk100% (1)

- Case Study - Stella JonesDocument7 pagesCase Study - Stella JonesLai Kok WeiNo ratings yet

- Focus InvestorDocument5 pagesFocus Investora65b66inc7288No ratings yet

- 2007VICW PabraiDocument19 pages2007VICW PabraiAshish AgrawalNo ratings yet

- The Art of Stock PickingDocument13 pagesThe Art of Stock PickingRonald MirandaNo ratings yet

- Value Investing Grapich NovelDocument16 pagesValue Investing Grapich NovelSebastian Zwph100% (1)

- Charlie Rose Warren Buffett InterviewDocument20 pagesCharlie Rose Warren Buffett InterviewkayeskowsikNo ratings yet

- Gems From Warren Buffett Wit and Wisdom From 34 Years of Letters To ShareholdersDocument81 pagesGems From Warren Buffett Wit and Wisdom From 34 Years of Letters To ShareholderskanNo ratings yet

- Notes From The 2004 Wesco Annual Meeting: May 5, 2004 Pasadena, CA by Whitney TilsonDocument24 pagesNotes From The 2004 Wesco Annual Meeting: May 5, 2004 Pasadena, CA by Whitney Tilsonshadysbr0kenNo ratings yet

- Osmium Partners Presentation - Spark Networks IncDocument86 pagesOsmium Partners Presentation - Spark Networks IncCanadianValue100% (1)

- Buffett's 50% Returns from Small InvestmentsDocument4 pagesBuffett's 50% Returns from Small InvestmentsKevin SmithNo ratings yet

- Glenn Greenberg at Columbia: How A Great Investor Thinks (Part 2) - Greg SpeicherDocument5 pagesGlenn Greenberg at Columbia: How A Great Investor Thinks (Part 2) - Greg SpeicherYen GNo ratings yet

- Michael L Riordan, The Founder and CEO of Gilead Sciences, and Warren E Buffett, Berkshire Hathaway Chairman: CorrespondenceDocument5 pagesMichael L Riordan, The Founder and CEO of Gilead Sciences, and Warren E Buffett, Berkshire Hathaway Chairman: CorrespondenceOpenSquareCommons100% (27)

- Schloss-2 408Document3 pagesSchloss-2 408Logic Gate Capital100% (1)

- EV The Price of A BusinessDocument11 pagesEV The Price of A BusinessseadwellerNo ratings yet

- Videoteca - Daniel Haddad (April 2019)Document21 pagesVideoteca - Daniel Haddad (April 2019)Daniel HaddadNo ratings yet

- Tollymore Letters To Partners Dec 2021Document193 pagesTollymore Letters To Partners Dec 2021TBoone0No ratings yet

- Warren BuffetDocument11 pagesWarren BuffetmabhikNo ratings yet

- Bibliophile Warren Buffett's Letter 1957-2017Document165 pagesBibliophile Warren Buffett's Letter 1957-2017Vishal Kedia0% (1)

- Distressed Debt InvestingDocument5 pagesDistressed Debt Investingjt322No ratings yet

- Buffett - 50% ReturnsDocument3 pagesBuffett - 50% ReturnsRon BourbondyNo ratings yet

- Steve Romick SpeechDocument28 pagesSteve Romick SpeechCanadianValueNo ratings yet

- Buffett InflationDocument10 pagesBuffett InflationslinjbiopharmNo ratings yet

- Glenn GreenbergDocument3 pagesGlenn Greenbergannsusan21No ratings yet

- Stay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindFrom EverandStay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindRating: 3 out of 5 stars3/5 (1)

- Economist on Wall Street (Peter L. Bernstein's Finance Classics): Notes on the Sanctity of Gold, the Value of Money, the Security of Investments, and Other DelusionsFrom EverandEconomist on Wall Street (Peter L. Bernstein's Finance Classics): Notes on the Sanctity of Gold, the Value of Money, the Security of Investments, and Other DelusionsNo ratings yet

- Value Investors Club: Intrawest Resorts Hldgs Inc (Snow)Document7 pagesValue Investors Club: Intrawest Resorts Hldgs Inc (Snow)Sarah RamirezNo ratings yet

- Prehospital EMS Essential Service and Public GoodDocument35 pagesPrehospital EMS Essential Service and Public GoodSarah RamirezNo ratings yet

- How To Rekindle Sexual Desire in A Long-TermDocument1 pageHow To Rekindle Sexual Desire in A Long-TermSarah RamirezNo ratings yet

- The Art of EvictionDocument1 pageThe Art of EvictionSarah RamirezNo ratings yet

- Crown Castle Small Cell OpportunityDocument1 pageCrown Castle Small Cell OpportunitySarah RamirezNo ratings yet

- Heinz Annual Report 2012Document104 pagesHeinz Annual Report 2012Sarah Ramirez100% (1)

- ANother Important StudyDocument1 pageANother Important StudySarah RamirezNo ratings yet

- Leon Cooperman - Henry SingletonDocument1 pageLeon Cooperman - Henry SingletonSarah RamirezNo ratings yet

- Mobile Handset Cellular NetworkDocument64 pagesMobile Handset Cellular NetworkSandeep GoyalNo ratings yet

- I Want Pardee Information: Very QuicklyDocument1 pageI Want Pardee Information: Very QuicklySarah RamirezNo ratings yet

- Greatest Powerpoint Slide of All TimeDocument1 pageGreatest Powerpoint Slide of All TimeSarah RamirezNo ratings yet

- Buffet Tu of Nebraska SpeechDocument26 pagesBuffet Tu of Nebraska SpeechSarah RamirezNo ratings yet

- Steve Eisman - Ira Sohn Conference - May 2010Document47 pagesSteve Eisman - Ira Sohn Conference - May 2010Terry Tate Buffett100% (2)

- Buffett's Shocking Sokol Affair ResponseDocument27 pagesBuffett's Shocking Sokol Affair ResponseSarah RamirezNo ratings yet

- 30+ Lifehacks V8Document54 pages30+ Lifehacks V8Sarah RamirezNo ratings yet

- BBrief Six Degrees of Tiger Management 01 03 12Document11 pagesBBrief Six Degrees of Tiger Management 01 03 12Sarah RamirezNo ratings yet

- Basketball Shows High Banker Pay Not A Slam Dunk - FTDocument2 pagesBasketball Shows High Banker Pay Not A Slam Dunk - FTSarah RamirezNo ratings yet

- Forward ContractsDocument31 pagesForward ContractsDeepthi Ravichandhran100% (1)

- COT ReportDocument6 pagesCOT Reportsofyanshah100% (1)

- Quiz 3 ProblemsDocument11 pagesQuiz 3 ProblemsRiezel PepitoNo ratings yet

- Ssy WorldscaleDocument24 pagesSsy WorldscaleFnu JoefrizalNo ratings yet

- Forex Currency Correlation Indicator - What It Is and How It Works - 1610129024373Document9 pagesForex Currency Correlation Indicator - What It Is and How It Works - 1610129024373SamsonNo ratings yet

- Forward ContractsDocument6 pagesForward ContractsAlpa JoshiNo ratings yet

- Financial Risk Management Techniques and StrategiesDocument2 pagesFinancial Risk Management Techniques and StrategiesInsanNo ratings yet

- Foreign Exchange Risk ManagementDocument65 pagesForeign Exchange Risk ManagementBhanu Pratap Singh Bisht100% (2)

- Adv Act NotesDocument77 pagesAdv Act Notesmzvette234100% (1)

- AFAR 13 Derivatives and Hedge Accounting Under PFRS 9Document10 pagesAFAR 13 Derivatives and Hedge Accounting Under PFRS 9Louie RobitshekNo ratings yet

- Private Equity, LBO & Hedge Funds (Bocconi University)Document14 pagesPrivate Equity, LBO & Hedge Funds (Bocconi University)ah02618No ratings yet

- BXE Presentation Aug 2016Document38 pagesBXE Presentation Aug 2016HunterNo ratings yet

- Equity ResearchDocument24 pagesEquity ResearchMaxime BayenNo ratings yet

- Amb Newsletter Screen1 PDFDocument13 pagesAmb Newsletter Screen1 PDFMark AldissNo ratings yet

- Project On Futures and OptionsDocument19 pagesProject On Futures and Optionsaanu1234No ratings yet

- CH 14Document33 pagesCH 144ever.loveNo ratings yet

- Derivative MarketDocument6 pagesDerivative MarketRandy ManzanoNo ratings yet

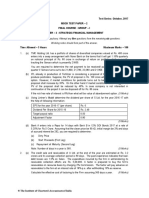

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument16 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerJINENDRA JAINNo ratings yet

- D2 JN 1 VRQJ WIDocument40 pagesD2 JN 1 VRQJ WITheoNo ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationSyed Muhammad JawwadNo ratings yet

- Options 101 A Beginner's Guide To Trading Options in The Stock Market by Steve Burns & Holly Burns PDFDocument42 pagesOptions 101 A Beginner's Guide To Trading Options in The Stock Market by Steve Burns & Holly Burns PDFJohn doe67% (3)

- Chapter 2 Concept of DerivativesDocument21 pagesChapter 2 Concept of DerivativesizwanNo ratings yet

- LIFFE-Bond Futures and OptionsDocument47 pagesLIFFE-Bond Futures and Optionsviktor1500No ratings yet

- HSBC InvestmentsDocument52 pagesHSBC Investmentstacamp daNo ratings yet

- Chapter 11: Forward and Futures Hedging, Spread, and Target StrategiesDocument56 pagesChapter 11: Forward and Futures Hedging, Spread, and Target StrategiesRahil VermaNo ratings yet

- Weather Derivative ValuationDocument392 pagesWeather Derivative ValuationDr. Mahuya BasuNo ratings yet

- PROJECT REPORT OF Angel BrokingDocument57 pagesPROJECT REPORT OF Angel BrokingChandrakant80% (5)

- Internship ReportDocument54 pagesInternship ReportKeerat KhoranaNo ratings yet

- WQU - DTSP - Module 5 - Compiled - Content PDFDocument32 pagesWQU - DTSP - Module 5 - Compiled - Content PDFvikrantNo ratings yet

- 3rd Sem Syallbus FinanceDocument8 pages3rd Sem Syallbus FinanceRutik ShrawankarNo ratings yet