Professional Documents

Culture Documents

Aviva PLC 2013 Interim Results Interview Transcript With Mark Wilson, Group CEO

Uploaded by

Aviva GroupOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviva PLC 2013 Interim Results Interview Transcript With Mark Wilson, Group CEO

Uploaded by

Aviva GroupCopyright:

Available Formats

Transcript

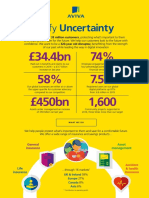

Half Year results 2013 08 August 2013 Simon: Mark, its good to see you. Thank you very much for joining us. Now lets talk about Avivas performance in the first six months. Whats your take on it? Mark: Simon, in one word, satisfactory. So far this year weve basically just done what we said we would do. Theres been a number of highlights and some things weve got to work on as well. For example the profit this year, the total bottom line profit after tax is 776 million pounds. That compares to a loss last year of about 624 million pounds. Thats quite a contrast. Simon: What progress are you making in your investment thesis? In particular how are you doing against your five key metrics? Mark: Simon, the investment thesis is crystal clear. Its about cash flow, plus growth in that order. And below that weve got the five key metrics and thats what we run the business on, thats our key focus. If you look at cash flow first. Cash flow is the money or the dividend we get paid from the subsidiary companies up to the group. Aviva is a profit making machine, our problem has been turning it into cash flow. So far this year its been adequate progress. The cash flow to group is about 600 million and thats about a 30% increase on the previous year. In terms of growth we measure that primarily by value of new business. The growth is about a 17% increase and theres been some pretty satisfactory results. And then our growth markets have performed pretty well as well. Its pretty balanced. Simon: What more would you want to say though about operating profit, expenses and COR? Mark: Well operating profit, which is another key measure for us, is about 1 billion. Thats a 5% increase from the previous year, again satisfactory progress. Expenses has been a key thing for both the market to follow and for us, and youll recall we put out a 400 million cost savings target. At a 9% reduction in actual expenses for the first half of the year, again we are on our way to achieving that target. And then on COR its been pretty stable at 96%. This is after taking a 70 million provision for the Alberta floods in Canada. Simon: So Mark what would you want to say today about the net asset value?

Mark: Well, Simon, the NAVs increased 3p; its increased modestly to 281 (pence). And thats been impacted by 8p and in fact 300 million provision on the commercial mortgages book. Now, Im slightly irritated weve had to take that. It relates to a pre-2009 book. Weve looked at it closely, weve looked at the loans and Im satisfied weve taken the appropriate action including strengthening the management team. Simon: Mark, lets talk about the balance sheet. Now you said that a key priority was reducing the intercompany loan. Whats the progress on that so far? Mark: Well, Simon, in all my many meetings with investors this seems to be the topic that comes up most, and I think thats probably an overhang on the stock. At the start of the year we said we were going to reduce this by 600 million over the next three years and by announcing that weve reduced it by 700 million in the first six months, clearly were a little bit ahead of their expectations. But I reiterate my previous guidance. Over the next two years we will only reduce, in terms of cash, 150 million in terms of 2014 and 150 million in terms of 2015. However, we will look to reduce that balance further in terms of noncash flow means. And weve got a lot of work to do. This is a complex issue, its a multi-year process. Simon: People are always keen to know what this means for the dividend. What can you say today about that? Mark: It doesnt mean much really. We signalled very clearly at the full year what the dividend was going to be. And the announcement of 5.6 pence today is, I think, entirely what the market was expecting. We are making progress; were about where we thought we would be at this time. Simon: In your words, these results are satisfactory. So what do you see as the key challenges and how are you going to focus on them? Mark: We really are focused on our key issues, I mean, after all, this is a turnaround story. To me theres a few things. Firstly Id look at the remittance ratios. Now our better peers are in the high 80s in terms of a ratio from OCG to dividends up to group. Last year we were 48%. Clearly that has to be higher and we would anticipate we need to get that into the 80s over the next few years. Simon: What would you want to say about external leverage? Mark: Well, external leverage, at the beginning of the year we went out to the market and we said we wanted to get that below 40% as a ratio. And thats a medium term target; were going to pay down 500 million over the medium term and then over time as NAV increases, well get it down. I think its important to note though that our internal measures are harder than the market. So, by way of an example, our S&P external debt ratio is 33%, so clearly were using a tougher measure internally.

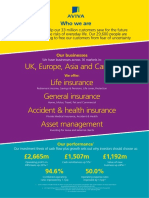

Simon: Now, at the full year you promised investors you would give further detail on Avivas geographic strategy, so whats your current thinking this far in? Mark: You know, Simon, when I think of our geographies I put the countries into three simple buckets. The first is cash flow generators, the second is turnaround businesses that should be cash flow generators and the third is growth markets that will be cash flow generators. Thats how I think of it. Simon: So tell us about cash flow generators, whats your take on that? Mark: We have three major cash cows I guess you can call them in the business. The UK, both the Life and General Insurance businesses, Canada, and France. They are real scale businesses, they each have differentiated propositions to the market and they each have a history of generating stable returns. You know even the back book alone out of those business generate capital generation [of] over 1 billion per annum for the next ten years. Simon: And whats your view of the turnaround businesses? Mark: These businesses are in need of some work. Weve strengthened the management teams, weve taken some pretty tough action in them, but this will be a journey. We need to do things like changing the product range, reducing the capital that we use to write new business, reducing expenses and again focusing on cash flow. Theres also been quite a big drag on the value of new business and we need to turn that round as well.

Simon: And your thinking on future cash generators? Mark: We have some excellent what I would call options for growth. I should state right up front I dont expect the market to give us credit for the growth at this stage. You know, 17% value new business growth so far this year is probably a bit out of character for a stock that doesnt have a growth premium, but we certainly have options for growth in the future. If you look at Poland, were number two life and pensions provider in Poland, we got a great position. Turkey, were also the number two life and pensions provider; Turkey has all the characteristics of Asia, great demographics, growing economy, it really is a very nice market and we have a strong leadership position. And then, Asia. Asia we are taking more of a focus strategy. Were focusing on China and South East Asia; were going to be in markets where we have scale or the ability to get scale and places where we have a competitive advantage. So, were going to be selective, were going to focus our attention and were making some progress. Simon: So what about Aviva Investors? Whats your thinking there? Mark: Well, for a business of the scale that it has, and its a good sized business - the fact that it only gives us 2% of our earnings is a problem. Its performed in terms of returns on the funds, it hasnt performed in terms of returns for the shareholders and we need to work on that. Jason Windsors been heading a

strategic group for the last few months and that strategys just coming to its final stages. Its really culminated in the appointment of Euan Munro to head that business. Euans a class act hes got an impeccable track record, and hell make a difference to that business. Simon: Looking ahead what can we expect from Aviva? What is the outlook from your perspective? Mark: You know, Simon, the interesting thing about the Aviva turnaround story, is that most of these issues are within our own gift to resolve, were not relying on great markets or things, were being pretty conservative in our assumptions. Its not a question of can we do it, but over what time frame its going to be. I think when you look at our potential, the potential for this group, I classify our results as barely adequate, barely adequate in terms of our potential going forward. In my view, there remains substantial value to unlock at Aviva. Simon: You describe your results as satisfactory, so, from your perspective, what does good look like? Mark: Well, Simon, the results are satisfactory or only adequate in terms or our potential. Good looks like were the top performing insurance and fund management group in the world. Good looks like when we have investors who are delighted with the total shareholder returns on the dividends theyre getting. Good looks like when I have customers ringing me up or emailing me telling me what wonderful products we have and what outstanding service theyve been getting. Good to me looks like when we have our staff who are clear about what the strategy is, clear about what their roles are in it and are telling us how happy they are to work in an organisation like Aviva. Good to me looks like when were leading innovation and technology. And good to me looks like when distributors cant get enough of our products. Thats what good looks like. The question is not can we achieve these things, the question is how long will it take? And we need to do a lot more work and a lot more planning and a lot of execution just to get there. Simon: Patience and hard work? Mark: Oh, Im not so patient! Ends -

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Under The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. GloriaDocument2 pagesUnder The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. Gloriaapperdapper100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PG&E 2012 Greenbook ManualDocument366 pagesPG&E 2012 Greenbook ManualVlade KljajinNo ratings yet

- Marketing Case - Cowgirl ChocolatesDocument14 pagesMarketing Case - Cowgirl Chocolatessarah_alexandra2100% (4)

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Document1 pageStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- Life of Pi Chapter QuestionsDocument25 pagesLife of Pi Chapter Questionskasha samaNo ratings yet

- 2017 Preliminary Results AnnouncementDocument143 pages2017 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Aviva 2018 Interim Results AnnouncementDocument10 pagesAviva 2018 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva 2018 Key Metrics InfographicDocument1 pageAviva 2018 Key Metrics InfographicAviva GroupNo ratings yet

- Aviva PLC - at A Glance March 2018Document2 pagesAviva PLC - at A Glance March 2018Aviva GroupNo ratings yet

- Aviva 2017 Interim Results Analyst PresentationDocument64 pagesAviva 2017 Interim Results Analyst PresentationAviva GroupNo ratings yet

- Enabling Europe To Compete in The Global World of FinTechDocument2 pagesEnabling Europe To Compete in The Global World of FinTechAviva GroupNo ratings yet

- Aviva 2017 Interim Results AnnouncementDocument131 pagesAviva 2017 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva PLC Capital Markets DayDocument2 pagesAviva PLC Capital Markets DayAviva GroupNo ratings yet

- Aviva Half Year 2015 AnnouncementDocument163 pagesAviva Half Year 2015 AnnouncementAviva GroupNo ratings yet

- Aviva HY16 Results Summary - InfographicDocument1 pageAviva HY16 Results Summary - InfographicAviva GroupNo ratings yet

- Aviva PLC 2016 ResultsDocument71 pagesAviva PLC 2016 ResultsAviva GroupNo ratings yet

- Aviva PLC 2016 Results InfographicDocument2 pagesAviva PLC 2016 Results InfographicAviva GroupNo ratings yet

- Aviva PLC 2016 Interims Results AnnouncementDocument127 pagesAviva PLC 2016 Interims Results AnnouncementAviva GroupNo ratings yet

- Mark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptDocument4 pagesMark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptAviva GroupNo ratings yet

- What Are We in Business For? Being A Good AncestorDocument22 pagesWhat Are We in Business For? Being A Good AncestorAviva GroupNo ratings yet

- Aviva at A Glance InfographicDocument2 pagesAviva at A Glance InfographicAviva GroupNo ratings yet

- Aviva 2015 Results InfographicDocument1 pageAviva 2015 Results InfographicAviva GroupNo ratings yet

- Aviva 2015 Full Year Results TranscriptDocument3 pagesAviva 2015 Full Year Results TranscriptAviva GroupNo ratings yet

- 2015 Half Year Results Interview With Group CEO Mark WilsonDocument4 pages2015 Half Year Results Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva 2015 Preliminary AnnouncementDocument10 pagesAviva 2015 Preliminary AnnouncementAviva GroupNo ratings yet

- Aviva Half Year 2015 Analyst PresentationDocument30 pagesAviva Half Year 2015 Analyst PresentationAviva GroupNo ratings yet

- Aviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsDocument4 pagesAviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsAviva GroupNo ratings yet

- 2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonDocument7 pages2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallDocument5 pagesInflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallAviva GroupNo ratings yet

- Aviva 2014 Results PresentationDocument26 pagesAviva 2014 Results PresentationAviva GroupNo ratings yet

- Aviva PLC 2014 Preliminary Results AnnouncementDocument9 pagesAviva PLC 2014 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Transcript of Jail Cell Interview With Robert PicktonDocument175 pagesTranscript of Jail Cell Interview With Robert PicktonToronto Star100% (1)

- Scott Mcmillan San Diego SanctionsDocument3 pagesScott Mcmillan San Diego SanctionsMcMillanLawLaMesaAlertNo ratings yet

- Chernobyl Disaster: The Worst Man-Made Disaster in Human HistoryDocument13 pagesChernobyl Disaster: The Worst Man-Made Disaster in Human HistoryGowri ShankarNo ratings yet

- BVP651 Installation ManualDocument12 pagesBVP651 Installation ManualAnonymous qDCftTW5MNo ratings yet

- Advent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaDocument7 pagesAdvent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaNitish GuptaNo ratings yet

- Nepotism in NigeriaDocument3 pagesNepotism in NigeriaUgoStan100% (2)

- Caste Endogamy A Multidimensional Analogy of Caste in The Indian SocietyDocument12 pagesCaste Endogamy A Multidimensional Analogy of Caste in The Indian SocietyRakshith L1No ratings yet

- Madhu Limaye Vs The State of Maharashtra On 31 October, 1977Document13 pagesMadhu Limaye Vs The State of Maharashtra On 31 October, 1977Nishant RanjanNo ratings yet

- Same Tractor Silver 80-85-90 105 160 180 Parts CatalogDocument17 pagesSame Tractor Silver 80-85-90 105 160 180 Parts Catalogalicebrewer210188ktm100% (64)

- A Comparative Study On Financial Performance of Private and PublicDocument17 pagesA Comparative Study On Financial Performance of Private and PublicaskmeeNo ratings yet

- LUL S1062 - Temporary Works - Issue A4Document29 pagesLUL S1062 - Temporary Works - Issue A4HNo ratings yet

- Philippine Clean Water ActDocument91 pagesPhilippine Clean Water Actfirmo minoNo ratings yet

- Unit Test 7A: 1 Choose The Correct Form of The VerbDocument4 pagesUnit Test 7A: 1 Choose The Correct Form of The VerbAmy PuenteNo ratings yet

- Statutory Construction NotesDocument8 pagesStatutory Construction NotesBryan Carlo D. LicudanNo ratings yet

- CNT A HandbookDocument276 pagesCNT A Handbookv_singh28No ratings yet

- PDHONLINE - Google SearchDocument2 pagesPDHONLINE - Google SearchThanga PandiNo ratings yet

- Libanan, Et Al. v. GordonDocument33 pagesLibanan, Et Al. v. GordonAlvin ComilaNo ratings yet

- Offshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfDocument23 pagesOffshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfVaibhav BanjanNo ratings yet

- Land Use Management (LUMDocument25 pagesLand Use Management (LUMgopumgNo ratings yet

- SPUBSDocument6 pagesSPUBSkuxmkini100% (1)

- Steinmann 2016Document22 pagesSteinmann 2016sofyanNo ratings yet

- Bernini, and The Urban SettingDocument21 pagesBernini, and The Urban Settingweareyoung5833No ratings yet

- Testimonies and PioneersDocument4 pagesTestimonies and Pioneerswally ziembickiNo ratings yet

- Chapter TwoDocument2 pagesChapter TwoQuilay Noel LloydNo ratings yet

- Negros Oriental State University Bayawan - Sta. Catalina CampusDocument6 pagesNegros Oriental State University Bayawan - Sta. Catalina CampusKit EdrialNo ratings yet