Professional Documents

Culture Documents

Bank Reconciliation

Uploaded by

Khawaja SohailCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation

Uploaded by

Khawaja SohailCopyright:

Available Formats

Bank Reconciliation

Part 1 Part 2 Introduction to Bank Reconciliation, Bank Reconciliation Process Sample Bank Reconciliation with Amounts

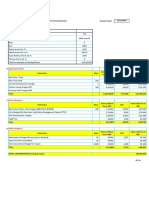

Sample Bank Reconciliation with Amounts

In this part we will provide you with a sample bank reconciliation including the required journal entries. We will assume that a company has the following items: Item #1. The bank statement for August 2011 shows an ending balance of $3,490. Item #2. On August 31 the bank statement shows charges of $35 for the service charge for maintaining the checking account. Item #3. On August 28 the bank statement shows a return item of $100 plus a related bank fee of $10. The return item is a customer's check that was returned because of insufficient funds. The check was also marked "do not redeposit. Item #4. The bank statement shows a charge of $80 for check printing on August 20. Item #5. The bank statement shows that $8 was added to the checking account on August 31 for interest earned by the company during the month of August. Item #6. The bank statement shows that a note receivable of $1,000 was collected by the bank on August 29 and was deposited into the company's account. On the same day, the bank withdrew $40 from the company's account as a fee for collecting the note receivable. Item #7. The company's Cash account at the end of August shows a balance of $967. Item #8. During the month of August the company wrote checks totaling more than $50,000. As of August 31 $3,021 of the checks written in August had not yet cleared the bank and $200 of checks written in June had not yet cleared the bank. Item #9. The $1,450 of cash received by the company on August 31 was recorded on the company's books as of August 31. However, the $1,450 of cash receipts was deposited at the bank on the morning of September 1. Item #10. On August 29 the company's Cash account shows cash sales of $145. The bank statement

shows the amount deposited was actually $154. The company reviewed the transactions and found that $154 was the correct amount.

Before we begin our sample bank reconciliation, learn the following bank reconciliation tip. Put it where it isn't. If an item appears on the bank statement but not on the company's books, the item is probably going to be an adjustment to the Cash balance on (per) the company's books. If an item is already in the company's Cash account, but has not yet appeared on the bank statement, the item is probably an adjustment to the balance per the bank statement. Our approach to the bank reconciliation is to prepare two schedules. The first schedule begins with the ending balance on the bank statement. We refer to this schedule as Step 1. The second schedule begins with the ending Cash account balance in the general ledger. We call this schedule Step 2. Items 1 through 10 above have been sorted into the following schedules labeled Step 1and Step 2. The item number is shown in the far right column of each schedule. Balance per Bank Statement on Aug. 31, $ 2011 3,490 Adjustments: 0 + Deposits in transit 1,450 Outstanding checks 3,221 Bank errors 0 $ Adjusted/Corrected Balance per Bank 1,719 $ 967 Item #1 Item #9 Item #8

Step 1.

Step 2.

Balance per Books on Aug. 31, 2011 Adjustments:

Item #7

Bank service charges NSF checks & fees Check printing charges Interest earned Note Receivable collected by bank Errors in company's Cash account Adjusted/Corrected Balance per Books

35 110 80 + 8 + 960 + 9 $ 1,719

Item #2 Item #3 Item #4 Item #5 Item #6 Item #10

Step 1 Amounts Let's review the schedule for Step 1. In all likelihood the balance shown on the bank statement is not the true balance to be reported on the company's balance sheet. The bank reconciliation process is to list the items that will adjust the bank statement balance to become the true cash balance. As the schedule for Step 1 indicates, the amount of deposits in transit must be added to the bank statement's balance. Also, the amount of checks that have been written, but not yet appearing on a bank statement, must be subtracted from the bank statement's balance. Next any bank errors should be listed and should be reported to the bank for correction. (The company does not report deposits in transit and/or outstanding checks to the bank.) Step 2 Amounts and Required Journal Entries Step 2 begins with the balance in the company's Cash account found in its general ledger. The bank reconciliation process includes listing the items that will adjust the Cash account balance to become the true cash balance. We will review each item appearing in Step 2 and the related journal entry that is required. Remember that any adjustment to the company's Cash account requires a journal entry. Generally, the adjustments to the books are the result of items found on the bank statement but have not yet been entered in the company's Cash account. Item #2 Bank service charges. Since the bank deducted $35 from the company's checking account, but the company has not yet deducted this from its Cash account, the following journal entry needs to be made. Date August 31, 2011 Account Name Bank Service Charge Expense Cash Debit 35 35 Credit

(If the annual amount of service charges is small, debit Miscellaneous Expense.) Item #3 NSF checks and fees. Since the bank deducted these legitimate amounts from the company's bank account, the company will need to deduct these amounts from its Cash account. As mentioned, the NSF check of $100 was from a customer. Therefore, the company will likely undo the reduction to Accounts Receivable that took place when the company originally processed the $100 check. If the company wishes to recover the bank fee of $10 from the customer, it should add the $10 fee to the amount that the customer owes the company. The journal entry might look like this: Date August 28, 2011 Account Name Debit Credit

Accounts Receivable 110 Cash (If the amount cannot be recovered from the customer, charge an expense.)

110

Item #4 Check printing charges. Because this expense is not yet entered on the company's books, but the amount has been deducted from its bank account, the company will make the following journal entry. Date August 20, 2011 Account Name Supplies Cash Debit 80 80 Credit

Item #5 Interest earned. The bank increased the checking account balance by $8 on August 31. Since the bank did not notify the company previously, the company must now increase the balance in its Cash account. Date August 31, 2011 Account Name Cash Interest Revenue Debit 8 8 Credit

Item #6 Notes receivable collected. The bank increased the company's checking account when it collected a note for the company on August 29. It was determined that the company had not yet made an entry to its Cash account for this transaction. As a result the following journal entry is needed. Date Account Name Debit Credit

August 29, 2011

Cash Bank Service Charge Expense Notes Receivable

960 40 1,000

Item #10 Company error. The company had entered $145 in its Cash account on August 29, but the bank statement showed the correct amount: $154. The transaction involved the cash sales for the day. As a result the company's Cash account will have to be increased by $9 as follows: Date August 29, 2011 Account Name Cash Sales Debit 9 9 Credit

Step 3 Comparing the Adjusted Balances In the above schedules the adjusted balance for Step 1 is $1,719 and the adjusted balance for Step 2 is $1,719. The company believes that all items involving cash have been included in the schedules. As a result the company has successfully completed its bank reconciliation as of the August 31, 2011. Additional Information and Resources Because the material covered here is considered an introduction to this topic, many complexities have been omitted. You should always consult with an accounting professional for assistance with your own specific circumstances.

QuickBooks 2012 QuickBooks 2010

QuickBooks 2008

Most

Recent

Questions

for

this

Topic

What is float? What is a credit memo? What is an uncleared cheque? What is the segregation of duties? What is bank balance and book balance? What is a restrictive endorsement? How do I write-off old outstanding checks?

Powered by Feed Informer

Deposits in transit A company's receipts that appear on the company's records but do not yet appear on the bank statement. For example, a retail store's receipts of March 31 are deposited after banking hours on March 31 or on the morning of April 1. Those receipts are in the company's general ledger Cash account on March 31, but are not on the March 31 bank statement. As a result they are said to be "in transit" on March 31. On the bank reconciliation a deposit in transit is an adjustment (an addition) to the balance per bank. Outstanding checks Checks which have been written, but have not yet cleared the bank on which they were drawn. In the bank reconciliation, outstanding checks are deducted from the balance per bank. To learn more, see Explanation of Bank Reconciliation. Bank errors

Errors made by the bank on a company's bank account. These are usually infrequent but could include an incorrect amount of a check or deposit or a check or deposit recorded in the wrong account. Bank service charge expense This is an administrative expense which reports the fees incurred by a company for the expenses associated with its checking account transactions.

Not sufficient funds (NSF) check A check often referred to as an NSF check, a rubber check, or a check that bounced. It is a check that was not paid by the bank of the issuer (writer) of the check because the checking account of the issuer did not have sufficient collected funds in the account.

Check printing charges A fee for the printing of checks ordered by a company. Often the amount is deducted automatically from a company's checking account by the company that printed the checks.

Interest earned An amount earned by a company on its interest bearing bank accounts or other investments. The amount should be reported as Interest Revenues, Interest Income, or Investment Revenues in the accounting period in which the interest is earned.

Notes receivable An asset representing the right to receive the principal amount contained in a written promissory note. Principal that is to be received within one year of the balance sheet date is reported as a current asset. Any portion of the notes receivable that is not due within one year of the balance sheet date is reported as a long term asset.

What is float? In accounting and bookkeeping, float is the time between the writing of a check and the time that the check clears the bank account on which it is drawn. For example, Payer Corporation writes a check for $5,000 and mails it to a supplier on Wednesday. However, the check will not clear Payer Corporations checking account until Monday. Hence, Payer Corporation will have $5,000 of float between Wednesday and Monday.

Mary plays the float when she mails her rent check on Thursday even though she does not have a sufficient balance in her personal checking account. She is counting on her paycheck being electronically deposited on Monday morning prior to her rent check clearing her checking account. Float is associated with the outstanding checks shown on the bank reconciliation.

What is a credit memo? One type of credit memo is issued by a seller in order to reduce the amount that a customer owes from a previously issued sales invoice. For instance, assume that SellerCorp had issued a sales invoice for $800 for 100 units of product that it shipped to BuyerCo at a price of $8 each. BuyerCo informs SellerCorp that one of the units is defective and SellerCorp issues a credit memo for $8. The credit memo will cause the following in SellerCorps accounting records: 1) a debit of $8 to Sales Returns and Allowances, and 2) a credit of $8 to Accounts Receivable. In other words, the credit memo reduced SellerCorps net sales and its accounts receivable. When BuyerCo records the credit memo, the following will occur in its accounting records: 1) a debit of $8 to Accounts Payable, and 2) a credit of $8 to Purchases Returns and Allowances (or Inventory). Another type of credit memo, also referred to as a credit memorandum, is issued by a bank when it increases a depositors checking account for a certain transaction.

What is an uncleared cheque? An uncleared cheque is a cheque that has been written and recorded in the payers records, but the cheque has not yet been paid by the bank on which it is drawn. In the U.S. accounting textbooks, an uncleared cheque is referred to as an outstanding check. In the bank reconciliation process an uncleared cheque (or outstanding check) is deducted from the balance shown on the bank statement to arrive at the correct or adjusted balance per bank.

What is the segregation of duties? The segregation of duties is associated with the safeguarding of an organizations assets and the topic known as internal control. An example of the segregation of duties would be a companys requirement that the bank statement for its checking account must be reconciled by someone other than a person writing checks and someone other than a person recording amounts in the companys general ledger. Another example of the segregation of duties is that the person handling cash cannot be the same person that records cash amounts in the companys ledgers. By segregating or separating the duties, it becomes harder for dishonest actions to go undetected.

What is bank balance and book balance? The terms bank balance and book balance are used in the accounting and bookkeeping procedure known as reconciling the bank statement. The bank balance is also known as the balance per bank or balance per bank statement and it refers to the ending balance appearing on a bank statement. For example, when a company receives its June checking account statement from its bank, the June 30 balance will be the bank balance. Usually this bank balance will not agree with the amount in the companys records since some checks written by the company will not have cleared the checking account by June 30. Similarly, some money received by the company on June 30 may not have been deposited in time for the amount to appear on the June bank statement. In the bank reconciliation the term book balance may be referred to as the balance per books, and it is the amount shown in the companys records. For example, the book balance at June 30 refers to the balance in the companys general ledger account Cash or Checking Account. (For an individual, the book balance is often the balance appearing in the persons check register.) Often the book balance at June 30 will not be the true amount until some items on the bank statement are recorded. For example, the June bank statement may reveal some bank fees that were withdrawn by the bank at the end of June.

What is a restrictive endorsement? A restrictive endorsement or restricted endorsement places a limitation on the use of a check or other negotiable financial instrument. The most common restrictive endorsement is the phrase For Deposit Only written along with the payees signature on the back of a check. Other wording for a similar restrictive endorsement might be Pay to the Order of Sample Bank for deposit to account #xxxx followed by the payees signature. Many companies endorse checks by using a rubber stamp containing this restriction. Using a restrictive endorsement is one of many actions that a company can take in order to improve the internal control of its assets.

How do I write-off old outstanding checks? Years ago when a check appeared on the bank reconciliations list of outstanding checks for a lengthy period the answer was easy: 1. Void the check and add the amount to your checkbook balance.

2. Debit the general ledger Cash account for the amount, and credit the account that was originally debited. 3. Remove the check from the bank reconciliations list of outstanding checks. Today, the answer is different for U.S. companies as states are now likely to have unclaimed property laws. For example, in my state a check issued to a vendor, but has not cleared the bank on which it is drawn, must be reported to the state after five years. In other words, you will now have to report a liability until the amount is remitted to your state. Since you wrote the check and intended for it to be paid from the money in your checking, why not contact the payee as soon as the check is outstanding for 30 days? You may learn that the payee did not receive the check, had misplaced it, etc. Why not help your vendor the way you would want to be helped by your customers? In short, communicate with the payees of your outstanding checks and eliminate the need for reporting and remitting to your state government many years after the original transactions.

You might also like

- Module 9. Bank ReconciliationDocument22 pagesModule 9. Bank ReconciliationValerie De los ReyesNo ratings yet

- Bank Reconciliation Process: Step 1. Adjusting The Balance Per BankDocument5 pagesBank Reconciliation Process: Step 1. Adjusting The Balance Per BankSulaimon AbiodunNo ratings yet

- Bank Reconciliation ProcessDocument6 pagesBank Reconciliation ProcessbluephoeNo ratings yet

- FABM2 Module 08 (Q2-W1-2)Document7 pagesFABM2 Module 08 (Q2-W1-2)Christian Zebua0% (2)

- LAS Q2 Week3 FABM2Document9 pagesLAS Q2 Week3 FABM2Dash DomingoNo ratings yet

- Bank - Reconciliatio Statement PowerpointDocument61 pagesBank - Reconciliatio Statement PowerpointLoida Yare LauritoNo ratings yet

- Bank ReconcilliationDocument2 pagesBank ReconcilliationAlyanna AlcantaraNo ratings yet

- Week 2 Leap FabmDocument7 pagesWeek 2 Leap FabmDanna Marie EscalaNo ratings yet

- Basic Reconciliation StatementsDocument41 pagesBasic Reconciliation StatementsBeverly EroyNo ratings yet

- Bank ReconciliationDocument5 pagesBank ReconciliationAngel PadillaNo ratings yet

- Chapter 9 Basic Reconcillation StatementDocument11 pagesChapter 9 Basic Reconcillation StatementRon louise Pereyra100% (1)

- FUNDAMENTALS OF ACCOUNTING PART 2Document12 pagesFUNDAMENTALS OF ACCOUNTING PART 2Angeles Lajara AlbertNo ratings yet

- Basic Reconciliation Statement 3 HoursDocument11 pagesBasic Reconciliation Statement 3 Hoursmarissa casareno almueteNo ratings yet

- My ch04Document44 pagesMy ch04ehab_ghazallaNo ratings yet

- Fabm2 Bank ReconDocument5 pagesFabm2 Bank ReconColleen SantosNo ratings yet

- Step BankDocument4 pagesStep BankSamrawit MewaNo ratings yet

- Bank Reconciliation Statement:: Unit - 6Document4 pagesBank Reconciliation Statement:: Unit - 6deepshrmNo ratings yet

- Bank ReconciliationDocument11 pagesBank ReconciliationWijdan saleemNo ratings yet

- Fabm2 q2 m3 Bank Reconciliation EditedDocument29 pagesFabm2 q2 m3 Bank Reconciliation EditedMaria anjilu VillanuevaNo ratings yet

- Fabm2 - June 17, 2021 Asynchronous Activity: Thanks, Happy Working. 3Document7 pagesFabm2 - June 17, 2021 Asynchronous Activity: Thanks, Happy Working. 3Khaira PeraltaNo ratings yet

- Worksheet 3 Q2 Acctg. 2 - 1 31Document14 pagesWorksheet 3 Q2 Acctg. 2 - 1 31Allan TaripeNo ratings yet

- Chapter 4 Financial AssetsDocument54 pagesChapter 4 Financial AssetsAddisalem MesfinNo ratings yet

- Bank Reconciliations: Meaning: A Bank Reconciliation Statement Is A Statement That Compares The Cash Book and TheDocument14 pagesBank Reconciliations: Meaning: A Bank Reconciliation Statement Is A Statement That Compares The Cash Book and TheApurvakc KcNo ratings yet

- Las1 Q2 BankreconDocument12 pagesLas1 Q2 BankreconCharlyn CastroNo ratings yet

- Bank ReconciliationDocument5 pagesBank ReconciliationaizaNo ratings yet

- Bank ReconciliationDocument23 pagesBank ReconciliationAlyson Jane ConstantinoNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationDenishNo ratings yet

- Introduction To Bank ReconciliationDocument11 pagesIntroduction To Bank ReconciliationD K DocumentsNo ratings yet

- Complete Bank Reconciliation in MinutesDocument3 pagesComplete Bank Reconciliation in MinutesBianca Jane GaayonNo ratings yet

- Long Quiz 2 ReviewerDocument3 pagesLong Quiz 2 ReviewerJayNo ratings yet

- Bank ReconciliationDocument11 pagesBank ReconciliationKamrul Hasan100% (1)

- ReviewerDocument7 pagesReviewerangel maeNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMikaella Adriana GoNo ratings yet

- If Your Bank Reconciliation Doesn't Balance, You Need To Find The Error or Errors. The Possible Causes of A Bank Balance Error CompriseDocument2 pagesIf Your Bank Reconciliation Doesn't Balance, You Need To Find The Error or Errors. The Possible Causes of A Bank Balance Error CompriseAnand SukumarNo ratings yet

- FABM2Document14 pagesFABM2sarmientocarlajoy2No ratings yet

- FABM2 Q2 Module WS 1Document14 pagesFABM2 Q2 Module WS 1Mitch Dumlao73% (11)

- Bank Reconciliation Statement - Definition, Explanation, Example and Causes of Difference - Accounting For ManagementDocument5 pagesBank Reconciliation Statement - Definition, Explanation, Example and Causes of Difference - Accounting For Managementpeter tichiNo ratings yet

- Introduction To Bank ReconciliationDocument8 pagesIntroduction To Bank ReconciliationNath Bongalon100% (1)

- Bank Reconciliation: Match Books to BankDocument5 pagesBank Reconciliation: Match Books to BankJireh RiveraNo ratings yet

- Bank Reconciliation Statement 2023Document30 pagesBank Reconciliation Statement 2023jsy claudeNo ratings yet

- NLKTDocument25 pagesNLKTBá Thiên Kim NguyễnNo ratings yet

- Bank Reconciliation StatementDocument17 pagesBank Reconciliation Statementyow jing pei100% (1)

- Accounting Cash Internal ControlsDocument14 pagesAccounting Cash Internal ControlsDave A ValcarcelNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationFem FataleNo ratings yet

- 07 - Petty Cash Fund and Bank ReconciliationDocument2 pages07 - Petty Cash Fund and Bank ReconciliationCy Miolata100% (2)

- Bookkeeping To Trial Balance 9Document17 pagesBookkeeping To Trial Balance 9elelwaniNo ratings yet

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementakankaroraNo ratings yet

- m1 Bank ReconDocument2 pagesm1 Bank ReconRedmond Abalos TejadaNo ratings yet

- Audit Cash Balances Apple BlossomDocument19 pagesAudit Cash Balances Apple BlossomAjisetiawans0% (2)

- Accounting Application: Tech-FSM 223Document52 pagesAccounting Application: Tech-FSM 223Rey Ann EstopaNo ratings yet

- CHAPTER SIX - Doc Internal Control Over CashDocument7 pagesCHAPTER SIX - Doc Internal Control Over CashYared DemissieNo ratings yet

- The Effects of The Reconciling ItemDocument16 pagesThe Effects of The Reconciling ItemElla BridgetteNo ratings yet

- Bank ReconciliationDocument9 pagesBank Reconciliationlit afNo ratings yet

- What Is Bank Reconciliation.Document11 pagesWhat Is Bank Reconciliation.Sabrena FennaNo ratings yet

- Business 2257 Tutorial #2Document17 pagesBusiness 2257 Tutorial #2westernbebeNo ratings yet

- CH 3Document25 pagesCH 3yared gebrewoldNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- The Lehman Brothers CaseDocument4 pagesThe Lehman Brothers CaseKhawaja SohailNo ratings yet

- CIA Four-Part To Three-Part Exam Content MapDocument10 pagesCIA Four-Part To Three-Part Exam Content MapSanjeev ChowdharyNo ratings yet

- Pakacc Apr June 2013Document47 pagesPakacc Apr June 2013Khawaja SohailNo ratings yet

- Islamic Studies CompulsoryDocument13 pagesIslamic Studies Compulsorymehakali04No ratings yet

- BA Form PrivateDocument5 pagesBA Form PrivateAli RazaNo ratings yet

- Cash BookDocument26 pagesCash Booksagiinfo1100% (1)

- ModuleDocument26 pagesModuleSantosh KumarNo ratings yet

- Apprenticeships To Change The WorldDocument36 pagesApprenticeships To Change The WorldKhawaja SohailNo ratings yet

- Exam Timetable Cma 15042k11Document1 pageExam Timetable Cma 15042k11Syed OsamaNo ratings yet

- Listfirms QCR SBPDocument2 pagesListfirms QCR SBPKhawaja SohailNo ratings yet

- Topic 6 DebtorsDocument28 pagesTopic 6 DebtorsKhawaja SohailNo ratings yet

- BankreconciliationDocument26 pagesBankreconciliationKhawaja SohailNo ratings yet

- Your Internal Audit Team BrandDocument15 pagesYour Internal Audit Team BrandKhawaja SohailNo ratings yet

- Trainee Application Form FACDocument3 pagesTrainee Application Form FACKhawaja SohailNo ratings yet

- Trainee Application Form FACDocument3 pagesTrainee Application Form FACKhawaja SohailNo ratings yet

- Accruals and Prepayments: ©ICAS 2012Document22 pagesAccruals and Prepayments: ©ICAS 2012Khawaja SohailNo ratings yet

- FinanceDocument17 pagesFinanceKhawaja SohailNo ratings yet

- Accruals and Prepayments: ©ICAS 2012Document22 pagesAccruals and Prepayments: ©ICAS 2012Khawaja SohailNo ratings yet

- Accruals and Prepayments: ©ICAS 2012Document22 pagesAccruals and Prepayments: ©ICAS 2012Khawaja SohailNo ratings yet

- Basic Group AccountsDocument30 pagesBasic Group AccountsKhawaja SohailNo ratings yet

- Fee Details Fee Details Fee DetailsDocument1 pageFee Details Fee Details Fee DetailsTabish KhanNo ratings yet

- Adoption of Digital Payments by Small Retail StoresDocument11 pagesAdoption of Digital Payments by Small Retail StoresmailbabuNo ratings yet

- Events Management ProposalDocument10 pagesEvents Management ProposalVEN VINCENT VelascoNo ratings yet

- Construction Tender Notice for Grampanchayat BuildingDocument2 pagesConstruction Tender Notice for Grampanchayat BuildingSD TECHNo ratings yet

- Bank - Reconciliatio Statement PowerpointDocument61 pagesBank - Reconciliatio Statement PowerpointLoida Yare LauritoNo ratings yet

- Progressive Dev't Corp. v. Quezon CityDocument4 pagesProgressive Dev't Corp. v. Quezon CityOne TwoNo ratings yet

- Design-Build Services Guide for ArchitectsDocument30 pagesDesign-Build Services Guide for ArchitectsFilgrace EspiloyNo ratings yet

- BFP Peza MoaDocument15 pagesBFP Peza Moalittlemisseee100% (2)

- Acca Toronto LSBFDocument5 pagesAcca Toronto LSBFMohamed KhalidNo ratings yet

- C4 FinalDocument1 pageC4 FinalMissa RoseNo ratings yet

- Moving From First Additions To The Barclays Bank Account With Tech Pack - 28-SEP-15 PDFDocument7 pagesMoving From First Additions To The Barclays Bank Account With Tech Pack - 28-SEP-15 PDFDecodare GsmNo ratings yet

- Cha - Mndoza.cha - Mendoza.cha - Mendoza.cha - Mendoza.cha - Mendoza.cha - Men Doza - ChaDocument1 pageCha - Mndoza.cha - Mendoza.cha - Mendoza.cha - Mendoza.cha - Mendoza.cha - Men Doza - Chabatusay575No ratings yet

- How To Finance Your Studies: Discounts On Tuition FeesDocument5 pagesHow To Finance Your Studies: Discounts On Tuition FeesPrem PatelNo ratings yet

- WellsFargo..0167 Business 2Document5 pagesWellsFargo..0167 Business 276xzv4kk5vNo ratings yet

- Crosby Crossing Swim Club Bylaws: Article I PurposeDocument12 pagesCrosby Crossing Swim Club Bylaws: Article I Purposeapi-86734998No ratings yet

- DFGDRDocument2 pagesDFGDRSampath RNo ratings yet

- Punjab Bus BrandingDocument12 pagesPunjab Bus BrandingMohit ChhabriaNo ratings yet

- SBI BPCL Card Mar21Document2 pagesSBI BPCL Card Mar21Sachin MehrolNo ratings yet

- Stellar Aim: Inheritance Tax ServiceDocument15 pagesStellar Aim: Inheritance Tax Servicesky22blueNo ratings yet

- 0-1.1a - Merchant Agreement OADocument13 pages0-1.1a - Merchant Agreement OACurtis WyffelsNo ratings yet

- Farmers Union Constitution BylawsDocument26 pagesFarmers Union Constitution BylawsGlenn LelinaNo ratings yet

- C2 Midterm Practice Test 02Document16 pagesC2 Midterm Practice Test 02Vi Lương Thị ThảoNo ratings yet

- TDS on salaries and other paymentsDocument3 pagesTDS on salaries and other paymentsSpUnky RohitNo ratings yet

- PEOS Certificate - MEL CANDODocument1 pagePEOS Certificate - MEL CANDOMel CandoNo ratings yet

- 2010he MS189Document7 pages2010he MS189Billa NaganathNo ratings yet

- Animal Control Ordinance - County 080312Document32 pagesAnimal Control Ordinance - County 080312savannahnow.comNo ratings yet

- Travel Tourism Glossary - OdtDocument26 pagesTravel Tourism Glossary - OdtAnonymous aFLkmhteNo ratings yet

- Revenue From Contracts With CustomersDocument3 pagesRevenue From Contracts With Customerscaloy cagzNo ratings yet

- Frequently Asked Questions - Leonardo by SujimotoDocument4 pagesFrequently Asked Questions - Leonardo by SujimotoAdetokunbo Ademola100% (1)

- FI London-Fall 2022-Revenue-MarcoDocument17 pagesFI London-Fall 2022-Revenue-MarcoFounderinstituteNo ratings yet