Professional Documents

Culture Documents

Lesson Plan in Bookkeeping For Demo

Uploaded by

Christine Garcia RafaelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson Plan in Bookkeeping For Demo

Uploaded by

Christine Garcia RafaelCopyright:

Available Formats

Polytechnic University of the Philippines Mabini Campus, Sta.

Mesa, Manila COLLEGE OF EDUCATION

Lesson Plan in Bookkeeping (CHAPTER 4: Measuring Business Income) I. TARGETS

At the end of the lesson, the students will be able to: 1. Identify the difference between the cash basis of accounting and accrual basis of accounting. 2. Determine the importance of the accounting period in any business entity. 3. Explain the revenue principle and the expense principle of accounting as well the framework it has for the preparation and presentation of financial statements. 4. Generalize the significance of the time-period concept in a business. II. CONCEPT Measuring Business Income SUBCONCEPT: Cash vs. Accrual Basis of Accounting Accounting Period Revenue Principle Expense Principle Time-Period Concept MATERIALS:

Projector Laptop

Cartolina and score cards Chalk / Whiteboard Marker REFERENCE: Hernane, Milagros. Principle in Financial Accounting, pages 101-103

III.

STRATEGIES A. PREPARATION 1. Routine Activities Greeting the class, prayer, passing of assignments (if they have) and ask them to keep all their notes away. 2. Review

Show them the illustration in the cartolina paper which indicates the table of debit and

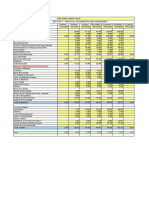

credit rules and let the whole class answer for the corresponding exercise. Ask one of the students for each right answer to write the correct answer in the board. DEBIT AND CREDIT RULES Increase ASSETS **Debit Credit Credit Debit Credit Debit Decrease Credit Debit Debit Credit Debit Credit Balance Credit Credit Debit Credit Debit Debit Norm

LIABILITIES CAPITAL Drawing EXPENSE 3. Motivation Owners,

REVENUE

**the shaded part shown in this table will be eliminated in the actual material.

A student has the tendency to divert his/her attention in some other stuff during the

discussion especially in a math class. Throughout the discussion this motivation would play part. The class will be divided into two groups. The name of the game is Pick Your Luck. Each group should have different representative to answer the questions throughout the discussion. The first player who raises his hand will be given the chance to answer the question. If the

player got the correct answer then, he will choose a number of his want in the score board then he will reveal whats inside it and the points will be added to the groups score. Take note that the score cards in the score board has special powers that can get the rivals point, import chance to answer the next question or they can share scores. one of the member of the other group and neutralizes the opponent so that it cannot get the

B. PRESENTATION Cash Basis of Accounting Cash vs. Accrual Basis of Accounting

Recognizes revenue when cash is received. Recognizes expense when cash is paid. Under the cash basis, service rendered in current year (2013) for which cash is

collected in the next year (2014) would be treated as 2014 revenue. the next year (2014) is 2014 expense.

Under the cash basis, expense incurred in current year (2013) for which cash is disbursed in Because of these improper assignments of revenues and expenses, the cash basis of

accounting is generally considered unacceptable. There is no need for adjusting entries under the cash basis of accounting. Accrual Basis of Accounting cash is received.

Recognizes revenue when sales are made or services are performed, regardless of when Recognizes expense as incurred, whether or not cash is paid out.

Under the accrual basis of accounting, adjusting entries are prepared to bring the accounts

up-to-date for an economic activity that has taken place but has not been recorded. Accounting Period Accounting period is the period of time: One month One year One quarter Into which an entitys life is arbitrarily divided for financial statement purposes. Every

business prepares Annual Financial Statements. Fiscal Year Twelve month accounting period used by an entity. Used by most companys coincides with the calendar year which ended on (some other) December 31.

Revenue Principle is the basis for recording revenues Tells accountants when to record revenue and the amount of revenue to record. Says to record revenue when it has been earned-but not before.

Revenue Principle

Framework for the Preparation and Presentation of Financial Statements States that Income or Revenue is recognized in the income statement when an increase in future economic benefit related to an increase in an asset or a decrease of a liability has risen that can be measured reliably. The Matching Principle Matching Principle guides accounting for expense. Identifies all expenses incurred during the period, measure the expenses, and match them against the revenue earned during the same time period. The Framework for the Preparation and Presentation of Financial Statements Expenses are recognized in the income statement when a decrease in future economic benefit related to a decrease in an asset or an increase of a liability has arisen that can be measured reliably. Time-Period Concept Ensures that information is reported at regular intervals. Fire insurance policies, for example, cover a period of 12 months. If a company prepares

monthly income statements, a portion of the cost of such policy should be allocated to the cost months. building, furniture & fixtures, machine & equipment provides benefits to the business over all the years in which such an asset is used. Not all transaction can be precisely divided by the accounting periods. The purchase of a

of insurance expense each month that is policy is in force. Cost of the policy=total cost/12

estimate objectively the number of accounting period. Accounting principle require that the expenditure be charge immediately to expense. C. APPLICATION 1. How many months does the fiscal year has? Ask questions to the students about the topic that has been discussed.

For some expenditures, such as advertising/employee training programs it is not possible to

2. State the basic principle of revenue in your own words. 3. State the basic principle of expense in your own words. 4. For you, which is better? Cash or Accrual basis of accounting?

D. EVALUATION E. AGREEMENT See attached paper Before dismissing the class, ask them to read ahead the next topic. Reference: Hernane, Milagros. Principle in Financial Accounting, pages 103-106

Polytechnic University of the Philippines Mabini Campus, Sta. Mesa, Manila COLLEGE OF EDUCATION

Name: _________________________________ Course, Year & Section: ___________________

Date: _______________ Miss Christine Garcia

GENERAL INSTRUCTIONS: Erasures and any form of alterations are invalid and will be considered wrong. I. IDENTIFICATION: Write on the spaces provided the term that is being described

______________1. Tells accountants when to record revenue and the amount of revenue to record. ______________2. Twelve month accounting period used by an entity. ______________3. Ensures that information is reported at regular intervals. ______________4. Recognizes revenue when cash is received. ______________5. Recognizes in the income statement when an increase in future economic benefit related to an increase in an asset or a decrease of a liability has risen that can be measured reliably. ______________6. Recognizes in the income statement when a decrease in future economic benefit related to a decrease in an asset or an increase of a liability has arisen that can be measured reliably. ______________7. Identifies all expenses incurred during the period, measure the expenses, and match them against the revenue earned during the same time period. ______________8. Into which an entitys life is arbitrarily divided for financial statement purposes. Every business prepares Annual Financial Statements. ______________9. Recognizes expense as incurred, whether or not cash is paid out. ______________10. Recognizes expense when cash is paid.

You might also like

- Lesson Plan Abm Semi DetailedDocument4 pagesLesson Plan Abm Semi DetailedLiza Reyes GarciaNo ratings yet

- A Lesson Plan in BookkeepingDocument4 pagesA Lesson Plan in Bookkeepingdolores100% (9)

- Books of Accounts Lesson for ABM StudentsDocument9 pagesBooks of Accounts Lesson for ABM StudentsJessuel Larn-eps100% (2)

- Lesson Plan Debits and Credits Using T AccountsDocument3 pagesLesson Plan Debits and Credits Using T AccountsAngela Edel93% (15)

- ABM Lesson PlanDocument3 pagesABM Lesson PlanCharapril Jen LabadanNo ratings yet

- Types of Business According to Activities Lesson PlanDocument3 pagesTypes of Business According to Activities Lesson PlanRaul Soriano Cabanting100% (2)

- Detailed Lesson Plan in ABMDocument5 pagesDetailed Lesson Plan in ABMDMarrie Abao Boniao-LabadanNo ratings yet

- Accounting Equation ExplainedDocument2 pagesAccounting Equation ExplainedLotisBlanca96% (95)

- DLP Pauline M. CustodioDocument7 pagesDLP Pauline M. CustodioPauline Custodio100% (2)

- Introduction to AccountingDocument5 pagesIntroduction to Accountingdelgadojudith67% (3)

- Introduction to Accounting BranchesDocument4 pagesIntroduction to Accounting Branchesdelgadojudith63% (8)

- ABM 11 Lesson PlanDocument4 pagesABM 11 Lesson PlanMabelle Dabu Facturanan100% (4)

- Semi Detailed Lesson Plan For Shs Abm StrandDocument7 pagesSemi Detailed Lesson Plan For Shs Abm StrandJudith100% (5)

- Lesson Plan FINAL ACCOUNTING EQUATIONDocument6 pagesLesson Plan FINAL ACCOUNTING EQUATIONrandy magbudhi100% (9)

- 7e's DLL - BOOKS OF ACCOUNTS For Observation3Document3 pages7e's DLL - BOOKS OF ACCOUNTS For Observation3Marilyn Nelmida TamayoNo ratings yet

- Adacuna DLP Fabm1 WK2 June 19, 2017 Branches of AccountingDocument4 pagesAdacuna DLP Fabm1 WK2 June 19, 2017 Branches of AccountingALMA ACUNANo ratings yet

- A Detailed Lesson Plan in AccountancyDocument4 pagesA Detailed Lesson Plan in AccountancyJane Dagpin92% (13)

- DLL W1 Fundamentals of Abm 1Document4 pagesDLL W1 Fundamentals of Abm 1Gladzangel Loricabv100% (1)

- ABM LESSON PLAN KoDocument3 pagesABM LESSON PLAN KoJohnrey Saguid PintoNo ratings yet

- Accounting Types of Major Accounts Lesson PlanDocument2 pagesAccounting Types of Major Accounts Lesson PlanJessie Rose Tamayo92% (13)

- Accounting Principles and Special JournalsDocument79 pagesAccounting Principles and Special JournalsMark Marasigan100% (2)

- Accounting Concepts and Principles ExplainedDocument5 pagesAccounting Concepts and Principles Explainedclaire juarez100% (1)

- Prepare Trial BalanceDocument6 pagesPrepare Trial Balancerachel100% (1)

- Detailed Lesson Plan - Accounting - EDUM233 - SLPDocument10 pagesDetailed Lesson Plan - Accounting - EDUM233 - SLPStephen Tusara100% (1)

- Daily Lesson Plan on Accounting Principles and Major Account TypesDocument13 pagesDaily Lesson Plan on Accounting Principles and Major Account TypesJevie GibertasNo ratings yet

- DETAILED LESSON PLAN ON ACCOUNTING CYCLEDocument5 pagesDETAILED LESSON PLAN ON ACCOUNTING CYCLErachel100% (1)

- DLL Fabm1 Week 5Document3 pagesDLL Fabm1 Week 5Emarilyn Bayot50% (2)

- Introduction To Accounting Lesson Plan Balance SheetDocument5 pagesIntroduction To Accounting Lesson Plan Balance SheetBelizean Buay100% (2)

- Lesson Plan For Demo - Fabm2Document6 pagesLesson Plan For Demo - Fabm2ma. benna mendiola67% (3)

- Staffing Training Programs ExplainedDocument2 pagesStaffing Training Programs ExplainedMichel Asturias100% (3)

- Adacuna DLP Fabm1 Wk2 June 23, 2017 Form of Business OrganizationDocument4 pagesAdacuna DLP Fabm1 Wk2 June 23, 2017 Form of Business OrganizationALMA ACUNA100% (1)

- ABM 1 LP COT Aug 29Document6 pagesABM 1 LP COT Aug 29ßella DC Reponoya100% (1)

- Lesson Plan Income Taxation FINALDocument6 pagesLesson Plan Income Taxation FINALRandy Magbudhi100% (2)

- Lesson Plan in Abm: Curriculum Guide)Document5 pagesLesson Plan in Abm: Curriculum Guide)Laarni GomezNo ratings yet

- Detailed Lesson Plan in ABMDocument5 pagesDetailed Lesson Plan in ABMAnonymous QZsOxQsJNo ratings yet

- DLL Grade 12 q2 Week 3 Fabm2Document4 pagesDLL Grade 12 q2 Week 3 Fabm2Mirian De Ocampo0% (1)

- ABM - AOM11 Ih J 16Document2 pagesABM - AOM11 Ih J 16Jarven Saguin100% (1)

- Trial Balance Lesson PlanDocument5 pagesTrial Balance Lesson Planapi-316199002100% (2)

- ABM - AOM11 IIa B 20Document3 pagesABM - AOM11 IIa B 20Jarven Saguin100% (1)

- CFS Lesson Plan for Grade 10 StudentsDocument2 pagesCFS Lesson Plan for Grade 10 StudentsEmarilyn Bayot75% (4)

- Fabm1 Dlp. 2Document5 pagesFabm1 Dlp. 2Rizalyn GarciaNo ratings yet

- Lesson Plan ABM 2 Accounting Books - Journal and LedgerDocument2 pagesLesson Plan ABM 2 Accounting Books - Journal and LedgerJessie Rose Tamayo88% (8)

- Lesson Plan in AccountingDocument7 pagesLesson Plan in AccountingRoz Ada0% (1)

- Types of Business According To ActivitiesDocument7 pagesTypes of Business According To ActivitiesBrenda SebandalNo ratings yet

- Accountancy Forms of BusinessDocument5 pagesAccountancy Forms of BusinessBrenda Sebandal100% (1)

- LP DemoDocument4 pagesLP Demoarthur caiñaNo ratings yet

- A Detailed Lesson Plan For Grade 10 in Salesmanship RecoveredDocument6 pagesA Detailed Lesson Plan For Grade 10 in Salesmanship RecoveredMera Largosa ManlaweNo ratings yet

- A Detailed Lesson Plan (Demo) 2Document4 pagesA Detailed Lesson Plan (Demo) 2randy magbudhi100% (6)

- DLL FABM Week8Document4 pagesDLL FABM Week8sweetzel100% (1)

- 1 Orgman Week 4Document4 pages1 Orgman Week 4RonellaSabadoNo ratings yet

- ADACUNA DLP FABM1 WK2 JULY 3, 2017 Types of Business According To ActivitiesDocument4 pagesADACUNA DLP FABM1 WK2 JULY 3, 2017 Types of Business According To ActivitiesALMA ACUNANo ratings yet

- Detailed Lesson Plan Acctg 3Document4 pagesDetailed Lesson Plan Acctg 3Ivyvine Abella100% (5)

- DLL Grade 12 q1 Week 5 Fabm2Document4 pagesDLL Grade 12 q1 Week 5 Fabm2Mirian De OcampoNo ratings yet

- Bank Accounts GuideDocument5 pagesBank Accounts GuideBrenda Sebandal100% (3)

- Detailed Lesson Plan - Fabm 1Document10 pagesDetailed Lesson Plan - Fabm 1Maria Benna Mendiola83% (6)

- Lesson Plan in Bookkeeping For DemoDocument5 pagesLesson Plan in Bookkeeping For DemoJudy BalaseNo ratings yet

- Lesson Plan in Bookkeeping-Final DemoDocument4 pagesLesson Plan in Bookkeeping-Final DemoJuadjie ParbaNo ratings yet

- Tanauan Institute Senior High Fundamentals WorkbookDocument8 pagesTanauan Institute Senior High Fundamentals WorkbookHanna CaraigNo ratings yet

- ADM BES Module 8 Financial PlanDocument23 pagesADM BES Module 8 Financial PlanVictoria Carumba83% (6)

- FINAL MGT Acct (QCF) Assignment 2 June 2015Document8 pagesFINAL MGT Acct (QCF) Assignment 2 June 2015Dian PuspitasariNo ratings yet

- 2014PPTannouncement PDFDocument7 pages2014PPTannouncement PDFangelgirlfabNo ratings yet

- Native Delicacies PowerpointDocument21 pagesNative Delicacies PowerpointChristine Garcia Rafael100% (3)

- Control TheoryDocument1 pageControl TheoryChristine Garcia RafaelNo ratings yet

- Food Preservation and ProcessingDocument3 pagesFood Preservation and ProcessingChristine Garcia RafaelNo ratings yet

- ParadigmDocument2 pagesParadigmChristine Garcia RafaelNo ratings yet

- Food Spoilage and AdditivesDocument14 pagesFood Spoilage and AdditivesChristine Garcia RafaelNo ratings yet

- ECOLOGYDocument13 pagesECOLOGYChristine Garcia RafaelNo ratings yet

- Use of Motivation in Teaching Learning ProcessDocument19 pagesUse of Motivation in Teaching Learning ProcessLetheyaGeoNo ratings yet

- ParadigmDocument2 pagesParadigmChristine Garcia RafaelNo ratings yet

- Bibliography of Jean PiagetDocument6 pagesBibliography of Jean PiagetChristine Garcia Rafael0% (1)

- Integumentary SystemDocument4 pagesIntegumentary SystemChristine Garcia RafaelNo ratings yet

- Anger and StressDocument5 pagesAnger and StressChristine Garcia RafaelNo ratings yet

- Impotence, Human Sexual BehaviorDocument5 pagesImpotence, Human Sexual BehaviorChristine Garcia RafaelNo ratings yet

- AdjectiveDocument4 pagesAdjectiveChristine Garcia RafaelNo ratings yet

- Government Budget - WikipediaDocument9 pagesGovernment Budget - WikipediaKazim jazaNo ratings yet

- Almoguera, Danielle D. Module 9Document2 pagesAlmoguera, Danielle D. Module 9MirafelNo ratings yet

- Mmu ProgramDocument27 pagesMmu Programabiri bunaebiNo ratings yet

- WSK M2P152 A1a2a3a4Document4 pagesWSK M2P152 A1a2a3a4aldairlopesNo ratings yet

- Research in Transportation Business & Management: Paulus Teguh AditjandraDocument12 pagesResearch in Transportation Business & Management: Paulus Teguh AditjandraHAI LIEN NGOCNo ratings yet

- Buma 20063 International Studies in Business Shared Im With Itech Domt 1Document90 pagesBuma 20063 International Studies in Business Shared Im With Itech Domt 1th yNo ratings yet

- Quantitative Techniques & Operations ResearchDocument6 pagesQuantitative Techniques & Operations ResearchNitin MadhogariaNo ratings yet

- ElementsBookKeepingAccountancy SQPDocument6 pagesElementsBookKeepingAccountancy SQPMohd JamaluddinNo ratings yet

- Fundamentals of Financial Management Lecture Notes 21mar2021Document311 pagesFundamentals of Financial Management Lecture Notes 21mar2021Ruchita SinghalNo ratings yet

- Orchid ExportDocument24 pagesOrchid ExportShaz AfwanNo ratings yet

- 33899Document6 pages33899shoaibNo ratings yet

- Computerization in Retail ShopsDocument78 pagesComputerization in Retail ShopsMrinal DeyNo ratings yet

- Nailpro Abril 2023Document55 pagesNailpro Abril 2023PCNo ratings yet

- ESG and Social Responsibility in the Resources SectorDocument1 pageESG and Social Responsibility in the Resources SectorAam MuhsramNo ratings yet

- Hatfield Resume 2020Document2 pagesHatfield Resume 2020api-468685679No ratings yet

- Term Report On Case Study: Farr Ceramics Production Division: A Budgetary AnalysisDocument10 pagesTerm Report On Case Study: Farr Ceramics Production Division: A Budgetary AnalysisImranul GaniNo ratings yet

- Vdocuments - MX Ykk Zipper CatalogueDocument92 pagesVdocuments - MX Ykk Zipper CatalogueLindy MindyNo ratings yet

- Financial Projections Rabbit FarmDocument9 pagesFinancial Projections Rabbit FarmKunal SinghNo ratings yet

- Functional FabricDocument33 pagesFunctional FabricCEO AV HouseNo ratings yet

- Finals: University of Santo Tomas Faculty of Engineering Mechanical Engineering DepartmentDocument2 pagesFinals: University of Santo Tomas Faculty of Engineering Mechanical Engineering DepartmentSecret SecretNo ratings yet

- What Is A Cryptocurrency ?Document13 pagesWhat Is A Cryptocurrency ?Э. Цэнд-АюушNo ratings yet

- A Goldmine of Customer Data:: CSP Strategies For MonetizationDocument14 pagesA Goldmine of Customer Data:: CSP Strategies For Monetizationstevieevan17No ratings yet

- Reliability Management at Asian PaintsDocument33 pagesReliability Management at Asian PaintsRACHURI POOJITHANo ratings yet

- Cash and Cash Equivalents FundamentalsDocument10 pagesCash and Cash Equivalents FundamentalsGRACE ANN BERGONIONo ratings yet

- Zan - ResumeDocument5 pagesZan - ResumeMyint Myint ZanNo ratings yet

- Entrepreneurial Soft Skills For The Future Author Branka MinicDocument35 pagesEntrepreneurial Soft Skills For The Future Author Branka MinicDavidNo ratings yet

- AMCRPS General Catalogue GB 2021 WebDocument64 pagesAMCRPS General Catalogue GB 2021 WebJesus Revelo BenavidesNo ratings yet

- Calculate Income Tax for Individual TaxpayersDocument4 pagesCalculate Income Tax for Individual TaxpayersKenneth Pimentel100% (1)

- QMS-000351 Nextracker Quality Plan and Documentation - Rev EDocument6 pagesQMS-000351 Nextracker Quality Plan and Documentation - Rev EMohamed ElSadekNo ratings yet

- 33 Ia 2023 I PDFDocument11 pages33 Ia 2023 I PDFMiteshNo ratings yet