Professional Documents

Culture Documents

13 Introduction To Insurance Financial Statements

Uploaded by

Oladipupo Mayowa PaulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

13 Introduction To Insurance Financial Statements

Uploaded by

Oladipupo Mayowa PaulCopyright:

Available Formats

Introduction to Insurance Financial Statements

A two-day workshop for those new to the analysis of insurance companies, covering the basics of insurance company financial statements, products and risks.

TARGET AUDIENCE

This programme is designed for analysts, regulators and insurance personnel who have limited or no experience in the interpretation and analysis of insurance company financial statements. The workshop is designed as a preparation for the Insurance Company Analysis workshop.

COURSE OBJECTIVES

The overall goal of this two-day workshop is for participants to understand the key components of an insurance companys financial statements to appreciate how these might vary according to the accounting standard used, and to learn to use a few key ratios to analyse financial strength. The course is designed to provide a basic technical background to the insurance industry as a precursor to attending our Insurance Company Analysis workshop. Specifically, in this introductory course, participants will be equipped to: Distinguish the risks inherent in the main products offered by life, non-life (P&C) and reinsurance companies and recognise how these are reflected in the financial statements Understand the key components of an insurance companys income statement, balance sheet and cash-flow statement Recognise the impact of differing accounting standards, reserving policies and changes in external variables (such as interest rates and asset prices) on the financial statements Calculate and apply some basic ratios to quantify an insurance companys financial strength, performance and risk profile.

Technical reserves: loss reserves, unearned premiums, mathematical provisions Investment reserves capital or liability? Fund for Future Appropriations, RfB, Unallocated Divisible Surplus, Discretionary Participation Features (DPF) Intangible and other assets: deferred acquisition costs, value of business acquired Impact of reinsurance on assets, liabilities, premiums and claims Calendar year, accident year and underwriting year reporting for non-life; loss development triangles Cash-flow statement: operating cash flow; divergence from earnings Expected balance sheet structures for different types of insurer Exercises: claims accounting and non-life accounting from scratch (a simplified worked example); balance sheet structures.

ACCOUNTING AND DISCLOSURES

CONTENT

INSURANCE MARKET OVERVIEW

Types of insurance company

Section aims: this section focuses on the characteristics of the main various lines of insurance business, and their inherent risks. Life, non-life and reinsurance Types of insurance co: mutual vs. proprietary, multi-line vs. monoline, underwriters vs. brokers, captive insurers and Lloyds entities.

Section aims: this section explains the key areas of divergence between insurance accounting standards: international differences; the differences between the approaches for shareholder accounts and for statutory supervision; embedded value reporting for life insurance; and accounting for Lloyds syndicates. Key differences between statutory (regulatory) accounts, IFRS (phases I and II) and other GAAP accounts Investment accounting: mark to market vs. cost accounting; treatment of unrealised gains & losses; impaired assets Overview of European Embedded Value (EEV) and MarketConsistent Embedded Value (MCEV) reporting and analysis Lloyds entities: 3-year accounting for syndicates vs. annual accounting Sources of information and quality of disclosure; potential for distortion Case study: IFRS vs. regulatory accounting.

RATIO ANALYSIS

Key activities and products

Non-life products: short tail and long tail lines; degrees of riskiness Life and investment products: whole life, annuity, endowment, term insurance and health products Investment bases for life products: fixed (stable value), unitlinked (variable), with profits, interest-sensitive Reinsurance products: proportional vs. non-proportional, finite risk, excess of loss and catastrophe covers Exercises: life and non-life insurance product risks.

Statement Logic

Section aims: this section explains the key financial items in insurance company financial statements and how the business model is reflected in the balance sheet. Relating the business to the balance sheet and income statement Key items of the balance sheet and income statement for life and non-life insurers Premium accounting: gross vs. net, written vs. earned Claim / loss accounting (non-life): claims incurred vs. paid, claims incurred but not reported (IBNR) Claim / benefit accounting (life): benefits and surrenders, annual and final bonuses

CONTACT US Worldwide: +44 20 3530 2330 E: enquiry@fitchlearning.com

Section aims: this section provides an introduction to the basic analysis of insurance companies using some key ratios from the financial statements. Key performance indicators for life, non-life and reinsurance companies, with benchmarks Investment risks: market and credit risk Underwriting risk: claims / loss ratio, expense and combined ratio and other basic indicators of underwriting performance, reserve adequacy and reinsurance risk Measures of overall profitability for life and non-life insurers Measuring life new business growth and new business profitability Capital adequacy: types of capital and ratios used to measure financial leverage (gearing) and solvency Case study: basic ratio analysis for a major composite insurer.

Learning Paths

US: 212 612 7799 Web: www.fitchlearning.com

Ref: 13 ASIA: +65 6796 7248 Fax: +44 20 3530 2325

You might also like

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- Embedded Value Calculation For A Life Insurance CompanyDocument27 pagesEmbedded Value Calculation For A Life Insurance CompanyJoin RiotNo ratings yet

- B Pension Risk TransferDocument7 pagesB Pension Risk TransferMikhail FrancisNo ratings yet

- Goldman Sachs Presentation To Credit Suisse Financial Services ConferenceDocument20 pagesGoldman Sachs Presentation To Credit Suisse Financial Services ConferenceEveline WangNo ratings yet

- Life InsuranceDocument17 pagesLife Insurancerchawdhry123No ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Insurance AccountingDocument16 pagesInsurance Accountingssp2000No ratings yet

- Bushee-2004-Journal of Applied Corporate FinanceDocument10 pagesBushee-2004-Journal of Applied Corporate Financeaa2007No ratings yet

- Audit Committee Quality of EarningsDocument3 pagesAudit Committee Quality of EarningsJilesh PabariNo ratings yet

- 1.4corporate Business Law PDFDocument180 pages1.4corporate Business Law PDFMohamed LaminNo ratings yet

- EV and VNB MethodologyDocument2 pagesEV and VNB MethodologySaravanan BalakrishnanNo ratings yet

- Lbo Model Long FormDocument5 pagesLbo Model Long FormGabriella RicardoNo ratings yet

- The Pension Risk Transfer Market at $260 BillionDocument16 pagesThe Pension Risk Transfer Market at $260 BillionImranullah KhanNo ratings yet

- European Re InsuranceDocument95 pagesEuropean Re InsuranceKapil MehtaNo ratings yet

- McKinsey Life Insurance 2.0Document52 pagesMcKinsey Life Insurance 2.0Moushumi DharNo ratings yet

- USS Global Equity Fund FactsheetDocument1 pageUSS Global Equity Fund Factsheetsteven burnsNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Basel II Risk Weight FunctionsDocument31 pagesBasel II Risk Weight FunctionsmargusroseNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- What Is The Difference Between Book Value and Market ValueDocument12 pagesWhat Is The Difference Between Book Value and Market ValueAinie Intwines100% (1)

- How to structure investments to protect downsideDocument6 pagesHow to structure investments to protect downsidehelloNo ratings yet

- 157 28235 EA419 2012 1 2 1 CH 08Document38 pages157 28235 EA419 2012 1 2 1 CH 08devidoyNo ratings yet

- Sector Specific Ratios and ValuationDocument10 pagesSector Specific Ratios and ValuationAbhishek SinghNo ratings yet

- Debt Service Coverage Ratio DSCR Net Income/ DebtDocument10 pagesDebt Service Coverage Ratio DSCR Net Income/ DebtAlvaroDeCampsNo ratings yet

- Enterprise Risk Management A Complete Guide - 2019 EditionFrom EverandEnterprise Risk Management A Complete Guide - 2019 EditionNo ratings yet

- Wealth & Asset ManagementDocument17 pagesWealth & Asset ManagementVishnuSimmhaAgnisagarNo ratings yet

- Leadership Risk: A Guide for Private Equity and Strategic InvestorsFrom EverandLeadership Risk: A Guide for Private Equity and Strategic InvestorsNo ratings yet

- Capital Structure of An LBO PDFDocument3 pagesCapital Structure of An LBO PDFTim OttoNo ratings yet

- ContentServer 9 PDFDocument17 pagesContentServer 9 PDFDanudear DanielNo ratings yet

- Process and Asset Valuation A Complete Guide - 2019 EditionFrom EverandProcess and Asset Valuation A Complete Guide - 2019 EditionNo ratings yet

- Applied Corporate Finance: Journal ofDocument15 pagesApplied Corporate Finance: Journal ofFilouNo ratings yet

- IveyMBA Permanent Employment Report PDFDocument10 pagesIveyMBA Permanent Employment Report PDFUmesh T NNo ratings yet

- Alternative Investment Strategies A Complete Guide - 2020 EditionFrom EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNo ratings yet

- Financial Fine Print: Uncovering a Company's True ValueFrom EverandFinancial Fine Print: Uncovering a Company's True ValueRating: 3 out of 5 stars3/5 (3)

- FCFE Vs DCFF Module 8 (Class 28)Document9 pagesFCFE Vs DCFF Module 8 (Class 28)Vineet AgarwalNo ratings yet

- Chapter 11 Leveraged Buyout Structures and ValuationDocument27 pagesChapter 11 Leveraged Buyout Structures and ValuationanubhavhinduNo ratings yet

- Mid MonthDocument4 pagesMid Monthcipollini50% (2)

- Assignment 3 - Financial Case StudyDocument1 pageAssignment 3 - Financial Case StudySenura SeneviratneNo ratings yet

- Investment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFDocument24 pagesInvestment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFQuantDev-MNo ratings yet

- Business Valuation ManagementDocument42 pagesBusiness Valuation ManagementRakesh SinghNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Private Companies (Very Small Businesses) Key Financial DifferencesDocument50 pagesPrivate Companies (Very Small Businesses) Key Financial DifferencesFarhan ShafiqueNo ratings yet

- Ohlson 2007Document10 pagesOhlson 2007mzurzdcoNo ratings yet

- Chapter One: Mcgraw-Hill/IrwinDocument17 pagesChapter One: Mcgraw-Hill/Irwinteraz2810No ratings yet

- Tax Issues in Purchase and Sale AgreementsDocument20 pagesTax Issues in Purchase and Sale AgreementsTaichi ChenNo ratings yet

- Guideline D-9: Source of Earnings Disclosure for Life Insurance CompaniesDocument7 pagesGuideline D-9: Source of Earnings Disclosure for Life Insurance CompaniesFredericYudhistiraDharmawataNo ratings yet

- Reformulation - Analysis of SCFDocument17 pagesReformulation - Analysis of SCFAkib Mahbub KhanNo ratings yet

- Starboard Value LP LetterDocument4 pagesStarboard Value LP Lettersumit.bitsNo ratings yet

- The Role of The Insurance Industry Association: Brad Smith and Diana KeeganDocument30 pagesThe Role of The Insurance Industry Association: Brad Smith and Diana Keeganrajesh_natarajan_4No ratings yet

- Financial Modeling ExamplesDocument8 pagesFinancial Modeling ExamplesRohit BajpaiNo ratings yet

- Financial Modeling Fundamentals QuizDocument10 pagesFinancial Modeling Fundamentals QuizdafxNo ratings yet

- Investment Risk and Return AnalysisDocument20 pagesInvestment Risk and Return AnalysisravaladityaNo ratings yet

- REIT (Real Estate Investment Trust) Valuation 101: Would You Like A Dividend With Your Funds From Operations?Document16 pagesREIT (Real Estate Investment Trust) Valuation 101: Would You Like A Dividend With Your Funds From Operations?ziuziNo ratings yet

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsFrom EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNo ratings yet

- Article - Mercer Capital Guide Option Pricing ModelDocument18 pagesArticle - Mercer Capital Guide Option Pricing ModelKshitij SharmaNo ratings yet

- Capital Structure: Capital Structure Refers To The Amount of Debt And/or Equity Employed by ADocument12 pagesCapital Structure: Capital Structure Refers To The Amount of Debt And/or Equity Employed by AKath LeynesNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulNo ratings yet

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNo ratings yet

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulNo ratings yet

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocument16 pagesBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNo ratings yet

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

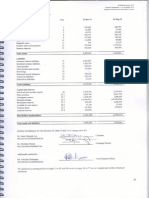

- Abridged Financial Statement September 2012Document2 pagesAbridged Financial Statement September 2012Oladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- Diamond Bank Half Year Results 2011 SummaryDocument5 pagesDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

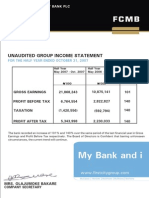

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocument4 pagesFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- FirstCity Group profit up 88% in 3 monthsDocument1 pageFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulNo ratings yet

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulNo ratings yet

- 2006 Q1resultsDocument1 page2006 Q1resultsOladipupo Mayowa PaulNo ratings yet

- 2011 Year End Results Press Release - FinalDocument2 pages2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Document5 pages9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- June 2009 Half Year Financial Statement GaapDocument78 pagesJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNo ratings yet

- GTBank FY 2011 Results PresentationDocument16 pagesGTBank FY 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2012 Results AnalysisDocument17 pagesGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulNo ratings yet

- Final Fs 2012 Gtbank BV 2012Document16 pagesFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- MINNA PADI INVESTAMA SEKURITAS 2017 ANNUAL REPORTDocument158 pagesMINNA PADI INVESTAMA SEKURITAS 2017 ANNUAL REPORTRina KusumaNo ratings yet

- E-banking services explainedDocument12 pagesE-banking services explainedSaniya MhateNo ratings yet

- G.R. No. 174269 - Pantaleon Vs AmEx (2009)Document3 pagesG.R. No. 174269 - Pantaleon Vs AmEx (2009)Sarah Jade LayugNo ratings yet

- Isa 805Document13 pagesIsa 805baabasaamNo ratings yet

- Bangladesh Development Bank loan application formDocument27 pagesBangladesh Development Bank loan application formJadid HoqueNo ratings yet

- Life Cycle of A LoanDocument12 pagesLife Cycle of A LoanSyed Noman AhmedNo ratings yet

- AudprobDocument3 pagesAudprobJonalyn MoralesNo ratings yet

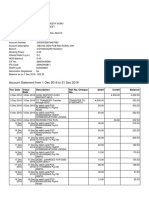

- Account Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceENDLURI DEEPAK KUMARNo ratings yet

- Afar 106 - Home Office and Branch Accounting PDFDocument3 pagesAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNo ratings yet

- Request PaymentDocument37 pagesRequest Paymentsaodahshidah100% (1)

- Sip Report - Bajaj MBADocument49 pagesSip Report - Bajaj MBAGaurav MantalaNo ratings yet

- Agent Name, License No & IRDA URN ListDocument20 pagesAgent Name, License No & IRDA URN ListHarshad BhirudNo ratings yet

- Bank Statement 2Document1 pageBank Statement 2bc180204979 ALI FAROOQNo ratings yet

- The Reasons of This Question: 2. Levels of Career GoalsDocument17 pagesThe Reasons of This Question: 2. Levels of Career GoalsRaviraj ZalaNo ratings yet

- Shippers Letter of InstructionDocument2 pagesShippers Letter of InstructionWilliam LooNo ratings yet

- SAP Question BankDocument33 pagesSAP Question Bankpunithan81No ratings yet

- Session 14 Digest CHARLES LEE V CADocument3 pagesSession 14 Digest CHARLES LEE V CAAnna Marie DayanghirangNo ratings yet

- Constitutions Heeb Farmers AssociationDocument20 pagesConstitutions Heeb Farmers AssociationSamoon Khan Ahmadzai100% (2)

- Lala Shanti Swarup Vs Munshi Singh & Ors On 3 January, 1967Document5 pagesLala Shanti Swarup Vs Munshi Singh & Ors On 3 January, 1967Knowledge GuruNo ratings yet

- Application Forms, Financial Results, EMI Calculator and MoreDocument21 pagesApplication Forms, Financial Results, EMI Calculator and MoreRohanTheGreatNo ratings yet

- 2 LetterDocument9 pages2 LetterSaif AzmanNo ratings yet

- Acme Shoe, Rubber and Plastic Corporation v. CA - Scire LicetDocument2 pagesAcme Shoe, Rubber and Plastic Corporation v. CA - Scire LicetRonn PagcoNo ratings yet

- Bills of ExchangeDocument16 pagesBills of ExchangeswayamNo ratings yet

- Impact of Cashback Offers On Consumer BehaviorDocument10 pagesImpact of Cashback Offers On Consumer BehaviorsonikaNo ratings yet

- Streamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221Document4 pagesStreamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221jo220171No ratings yet

- Pengetahuan Cargo 2016Document121 pagesPengetahuan Cargo 2016danu yp100% (3)

- Marine and Energy CoversDocument13 pagesMarine and Energy CoversmanojvarrierNo ratings yet

- Barbados Credit Unions Funeral InsuranceDocument12 pagesBarbados Credit Unions Funeral InsuranceKammieNo ratings yet

- Prepare The Cash BookDocument4 pagesPrepare The Cash BookShaloom TV100% (1)

- B3 PDFDocument465 pagesB3 PDFabdulramani mbwana100% (7)