Professional Documents

Culture Documents

Avoiding The Pitfalls of Centralised Procurement

Uploaded by

FredoMari LCOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Avoiding The Pitfalls of Centralised Procurement

Uploaded by

FredoMari LCCopyright:

Available Formats

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

Home

Supply Chain

Procurement

Logis cs

Change Management

About Us

News

Contact Us

News

Member of the Associa on of Professional Interims

Blog Archive:

Like 4 Send Tweet Share

Execu ve Interim Manager and ACUITY Director, Tony Colwell on Twi#er

View Tony Colwell's prole

Avoiding the Pi%alls of Centralised Procurement 16 Reasons why procurement cost-saving ini a ves fail to deliver to the bo#om line

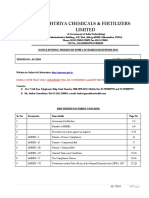

Tony Colwell - 17 November 2011 This ar cle is the .h in a series on how to avoid the pi%alls of centralised procurement. In the rst ar cle I commented on the reasons why, when many large organisa ons embark on centralised procurement ini a ves with the promise of substan al savings, direct increases in protability fail to materialize within the business units. A discussion to capture the views of other procurement professionals has been running at Procurement Professionals Group on LinkedIn. This week I shall analyze the comments - 157 at me of wri ng this ar cle - from 65 contributors, excluding myself. As a piece of qualita ve research, the discussion was not intended or designed for quan ta ve analysis. I have a/empted, nevertheless, to iden fy, normalize and count the reasons for failure men oned by the 65 contributors. Whilst I accept that the validity of this analysis is ques onable, I do feel the results give some valuable insight to the causes of failure, and possible areas to be given a#en on in order to deliver a successful centrally-led procurement programme. First I shall comment briey on the method of analysis. The ini al comment from each contributor was examined and the key reasons iden ed. Typically contributors gave between one and four reasons. A few contributors gave no reasons in their rst comment (for example one contributor's rst comment was a ques on) but did so in their second comment. In such cases the reasons in their second comment were iden ed. Collec vely, I have called these 'original men ons'. Some contributors posted several comments, resta ng and clarifying their views. I chose not to count the subsequent men ons of their original reasons. Also, in their later pos ngs, some contributors were deba ng others' reasons and, again, I chose not to count these men ons. The reasons were listed and normalized to produce the 16 Reasons listed in Table 1. A few reasons we unclear or ambiguous, so they were categorized as "Other". Two counts are listed against each of the 16 Reasons. The counts are also expressed as a percentage of their respec ve totals. The rst is the total count of 'original men ons'. The second is a weighted value calculated by a/ribu ng to each contributor a total value of 1 shared equally across his/her reasons. For example, if a contributor provided 4 reasons each was given a value of 0.25. The rst count gives equal weight to each men on, and the second count equal weight to each contributor. There are a total of 109 men ons from the 65 contributors. Table 1

GO TO BLOG ARCHIVE INDEX GO TO LIVE BLOG

Tony Colwell

tonycolwell

tonycolwell How Procurement Professionals Can Win Over Reluctant Internal Customers, Part I blog.purchasingcourses.com/2012 /12/how-pr

5 day s ago reply retweet favorite

tonycolwell 18 Reasons why #procurement cost-saving initiatives fail to deliver to the bottom line acuityconsultants.com/wp /?p=397

15 days ago reply retweet fav orite

tonycolwell MT @Procurian: @thehackettgroups report to close the gap between claimed & real savings slidesha.re/TuulBY

15 days ago reply retweet fav orite

tonycolwell @WarrenJessi Misguided strategy (blanket supplier rationalization/consolidation) is the first barrier. Diversity may offer better value!

15 days ago reply retweet fav orite

tonycolwell @Adroitinconsult @UnimastersCom @MSUSupplyChain @HenryMarshal1 @andrea_patrucco @beyondprocure @CulverBruce TY for following @tonycolwell

16 days ago reply retweet fav orite

tonycolwell @MaggieSlowik @wanjue5 @sheanngaskin @CCabellec @enderozatay @richardmetz @2LayerPCB @MarkFritz @DGatesPhD TY for following @tonycolwell

16 days ago reply retweet fav orite

tonycolwell Why have we become such crappy managers? shar.es/hWquj via @pfersht Solution: hire professional interim managers!

17 days ago reply retweet fav orite

tonycolwell From the archives: 10 Tips on the use of Value Chain Analysis for #Procurement Strategy acuityconsultants.com/news.html#blog

17 days ago reply retweet fav orite

tonycolwell RT @mputters Category Management And The Challenges For Public And Private Sectors (Part II) ow.ly/fZNKb #procurement

17 days ago reply retweet fav orite

tonycolwell @Hal_Good @ProcurementPros @NPI_procurement @andrewmarketts

1 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

Join the conversation

Blog posts:

Avoiding the PiHalls of Centralised Procurement Part 1 : Why so many procurement cost saving ini a ves fail to deliver to the bo/om line. Part 2 : Strategic or Tac cal Cost-Savings Programme? Part 3 : How to Start a Strategic Value-Added Programme Part 4 : Are your Procurement stakeholders champions or saboteurs? Part 5 : 16 Reasons why procurement cost-saving ini a ves fail to deliver to the bo/om line 10 Tips on the use of Value Chain Analysis for Procurement Strategy How to select suppliers to create value Part 1 : How to select suppliers to create value (Introduc on) Part 2 : Supplier Appraisal (Pre-contract) Three Principles for Eec ve Services Contrac ng Change Management: 7 Essen al Elements of Stakeholder Engagement Eec veness of Interim Management Supply Models Part 1 : The Metrics? Part 2 : Consultancy and Interim Assignments, if you could tell me how to value the outputs that would be fantas c. Part 3 : Where Next? A Case for Business Process Management Part 1 : Business reali es and the business process perspec ve Overcoming obstacles to successful change programmes U lising Professional Interims to help reduce the budget decit Professional Interims: consultants or con ngent labour? A single, shared forecast for the business... so what's the problem? Part 1 : The mess businesses get into Part 2 : Products at risk, and managing inbound supply Do the UK electoral polling and coun ng processes need reform?

The most frequent reason given for failure of cost savings ini a ves to deliver to the bo/om line, was Procurement's lack of understanding of the true costs and resultant savings. This was a clear leader followed, some way behind by the next 3 reasons, grouped in close proximity to each other (in order dependent on the number of men ons or weigh ng by number of contributors). Poor planning and leadership/unclear objec ves covered a range of procurement management-related reasons, including misdirec on and inappropriate pursuit of cost reduc on where other objec ves (e.g. quality or eciency) were deemed more important. Savings redirected refers to redirec on within Business Units or by budget holders, for example where budgets are not adjusted downwards to reect the procurement savings, or where savings are passed on to customers. Comments rela ng to savings taken centrally and not passed to BUs or budget holders, for example central rebates, were counted separately. Inadequate stakeholder engagement was the third reason in this following group. Arguably, lack of stakeholder engagement is a cause of other failures, notably lack of understanding of the true costs, unplanned redirec on of savings, delays and non-compliance. Contrary to the results, it is my belief that inadequate stakeholder engagement is the number one reason for failure and that these other causes are symptoma c. The discussion thread gave some support to this hypothesis but the construct of the research provides no means of tes ng it objec vely. Readers may be interested in the ar cle "7 Essen al Elements of Stakeholder Engagement" in which I give a pragma c guide to ensuring stakeholder engagement in projects and programmes. Economic factors, e.g. ina on, exchange rates were given as a reason but, arguably, these should be forecast and any losses oset by comparable gains. Failure to forecast was included here rather than in cos ng inaccuracies. Inadequate follow through/contract management refers to the disengagement and dissocia on of Procurement aDer seEng up the contract. This behaviour might be reinforced by performance measures based on theore cal 'contracted savings' rather than 'realized savings', with non-compliance being a major reason for the dierence between the two. Inadequate sponsorship refers to sponsorship by C-level execu ves, as dis nct from procurement leadership covered in an earlier Reason. Conic ng metrics and conic ng incen ves, and a lack of joined-up KPIs across departments and func ons, can encourage non-compliance especially if communica ons and stakeholder engagement are poor. Lack of necessary skills refers to the capability of procurement management and sta. We might expect this reason to be understated given that the contributors were mainly from the procurement func on. Op mis c mescales and delays in achieving savings (doing the right things more slowly than planned) were iden ed separately from other planning and control issues (doing the wrong things) covered in an earlier Reason. There was a specic reference to contrived savings, or fabrica on of results, which was worthy of men on separately from cos ng inaccuracies. Finally, the prac ce of taking savings centrally to withhold them from BUs and budget holders was discussed, and views expressed regarding the adverse eect this may have on rela onships with some stakeholders. I hope that any readers involved in a centrally-led procurement programme will nd this analysis helpful as an aid memoire when considering the risks to successful delivery to the bo#om line.

Individual comments and the opportunity for readers to post their own comments are available in the discussion "Why do so many procurement cost saving ini a ves fail to deliver to the bo,om line?" in the Procurement Professionals (Open) Group on LinkedIn.

PROFESSIONAL EXECUTIVE INTERIM MANAGERS AND CONSULTANTS PROCUREMENT & SUPPLY CHAIN SERVICES AND EXPERTISE

Acuity (Consultants) Ltd provides professional interim execu ves, execu ve interim managers, consultants and experts in procurement and supply chain, transforma on and change management.

Go to top

How to select suppliers to create value Supplier Appraisal

Tony Colwell - 10 November 2011 In my recent series of ar cles "Avoiding the PiHalls of Centralised Procurement" I wrote on the subject of star ng a strategic, value-crea ng procurement programme. Last week I reected on the iden ca on of suppliers that will create or add value. Central to my argument was the need to assess the supplier's capability to collaborate and innovate, to help us op mize exis ng products/services, and to achieve our desired business outcomes. Rather than focus exclusively on the required product or service we need to pay a/en on to supplier evalua on and pre-qualica on. This week I shall be commen ng in more detail on the methodology for supplier appraisal and how I tailor my approach to

2 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

meet the requirements of corpora ons and individual businesses within their specic industry context. My aim is not to repeat the advice of other guides but rather to suggest to readers that they develop their own approach. Why should we do this when there are 'best prac ce' templates to follow? Anyone who is familiar with push and pull strategies in supply chain management will understand the advantages of pull strategies when it comes to mee ng customer-specic requirements. My point is the supplier appraisal design can be 'pulled' by (external and internal) customer values rather than 'pushed' by generic best prac ce. Compe ve advantage is elusive and uniquely interwoven with the customer values within a supply chain. Generic templates are ne for generic results. If you are looking for the truly excep onal, then you need a dieren ated approach... one tailored to your, and your customers', specic needs. Here we are looking at supplier evalua on and pre-qualica on processes mainly for partnerships. We perhaps need to qualify where partnerships are appropriate. For other types of rela onship a generic approach may be more than adequate. To be clear, I am not saying that the design of appraisals for partnerships should be totally new. There will be important elements - for example nancial background - which can be taken from generic 'best prac ce' models. I would encourage appraisers to review and use elements of exis ng published models and then add criteria appropriate to their specic needs. (I'll come to this later.) Also It helps to know your subject before trying to develop a new approach... so rst I shall recommend a couple of good sources of advice on general prac ce. The rst source is the Supply Management (CIPS) Guide to... Supplier Appraisal - an excellent concise guide to pre- and post-contract appraisal, and a recommended read for anyone new to the subject. It denes supplier appraisal as follows: "Supplier appraisal is the evalua on and monitoring of supplier capability to ensure successful delivery of commercial outcomes. It is an essen al part of strategic sourcing, supplier management and securing compe ve advantage." Whilst it iden es supplier appraisal as essen al to securing compe ve advantage, the Guide oers no substan ve connec on between appraisal and the means by which compe ve advantage can be secured. The pre-contract appraisal focuses on risk mi ga on rather than the iden ca on and exploita on of opportunity: "Conduc ng checks or due diligence on your poten al supplier does not guarantee there wont be any future problems, but it will help reduce the chance of them arising." "...an appraisal process is usually used if any, or a combina on, of the following contract condi ons exist: High value; Highly complex; Long term; Business cri cal; Likely to aect reputa on; Interna onal in nature; It would be dicult to change suppliers; The market has a limited number of suppliers." My par cular interest is in 'business cri cal' condi ons. One needs to be wary of the presump on that Procurement knows exactly what condi ons are business cri cal. While there will be business cri cal condi ons that are apparent to all, there are usually some (especially opportuni es) that go unno ced... and not just by Procurement! These less obvious condi ons or opportuni es are oDen the source of compe ve advantage. (If they were that obvious then everyone, compe tors included, would be addressing them!) The second source is a research paper "Supplier Evalua on Framework Based on Balanced Scorecard with Integrated Corporate Social Responsibility Perspec ve" by Worapon Thanaraksakul and Busaba Phruksaphanrat (2009) The authors developed an evalua on framework from a literature review of 76 papers related to supplier selec on criteria. The original evalua on frameworks were conducted in various contexts, and some papers reviewed mul ple selec on models. From their review, Thanaraksakul and Phruksaphanrat created a generic model - ranking the selec on criteria based on frequency of appearance. Given the varied contexts of the original frameworks, individual criteria would have assumed diering importance and been given dierent weigh ngs. The ranking in the generic model does not take this into account, and I would advise readers not unwiEngly to infer that the ranking has any signicance to their own circumstances. I feel I also need to comment on Balanced Scorecard ("BSC"). BSC is ul mately about choosing measures and targets associated with the main ac vi es required to implement a business strategy, not a supplier appraisal tool. (Readers might also consult the EFQM Business Excellence model which is more aligned to achieving excellence through con nuous improvement in business processes and management.) BSC aims to provide a 'one size ts all' set of metrics to be cascaded down and across the business, and a balance between the 4 perspec ves: Financial; Customer; Internal Business Processes; Learning & Development (5 perspec ves if you include Corporate Social Responsibility). The Balanced Scorecard Ins tute (a private company) acknowledges that these perspec ves may not be relevant to non-prot organisa ons or units within complex organisa ons, which might have high degrees of internal specialisa on. In pursuit of supplier partnerships we may be looking for specialisa on and skewed focus i.e. within a par cular context, very specically at certain criteria. Having cri cised BSC for supplier pre-contract appraisal, I can thoroughly recommend Thanaraksakul and Phruksaphanrat's paper as a source of generic supplier appraisal criteria. As a third source, readers with special interest in quality assurance might look at the Interna onal Society for Pharmaceu cal Engineering's Good Automated Manufacturing Prac ce Guides. which deal with supplier audits. The assurance demands of automa on in this highly regulated industry are par cularly challenging, so the GAMP guides are very thorough. The focus on valida on planning and supplier due diligence have relevance to answering the ques on "Is the supplier able to perform?" The Guides are not cheap, but a quick scan of the contents pages may give a few ideas and help determine if a purchase is worthwhile. Now I shall address the iden ca on of suppliers that warrant a tailored appraisal, and then the tailoring. Supply Management proposes the use of Kraljic's Purchasing PorHolio matrix (1983), which plots prot poten al against supply vulnerability. The recommenda on is to apply the most rigorous appraisals to the high prot poten al, high vulnerability quadrant. Most procurement professionals will be familiar with a number of similar 4-quadrant 'supply posi oning'models that have been developed subsequently, for example Ellio/ Shircore & Steele's Procurement Pos oning (1985), and Van Weele's Purchasing PorHolio (2000). 'Supply posi oning' models convey important concepts but have signicant weaknesses in their prac cal applica on to supplier appraisal: they are intended for purchase items or categories, not suppliers; individual suppliers may therefore span more than one quadrant; the supplier's side of the supplier/buyer rela onship is disregarded; they pose unanswered ques ons about what will be posi oned, at what level of aggrega on, and for what organiza onal unit will the analysis be performed. In prac ce, if you perform a porHolio analysis on individual categories you will oDen iden fy component groups that map across

3 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

dierent quadrants of the grid; then when you look within component groups you may nd individual items sit in dierent quadrants; dierent mappings are generated with dierent opera ng units, and so on. So whilst Kraljic and the like are informa ve in terms of an overview, they do li/le to connect specic cri cal issues and opportuni es to supplier capability. In order to address these issues I've developed my own matrix, based on 'intrinsic value' (as value is what we are ul mately trying to deliver): - to perform item/category analysis (supply pos oning) from an opera onal perspec ve - to link to Value Chain Analysis for the strategic and supplier perspec ves. This enables the use of a common ra ng/ranking system across strategic and tac cal opportuni es. Value Chain Analysis ("VCA") answers the aggrega on and organisa onal ques ons le. unanswered by supply posi oning. The point about VCA is that it circumvents the porHolio analysis. VCA will iden fy cri cal requirements which cannot be resolved in-house and therefore require solu ons to be procured. If VCA does not highlight an opportunity or risk, then the required rela onship is probably non-strategic and non-partnership. Note that there may be partnership requirements with the same supplier in other value chains. (This emphasises the need to perform a strategic analysis before embarking on tac cal cost-reduc on programmes. See ar cle "Strategic or Tac cal Cost-Savings Programme?") The other things that VCA addresses: VCA exposes cri cal issues and previously unrecognized (or inac ve) opportuni es, within very specic circumstances-within-business-within-industry context... to gain compe and links these specically to required supplier inputs. You will know, beyond the generic requirements, specically what you are looking for in your key suppliers. If you have performed VCA you have the informa on to tailor the supplier evalua on matrix. Regarding the BSC format, conceptually, the range of criteria is a good: we need to consider all angles. But dieren a on - the source of compe ve advantage - may be very unbalanced. We may be looking at a focus on specic bo/lenecks or opportuni es for which the overall scorecard may have li/le relevance. Addi onally, BSC has always been subject to cri cism that the content of each perspec ve is somewhat arbitrary. The focus on dening a simple set of broadly applicable measures conicts with the requirements for a comprehensive set of criteria both to mi gate supply risks and appraise partnership poten al. Arguably, a more comprehensive version can be used for pre-contract appraisal; then a consistent, stripped-down version containing only key performance measures could be used for post-contract review. Personally, I do not like the format for pre-contract appraisal, mainly because I can see a more logical and helpful structure. My 3-part supplier appraisal separates (1) Readiness - the physical a/ributes (requiring ac on to modify), from (2) Willingness - the metaphysical (subject to inuence, to reasoning and persuasion), and (3) Ability - the eviden al, reasoning material, which indicates the supplier's power or capability to translate the metaphysical into the physical... to realize the dream! I nd this format more conducive to developing a supplier management strategy. To recap, my appraisal format is in three parts: Is the supplier ready? Does the supplier have the right infrastructure technology and resources...the appropriate means to provide the products or services you need? Poten al suppliers may not have the product or service today, but the capability to provide it. (Perhaps there is a reverse marke ng opportunity?) Is the supplier willing? What are the supplier's values, market orienta on, direc on and strategy? How exible and adaptable are they, opera onally and commercially? Are you aligned, and will you be a valued customer? Is the supplier able to do business? Some suppliers may have the right infrastructure, technology and resources; they are focusing on the right market; they express similar values; they say they want your business. The promise is there, but they simply fail to deliver. So, here, we are looking for demonstrable capability to perform. I am not going further to populate the three categories but I will comment briey on weigh ng and scoring. 'Best prac ce' guides generally refer to weigh ng the criteria. Preparing and agreeing a weigh ng system with stakeholders can be a lengthy task. Although I do it, in prac ce I have never found weigh ng was necessary; I've never performed a partnership evalua on that came down to the weigh ngs on individual criteria. I do advise that you classify criteria, to be clear what is essen al, highly desirable or nice to have. When it comes to ra ng, make scores as objec ve as possible. I like to use a 7-point Likert-type scale: a supplier may have a/ributes that support or run counter to the achievement of your objec ves. A nega ve score might apply, for example, if a supplier had a strategic rela onship with a compe tor which would impact adversely on their willingness to support your business. Finally, the numbers are an aid to stakeholder discussion and agreement. I would never reduce the process to an evalua on by numbers - to a decision based on total score. ve advantage,

I am invi ng the views of procurement professionals. and other readers who may wish to comment, at " How would you assess a supplier's capability to collaborate and innovate, and to create value in your business?" in the Procurement Professionals (Open) Group on LinkedIn. Related Items Readers may also be interested in the discussion " Why do so many procurement cost saving ini a ves fail to deliver to the bo,om line?" at Procurement Professionals (Open) Group on LinkedIn.

References and further reading The Supply Management (CIPS) "Guide to... Supplier Appraisal", Very similar: "How to appraise suppliers" - CIPS Knowledge Works (available for download on the Chartered Ins tute of Purchasing & Supply Web Site) "Supplier Evalua on Framework Based on Balanced Scorecard with Integrated Corporate Social Responsibility Perspec ve" Worapon Thanaraksakul and Busaba Phruksaphanrat (2009) Informa on on the purpose and applica on of Balanced Scorecard at The Balanced Scorecard Ins tute (private company) "A Study to Compare Rela ve Importance of Criteria for Supplier Evalua on in e-Procurement - Ashis Kumar Pani and Arpan Kumar Kar (2007) Go to top

4 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

How to select suppliers to create value

Tony Colwell - 3 November 2011 In my recent series of ar cles "Avoiding the PiHalls of Centralised Procurement" I wrote on the subject of star ng a strategic, value-crea ng procurement programme, and subsequently went on to give 10 ps for the use of Value Chain Analysis. This week I want to reect on the iden ca on of suppliers that will create or add value. My theme for this week was inuenced by a recent video of sales trainer Eric LoDholm in which he talks about the importance of collabora on, innova on and op misa on in the sales process. When engaging with suppliers of strategic goods or services - repe ve supplies, or one-o purchases that have a con nuing maintenance requirement - we can o.en create value through collabora on, innova on and op misa on. We need to focus on the business outcomes we are trying to achieve not simply on our perceived input requirements. Procurement generally focuses on the required product and, oDen, not enough on the inherent capabili es of the supplier. We need to assess the supplier's capability to collaborate and innovate, to help us op mize exis ng products/services, and to achieve our desired business outcomes. The implica ons of such 'product' focus in public sector procurement are all too evident. There are many areas (ICT for example) where rapid change can render products and services virtually obsolete by the me they are deployed. Similar failings are less visible in the private sector, where the procurement processes are more agile, and greater exibility exists to change specica ons or source add-ons. But the symptoms are manifest: excessive complexity and fragmenta on; cost overruns; supplier margin creep; failing 'partnerships'; suppliers either lacking commitment or gaining a stranglehold over customers. The answer, I believe, is be#er supplier evalua on and pre-qualica on. The public sector procurement process mandates that all suppliers are treated equally... the inten on is to level the playing eld... the outcome is that mediocre suppliers get carried though the process. The process appears to be founded on unreliable assump ons: that there are mul ple suppliers who are capable; good suppliers will be keen to supply; their products will be similar and can be evaluated against a single specica on. The reality is this: in the supply of all but the most basic commodi es there will be one supplier best placed to meet the customer's needs. Procurement's task is to iden fy and contract (not necessarily exclusively) with that supplier. This is par cularly important in strategic categories, where reverse marke ng may also be benecial. Success cannot be guaranteed by focusing on the product alone. The boundary of the supplier and customer's interac ons - the op mum solu on - will be determined by the supplier's capability... more precisely, by the supplier and customer's rela ve capabili es across a broad spectrum of requirements. So how do we iden fy the best supplier? How do we evaluate capability? A former colleague and purchasing manager, Bill Weinert, once said "There are only three ques ons you need to answer: is the supplier ready, willing, and able to do the business? " It was a great piece of advice that I've taken and developed into a supplier appraisal process. The process is tailored to the specic value crea on opportuni es within a business, which I'll save for a future blog. For now, I will outline the basic principles. Is the supplier ready? Does the supplier have the right infrastructure technology and resources...the appropriate means to provide the products or services you need? Poten al suppliers may not have the product or service today, but the capability to provide it. (Perhaps there is a reverse marke ng opportunity?) Is the supplier willing? What are the supplier's values, market orienta on, direc on and strategy? How exible and adaptable are they, opera onally and commercially? Are you aligned, and will you be a valued customer? Is the supplier able to do business? This is the more dicult of the three ques ons. Some suppliers may have the right infrastructure, technology and resources; they are focusing on the right market; they express similar values; they say they want your business. The promise is there, but they may s ll fail to deliver. So, here, we are looking for demonstrable capability to perform. Conven onal supplier audits can tell us a lot: do suppliers have the processes, assurance systems, training, etc. Supplier audits, and procurement due diligence, are usually directed at valida ng and verifying suppliers' 'readiness', rarely on valida ng their 'willingness'. The valida on of suppliers' willingness needs to be prospec ve, not retrospec ve. Nego a ons oDen play on suppliers' willingness to compromise in order to make a sale; this should not be confused with willingness to perform in the longer term. The key a#ribute is free will, not the product of coercion. A#empts to gain co-opera on by contractual means (obliga ons and warran es) are not the answer; this amounts to use of force. As I explained last week - in my blog "Are your Procurement stakeholders champions or saboteurs?" - force can only guarantee reluctant compliance. And reluctant compliance is not a founda on for collabora on and innova on. We need to look beyond the conven onal audit criteria... to ask "What are this supplier's mo va ons to collaborate and innovate?" and then, "How do we validate these in our specic context?" Next week I shall be commen ng in more detail on the methodology for supplier appraisal and how I tailor my approach to meet the requirements of corpora ons and individual businesses within their specic industry context. In the mean me I am invi ng the views of procurement professionals. and other readers who may wish to comment, at " How would you assess a supplier's capability to collaborate and innovate, and to create value in your business?" in the Procurement Professionals (Open) Group on LinkedIn.

Related Items Readers may also be interested in the discussion " Why do so many procurement cost saving ini a ves fail to deliver to the bo,om line?" at Procurement Professionals (Open) Group on LinkedIn. Go to top

Avoiding the Pi%alls of Centralised Procurement Are your Procurement stakeholders champions or saboteurs?

5 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

Tony Colwell - 27 October 2011 This ar cle is the fourth in a series on how to avoid the piHalls of centralised procurement. In the rst ar cle I commented on the reasons why, when many large organisa ons embark on centralised procurement ini a ves with the promise of substan al savings, direct increases in protability fail to materialize within the business units. In my second ar cle I compared strategic and tac cal cost-savings programmes and exposed some of the myths associated with tac cal programmes. My third ar cle focused on star ng a strategic, value-crea ng procurement programme, and, last week, I digressed from the core theme to give 10 ps for the use of Value Chain Analysis. This week I want to return to the core theme - the piHalls of centralised procurement - to touch on the subject of stakeholder management. A discussion thread to capture the views of other procurement professionals has been running at Procurement Professionals Group on LinkedIn. There have been many comments rela ng to lack of leadership and conicts between stakeholders. Par cipants recognize that conicts can occur as a consequence of inter-departmental inconsistency in func onal objec ves and targets. However, we also noted that good personal rela onships can, in part, overcome some of these divisive inuences. On reading through the en re discussion thread (80 comments at me of wri ng) I was surprised to nd that there were no references to formal stakeholder analysis or the development of supporters. Given that category management is at the heart of many centralised procurement programmes, one might have expected some reference to the importance of category champions. In contrast there were several references to mandates and use of force... perhaps reec ng that procurement leaders put more emphasis is on pressurising resistors and restraining mavericks. Similar views have been expressed in other discussion threads, for example, "How do you get the business to take Procurement seriously?" A Web search will reveal many sources of advice and guidance on stakeholder mapping (including templates) and stakeholder engagement. Indeed I have already wri/en on the subject, "Change Management: 7 Essen al Elements of Stakeholder Engagement." Now I invite readers to reect on what I call "The Engagement Spectrum" - a graphic illustra ng the degree to which stakeholders support or resist a proposi on - and the ac ons they might take to move stakeholders from a resis ve (or less suppor ve) to a suppor ve (or less resis ve) stance.

The key message here is that the maximum degree of engagement that you can guarantee by use of force is 'reluctant compliance'. Now there may be some circumstances in which reluctant compliance is all you need, in which case, why go any further? But such cases must be few and far between. So why is there such emphasis on mandates and use of force?

Join the discussion in the Procurement Professionals (Open) Group on LinkedIn: "Are your Procurement stakeholders champions or saboteurs?" Where do your stakeholders sit on The Engagement Spectrum and what are you doing to move them towards the champions end?" Go to top

10 Tips on the use of Value Chain Analysis for Procurement Strategy

Tony Colwell - 21 October 2011 Last week as part of my series on Avoiding the PiHalls of Centralised Procurement I wrote an ar cle "How to Start a Strategic

6 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

Value-Added Programme." I commented on the use of Value Chain Analysis ("VCA") which was developed by Harvard strategy guru Michael Porter. In developing VCA, Porter addressed the limita ons of his Five Forces model. Whilst Porter's Five Forces model has been taken up extensively by the Procurement community as a strategy development tool, VCA remains li/le used despite its superior capability. In this ar cle, I give my ps on the use of VCA in the context of developing procurement strategies. Readers will benet from prior knowledge or reading on the subject. VCA experts may disagree with my approach - it does deviate from Porter's concept for which I make no apology. My reasons will become apparent. First I shall recap on the VCA steps that I outlined in a li/le more detail last week. 5 steps to developing procurement strategy using Value Chain Analysis: (1) Create a model of the value chain, seEng out the key ac vi es. (2) Capture external factors and customer values. (3) Assess the rela onship between customer values on key ac vi es. Assess the poten al to create dieren a on and cost advantage. (4) Determine opera onal strategies whereby value to the customer can be most improved, and compe most enhanced and sustained. ve advantage can be

(5) Determine procurement strategies to support the opera onal strategy needs and maximise added value. Michael Porter said, " In a world where managers are prone to look for simple prescrip ons, detailed ac vity analysis was and is challenging." Value Chain Analysis as prescribed in full by Porter is indeed a challenging and intensive exercise. For our purpose it doesn't need to be. Here are my 10 ps for running Value Chain Analysis The rst two are sugges ons for limi ng the scope and simplifying the process: Tip #1 Be clear on the purpose If you are using Value Chain Analysis to develop procurement strategy, not as part of a larger programme to formulate business strategy, you are likely to encounter some resistance from other func ons. Func onal heads may think Procurement is trying to interfere in the formula on of their strategies. Rather than try to re-dene business strategy, use VCA as a tool to "listen" to the strategies of other func ons. VCA will capture their objec ves and how these link, or not, to customer values. This can enable other func ons to discover for themselves aws or holes in their own strategies, and inconsistencies between strategies... also to nd new ways of opera ng, and new ways of using the procurement func on to add value. Tip #2 Limit the scope VCA examines two sources of compe ve advantage: cost leadership and dieren a on. If you are not the clear cost leader in your markets, focus on procurement alone is unlikely to achieve that posi on. The analysis of cost structure is an intensive, numerical process. Use the cross-func onal team to focus on opportuni es to develop dieren a on. Rely on the subjec ve views of par cipants: opportuni es to create be/er value-for-money and to take cost out of the value chain will be iden ed. You can always re-evaluate these later by more objec ve, numerical analysis. Purists may argue that these two sugges ons deviate from Porters concept. Porter failed to address some of the prac cal issues of conduc ng VCA, in par cular how to deal with the commercial risk when involving suppliers or customers. Focusing on dieren a on rather than cost reduc on mi gates the risk; it also lends itself to use of cross-func onal workshops, which promote collec ve ownership. Tip #3 Reect on project management methodology and communica ons Even if you go for a narrow scope VCA (as suggested above) it is going to touch all areas of the business. You will need appropriate sponsorship and buy-in at senior level, you will need to borrow some key people, and you will gain from communica ng to all people who would normally be involved in strategy formula on. You may not be seEng out to re-write their strategies but you will be re-wri ng the way they are supported by procurement; so the strategy makers need to be given the opportunity properly to communicate their strategies. Ul mately, all employees, regardless of their distance from the strategy development process, will need to know what is expected of them but at this stage we are concerned with strategy formula on, not execu on. I am not going to comment on formal project management methodology or advocate its use, but I would suggest that VCA users consider what is appropriate for their circumstances. Tip #4 Determine the general approach Value Chains exist at business level, not at corporate level. Businesses may have more than one value chain. This will either be self-evident or will emerge during the VCA session. If evident in advance, you have two op ons: (i) run en rely separate sessions for each value chain, or (ii) run a session to capture overarching business drivers, issues and objec ves, then run separate sessions for each value chain. The advantage of (i) is that par cipants will be involved in the en re process for the value chain in which they are stakeholders; the disadvantage is that you may be duplica ng analysis of similar ac vi es. The advantages of (ii) are that you can engage a broader range of stakeholders (e.g. more senior for the overarching session, more junior for the others) and avoid duplica on; the disadvantage is the poten al for a disconnect. Tip #5 Propose the Ac vity Categories It helps to have a straw man to take to the rst session and to guide your team selec on. Aim to use the same categories for all sessions; you may have to make excep ons, but try to avoid unnecessary dierences in the models for each value chain. Mul ple models will confuse stakeholders and make consolida on of outputs dicult. Tip #6 Select your team Ideally all the categories need to be represented. I nd workshops are easiest to run with 7 people and become increasingly dicult as numbers increase. So immediately we are looking for a compromise. I once ran a VCA workshop with 22 par cipants, but would try to keep numbers to 12 or less. You may be able to leave out some or all support ac vi es. You may need to run mul ple workshops, for example (a) as suggested in p #5 above, or (b) separate workshops, one for primary and one for support ac vi es. There are three important characteris cs required of team members. Ideally they will be: crea ve and open-minded. The conserva ve and cri cal can have their input later. from the same peer group. No individual must be overly dominant, so don't put the MD with junior sta! suciently senior and established within the business. They need to understand the business and its current direc on, and be able to challenge exis ng strategy. Typically, you would be drawing from BU Execu ve or the level below. In split sessions - i.e. 4(ii) above - you might draw from 3 levels... no more. Tip #7 Make sessions easy for par cipants VCA sessions are held in cross-func onal workshops. I like to run workshops that require no prepara on by par cipants. You will

7 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

need to do some work on the outputs but that should not require all par cipants to be present, or put big demands on other stakeholders. As a piece of prac cal advice - to minimise digressions into non value-adding ac vi es - my 'rules of engagement' for par cipants in VCA would include the following deni on of a value chain: A Value Chain is the chain of ac vi es that add value to a product Value exists only where a customer need is sa sed Any ac vity or process that does not serve a customer need is not part of the Value Chain Tip #8 Separate idea genera on from evalua on The process of working from the customer interface down the primary categories, looking at the impact of customer values, is a fairly logical process but one that should not exclude crea ve thinking. This is especially important when it comes to iden fying opportuni es for dieren a on and enhancing compe ve advantage. Apply 'brainstorming rules' to encourage free thinking: let the ideas ow, then evaluate the ideas aDer running through all primary categories. Tip #9 Pay a#en on to linkages and informa on ows Porter highlighted that the linkages between ac vi es and, indeed, ver cal links up and down the value chain (including links to suppliers and customers) are a key source of compe ve advantage. The key to linking ac vi es together in a way that gives a company an advantage over others is to understand the ow of informa on that occurs between the various ac vi es. Tip #10 Involve trading partners with great care The congura on of ac vi es for compe ng in a par cular way also shapes the appropriate contractual rela ons with other rms. Exploring the linkages between ac vi es demands the involvement of cross func onal teams and possibly the involvement of trading partners. The risk of involving trading partners in VCA sessions is the poten al loss of commercial advantage and margin: "the por on of the created value we are capturing" may be lost to the trading partner. It is safer to leave trading partners outside of ini al analysis... un l you have sucient experience and a properly formulated nego a on plan to deal with commercial issues. In most cases it is be/er not to involve suppliers in the workshops but take specic outputs to them later. VCA might highlight issues, opportuni es, or required outcomes; how those issues might be addresses, or the outcomes achieved, would be up for discussion with relevant suppliers. In introducing VCA last week I wrote "If Procurement has never engaged in such an exercise, Pareto will almost certainly apply: 80% of the benet from 20% of the eort!" I hope I have encouraged readers to explore the use of VCA for procurement strategy, and that these 10 ps will be of help in developing a prac cal approach without too much eort.

Join the discussion, " How do you start a strategic, value-added procurement programme?" at Procurement Professionals (#1 supply chain & sourcing group) on LinkedIn References: " Compe ve Advantage: Crea ng and Sustaining Superior Performance", Michael E. Porter, First Free Press Edi on 1985 Go to top

Avoiding the Pi%alls of Centralised Procurement How to Start a Strategic Value-Added Programme

Tony Colwell - 14 October 2011 This ar cle is the third in a series on how to avoid the piHalls of centralised procurement. In the rst ar cle I commented on the reasons why, when many large organisa ons embark on centralised procurement ini a ves with the promise of substan al savings, direct increases in protability fail to materialize within the business units. In my second ar cle I compared strategic and tac cal cost-savings programmes and exposed some of the myths associated with tac cal programmes. A discussion thread to capture the views of other procurement professionals has been running at Procurement Professionals Group on LinkedIn. This week I want to touch on the subject of star ng a strategic, value-crea ng procurement programme. In another Procurement Professionals Group discussion thread, "Are savings the wrong way to report procurement department performance?" Bill Young introduced a paper co-authored with Charles H. Green, which provides some interes ng insights to the cause of unresolved conicts between Procurement and its internal clients, and the reasons why Procurement is oDen less strategic than it would like to be: "Procurement today is a complex management service, intended to support the strategic aims of the organisa on. However, some of Procurements intended customers are confused about its role and inten ons, and hence dont trust its mo ves. "We argue that trust is fundamental and essen al in the type of rela onship that Procurement is aiming for, but that the metrics and governance used by Procurement are an the cal to its aims." I would recommend any reader involved in, or about to set up, centralised procurement to read this paper. Returning to the discussion I ini ated, some observa ons by contributors have been directed at the need to create value rather save costs: "Most procurement [departments] are measured on savings - not on value crea on," "Savings... should leave room for innova on, improved quality, shorter lead mes, and not be a bo<leneck... [to benets delivery.]" "...the same spend with increased revenue, throughput, etc." "... a truly strategic sourcing group delivers value....." And the most inuen al comment, a ques on: "What por on of the created value are we capturing?" This leads me to comment on a technique I like to use to engage stakeholders and iden fy value-crea on opportuni es - and a good rst step in developing trust and in determining the strategic objec ves of procurement - Value Chain Analysis ("VCA"). The value chain was a concept ini ally proposed by management consultants McKinsey and later developed and made public in 1985 by Michael Porter in his book, "Compe ve Advantage: Crea ng and Sustaining Superior Performance". I was fortunate in my earlier corporate career to par cipate in a joint supplier/customer VCA programme run by McKinsey. That par cular programme was designed to inform and develop marke ng strategy for a major petrochemicals company (the supplier). I took the concept and turned it on its head; now we are using it to inform and develop value-focused procurement strategies. Porter's Five Forces and SWOT analysis have become generally accepted tools for the development of procurement category

8 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

strategies. Despite Porter's development of VCA as a more relevant tool, I have not seen VCA used by Procurement anywhere other than where we have introduced it. I have seen the term used, but it has been misinterpreted as cost analysis of suppliers using conven onal accoun ng structures, which VCA is most certainly not. Michael Porter published Value Chain Analysis in 1985 as a response to cri cism that his Five Forces framework lacked an implementa on methodology that bridged the gap between internal capabili es and opportuni es in the compe ve landscape. Whilst Five Forces and SWOT have their place, properly deployed VCA is much more rigorous and produc ve. The Five Forces model applies to all compe tors within an industry or market. SWOT provides a simple framework for individual companies but relies on the user to determine the scope, which leaves the capture of all relevant factors very much to chance. By contrast VCA provides a tailored and structured framework to iden fy company-specic strengths, weaknesses, opportuni es and threats, and to develop strategies, within the context of a very specic compe ve landscape. This includes ver cal links to customers and suppliers... value crea on from procurement and supplier contractual rela ons. Whereas Five Forces and SWOT can be conducted by the procurement team, VCA has to be performed by a cross-func onal team. This brings substan al benet as the cross-func onal team members develop shared strategies and a clear understanding of how those strategies both determine and support their individual objec ves. The value chain allows an organisa on to understand what ac vi es it performs, classify them into primary and support ac vi es and most importantly of all, understand which ones add value to the customer. Porter proposed 9 categories of ac vi es: - 5 categories of primary ac vi es - inbound logis cs, opera ons, outbound logis cs, marke ng and sales, services - 4 categories of support ac vi es (so called because they support the primary ac vi es) - procurement, technology development, human resource management, infrastructure. These 9 categories can be further subdivided by analysts into their rm's industry-specic and business-specic ac vi es. Successful use of VCA may challenge Porter's original generic model. I prefer to tailor the value chain at the category level. Despite Porter's claim that the 9 generic categories exist in every business, they do not work well for some products and many services. For example, in developing a procurement strategy (unclassied) for military support services (which excluded the procurement of military hardware plaHorms and associated dedicated services) we found that Porter's classica ons were far from ideal. We dened 6 primary categories: recrui ng; basic training, equiping; collec ve training; mobiliza on; deployment. My point is that Porter's classica ons are not sacrosanct. The important things to recognize are that the deni ons must reect business terminology, and the disaggrega on of ac vi es must be sucient to reveal the sources of compe ve advantage, whether they be in primary or support ac vi es. There are 5 steps to developing procurement strategy using Value Chain Analysis: (1) Create a model of the value chain, breaking down a market ver cal/organisa on into its key ac vi es under each of the classica ons. Include upstream links/channels. (2) Consider the macro-environment, and external factors. What are the factors impac ng on the markets and customers? Capture, explicit and implicit customer needs, known customer values and trends that will aect customer values. (3) Working from the customer interface down the primary categories, assess the impact of (internal as well as external) customer values. Capture key objec ves and cri cal success factors within each key ac vity. Within each key ac vity assess the poten al for enhancing value. Consider points of dieren a on and areas where the business appears to be at a compe ve advantage / disadvantage. Capture opportuni es to enhance value (and to defend exis ng compe ve advantage). Move on to consider and capture opportuni es to add value through support ac vi es. (4) Determine opera onal strategies built around focusing on ac vi es where value to the customer can be most improved, and compe ve advantage can be most enhanced and sustained. (5) Link opportuni es captured in step 3, and strategies in step 4, to procurement ac vi es and to suppliers. Determine procurement strategies to support the opera onal strategy needs and maximise added value. Michael Porter said, " In a world where managers are prone to look for simple prescrip ons, detailed ac vity analysis was and is challenging." A full analysis of the value chain as set out in "Compe ve Advantage" is indeed a challenging and intensive exercise. For our purposes it doesn't need to be. If Procurement has never engaged in such an exercise, Pareto will almost certainly apply: 80% of the benet from 20% of the eort! Next week I shall be giving my ps on running the Value Chain Analysis process.

Join the discussion, " How do you start a strategic, value-added procurement programme?" at Procurement Professionals (#1 supply chain & sourcing group) on LinkedIn References: " Compe ve Advantage: Crea ng and Sustaining Superior Performance", Michael E. Porter, First Free Press Edi on 1985 Go to top

Avoiding the Pi%alls of Centralised Procurement Strategic or Tac cal Cost-Savings Programme?

Tony Colwell - 7 October 2011 This ar cle is the second in a series on how to avoid the piHalls of centralised procurement. In last week's blog, I commented on the reasons why, when many large organisa ons embark on centralised procurement ini a ves with the promise of substan al savings, direct increases in protability fail to materialize within the business units. A discussion thread to capture the views of other procurement professionals has been running at Procurement Professionals Group on LinkedIn. This week I compare strategic and tac cal cost-savings programmes and expose some of the myths associated with tac cal programmes. I'll also be raising relevant points captured in the LinkedIn discussion, in par cular in connec on with adding value rather than simply reducing costs. The comparison is in the context of a newly formed central procurement organisa on. Similar arguments may be made for new programmes run by an established central organisa on, the arguments geEng progressively weaker with increasing level of procurement capability maturity. (Note: beyond level 3 of a 5-level Capability Maturity Model the organisa on is opera ng in strategic, value-adding mode.) Before going any further it is necessary to make clear that tac cal and strategic programmes are, to a large extent, mutually exclusive. The strategic approach demands porHolio segmenta on and the adop on of dieren ated approaches for each segment. There are various models for this (supply posi oning for example) and a host of tools and techniques - which I will not go into here - for determining and applying approaches appropriate to each segment. The tac cal programme dispenses with the

9 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

analysis and segmenta on, applying a more uniform approach across all categories, typically based on supplier ra onalisa on and leverage. Later, I will argue that not only are these programmes mutually exclusive, but also the poten al to switch from tac cal to strategic - and the poten al to gain strategic benet - is progressively diminished as the tac cal programme is pursued. Moving on to the comparison, rst let us consider the typical measurement of procurement cost savings. Savings are usually measured by purchase price variance for directs, and by similar 'input' measure for indirects. For sake of simplicity, I will refer to these measures collec vely as "PPV" measures. Figure 1 shows the progress of fast tac cal and strategic programmes based on PPV measures. Figure 1

Advocates of tac cal cost-savings programmes argue that they achieve quick results. Some Big 4 Consultants and specialist purchasing consultancies run fast tac cal programmes claiming both quick results and that the cumula ve savings of a strategic programme rarely catch up with the tac cal approach. Clients may be seduced by this simple message; it's what they want to hear... the promise of quick wins! But the truth is seldom that simple. When I've made my case, I'll leave readers to speculate as to whether the advocates are proering a deliberate distor on or whether they are just naive. Figure 2 includes the hidden costs of the fast tac cal programme and the addi onal benets of a strategic programme. Figure 2

The "hidden costs" are hidden and unquan ed because the tac cal programme does not allow the me to iden fy, design and measure how and where collateral damage will occur. This is one of the main reasons why tac cal cost-saving programmes in par cular fail to deliver to the bo/om line. Hidden costs might include impact on quality, outputs and waste, as I covered at length last week, or unmanaged risks, for example exposure to insecure supplies, currency varia ons, etc. The addi onal benets of a strategic programme come from: be/er stakeholder engagement and use of cross-func onal teams

10 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

development of joined-up KPIs and func onal targets/incen ves focus on total cost of ownership, risk mi ga on across relevant segments/categories benets of supplier partnerships and their innova ons pursuit of value-adding opportuni es be/er analy cs control of maverick spend higher levels of compliance A strategic programme does not preclude the possibility of pursuing quick wins - just that the approach will be veried and, for a given level of resource, fewer individual ini a ves can be pursued simultaneously than would be possible within a tac cal programme. Figure 3 shows the net eect of savings, hidden costs and addi onal benets. Figure 3

Unless an adjustment factor has been applied to PPV, the cumula ve net benet of the tac cal programme will be less than PPV predic ons. In extreme cases the 'savings' may actually be nega ve. Even in the best case, benets are unlikely to be sustainable; year-on-year improvements become smaller and it proves impossible to nd savings that do not impact in some way on value crea on. The cumula ve net benet from the strategic programme will exceed PPV predic ons. The overall eects are twofold: 1. a much greater rela ve benet from the strategic approach and 2. an earlier crossover than the advocates of tac cal programmes would have you believe. A well designed and well run strategic programme will deliver sustainable benets and a greater ROI than a tac cal programme. So, why can't we have the short term benets of a tac cal programme, then switch to a strategic programme for the long-term benets? Included in the collateral damage of the tac cal programme is the adverse eect on key supplier rela onships of inappropriate adversarial and hard-line behaviour: loss of trust, co-opera on and commitment. Adversarial and hard-line approaches are supported by a strategic programme but, because of the analysis and strategy development, are directed only to appropriate segments of the porHolio. It is this collateral damage that inhibits the switch from a tac cal to a strategic approach. Once supplier trust, co-opera on and commitment have been lost they will be dicult, some mes impossible, to regain. In my rst ar cle, I drew to conclusion as follows: "Given that many central procurement organisa ons are founded on the promise of procurement excellence and dubious procurement 'savings' it is clear that reliable delivery of improved protability requires systems thinking - an integrated supply chain approach - rather than typical current prac ce." To this I would add that procurement best prac ce is about maximising added value, not necessarily reducing costs. Acuity (Consultants) Ltd takes a holis c and strategic approach, engaging all key internal (and, where approproate, external) stakeholders to deliver added value and to ensure procurement ini a ves deliver sustainable bo/om-line prot improvement.

Join the discussion, "Why do so many procurement cost saving ini a ves fail to deliver to the bo/om line?" at Procurement Professionals (#1 supply chain & sourcing group) on LinkedIn Go to top

Avoiding the Pi%alls of Centralised Procurement Why so many procurement cost saving ini a ves fail to deliver to the bo#om line

Tony Colwell - 30 September 2011 Many large organisa ons embark on centralised procurement ini a ves with the promise of substan al savings, yet direct increases in protability fail to materialize within the business units. Judging by the focus of much literature on procurement prac ce, few organisa ons would appear to be aiming let alone achieving much higher than level 3 of a 5-level Procurement Capability Maturity Model. (This subjec ve view is not materially inconsistent with ndings of research by Batenburg and Versendaal in the Netherlands in 2008.) To explain briey, the inference is that Procurement may prac se category management, and aspire to achieve lowest total cost of ownership ("TCO"), but would not be looking at the implica ons of external integra on (e.g. op mising the extended supply chain) and value chain integra on

11 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

(e.g. increasing business value derived from spend). Typically targets are set, and 'signed up to', by the procurement department, then savings are iden ed at the end of each sourcing process and are reported as a measure of procurement department success. It is generally recognised that savings are only realized as purchases are made on the contract; responsibility for the delivery of those savings usually falls with the consumers of goods and services. Procurement may monitor compliance - 'realized savings' vs 'iden ed savings' or some measure of the uptake of central contracts - and use this as a s ck to beat users to make purchases under the contract when they might otherwise buy elsewhere. Low compliance may therefore be seen as a measure of errant users rather than ineec ve procurement, yet oDen it is indica ve of underlying problems either with the procurement or execu on of the contract. And even when compliance is high, it s ll does not necessarily deliver equivalent improvements in protability. The reasons are in the way 'savings' are measured and the behaviours the par cular measures drive. Procurement savings are usually measured by purchase price variance ("PPV") for directs, and by similar 'input' measure for indirects. The true costs can only be measured in terms of outputs, aDer accoun ng for consequen al (in)eciencies and waste. For capital items, or consumables involving set-up or maintenance costs, full lifecycle cos ng - TCO - is necessary. But even TCO has its limita ons, focusing on internal costs, ignoring external factors and value that may derived from the expenditure. Opera onal departments and users may have to suer the consequences of procurement shortcomings long aDer the sourcing process is concluded. Procurement KPIs rarely include appropriate measures of downstream, or lifecycle, performance. This inevitably leads to conic ng pressures on the various stakeholders. In such circumstances, op mum performance, and protability, may depend on stakeholder rela onships and personal integrity running in opposi on to individuals' performance incen ves. Consider a very simple example. Procurement department sources packaging for a new product launch. Say Procurement performance is measured by PPV rela ve to target packaging price for the product group. This drives a minimum specica on, low-price, high-discount approach... pile it high, buy it cheap! The Packaging Technologists are interested in protec ve proper es and pack integrity; Produc on performance is measured on packing line speeds and minimum waste. Both drive for higher specica ons (at higher prices). The stakeholders are in conict. By changing the performance measure from 'cost per unit purchased' to 'cost per unit packed' the three stakeholders are more aligned and working to the same ends. Looking further downstream, one might also measure 'cost per unit sold' (net of credits for damages). Given that many central procurement organisa ons are founded on the promise of procurement excellence and dubious procurement 'savings' it is clear that reliable delivery of improved protability requires systems thinking - an integrated supply chain approach - rather than typical current prac ce. Acuity (Consultants) Ltd takes a holis c approach, engaging all key internal (and, where approproate, external) stakeholders to deliver added value and to ensure procurement ini a ves deliver bo/om-line prot improvement.

This ar cle is the rst in a series on how to avoid the pi4alls of centralised procurement. Next week I look at strategic vs tac cal cost-saving programmes. Join the discussion, "Why do so many procurement cost saving ini a ves fail to deliver to the bo/om line?" at Procurement Professionals (#1 supply chain & sourcing group) on LinkedIn References: "Maturity Ma/ers: Performance Determinants of the Procurement Func on", R Batenburg & J Versendaal, Utrecht University 2008. Go to top

Three Principles for Eec ve Services Contrac ng

Tony Colwell - 23 September 2011 In the last week the media have reported huge waste of UK public funds associated with shared services projects. This triggered broader debate about the value of public sector projects. Cri cs frequently refer to the failure to control suppliers of services - the consultancy architects of shared services; technology suppliers; outsourced services providers - and the hidden legacy of debt from PFI projects. The problem is not conned to the public sector. In a recent live discussion hosted by The Guardian, it was claimed that research in the private sector shows 70% of shared services and mergers fail to deliver to expecta ons, and that the problems are not about processes, they relate to people, power and poli cs. Craneld University es mates for many rms, up to 75% of the products and services they provide are sourced from suppliers, sugges ng that rela onships between rms are a key source of compe ve advantage as opposed to the focus on managing processes and physical assets. Sustainable compe ve advantage requires agreement to operate on terms where neither partner can exploit the other. Anecdotal evidence suggests that public sector procurement processes and the resultant contracts for services are failing to provide adequate protec on. In my experience, private sector contracts frequently have similar shortcomings. Legal advisors oDen focus on documen ng current requirements - a kind of snapshot - rather than considering how the requirements and rela onships might evolve. Service agreements need to provide a dynamic framework for controlling the evolving commercial rela onship over the contract life cycle. Otherwise, as requirements and services digress from the original scope and intent, the result will be costly and uncompe ve add-ons, and margin creep generally in the supplier's favour. So, here are 3 guiding principles to ensuring enduring compe ve service:

1. Procurement must focus on determining, and contrac ng on the basis of, supplier capability, not on lowest cost or perceived best value of current, soon-to-be-obsolete solu ons. Selec on criteria need to take account of suppliers' intrinsic strengths and weaknesses: (a) infrastructure, resources and technology; (b) alignment and strategy; (c) assurance systems and demonstrable ability. 2. Contract in a way that prevents suppliers from exploi ng and pro ng excessively from changing requirements. Contract provisions must include (a) change control procedures to deal with any signicant changes - in the business, the requirements, the assets and resources deployed, the methods of providing the services - and to set the costs or budget for modied services. The procedures must

12 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

permit customer discre on in determining the way forward, including the use of third par es if the incumbent supplier is uncompe ve. (b) supplier obliga on not unreasonably to refuse to perform similar services to protect against 'cherry picking' or a/empts to frustrate the development of services; (c) benchmarking to establish con nuing compe veness, both in terms of cost and good prac ce. The inten on is to protect against - divergence in customer's requirement and supplier's capability - driD caused by cumula ve eect of small changes - uncompe ve pricing for changes. (d) termina on provisions on grounds of service and cost in whole or in part, to allow the separa on of services for which the supplier is no longer suitable. 3. Manage supplier performance. A service level agreement should include a formal, documented process comprising: (a) responsibili es matrix; (b) key performance measures and repor ng cycles; (c) incen ves to balance cost and service; (d) contractual cost targets at contract start, as modied under change control and benchmarking; (e) contractual service levels reec ng industry good prac ce, as modied by change control and benchmarking. If your chosen supplier is reluctant to co-operate in any of the above, you have to ask, "Have I found the best supplier?" If customer and supplier are condent that the supplier is the best placed to provide the service, then reaching agreement in these areas should be possible.

Discussion at Procurement in UK Public Sector Group on LinkedIn Go to top

Eec veness of Interim Management Supply Models Where next?

Tony Colwell - 16 September 2011 ADer the lull of the holiday season the Interim Management community has shown renewed interest in subject of "Catch 22" the Cabinet Oce's constraints on public sector deployment of Interim Managers. A discussion thread has restarted in the Odgers Interim Management Group on LinkedIn. The discussion had turned nega ve and a new direc on, leading to some posi ve ac on, was called for. Because this is a closed Group, I thought it would be appropriate to reproduce my comment, which (with minor edi ng) was as follows. This [Odgers Interim Management] discussion thread started on 3rd June. Alf Oldman and I had a mee ng with the Cabinet Oce on 1 July at which we were informed of plans to introduce new framework agreements to cover consultancy and execu ve interim requirements. We were not bound by non-disclosure agreement; it is more out of regard for our professional integrity that we have not broadcast plans that the Cabinet Oce has chosen not to announce formally. It might be helpful, to take the debate forward in a construc ve manner, to disclose some of what we know. The mee ng dispelled a few myths surrounding "Catch 22". The Cabinet Oce constraints on the use of 'consultants' applied to Central Government only. The use of consultants and interims by local authori es has been aected by budgetary constraints, not (as far as I am aware) by Central Government direc ve. William Jordan, former head of OGC, mandated that Central Government departments choose from 3 pre-exis ng models: 1. DWP Cipher - the outsourced Capita supply model; 2. Internal Buying Hub (CIX)/Home Oce portal to Buying Solu ons' frameworks. 3. ANY OTHER OPTION OFFERING EQUIVALENT VALUE. The mandate required that any excep ons valued at more than 20k (but less than the 100k threshold requirement for tendering via OJEU) be supported by a business case approved by the department head, and the Cabinet Oce no ed. I am not clear it was mandated that the Cabinet Oce would have to approve such business cases. Besides, the freedom to use "any other op on" gives enormous scope, especially in light of the Public Accounts Commi/ee's ndings that the Cabinet Oce is incapable of assessing value. Cabinet Oce (and formerly Buying Solu ons') frameworks - of which there are currently 19 ac ve - have never been mandated, and neither will they be. That the Cabinet Oce should be seen to prevent Central Government departments, or local authori es, from discharging their responsibili es is clearly unwise both poli cally and in terms of maintaining managerial accountability. The proposed new frameworks are to fall within two dis nct categories: (1) con ngent labour; (2) consultancy, INCLUDING EXECUTIVE INTERIM. Execu ve interim will not be classied as con ngent labour, but 'handle-turning' contractors' roles will be. I feel it is inappropriate to comment on the dividing line in terms of day rates but it was clear to me that many exis ng public sector 'interims' will fall into the con ngent labour category, including those working at rates above recognised as lower-limit thresholds by the two professional bodies, API and IIM. This is to be welcomed. If the Cabinet Oce delivers what Alf and I were told is planned, then the recogni on of execu ve interim status and the crossover with, and alterna ve to, big consultancy will be addressed. My focus since the mee ng has been on the interim management supply model. The success of any new frameworks is en rely dependent on the outcome of the tendering process. The cri cal factors are (a) Cabinet Oce recogni on that best value does not equate to lowest Interim Service Provider's ("ISP") margin, and (b) ISP's placing bids that demonstrate, can deliver, and can measure the added value of a higher-margin service. The Cabinet Oce is fully aware of the need to evaluate dierent interim management supply models. To this end Alf and I produced a second White Paper which we have not published (in the public domain). Much of the content regarding measuring the eec veness of interim management supply models has been put to the IM community for discussion, both before and aDer we submi/ed the White Paper to the Cabinet Oce. Details can be found in my earlier blog.

13 de 26

03/01/2013 17:09

ACUITY CONSULTANTS News & Blog Archive: Supply Chain, Pro...

http://www.acuityconsultants.com/news.html#why_do_procurement_in...

I also started discussions in the most ac ve ISP's own Groups - including a discussion at Odgers Interim LI Group - to ensure that ISPs as well as the broader Interim community were aware of the need to develop innova ve models . Disappoin ngly, these a/racted only moderate interest and li/le comment from the ISPs themselves. Alf and I know from private discussions we had with various ISPs that more is going on behind the scenes than is apparent in the public domain. I would expect some re cence to discuss publically what ISPs might be doing to establish their own posi ons and place their bids. The future of the execu ve interim opportunity in Central Government departments is at stake. So perhaps this discussion should be redirected towards ensuring that ISPs provide the type of interim supply model that we execu ve interims would wish.

Non-members of the Odgers Interim Management Group can join the discussion "Eec veness of Interim Management Supply Models Where Next?" at API (open) Group on LinkedIn Go to top

Change Management: 7 Essen al Elements of Stakeholder Engagement