Professional Documents

Culture Documents

Chapter 4 5 6

Uploaded by

nguyen2190Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 5 6

Uploaded by

nguyen2190Copyright:

Available Formats

9/23/2012

Chapter 4 COMPLETING THE ACCOUNTING CYCLE

Closing entries

After all revenue & expense have been closed at the end of the fiscal year + Income Summary has a debit of $ 521,900 and a credit of $ 729,350

Worksheet and its benefits

From trial balance to adjusted trial balance

+ Brenda, Capital has a credit balance of $ 405,700 + Brenda, Drawings has a balance of $ 40,000

Closing Entries

A, Journalise the entries required to complete the closing of the accounts

Financial Statements

B, Determine the amount of Brenda, Capital at the end of the period

The data needed to determine year-end adjustments are as follows:

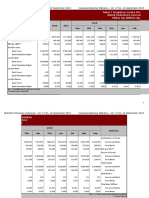

Habor RealtyTRIAL BALANCE

December 31, N Account Title Cash Supplies Accounts Receivable Prepaid Insurance Office Equipment Acc Depreciation Account Payable Unearned Fees T.Roderick, Capital T.Roderick, Drawing Fee Earned Wage Expense Rent Expense Utilities Expense Miscellaneous Expense Totals Trial Balance Dr. Cr. 3,425 7,000 1,270 620 51,650 9,700 925 1,250 29,000 5,200 59,125 22,415 4,200 2,715 1,505 100,000 100,000

A, Supplies on hand at 31, Dec are $ 380 B, Insurance Premiums expired during the year are $315 C, Depreciation of equipment during the year is $ 4,950 D, Wages accrued but not paid at 31, Dec are $440 E. Accrued fees earned but not recorded are $1,000 F. Unearned fees became Earned $ 750

1, Enter the trial balance on a ten-column worksheet and complete the worksheet 2, Prepare Financial Statements 3, Journalize the closing entries

CHAPTER 4 COMPLETING THE ACCOUNTING CYCLE

Crazy Young TRIAL BALANCE December 31, N Account Title (000 ommited) Cash at bank Trade debtors Prepaid insurance Equipment Acc Dept Equipment Trade creditors Charles Metlock, Capital Charles Metlock, Drawings Service Revenue Wages Expense Electricity Expense Sundry Expense Totals Trial Balance Dr. Cr. $ 10 8 2 20 $8 4 27 5 32 17 6 3 71

CHAPTER 4 COMPLETING THE ACCOUNTING CYCLE

Crazy Young TRIAL BALANCE December 31, N

The following unadjusted trial balance was taken from the ledger of Matlock Agencies on 31, Dec, N

71

Account Title (000 ommited) Cash at bank Trade debtors Prepaid insurance Equipment Acc Dept Equipment Trade creditors Charles Metlock, Capital Charles Metlock, Drawings Service Revenue Wages Expense Electricity Expense Sundry Expense Totals

Trial Balance Dr. Cr. $ 10 8 2 20 $8 4 27 5 32 17 6 3 71

A- Prepare a 10-column worksheet using the following additional information on 31, Dec, N (1) Expired insurance $1 (2) Accrued wages, $2 (3) Depreciation on Equipt 4$

B. Prepare Income Statement, Balance Sheet, Owners Equity Statement

71

C. Recording the adjusting and closing entries in the General Journal

9/23/2012

A partially completed work sheet is shown below. The unadjusted trial balance columns are complete. Complete the adjustments, adjusted trial balance.

CHAPTER 5

Accounting for Merchandising Operations

CHAPTER 5 - MERCHANDISING

Prepare the journal entries to record each of the following purchases transactions of a merchandising company. Show supporting calculations and assume a perpetual inventory system

1, Mar,5: 1. Merchandising Operation 2. Purchases for Merchandising 3. Sales for Merchandising 4. Financial Statements Purchased 1,000 units of product at a cost of $12 per unit. Terms of the sale are 2/10, n/60, the invoice is dated Mar 5 2. Mar, 7: Returned 50 defective units from the Mar 5 purchase and received full credit 3.Mar 15: Paid the amount due from the Mar 5 purchase less return on Mar 7

Purchased 1,000 units at a cost of $12 per unit.

Paid the amount due from the Mar 5 purchase less return on Mar 7 + Dr. Account Payable 11,400

Terms of the sale are 2/10, n/60, the invoice is dated Mar 5

+ Dr. Merchandise Inventory

12,000

Cr. Account Payable

12,000

Cr. Cash

11,400

Returned 50 defective units from the Mar 5 purchase and received full credit

How about the seller?

+ Dr. Account Payable

600 600

Cr. Merchandise Inventory

9/23/2012

2

Determine the amount to be paid in full settlement of each of the following invoices assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period

Prepare the journal entries (perpetual inventory )

1, Purchased merchandise from Johns Company under the following

terms: $ 5,900 price, invoice dated April,2, credit terms of 2/15, n/60 and FOB shipping point

2, Paid $ 330 for shipping charges on April,2 purchase 3, Returned to Johns Company unacceptable merchandise that had

an invoice price of $ 900

Merchandise A, $ 4,000 B, 1,500 C, 9,500 D, 2,500 E, 5,000

Transportation paid by seller $ 50 75 FOB shipping point, 1/10, n/30 FOB shipping point, 2/10, n/30 FOB destination, n/30 FOB shipping point, 1/10, n/30 FOB destination, 2/10. n/30

Return and Allowance $ 1,200 700 400 600 -

4, Purchased merchandise from William Corp. under the following

terms $12,250 price, invoice date April 18, credit terms of 2/10,n/60, FOB destination

5, After negotiations, received from William a $ 3,250 allowance on

Apr 18 purchase

6, Sent check to William paying for the April 18 purchase, net pf the

discount and allowance

4

On Mar 31,2008, Merchandise Inventory was 27,941. Supplementary records of merchandising activities for the year ended March 31, 2009 reveal the following itemized cost:

Invoice cost of merchandise purchases Purchase discounts received Purchase return & allowances Costs of transportation-in $ 101,430 2,130 4,868 3,900

2, Calculate total cost of merchandise purchased for the year

Fords LaundryTRIAL BALANCE March 31, 2009 Trial Balance Account Title Dr. Cr. Merchandise Inventory 34,500 Other (non-inv asset) 128,000 Account Payables 39,847 Frisco, Capital 115,110 Frisco, Withdrawal 8,000 Sales 235,980 Sales discount 3,610 Sales returns & Allowance 15,574 Cost of Good Sold 91,673 Sales Salaries Expense 32,329 Rent Expense-selling space 11,091 Store Supplies Expense 2,831 Advertising Expense 20,058 Office salaries Expense 29,497 Rent expense-Office space 2,831 Office supplies Expense 943 Totals 390,937 390,937

1, Calculate net sales? 2, Calculate total cost of merchandise purchased for the year 3, Prepare Multi-step Income statement that

includes separate categories for selling EX and general and administrative EX?

4, Single-step IS

that includes these EX categoriesL COGS,selling EX, general & admin EX?

CHAPTER

1

Jan 1 Jan 12 Jan 19 Jan 20

Chapter 6 - INVENTORY

Part 1: Overview Part 2: Inventory Counting System Part 3: Inventory Valuation Part 4: Accounting for Inventory

A company sells a climbing kit and uses the perpetual inventory system to account for its merchandise. The beginning balance of the inventory and its transactions during January were as follows:

Beginning balance of 18 units at $ 13 each Purchased 30 units at $ 14 each Sold 24 units at $ 30 selling price each Purchased 24 units at $ 17 each

Jan 27

Sold 27 units at $ 30 selling price each

INVENTORY

Calculate the cost of ending inventory using inventory method: a. LIFO method. b. FIFO method. c. Weighted-average method.

9/23/2012

What is the cost of the ending inventory?

What is the cost of the ending inventory?

1, A company has inventory of 15 units at a cost of $12 each on August 1. On August 5, it purchased 10 units at $13 per unit. On August 12 it purchased 20 units at $14 per unit. On August 15, it sold 30 units for $20 each. Using the FIFO periodic inventory method, what is the COGS? what is the value of the inventory at August 15 after the sale (Ending inventories)?

2, A company had inventory of 10 units at a cost of $20 each on November 1. On November 2, it purchased 10 units at $22 each. On November 6 it purchased 6 units at $25 each. On November 8, it sold 22 units for $54 each. Using the FIFO perpetual inventory method, what was the cost of the 22 units sold?

Prepare journal entries for the transactions.

Prepare journal entries for transactions.

ME company sold 200 units of its goods for $5 each. The COGS is $3 each. i) 10 days later, customer returned 50 units of goods ii) 10 days later, customer wanted to return 50 defective units of goods, the company agreed to reduce price to $3, so that the customer accepted the goods and not returned.

a) Purchase 20 sets of TV Sony, $200/set, paid in cash

b) Sell on credit 10 sets of TV for company A at the selling price

of $300/set. c) Sell 3 sets of TV at price of $350/set, already received cash. d) Sell on credit 4 cars with price per car is $ 40,000, total costs to import and put in sale these cars are $20,000 per car.

You might also like

- Chapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsDocument11 pagesChapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsRavinesh Amit PrasadNo ratings yet

- Chapter 5 & 6 exercises solutionsDocument7 pagesChapter 5 & 6 exercises solutionsĐức TiếnNo ratings yet

- Ethics CaseDocument38 pagesEthics Casemeochip21No ratings yet

- CREDIT RISK MANAGEMENTDocument15 pagesCREDIT RISK MANAGEMENTKhánh LinhNo ratings yet

- OFOD7 e Test Bank CH 03Document2 pagesOFOD7 e Test Bank CH 03Danny NgNo ratings yet

- MNC Nep PresentationDocument53 pagesMNC Nep PresentationSaajan RathodNo ratings yet

- F6 PIT AnswersDocument18 pagesF6 PIT AnswersHuỳnh TrungNo ratings yet

- Preparation Unit 6Document26 pagesPreparation Unit 6api-357340520No ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Exercises FS AnalysisDocument24 pagesExercises FS AnalysisEuniceNo ratings yet

- Individual Assignment: Subject: Eco121Document5 pagesIndividual Assignment: Subject: Eco121Doanh PhùngNo ratings yet

- Tb05 - Test Bank Chapter 5 Tb05 - Test Bank Chapter 5Document59 pagesTb05 - Test Bank Chapter 5 Tb05 - Test Bank Chapter 5Renz AlconeraNo ratings yet

- GROUP 1 - Top-Down AnalysisDocument26 pagesGROUP 1 - Top-Down AnalysisSukma Wardha0% (1)

- Multinational Inventory ManagementDocument2 pagesMultinational Inventory ManagementPiyush Chaturvedi75% (4)

- Chapter 1 & 2 QuizzesDocument51 pagesChapter 1 & 2 QuizzesArmand Hajdaraj33% (3)

- U3 Replies To EnquriesDocument20 pagesU3 Replies To EnquriesK58 Hoa Trần Quỳnh TrangNo ratings yet

- What's Special About International Finance?Document6 pagesWhat's Special About International Finance?Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- Principles of Marketing 2Document13 pagesPrinciples of Marketing 2Hiển NguyễnNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisAreti SatoglouNo ratings yet

- 2.BMMF5103 - EQ Formattedl May 2012Document7 pages2.BMMF5103 - EQ Formattedl May 2012thaingtNo ratings yet

- TN Đttc. 1Document40 pagesTN Đttc. 1Nguyễn Thị Thùy DươngNo ratings yet

- Week 1 Practice SolutionsDocument7 pagesWeek 1 Practice SolutionsalexandraNo ratings yet

- file ôn trắc nghiệm cuối kì 8 .vi.enDocument38 pagesfile ôn trắc nghiệm cuối kì 8 .vi.en2-Nguyễn Thị Lan Anh100% (2)

- TM Tut 13 Credit Derivatives Revision PDFDocument5 pagesTM Tut 13 Credit Derivatives Revision PDFQuynh Ngoc DangNo ratings yet

- InflationDocument11 pagesInflationZakaria ZrigNo ratings yet

- CH 1Document16 pagesCH 1dragopyreNo ratings yet

- PartB-4d-Throughput Accounting-StudentDocument5 pagesPartB-4d-Throughput Accounting-StudentDebbie BlackburnNo ratings yet

- ECO121 Macroeconomics Class AssignmentDocument3 pagesECO121 Macroeconomics Class AssignmentTrần Trác Tuyền Vietnam Fanpage Sweet DreamNo ratings yet

- Modes of International Payment 1. Bill of Exchange (Draft)Document38 pagesModes of International Payment 1. Bill of Exchange (Draft)Thanh Lê Thị HoàiNo ratings yet

- Lí thuyết tacn2Document27 pagesLí thuyết tacn2Nguyễn Thị Ngọc AnhNo ratings yet

- (123doc) - Testbank-Chap18-Corporate-Finance-By-Ross-10thDocument6 pages(123doc) - Testbank-Chap18-Corporate-Finance-By-Ross-10thHa Lien Vu KhanhNo ratings yet

- Week 8 Practice Test With SolutionsDocument8 pagesWeek 8 Practice Test With SolutionspartyycrasherNo ratings yet

- F5 RevDocument69 pagesF5 Revpercy mapetereNo ratings yet

- ECO121 - Test01 - Fall2021 - Lê Hoằng Anh - HE153555Document6 pagesECO121 - Test01 - Fall2021 - Lê Hoằng Anh - HE153555Le Hoang Anh (K15 HL)No ratings yet

- Standard Cost Systems: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesDocument56 pagesStandard Cost Systems: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasessumanNo ratings yet

- GUC Bank Management Liquidity and Reserves TutorialDocument3 pagesGUC Bank Management Liquidity and Reserves TutorialHadeerMounirNo ratings yet

- End of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83Document2 pagesEnd of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83opi ccxv100% (1)

- IFRS C1 QuizDocument12 pagesIFRS C1 QuizDuongNguyenNo ratings yet

- MNC Multinational Corporation: Business Studies Assignment Group PresentationDocument14 pagesMNC Multinational Corporation: Business Studies Assignment Group PresentationSankarshan BaddarNo ratings yet

- Accounting Principles Pilot TestDocument6 pagesAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNo ratings yet

- Exercise Chapter 4Document5 pagesExercise Chapter 4nguyễnthùy dươngNo ratings yet

- Assignment 8 AnswersDocument6 pagesAssignment 8 AnswersMyaNo ratings yet

- Bài tập kinh tế vĩ mô 11Document6 pagesBài tập kinh tế vĩ mô 11DuyenNo ratings yet

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- CH 06Document8 pagesCH 06Tien Thanh DangNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 11: Dividend and Share Repurchases (Common Questions)Document2 pagesNanyang Business School AB1201 Financial Management Tutorial 11: Dividend and Share Repurchases (Common Questions)asdsadsaNo ratings yet

- Final2017 Solution PDFDocument14 pagesFinal2017 Solution PDFVikram SharmaNo ratings yet

- International Payment LawDocument45 pagesInternational Payment LawSancy NguyenNo ratings yet

- BÀi tập tài chínhDocument5 pagesBÀi tập tài chínhlam nguyenNo ratings yet

- Thu Tin Giao DichDocument13 pagesThu Tin Giao DichNguyễn Đặng Ngọc TrinhNo ratings yet

- Week 3 Solutions To ExercisesDocument6 pagesWeek 3 Solutions To ExercisesBerend van RoozendaalNo ratings yet

- lý thuyết cuối kì MNCDocument6 pageslý thuyết cuối kì MNCPhan Minh KhuêNo ratings yet

- Maktin (ML) PDFDocument89 pagesMaktin (ML) PDFbichlynguyenNo ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- Fin202 Midterm Spring2020Document3 pagesFin202 Midterm Spring2020Min SugaNo ratings yet

- P2 November 2014 Question Paper PDFDocument20 pagesP2 November 2014 Question Paper PDFAnu MauryaNo ratings yet

- IlliquidDocument3 pagesIlliquidyến lêNo ratings yet

- FIN4646Final Summer2020sec7Document2 pagesFIN4646Final Summer2020sec7Mahi0% (1)

- Exercises For Final PDFDocument11 pagesExercises For Final PDFThanh HằngNo ratings yet

- List of Banks in IndiaDocument5 pagesList of Banks in IndiamahendranmaheNo ratings yet

- Managing Emotion Conflict and ChangeDocument6 pagesManaging Emotion Conflict and ChangeRohanNo ratings yet

- ONline BankingDocument5 pagesONline BankingjavedalyNo ratings yet

- Barrel Race Entry FormDocument2 pagesBarrel Race Entry Formapi-245044768No ratings yet

- AFISCO Insurance Pool Ruled Taxable CorporationDocument2 pagesAFISCO Insurance Pool Ruled Taxable Corporationstickygum08100% (2)

- Due Diligence Data Room ChecklistDocument10 pagesDue Diligence Data Room ChecklistanishsinglaNo ratings yet

- Central Bank Statement From 22-Apr-2023 To 22-Jul-2023.Document20 pagesCentral Bank Statement From 22-Apr-2023 To 22-Jul-2023.Shafi MuhimtuleNo ratings yet

- POS rental forms replyDocument1 pagePOS rental forms replyIsabelle Che KimNo ratings yet

- T.B - CH09Document17 pagesT.B - CH09MohammadYaqoobNo ratings yet

- Lic Receipt PDFDocument1 pageLic Receipt PDFrohitjain444No ratings yet

- Statement of Account: Date Particulars CHQ - No. Withdrawals Deposits BalanceDocument3 pagesStatement of Account: Date Particulars CHQ - No. Withdrawals Deposits BalanceDeepak Raj KumarNo ratings yet

- Banking-Finance Degree at Beirut Arab UniversityDocument5 pagesBanking-Finance Degree at Beirut Arab UniversityAA BB MMNo ratings yet

- Sample Quiz On Acctg BasicsDocument1 pageSample Quiz On Acctg BasicsDarren Jacob EspinaNo ratings yet

- Research MethodologyDocument34 pagesResearch MethodologySangeetaLakhesar80% (5)

- History of Microfinance in NigeriaDocument9 pagesHistory of Microfinance in Nigeriahardmanperson100% (1)

- 820 Specimen 2018Document12 pages820 Specimen 2018Sunny KiskuNo ratings yet

- Certificate of Existence Group and Ind AnnuityDocument1 pageCertificate of Existence Group and Ind AnnuityRajesh MukkavilliNo ratings yet

- Updated NullDocument1,965 pagesUpdated Nullazsial4456No ratings yet

- Vidhyaashram First Grade College Corporate Accounting III II AssignmentDocument4 pagesVidhyaashram First Grade College Corporate Accounting III II AssignmentveenaNo ratings yet

- Notice: Ocean Transportation Intermediary Licenses: CBE USA International Inc. Et Al.Document2 pagesNotice: Ocean Transportation Intermediary Licenses: CBE USA International Inc. Et Al.Justia.comNo ratings yet

- Unit 3 Ledger Posting and Trial Balance PDFDocument46 pagesUnit 3 Ledger Posting and Trial Balance PDFPankaj VishwakarmaNo ratings yet

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocument10 pagesTanggal Uraian Transaksi Nominal Transaksi SaldoSasongko Family0% (1)

- Customers and Account HoldersDocument23 pagesCustomers and Account HoldersMAHESH VNo ratings yet

- Payroll Direct DepositDocument1 pagePayroll Direct Depositumang parmarNo ratings yet

- Indonesia Banking Statistics - Vol. 17 No. 10 September 2019 Table 1.1 Commercial Bank ActivitiesDocument818 pagesIndonesia Banking Statistics - Vol. 17 No. 10 September 2019 Table 1.1 Commercial Bank ActivitiesDewiNo ratings yet

- Chhattisgarh DR ListDocument2 pagesChhattisgarh DR Listaakash DiagnosticNo ratings yet

- 10 Steps To Making A MillionDocument10 pages10 Steps To Making A Millionadeng96No ratings yet

- Global Payments Guide 2018Document79 pagesGlobal Payments Guide 2018annmj170% (1)

- Factors Influencing Consumers' Intention to Use Mobile Money in NigeriaDocument159 pagesFactors Influencing Consumers' Intention to Use Mobile Money in NigeriaNk NoviaNo ratings yet

- Management of Primary ReservesDocument13 pagesManagement of Primary ReservesNuhman.MNo ratings yet