Professional Documents

Culture Documents

Act Fine Con

Uploaded by

poonyorkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Act Fine Con

Uploaded by

poonyorkCopyright:

Available Formats

2005 DECA Ontario December Provincials

ACT Event 2 OCCUPATIONAL CATEGORY Accounting Applications Series

An Association of Marketing Students

INSTRUCTIONAL AREA Economics

PARTICIPANT INSTRUCTIONS

PROCEDURES 1. The event will be presented to you through your reading of these instructions, including the Performance Indicators and Event Situation. You will have up to 10 minutes to review this information to determine how you will handle the role-play situation and demonstrate the performance indicators of this event. During the preparation period, you may make notes to use during the role-play situation. 2. You will give an ID label to your adult assistant during the preparation time. 3. You will have up to 10 minutes to role-play your situation with a judge (you may have more than one judge). 4. You will be evaluated on how well you meet the performance indicators of this event. 5. Turn in all your notes and event materials when you have completed the role-play.

PERFORMANCE INDICATORS 1. Identify factors affecting a businesss profit. 2. Determine factors affecting business risk. 3. Explain the concept of competition. 4. Value long-term debt. 5. Use ratio analysis to evaluate company performance.

Published 2006 by DECA Related Materials. Copyright 2006 by DECA Inc. No part of this publication may be reproduced for resale without written permission from the publisher. Printed in the United States of America.

2005 DECA Ontario December Provincials EVENT SITUATION

ACT Event 2

You are to assume the role of assistant manager at FIRST BANK, a small, community bank. FIRST BANKs president (judge) has asked you to analyze financial statements for a small, locally owned general merchandise store, KESSLERS, and recommend whether FIRST BANK should approve KESSLERS loan request. KESSLERS has been a customer of FIRST BANK for 50 years and has done well in the past but has recently experienced a decline in sales caused by competition from a new discount store. KESSLERS is now applying for a loan to meet their obligations. The president of FIRST BANK (judge) has asked you to interpret the financial information and help him/her decide whether to approve the loan to KESSLERS. You have been given a copy of KESSLERS Balance Sheet and Income Statement Summary for the past year as well as the industry standards for the ratios listed below. You are to recommend to the president (judge) whether he/she should consider lending KESSLERS the money based on its performance over the past year. Along with your recommendation, you should also explain your financial calculations and the reasoning behind your recommendation. Your calculations and explanation should address, at a minimum, the following: Turnover of Cash Ratio Industry Standard: 3.20 Current Ratio Industry Standard: 2.70 Debt to Equity Ratio Industry Standard: 1.64 You will present your recommendation to FIRST BANKs president (judge) in a role-play to take place in the presidents (judges) office. The president (judge) will begin the role-play by greeting you and asking to hear your recommendation. After you have made your presentation and have answered the presidents (judges) questions, the president (judge) will conclude the role-play by thanking you for your work.

2005 DECA Ontario December Provincials

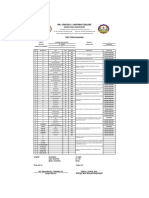

Kesslers Balance Sheet December 31, 2004 2004 ASSETS Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Property and Equipment Furniture Computer Hardware and Software Building Total Property and Equipment Total Assets LIABILITIES AND EQUITY Liabilities Accounts Payable Wages Payable Total Current Liabilities Long Term Liabilities Note Payable Total Liabilities OWNERS EQUITY Kesslers, Capital Total Liabilities and Equity $40,000 10,000 $50,000 $180,000 $230,000 $110,000 $340,000 $75,000 50,000 75,000 5,000 $205,000 $15,000 20,000 100,000 $135,000 $340,000

ACT Event 2

Income Statement Summary for Year Ending December 31, 2004 Net Sales Cost of Goods Sold Gross Profit Total Operating Expenses Operating Income Other Income Net Income (before taxes) $640,000 310,000 $330,000 $150,000 $180,000 0 $180,000

2005 DECA Ontario December Provincials

ACT Event 2

JUDGES INSTRUCTIONS

DIRECTIONS, PROCEDURES AND JUDGES ROLE

In preparation for this event, you should review the following information with your event manager and other judges: 1. 2. Procedures and Performance Indicators Event Situation and Judge Role-play Characterization Participants may conduct a slightly different type of meeting and/or discussion with you each time; however, it is important that the information you provide and the questions you ask be uniform for every participant. 3. Judges Evaluation Instructions and Judges Evaluation Form Please use a critical and consistent eye in rating each participant.

JUDGE ROLE-PLAY CHARACTERIZATION You are to assume the role of president of FIRST BANK, a small, community bank. You have asked your assistant manager (participant) to analyze financial statements for a small, locally owned general merchandise store, KESSLERS, and recommend whether FIRST BANK should approve KESSLERS loan request. KESSLERS has been a customer of FIRST BANK for 50 years and has done well in the past but has recently experienced a decline in sales caused by competition from a new discount store. KESSLERS is now applying for a loan to meet their obligations. You have asked your assistant manager (participant) to interpret the financial information and help him/her decide whether to approve the loan to KESSLERS. The assistant manager (participant) has been given a copy of KESSLERS Balance Sheet and Income Statement Summary for the past year as well as the industry standards for the ratios listed below. Using his/her accounting skills, the assistant manager (participant) is to recommend to you whether you should consider loaning KESSLERS the money based on its performance over the past year. Along with the recommendation, the assistant manager should also explain his/her financial calculations and the reasoning behind the recommendation. Your calculations and explanation should address, at a minimum, the following: Turnover of Cash Ratio Industry Standard: 3.20 Current Ratio Industry Standard: 2.70 Debt to Equity Ratio Industry Standard: 1.64 The assistant manager (participant) will present the recommendation to you in a role-play to take place in your office. You will begin the role-play by greeting the assistant manager (participant) and asking to hear the recommendation. During the course of the role-play you are to ask the following questions of each participant: 1. Would you rank this business (KESSLERS) as financially strong, average or weak? 2. In addition to the financial position of the store, is there anything else I should consider? Once the assistant manager (participant) has made the presentation and has answered your questions, you will conclude the role-play by thanking the assistant manager (participant) for the work. You are not to make any comments after the event is over except to thank the participant.

4

2005 DECA Ontario December Provincials

ACT Event 2

ANSWERS (for judge use only):

Turnover of Cash Ratio Net Sales/Working Capital(Current Assets-Currents Liabilities) = $640,000/$155,000 = 4.13 Current Ratio Current Assets/Current Liabilities = $205,000/$50,000 = 4.10 Debt to Equity Ratio Total Liabilities/Owners Equity = $230,000/$110,000 = 2.09

Kesslers Balance Sheet December 31, 2004 2004 ASSETS Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Property and Equipment Furniture Computer Hardware and Software Building Total Property and Equipment Total Assets LIABILITIES AND EQUITY Liabilities Accounts Payable Wages Payable Total Current Liabilities Long Term Liabilities Note Payable Total Liabilities OWNERS EQUITY Kesslers, Capital Total Liabilities and Equity $75,000 50,000 75,000 5,000 $205,000 $15,000 20,000 100,000 $135,000 $340,000

$40,000 10,000 $50,000 $180,000 $230,000 $110,000 $340,000

Income Statement Summary for Year Ending December 31, 2004 Net Sales Cost of Goods Sold Gross Profit Total Operating Expenses Operating Income Other Income Net Income (before taxes) $640,000 310,000 $330,000 $150,000 $180,000 0 $180,000

2005 DECA Ontario December Provincials

ACT Event 2

JUDGES EVALUATION INSTRUCTIONS

Evaluation Form Information The participants are to be evaluated on their ability to perform the specific performance indicators stated on the cover sheet of this event and restated on the Judges Evaluation Form. Although you may see other performance indicators being demonstrated by the participants, those listed in the Performance Indicators section are the critical ones you are measuring for this particular event. Evaluation Form Interpretation The evaluation levels listed below and the evaluation rating procedures should be discussed thoroughly with your event chairperson and the other judges to ensure complete and common understanding for judging consistency.

Level of Evaluation Exceeds Expectations

Interpretation Level Participant demonstrated the performance indicator in an extremely professional manner; greatly exceeds business standards; would rank in the top 10% of business personnel performing this performance indicator. Participant demonstrated the performance indicator in an acceptable and effective manner; meets at least minimal business standards; there would be no need for additional formalized training at this time; would rank in the 70-89 th percentile of business personnel performing this performance indicator. Participant demonstrated the performance indicator with limited effectiveness; performance generally fell below minimal business standards; additional training would be required to improve knowledge, attitude and/or skills; would rank in the 50-69th percentile of business personnel performing this performance indicator. Participant demonstrated the performance indicator with little or no effectiveness; a great deal of formal training would be needed immediately; perhaps this person should seek other employment; would rank in the 0-49th percentile of business personnel performing this performance indicator.

Meets Expectations

Below Expectations

Little/No Value

DO NOT WRITE ON THIS PAGE. RECORD ALL SCORES ON THE SCANTRON SHEET PROVIDED.

JUDGES EVALUATION FORM

ACT Event 2

DID THE PARTICIPANT: 1. Identify factors affecting a businesss profit?

Little/No Value 0, 2 Attempts at identifying factors affecting a businesss profit were inadequate or weak. Below Expectations 4, 6, 8 Adequately identified factors affecting a businesss profit. Meets Expectations 10, 12, 14 Effectively identified factors affecting a businesss profit. Exceeds Expectations 16, 18 Very effectively identified factors affecting a businesss profit.

2. Determine factors affecting business risk?

Little/No Value 0, 2 Attempts at determining factors affecting business risk were inadequate or weak. Below Expectations 4, 6, 8 Adequately determined factors affecting business risk. Meets Expectations 10, 12, 14 Effectively determined factors affecting business risk. Exceeds Expectations 16, 18 Very effectively determined factors affecting business risk.

3. Explain the concept of competition?

Little/No Value 0, 2 Attempts at explaining the concept of competition were weak or incorrect. Below Expectations 4, 6, 8 Adequately explained the concept of competition. Meets Expectations 10, 12, 14 Effectively explained the concept of competition. Exceeds Expectations 16, 18 Very effectively explained the concept of competition.

4. Value long-term debt?

Little/No Value 0, 2 Attempts at valuing longterm debt were inadequate or unclear. Below Expectations 4, 6, 8 Adequately valued longterm debt. Meets Expectations 10, 12, 14 Effectively valued long-term debt. Exceeds Expectations 16, 18 Very effectively valued long-term debt.

5. Use ratio analysis to evaluate company performance?

Little/No Value 0, 2 Attempts at using ratio analysis to evaluate a companys performance were inadequate or weak. Below Expectations 4, 6, 8 Adequately used ratio analysis to evaluate a companys performance. Meets Expectations 10, 12, 14 Effectively used ratio analysis to evaluate a companys performance. Exceeds Expectations 16, 18 Very effectively used ratio analysis to evaluate a companys performance.

6. Overall impression and response to the judges questions:

Little/No Value 0, 1 Demonstrated few skills; could not answer the judges questions. Below Expectations 2, 3, 4 Demonstrated limited ability to link some skills; answered the judges questions adequately. Meets Expectations 5, 6, 7 Effectively demonstrated specified skills; answered the judges questions effectively. Exceeds Expectations 8, 9, 10 Demonstrated skills confidently and professionally; answered the judges questions very effectively and thoroughly.

Judges Initials

TOTAL SCORE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- British Gas Example BillDocument2 pagesBritish Gas Example BillYoutube Master13% (8)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- NOC Form The Society MortgageDocument2 pagesNOC Form The Society MortgageHardik Nagda62% (13)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bloomberg Terminal Getting Started StudentsDocument38 pagesBloomberg Terminal Getting Started StudentsK Park80% (5)

- Republic of The Philippines Court of Tax Appeals Quezon: DecisionDocument10 pagesRepublic of The Philippines Court of Tax Appeals Quezon: DecisionPGIN Legal OfficeNo ratings yet

- Development proposal for office & apartment blocks in Ampang, Kuala LumpurDocument16 pagesDevelopment proposal for office & apartment blocks in Ampang, Kuala Lumpursongkk100% (1)

- JPM CDO Research 12-Feb-2008Document20 pagesJPM CDO Research 12-Feb-2008Gunes KulaligilNo ratings yet

- Dr. Carlos S. Lanting College Test Item AnalysisDocument1 pageDr. Carlos S. Lanting College Test Item AnalysisEdna Grace Abrera TerragoNo ratings yet

- Final PPT UmppDocument13 pagesFinal PPT UmppDhritiman PanigrahiNo ratings yet

- Lesson 6 Worksheet - Yangsan Map 1Document1 pageLesson 6 Worksheet - Yangsan Map 1poonyorkNo ratings yet

- CNTAE Compoverview NEW2013v4Document9 pagesCNTAE Compoverview NEW2013v4poonyorkNo ratings yet

- CUPE 3902 Spending Account and Claim Form Sept 1 2013 Version 2Document1 pageCUPE 3902 Spending Account and Claim Form Sept 1 2013 Version 2poonyorkNo ratings yet

- X5C User Manual 1 PDFDocument5 pagesX5C User Manual 1 PDFtrinexNo ratings yet

- Notes 1. Networking Involve in Activities in Person To Enlarge Your Network, Make Yourself Visible. Before Doing That, Equip Yourself With A PhoneDocument1 pageNotes 1. Networking Involve in Activities in Person To Enlarge Your Network, Make Yourself Visible. Before Doing That, Equip Yourself With A PhonepoonyorkNo ratings yet

- Lesson 11 - Canyoudance WorksheetDocument1 pageLesson 11 - Canyoudance WorksheetpoonyorkNo ratings yet

- Sports TextDocument172 pagesSports TextpoonyorkNo ratings yet

- C36 Notes1Document1 pageC36 Notes1poonyorkNo ratings yet

- AsdfDocument7 pagesAsdfpoonyorkNo ratings yet

- Scribd 1234 JKL AsdfweDocument1 pageScribd 1234 JKL AsdfwepoonyorkNo ratings yet

- Scribd 1234 JKL AsdfweDocument1 pageScribd 1234 JKL AsdfwepoonyorkNo ratings yet

- New Microsoft Office PowerPoint PresentationDocument1 pageNew Microsoft Office PowerPoint PresentationGbsReddyNo ratings yet

- Air CanadafdsaDocument2 pagesAir CanadafdsapoonyorkNo ratings yet

- AsdfewerasdfDocument1 pageAsdfewerasdfpoonyorkNo ratings yet

- Mariahcarey-Merrychristmas: Marcos Oscar EspinozaDocument1 pageMariahcarey-Merrychristmas: Marcos Oscar EspinozapoonyorkNo ratings yet

- Budget Break Down - AdsfxlsxDocument3 pagesBudget Break Down - AdsfxlsxpoonyorkNo ratings yet

- Ass2 S2013 L01Document1 pageAss2 S2013 L01poonyorkNo ratings yet

- CasdfDocument2 pagesCasdfpoonyorkNo ratings yet

- AsdfDocument4 pagesAsdfpoonyorkNo ratings yet

- JJHHGDocument1 pageJJHHGpoonyorkNo ratings yet

- Piaget Recap From Last LectureDocument2 pagesPiaget Recap From Last LecturepoonyorkNo ratings yet

- Participant Instructions: Occupational CategoryDocument6 pagesParticipant Instructions: Occupational CategorypoonyorkNo ratings yet

- Fall Course Registration 2013-14asdfDocument2 pagesFall Course Registration 2013-14asdfpoonyorkNo ratings yet

- Participant Instructions: Occupational CategoryDocument7 pagesParticipant Instructions: Occupational CategorypoonyorkNo ratings yet

- Participant Instructions: Occupational CategoryDocument7 pagesParticipant Instructions: Occupational CategorypoonyorkNo ratings yet

- Participant Instructions: Occupational CategoryDocument6 pagesParticipant Instructions: Occupational CategorypoonyorkNo ratings yet

- 13 SqweDocument1 page13 SqwepoonyorkNo ratings yet

- Asdf 456Document1 pageAsdf 456poonyorkNo ratings yet

- REVIEWER IN CREDIT TRANSACTIONS - General ConceptsDocument1 pageREVIEWER IN CREDIT TRANSACTIONS - General Conceptsluis capulongNo ratings yet

- GBF Unit - IVDocument50 pagesGBF Unit - IVKaliyapersrinivasanNo ratings yet

- CLASS X - CHAPTER 3. Notes - MONEY AND CREDITDocument5 pagesCLASS X - CHAPTER 3. Notes - MONEY AND CREDITSlick Life VlogsNo ratings yet

- Harvard Business ReviewDocument15 pagesHarvard Business ReviewMichael Green100% (1)

- Golf Course Valuation TrendsDocument3 pagesGolf Course Valuation TrendsSarahNo ratings yet

- 2015 Bar Exam Suggested Answers in Mercantile LawDocument14 pages2015 Bar Exam Suggested Answers in Mercantile Lawargao100% (1)

- People Vs GasacaoDocument1 pagePeople Vs GasacaoKling King0% (1)

- Unicredit International Bank (Luxembourg) S.ADocument126 pagesUnicredit International Bank (Luxembourg) S.AViorel GhineaNo ratings yet

- Export Finance: Project Guide: Prof.S.B. Kasture Project Prepared By: Sachin Parab Nmims MFM - Iii B ROLL NO.113Document56 pagesExport Finance: Project Guide: Prof.S.B. Kasture Project Prepared By: Sachin Parab Nmims MFM - Iii B ROLL NO.113rahulsatelli100% (2)

- Equitable PCI Bank foreclosure disputeDocument22 pagesEquitable PCI Bank foreclosure disputearsalle2014No ratings yet

- FInalDocument7 pagesFInalRyan Martinez0% (1)

- Caroline WanzaDocument1 pageCaroline Wanzajamescarolyne597No ratings yet

- Declaration Towards Advance Against ExportsDocument2 pagesDeclaration Towards Advance Against ExportsShiva KumarNo ratings yet

- Chapter 1 Introduction To Engineering EconomyDocument55 pagesChapter 1 Introduction To Engineering EconomyNadia IsmailNo ratings yet

- Acc Ch-7 Average Due Date SaDocument15 pagesAcc Ch-7 Average Due Date SaShivaSrinivas100% (3)

- HQ05 - Capital Gains TaxationDocument10 pagesHQ05 - Capital Gains TaxationClarisaJoy Sy100% (3)

- AssignmentDocument3 pagesAssignmentMarilou Arcillas PanisalesNo ratings yet

- Affordable Housing Recommendations To The Mayor ReportDocument30 pagesAffordable Housing Recommendations To The Mayor ReportMinnesota Public RadioNo ratings yet

- RBI Current Affairs Refresher for IBPS Clerk MainDocument60 pagesRBI Current Affairs Refresher for IBPS Clerk MainShaileswor PandaNo ratings yet

- Real Estate Acquisition Process From A Legal Perspective 2 21Document11 pagesReal Estate Acquisition Process From A Legal Perspective 2 21mzhao8No ratings yet

- Pasani Loan Terms & Condition For Baloyi Wisani CydrickDocument6 pagesPasani Loan Terms & Condition For Baloyi Wisani CydrickClint AnthonyNo ratings yet

- Australian Trusts PDFDocument59 pagesAustralian Trusts PDFsamu2-4uNo ratings yet

- Catering Services Agreement SummaryDocument17 pagesCatering Services Agreement SummaryStacey100% (1)