Professional Documents

Culture Documents

Numericals On Stock Swap - Solution

Uploaded by

Animesh Singh GautamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Numericals On Stock Swap - Solution

Uploaded by

Animesh Singh GautamCopyright:

Available Formats

Question 5

B Limited is a highly successful co. and wishes to expand by acquiring other firms. Its expected high growth in earning and dividends is reflected in its PE Ratio of 17. The Board of Directors of B Ltd. has been advised that if it were to take over other firms with a lower PE ratio than its own, using share for share exchange, then it could increase its reported earning per share. C Limited has been suggested as a possible target for a takeover, which has a PE ratio of 10 and 1,00,000 shares in issue with a share price of Rs. 15. B limited has 5,00,000 shares in issue with a share price of Rs. 12 Calculate the change in earnings per share of B Limited, if it acquires the whole of C Limited by issuing shares at its market price of Rs. 12. Assume the price of B Limited remains constant.

Solution: PE Ratio No. of shares Market Price PE Ratio 10 EPS Earning Total Earning

C Limited 10 100000 15 MPS / EPS 15/EPS 1.5 EPS * No. of shares 1.5 * 100000 150000 PE Ratio No. of shares Market Price PE Ratio 17 EPS Earning Total Earning

B Limited

No. of shares to be issued Total No. of shares after merger EPS after merger

125000 625000

based on market price

Total Earnings / No. of shares 150000+352941 / 625000

EPS after merger Change in EPS Increase in EPS 0.8 - 0.7

0.8

0.1

Question 7

MK Limited is considering acquiring NN Limited. The following information is available: Company MK Ltd NN Ltd EAT 6000000 1800000 No. of Equity Shares 1200000 300000 Market value of shares 200 160

Exchange of equity shares for acquisition is based on current market value as above There is no synergy advantage available. (1) Find the EPS for company MK Limited after merger and (2) Find the exchange ratio so that shareholders of NN Limited would not be at a loss.

Solution: 1 No. of shares to be issued to the shareholders of NN Limited based on the market price Total no. of shares after merger Total Earnings EPS after merger 240000 1440000 7800000 5.416666667

2 To find out the exchange ratio so that shareholders of NN Limited would not be at a loss: It should be premerger EPS ratio. Present EPS of MK Limited 5

Present EPS of NN Limited

Exchange ratio should be 6 shares of MK Limited for every 5 shares of NN Limited. Shares to be issued to NN Limited Total no. of shares of MK Ltd and NN Ltd EPS after merger Total earning availavle to shareholders of NN Limited after merger This is equal to the earnings prior merger for NN Limited Exchange ratio on the basis of Earnings per share is recommended. 360000 1560000 5 1800000

Question 8

A Limited wants to acquire T Limited and has offered a swap ratio of 1:2 (0.5 shares for every one share of T Limited) Following information is provided: A Limited 1800000 600000 3 10 times 30 T Limited 360000 180000 2 7 times 14

PAT No. of equity shares EPS PE Ratio Market price per share

(i) (ii) (iii) (iv) (v)

Required: No. of equity shares to be issued by A Limited for acquisition of T Limited What is the EPS of A Ltd. after acquisition? Determine the equivalent earnnings per share of T Limited? What is the expected market price per share of A Limited after acquisition, assuming its PE multiple remains unchanged? Determine the market value of the merged firm.

Solution (i) No. of equity shares to be issued by A Limited for acquisition of T Limited Swap ratio 0.5 shares for every share of T Limited

No. of shares to be issued to the shareholders of T Limited 900000

(ii) What is the EPS of A Ltd. after acquisition? Total no. of shares Total earnings EPS after merger (iii) Determine the equivalent earnnings per share of T Limited? No. of shares issued to T Limited EPS Equivalent EPS 0.5 3.13 1.565 1500000 2160000 1.44

(iv) What is the expected market price per share of A Limited after acquisition, assuming its PE multiple remains unchanged? PE Ratio 10 Market Price Per share MPS/EPS MPS/3.13 31.3

(v) Determine the market value of the merged firm. Total number of shares 690000

Market Price Per share Market Values

31.3 21597000

Question 9

ABS Ltd is intending to acquire XYZ Limited by merger and the following information is available in respect of the companies:

No. of equity shares EAT Market price per share

ABC Limited 1000000 5000000 42

XYZ Limited 600000 1800000 28

Required: (i) What is the present EPS of both the companies? (ii) If the proposed merger takes place, what would be the new earning per share for ABC Ltd.? Assume that the merger takes place by exchange of equity shares and the exchange ratio is based on the current market price. (iii) What should be the exchange ratio, if XYZ Ltd. wants to ensure the earnings to members are as before the merger takes place.

Solution: (i) What is the present EPS of both the companies? EPS ABC XYZ Earning / No. of shares 5 3

(ii) If the proposed merger takes place, what would be the new earning per share for ABC Ltd.? Assume that the merger takes place by exchange of equity shares and the exchange ratio is based on the current market price. No. of shares issued to XYZ Limited (based on the current market price) 400000

Total no. of shares Total Earnings EPS

1400000 6800000 4.857142857

(iii) What should be the exchange ratio, if XYZ Ltd. wants to ensure the earnings to members are as before the merger takes place. Shares to be exchanged based on the pre merger EPS ratio: XYZ ABC 3 5 360000

No of shares to be issued to shareholders of XYZ Limited to ensure the same earnings EPS after merger Total No. of shares Total Earnings EPS Total earnings available to shareholders of XYZ Limited Thus to insure the earnings of the shareholders of XYZ Limited, the ratio of exchange should be 3/5

1360000 6800000 5 1800000

Question 10

XYZ Limited is considering a merger with ABC Limited. XYZ Limited's shares are currently traded at Rs. 20. It has 250000 shares outstanding and its EAT amount to Rs. 5,00,000. ABC Ltd has 1,25,000 shares outstanding and its current market price is Rs. 10 and its EAT is Rs. 1250 The merger will be effected by means of stock swap. ABC Limited has agreed to a plan under which XYZ Limited will offer the current market value of ABC Ltd shares:

Required: (i) What is the peremerger EPS and PE Ratio of both the companies? (ii) If ABC Limited PE Ratio is 6.4, what is the current market price? What is the exchange ratio? What will be XYZ Limited's post merger EPS be? (iii) What should be the exchange ratio, if XYZ Ltd. premerger and post merger EPS are to be the same.

(i) What is the peremerger EPS and PE Ratio of both the companies? XYZ Market Price No. of share EAT EPS 20 250000 500000 Earning / No. of shares 2 PE Ratio MP/EPS 10 PE Ratio ABC Market Price No. of share EAT EPS

(ii) If ABC Limited PE Ratio is 6.4, what is the current market price? What is the exchange ratio? What will be XYZ Limited's post merger EPS be? PE Ratio 6.4 Market Price New exchange ratio No. of share to be issued to ABC Total no. of shares Earning EPS MP/EPS MP/1 6.4 6.4/20

based on new market price

40000 290000 625000 Earning/Total no. of shares

2.155172414

(iii) What should be the exchange ratio, if XYZ Ltd. premerger and post merger EPS are to be the same. Desired Exchange Ratio Total No. of shares in the post merged company Post merged earnings / Premerger EPS of XYZ Ltd. 312500 No. of shares to be issued The exchange ratio is 62500/125000 62500

Ignore the typing error

and dividends ms with a lower PE ratio n suggested as a possible target 000 shares in issue with a share price of Rs. 12

arket price of Rs. 12.

B Limited 17 500000 12 MPS / EPS 12/EPS 0.71 EPS * No. of shares 0.705882352 * 500000 352941

s current market price is Rs. 10 and its EAT is Rs. 125000 ffer the current market value of ABC Ltd shares:

's post merger EPS be?

10 125000 125000 Earning / No. of shares 1 MP/EPS 10

's post merger EPS be?

You might also like

- 2 Real Options in Theory and PracticeDocument50 pages2 Real Options in Theory and Practicedxc12670No ratings yet

- One Page M&A Simple Model Improved BlankDocument21 pagesOne Page M&A Simple Model Improved BlankAllen FengNo ratings yet

- Private Equity Valuation - PresentationDocument13 pagesPrivate Equity Valuation - Presentationjoe abramsonNo ratings yet

- Cost Volume ProfitDocument4 pagesCost Volume ProfitProf_RamanaNo ratings yet

- WACC CALCULATIONSDocument4 pagesWACC CALCULATIONSshan50% (2)

- Maximizing Shareholder Value with VBMDocument20 pagesMaximizing Shareholder Value with VBManisahNo ratings yet

- Equity ResearchDocument3 pagesEquity Researchanil100% (2)

- Tutorial 3 Cost of CapitalDocument1 pageTutorial 3 Cost of Capitaltai kianhongNo ratings yet

- Valuation Final ProjectDocument31 pagesValuation Final ProjectsidchorariaNo ratings yet

- IFRS Functional Currency CaseDocument23 pagesIFRS Functional Currency CaseDan SimpsonNo ratings yet

- Accretion Dilution ModelDocument10 pagesAccretion Dilution ModelQuýt BéNo ratings yet

- Valuation Presentation 110929211642 Phpapp01Document44 pagesValuation Presentation 110929211642 Phpapp01Nicole BambaNo ratings yet

- Chapter9Solutions (Questions)Document14 pagesChapter9Solutions (Questions)ayaNo ratings yet

- Arrow Greentech Poised for Growth on Back of Patent Portfolio and WSF ExpansionDocument53 pagesArrow Greentech Poised for Growth on Back of Patent Portfolio and WSF ExpansionanantNo ratings yet

- A Note On Valuation in Entrepreneurial SettingsDocument4 pagesA Note On Valuation in Entrepreneurial SettingsUsmanNo ratings yet

- What Is The Difference Between Book Value and Market ValueDocument12 pagesWhat Is The Difference Between Book Value and Market ValueAinie Intwines100% (1)

- Mini Case Chapter 3 Final VersionDocument14 pagesMini Case Chapter 3 Final VersionAlberto MariñoNo ratings yet

- 1-Deal StructuringDocument13 pages1-Deal StructuringNeelabhNo ratings yet

- Early-Stage Companies and Financing Valuations - The Venture Capital MethodDocument15 pagesEarly-Stage Companies and Financing Valuations - The Venture Capital MethodMartín MaturanaNo ratings yet

- Quiz 2 - QUESTIONSDocument18 pagesQuiz 2 - QUESTIONSNaseer Ahmad AziziNo ratings yet

- FDsetia 20150923pj8xfnDocument41 pagesFDsetia 20150923pj8xfnJames WarrenNo ratings yet

- Equity TrainingDocument224 pagesEquity TrainingSang Huynh100% (3)

- Fernandez Corporation Financial StatementsDocument20 pagesFernandez Corporation Financial StatementsKhánh Huyền0% (2)

- Chapter 10: Equity Valuation & AnalysisDocument22 pagesChapter 10: Equity Valuation & AnalysisMumbo JumboNo ratings yet

- Bond ValuationDocument52 pagesBond ValuationDevi MuthiahNo ratings yet

- Forward Rate AgreementDocument8 pagesForward Rate AgreementNaveen BhatiaNo ratings yet

- Fauji Fertilizer Company (FFC) : Target Price StanceDocument17 pagesFauji Fertilizer Company (FFC) : Target Price StanceAli CheenahNo ratings yet

- Admin Law CasesDocument15 pagesAdmin Law CasesBfp Siniloan FS LagunaNo ratings yet

- DCF Analysis Discounted Cash Flow ValuationDocument4 pagesDCF Analysis Discounted Cash Flow ValuationChristopher GuidryNo ratings yet

- Bank ValuationsDocument20 pagesBank ValuationsHenry So E DiarkoNo ratings yet

- PPT4-Consolidated Financial Statement After AcquisitionDocument57 pagesPPT4-Consolidated Financial Statement After AcquisitionRifdah SaphiraNo ratings yet

- Reading 31 Slides - Private Company ValuationDocument57 pagesReading 31 Slides - Private Company ValuationtamannaakterNo ratings yet

- Weeks 1 To 4 Fundamental AnalysisDocument166 pagesWeeks 1 To 4 Fundamental Analysismuller1234No ratings yet

- 5 Important Elements in Fundamental AnalysisDocument5 pages5 Important Elements in Fundamental AnalysisSaverio NataleNo ratings yet

- 23 LboDocument15 pages23 LboBhagaban DasNo ratings yet

- 2 Risk&ReturnDocument23 pages2 Risk&ReturnFebson Lee MathewNo ratings yet

- Shriram Transport Finance Company Ltd. - Initiating Coverage - 30032021Document12 pagesShriram Transport Finance Company Ltd. - Initiating Coverage - 30032021Devarsh VakilNo ratings yet

- PPT1-Introduction To Business Combinations and The Conceptual FrameworkDocument54 pagesPPT1-Introduction To Business Combinations and The Conceptual FrameworkRifdah SaphiraNo ratings yet

- 09 JAZZ Equity Research ReportDocument9 pages09 JAZZ Equity Research ReportAfiq KhidhirNo ratings yet

- Value Added Metrics: A Group 3 PresentationDocument43 pagesValue Added Metrics: A Group 3 PresentationJeson MalinaoNo ratings yet

- Investment Analysis and Portfolio Management Christmas Worksheet 2009Document2 pagesInvestment Analysis and Portfolio Management Christmas Worksheet 2009farrukhazeemNo ratings yet

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- Leverage Buyout - LBO Analysis: Investment Banking TutorialsDocument26 pagesLeverage Buyout - LBO Analysis: Investment Banking Tutorialskarthik sNo ratings yet

- MENG 6502 Financial ratios analysisDocument6 pagesMENG 6502 Financial ratios analysisruss jhingoorieNo ratings yet

- Cash Flow Estimation: Understanding FCFF and FCFEDocument56 pagesCash Flow Estimation: Understanding FCFF and FCFEYagyaaGoyalNo ratings yet

- Wacc MisconceptionsDocument27 pagesWacc MisconceptionsstariccoNo ratings yet

- CMG - Analyst Report - Mihai MaziluDocument16 pagesCMG - Analyst Report - Mihai MaziluMihai MaziluNo ratings yet

- Case 75 The Western Co DirectedDocument10 pagesCase 75 The Western Co DirectedHaidar IsmailNo ratings yet

- Pizza Asm 2020 ReportDocument130 pagesPizza Asm 2020 ReportJohn Robert ColladoNo ratings yet

- Problem Set - Cost of CapitalDocument19 pagesProblem Set - Cost of CapitalSagar Bansal100% (1)

- Accounting for Heritage and Biological AssetsDocument10 pagesAccounting for Heritage and Biological AssetsVenessa YongNo ratings yet

- Valuation For Investment BankingDocument27 pagesValuation For Investment BankingK RameshNo ratings yet

- 10 BrazosDocument20 pages10 BrazosAlexander Jason LumantaoNo ratings yet

- RC Equity Research Report Essentials CFA InstituteDocument3 pagesRC Equity Research Report Essentials CFA InstitutetheakjNo ratings yet

- Quality of Earnings MattersDocument7 pagesQuality of Earnings MattersKanu Raj AnandNo ratings yet

- Telecom Egypt Credit RatingDocument10 pagesTelecom Egypt Credit RatingHesham TabarNo ratings yet

- Flirting with Risk: Managing Investment PortfoliosDocument13 pagesFlirting with Risk: Managing Investment PortfoliosKristin Joy Villa PeralesNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Report Ford Case StudiesDocument192 pagesReport Ford Case StudiesAnimesh Singh GautamNo ratings yet

- Report Ford Case StudiesDocument192 pagesReport Ford Case StudiesAnimesh Singh GautamNo ratings yet

- UntitledDocument1 pageUntitledAnimesh Singh GautamNo ratings yet

- Time TableDocument3 pagesTime TableAnimesh Singh GautamNo ratings yet

- Google HR PolicyDocument1 pageGoogle HR PolicyAnimesh Singh GautamNo ratings yet

- The Corner Shop: Income StatementDocument6 pagesThe Corner Shop: Income StatementAnimesh Singh GautamNo ratings yet

- World's Top 100 Universities 2012 - Their Reputations Ranked by Times Higher EducationDocument8 pagesWorld's Top 100 Universities 2012 - Their Reputations Ranked by Times Higher EducationAnimesh Singh GautamNo ratings yet

- A K Ramanujan Three Hundred Ramayanas PDFDocument16 pagesA K Ramanujan Three Hundred Ramayanas PDFAbhishek Anbazhagan100% (1)

- GKDocument11 pagesGKAnimesh Singh GautamNo ratings yet

- Synopsis Contrary ThinkingDocument5 pagesSynopsis Contrary ThinkingHareet GillNo ratings yet

- Parcoa CorporationDocument4 pagesParcoa Corporationjoinesmar09No ratings yet

- VC Valuation Methods SummaryDocument9 pagesVC Valuation Methods Summarybia070386No ratings yet

- FINANCIAL MARKETS AND INSTITUTIONS OVERVIEWDocument16 pagesFINANCIAL MARKETS AND INSTITUTIONS OVERVIEWNerissaNo ratings yet

- Intra CorporateDocument3 pagesIntra CorporateEunice Serneo100% (1)

- Prospectus, Meetings & Dividend Question Paper - 1223261 - 2024 - 01 - 22 - 00 - 53Document2 pagesProspectus, Meetings & Dividend Question Paper - 1223261 - 2024 - 01 - 22 - 00 - 53Anjali SomaniNo ratings yet

- Leveraged BuyoutDocument8 pagesLeveraged Buyoutmanoraman0% (1)

- THOM v. BALTIMORE TRUST CO.Document2 pagesTHOM v. BALTIMORE TRUST CO.Karen Selina AquinoNo ratings yet

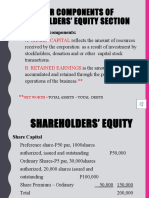

- Shareholders' Equity p21 28Document19 pagesShareholders' Equity p21 28Rizalito SisonNo ratings yet

- Vertical Analysis & Common Sized StatementsDocument2 pagesVertical Analysis & Common Sized StatementsNawab AliNo ratings yet

- Case Analysis HP Compaq MergerDocument12 pagesCase Analysis HP Compaq MergerSheetanshu Agarwal MBA 2016-18No ratings yet

- Correction Rules: Adeel Raza Inspire Academy JauharabadDocument12 pagesCorrection Rules: Adeel Raza Inspire Academy JauharabadAdeel RazaNo ratings yet

- Financial Managment 1 - Chapter 15Document4 pagesFinancial Managment 1 - Chapter 15lerryroyceNo ratings yet

- AECOM URS PresentationDocument20 pagesAECOM URS PresentationhtoocharNo ratings yet

- FINANCIAL RATIO ANALYSISDocument8 pagesFINANCIAL RATIO ANALYSISFATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- Stanford Case Study PDFDocument20 pagesStanford Case Study PDFWilliam LouchNo ratings yet

- Limited Liability With One-Man Companies and Subsidiary Corporati PDFDocument32 pagesLimited Liability With One-Man Companies and Subsidiary Corporati PDFansanjunelynNo ratings yet

- IBM Stock ValuationDocument23 pagesIBM Stock ValuationZ_BajgiranNo ratings yet

- KSDL 42nd AGM Annual Report 2021-22Document95 pagesKSDL 42nd AGM Annual Report 2021-22nagaraju tatikondaNo ratings yet

- Corporate Restructuring Combinations and DivestituresDocument11 pagesCorporate Restructuring Combinations and Divestituresapi-1948267850% (2)

- NATWIDE AnnualReport2014Document114 pagesNATWIDE AnnualReport2014Atheera MohamadNo ratings yet

- Initial Coin Offering "ICO OverviewDocument13 pagesInitial Coin Offering "ICO OverviewAdam S. TracyNo ratings yet

- C14 CHP 12 2 Homework Sol S CorpsDocument6 pagesC14 CHP 12 2 Homework Sol S CorpsRimpy SondhNo ratings yet

- On-Line Lesson 1 Part 2Document28 pagesOn-Line Lesson 1 Part 2Kimberly Claire AtienzaNo ratings yet

- Certificate of Increase of Capital Stock TEMPLATEDocument2 pagesCertificate of Increase of Capital Stock TEMPLATEdeleondesiderioNo ratings yet

- Literature Review 2Document9 pagesLiterature Review 2Hari Priya0% (1)

- IEPFDocument5 pagesIEPFachlaNo ratings yet

- Cocofed Vs Republic DigestDocument2 pagesCocofed Vs Republic DigestJohn Dy Castro FlautaNo ratings yet

- Companies Vision and MissionDocument3 pagesCompanies Vision and MissionAnonymous cwC8kTyNo ratings yet

- Writing The Business Plan IDG VenturesDocument9 pagesWriting The Business Plan IDG VentureswindevilNo ratings yet