Professional Documents

Culture Documents

ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDF

Uploaded by

Piyal HossainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDF

Uploaded by

Piyal HossainCopyright:

Available Formats

ACCA

Paper F7 Financial Reporting (International)

Revision Mock Examination June 2013 Question Paper

Time Allowed

15 minutes 3 hours

Reading and planning Writing

All FIVE questions are compulsory and MUST be attempted Do NOT open this paper until instructed by the supervisor. During reading and planning time only the question paper may be annotated. You must NOT write in your answer booklet until instructed by the supervisor.

Interactive World Wide Ltd, March 2013 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Interactive World Wide Ltd.

www.studyinteractive.org

This is a blank page. Question 1 starts on page 4.

www.studyinteractive.org

ALL questions are compulsory and MUST be attempted

1

Primrose, a public listed company acquired 900 million ordinary shares in Sunflower on 1 December 2011. The purchase consideration is made up as follows: An immediate cash payment of $180 million. A share exchange of two shares in Primrose for four shares in Sunflower. A deferred cash payment of 17 cents per share acquired, payable on 1 December 2012. Primrose has only recorded the cash payment. The value of each share in Primrose and Sunflower at the date of acquisition was 90 cents and 59 cents respectively. The Primrose cost of capital is 7% per annum. The statements of the financial position of the two companies at 30 November 2012 are shown below: Primrose $m $m Non-current assets Property, plant and equipment Intangible: Software Investments In Sunflower In Agapanthus Current assets Inventory Trade receivables Bank 960 Nil 180 20 94 126 Nil ___ 220 _____ 1,380 _____ 30 66 6 ___ 102 _____ 660 _____ Sunflower $m $m 510 48 Nil Nil

Total assets Equity and liabilities Equity Equity shares of 25 cents each Retained earnings - 1 Dec 2011 - year ended 30 Nov 2012

450 315 135 ___ 450 _____ 900 180 30 ___

300

210 _____ 510 30

Non-current liabilities 10% loan notes Current liabilities Trade payables Income taxes payable Operating overdraft

180

195 68 37 ___ 300 _____ 1,380 _____

86 34 Nil ___ 120 _____ 660 _____

Total equity and liabilities

www.studyinteractive.org

The following information is relevant: (i) On the 1 December 2011 the fair value of Sunflowers property, plant and equipment exceeded their carrying value by $90 million. The property, plant and equipment had a remaining useful life of 18 years at this date. The software of Sunflower represents the amortised development cost of an integrated electronic reporting package. It was completed at a capitalised cost of $60 million and went on sale on 1 December 2010. Sunflowers directors are currently amortising the development over ten years. However, the directors of Primrose feel that it would be more appropriate to amortise the development over a six-year period. Sunflower sold goods to Primrose for $12 million in the post-acquisition period. One third of these goods remain in inventory at 30 November 2012. Sunflower applies a 25% gross profit margin on all sales. Sunflowers trade receivables account balance includes $11m due from Primrose at the year-end. However this does not agree with the current account balance included within Primroses trade payables account due to cash-in-transit of $7 million paid by Primrose. Primrose bought 10 million shares in Agapanthus on 1 June 2012; this represents a holding of 30% of Agapanthus equity. Agapanthus profit is subject to seasonal variation. Its profit for the year ended 30 November 2012 is $18 million; $12 million was made from 1 December 2011 to 31 May 2012. Primrose uses equity accounting in its consolidated financial statements for its investment in Agapanthus. Goodwill is reviewed for impairment annually. At 30 November 2012 there had been an impairment loss of $40 million in the value of consolidated goodwill since acquisition. Due to the difficult economic conditions as evidenced by falling profits, the value of the investment in Agapanthus was impaired by $2.8 million.

(ii)

(iii)

(iv)

(v)

(vi)

(vii) It is group policy to value the non-controlling interest at acquisition at full (or fair) value. Required: Prepare the Consolidated Statement of Financial Position of Primrose as at 30 November 2012. (25 marks)

www.studyinteractive.org

The following trial balance relates to Kasabian, a listed company, at 31 March 2013. $000 Ordinary shares 50 cents each Retained earnings at 1 April 2012 Revaluation reserve (from land and buildings) 2% Debenture 2016 Revenue Investment properties at valuation 1 April 2012 Land and buildings at valuation 1 April 2012 Plant at cost 1 April 2012 Plant - accumulated depreciation 1 April 2012 Distribution costs Administration expenses Inventory at 1 April 2012 Debenture interest paid Income tax Carriage inwards Investment income Purchases Trade receivables Trade payables Bank Deferred tax 1 April 2012 Suspense account $000 105,000 44,625 24,500 140,000 315,700 46,375 227,500 224,000 56,000 19,250 21,875 33,100 1,400 700 125 3,850 189,200 61,425 60,725 11,550 19,600 42,000 _______ 824,250 _______

_______ 824,250 _______

The following information is relevant: (i) The 2% Debenture was issued on 1 October 2012 under terms that provide for a large premium upon redemption in 2016. The finance department has calculated that the effective interest rate of this type of debt instrument is 6% per annum. Kasabian also paid in cash issue costs of $1.5 million; these have yet to be accounted for. Kasabian intends to hold these debentures to maturity. Kasabian has a policy of revaluing its land and buildings to their fair value at each year-end. The valuation of land and buildings includes a land element of $52.5 million. On 31 March 2013 a professional valuer valued the buildings at $161 million with no change to the value of land. The estimated remaining life of buildings at 1 April 2012 was 25 years. Depreciation is charged 50% to cost of sales, 25% to distribution costs and 25% to administration expenses. Later, the valuers informed Kasabian that investment property of the type Kasabian owned had increased in value by 8% in the year to 31 March 2013. Plant is depreciated at a rate of 15% per annum using the reducing balance method and charged to cost of sales. The directors of Kasabian have estimated the income tax liability for the year ended 31 March 2013 at $32.3 million. The balance of the income tax account in the trial balance represents under/over provision of the

(ii)

(iii)

(iv) (v)

www.studyinteractive.org

previous years estimate. At 31 March 2013 there were $80 million of taxable temporary differences due to capital allowances exceeding depreciation. The applicable tax rate is 25%. (vi) The suspense account in the trial balance represents the credit entry for the proceeds of a one for three rights issue of ordinary shares made on 1 February 2013. The issue was for 60 cents per share. The issue was fully subscribed.

(vii) Inventory on 31 March 2013 was $66,325,000. Required: Prepare for Kasabian (a) (b) (c) an Income Statement; and a Statement of Financial Position as at that date; and (9 marks) (13 marks)

a Statement of Changes in Equity for the year ended 31 March 2013. (3 marks) (25 marks)

www.studyinteractive.org

Jennie Mae, a public company, is a national clothing retailer that sells luxury designer clothing. The company has recently expanded its operations and commissioned a famous supermodel to endorse its womens clothing line. This has led to increased sales, however; overall profits of the company are down. The managing director of the company has expressed her extreme disappointment with the current years results and would like an explanation as to why these increased sales has not led to increased profitability. Details of Jennie Maes financial statements 30 September 2012 are shown below. Income Statements for the year ended: for the two years to

30 Sept 2012 $000 57,500 (48,125) ______ 9,375 (6,875) ______ 2,500 (750) ______ 1,750 (625) ______ 1,125 ______

30 Sept 2011 $000 49,000 (39,250) ______ 9,750 (4,750) ______ 5,000 (200) ______ 4,800 (1,300) ______ 3,500 ______

Revenue Cost of sales Gross profit Operating expenses Operating profit Interest expense Profit before tax Taxation expense Profit for the year Statements of Financial Position as at: 30 September 2012 $000 $000 Non-current assets Property, plant and equipment (note i)

30 September 2011 $000 $000

30,000

16,250

Current assets Inventory Trade receivables Bank

7,250 250 Nil ______ 7,500 ______ 37,500 ______

3,750 125 1,125 ______ 5,000 ______ 21,250 ______

Total assets

www.studyinteractive.org

Statements of Financial Position as at: 30 September 2012 $000 $000 Equity and liabilities Equity Ordinary share capital ($1) Share premium Retained earnings Non-current liabilities Long-term loans Current liabilities Bank overdraft Trade payables Income tax payable 30 September 2011 $000 $000

12,500 2,500 4,375 ______ 19,375 7,500

7,500 Nil 4,750 ______ 12,250 2,500

2,325 7,750 550 ______ 10,625 ______ 37,500 ______

Nil 5,375 1,125 ______ 6,500 ______ 21,250 ______

Total equity and liabilities The following information is relevant: (i)

Property, plant and equipment can be analysed as follows: 2012 $000 Cost Accumulated depreciation Carrying amount 42,500 (12,500) ______ 30,000 ______ 2011 $000 23,750 (7,500) ______ 16,250 ______

The increase in property, plant and equipment was due to the acquisition of six new stores in the London area and the refurbishment of existing stores in the regions. Because of the refurbishment, some fixtures and fittings were scrapped which has a book value of $3.125 million and had originally cost $7.5 million. These fixtures had no scrap value. (ii) Dividends paid by the company to ordinary shareholders were $1.5 million in both 2011 and 2012. The directors have signalled their intention to maintain the annual dividend at $1.5 million for the foreseeable future.

www.studyinteractive.org

(iv)

The following ratios have been calculated for 2011: Gross profit margin Operating profit margin Net profit margin Return on capital employed Gearing Interest cover Current ratio Inventory days Payables days 19.9% 10.2% 7.1% 33.9% 17.0% 25 times 0:77:1 35 days 50 days

Required: (a) (b) Prepare the Statement of Cash Flow for Jennie Mae for the year ended 30 September 2012 using the indirect method. (10 marks) Write a report to the managing director of Jennie Mae analysing the financial performance and financial position of Jennie Mae for the two years ended 30 September 2012. (15 marks) (25 marks)

10

www.studyinteractive.org

(a)

The International Accounting Standards Committee Foundation (IASCF) is committed to developing a single set of high quality, understandable, enforceable and globally accepted international financial reporting standards (IFRSs) and to promote the use and rigorous application of those standards. Required: Describe the functions of the various internal bodies of the IASCF. (7 marks)

(b)

The qualitative characteristics of financial information are identified in the IASBs framework for the preparation and presentation of financial statements. Required: Define the qualitative characteristics set out in the IASBs framework and explain how they make financial information useful. (8 marks) (15 marks)

(a)

IAS 12 Income taxes details the requirements relating to the accounting treatment of deferred taxes. Required: Explain, with examples, the nature and purpose of deferred tax and outline the effect of deferred tax in the financial statements. (5 marks)

(b)

Rainsbury purchased an item of machinery for $500,000 on the 1 September 2010. Rainsbury has a policy of depreciating all noncurrent assets at 20% per annum on a straight-line basis. The tax authorities do not allow depreciation as a deductible expense. Instead, capital allowances are given at an accelerated rate of 50% on cost in the year of purchase and then 25% per annum thereafter on a reducing balance basis. The rate of income tax is given as 30%. Required: In respect of the item of machinery, calculate the deferred tax charge/credit in Rainsburys statement of comprehensive for the year ended 31 August 2012 and the deferred tax balance in the statement of financial position at that date. (5 marks) (10 marks)

www.studyinteractive.org

11

You might also like

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Financial Reporting: March/June 2016 - Sample QuestionsDocument7 pagesFinancial Reporting: March/June 2016 - Sample QuestionsViet Nguyen QuocNo ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- ACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFDocument24 pagesACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFPiyal Hossain100% (1)

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- December 2002 ACCA Paper 2.5 QuestionsDocument11 pagesDecember 2002 ACCA Paper 2.5 QuestionsUlanda2No ratings yet

- F9 2014-2019 Past Year QDocument133 pagesF9 2014-2019 Past Year QFarahAin FainNo ratings yet

- Becker F4 - Corporate and Business Law (Russia) - Revision Question BankDocument196 pagesBecker F4 - Corporate and Business Law (Russia) - Revision Question BankIrina NuzhnovaNo ratings yet

- 8int 2006 Jun QDocument4 pages8int 2006 Jun Qapi-19836745No ratings yet

- f7 Mock QuestionDocument20 pagesf7 Mock Questionnoor ul anumNo ratings yet

- 05 DEC AnswersDocument15 pages05 DEC Answerskhengmai100% (5)

- Dec 2007 - AnsDocument10 pagesDec 2007 - AnsHubbak KhanNo ratings yet

- f8 RQB 15 Sample PDFDocument98 pagesf8 RQB 15 Sample PDFChandni VariaNo ratings yet

- F9 Past PapersDocument32 pagesF9 Past PapersBurhan MaqsoodNo ratings yet

- Jun 2006 - Qns Mod ADocument11 pagesJun 2006 - Qns Mod AHubbak Khan100% (2)

- SA 701 MCQsDocument2 pagesSA 701 MCQspreethesh kumarNo ratings yet

- F7 Sir Zubair NotesDocument119 pagesF7 Sir Zubair NotesAli OpNo ratings yet

- F7 Workbook Q & A PDFDocument247 pagesF7 Workbook Q & A PDFREGIS Izere100% (1)

- F1FAB Revision Question Bank - Contents - j14-j15 (Encrypted)Document144 pagesF1FAB Revision Question Bank - Contents - j14-j15 (Encrypted)karan100% (3)

- F7 FR Jun21 Mock QuestionDocument19 pagesF7 FR Jun21 Mock QuestionAnuj ShethNo ratings yet

- F7 Course Note by Mezbah UddinDocument107 pagesF7 Course Note by Mezbah UddinAsim NazirNo ratings yet

- Acca p4 Notes From EmilyDocument139 pagesAcca p4 Notes From EmilyCường Lê TựNo ratings yet

- F7 ACCA June 2013 Exam: BPP AnswersDocument16 pagesF7 ACCA June 2013 Exam: BPP Answerskumassa kenya100% (1)

- ACCA F9 Past Paper AnalysisDocument6 pagesACCA F9 Past Paper AnalysisPawan_Vaswani_9863100% (1)

- Sample Exam - AssuranceDocument57 pagesSample Exam - AssuranceHương MaiNo ratings yet

- Consolidated Financial StatementsDocument33 pagesConsolidated Financial StatementsTamirat Eshetu Wolde100% (1)

- Acca P3Document43 pagesAcca P3Goh Guat Ling100% (1)

- September 2022 Audit and Assurance Paper ICAEWDocument10 pagesSeptember 2022 Audit and Assurance Paper ICAEWTaminderNo ratings yet

- FR - MID - TERM - TEST - 2020 CPA Financial ReportingDocument13 pagesFR - MID - TERM - TEST - 2020 CPA Financial ReportingH M Yasir MuyidNo ratings yet

- Cima C01 Samplequestions Mar2013Document28 pagesCima C01 Samplequestions Mar2013Abhiroop Roy100% (1)

- ACCA F5 Exam Tips for Activity Based CostingDocument32 pagesACCA F5 Exam Tips for Activity Based CostingVagabond Princess Rj67% (3)

- CIMA C5 Mock TestDocument21 pagesCIMA C5 Mock TestSadeep Madhushan100% (1)

- F6 Revision Notes PDFDocument124 pagesF6 Revision Notes PDFЛюба Иванова100% (1)

- Financial Management: Acca Revision Mock 2Document22 pagesFinancial Management: Acca Revision Mock 2Sidra QamarNo ratings yet

- ICAEW - Accounting 2020 - Chap 4Document78 pagesICAEW - Accounting 2020 - Chap 4TRIEN DINH TIENNo ratings yet

- Icaew Mi - WorkbookDocument452 pagesIcaew Mi - WorkbookDương Ngọc100% (2)

- F5 ATC Pass Card 2012 PDFDocument102 pagesF5 ATC Pass Card 2012 PDFsaeed_r2000422100% (1)

- Paper f8 Mnemonics Sample Download v1Document72 pagesPaper f8 Mnemonics Sample Download v1pacorex1004355No ratings yet

- Compare investment projects using payback period and ARRDocument24 pagesCompare investment projects using payback period and ARRzaheer shahzadNo ratings yet

- Part C F5 RevisionDocument20 pagesPart C F5 RevisionMazni HanisahNo ratings yet

- ACCA F5 Revision Mock June 2013 ANSWERS Version 5 FINAL at 25 March 2013Document20 pagesACCA F5 Revision Mock June 2013 ANSWERS Version 5 FINAL at 25 March 2013Shahrooz Khan0% (1)

- f9 Mock-ExamDocument15 pagesf9 Mock-ExamSarad KharelNo ratings yet

- f1 Answers Nov14Document14 pagesf1 Answers Nov14Atif Rehman100% (1)

- F20-AAUD Questions Dec08Document3 pagesF20-AAUD Questions Dec08irfanki0% (1)

- F9 JUNE 17 Mock AnswersDocument15 pagesF9 JUNE 17 Mock AnswersottieNo ratings yet

- Thông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Document367 pagesThông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Kent PhamNo ratings yet

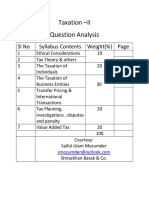

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Document68 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionNo ratings yet

- Intution Revision NotesDocument76 pagesIntution Revision NotesPhebin PhilipNo ratings yet

- Mock Exam QuestionsDocument21 pagesMock Exam QuestionsDixie CheeloNo ratings yet

- Acca Performance Management (PM) : Practice & Revision NotesDocument114 pagesAcca Performance Management (PM) : Practice & Revision NotesХалиун Тунгалаг100% (1)

- Cima C1Document52 pagesCima C1hopeaccaNo ratings yet

- ICAEW AssuranceDocument156 pagesICAEW AssuranceThành Vinh NguyễnNo ratings yet

- Performance Management: Intermediate LevelDocument585 pagesPerformance Management: Intermediate LevelNyanda Jr10100% (1)

- Tuition Mock D11 - F7 Questions FinalDocument11 pagesTuition Mock D11 - F7 Questions FinalRenato WilsonNo ratings yet

- ACCA QuestionDocument9 pagesACCA QuestionAcca Fia TuitionNo ratings yet

- F7int 2013 Dec QDocument9 pagesF7int 2013 Dec Qkumassa kenyaNo ratings yet

- Appendix Scanner Gr. I GreenDocument25 pagesAppendix Scanner Gr. I GreenMayank GoyalNo ratings yet

- Reset Federal Financial Report FormDocument1 pageReset Federal Financial Report FormPiyal HossainNo ratings yet

- Basics of OptionsDocument2 pagesBasics of OptionsPiyal HossainNo ratings yet

- ICMA Bangladesh Student Exemption List 2015Document12 pagesICMA Bangladesh Student Exemption List 2015Piyal HossainNo ratings yet

- Microsoft Dynamics NAV 2013: PreviewDocument4 pagesMicrosoft Dynamics NAV 2013: PreviewPiyal HossainNo ratings yet

- Visa ExperiencesDocument464 pagesVisa Experiencesapi-3702381100% (4)

- ASAEvalguideDocument80 pagesASAEvalguidePiyal HossainNo ratings yet

- 6ea69ba1a0bd7f6fb72976eefb2d4afcDocument264 pages6ea69ba1a0bd7f6fb72976eefb2d4afcPiyal Hossain100% (2)

- CIA Fee StructureDocument2 pagesCIA Fee StructurePiyal HossainNo ratings yet

- CH 15Document79 pagesCH 15Piyal Hossain100% (1)

- Acca Ocrlive 15h1Document19 pagesAcca Ocrlive 15h1Piyal HossainNo ratings yet

- Finance Bill 2015-2016Document86 pagesFinance Bill 2015-2016Piyal HossainNo ratings yet

- Destination Bangladesh Unusual Unique AuthenticDocument13 pagesDestination Bangladesh Unusual Unique AuthenticPiyal HossainNo ratings yet

- Bangladesh Holidays, Contacts, Weather and Sunrise SunsetDocument1 pageBangladesh Holidays, Contacts, Weather and Sunrise SunsetPiyal HossainNo ratings yet

- Phuket: Photo: Edwin.11Document17 pagesPhuket: Photo: Edwin.11Piyal HossainNo ratings yet

- Finance Bill 2015-2016Document86 pagesFinance Bill 2015-2016Piyal HossainNo ratings yet

- EMBA Brochure Fall2014Document6 pagesEMBA Brochure Fall2014Piyal HossainNo ratings yet

- IBA Admission GuideDocument1 pageIBA Admission GuideMd Rifat RahmanNo ratings yet

- November 2014 Q4a - 2Document3 pagesNovember 2014 Q4a - 2Piyal HossainNo ratings yet

- Microsoft Dynamics NAV 2015Document54 pagesMicrosoft Dynamics NAV 2015Piyal HossainNo ratings yet

- System Requirements Microsoft Dynamics NAV 2013Document9 pagesSystem Requirements Microsoft Dynamics NAV 2013Piyal HossainNo ratings yet

- Result Slip December 2014Document2,846 pagesResult Slip December 2014Piyal HossainNo ratings yet

- ASAEvalguideDocument80 pagesASAEvalguidePiyal HossainNo ratings yet

- E F - Cima P - T 2015: Nrolment ORM ART IMEDocument6 pagesE F - Cima P - T 2015: Nrolment ORM ART IMEPiyal HossainNo ratings yet

- Gca BookDocument27 pagesGca Bookgcuf243No ratings yet

- Workshop NoticeDocument2 pagesWorkshop NoticePiyal HossainNo ratings yet

- EMBA Brochure Fall2014Document6 pagesEMBA Brochure Fall2014Piyal HossainNo ratings yet

- AaDocument308 pagesAaPiyal HossainNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Autumn 2014Document6 pagesSuggested Answers Certificate in Accounting and Finance - Autumn 2014IrfanNo ratings yet

- Rutine April-2015 ExamDocument1 pageRutine April-2015 ExamPiyal HossainNo ratings yet

- Exam Latest Circular by Icap: Not-For-Profit Organizations (Nfpo)Document2 pagesExam Latest Circular by Icap: Not-For-Profit Organizations (Nfpo)Piyal HossainNo ratings yet

- Ifrs All About Debit and Credit: CS. Rajkumar S AdukiaDocument40 pagesIfrs All About Debit and Credit: CS. Rajkumar S AdukiaAbhiraj ShuklaNo ratings yet

- Suzlon Energy: Previous YearsDocument15 pagesSuzlon Energy: Previous YearsSorav SharmaNo ratings yet

- AaaaaaaaaaaaaaaDocument14 pagesAaaaaaaaaaaaaaapreetianvay100% (1)

- Teresita Buenaflor Shoes Worksheet 1 RegineDocument24 pagesTeresita Buenaflor Shoes Worksheet 1 RegineBaby Babe100% (1)

- Analyze Credit Using Liquidity, Capital StructureDocument58 pagesAnalyze Credit Using Liquidity, Capital Structurehy_saingheng_760260967% (9)

- Lecture 6Document64 pagesLecture 6Zixin Gu100% (1)

- Audit Assertions and Audit ObjectivesDocument6 pagesAudit Assertions and Audit ObjectivesKimberly parciaNo ratings yet

- C5 Corporate Liquidation and Organization Problem 3 and 5Document13 pagesC5 Corporate Liquidation and Organization Problem 3 and 5skilled legilimenceNo ratings yet

- Test - Consolidated Financial StatementsDocument1 pageTest - Consolidated Financial StatementsSibika GadiaNo ratings yet

- Analysis of Price Fluctuation of Raw Cotton and Cotton YarnDocument116 pagesAnalysis of Price Fluctuation of Raw Cotton and Cotton Yarnjaysean28No ratings yet

- Brookfield Asset Management Investor Day 2023Document128 pagesBrookfield Asset Management Investor Day 2023chi.leNo ratings yet

- Interim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Document23 pagesInterim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Сергей АнуфриевNo ratings yet

- Goldman Valuation TelemigDocument44 pagesGoldman Valuation Telemigarvindrobin9835100% (1)

- Consolidated-Financial-Statements-80%-Owned-SubsidiaryDocument10 pagesConsolidated-Financial-Statements-80%-Owned-SubsidiaryBetty SantiagoNo ratings yet

- Macy'sDocument8 pagesMacy'slibro1997No ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetDocument32 pagesSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetASHISH KUMARNo ratings yet

- Chiropractic Business Plan TemplateDocument11 pagesChiropractic Business Plan TemplateAhmed M. RafatNo ratings yet

- Accounting For A PartnershipDocument11 pagesAccounting For A PartnershipMathewos Woldemariam BirruNo ratings yet

- BSNL Financial AnalysisDocument16 pagesBSNL Financial AnalysisAyushi JainNo ratings yet

- 2Document52 pages2JDNo ratings yet

- FR (New) Suggested Ans CA Final Jan 21Document33 pagesFR (New) Suggested Ans CA Final Jan 21ritz meshNo ratings yet

- Hilton Blackstone Case StudyDocument31 pagesHilton Blackstone Case StudyArush Sharma100% (1)

- Ktu-Fsa-Course Project PresentationDocument19 pagesKtu-Fsa-Course Project PresentationAlbert VargheseNo ratings yet

- 2021 Proportunity - Investment AnnouncementDocument3 pages2021 Proportunity - Investment Announcementclaus_44No ratings yet

- Ministop Business ModelDocument9 pagesMinistop Business ModelGizella Almeda100% (1)

- Week 4 Morgan PLC ProblemDocument6 pagesWeek 4 Morgan PLC Problemgiangpham271003No ratings yet

- ProblemsDocument7 pagesProblemsNguyen Thanh Thao (K16 HCM)No ratings yet

- Bill Snow Financial Model 2004-03-09Document43 pagesBill Snow Financial Model 2004-03-09franicoleNo ratings yet

- 2017 AFR GCs Volume I PDFDocument897 pages2017 AFR GCs Volume I PDFJessica Aldea100% (1)

- Accounting Class Notes PDFDocument146 pagesAccounting Class Notes PDFshahzebkhans50% (2)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (197)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)