Professional Documents

Culture Documents

KBC Flash - FOMC Statement: No Hints About Tapering

Uploaded by

KBC EconomicsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KBC Flash - FOMC Statement: No Hints About Tapering

Uploaded by

KBC EconomicsCopyright:

Available Formats

Thursday, 01 August 2013

FOMC statement: no hints about tapering

FOMC keeps policy unchanged. Asset purchase programme continues .while Fed funds target range remains 0 to 0.25%. Fed reaffirms highly accommodative policy will remain appropriate for long Committee is slightly more cautious on economic growth and too low inflation. Statement contains no hint about timing of the start of tapering asset purchases We still favour the Sept. meeting as starting point tapering, but data-dependent Market reactions subdued.

Unchanged policy stance is no surprise

heFOMCkeptitspolicyunchanged.TheFedfundtarget rangeremainsat0to0.25%andtheassetpurchase programmecontinuesunaltered.Nooneexpectedthe FOMCtomakesuchchangestoitspolicyatthismeeting. Howeversomeexpectedtogetsomehintsaboutthe futureoftheFedsassetpurchaseprogrammeorsome changesinitscommunicationonrates.Indeed,afterthe Junemeeting,Bernankegave multiple hints that the Fed may soon start to reduce gradually the pace of purchases.Iftheeconomyevolvesaccording totheeconomicprojections,theFOMCmaydecidethis yeartostarttaperingthepurchases.Thereductionmay continueinthefirsthalfof2014andmay end by mid 2014, when unemployment should have fallen to 7%.

No hints about timing policy change

However, yesterdays FOMC statement gave no hints whatsoever about the start of this tapering.Thisshouldbenobigsurprise,astherewas sincetheJunemeetingonlylittleneweconomic informationavailable.ItwasalsounlikelytheFOMC wouldhavechangedpolicyinthemidstofthesummer holidayswhenmarketsarethinandsurprisescause unusuallyhighvolatility.Nevertheless,someFed watchersspeculatedthattheFOMCwouldmakesome changesinitscommunicationthatwoulddefacto prolongthetimetheFOMCwouldkeepavery accommodativepolicy(seebelow).Otherswerelooking forhintsaboutthetimingofthestartofthereductionof purchases.Theydidntfindsuchhints.TheMinutesof themeeting,tobereleasedmidAugust,maygiveus moreinsightswhichwaytheCommitteeleanson

P.1

Thursday, 01 August 2013

purchasetapering.Ifnot,thentheSeptembermeeting shouldbedecisive.

Some more caution though

ComparedtotheJunestatement,theJulystatement containedonlysomelimitedchanges.Nevertheless, they pointed to a somewhat more cautious position of the Committee on the outlook and some will say they diminish chances the FOMC would start its taperingof purchases in September.We do not agree with the latter deduction and keep the September meeting as the most likely starting date for the reduction of asset buying. First,theFOMC downgraded its assessment of the economyslightlyandsaidactivityexpandedata modestpaceinthefirsthalfoftheyear,whileinJuneit stillcharacterizedtheactivityasexpandingmoderately. Second,itaddedthe rise in mortgage rates as a downside risk,besidestherestraintcomingfromfiscal policy,whichwasalreadyinthepreviousstatement.The descriptionofthedevelopmentsinthevarioussectors likethelabourmarket,householdspending,business fixedinvestmentandhousingwasunchanged(fromthe previousstatement)andquiteoptimistic. Alsotheparagraphonthe outlookcontainedtwo changes.First,theCommitteeexpectsthateconomic growthwillpickupfromitsrecentpace,whileinJune, thestatementsaidtheCommitteeexpectseconomic growthwillproceedatmoderatepace.Thischangewas probablyinspiredbythedowngradingoftheactual economicsituation(seehigher)andthusmayhavebeen triggeredbytheneedtodescribetheecosituationinline withtheharddata.GDPgrowthof1.1%and1.7%inthe firsttwoquartersisindeedmodestandnotmoderate. Thereforewewouldntreadtoomuchinthischange. More importantly,theCommitteenowrecognizes explicitlythatinflationpersistentlybelowits2% objectivecouldposeriskstoeconomicperformance.The statementcontinuesbysayingthatitanticipatesthat inflationwillmovebacktowardsitsobjectiveoverthe mediumterm.Onecouldconsiderthisadditionas dovishanddiminishchancesforapolicychangeon purchasesinSeptember.Itsadditionwasprobablymade tobringStLouisFedgovernorBullardagainonboard,He dissentedinJune,becausehewantedtheFOMCshould signalmorestronglyitswillingnesstodefenditsinflation

goalinthelightofrecentlowinflationreadings.Asa consequence,Bullardjoinedthemajoritythistimeand fullyagreedwiththestatement.ThatleftKansascityFed Georgeastheonlydissenter.Shevotednowforthefifth timeagainstthepolicywhichshesaidincreasesrisksof futureimbalances.

Accommodative policy appropriate

TheFOMCreaffirmeditsviewthatahighly accommodativestanceofmonetarypolicywillremain appropriateforaconsiderabletimeaftertheasset purchaseprogrammeendsandtheeconomy strengthens.Italsodecidedthattheexceptionallylow rangefortheFederalfundsratewillbeappropriateat leastaslongastheunemploymentrateremainsabove 6.5%,inflationonetotwoyearsaheadisprojectedtobe nomorethan0.50%pointabovethe2%longerrungoal andlongterminflationexpectationscontinuetobewell anchored.SomeobserversexpectedtheFOMCtolower theunemploymentratethresholdto6%and/ortoinsert alowerboundforinflationtoclearlyseparatetheQE policyfromtherateandexitpolicy.Indeed,afterthe JunemeetingwhenBernankesetoutthescenariofor endingtheassetpurchases,marketsstartedtobring forwardtheliftoffdateforratehikes,whichtheFed didntlikeatallandcausedsomeverbalinterventionby Bernanke.However,theFeddidntdoitandkeptthe thresholdsunchanged.

Market reactions subdued

First,themarketreactioncorrespondedwithadovish lectureofthestatement.USTreasurieswentup,asdid equitieswhilethedollarlostground.However,assaid, theFOMCstatementcontainsnostrongpolicymessage andthuswearentsurprisedtheinitialmoveswere largelyerasedbytheendofthesession.Yields at the longer end were though still a few basis points lower in a daily perspective.Letswaitnowfor freshecodata,startingwiththeISMtodayandpayrolls tomorrow. PietLammens,KBCBrussels

.

P.2

Thursday, 01 August 2013

Contacts

BrusselsResearch(KBC) PietLammens PeterWuyts JokeMertens MathiasvanderJeugt DublinResearch AustinHughes ShawnBritton PragueResearch(CSOB) JanCermak JanBures PetrBaca BratislavaResearch(CSOB) MarekGabris WarsawResearch BudapestResearch DavidNemeth

ALLOURREPORTSAREAVAILABLEONWWW.KBCCORPORATES.COM/RESEARCH

Thisnonexhaustiveinformationisbasedonshorttermforecastsforexpecteddevelopmentsonthefinancialmarkets.KBCBankcannotguarantee thattheseforecastswillmaterializeandcannotbeheldliableinanywayfordirectorconsequentiallossarisingfromanyuseofthisdocumentorits content.Thedocumentisnotintendedaspersonalizedinvestmentadviceanddoesnotconstitutearecommendationtobuy,sellorholdinvestments describedherein.AlthoughinformationhasbeenobtainedfromandisbaseduponsourcesKBCbelievestobereliable,KBCdoesnotguaranteethe accuracyofthisinformation,whichmaybeincompleteorcondensed.AllopinionsandestimatesconstituteaKBCjudgmentasofthedataofthe reportandaresubjecttochangewithoutnotice.

+3224175941 +3224173235 +3224173059 +3224175194 +35316646889 +35316646892 +420261353578 +420261353574 +420261353570 +421259668809 +3613289989

GlobalSalesForce Brussels CorporateDesk CommercialDesk InstitutionalDesk London Frankfurt Paris NewYork Singapore Prague Bratislava Budapest

+3224174582 +3224175323 +3224174625 +442072564848 +496975619372 +33153898315 +12125410697 +655333410 +420261353535 +421259668436 +3613289963

P.3

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CFA Level 1 - Economics Flashcards - QuizletDocument20 pagesCFA Level 1 - Economics Flashcards - QuizletSilviu Trebuian100% (3)

- F 843Document1 pageF 843Manjula.bsNo ratings yet

- Unit Test 9Document3 pagesUnit Test 9Giovanny41% (29)

- Demand Side PolicyDocument15 pagesDemand Side PolicyAnkit Shukla100% (1)

- Public ExpenditureDocument6 pagesPublic ExpenditureNaruChoudhary0% (1)

- Taxation LectureDocument42 pagesTaxation LectureTatek DinberuNo ratings yet

- Day To Day EconomicsDocument12 pagesDay To Day EconomicsPrateek SinglaNo ratings yet

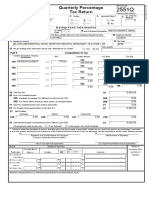

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoNo ratings yet

- Speech Thomas Leysen IBEC - CEO Conferentie Economisch en Monetair Beleid in Europa: Naar Een Goede BalansDocument7 pagesSpeech Thomas Leysen IBEC - CEO Conferentie Economisch en Monetair Beleid in Europa: Naar Een Goede BalansKBC EconomicsNo ratings yet

- Kwartaalupdate Kwetsbaarheidsindicator Publieke Financiën (SVI)Document9 pagesKwartaalupdate Kwetsbaarheidsindicator Publieke Financiën (SVI)KBC EconomicsNo ratings yet

- Ierland Maakt Schoon Schip Met Loodzware BankenerfenisDocument5 pagesIerland Maakt Schoon Schip Met Loodzware BankenerfenisKBC EconomicsNo ratings yet

- Herexamen Voor Troika in CyprusDocument5 pagesHerexamen Voor Troika in CyprusKBC EconomicsNo ratings yet

- The Rationale of New Economic Policy 1991Document3 pagesThe Rationale of New Economic Policy 1991Neeraj Agarwal50% (2)

- Honeywell and Pakistan InternatiDocument2 pagesHoneywell and Pakistan InternatiCristina GheorgheNo ratings yet

- Inflasi, Pengangguran, Dan Siklus BisnisDocument16 pagesInflasi, Pengangguran, Dan Siklus BisnisReza AfrisalNo ratings yet

- CAGE China vs. IndiaDocument2 pagesCAGE China vs. IndiaVinny TuschkaNo ratings yet

- Resume of Srpeak4Document2 pagesResume of Srpeak4api-25647173No ratings yet

- Aggregate Supply PowerPoint PresentationDocument24 pagesAggregate Supply PowerPoint PresentationRatna VadraNo ratings yet

- Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldDocument39 pagesPrepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldNazish GulzarNo ratings yet

- Angus Maddison Growth and Interaction in The World EconomyDocument104 pagesAngus Maddison Growth and Interaction in The World Economyjsrplc7952No ratings yet

- BCG Back To MesopotamiaDocument15 pagesBCG Back To MesopotamiaZerohedgeNo ratings yet

- Research Statment - Sonam DorjiDocument2 pagesResearch Statment - Sonam DorjisondorjiNo ratings yet

- TaxDocument234 pagesTaxPaul MachariaNo ratings yet

- Primary Source DocumentsDocument5 pagesPrimary Source DocumentschelseaNo ratings yet

- ST Louis Fed Qe StudyDocument17 pagesST Louis Fed Qe StudyZerohedge100% (1)

- Government Influence On Exchange RatesDocument3 pagesGovernment Influence On Exchange RatesReza RaharjoNo ratings yet

- Washington Consensus ChapterDocument12 pagesWashington Consensus ChapterBropa-sond Enoch KategayaNo ratings yet

- Group2 Paper3Document3 pagesGroup2 Paper3api-3826334No ratings yet

- Advantages and Disadvantage of ProtectionismDocument3 pagesAdvantages and Disadvantage of ProtectionismMai Anh NguyễnNo ratings yet

- Optimum Currency Areas and The European Experience: ECO41 International Economics Udayan RoyDocument57 pagesOptimum Currency Areas and The European Experience: ECO41 International Economics Udayan RoyБежовска СањаNo ratings yet

- CBP Form 434Document2 pagesCBP Form 434CINTHYANo ratings yet

- Aschauer, D. 1989 PDFDocument18 pagesAschauer, D. 1989 PDFAliJesusNavarroNo ratings yet

- ESP2 - Unit 8 Central Banking - KEYDocument7 pagesESP2 - Unit 8 Central Banking - KEYVeo Veo ChanNo ratings yet

- 2013 S2 Econ1016Document22 pages2013 S2 Econ1016Tom AfaNo ratings yet